The companies who excel at this exude technical prowess and as a result earn and keep trust. For Cloud Infrastructure as a Service (IaaS) platform providers, getting developers, both at partner companies and at enterprise customers to build applications, is a critical catalyst for future growth.

Assessing Cloud Infrastructure as a Service Providers with Inquiry Analytics

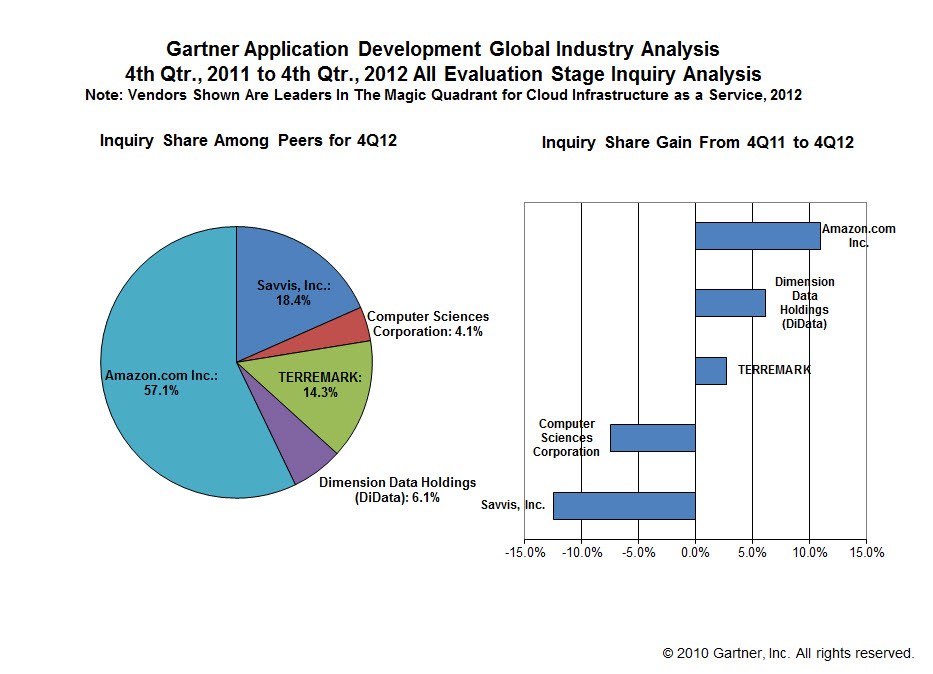

Using the Magic Quadrant for Cloud Infrastructure as a Service, 2012 published October 18, 2012 as the baseline and shown above from Rueven Cohen’s excellent post last year, the five leaders were compared using the Inquiry Analytics Statistics: Topic and Vendor Mind Share for Software, 4Q12 published March 13th of this year. Analyzing the five leaders in the Magic Quadrant using Inquiry Analytics shows that Amazon Web Services (AWS) was 57.1% of inquiry share worldwide for application development during the 4th quarter of 2012.

From 4th quarter 2011 to 4th quarter 2012, Amazon Web Services showed just over 10% inquiry gain against the other vendors listed as leaders in the quadrant. Only five vendors can be compared at once using the Gartner Inquiry Analytics tool so the leaders were included in the comparison first.

A second pass through the Inquiry Analytics was done comparing Amazon Web Services to the other vendors in the quadrant. AWS had 63.6% of inquiries in the application development category during the 4th quarter of 2012 compared to non-leader vendors in the quadrant who were listed in the Inquiry Analytics database. It was surprising to find that a few of the vendors listed in the Cloud IaaS Magic Quadrant don’t have data available in the Inquiry Analytics Statistics: Topic and Vendor Mind Share for Software, 4Q12 indicating inquiries. During this pass, Rackspace share of inquiries between the 4th quarter of 2011 to the 4th quarter of 2012 declined just over 5% and Dell declines approximately 2%.

Bottom line: The land grab for developers is accelerating on IaaS and will be a major factor in who establishes a long-term cloud platform for years to come.