As seen in this recent infographic from Forrester Research, the global mobile payments marketplace is quite crowded.

However the high number of players has not helped to increase the adoption rate among consumers and businesses.

Nowadays the challenges are not to develop the technology but to change the habits of consumers/businesses and win their trust.

Most consumers do not mind using their cards or cash to make a payment and will not switch to mobile payments until they understand the real benefits for them.

The same idea holds true for businesses – to adopt new payment services, they need to recognize the benefits, not just for themselves, but also for their customers. This whitepaper explores a new trend in finance – the concept of ‘cooperative competition’, particularly in the British banking sector, which is increasingly investing in mobile payments.

Recent research carried out by PwC, ‘Retail Banking 2020: Evolution or Revolution’, based on a survey of 560 financial services executives from leading financial institutions in 17 countries, reveals that 55% of the senior retail banking executives surveyed view non-traditional financial services providers as a threat to traditional banks, while 31% perceive them as ‘innovative partnership opportunities’.

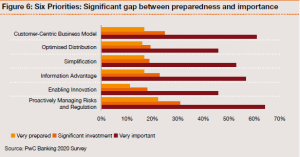

PwC also identified the main areas for innovation and six priorities for retail banks to stay ahead of the game. As seen in the graph, there is a striking gap between the importance of the priorities and the level of preparedness. Technological, organisational, talent and cost constraints were identified as the main obstacles to success.

For a functional and successful marketplace (any type – be it retail, financial etc.) rivalry between companies or groups is a common and necessary presence. However these days a new model is emerging in the banking marketplace, triggered by the new wave of players and their disruptive technologies.

To keep up with trend setters such as PayPal, Square, V.me from Visa etc, the banking industry must radically reshape and innovate its products and channels. Therefore some banks and financial institutions have adopted a new strategy – the ‘cooperative competition’ (as Philippe Eschenmoser, Head of Business Consulting at SIX Payment Services named it) which means partnering either with other banks or with various mobile payments providers.

This spirit of collaboration is definitely defining a new era of innovation in financial services.

Banks meet consumers’ need for trust and security, while mobile payment providers have the technological means to deliver an innovative, fast and convenient customer experience.

In Europe, recent examples of this spirit of cooperation can be found in Sweden, France, Poland and UK.