LinkedIn, the former dark horse of social media, has not only grown past Twitter, but is a serious publishing platform in its own right. Let’s see what LinkedIn reported for its Q3 earnings.

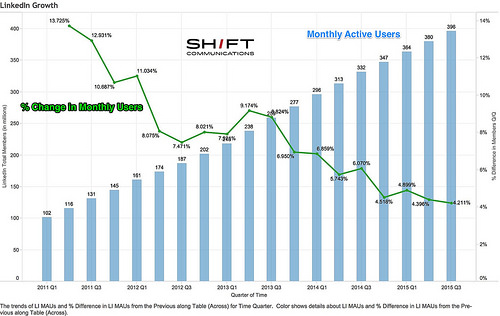

Growth

LinkedIn’s membership growth has remained strong despite passing the 350 million monthly active users mark earlier this year:

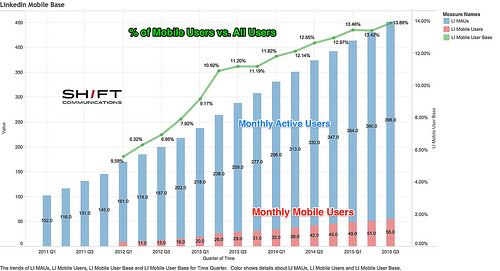

Above, we see sustained 4% quarter over quarter growth, indicating a still-healthy social network. Of interest, however, is this statistic about mobile users:

Contrary to other major social networks, a surprisingly small portion of LinkedIn’s user base are using the service from mobile devices, hitting 55% this quarter. This is an outlier; Facebook, Twitter, and Instagram all have significant majorities of members using their respective services from mobile devices.

Why? Part of the reason may be LinkedIn’s legacy as a career-focused portal. Many talent solutions and applicant tracking systems are poorly designed for mobile devices; if you’ve ever tried to apply for a job from your smartphone, you know just how cumbersome the process can be. LinkedIn members still frequent the service for career purposes; year over year, they have quadrupled the number of jobs available. Thus, job seekers may likely be doing career searches from their desktop computers, affecting LinkedIn’s mobile usage.

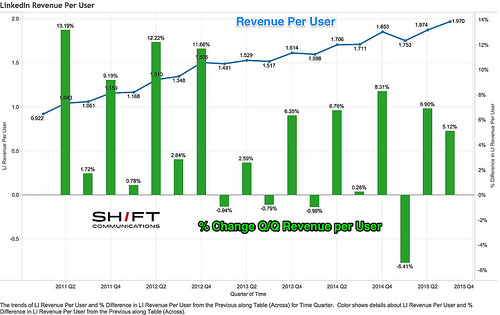

Revenue

Overall, LinkedIn’s financial performance continues to improve, nearing the $2 revenue per user mark:

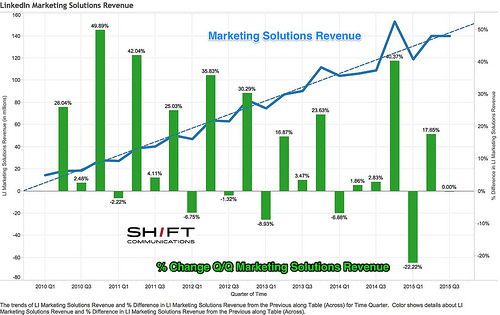

This is good news for LinkedIn; however, there was a surprise in there for those of us who use their marketing solutions:

Above, we see that Marketing Solutions – which includes their advertising systems, sales systems, and lead acceleration services – was flat. While Q3 has not historically been the strongest quarter for their marketing revenue, it’s been especially weak. This is aligned with CEO Jeff Weiner’s previous comments about significant revenue challenges from PPC advertising and the real-time buying ad market.

Looking Ahead: What It Means for Marketers and PR Pros

LinkedIn is making significant investments to close the gap in its mobile experience, beginning with a revamp of its mobile messaging experience. Expect to leverage these improvements for 1:1 outreach and communication with other members on LinkedIn. Further simplification is expected to roll out broadly in November 2015.

Mr. Weiner also remarked that Sponsored Updates have doubled their value, a 100% increase year over year in revenue. For marketers, that means the pricing of Sponsored Updates is significantly more competitive than it has been in the past. Expect to pay more or get lesser results with the same budget as competition for Sponsored Updates grows more fierce.

We also anticipate accelerated rollouts of LinkedIn Elevate (the employee advocacy service) and Social Selling Index. The former could provide stiff competition for companies such as GaggleAMP and Dynamic Signal, especially if a large portion of your employee base is active on LinkedIn. The latter, if made available via API, could provide a differentiated competitor to influence scores provided by companies like Klout, Kred, FollowerWonk, and PeerIndex. Stay tuned; if the Social Selling Index does become programmatically available, PR professionals will want to incorporate it into their influencer identification and scoring models.

What should marketers and communicators do now? Be active on LinkedIn, especially with regard to its publishing platform. Consider syndicating career and productivity blog posts to LinkedIn’s platform (as well as Medium and Facebook Notes) to determine whether your audience is more interested in reading your content there. While you wait for Elevate, consider using an existing employee advocacy program to leverage the personal social network reach of your employees as well.