Using one of the best payroll software solutions is an absolute necessity, regardless of the size of your business, to avoid human error in the process, late payments, and compliance issues arising. That said, finding a suitable solution for your needs and budget can be tough, given the number of options available to you.

To help, we’ve ranked and reviewed the market’s best payroll solutions below, from the almighty ADP to Deel, Gusto, and Rippling. Read on to learn more about each one and find the one best suited to your needs.

Our pick for best payroll software: ADP Workforce

- The best payroll software should not only handle your payroll processing but also integrate with other HR tools to make management a breeze.

- One of the best options for this would be ADP Workforce – they offer a world-class user interface and at an affordable price point to boot.

- Being able to start on a smaller plan and then scale up as your company grows is crucial – and ADP Workforce allows you to do just that.

The Best Payroll Management Software

By taking into account factors like ease of use and onboarding, pricing, features, and user satisfaction, we’ve ranked each one and given a brief outline of what each one is best suited for:

- ADP Workforce – The best all-round payroll system

- Deel – Best global payroll solution for on-time, accurate payments

- Gusto – The best for transparent pricing and no hidden fees

- Rippling – Powerful payroll/HR/IT software that helps you scale your business

- Paylocity – Perfect for combining your HR software with payroll

- Dayforce – The best self-service platform for your employees

- Paychex Flex – Unbeatable custom reports

- BambooHR – The choice for you if you need to integrate time tracking

- Intuit Quickbooks – Perfect for starting small and growing with you

- Square Payroll – The best choice for contractors and solopreneurs

Reviews of the Best Payroll Software

Now that you know what the market leaders are, let’s take a closer look at each one to help you find the one that ticks all the boxes for you.

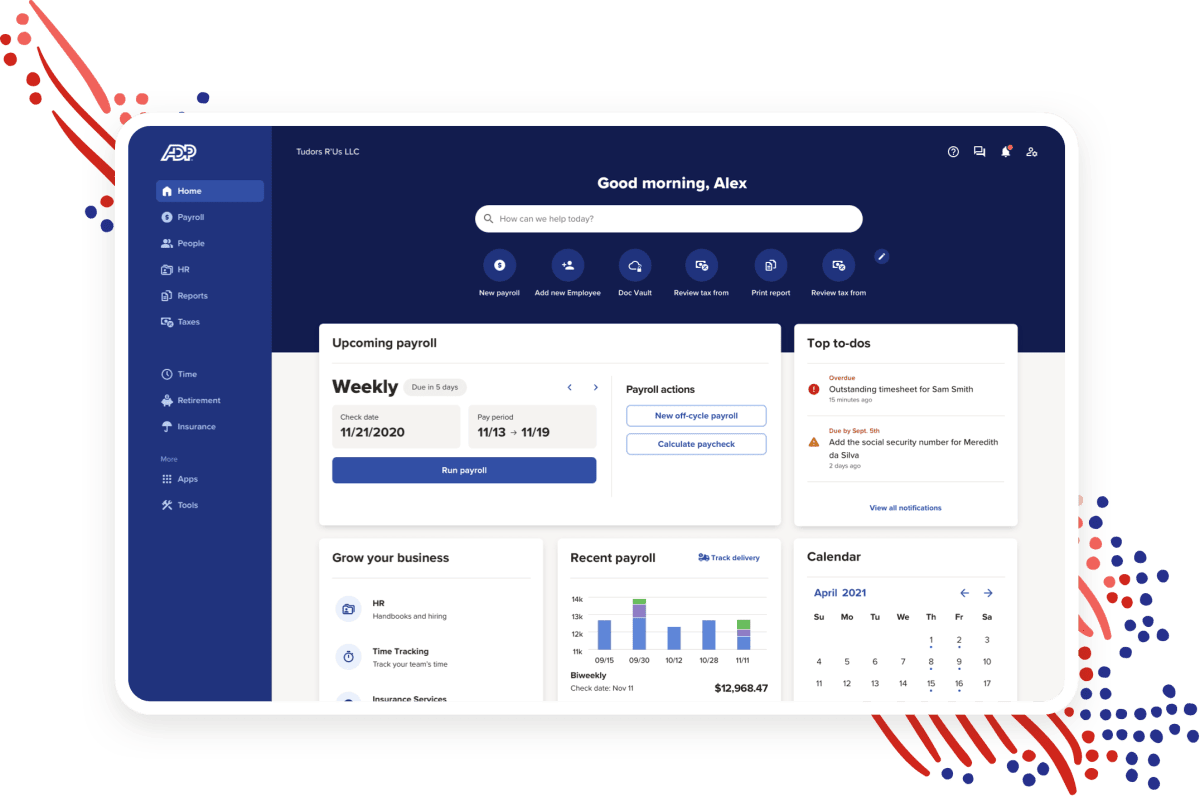

1. ADP Workforce – The Best All-Round Payroll System

ADP is one of the most popular payroll and HR platforms and is backed with more than 70 years of expertise. ADP offers nine payroll packages to cater to the needs of businesses of all sizes.

The most cost-effective option, Roll, starts at $29 plus $5 per employee per month and supports a self-service employee portal, payroll processing, direct deposit, and reporting.

The more costly plans come with advanced features and HR services. For example, ADP RUN service is an online payroll product best for smaller businesses. It has four plans to choose from: RUN Powered Essential, RUN Powered Enhance, RUN Powered Complete, and RUN Powered HR Pro.

ADP Workforce Now is best-suited for businesses of all sizes, and it particularly shines for large and fast-growing companies. ADP doesn’t publish pricing for all plans and options; you get your custom quote based on the number of employees and your business needs.

You can read our full ADP Workforce review by following this link.

Pros:

- A wide variety of payroll options to cover all needs

- Multiple HR add-ons that make integration a breeze

- Effective reports for any business need

- Excellent customer support

Cons:

- The wide feature set might be overkill from some small businesses

| Software | Our score | Pricing |

| ADP Workforce | ⭐⭐⭐⭐⭐ | Contact them for a custom quote |

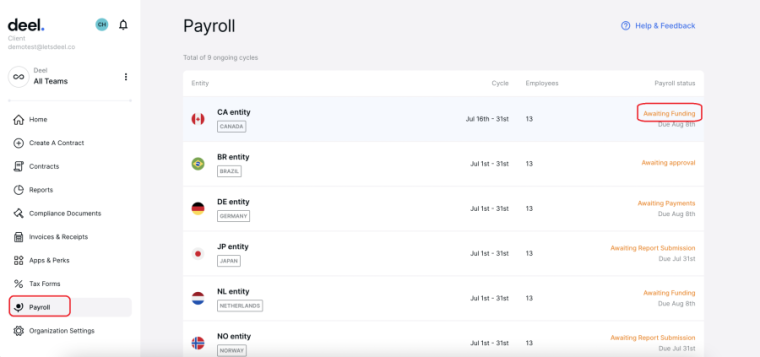

2. Deel — Best Global Payroll Solution for On-Time, Accurate Payments

Deel is a renowned name in the payroll and HR space, and for a good reason. It offers everything businesses need to streamline their payroll to ensure error-free and timely payments — particularly with respect to managing a remote, global workforce.

Working with a global team can make payroll and HR a nightmare. Deel simplifies it all by allowing you to easily create and manage contracts, onboarding, payroll, taxes, compliance, and even benefits — all tailored to where the employee is based. Need we say more?

So, with Deel, you can hire in 150+ countries without setting up entities and automate your payroll, contractor invoicing, and payslips to make managing a global workforce an absolute breeze. In fact, with this tool, you’ll have over 15 payment options to choose from.

Plus, freelancers and contractors will have over 7 withdrawal methods available to them — including cryptocurrency. Overall, the platform doesn’t just simplify all the tasks for your HR team, but also for the other employees on your payroll.

At a glance, your employees will see upcoming and a history of payments, their compliance documents, contracts, and more with ease. Of course, on the flip side, you’ll be able to see headcount, plus employee churn and costs.

Pros:

- Has in-house payroll experts

- Boasts built-in compliance

- Let’s you pay employees in 100+ countries

- Offers an intuitive interface and phenomenal automation

- It has impressive reviews and case studies

- Free version for companies with less than 200 employees

Cons:

- There’s no mobile app

| Software | Our score | Pricing |

| Deel | ⭐⭐⭐⭐⭐ | Starts free |

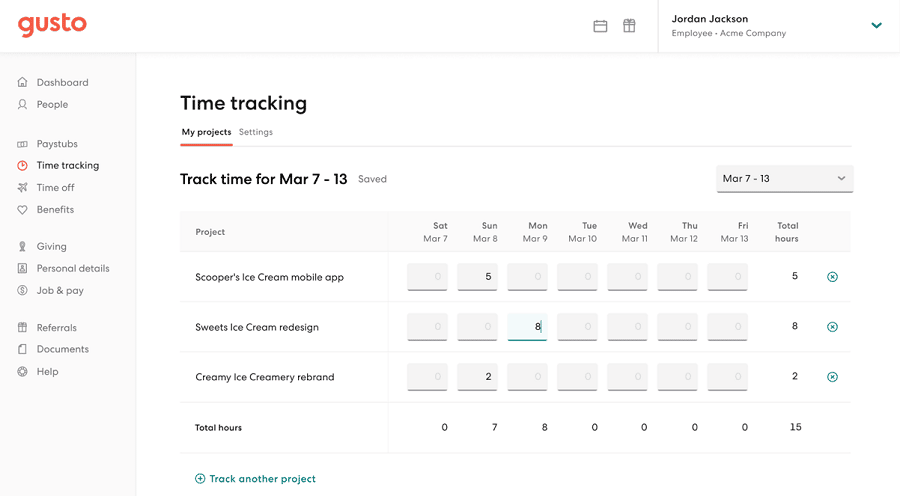

3. Gusto — The Best for Transparent Pricing and No Hidden Fees

Gusto is a integrated payroll and HR software solution. It offers two payroll plans (Simple and Plus) and an additional Premium plan offering greater customization. Each of them has full-service automated payroll that’s best for the needs of small to midsize companies.

It provides unlimited payroll runs, direct deposit or checks, time tracking, and accounting integrations. It also allows you to automate your payroll calendar, and it can automatically track and file local, state, and federal taxes.

Gusto is unique because it provides you with more convenient payroll solutions for each tier that you go up. For example, direct deposit will take up to four days on the basic plan and one day if you select the more expensive plan.

The pricing starts at $40 per month plus $6 per employee per month for the Simple plan. The Higher tiers provide advanced features, such as time management tools, HR assistance, and dedicated customer support.

You can read our full Gusto review by following this link.

Pros

Cons

| Software | Our score | Pricing |

| Gusto | ⭐⭐⭐⭐ | Starts at $46/m |

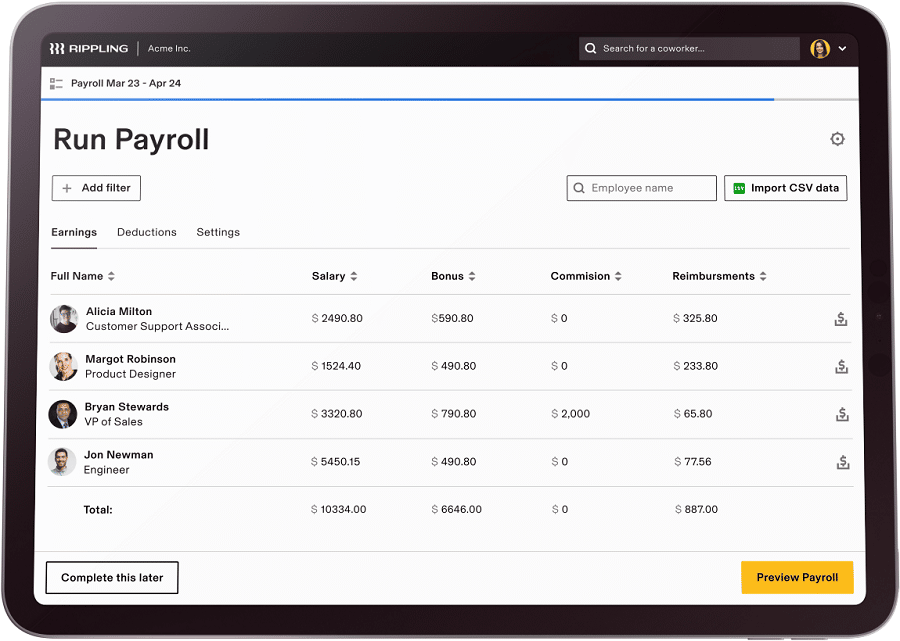

4. Rippling — Powerful Payroll/HR/IT Software That Helps You Scale Your Business

Run payroll in 90 seconds? Check. Pay employees and contractors worldwide? Check. Effortless integration between finance and HR that means everything is calculated automatically? Check.

Rippling’s smart, powerful and stylish platform is payroll for the 21st century — and that’s just the start.

Where Rippling really shines is the advanced features that make it far more than a mere payroll provider.

Like its learning management tool that helps you organize important sessions such as sexual harassment training, how it helps you track employee satisfaction through regular surveys, and intelligent analytics that can help you identify areas where your business could run more efficiently.

Check out the free demo now to see Rippling in action.

Pros

Cons

| Software | Our score | Pricing |

| Rippling | ⭐⭐⭐⭐ | N/A |

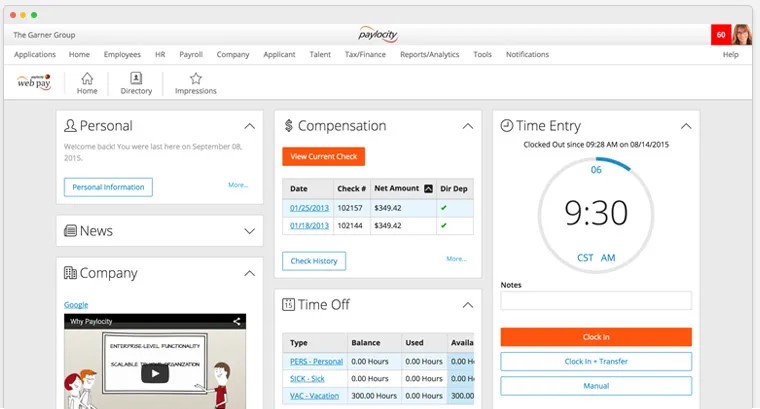

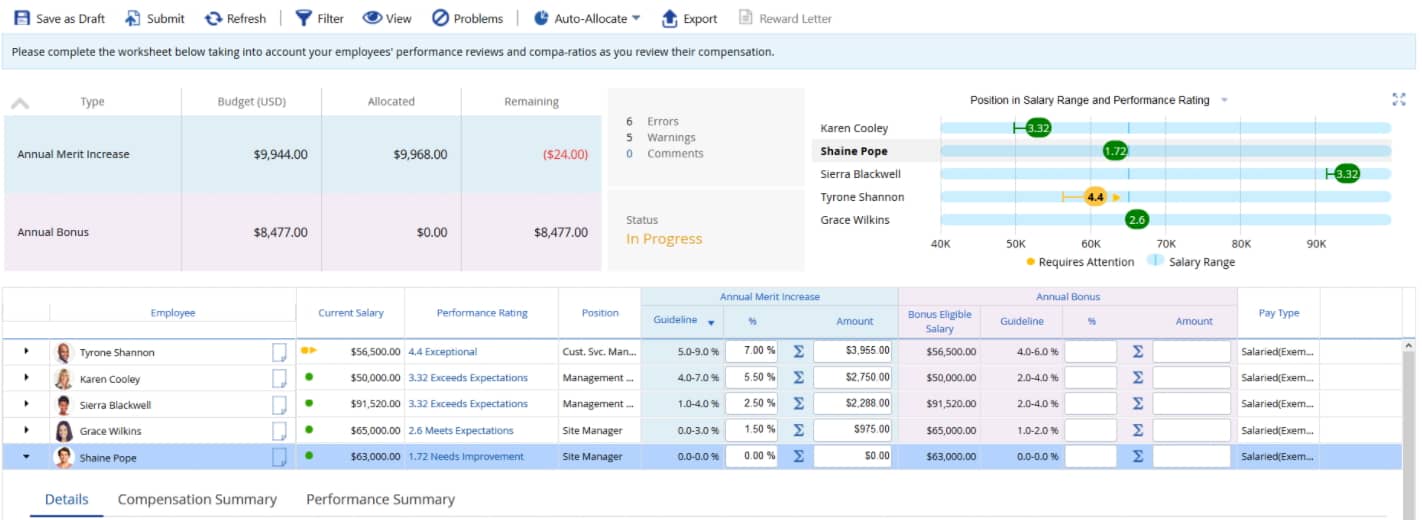

5. Paylocity – Perfect for Combining Your HR Software With Payroll

Paylocity is a web-based platform providing small business payroll and HR software. It also offers talent management, tax filing, and time and labor tracking.

Paylocity has a built-in app called QuickPay, where you can process payrolls quickly thanks to the onboarding templates. In addition, there is a self-service portal with advanced reporting tools. Your employees can sign up for deposits, and you can run reports to gain valuable insights.

The payroll software includes onboarding, scheduling, and learning management solutions. You have to enter your details to get a custom quote based on your business needs.

Pros

- Numerous integrations with other software tools

- Time-saving payroll features and less manual work

- Helpful self-service portal

- Opportunity to connect your hiring, benefits, and payroll all in one package

Cons

- Pricing can be a bit difficult to find

- Customer support is lacking in some places

| Software | Our score | Pricing |

| Paylocity | ⭐⭐⭐⭐ | Contact them for a custom quote |

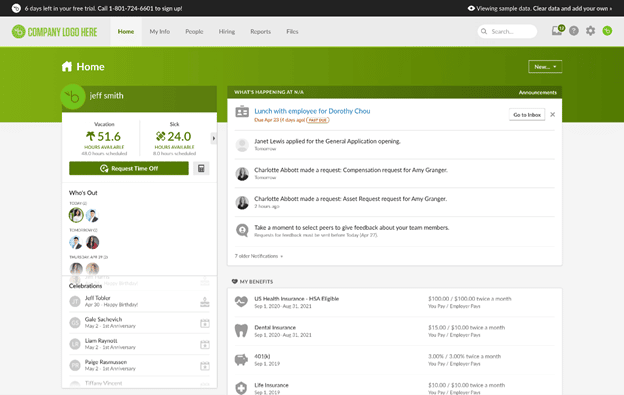

6. Dayforce – The Best Self-Service Platform for Your Employees

Also, organizations can hire talents, maintain HR records, track employee development, schedule staff with work-life balance process payments, and administer benefits.

Dayforce is best for small, medium, and large businesses. However, the platform does not reveal pricing on their website, and you have to ask for your quote.

You can read our full Dayforce review by following this link.

Pros

Cons

| Software | Our score | Pricing |

| Ceridian Dayforce | ⭐⭐⭐ | Contact them for a custom quote |

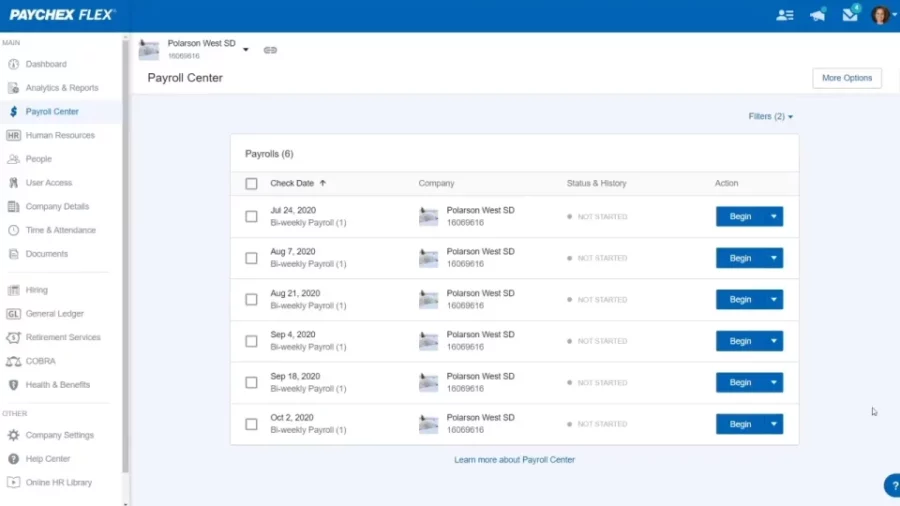

7. Paychex Flex – Unbeatable Custom Reports

Paychex Flex is a cloud-based payroll management and HR solution designed for businesses of all sizes. It’s particularly suitable for small business payroll and offers three tiers of service.

The Essentials plan is $39 per month and $5 per employee. However, the prices of the other two plans (Paychex Flex Select and Paychex Flex Pro) are available only after you ask for a custom quote.

For midsize businesses and enterprises, Paychex Flex offers three tiers: Paychex Flex Select, Pro, and Enterprise, with the pricing available upon getting a custom quote.

Paychex easily automates the submission of local payroll federal and state taxes and ensures compliance. In addition, you can integrate this payroll software with QuickBooks and Xero accounting software, attendance, time tracking, and HR software.

Also, it has more than 160 reports allowing you to get a clear picture of wages, turnover, and more. However, Paychex may have extra fees for software integrations, employee benefits administration, and payroll tax administration.

With all these expenses in mind, Paychex is best for companies that care more about built-in scalability. You can read our full Paychex Flex review by following this link.

Pros

- Excellent customer support

- You can create 160+ reports – a dream for the accountant in you

- Lots of options to manage your HR within the tool

Cons

- Extra fees for what should be “as-standard”

- The platform can feel a bit sluggish and dated

| Software | Our score | Pricing |

| Paychex Flex | ⭐⭐⭐⭐ | Starts at $39/m for 5 employees |

8. BambooHR – The Choice for You if You Need to Integrate Time Tracking

BambooHR is an all-in-one HR platform offering small and medium-sized businesses time tracking, payroll processing, employee engagement tools, and workforce data analytics.

The payroll software is designed to streamline the HR data collection, hiring, onboarding, and payroll compensation.

Using the BambooHR built-in applicant tracking system, you can track hiring assessments for every candidate, send notifications, and discuss hiring decisions with others. Also, BambooHR has a mobile application for mobile recruiting and hiring.

BambooHR pricing is based on the number of employees, and no pricing details are publicly available. You can read our full BambooHR review by following this link.

Pros

Cons

| Software | Our score | Pricing |

| BambooHR | ⭐⭐⭐ | Contact them for a quote |

9. Intuit Quickbooks – Perfect for Starting Small and Growing With You

Quickbooks is a web-based accounting software best for small and mid-sized businesses.

It helps companies in several areas such as payroll, tax management, expense tracking, financial reporting, invoice management, bookkeeping, and more. The QuickBooks intuitive interface and mobile app make running payroll easy for every user.

This payroll software offers four pricing plans starting at $12.50 per month, including invoice management and auto-generated tax reports. The Essentials plan is priced at $25 per month, and you can take advantage of more users, time tracking, and bill payments.

The pricing of the Plus plan is $40 per month, and it features inventory tracking and project profitability tracking. The Advanced plan is priced at $95 per month and features premium apps, on-demand training, batch invoices, and more, making it best for medium-sized businesses.

You can read our full Quickbooks review by following this link.

Pros

Cons

| Software | Our score | Pricing |

| Intuit Quickbooks | ⭐⭐⭐⭐ | Starts at $12.50/m |

10. Square Payroll – The Best Choice for Contractors and Solopreneurs

Square Payroll is payroll software designed to help small businesses pay employees online. It offers payroll process automation, automated tax filing, integration with employee management systems, accounting software, and more.

The automated file taxes include W-2 forms, federal and state taxes, and it allows employee benefits offerings and direct deposits.

In addition, square Payroll has a mobile app to provide users with on-the-go payroll management. It also allows you to track employees’ compensation, ensuring payroll compliance.

Square Payroll pricing starts at $5 per person paid per month, including unlimited pay runs. The expensive plan is priced at $35 subscription per month + $5 per employee or contractor paid month.

It features multi-state payroll, live support for account setup, timecards, employee app, and more. You can read our full Square Payroll review by following this link.

Pros

Cons

| Software | Our score | Pricing |

| Square Payroll | ⭐⭐⭐⭐ | Starts at $5/m per person |

What is Payroll Software?

Payday is the favorite day of the month! Not for the payroll administrator, however. If you’re also carrying the burden of performing endless payroll chores while striving to meet tight deadlines and avoid non-compliance, perhaps it’s time you considered ways to reduce administrative headaches by adopting a payroll software solution.

The software is usually a cloud-based technology, but sometimes a desktop or on-premises technology, designed to manage, maintain, and automate payments to employees, contractors, and freelancers.

Such applications streamline tax filing and reporting. A payroll solution provides accurate and cost-effective execution of tasks like:

- Keeping track of working hours

- Calculating employee wages

- Tracking employee attendance

- Calculating and withholding payroll taxes and deductions

- Creating tax forms

- Producing and delivering checks

- Completing direct deposits

- Calculating and paying benefits and compensations

- Paying premiums to insurance carriers

- Submitting employment taxes

- Generating reports

Implementing a full-fledged and integrated payroll system can help businesses of all sizes ensure tax compliance and allows for local and state tax regulations. Reliable payroll software provides essential automation for streamlining internal audits and tax processing.

It enables payroll administrators and auditors to identify any potential inconsistencies and helps you reduce risks of non-compliance.

Types of Payroll Software

The different types of payroll software that are currently available can be considered in two categories: online systems operating over the Internet and in-house payroll software installed on your computer.

Online or Cloud-Based Payroll Software

This is a web-based application that performs payroll processing using the Internet. An online system offers location and time flexibility of running payroll, provided an Internet connection is available.

With an online or cloud-based system, your data is stored remotely, either on your software provider’s server or in the cloud. You can easily access it from different locations through a secure login.

Using an online system, you can perform extensive payroll functions, including calculating payroll, printing checks, generating reports, and keeping up with tax regulations. Also, online payroll companies offer payroll tax filing and payment so that you can invest your time in revenue-generating activities.

Cloud-based solutions offer a wide range of benefits, such as cost-effectiveness and scalability, multiple access on different devices, employee self-service, ensuring compliance and security, and avoiding running behind schedules and deadlines.

In-House Payroll for Small Businesses

You may think that payroll is an easier task when it comes to small businesses. However, even with a limited number of employees, manually doing payroll is a considerable challenge.

A National Small Business Association survey reports that 20% of small business owners spend more than six hours monthly dealing with payroll taxes only.

In-house payroll systems are a viable option for small businesses. In-house payroll software is a standalone solution installed on your premises and is run by an in-house person.

However, a simple platform, which concentrates your payroll processing on just one computer, may have limited functionalities. So, you may need to combine it with manual operations or use other solutions or integrations.

While such solutions offer simplicity and ease of operation, there are some disadvantages you need to be aware of. You’re responsible for keeping up your in-house payroll with any changes in tax and labor laws.

The in-house software is more vulnerable to error and security issues than the cloud-based option and doesn’t allow for multiple access.

How Does Payroll Software Work?

Although every payroll service provider is dedicated to delivering a unique experience, all solutions we considered above ensure a user-friendly interface and follow similar structures.

The onboarding process and setting the system up is the most time-consuming and detail-focused stage of adopting automated payroll management. It requires detailed records of each employee’s payroll data and bank accounts, along with your company’s banking details.

After you’ve provided all the necessary information and settings, you can easily follow your payment calendar. Many providers offer payroll processing automation, such as calculating and automatically filing and paying your local, state, and federal taxes.

Also, your employees can automatically receive their W2s and 1099s tax forms at the end of the year. Payroll software offers additional features like benefits administration supporting your workforce while streamlining your HR operations.

All platforms discussed here have a built-in time-tracking feature that can easily integrate with your payroll. This will help eliminate tedious manual working hour calculations, entering and reentering, prone to human error.

Besides, linking your payroll with time-tracking software is a way to ensure regulatory compliance and defense against potential groundless wage and hour claims. Payroll systems can also readily integrate with expense management, accounting, and other business applications you may be using.

Which Type of Payroll Software is Right for You?

Your payroll software should be the right fit for your business – it should never be the other way around.

Choosing the right software will depend on lots of factors, such as the size of business that you run, and whether you need your software to look after payroll only, or to integrate with your other business functions.

Here’s a list of the top things you should consider when finding the type of payroll software that’s right for you:

- Whether the software is specifically designed for your company size. In our list, you’ll find plenty of software options that cater to both SMEs and large, enterprise clients alike. Some software can even scale with you as you grow. Our advice: choose the software that’s right for your size right now – there’s no point in “future-proofing”

- Customer support that’s available in your business hours. Double-check when the software provider offers support (and whether that’s on the phone, email, ticketing system, or social media). At some point, you’re guaranteed to come across a serious problem with your payroll software – you don’t want to be fighting fires with a 5 hour time difference between you.

- Pricing that you can make sense of. Don’t be afraid to share what you’re comfortable with paying for your payroll tool. A lot of the options out there have confusing pricing structures, based on number of features used, number of employees etc. If in doubt – ask the software provider directly, and stick to your budget.

- Go for a cloud-based solution. One of the major benefits of choosing a software provider from our list is that your payroll isn’t dependent on one person anymore, and they’re old, dusty laptop that hasn’t been replaced for years. Get a cloud-based solution with multiple seats, so that your team can login and access your payroll in case someone is absent.

- Make sure the software provides tax-compliant reports. One of the major time savings with payroll software is the ability to generate and deposit tax reports directly. You’ll want to make use of this feature – so take some time in making sure that the report the software generates is compliant

Can You Do Payroll Yourself?

Employee and contractor payroll management is one of the trickiest and scariest aspects of business accounting. You can outsource payroll processing with an external accountant or payroll company hired to perform all payroll tasks and ensure regulatory compliance.

This hands-off approach will free you from chores and liabilities for non-compliance but will impose significant recurring costs. If you want to retain control over your company payroll management and avoid extra expenses, you can do the payroll yourself. You have two options:

- Manual payroll processing means that you use spreadsheets and determine tax withholdings and other deductions with online payroll calculators. Due to the different salaries and tax withholding options, manual payroll processing can be confusing and vulnerable to human error. In addition, you have to constantly follow any changes in regulations and taxes to avoid non-compliance. Manually managing employees’ payments requires maintaining a paper trail as evidence in case of an audit. Although it doesn’t involve extra spending, this is a time-consuming and demanding burden introducing a risk of costly errors and complications.

- Software solutions free you and your team from the most laborious aspects of handling payroll while letting you control the process. A robust payroll system stays updated on legal requirements and automates the calculation of earnings and deductions, real-time reviewing payroll, filing payroll tax, and delivering tax forms. Implementing payroll software is a little more costly than manual operations, but the reduced risk of human error and time savings will compensate for the spending.

How Much Does Payroll Software Cost?

Payroll services pricing consists of two elements: the monthly base fee and the monthly per-employee fee. Note that the cost is determined by the services you opt for. A more cost-effective plan for small businesses that require simple payroll processing will be a better option.

However, larger and more complex operations organizations will need payroll services offering full functionalities to deal with benefits, commissions, and multi-state tax regulations.

So, if your company has fifteen workers, and you select the Paychex Flex Essentials plan that works great for small business payroll, the total amount you’ll have to pay will be $114 per month – a base fee of $39 and $5 per employee.

If you’re running a larger business with 70 employees and select the Gusto Concierge plan, then your monthly cost will come to $920 – a base fee of $80 and $12 per employee. To extend the capabilities of your plan, payroll software providers may offer additional integrations and services.

However, keep in mind that each add-on means an extra monthly fee added to your regular costs, and switching to another plan that includes them can turn out to be a more cost-effective strategy.

Does the cost of utilizing a payroll solution seem too high? Just think of the severe payroll penalties and the time wasted in payroll chores.

Conclusion: What is the Best Payroll Software in 2025

To sum up, choosing the best payroll software for your needs is an important decision that may have a long-term impact on how efficiently you run your business. It’s not uncommon to switch software as you grow, but ideally you’d want to keep some continuity in your tool choice.

Based on our analysis, ADP Workforce Now is the best platform for most of our readers. This award-winning software has a brilliant user interface, a full suite of features and integrations, and is just as suitable for a small business as it is for a large enterprise.

Bottom Line

Manually doing payroll means opening space for costly errors and numerous working hours spent entering, reentering, calculating, and tracking down information. Dedicated software solutions help streamline your accounting, minimize the risk of non-compliance, and save valuable time. All you need to do is go through the best payroll services we’ve discussed, consider their offerings, and select the one that will work best for your business.

Payroll Software FAQs

What is payroll software?

How does payroll software work?

Can you do payroll yourself?

How much does payroll software cost?

Sources:

- Small business cash flow: The State of Payroll 2020 – Quickbooks

- IRS Databook 2020

- 2018 Small Business Taxation Survey – NSBA