Source: Freepik

Fintech (financial technology) apps bear a heavy responsibility. We trust these apps to manage our bank accounts, personal budgets, insurance payments, and more.

Sometimes users opt in to push notifications from too many apps, and they get in the habit of ignoring certain messages. But few people would instinctively ignore a push from their bank or stockbroker.

With great power comes great responsibility. The sensitive nature of finance apps means they can easily grab users’ attention with push notifications — but if the content isn’t urgent or valuable, apps risk losing user trust.

Nonetheless, it’s possible for finance apps to plan effective messaging campaigns that aren’t purely transactional. Here are four campaign ideas to get you started.

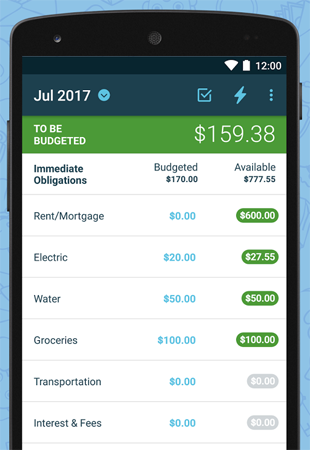

Push Notifications From Personal Finance Apps

Source: Google Play

Typically, budget-related push notifications are seen as transactional messages. A bank’s low balance alert is likely not meant to boost user engagement; it’s more of a tool to help users avoid overdraft fees. However, for personal finance apps, push notifications can genuinely assist users in making the most of the app and creating better budgets.

Over time, users of budgeting apps like You Need A Budget and Mint develop personalized categories and spending limits to suit their needs. However, each user must manually create purchase categories and savings goals. Thanks to all the manual effort involved, some will end up under-utilizing the app.

Push notifications can notify users about poor or wrong settings. For example, if someone sets their monthly spending limit for restaurants at a certain amount but goes over that limit by $50 for several months, the app could send a push notification to alert them and recommend adjusting the spending limit. This would help the budget match the person’s true spending habits, enhancing the app’s overall usefulness.

Apps can also help users reach savings goals. Budgeting apps can send alerts once users are approaching their spending limit for the month to make sure they don’t forget to put money aside. The notification could even reveal which categories they’re overspending on so they’ll know where to cut back.

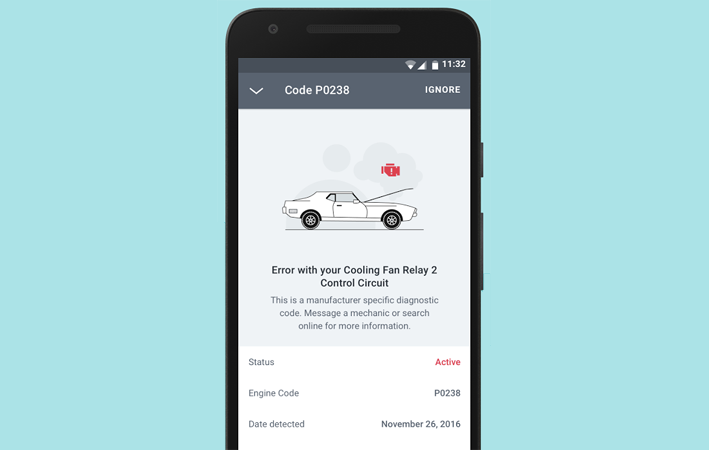

Emails From Insurance Apps

Source: Google Play

Insurance apps like Metromile and Lemonade operate in a complex industry. Consumers might not understand the finer points of car and home insurance. Normally, this isn’t a problem — many insurance providers try to make the process intuitive to people without much background knowledge. However, there are situations where understanding the fine print can help you save money and mitigate risk.

Email newsletters are a good way to keep users informed and engaged. A general purpose newsletter can talk about different types of insurance, how much coverage you get for different plans, and what happens when you file a claim.

Of course, emails can be personalized too. Apps can send customized messages to users of a particular plan or with a particular type of vehicle/home to explain the specifics.

Emails are a great way to provide money-saving tips that help users in the long run. Today, a user might simply pay a flat fee for car insurance, but it would help if they knew the average cost of insurance for different types of cars. This could impact their vehicle purchases in the future. And if the emails constantly add value like this, users will be less inclined to unsubscribe, keeping your app and service top-of-mind.

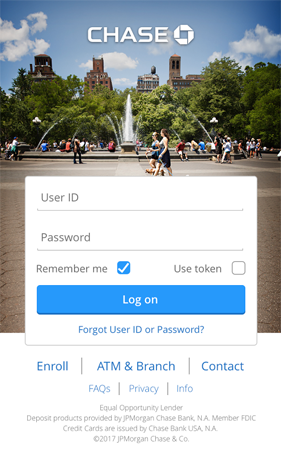

In-App Messages From Banking Apps

Source: Google Play

The generic use case for a banking app is to manage your primary checking account, but banks offer a plethora of other products and services. Websites, especially on desktop, offer plenty of screen real estate to display promotions and upsells. In the process of logging into your account, you’re likely to see ads for mortgages, credit cards, and more.

At first glance, it seems difficult to replicate this layout on mobile. With less space to go around, mobile sites and apps tend to focus on core features, at the cost of potential upsells.

In-app messages help banking apps navigate this problem. In-app messages aren’t a permanent part of the UI; they can be displayed and removed through a messaging platform, independent of the app’s code. Plus, some messages can be shown as persistent on-screen elements while others can temporarily pop up in the middle of the screen. This adds variety and flexibility to your promotions, making it easier to include content to accompany the core features of the screen.

When implemented correctly, in-app messages can actually be more powerful than website upsells. By leveraging mobile app analytics, marketers can personalize messages to appeal to individual users. A banking app could display promotions for credit cards that match the user’s credit score, or special rates on small business loans for users with a business checking account. These personalized offers are a near-guaranteed way to lift conversions.

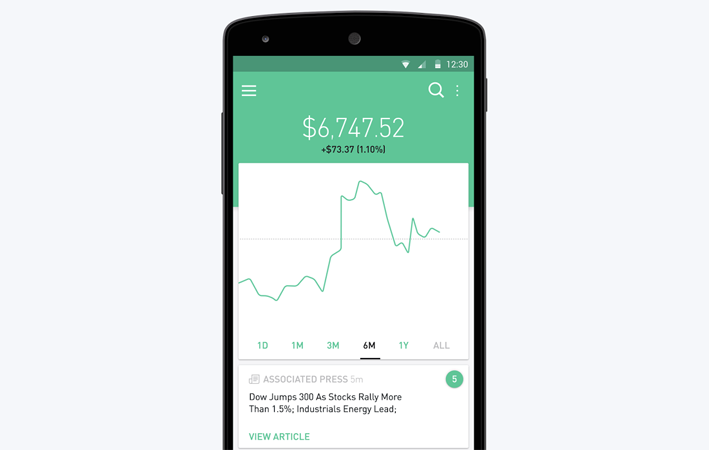

App Inbox Messages From Stockbrokers

Source: Google Play

The stock market moves quickly, and some stocks are very sensitive to current events. Push notifications for every market-related event might get overwhelming, but App Inbox messages are perfect for this use case. They’re browsable at the user’s convenience, yet they don’t spam the recipient’s email inbox or occupy as much screen space as in-app messages.

Stock trading apps like Robinhood can use App Inbox messages to keep users informed in a non-disruptive way. These messages will stay in the inbox even after they’re read, so users can scroll back to yesterday’s news if necessary. Quick access to news within the app could help people make better trading decisions in the long run.

These messages could be further improved with personalization. The first step is to only send messages that relate to stocks in a person’s portfolio or watchlist, but we can go even further.

Personalized App Inbox messages can deliver alerts based on a person’s browsing history, much like product recommendations in a retail app. If someone browses Google’s or Amazon’s stock without explicitly watchlisting it, they’ll find more headlines about tech stocks in their inbox the next day. Or, if a person browses securities of a particular category (such as bonds or ETFs), headlines will feature news from any industry if it relates to those categories. This is a good way to increase content discovery and engagement without waiting on explicit user actions.

Other Mobile Messaging Use Cases For Fintech Apps

The messaging campaigns described in this post are tailored to financial apps, but some campaigns work for every app vertical. Lifecycle campaigns that proactively reach out to users at major touchpoints are a good way to support engagement and retention.