When most people hear “Intuit,” they think of tax season. Individuals and businesses know the company for its TurboTax DIY tax preparation software. Therefore, it’s no surprise that the company’s new online payroll software aims to simplify things for businesses during tax time by automatically calculating federal and state taxes.

This Intuit Online Payroll review will look at the new payroll solution’s features and pricing to determine its value to businesses of all sizes.

About Intuit Online Payroll

Intuit is one of the leading financial software companies globally, known for popular products like QuickBooks, Quicken, and GoPayment. Intuit Payroll is available as part of QuickBooks and online. Intuit Online Payroll offers Cloud features, enabling users to manage payroll from any mobile device, allowing payroll tasks to be done from anywhere.

Main Functionality of Intuit Online Payroll

Intuit Online Payroll automates the timekeeping and payment processes for an organization, providing an interface for easily entering each worker’s time each pay period. Once time is entered, payment is just one click away, making the payroll process quick and painless.

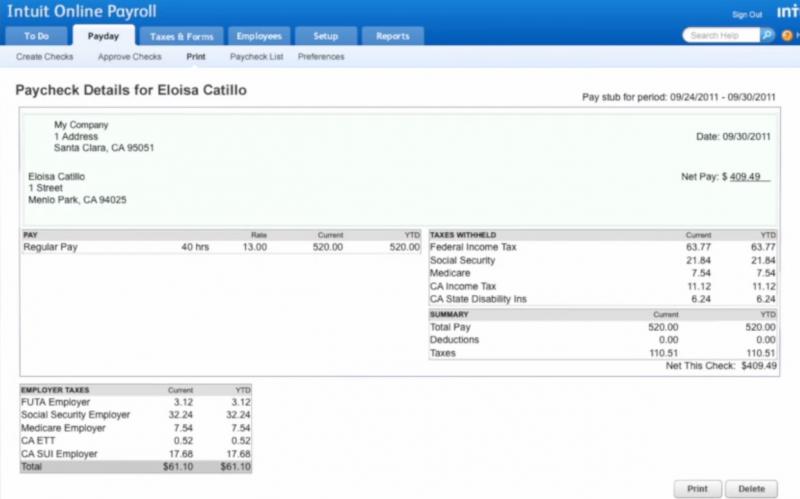

In addition to processing payroll, Intuit Online Payroll also provides the ability to print year-end W-2s in its enhanced version. When combined with the ability to automatically calculate and pay payroll taxes, these features alone offer time-saving benefits to businesses.

Benefits of Using Intuit Online Payroll

Whether it’s payday or tax time, Intuit Online Payroll keeps supervisors on track by sending e-mail reminders. One of the biggest benefits to Intuit’s Cloud-based payroll software is that it can be accessed using a mobile device. Because of its simple, straightforward interface, supervisors can input time and submit payment requests from anywhere–even while vacationing in the beach.

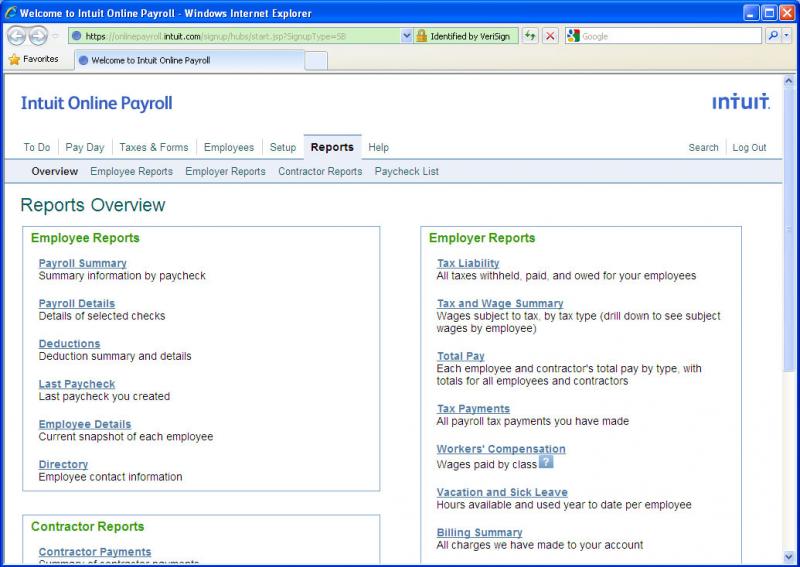

One of the best features of Intuit Online Payroll is its interaction with tax information. Payroll tax forms are automatically completed for employers and can be sent to the IRS online. Intuit Online Payroll can be used to process pay for both employees and contractors.

The Basics: What Does It Look Like?

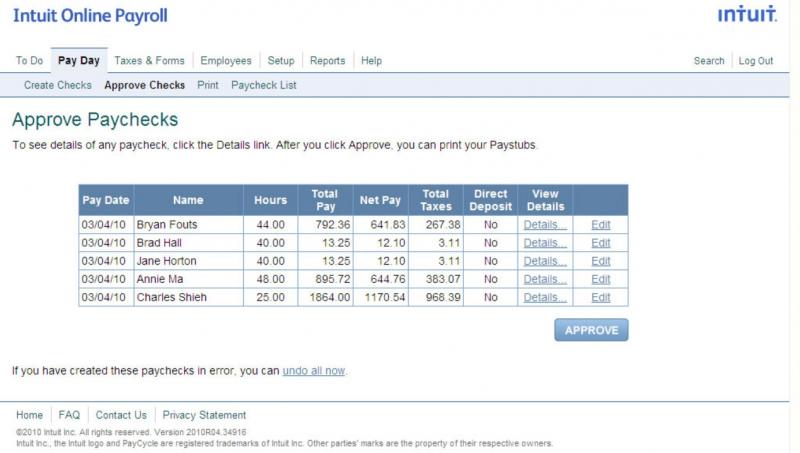

On payday, supervisors will receive an e-mail notifying them it’s time to run payroll. Employers merely click on the link in the e-mail to go directly to their Intuit Online Payroll account. On this screen, the supervisor enters hours for each worker, along with any bonus pay, and clicks “Create Paychecks.”

Pay is calculated instantly and checks are sent via the method specified by the employer. Checks can be sent by direct deposit, formatted into a printable check, or printed as a pay stub from which employers can hand-write their own checks.

With Intuit’s reporting features, employers can get an overview of payroll information by check, deductions, tax liability, and more.

Support Information

Through its Tax Help support section, Intuit provides a large number of “how to” articles to answer many user questions. But customers also have access to online chat with a representative, which appears every time a user is on the Intuit Payroll site. Lastly, online webinars and other training videos are available in the support section to walk consumers through using Intuit products.

Pricing Information

Basic plans start at only $20 per month, which includes paychecks only. To enjoy automatic tax calculations, users will have to upgrade to $28 per month.

The Bottom Line

Intuit’s interface is impressively easy to use, whether a supervisor is entering time using a PC or a mobile device. The e-mail reminders ensure employers never forget to process payroll or file the appropriate payroll taxes when they’re due. For businesses that employ contractors or employees, Intuit Online Payroll is an affordable solution that takes the pain out of processing payroll.

Ratings: ease of use 5/5, features 5/5, value 5/5