Apple, Android or both? Retailers researching a mobile marketing strategy must ask themselves this question before going forward with any mobile retail app development. Now, a new report from The Yankee Group and Mobidia is adding fuel to the fire that one platform, and user base, is better to focus on when it comes to financial returns.

According to the report, only a small number of companies are really taking advantage of mobile shopping to its potential. Some retailers, like Kohl’s and Starbucks, proved that they are able to create engagement via their app offerings. The study showed they both sit at the top of the chart, with usage rates of 68 percent and 60 percent, respectively, while the industry average rests at 46 percent.

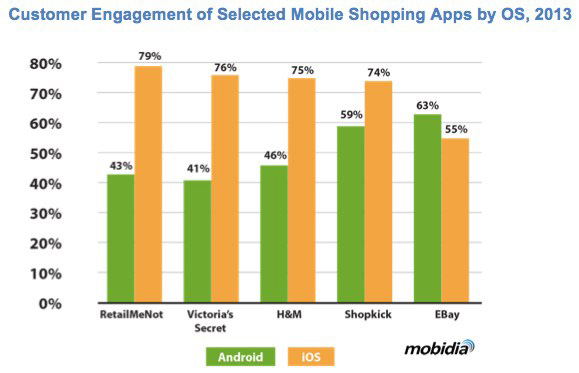

One statistic that really stands out; retailers invested in mobile apps are seeing increased engagement on the Apple iOS platform. For instance, RetailMeNot and Victoria’s Secret both see much higher engagement rates for their iOS apps compared to their Android versions. In some cases the gap is more than 35 percent.

90 percent of mobile consumers are interested coupons and shopping. 66 percent of ‘advanced’ mobile consumers use their phones and apps to download coupons, check product reviews, receive text offers, respond to daily deals and more. Aside from just purchasing options, the most successful apps offer inventory checkers, rewards systems and “look books,” among other features.

Mobile: Where Customers Are Spending

This study is the just the latest in a line of research that shows retailers that mobile shopping has the ability to increase sales. Coinciding with the Yankee Group report, research group Juniper has published new estimates of future mobile retail shopping growth. “Annual retail payments on mobile handsets and tablets are expected to reach $707 billion by 2018, representing 30 percent of all eRetail by that time. This compares with mobile retail spend of $182 billion last year, when mobile accounted for around 15 percent of eRetail.”

Having an app alone is not enough for retails looking to make a difference in their bottom lines. Shoppers want apps that both are deep in ability and easy to use. Retailers need to make sure that their app makes searching for products, checking reviews, placing an order and paying for it as easy as possible. Other features shoppers told researches they flock to are inventory checkers and reward systems. None of the features are new to retailers; they’ve been used in stores for decades. What the research is saying is consumers want the same features and abilities on their mobile devices as well.

Putting Customers First

The key for retailers is to listen to their specific customers and be willing and able to adapt based on what they say they want and need from a mobile shopping app. Just because shopping is moving toward digital and mobile doesn’t mean that customers can be put second, it means retailers have to adjust to their wants and needs even faster than before.