Decentralized finance (DeFi) as an industry is growing rapidly, and with the potential to generate substantial returns and financial independence, many are eager to learn how to invest in DeFi.

In this comprehensive guide, we will explore the steps and strategies to navigate the exciting world of DeFi investments.

Best Ways to Invest in DeFi

If you are learning how to invest in DeFi projects for the first time, some of the best ways to get into DeFi are:

- Invest in DeFi Coin (DEFC) – Undervalued DeFi Project in 2025

- DeFi Staking – Generate a Yield by Locking Your Tokens

- DeFi Savings Accounts – Earn Interest via a DeFi Savings Account

- DeFi Yield Farming – Earn a Share of Trading Fees by Providing Liquidity

- Invest in DeFi Stocks – Gain Exposure to DeFi via the Stock Market

- Secured DeFi Loans – Leverage Your Crypto Investments by 50%

- Get a DeFi Wallet – Store Tokens and Earn Interest via a DeFi Wallet

- Hold Stablecoins – Enjoy DeFi Rewards Without Volatility

- Invest in NFTs – Add NFTs to Your Portfolio via a DeFi Marketplace

How to Invest in DeFi – Methods Explained

One of the critical aspects of DeFi is the ability to invest and earn returns on digital assets. However, all DeFi investments carry an inherent level of risk, so as with any investment, it is advisable to start small and gradually increase your exposure to DeFi.

If you’re wondering how to invest in DeFi to maximize your potential gains as safely and as quickly as possible – consider one of the 9 methods outlined below.

1. Invest in DeFi Coin

A simple and popular way to invest in decentralized finance is to buy the best DeFi coins for your portfolio.

Like all crypto tokens, the DeFi coins that you buy will be listed on crypto exchanges – some offer a bespoke DeFi portfolio as a way to invest in DeFi crypto assets, which we’ll review further down this list.

Holding DeFi crypto, the value of your investment will go up and down throughout the day – based on the market forces of demand and supply. According to CoinMarketCap, there are now over 540 DeFi tokens that you can buy. Each token and project will focus on a specific area of the decentralized finance industry, so you will need to do some research to pick the right coin for your portfolio.

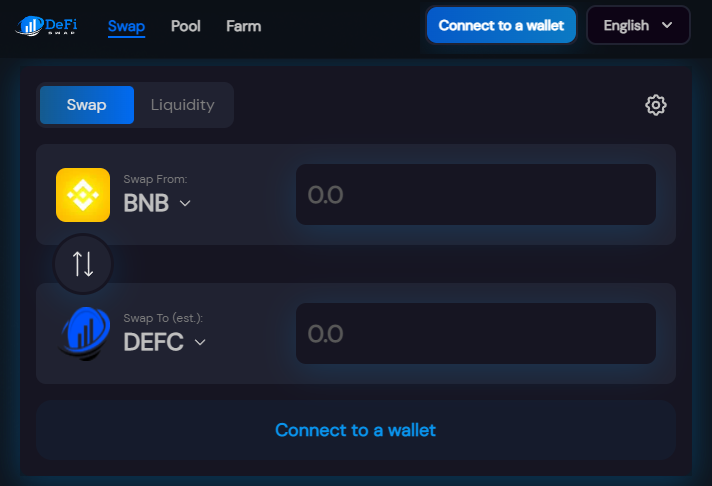

One undervalued project currently is DeFi Coin (DEFC) – which launched in 2021 and aimed to become the go-to hub for all things decentralized finance. DeFi Coin is the native token of the DeFi Swap exchange, a decentralized exchange which offers a variety of decentralized applications (dApps) and tools.

DeFi Coin itself is built on top of the Binance Smart Chain and it carries an innovative taxation system that penalizes short-term market speculators.

The underlying smart contract does this by taxing sell orders at 10%.

2. DeFi Staking

Another popular method is to use a platform that supports crypto staking. The main concept of this way of DeFi investing is that you will ‘lock’ your tokens for a certain time period. In turn, you will generate interest on the tokens you have deposited.

There are actually two ways in which you can achieve this. First, you can stake your tokens on a PoS (Proof-of-Stake) blockchain like Solana or Cardano. The tokens will then be locked into the respective blockchain and subsequently used to verify transactions.

Instead, it’s much better to use a third-party staking platform that not only has a good reputation – but offers a high APY. In doing so, you will deposit your tokens into the provider’s smart contract, which, in turn, will be used to fund liquidity pools and loans.

As a prime example, you can stake the platform’s native DeFi Coin and earn up to 75% on a 1-year lock-up term. If this is too long for you, DeFi Swap also offers 1, 3, and 6-month terms, albeit, at a lower yield.

3. DeFi Savings Accounts

You may also consider crypto savings accounts as a way to invest in DeFi. The process entails depositing your idle crypto tokens into a savings account and in return you generate interest.

DeFi savings accounts pay high yields depending on various factors – such as the DeFi platform in question, which tokens you wish to save, and if you commit to a lock-up period. Some DeFi accounts pay higher rates when you stake their native token.

Aqru is a more simple crypto interest account provider. It has no lock-up terms, deposits are flexible and investors are free to withdraw at any time until the yield rate recovers if they wish.

It takes just minutes to open an account with Aqru and if you do not have any crypto tokens to hand – you can actually deposit fiat money via a bank wire or debit/credit card.

Visit Aqru.io to check the latest APY rate.

4. DeFi Yield Farming

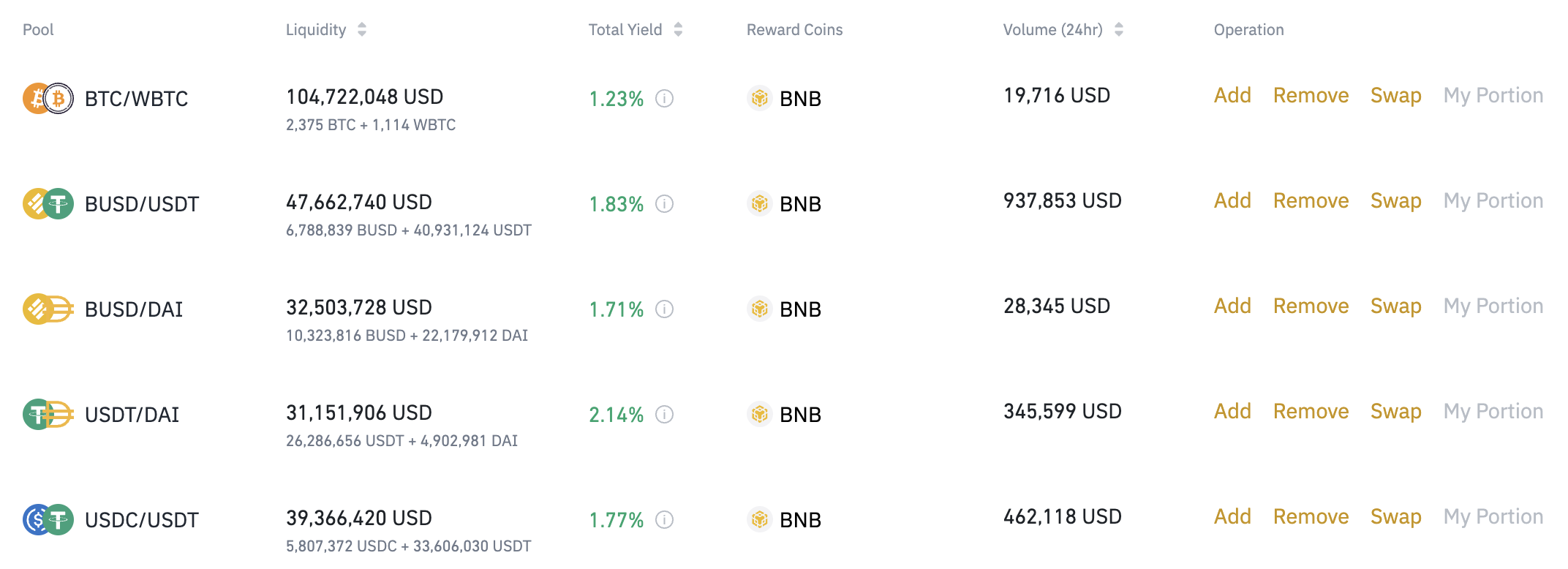

Next up on our list of the best ways to invest in DeFi is yield farming. This works in a somewhat similar way to the previously discussed staking, This is because you will be lending your idle tokens to a decentralized exchange of your choosing. However, the key difference is that you will be providing liquidity to the exchange.

Moreover, as liquidity allows buyers and sellers to trade without a third party, you will need to provide tokens for a specific trading pair.

In other words, if you add $1,000 worth of BNB, you will also need to add $1,000 worth of CAKE. In doing so, this will allow people of the respective exchange to swap BNB for CAKE in a decentralized manner – and vice-versa. Each buyer and seller that uses the respective liquidity pool will subsequently pay a trading fee.

And, as you have contributed liquidity to the pool, you will be entitled to a share of any trading fees collected.

If you’re looking for the best place to invest in DeFi farming pools, consider DeFi Swap. As noted earlier, this DEX offers high-interest yields across both farming and staking in a user-friendly and trusted environment.

5. Invest in DeFi Stocks

You can now gain exposure to the DeFi industry via the traditional stock markets. In a nutshell, you look to invest in stocks that are in some way, shape, or form involved in the growth of decentralized finance.

That way you won’t need to buy cryptocurrency to speculate on DeFi, nor will you need to worry about exchanges or wallets. Instead, you need to open an account with a regulated stockbroker and purchase your chosen number of shares.

6. Secured DeFi Loans

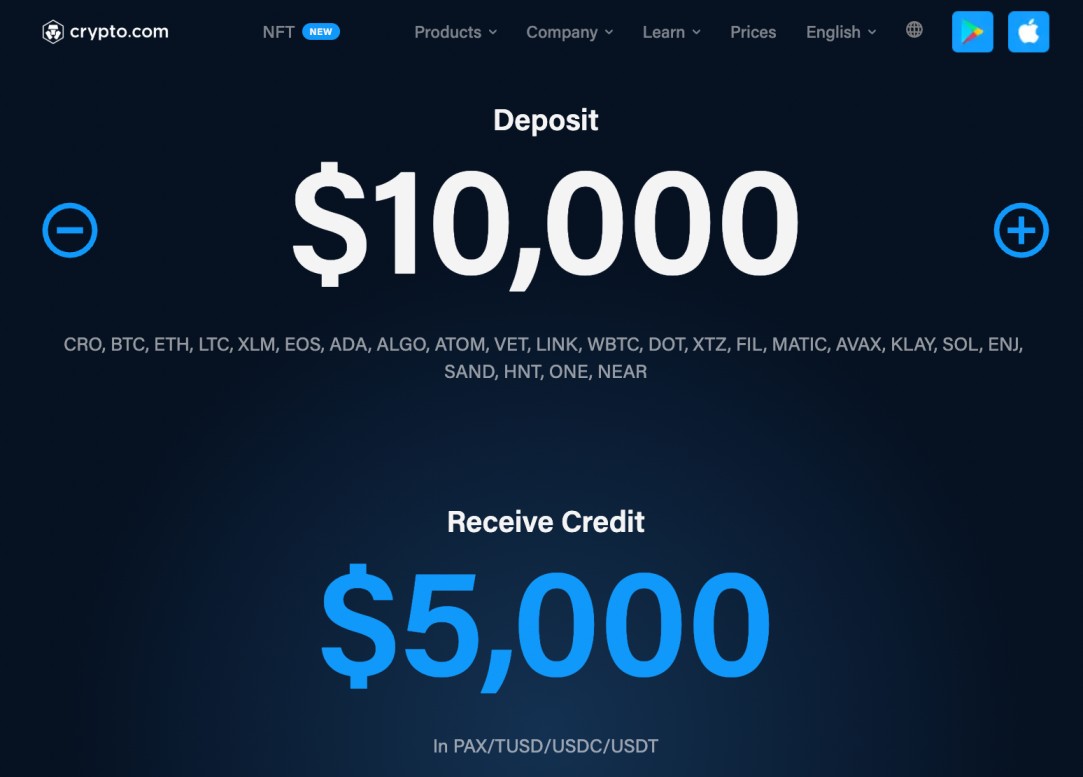

A core segment of the DeFi investment scene is that of crypto loans. DeFi loans can be taken out instantly without the need for a credit check or any documentation, and all you need to do is deposit some collateral in the form of crypto tokens.

Now, in terms of how to utilize DeFi loans from an investment perspective, the concept allows you to obtain leverage. For example, let’s suppose that you deposit $5,000 worth of Ethereum tokens into a DeFi loan site that offers an LTV of 50%.

This means that in return, you can borrow funds up to 50% of the value of your collateral – so that’s $2,500. This $2,500 can then be used to invest in other DeFi projects – such as tokens, stocks, or yield farming. Furthermore, and perhaps most importantly, you still retain full ownership of the $5,000 worth of Ethereum that you deposited.

As a result, crypto loans offer one of the best ways to raise finance when investing in DeFi.

7. Get a DeFi Wallet

If you’re looking to invest in decentralized finance as part of a long-term strategy, then it is crucial that you get yourself a suitable DeFi wallet. That way you can store your crypto tokens in a non-custodial manner – just as they should be in the DeFi space.

We found that the best DeFi wallet in the market is currently being offered by Crypto.com. Not only does the Crypto.com wallet offer a safe storage facility, but you can access a range of DeFi services.

8. Hold Stablecoins

One of the main issues that inexperienced investors have with the DeFi space is that oftentimes – volatility levels can be extremely high, meaning if the value of the respective tokens witnesses a major decline, you might end up losing money.

This is where stablecoins come in. By opening a DeFi interest account that supports stablecoins, you can enjoy the benefits of high yields without worrying about volatility, as stablecoins are pegged to conventional fiat currencies like the US dollar or euro.

With that being said, stablecoins are not totally risk-free – as we saw with the recent Terra USD saga. For those unaware, Terra USD lost its peg to the US dollar and even hit lows of sub$0.20. Nonetheless, by focusing on solid stablecoins like DAI or USD Coin, you can earn a highly attractive interest rate of 12% at leading platform Aqru. No lock-up periods are required.

9. Invest in NFTs

The final option to consider from our list of DeFi investments is that of non-fungible tokens – or NFTs, one of the fastest-growing segments of the DeFi industry.

After all, when you buy an NFT and add it to your wallet, you are the only person that has access to the underlying item. One of the best NFT investments in the market right now is being offered by Lucky Block.

Is DeFi a Good Investment?

Cryptocurrency and blockchain technology is expected to revolutionize a vast range of industries and sectors. And perhaps at the forefront of this is the traditional financial services market.

DeFi could represent a highly viable addition to your investment portfolio. As this guide has discussed, you can invest in DeFi through a number of popular channels and platforms. There are an extensive range of DeFi products that allow you to earn interest – each of which comes with varying risks and yields.

Where to Invest in DeFi?

If you want to invest in DeFi because you believe that decentralized finance will eventually replace conventional service providers – then you will need to do so via a top-rated platform.

Although there are plenty of options in this market, we found that DeFi Swap is the overall best platform to access decentralized financial tools in a user-friendly manner.

DeFi Swap – Overall Best DeFi Lending Platform for 2025

DeFi Swap is a decentralized platform that has been built on top of the Binance Smart Chain. As such, it is able to facilitate transactions not only without the need for a third party, but in a fast and low-cost manner. In choosing DeFi Swap as your go-to platform, you will have access to a variety of high-yield investment tools.

- First, you might consider utilizing its crypto farming feature, which allows you to provide liquidity for its decentralized exchange.

- In doing so, on each buy and sell transaction that goes through the pair that you provide liquidity for, you will earn a share of trading fees. This offers a great way to earn passive income on crypto tokens that would otherwise sit idle in a wallet.

- Next, you can also earn an APY of up to 75% through the DeFi Swap staking function.

- This comes with four options in terms of lock-up periods – 30, 90, 180, and 365 days.

- Additionally, you can also use DeFi Swap to access your favorite BSc tokens. That is to say, you can swap one token for another instantly – without needing to use a traditional crypto exchange.

Most importantly, there is no human interaction when transactions go through the DeFi Swap platform. On the contrary, transactions are executed via an audited and immutable smart contract. This means that if, for example, you opt for the yield farming or staking tool, your tokens will be returned to your wallet automatically once the respective term concludes.

We also like DeFi Swap as it is backed by the aforementioned DeFi Coin. As we discussed earlier, DeFi Coin rewards long-term holders by sharing 50% of the tax that it collects from sell orders. DeFi Swap is only at the very start of its decentralized finance journey, with a mobile app for iOS and Android as well as an NFT facility in the pipeline for 2025.

Pros

Cons

Conclusion

Learning how to invest in DeFi can result in a fantastic investment opportunity.

One promising way is to add some DeFi tokens to your portfolio. We like DeFi Coin (DEFC) for this purpose, which is backed by the decentralized platform DeFi Swap.

However, make sure you conduct analysis and research before investing, as there are significantly higher security risks due to DeFi’s new and largely unaudited nature.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.