Mobile phones are an extension of us. Sound extreme? Take a walk around any public place and look at how many people have their phone in their hand. It’s pretty staggering. And since we rely on our smartphones to operate day-to-day, it would only make sense that eventually we would also rely on them as our primary payment method.

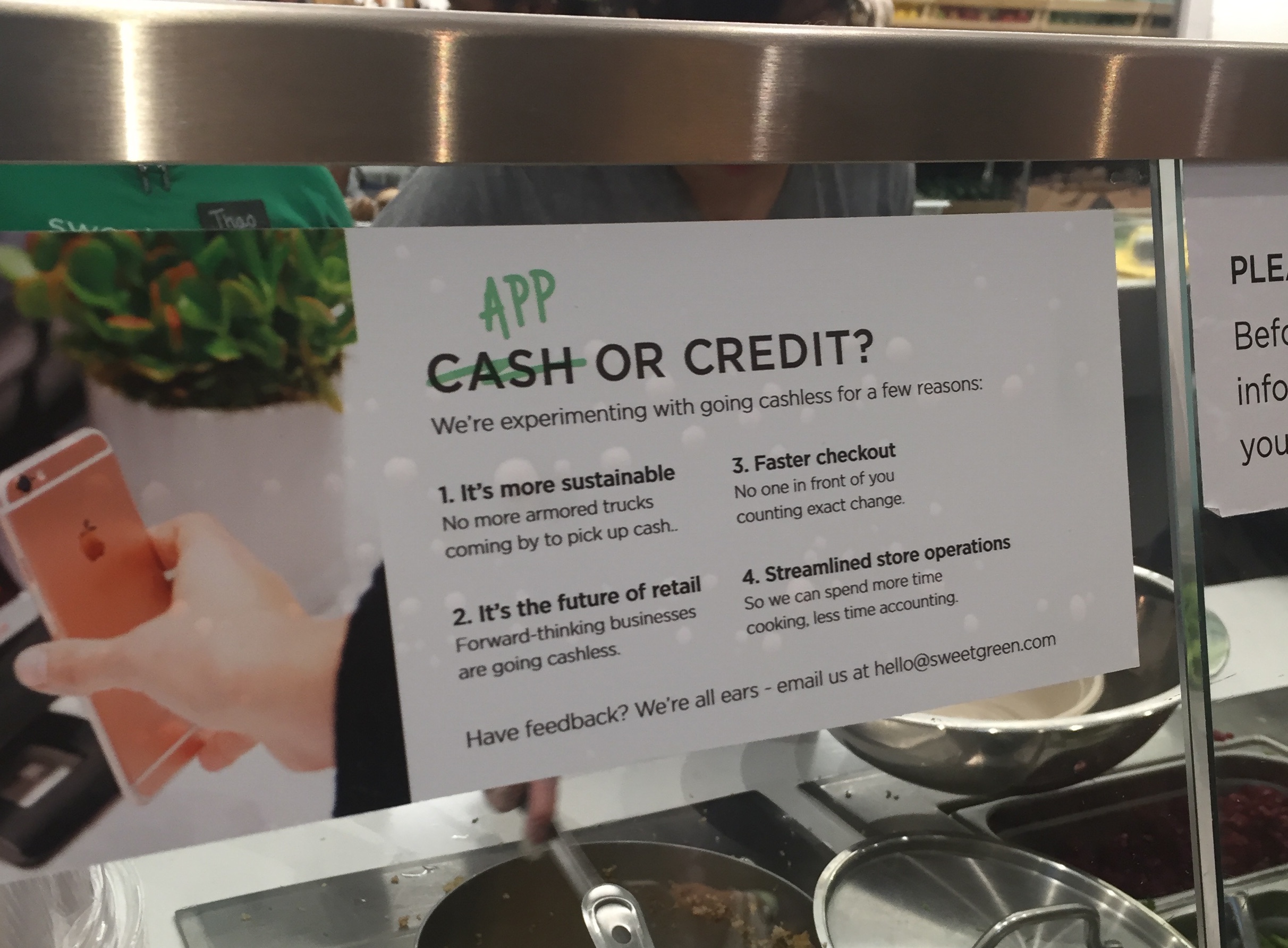

In fact, if you think about it, we are already using mobile as a primary payment form for various exchanges. We make purchases on shopping apps like Amazon, pay our friends back on apps like Venmo, and handle finances on banking apps. The missing piece to the puzzle? The wide adoption of mobile payment for in-store transactions. That’s quickly changing, though, as many companies have the foresight to recognize not only the shift in consumer preference, but the benefits mobile payment has to offer their bottom line.

So why exactly are companies and consumers alike adopting mobile payments? The below is my take on why mobile payments will eventually overtake cash.

Cash is Clunky

Paying with cash is inefficient. It means continuous trips to the bank, and fumbling with change during checkout. Not to mention, unless you’re super organized with receipts, you forfeit any real record of your purchase. While having no paper trail is beneficial for criminals, for the modern day consumer, it’s less than ideal. There’s no question that cash transactions are on the decline. In fact, according to a 2015 study by Business Insider, 40% of millennials surveyed would give up cash entirely if it were possible to do so.

Looking at it from a macro perspective, the notion of a ‘cashless society’ is very close to a reality for several European countries. Sweden expects to be cashless within the next five years, as physical cash now makes up a mere two percent of their economy. Denmark has pledged to eradicate cash by 2030 and Norway isn’t far behind, either. As for the US? We’re already at over 50% for cashless payments and quickly growing, paving the way for a mobile payment takeover.

The EMV Chip Is Painfully Slow

In addition to the natural consumer shift towards mobile payment, it’s also getting help from the government. While the adoption of the EMV (Europay, Mastercard, Visa) chip reader technology in the US had good intentions of mitigating fraud, it’s been met with backlash as consumers’ face longer checkout times.

As a modern day consumer who now is forced to use EMV, I feel like I just went back in time and it’s incredibly frustrating. My checkout process went from quick and streamlined to slow and painful. Is this process really necessary? Why are there this many purchasing steps between me and my bottle of Gatorade? Like most millennials, I’m someone who yearns for efficiency (aka I’m really impatient), and this implementation of EMV is the reason I personally adopted Apple Pay. Apparently? I’m not the only one. Many journalists and experts alike believe this EMV “chip dip” has lead consumers to flock to mobile payment. Wired’s hilarious take on the EMV crisis breaks it down in detail.

Security

While the counter argument to the EMV implementation may be that it’s “worth the wait” to ensure you’re more protected, studies have shown that mobile pay is just as safe, or even more secure, than EMV. Why? Because while we’ve implemented the EMV technology, many retailers aren’t following the secure process of “chip and pin”, where you’re forced to insert your card and put in a pin number rather than sign. Retailers fear this is too much change for their consumers, and don’t want to put themselves at a competitive disadvantage.

So what’s the resolution to the security woes? Mobile payments. The NFC (near-field communication) technology that Apple, Google Wallet, and Samsung Pay use is just as secure as EMV and allow consumers to pay with a quick tap of their phone. Plus, the fingerprint security for those who use Apple Pay provides an added element of security with little slowdown.

Proof of Purchase

Yet another way to limit the slowdown and increase efficiency? Using digital receipts. While some retailers have implemented digital receipts even if you swipe a card, the vast majority of them are still on the old ink and paper. And while I can get on my soapbox about the egregious waste of paper physical receipts are, I’ll stick to the basics:

Digital receipts allow you to keep a safe record of all purchases online, in one safe place. How many times have you gone to return something, only to realize you’ve lost the receipt? Or went on a business trip and became overwhelmed with the paper trail? Digital receipts just make sense, not to mention, speed up the check-out process.

Incentives

Another thing that makes sense? Businesses rewarding customers for their loyalty. Many retailers have begun implementing mobile payment into their app, allowing consumers to access coupons and reap rewards based on frequent visits which drives revenue. Furthermore, retailers realize that a seamless checkout improves in-store efficiency, which positively impacts their bottom line.

Not interested in downloading more apps? No problem. The major mobile payment platforms (Apple, Google, etc.) allow you to add your loyalty cards directly to their platform for ease of use, still allowing you to tap into rewards while enjoying a seamless checkout. Mobile payments are a win-win for both the consumers and the retailers.

Mobile Marketer’s’ Role

As we continue down the path to virtual payments, mobile marketers have a prime opportunity to capitalize. Allowing consumers to pay with your app is a compelling reason in itself for them to download it. And once they’ve downloaded it, the sky’s the limit. You’ll have a 360° view of your consumers including their purchase history, allowing you to create powerful marketing campaigns and improve user engagement. Basically? You can personalize their entire brand experience which is exactly what the modern day consumer wants.

Mobile payments create the seamless interaction consumers have come to expect, tying the digital world together with brick and mortar. Everything your consumer needs is in once place; and since modern day consumers crave convenience, mobile payments are the perfect solution.

Retail brands who were early adopters of mobile pay are reaping the rewards, seeing efficiency increase alongside revenue. As we continue towards a cashless society, marketers need to invest in mobile payment now, or risk losing out to competitors in a big way.