The exponential growth in the NFT market over the past 18 months has offered up numerous exciting ways for investors to generate a return. Digital assets have become a compelling way to diversify investment portfolios – with this trend set to become increasingly popular in the years ahead.

This guide will discuss how to make money with NFTs in detail, highlighting the most profitable approaches you can take before showing you which trading platforms are the best for investing in NFTs today – all from the comfort of your own home.

The Best Ways to Make Money with NFTs

If you’re wondering how to make money with NFTs, it’s vital to understand the approaches that produce the greatest chance of profitability.

Listed below are ten of the best methods you can employ to make money on NFT tokens – all of which will be discussed in the following section:

A Closer Look at How to Make Profit with NFTs

When researching how to buy NFTs, you should pay sufficient attention to the approach you will take to generate a return. Thanks to the growth of the NFT market, there are numerous ways to produce profits through NFTs – whether that be actively or passively.

With such a saturated NFT market, some projects are offering the best NFT giveaways to encourage new users to engage with a variety of NFT collections.

With that in mind, let’s dive in and explore how to make money with NFT tokens by reviewing the most profitable strategies that you can take:

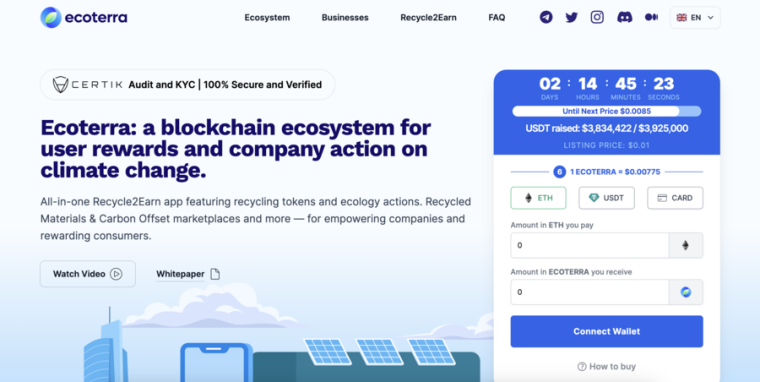

1. Ecoterra Platform: Leveraging NFTs to Incentivize Eco-Friendly Actions

Ecoterra uses NFTs as a tool in the fight against climate change while allowing users to make money. This strategy primarily aims to incentivize individuals to combat global warming actively.

A significant feature of this platform is the integrated carbon offset market.

This allows users to reduce carbon emissions by swapping EcoTerra tokens for carbon tonnes. These carbon offset achievements can be earned through involvement in certified, high-quality global initiatives and exchanged for NFTs. The presale price for an $ECOTERRA token currently stands at 0.00775 USDT.

Ecoterra has successfully raised over $3.8 million in its presale, offering tokens at a price as low as $0.00775 USDT.

The platform’s AI-driven database is highlighted in Ecoterra’s whitepaper to illustrate its unique features.

The Recycle2Earn platform further simplifies recycling by providing users with the nearest Reverse Vending Machine location. To claim rewards, users are required to photograph their receipts and upload them to the app.

This application tracks personal environmental efforts through individual user profiles. Similarly, businesses can track their “impact profiles” comprising various materials, aiding in offsetting the negative environmental consequences of their production activities. This method promotes openness and accountability in the pursuit of sustainability among all involved parties.

Owing to its flexibility, Ecoterra can cater to the recycling needs of RVM users across diverse sectors such as consumer goods, IT, fashion, and hospitality.

The platform holds immense potential, offering a long-term solution encouraging worldwide eco-friendly actions.

Ecoterra’s inventive app and distinctive features can significantly transform our environmental conservation and recycling approach. One can join the Ecoterra Telegram group to learn more about the platform.

Hard Cap

$6,700,000

Total Tokens

2,000,000,000

Tokens available in presale

1,000,000,000

Blockchain

Ethereum Network

Token type

ERC-20

Minimum Purchase

$10

Purchase with

USDT, ETH, Bank Card

2. Receive Compounded Gains from a HFT Fund by Investing in the Uncharted NFT

Another way to make money with NFTs is to purchase one connected to a real-world functioning trading fund that distributes earnings to holders. One excellent option is to invest in The Uncharted NFT collection, a project that bridges the gap between TradFi and the Web3 industry.

Owners of the Uncharted NFT collection earn 20% per month, distributed to all holders each quarter. The revenue is generated from a high-frequency trading (HFT) fund with a proven track record that can boast past performance of up to 400% per annum.

All revenue generated from the NFT sale is deposited into the XETA Capital Fund (XCF) to be deployed in the HFT algorithm. The fund conducts trades with the capital as dictated by a complex and secure HFT algorithm and a team of experienced traders to generate revenue for all NFT holders.

Buying into the NFT collection puts holders on a three-year journey of investment, compounding, distribution, and profits. Then, as the fund continues to compound and grow, all holders receive a percentage of quarterly profits through an airdrop.

The team estimates holders will earn 20% per month based on the previous track record of the HFT Fund’s performance. XETA Capital is a 90 days startup that raised $3.2 million and paid back $7.2 million to investors – during a bear market!

At the end of the three years, the project will split all the revenue in the fund between NFT holders and The Uncharted LTD company. However, if you wish to exit before the term, you can always sell your NFT on OpenSea.

The NFT collection consists of 5,000 Southern Ring Nebula NFTs that provide a ticket to explore the depths of outer space in The Uncharted. You can purchase each NFT for $295 in ETH when the collection launches during Q1 2023.

Overall, The Uncharted NFT collection is opening the doors for regular people to invest in traditional finance products that were previously only accessible to high-net-worth individuals.

3. Invest in Promising New NFTs Early

One of the best ways to make money on an NFT is by investing in promising new collections early before they skyrocket in value. Many of the best NFTs to buy were initially minted at a low price, with their value increasing exponentially in the weeks and months after launch. Some of the best utility NFTs have so much potential to enter mainstream adoption. Check out our guide on the best utility NFTs for more information.

A prime example of this is CryptoPunks, which could be purchased in 2017 for between $1 and $34. When the NFT craze took over in 2021, these ‘Punks’ became incredibly valuable due to their first-mover status within the space. This culminated in these NFTs being purchased by celebrities and other high-profile names – with one Punk even selling for $24 million!

4. NFT HODLing

One of the best strategies to employ when researching how to make money with an NFT is to invest and ‘HODL’. For those who haven’t heard the term, HODL stands for ‘Hold On for Dear Life’ and was popularized by retail traders during the GameStop short squeeze of 2021. Since then, the term has been used to describe an investment strategy where you simply do not sell – regardless of what happens.

Investors who buy cryptocurrency will know that there are both pros and cons to adopting this approach. However, if conducted strategically, HODLing can be a great way to make money with NFTs. Going back to our example of CryptoPunks, investors back in 2017 may have opted to sell because the value of their Punk was not going up. However, those investors who chose to HODL will have reaped the rewards when prices skyrocketed in 2021.

Needless to say, this approach won’t always work, as some NFT collections will not experience the uptake necessary to generate price momentum. However, many of the projects listed on our NFT calendar are already beginning to gather momentum from social media – meaning there could be some great investment opportunities in the weeks and months ahead.

Cryptoassets are a highly volatile unregulated investment product.

5. Flipping NFTs

‘Flipping’ is another effective way to make money with NFTs. As defined by Fortune.com, flipping refers to the process of buying low and selling high, thereby producing a positive return. The critical distinction between flipping and other investment strategies is that flipping is usually a very short-term approach, contrasting with the HODL strategy described above.

Finding the best NFT to make money and then flipping it for a profit is challenging, especially since there is so much competition in the market nowadays. However, it is not impossible – although there are numerous factors to consider when researching how to flip NFTs for profit.

The token’s utility should be at the forefront of your mind, as this will be one of the main reasons other investors would purchase it. Community backing should also be considered, along with the development team behind the project. Finally, the visual appeal of the NFT is essential to note, as most investors will wish to display their digital art as their profile picture on social media or via a digital art gallery.

Cryptoassets are a highly volatile unregulated investment product.

6. Minting Your Own NFTs

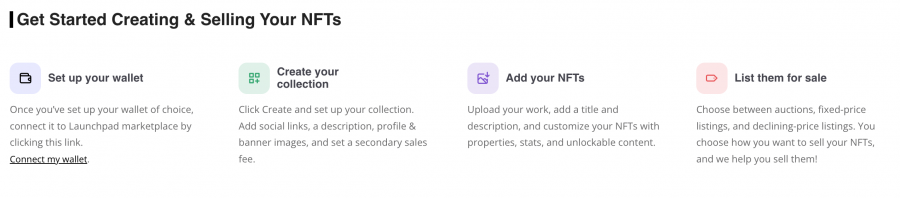

A common approach for those wondering how to make money on NFTs is to mint your own NFT. Minting refers to the process of taking a digital asset (such as digital art or music) and placing it on the blockchain. Once the asset is minted to the blockchain, it can then be traded on the best NFT marketplaces, allowing you to monetize your creation.

Minting NFTs is a relatively straightforward process, with top marketplaces like NFT LaunchPad making the process easy for beginners. Due to the enormous growth in the NFT market, the competition among creators is intense, with new collections springing up every day. Thus, if you wish to take this approach, you’ll need to ensure that your creation stands out from the crowd.

Assuming you have created your own NFT and minted it to the blockchain, it’s just a waiting game to see if someone buys it. This is where marketing plays an important role, as most collections will not be visible to potential investors unless they are promoted effectively. Once your NFT sells, you will receive the proceeds from the sale (minus the marketplace’s fee), which you can withdraw to your crypto wallet.

Cryptoassets are a highly volatile unregulated investment product.

7. NFT Trading

In a similar vein to NFT HODLing and flipping NFTs is NFT trading. This process is more geared toward making incremental capital gains over the long term rather than getting in and out of the market as quickly as possible. Investors interested in NFT trading will often buy and sell an NFT for a small profit and then repeat this process again and again.

Ultimately, this process requires much more patience and market knowledge than HODLing, as it relies on purchasing undervalued NFTs and then selling them at the right time. However, this can result in exponential capital gains over the longer term, which is why this approach is so popular amongst experienced investors.

Cryptoassets are a highly volatile unregulated investment product.

8. Staking NFTs

Those interested in crypto staking will be pleased to know that this process can also be related to NFTs. NFT staking can come in various forms, although the primary mechanism used is to ‘lock up’ their digital asset on a DeFi platform and receive rewards in return. This usually occurs on Proof-of-Stake (PoS) blockchains and rewards the owner with the network’s native token.

Ultimately, this process helps validate transactions that occur on the network, much like when crypto holders stake their tokens. Since this area of the market is still in its infancy, there are only a few platforms that offer NFT staking – mainly in the P2E gaming sector. Examples of these platforms include MOBOX and Zookeeper.

If you are wondering how to make money with NFTs passively, then this approach is perhaps the most optimal. APYs will vary from platform to platform and depend on the exact NFT you are staking. However, with more NFT projects becoming wise to this flourishing area of the market, we’d expect this process to increase in popularity throughout the year.

Cryptoassets are a highly volatile unregulated investment product.

9. Generating Royalties

Royalties go hand in hand with selling NFTs and form one of the most exciting elements of the market. During the minting process, the creator can set their own royalty percentage, which means that any secondary market sales will provide the original creator with a payment. Most NFT royalty levels are set at 5% or 10%, although some do go higher than this.

Many of the most expensive NFTs will have a royalty percentage embedded into them, which provides the creator with passive income whenever they are resold. Certain NFT marketplaces will cap royalties, usually around 10%, to ensure that these assets are still attractive to future investors.

However, creators must ensure that their NFT collections are worth investing in to make the most of the royalty process. There’s no point in setting royalties if the NFT will only be purchased once – so embedding unique use cases or benefits into NFT ownership is crucial to producing a worthwhile income stream.

Cryptoassets are a highly volatile unregulated investment product.

Where to Invest in NFTs

Now that you have a comprehensive understanding of how to buy and sell NFTs for a profit, let’s turn our attention to the investment process itself. If you’re looking to invest in new NFT projects for flipping or simply wish to buy an NFT and HODL, choosing a safe and reliable marketplace is vital to facilitate your purchase.

With that in mind, presented below are our top picks for where to invest in NFTs this year:

1. NFT LaunchPad – Overall Best NFT Marketplace

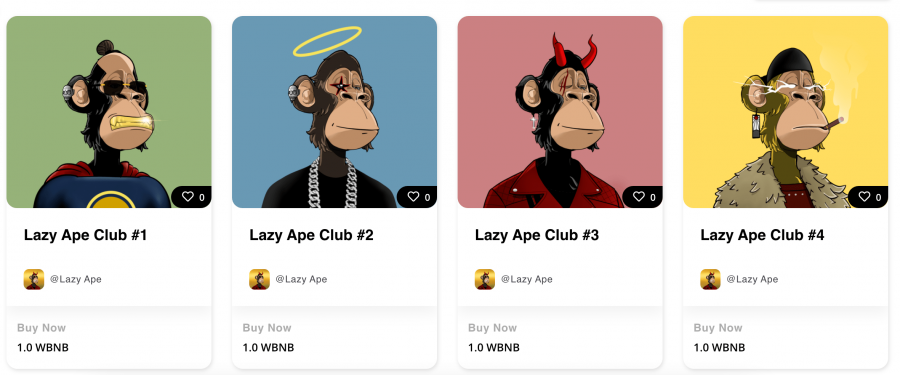

In terms of NFT investing, NFT LaunchPad offers a wide range of categories to choose from, including digital art, animations, games, music, videos, and more. All NFTs are denominated in wBNB, which can be easily purchased from the best altcoin exchanges. In addition, NFT LaunchPad has full support for MetaMask wallets, with Trust Wallet support arriving in the near future.

Minting is also easy with NFT LaunchPad, and users can choose from various formats – including MP4. It’s easy to create single or multiple collections, with options for fixed-price sales or auctions. NFT LaunchPad even allows users to set their own royalties, providing a pathway towards a passive income stream.

Your capital is at risk.

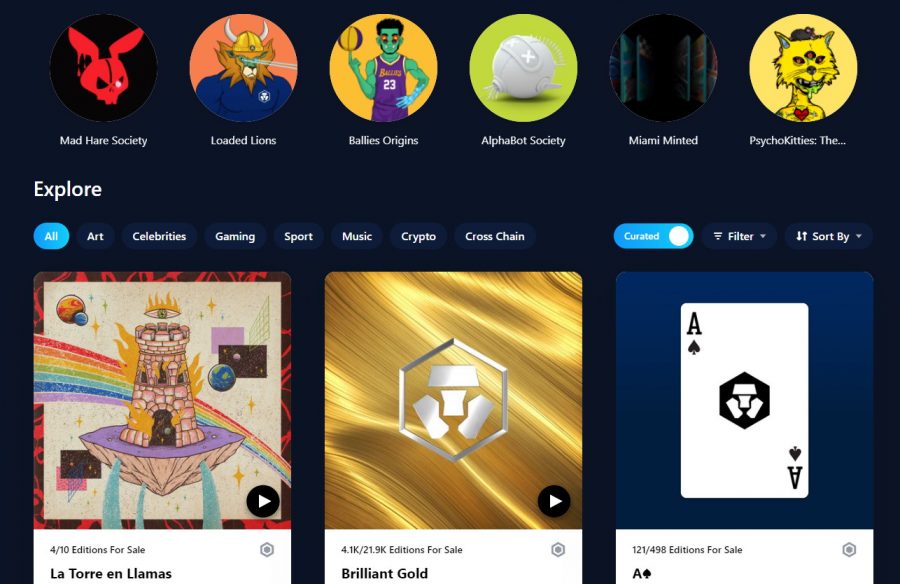

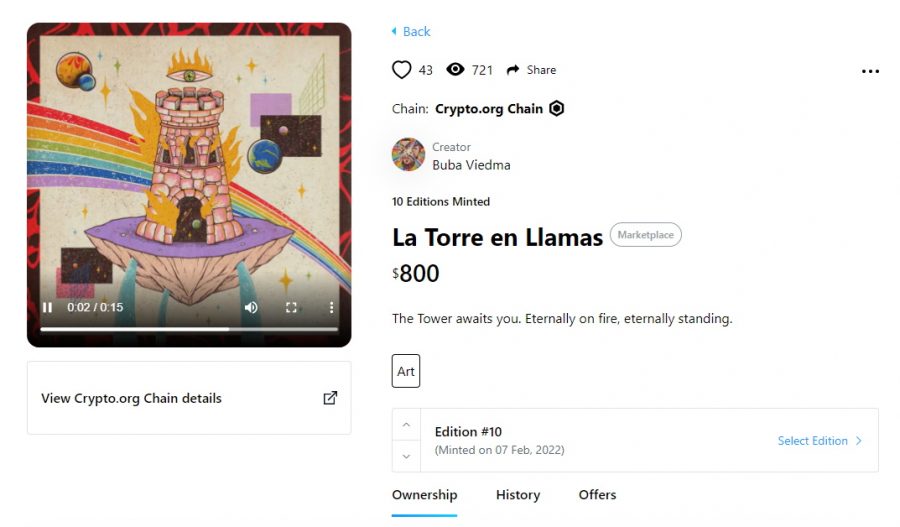

2. Crypto.com NFT Marketplace – Popular NFT Marketplace with Low Trading Fees

When purchasing an NFT on the Crypto.com marketplace, there is no transaction fee, making it one of the cheapest places to invest in these assets. In addition, Crypto.com also allows users to buy NFTs using a credit or debit card – removing the need to hold crypto beforehand.

Users can choose between numerous NFT categories, such as art, gaming, music, sport, and celebrities. Crypto.com also has a dedicated ‘Drops’ page so that you can keep tabs on hotly-anticipated collections. Finally, Crypto.com is also in the process of integrating the NFT marketplace into the Crypto.com mobile app – offering an easy way to invest in NFTs on the go.

Your capital is at risk.

How to Make Money with NFTs – Conclusion

To summarize, this guide has discussed everything you need to know about how to make money with NFTs, highlighting ten of the most profitable approaches you can take in the market. With the NFT craze showing no signs of dying down, there’s tremendous returns potential for investors – providing a viable alternative to traditional asset classes.

If you’re looking for the best NFT to make money, we recommend checking out Ecoterra. This is a new NFT-based eco-friendly platform which allows investors to combat climate change while also earning incentives for recycling items. Currently, buyers can grab the $ECOTERRA tokens for a discounted rate of $0.00775 USDT each.

Read more: