In order to buy and sell digital currencies online in New Zealand – you will need to have an account with a crypto exchange.

In this guide, we compare the overall best NZ crypto exchanges in the market today. We focus on a variety of important factors in our reviews – covering everything from regulation, deposit methods, and commissions to trading tools, supported coins, and customer service.

The Best NZ Crypto Exchanges for 2025

After researching the market extensively, we found that the overall best NZ crypto exchanges to buy Bitcoin in 2025 are those listed below:

- Crypto.com – Overall Best NZ Crypto Exchange

- Capital.com – Best Platform to Trade Leveraged Crypto Markets

- Coinbase – Top Crypto Exchange for Beginners

- Binance – Popular Crypto Exchange With Over 600+ Supported Coins

- Swyftx – Trade 320+ Cryptos With Free NZD Deposit

- Easy Crypto – NZ Crypto Exchange With Recurring Investments

- Coinspot – User-Friendly Crypto Exchange Operational Since 2013

No two crypto exchanges are the same in NZ, so read on to find the best platform for your experience level and trading goals.

The Top Bitcoin Exchanges NZ Reviewed

Finding the best NZ crypto exchange for you is an important task.

Not only do you need to select an exchange that is suitable for your skillset and budget, but the crypto exchange should support your preferred payment method. And, don’t forget to assess the fee structure of your chosen NZ exchange too.

Below, you will find reviews of the best New Zealand crypto exchanges to consider for your trading goals.

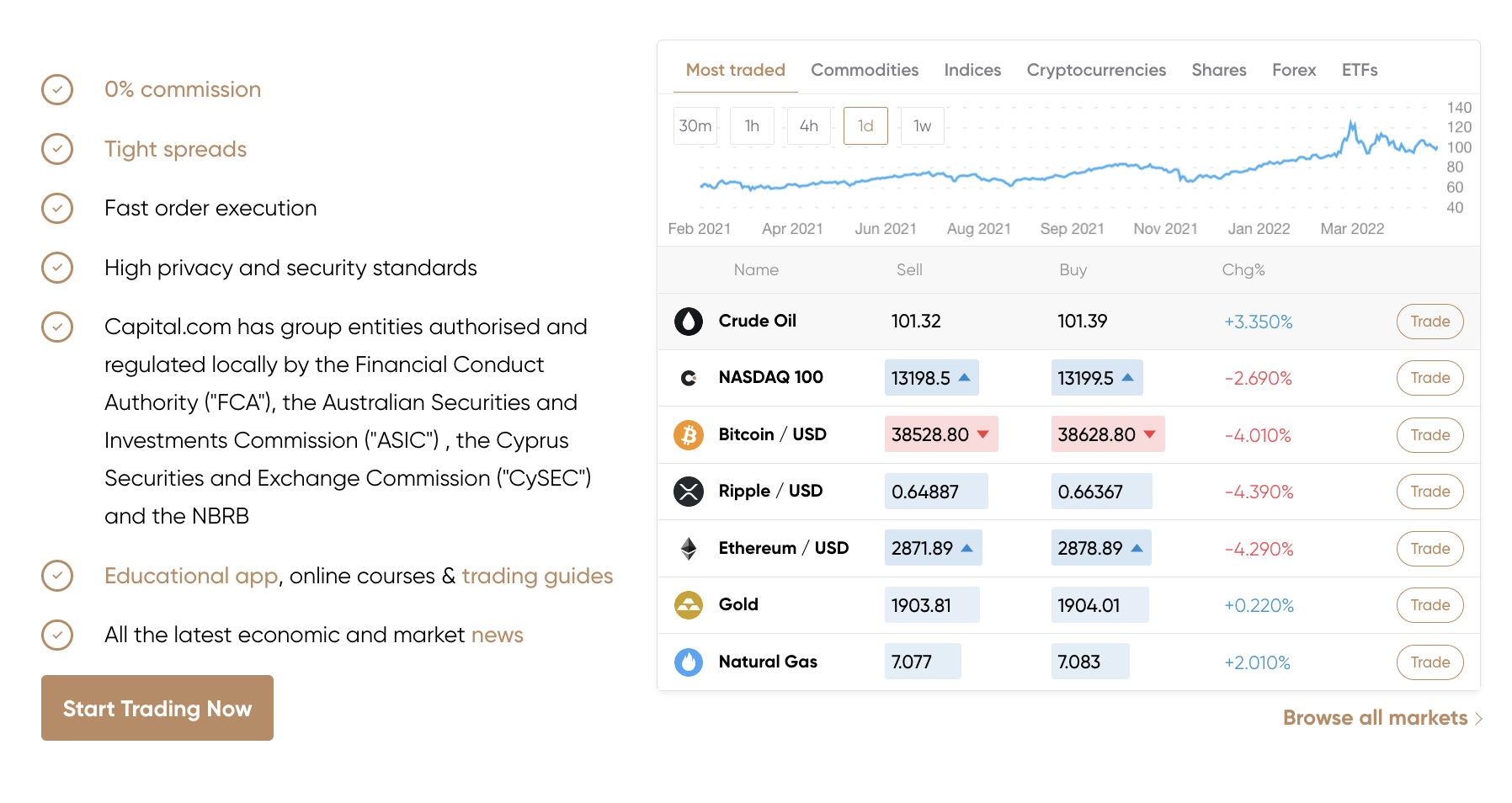

1. Crypto.com – Overall Best NZ Crypto Exchange

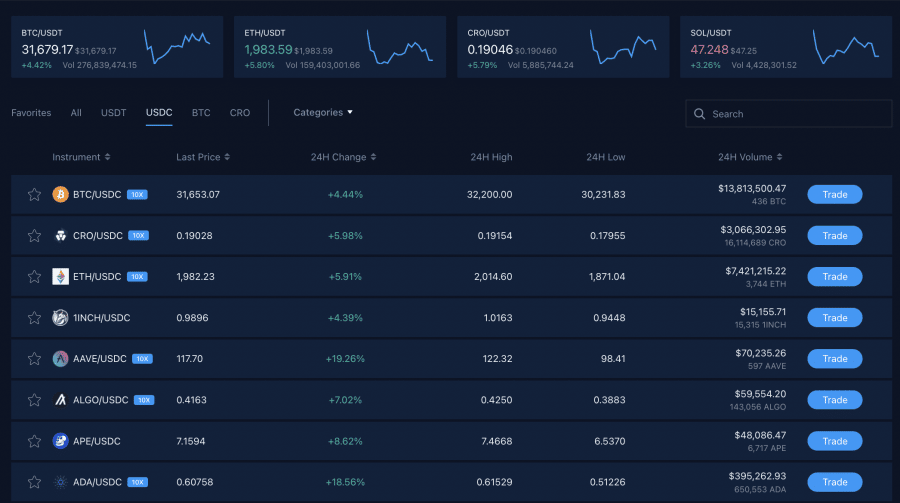

The overall best NZ crypto exchange to consider today is Crypto.com. We should note that Crypto.com is more than just an exchange. After all, this top-rated platform offers everything from crypto loans and interest accounts to an NFT marketplace and even a Visa-backed debit card.

As such, Crypto.com offers an all-in-one digital asset ecosystem. Back to its exchange, Crypto.com offers some of the lowest fees in the industry. The platform operates a market maker-taker model and the most you will pay to trade here is 0.40% per slide.

As you begin to trade larger amounts throughout the month, this fee will be reduced. In terms of getting funds into your Crypto.com account, the easiest option is to use your Visa or MasterCard. Both debit and credit cards are supported for this purpose and you will be charged a reasonable fee of 2.99%.

Most traders will opt to use the Crypto.com app for iOS and Android. This gives you access to all features available on the main Crypto.com website but in a comprised and fully-optimized way. When it comes to supported markets – this is where Crypto.com really stands out. Put simply, this exchange gives you access to no less than 250+ coins.

More coins are added to the Crypto.com platform on a regular basis to meet client demand. Once you have made an investment into your chosen coin, you might decide to deposit the funds into a Crypto.com savings account. This will allow you to generate interest on your digital assets – with stablecoins paying 10% and cryptocurrencies up to 14.5%.

The highest rates are offered when you opt for a 3-month savings account, albeit, 1-month and even flexible terms are available too. You can also earn a higher yield by buying and staking CRO tokens. This token backs the Crypto.com exchange and it is now a top-10 digital currency for market capitalization.

Another feature that you might like at Crypto.com is its NFT marketplace. As a buyer, you will not pay any fees to buy NFTs here and there are thousands of collections to choose from. If you need to raise funds but you don’t want to sell your digital assets, Crypto.com also offers instant crypto loans with a maximum LTV of 50%.

Finally, and perhaps most importantly, Crypto.com is a safe exchange that is adequately regulated. The majority of coins that it holds for clients are kept in cold storage. This means that they remain offline and away from the threat of remote hackers. The platform also offers two-factor authentication for added security.

| Number of Cryptocurrencies | 250+ |

| Debit Card Fee | 2.99% |

| Fee to Buy Bitcoin | Up to 0.40% commission |

| Minimum Deposit | $20 |

Features:

Cryptoassets are a highly volatile unregulated investment product.

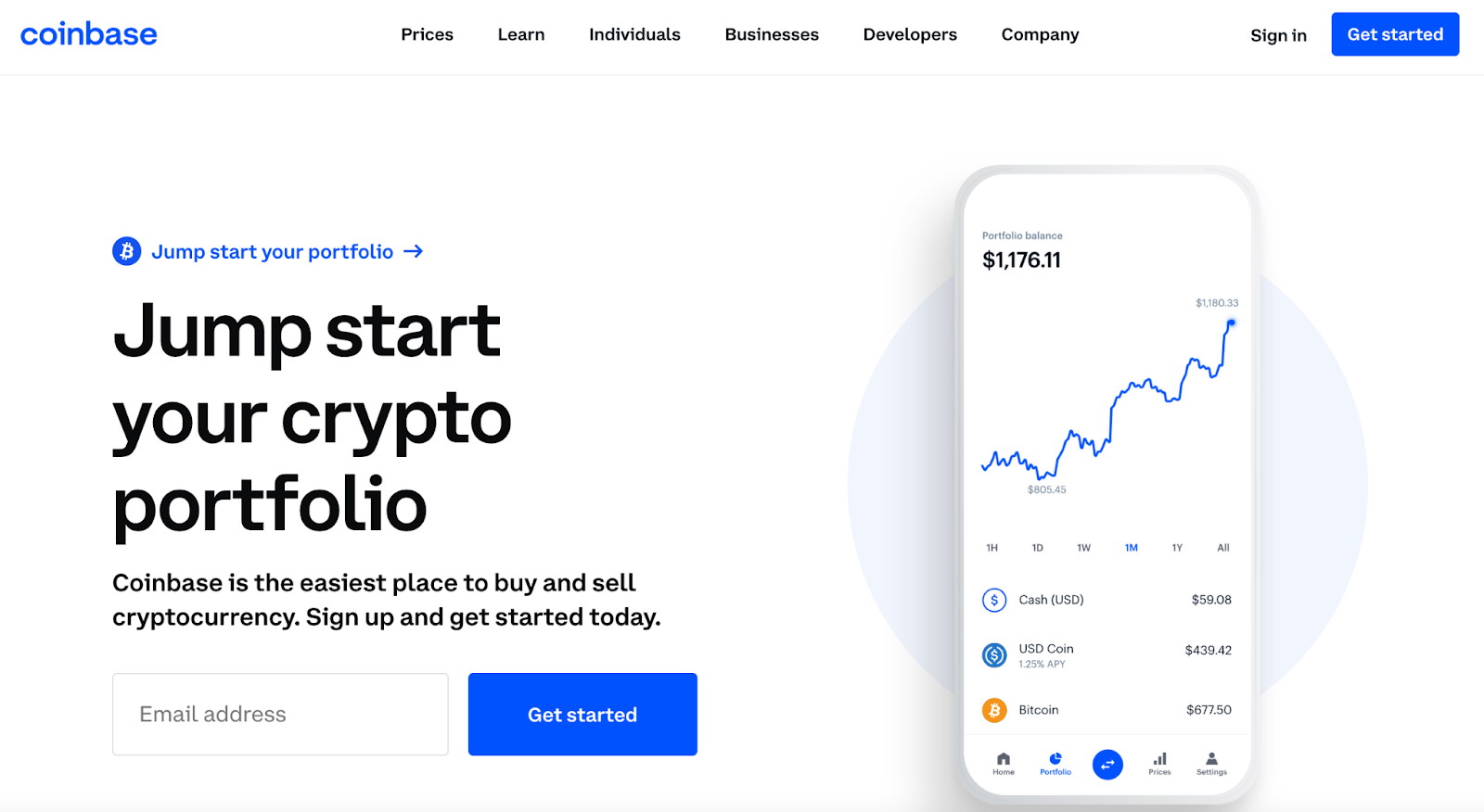

2. Capital.com – Best Platform to Trade Leveraged Crypto Markets

If you’re a short-term trader that is looking to buy and sell crypto with advanced tools – Capital.com is well worth considering. First and foremost, Capital.com is a CFD trading platform – which means that you can speculate on the future value of a crypto pair without owning any coins.

And therefore, as the underlying asset does not exist, you do not need to worry about wallets, storage, or private keys. Plus, all supported markets on the Capital.com platform can be traded at 0% commission alongside competitive spreads. In total, the platform offers 470+ crypto markets – which covers tokens of all shapes and sizes.

This includes both crypto-cross (e.g. ETH/BTC) and crypto-to-fiat (e.g. BTC/NZD) pairs. As a CFD platform, Capital.com allows you to go long or short on your chosen crypto market. This gives you a superb opportunity to attempt to profit from both rising and falling markets. This is especially the case in 2022 – where crypto prices continue to fall.

In addition to offering a huge number of markets and low trading fees, we also like Capital.com for its offering of leverage. This allows you to trade with more than you have in your account. In most cases, you will be offered a maximum of 1:2 – which means that for every $100 staked, you can trade with $200.

Outside of its cryptocurrency department, Capital.com offers thousands of other trading markets. This covers indices, ETFs, stocks, commodities, and forex. We also like that Capital.com offers a fully-optimized mobile app for iOS and Android. This links to your main Capital.com account and will give you the option of trading crypto no matter where you are located.

Capital.com also offers educational tools – which can be great for learning the ropes of how the crypto markets work. Alongside this, you will also have access to a free demo trading account that mirrors live market conditions. This will enable you to trade crypto without risking any money and thus – you can practice new strategies.

When it comes to safety, Capital.com is a heavily regulated CFD platform. It is authorized and licensed by ASIC, FCA, CySEC, and NBRB. You will only need to deposit $20 to get started with an account if choosing a debit/credit card or e-wallet as your preferred payment method. Bank wires require a minimum of $250. Either way, no deposit fees are charged by Capital.com.

| Number of Cryptos | 470+ markets |

| Debit Card Fee | No fee |

| Fee to Trade Bitcoin | Commission-free |

| Minimum Deposit | $20 on debit/credit cards and e-wallets and $250 on bank wires |

Features

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and can afford the risks.

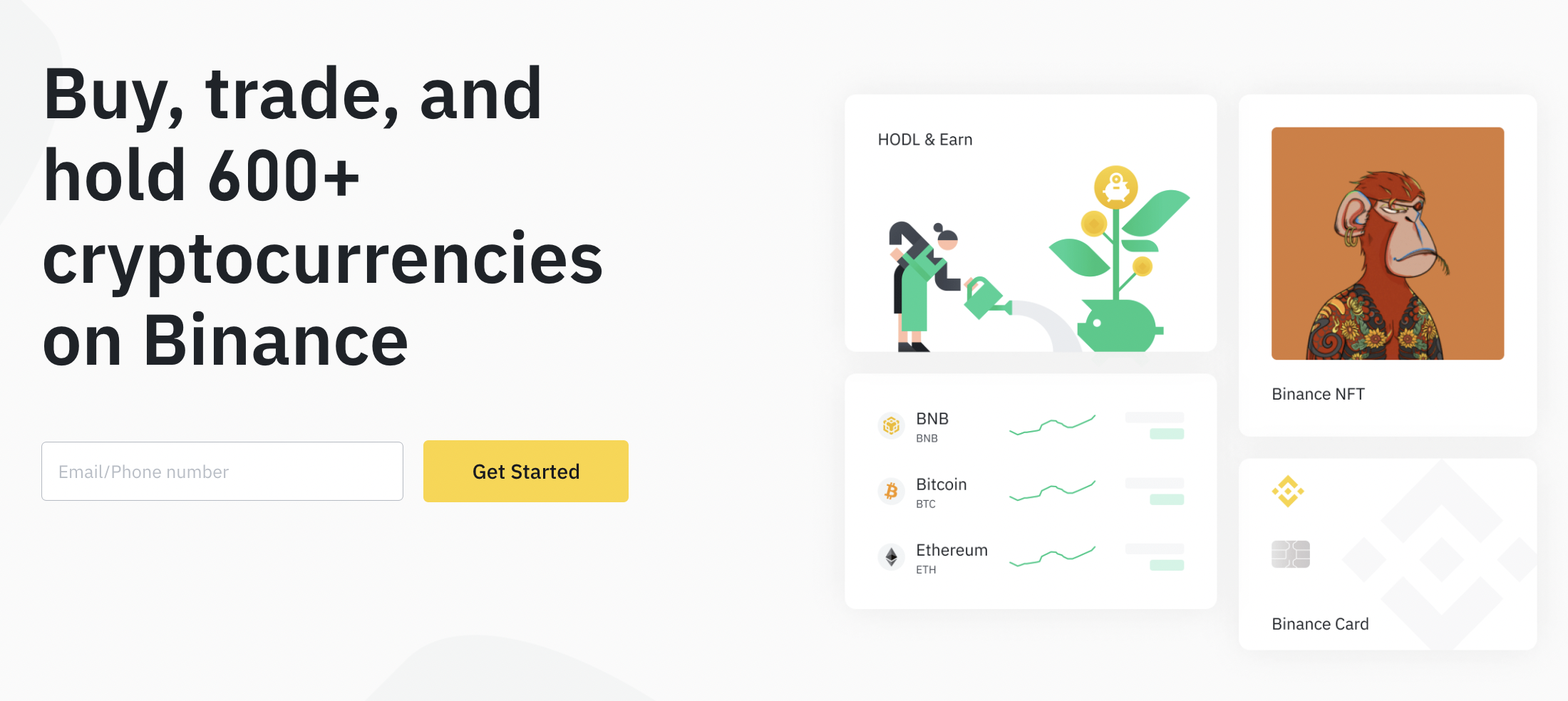

3. Coinbase – Top Crypto Exchange for Beginners

Everything is laid out clearly and the account registration process simply requires some personal information and a copy of your ID. You can then buy crypto instantly with a Visa or MasterCard. This will cost you 3.99% in fees – which is more expensive than Crypto.com. You will, however, have over 150 different digital currencies to choose from.

In addition to offering a simple and burden-free way of trading crypto, Coinbase offers a top-rated wallet app. You can download the Coinbase app to your iOS or Android device and then link it to your main account. This will then give you the option of trading crypto on the move at the click of a button. For more information on the best crypto wallets in New Zealand you can read our in-depth guide.

Take note, however, that Coinbase charges a standard trading fee of 1.49% per slide. This means that for every $1,000 that you buy or sell, you will be charged $14.90.In comparison, Crypto.com charges just 0.40% per slide. Nonetheless, we like that Coinbase is expanded into other products and services to offer a comprehensive user experience.

For example, Coinbase recently launched its much-anticipated NFT marketplace. This will give you access to some of the hottest NFT collections in the space and you can pay for your chosen project with a debit/credit card. Coinbase also offers staking services across six different tokens – which will enable you to generate a passive income yield.

With all that being said, Coinbase’s biggest strength is perhaps its industry-leading security practices. Not only is the exchange heavily regulated in the US and now a public company listed on the NASDAQ, but it keeps 98% of client funds in cold, multi-sig wallets. All Coinbase users are required to set up two-factor authentication too.

| Number of Cryptos | 60+ |

| Debit Card Fee | 3.99% |

| Fee to Buy Bitcoin | 1.49% standard commission |

| Minimum Deposit | $50 is recommended by the exchange |

Features

Cryptoassets are a highly volatile unregulated investment product.

4. Binance – Popular Crypto Exchange With Over 600 Supported Coins

And, the most you will pay to trade at Binance is a mere 0.10% per slide. Binance operates a market maker-taker model, so you will be offered even lower commissions as you begin to increase your trading volumes. If you’re interested in buying and staking BNB – which is native to Binance, you will receive a further discount of 25% on your trading commissions.

In addition to its large digital asset suite and low fees, Binance also stands out for its high-level trading tools. This is inclusive of leveraged tokens and crypto derivatives, alongside real-time pricing charts and even technical indicators. You can also access TradingView directly from the Binance website.

In a similar nature to Crypto.com, Binance offers a wide variety of DeFi tools that allow you to generate income on your digital currency investments. For instance, you can deposit your tokens into a Binance savings account on a flexible or lock-up period and earn interest. This includes a headline rate of 5% on Bitcoin, albeit, this is capped to 0.01 BTC.

If you need access to liquidity and you want to avoid cashing out your tokens, Binance offers instant loans too. You can also engage in crypto staking and yield farming. Should you wish to trade crypto on the move, the Binance app has been fully optimized for both iOS and Android devices.

You also have plenty of options when it comes to storing your crypto tokens. The Binance web and mobile wallets are custodial -which means the exchange will safeguard your tokens on your behalf. If you would prefer to have full control over your private keys, the Trust Wallet app – which is backed by Binance, might be of interest.

| Number of Cryptos | 600+ |

| Debit Card Fee | Depends on the payment processor |

| Fee to Trade Bitcoin | 0.1% standard commission |

| Minimum Deposit | Varies depending on the payment type |

Features

Cryptoassets are a highly volatile unregulated investment product.

5. Swyftx – Trade 320 Cryptos With Free NZD Deposit

Swyftx is a popular exchange that serves Australia and New Zealand clients. By opening an account with this exchange, you will be able to buy and sell over 320 different digital assets. Swyftx continuously adds new markets to keep up with customer demand.

When it comes to fees, you can deposit NZ dollars without being charged. Supported payment methods include debit/credit cards, POLi, and local bank transfers. The minimum deposit stands at just $10. Trading commissions are competitive too at just 0.6% per slide and spreads start at 0.41%.

Swyftx also offers an earning tool that allows you to generate interest on your idle crypto tokens. Stablecoins average an APY of 5-7%, albeit, the likes of Axie Infinity are yielding over 100% as of writing. If you’re a complete beginner, Swyftx also offers an educational facility that aims to teach you the ins and outs of crypto and blockchain technology.

| Number of Cryptos | 320+ |

| Debit Card Fee | No Fee |

| Fee to Trade Bitcoin | 0.6% |

| Minimum Deposit | $10 |

Features

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

6. Easy Crypto – NZ Crypto Exchange With Recurring Investments

Easy Crypto is an NZ-based crypto exchange that is now used by over 100k customers. The platform offers a user-friendly website that has been designed with beginners in mind. A popular feature offered by Easy Crypto is its recurring investment tool.

This allows you to automatically buy your chosen cryptocurrency on a set day of the week or month. And as such, you will be able to dollar-cost average your investments. However, perhaps the main drawback with Easy Crypto is that it does not have a fixed pricing structure.

Instead, the only way to find out what fees you paying is to set up an order. We typically suggest avoiding crypto exchanges that are not transparent on fees and commissions. Moreover, Easy Crypto continuously uses the term ‘100% guarantee’ when discussing the safety of its platform without providing any solid evidence of how it intends to honor this commitment.

| Number of Cryptos | 160+ |

| Debit Card Fee | Not supported |

| Fee to Trade Bitcoin | Not specified – only revealed when you set up an order |

| Minimum Deposit | Not stated |

Features

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

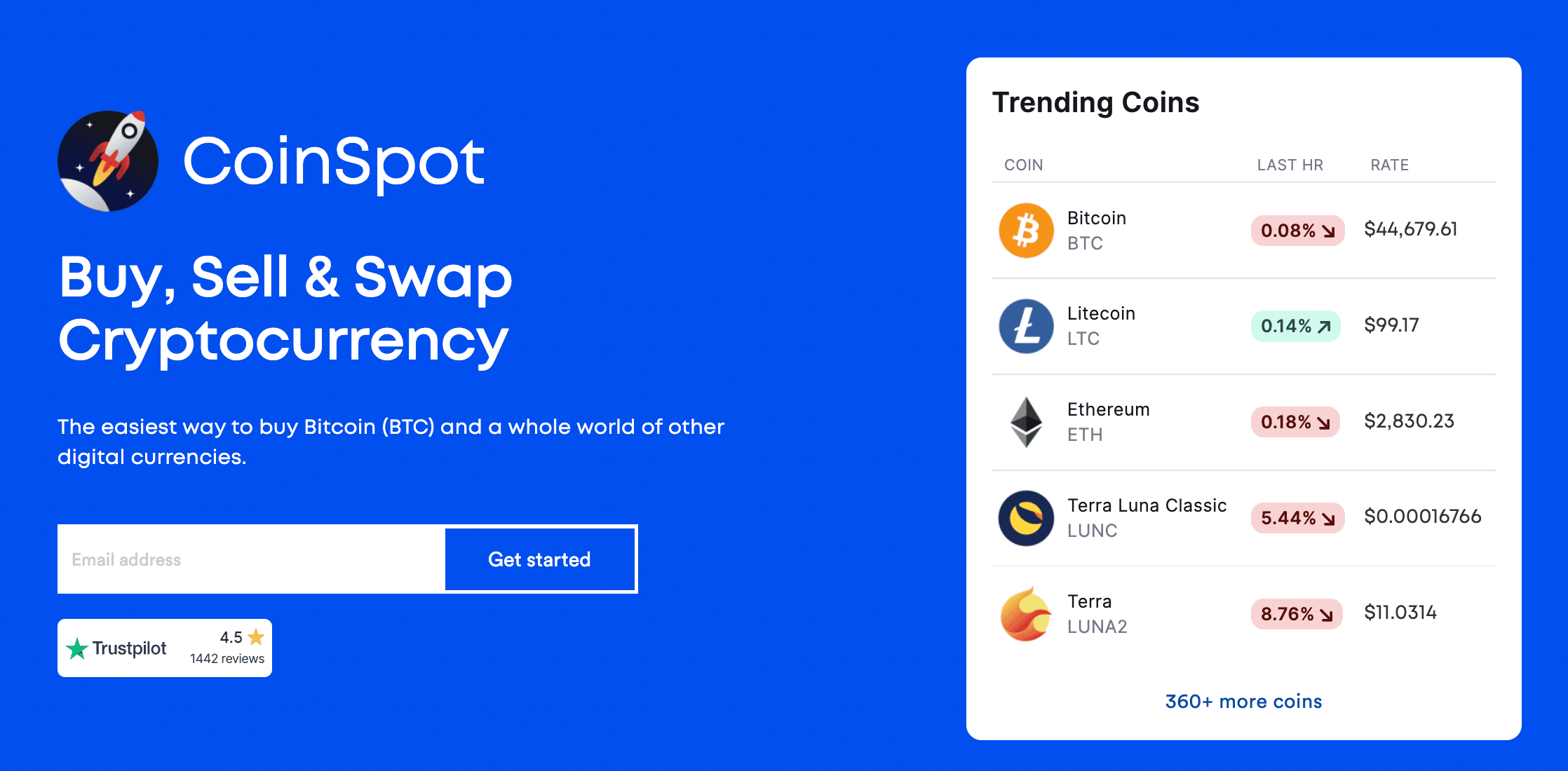

7. CoinSpot – User-Friendly Crypto Exchange Operational Since 2013

CoinSpot is a popular crypto exchange based in Australia, albeit, it serves NZ clients too. The platform was first launched in 2013, which makes it one of the most established crypto exchanges in this space. CoinSpot now boasts a customer base of over 2 million clients.

In total, you will have access to over 360+ cryptocurrencies on this platform, so you can easily create a highly diversified portfolio. It takes just minutes to open an account and you can deposit funds via PayID, POLi, or a bank transfer. In terms of fees, you will pay an instant buy and sell commission of 1%.

However, when placing a market order on the CoinSpot exchange, this commission is reduced to just 0.10%. You do, however, need to be careful when placing market orders – as if there isn’t enough liquidity, you might find that you are entering the market at an unfavorable price. CoinSpot also offers recurring buys, which is great for dollar-cost averaging your investments.

| Number of Cryptos | 360+ |

| Debit Card Fee | Not supported |

| Fee to Trade Bitcoin | 1% instant buy order, 0.10% market orders |

| Minimum Deposit | $1 |

Features

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

The Best Cryptocurrency Exchanges NZ Compared

For an overview of the best NZ crypto exchanges that we reviewed above – check out the comparison table below:

| Crypto Exchange | Number of Coins | Fee for Buying Bitcoin | Debit Card Fee |

| Crypto.com | 250+ | Up to 0.40% per slide | 2.99% |

| Capital.com | 470+ | Commission-free | No fee |

| Coinbase | 150+ | 1.49% standard commission | 3.99% |

| Binance | 600+ | Up to 0.10% per slide |

Depends on the payment provider

|

| Swyftx | 320+ | 0.6% per slide | No fee |

| Easy Crypto | 160+ | Not specified – only revealed when you set up an order | Not supported |

| Coinspot | 360+ | 1% instant buy order, 0.10% market orders | Not supported |

How do NZ Cryptocurrency Exchanges Work?

In a nutshell, cryptocurrency exchanges in NZ allow you to buy, sell, and trade digital assets like Bitcoin and Ethereum. The exchange will sit between you and other market participants.

- For instance, let’s suppose that you are looking to buy $500 worth of Bitcoin from an NZ crypto exchange.

- In order for this trade to go through, somebody on the same exchange would need to be willing to sell $500 worth of Bitcoin.

- When the exchange is matched, then funds will be deposited from your account and the Bitcoin will subsequently be added to your portfolio.

For matching you with another trader, your chosen crypto exchange will charge a commission. For instance, at Crypto.com, you will pay just 0.40% – which amounts to just 40 cents for every $100 that you trade. In comparison, Coinbase charges 1.49%. This means that for the same position, you would pay $1.49.

The best crypto exchanges in this space will offer support for NZD deposits. This will often cover the likes of a debit/credit card, POLi, and local bank transfers. Be sure to check out what fees apply, as some crypto exchanges in NZ charge handsomely on fiat currency payments.

Although the buying and selling of digital assets is the primary service facilitated, the best crypto exchanges in NZ offer additional products. For instance, Crypto.com allows you to earn interest on your digital asset investments and even take out an instant loan. Capital.com offers CFD services – so you can trade crypto with leverage and even engage in short-selling.

How to Choose the Best NZ Crypto Exchange for You

From trying your luck with the best Bitcoin casinos in New Zealand to the top crypto exchanges making the right decisions requires market research. With so many providers operating in this space, choosing the best Bitcoin exchange in NZ for your requirements can be a cumbersome task.

To ensure that you select the right platform, consider the factors discussed below.

Regulation

Regulation is without a doubt the most important factor to consider when selecting the best NZ crypto exchange for you. Don’t forget – in 2019, NZ-based exchange Cryptopia was hacked for $25 million worth of client digital assets.

As a result, virtually all customers lost their hard-earned funds. This is one of the main reasons why we like Crypto.com and Capital.com – both of which are regulated entities that offer a wide variety of safeguards.

Tradable Cryptos

While the vast bulk of first-time crypto investors in NZ will opt for either Bitcoin or Ethereum, there are many other tradable tokens in this marketplace.

After all, the likes of Shiba Inu, Dogecoin, and Solana have generated far higher returns over the prior couple of years when compared to the aforementioned projects.

As such, when searching for the best NZ crypto exchanges in the market, be sure to consider what tokens you will have access to.

At Crypto.com, for instance, you can choose from over 250 tokens. Capital.com also offers a vast number of markets – with the CFD platform supporting over 470 tradable pairs.

Sign-Up Offers

Some crypto exchanges offer a sign-up offer as a means to entice you to their platform. Ordinarily, you will need to meet a minimum deposit or investment and in turn – the exchange will give you a small amount of crypto tokens.

It is important to read the terms of any sign-up offers that you are thinking about claiming.

Fees

Even the best NZ crypto exchanges need to charge fees to remain operational.

The first fee to check is with regards to deposits.

- For instance, we mentioned earlier that in order to use a debit or credit card Coinbase – you will need to pay a fee of 3.99%.

- When performing the same transaction at Capital.com – you won’t pay any fees at all.

In addition to deposit fees, you should also check what commissions you will be required to pay when buying and selling crypto.

Capital.com also stands out here, as the platform operates a 0% commission model across all supported markets. Crypto.com is also very competitive, with the exchange charging just 0.40% per slide.

Tools & Features

There are many tools and features to consider when choosing the best crypto exchange in NZ for you.

- For instance, if you want to trade crypto with leverage or engage in short-selling, Capital.com is worth checking out.

- If you’re looking to earn interest on your digital asset investments, Crypto.com offers savings accounts that pay up to 14.5% per year

- You might also consider Crypto.com if you are looking to invest in NFTs

On the other hand, some of the NZ Bitcoin exchanges that we reviewed offer very little in addition to standard trading services.

Payment Methods

If you’re looking to buy crypto from an exchange for the first time, you will need to choose a provider that supports NZD. Some of the most convenient payment methods include debit/credit cards, POLi, and local bank transfers.

Once again, just be sure to check what fees apply to your chosen payment method.

Customer Service

If at any point you need assistance on your crypto exchange account, it will be handy if your chosen provider offers a live chat feature. Otherwise, a telephone support line will likely suffice.

With that said, some crypto exchanges only offer assistance via a support ticket or email. This means that you won’t be able to speak with an agent in real-time.

How to Use a Crypto Exchange in New Zealand

If you’re ready to start trading digital assets from a top-rated New Zealand Bitcoin exchange right now – we are now going to show you the ropes with Crypto.com.

We found that this provider is the overall best NZ crypto exchange – not least because it offers over 250+ digital currencies and commission amount to just 0.40%. Plus, you can earn up to 14.5% per year in interest via a Crypto.com savings account.

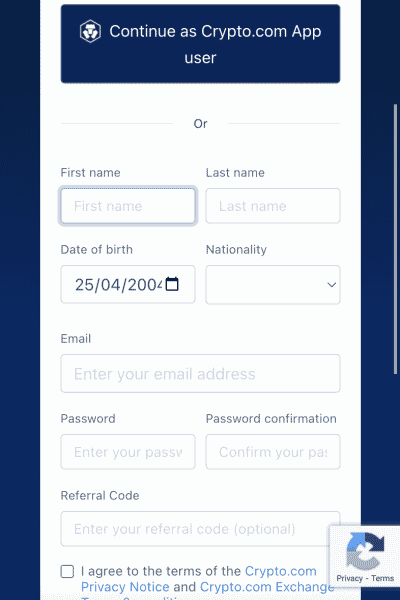

Step 1: Visit Crypto.com Website and Download App

Crypto.com offers its fiat currency services via its mobile app. As such, the first step is to visit the Crypto.com website and elect to download the official app to your iOS or Android device.

Step 2: Open Crypto.com Account

Now that you have downloaded the app, you can register a Crypto.com account. This will require you to provide some basic personal information.

You will also need to choose a strong password for your newly created Crypto.com account.

Step 3: Deposit Funds

Now that you have set up your account via the Crypto.com app – you are ready to deposit funds. To do this instantly, you can use your Visa or MasterCard.

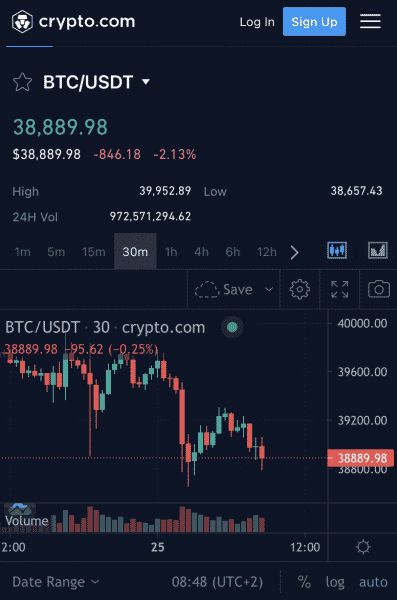

Step 4: Search for Crypto and Place Order

Crypto.com is home to over 250 cryptocurrencies. To find the digital asset that you wish to add to your portfolio, use the search bar.

This will then bring up the investment page for the respective crypto. To place an order, you will need to enter your stake. Confirm the position and Crypto.com will deduct the funds from your account and add the tokens to your wallet.

Conclusion

This comparison guide has reviewed the best NZ crypto exchanges to consider today. Overall, in terms of security and regulation, low fees, and supported markets – we like Crypto.com.

It takes just five minutes to open an account with Crypto.com via the iOS and Android app – and you can then buy more than 250+ digital currencies with your Visa or MasterCard.

Cryptoassets are a highly volatile unregulated investment product.