“So how much do you think I should spend on marketing?”

This is one of the most common questions that I receive during the initial SEO consultation with small business owners. It underlines a serious problem that many businesses have—how to acquire new customers and how much to spend in order to do so.

The common rule of thumb of dedicating 5% of your revenue to marketing purposes is quite unusable when accounting for wild variations in marketing spends from industry to industry.

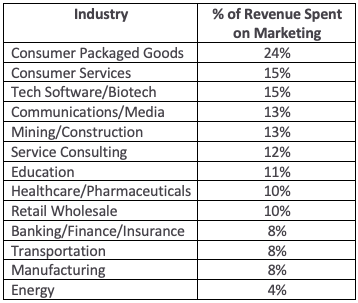

While consumer packaged goods spend as much as 22% of revenue on customer acquisition/marketing, professional services such as law firms tend to spend around 7%. Across industries, businesses spend on average only 2% to 5%, which is the source of the commonly cited “5% rule.”

Just because a specific percentage is typical in your industry doesn’t mean that’s the amount you should spend on your marketing budget. Factors like your growth stage and how competitive your industry is will affect this percentage, so you need to keep all of this in mind.

At the same time, there are some simple steps you can take that will help you to determine how much you should be spending on your marketing. This post is going to share some actionable approaches to establishing a marketing budget that can feed your growth engine.

Step 1: Select a Marketing Strategy that Aligns With Your Growth Stage

Are you a new company that is hoping to acquire market share? Are you an established business that simply wishes to maintain its market share? Are you able to burn cash to quickly acquire new customers in order to push out competitors?

These are all vital strategic questions that you will need to answer before establishing a marketing budget.

An established business is not necessarily going to have to spend as much as a startup to acquire new customers and gain market share. New businesses often have to spend several times more than incumbent businesses in order to capture market sure, often at a loss.

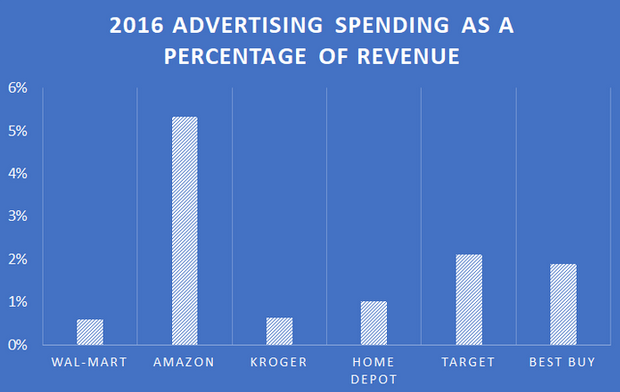

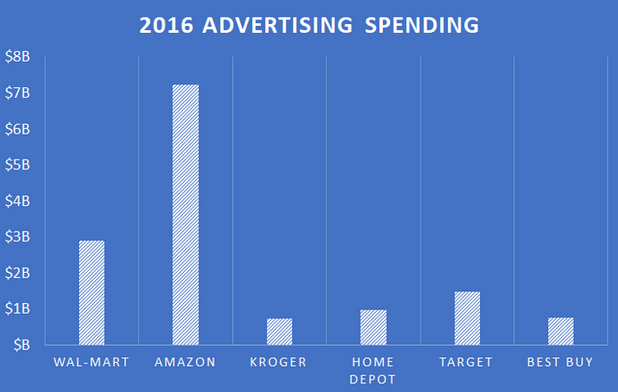

As a matter of fact, it is an extremely common strategy for startups to spend unprofitably high amounts on marketing/customer acquisition in order to gain market share and push out competitors. This was Amazon’s strategy for many years and one of the reasons why it has turned into the giant it has become. While Walmart spends about 0.5% of its revenue on advertising and Target spends about 2%, Amazon spends a whopping 5% of its revenue on advertising, several times higher than industry averages.

(courtesy of: https://www.fool.com/investing/2017/06/15/amazon-spends-more-on-marketing-than-wal-mart-targ.aspx)

While it may be quite a stretch to still refer to Amazon as a “startup,” the strategy it employs is common in the world of startups. Peter Thiel refers to this as “escaping the competition” through achieving “escape velocity”—basically, spending so much money that you end up so far ahead of competitors that they will never be able to catch up to you.

While you may not be a Silicon Valley startup, this strategy can be used for any new business that can afford to burn cash in order to gain market share. There is nothing keeping a new pizzeria, gym, or other small business from dominating a category in a local market by overwhelming competitors through marketing.

Step 2: Determine Your Customer Lifetime Value

How much are you willing to spend to acquire a new customer?

If you don’t know how much a customer is worth, you can’t answer that question.

While some businesses keep extensive spreadsheets and track of their customer lifetime value to the penny, most small to medium-size businesses don’t. When I ask them questions about their customer lifetime value, are usually give me a number for their average sale.

Customer lifetime value is the net present value of your average customer profit over a lifetime, including any potential referral business that may be generated. While I’m not going to get into the details of calculating CLV, this post will show you how to handle it.

Once you determine your customer lifetime value, you can calculate the amount you can spend on acquiring customers.

Just keep in mind that this must align itself with the growth strategy you are pursuing. It may be worth earning cash to acquire market share with the hope of profiting once you dominate the market. You also may find yourself in a situation where you need to generate profits now.

What If I Can’t Figure Out My Customer Lifetime Value?

This is less than an ideal situation, but you still have some options for figuring out how much to spend.

Deloitte has a chart that outlines the average spent on marketing as a percentage of revenue for public companies by industry:

(courtesy of: https://vtldesign.com/digital-marketing/content-marketing-strategy/percent-of-revenue-spent-on-marketing-sales/)

While this chart can serve as a benchmark, it is important to consider some of the factors mentioned earlier; namely your growth stage in relation to your competitors, your cash status, and your growth strategy.

If you are an emergent business in your industry wishing to achieve escape velocity to acquire market share, you should probably consider doubling or tripling the average of your industry.

If you are an established player that simply needs to maintain market share, you may even be able to spend below this average.

Ultimately, All That Matters Is Profitability

Once you determine how much a customer is worth to you, you can determine how much you can spend to acquire a customer. The only variable is whether you are willing and able to use your marketing budget to accelerate market share acquisition to the point where you own the category.

It is all a question of how much you can spend to acquire customers now and or sometime in the future. Now, let’s fire up a spreadsheet, calculate our customer lifetime value, choose a growth strategy, establish a budget, and explore the different marketing channels that you can leverage with your marketing budget.