We provide a roundup of 12 new cryptocurrency to invest in this month – April 2022 – that have the potential to scale for mass adoption in financial markets, but also other areas of the economy, from cloud computing to content delivery networks.

In our survey we will resist the temptation to take an adversarial approach, where crypto’s gain is taken to be the current incumbents’ loss. We don’t believe that is how things will develop. Indeed, many of today’s leading SaaS companies are likely to be leaders in adopting aspects of blockchain technology.

To have the best shout at gaining exposure to the best the crypto sector has to offer, it is probably necessary to diversify across the asset class’s various sub sectors, which is what we have tried to do with our nifty dozen picks.

We have selected 12 cryptocurrency with the technology, adoption progress, execution and product marketing prowess to deliver on the promise of blockchain as a disruptor and disintermediator that could change the face of the SaaS space in innovative and profitable ways.

As with all definitions, competing ones can bleed into each other, but we have grouped our token selections into the following four business sectors, with three crypto in each:

Here’s our 12 Best New Cryptocurrency to Invest in 2022

Before you get started, you might also want to read our Best Bitcoin Brokers in the UK guide for a breakdown of the most popular places to buy cryptos in 2022.

Web 3.0 cryptocurrency for April 2022

1. Lucky Block – transforming crypto games with blockchain tech

Lucky Block is a new crypto games platform that aims to revolutionise the $330 billion global industry around games of chance by solving, among other things, the lack of transparency and trust in current lottery products. Breaking the grip of the centralised lottery operators by applying the power of ‘Web 3.0’ decentralised networks is how Lucky Block plans to succeed.

With Lucky Block, winners are not just randomly generated in a verified manner but players will be able to vote on where charitable donations go – with all transactions visible on the public blockchain.

In addition, the cost savings that accrue from running draws on a blockchain are the basis for better odds for ticket buyers. The benefits don’t end there. Lucky Block, which launches on 21 March when the desktop app is scheduled to be available, also pays a token distribution to every token holder. Ten per cent of every jackpot goes to token holders.

Then there is the added allure of the 12% transaction fee on sales of the native token of the platform, LBLOCK, which acts to incentivise long-term investment as opposed to purely speculative trading so common in crypto hitherto.

Lucky Block’s mission is nothing less than the replacement – or supplementing – of the offerings from the current industry incumbents with a truly global system open to all. There’s all to play for, so to speak. Lucky Block is also the best crypto under $1.

Data in table below is from decentralised exchange PancakeSwap and is correct as at 11 April 2022. We have included volume data from centralised exchange LBank, where LBLOCK also trades.

| LuckyBlock (LBlock/WBNB) | |

| Price: | $ 0.002531 |

| Volume 24 hour: | $340,768 |

| Holders: | 50,266 |

| Transactions: | 266,000 |

| Pooled LBlock: | 1.36 billion |

| Pooled WBNB: | 8,574 |

| Total liquidity: | $6,868,404 |

| Diluted Market CAP: | $253 million |

Table data correct as at 11 April 2022

Cryptoassets are a highly volatile unregulated investment product.

2. Polygon (MATIC) – layer 2 platform for Ethereum dapp platform

Typically categorised as a Layer 2 platform because of its increasingly important role in reducing the cost of Ethereum transactions, Polygon, because of this role, is a critical part of the current Web3 infrastructure.

Polygon is a platform design to support infrastructure development and help Ethereum scale. Its core component is a modular, flexible framework (Polygon SDK) that allows developers to build and connect Layer-2 infrastructures like Plasma, Optimistic Rollups, zkRollups, and Validium and standalone sidechains like the project’s flagship product, Matic POS (Proof-of-Stake). Polygon rebranded from Matic Network in February 2021 and pivoted towards supporting multiple Layer-2 infrastructure.

But with Ethereum migrating to Eth 2.0, doesn’t that remove the need for Polygon’s sidechain approach. Far from it. At the end of last year Polygon acquired Mir =which specialises in ZK rollups that can be applied to Eth 2.0 to add yet more scaling potentiality. Now and in the future, Polygon will be at the heart of web3.

| RETURN ON INVESTMENT (USD – %) | |

| 24H | 5.54 |

| 7D | -13.02 |

| 1M | 12.61 |

| 3M | -54.77 |

| 1Y | -13.12 |

Institutional investors

- Au21 Capital

- Coinbase Ventures

- Binance Labs

Cryptoassets are a highly volatile unregulated investment product.

Metaverse and NFT cryptocurrency for April 2022

3. The Sandbox (SAND) – metaverse and gaming digital asset monetisation platform

The Sandbox platform is an ecosystem where gamers can create, own, and monetise their activities wit the help of non-fungible tokens (NFTs) and its utility token $SAND. NFTs are in effect a digital certificate of ownership.

Players can use NFTs to assign verifiable ownership to their digital assets integrate into games and trade on marketplaces. The Sandbox provides tools such as the Game Maker to enable player engagement.

Also, The Sandbox virtual world – or metaverse – is comprised of digital lots of real estate bought with LAND tokens, where players can become digital property developers and interact.

Companies such as Facebook owner Meta are betting big on the metaverse as the next iteration of the internet, where people will work, play, socialise and shop, so there will be money to be made.

An unknown buyer recently paid $450,000 for a patch of virtual land next to rapper and businessman Snoop Dogg’s Sandbox ‘residence’.

The Sandbox is an excellent new cryptocurrency to buy.

| RETURN ON INVESTMENT (USD – %) | |

| 24H | 4.69 |

| 7D | -16.71 |

| 1M | 11.56 |

| 3M | -37.44 |

| 1Y | 943.06 |

Institutional investors

- Binance Labs

- HASHED

- True Global Ventures

Cryptoassets are a highly volatile unregulated investment product.

4. Filecoin (FIL) – distributed file transfer and storage

Filecoin is a relatively new cryptocurrency to invest buy for exposure to distributed data storage network that seeks to turn unused data storage into a business resource, where those with excess capacity are able to sell it users seeking greater capacity.

Exchange takes place in an automated algorithmically driven marketplace.

The network is built on top a protocol known as InterPlanetary File System (IPFS), acting as both a layer to incentivise participation in the network and provide security in addition to its peer-to-peer sharing of storage.

Protocol Labs is the company behind Filecoin.

| RETURN ON INVESTMENT (USD – %) | |

| 24H | 0.48 |

| 7D | -1.91 |

| 1M | 6.88 |

| 3M | -60.73 |

| 1Y | -54.55 |

Institutional investors

- Ausum Ventures

- Blockchain Capital

- BlueYard Capital

- Boost VC

- Coefficient Ventures

- Continue Capital

- Digital Currency Group

- Galaxy Digital

- Kosmos Capital

- Nirvana Capital

- Notation Capital

- Pantera Capital

- Placeholder VC

- Y Combinator

- a16z Crypto

- zk Capital

Cryptoassets are a highly volatile unregulated investment product.

5. Enjin (ENJ) – gaming community platform, virtual goods marketplace

Enjin Coin is another game-focused metaverse product from the crypto world, this time focused on making its token the go-to digital asset for in-game items. Enjin aim is to become the “largest gaming community platform online” and already boasts the involvement of 250,000 gaming communities with a total of 18.7 million gamers.

The Enjin team are innovators in the NFT field, with a token they invented winning approval as an Ethereum token standard for specialised NFTs – ERC-1155.

Similarly to the The Sandbox, Enjin distributes software development kits (SDKs) to developers in order to facilitate rapid deployment of integrations into games.

For more details on the investment process read our how to buy Enjin coin.

| RETURN ON INVESTMENT (USD – %) | |

| 24H | 6.09 |

| 7D | -6.73 |

| 1M | 8.30 |

| 3M | -57.55 |

| 1Y | 184.58 |

Institutional investors

- CoinFund

- Coinbase Ventures

- DT Capital Partners

- Digital Currency Group

- Framework Ventures

- Kilowatt Capital

- LedgerPrime

- Lemniscap

- Multicoin Capital

- ParaFi Capital

Cryptoassets are a highly volatile unregulated investment product.

6. Decentraland (MANA) – Metaverse virtual world

Decentraland is similar to The Sandbox in its virtual world aspect and another solid cryptocurrency to invest in. Here there are also LAND tokens which are purchased with the ERC-20-compatible MANA token that runs on the Ethereum blockchain.

Again NFTs are used to assign ownership to the digital real estate. And just like in the real world, the most valuable LAND is to found in the busiest places.

NFT-focused company Tokens.com spent nearly $2.5 million on LAND in the virtual world in an indication of the burgeoning interest in the metaverse and the commercial opportunities it offers.

And at the end of January the metaverse’s first mortgage was taken out. On 29 January TerraZero, a vertically integrated metaverse company, advanced financing to one of its clients so they could buy Decentraland real estate.

While Mark Zuckerberg’s Meta Platforms is spending billions to build its metaverse, crypto have been quietly building an ‘open’ metaverse for a number of years, and at far less cost.

| RETURN ON INVESTMENT (USD – %) | |

| 24H | 1.01 |

| 7D | 3.76 |

| 1M | 44.69 |

| 3M | -26.72 |

| 1Y | 838.60 |

Institutional investors

- Animoca Brands

- Boost VC

- Digital Currency Group

- Fabric Ventures

- Fundamental Labs

- HASHED

- Kenetic Capital

- Kosmos Capital

Cryptoassets are a highly volatile unregulated investment product.

DeFi cryptocurrency for April 2022

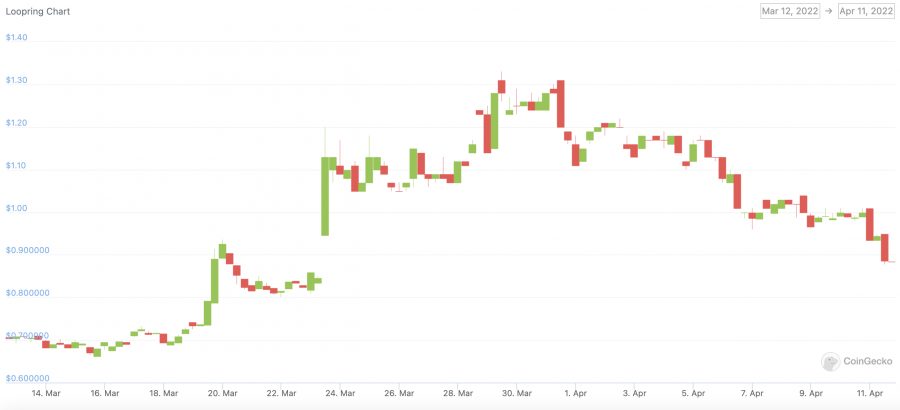

7. Loopring (LRC) – decentralised exchange

Loopring is similar to Polygon in being a Layer 2 solution for ethereum. More specifically it is focused on making DEXs better. To do this it uses ZK rollups to making DEXs more scalable and to reduce fees.

As such it is an open protocol and claims to be able to offer scalability without degrading security which is something approaching the holy grail in blockchain technology.

Breaking down its tech to the essentials, Loopring provides DEX with a way of choosing between storing transaction on or off chain at any given point in time.

This On-chain data availability (OCDA) combines with its Ring Miners and order rings to deliver greater DEX scalability.

Off-chain storage with Loopring delivers transactions per second (tps) of 16,400. Its that sort of tps that is getting Loopring noticed.

| RETURN ON INVESTMENT (USD – %) | |

| 24H | 4.39 |

| 7D | -8.29 |

| 1M | -12.67 |

| 3M | -56.17 |

| 1Y | -66.23 |

Institutional investors

- Amplifi Capital

- Chain Funder

- Hash Capital

- Consensus FinTech Group

- Kosmos Capital

- LD Capital

- Zhi Zi Fund

- Obsidian Capital

- UniValue Associates

- Matrix CIB

Cryptoassets are a highly volatile unregulated investment product.

8. Curve (CRV) – decentralised exchange

Curve protocol has been a fast-grower in the decentralised finance (DeFi) sector. Its approach was initially centred on leveraging the liquidity of stablecoins to create more stable sources for yields on loans. There are no order books for the markets on Curve, with market making instead an automated process built around liquidity pool trading pairs.

Today it has expanded to become a venue trading all manner of coins with pegged values, such as so-called wrapped tokens that run blockchains other than Ethereum where Curve runs.

Currently, Curve has 122 different liquidity pools for the pairs that can be swapped on the decentralised exchange (DEX), where its highly competitive trading fees, deep liquidity and constrained slippage (when the price slips between the time the trade execution began and it finishing).

At this point, we rate Curve as a safe choice of cryptocurrency to invest in. For more information on how to buy Curve you can refer to our handy guide.

| RETURN ON INVESTMENT (USD – %) | |

| 24H | 2.55 |

| 7D | -7.60 |

| 1M | -7.00 |

| 3M | -46.94 |

| 1Y | -7.78 |

Institutional investors

- Fuel Venture Capital

- Crowdcube

- CreditEase Fintech Investment Fund

- Outward VC

Cryptoassets are a highly volatile unregulated investment product.

9. PancakeSwap (CAKE) – decentralised exchange

PancakeSwap is a decentralised exchange (DEX) that run on the Binance Smart Chain (BSC) and is also based on automated market making system. PancakeSwap is a fork of SushiSwap, which is another Ethereum-based DEX.

A fork refers to a coin that shares it’s codebase with another crypto, but there are differences that add extra features. In this case, the change is the DEX runs on the Binance Smart Chain which is faster and cheaper to transact over.

BSC is built by the world”s largest crypto exchange Binance and operates with a form of what is known as a proof of stake system, where just 21 validators verify transactions as oppose to thousands of nodes on Ethereum.

CAKE is a relatively new cryptocurrency to invest in and we think it has much further to grow in the DEX space.

| RETURN ON INVESTMENT (USD – %) | |

| 24H | 4.23 |

| 7D | -4.21 |

| 1M | 2.26 |

| 3M | -48.02 |

| 1Y | -53.86 |

Institutional investors

- LedgerPrime

- Binance Labs

Cryptoassets are a highly volatile unregulated investment product.

Data management cryptocurrency for April 2022

10. The Graph (GRT) – indexing protocol for querying blockchains

We take for granted that the internet “just works”, without having to think about how universal resource locators (urls – web links) actually work of what TCP/IP protocols are. Without them there would be no Google search engine. The Graph is attempting to build the indexing standard for the decentralised application world, so that data on blockchains can be queried in an easily accessible way.

Developers build applications with The Graph’s open APIs can readily access on-chain data that have been previously indexed by a network of node operators.

The Graph’s technology – called Subgraphs – is open source so all-comers can build decentralised apps (dApps) using them. Among the many Ethereum dApps using Subgraphs are high-profile projects Audius, Uniswap, and Synthetix.

GRT is a good strategic pick for a cryptocurrency to invest in for your portfolio.

| RETURN ON INVESTMENT (USD – %) | |

| 24H | 6.00 |

| 7D | 3.13 |

| 1M | 0.16 |

| 3M | -53.77 |

| 1Y | -81.92 |

Institutional investors

- Coinbase Ventures

- DT Capital Partners

- Digital Currency Group

- Framework Ventures

- Kilowatt Capital

- LedgerPrime

- Lemniscap

- Multicoin Capital

- ParaFi Capital

- Tally Capital

Cryptoassets are a highly volatile unregulated investment product.

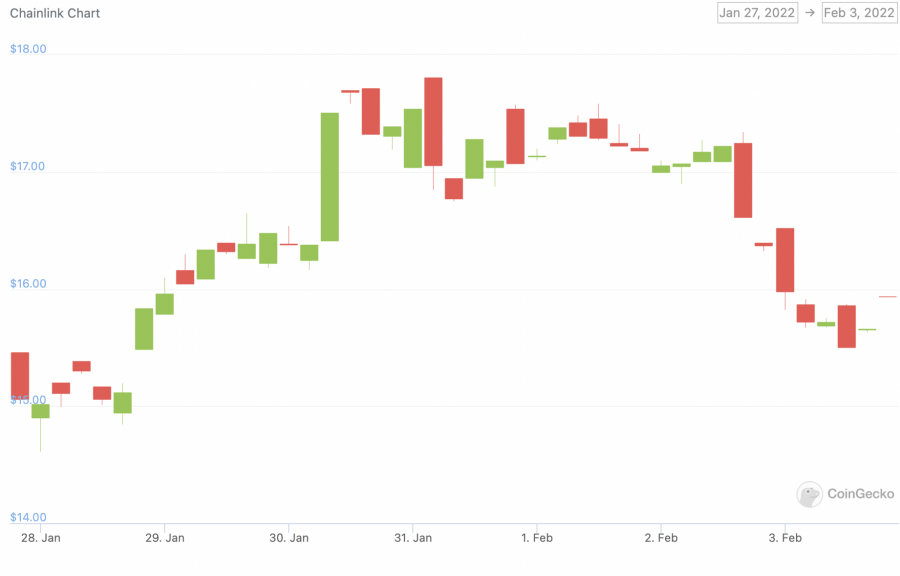

11. Chainlink (LINK) – decentralised oracle network

Chainlink’s purpose is to solve the problem of connecting smart contracts to real-world events in a secure fashion. Smart contracts are pieces of code that embody certain business logic, such as when to pay an interest on a loan. In order to known when to make the payment to lenders, the smart contract in this case would need to know the calendar date.

Real-world information such as this is provided by ‘oracles’, which are in effect data feeds of one kind or another that exist off-chain. Chainlink is a network of independent oracle node operators, which makes it more secure than previous oracle services.

Services such as those provided by Chainlink are emerging as the essential plumbing of the blockchain world. Another crypto which could take the market by storm is 1inch. For more details read our how to buy 1inch token guide.

| RETURN ON INVESTMENT (USD – %) | |

| 24H | 4.52 |

| 7D | -4.00 |

| 1M | -3.73 |

| 3M | -43.34 |

| 1Y | -55.27 |

Institutional investors

- Anmi OECD

- Consensus Capital

- Framework Ventures

- Outlier Ventures

Cryptoassets are a highly volatile unregulated investment product.

12. Dent (DENT) – decentralised mobile data marketplace

Dent says its vision is to create a global exchange using the Ethereum blockchain, where everyone has the opportunity to buy and sell mobile bandwidth in any country. With 7.26 billion thought to own a smart or feature phone – 91.62% of the world’s population – the business opportunity in this market is immense.

The company has already attracted more than 25 million mobile device users onto its decentralised marketplace for trading data surpluses. Dent’s service is available in more than 140 countries.

It is making significant strides forward in enterprise. Dent has partnerships in place with Samsung Blockchain and Telecom Infra, for instance.

| RETURN ON INVESTMENT (USD – %) | |

| 24H | 5.97 |

| 7D | -5.38 |

| 1M | 7.21 |

| 3M | -53.18 |

| 1Y | 14.68 |

Institutional investors

- SEED Venture Capital

Cryptoassets are a highly volatile unregulated investment product.

Conclusion – the best cryptocurrency to buy April 2022

Prices in the crypto market are rangebound at the moment, with altcoins taking their cue from bitcoin. With bitcoin trading around the $38,000 mark there is much chatter as to whether a breakout to the upside is imminent, perhaps assisted by the geopolitical tensions affecting the global economy in the first quarter of 2022.

The juries out on the exact timing of any such breakout. Nevertheless, we think the market is at or near the bottom for this cycle. That means a diversified portfolio of crypto assets based among the 12 coins highlighted here, should provide investors with plenty of upside.

If held for the medium term, which would be for up to three years, buying crypto assets near cycle lows presents an excellent risk-reward opportunity.

Investors may wish to consider dollar cost averaging into the market by buying relatively small amount on a regular basis to smooth out returns, thereby foregoing the need to attempt to time the best moment to invest a lump sum.

Cryptoassets are a highly volatile unregulated investment product.