Going to the bank and financial planning ranks closely with getting a cavity filled at the dentist. Banks and financial services firms know this and it’s why they are obsessed with making key app features easy-to-use, quick and fun to use. Financial services firms know more and more consumers are turning to apps to transact and track their finances. Two of the fastest growing app categories are finance and mobile commerce. And it’s not just older audiences spending time in banking and financial apps—it’s millennials, too!

In a recent study, George Washington University found that 70% of young people rated themselves highly in financial literacy. The same study also revealed that only 8% actually had extensive financial knowledge. As engagement with millennials grows banks and financial services apps with excellent app insights and easy-to-use key features are ensuring their apps have sticky features with a young, and very mobile savvy and fast-growing audiences.

In this post, we explore three of the top finance apps (Acorns, SigFig, and Mint) and their key features that help these apps’ find success with their customers and differentiate them from the competition. If you’re a mobile product manager these finance app features can provide insights and ideas for how you can shape app feature strategy – regardless of your vertical focus.

1. Acorns

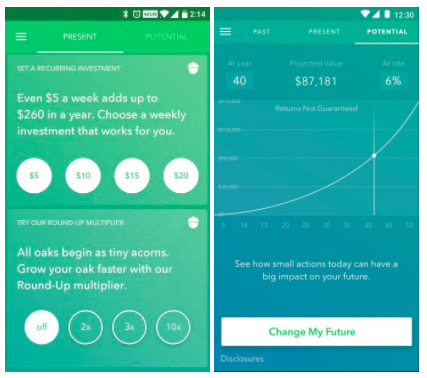

Features: Potential, Multiplier

Acorns has been growing fast and is one of the most popular financial investment apps with millennials. Acorns takes spare change from everyday purchases and rounds up spending to the nearest dollar and invests the difference. Once you link a credit card and bank account, the Acorns app does the rest. This micro-investing feature of the app helps initiate investing and lets you watch how small savings and add up without the pain of having to think about a larger investment strategy and making monthly or manual investments.

It’s tough to see savings growth from squirreling away so many spare change micro-investments. Investors want to see accumulation and long-term potential. Since account balances from spare change accumulate slowly, Acorns decided to add the “Potential” tab, which helps investors see growth potential vs. an account balance. This simple feature highlights what small investment adjustments can do over the long term.

The “Potential” feature has been very effective for Acorns. According to an interview with the LA Times, Acorns said that in the first month of testing with this feature with just 5% of Acorns audience, over 17% of investors used the feature and added to their recurring investments. Acorns followed up with the “round up multiplier” feature. Combined these two features let investors see potential to invest more from purchases. For example, instead of investing 25 cents after a $5.75 purchase, investors multiple that “spare change” by two, three or 10.

2. SigFig

Feature: Guidance

SigFig is a robo-advisor. If you’ve ever looked at robo-investing, you know the marketplace is crowded. Feature differentiation is critical to success. SigFig has integrations with Fidelity, Schwab, and Ameritrade, the company’s algorithmic investment strategies work to analyze, monitor and improve any portfolio, automatically balancing and diversifying investments enables investors to create a single portfolio view across multiple brokerages. That alone is an amazing feature – especially since it’s free.

SigFig introduced the “Guidance” feature after analyzing data from over $300 billion in tracked assets. With just a few clicks, “Guidance” enables investors to optimize portfolio data, and quickly turn that big data into actionable, and unbiased investing insights. Using “Guidance” SigFig investors can improve their returns, save more money and find ways to reduce or eliminate fees across multiple brokerages. Getting unbiased financial advice can be expensive or difficult to find. Using “Guidance” quickly and easily solves this for investors by the click of a button.

3. Mint

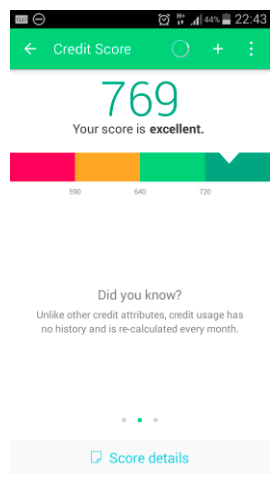

Features: Budget Tracker, Credit Score

Mint is an all-in-one budgeting app. Once bank accounts, credit cards, and monthly bills are synced and once a budget is set, Mint provides a comprehensive overview to help you better manage your money in just seconds. Saving conscience audiences with key tools to help easily save and invest.

Mint is best known for their “Budget Tracker” feature. In one click you can see your entire monthly budget vs. actual spend across all your categories (e.g. restaurants, clothing, groceries). “Budget Tracker” shows your entire budget on a single page.

Checking your credit score can be cumbersome and time-consuming. Mint’s integration with Equifax makes “Credit Check” a very attractive feature for a lot of audiences. Mint’s credit check is fast and easy, especially since you Mint already has your info needed since credit cards can be connected to Mint and it knows balances, spending levels.

In conclusion

All of the financial services apps mentioned above found pathways to deepen app engagement with their customers by better understanding data from within their app. In some cases, apps further developed features to strengthen existing customer habits outside an app.

As you develop your app and feature roadmap, gather deeper in-app data insights and think about if there are ways to leverage pre-existing customer habits. It’s been a recipe for success for these financial services apps—and could be for you, too!