Many investors are asking: what is impact investing? And the answer is investing in companies with the aim of making a positive social or environmental impact. The impact investing industry has grown from $50bn of assets under management in 2009 to over $700bn invested in 2019.

There is a lot of jargon around sustainable investing in general. And we cut through it below, spelling out what impact investing is, and how retail investors can get involved. We also review two popular brokers charging zero commission on stock transactions where investors can browse impact investing opportunities. And, in stop press news, we pinpoint a not-to-be-missed opportunity in the dynamic crypto sector.

What is Impact Investing?

Impact investing is part of the powerful trend toward sustainable investing in general. This broadly means investing ethically.

Impact investing definition: ‘investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return.’ (Global Impact Investing Network)

- Key players in impact investing include charitable foundations, high net worth individuals (HNWIs), pension funds and other institutions.

- Retail investors can get involved in impact investing using specific impact investing funds and other methods.

- For individuals operating outside of the professional requirement to track the impact of investments, a lot of flexibility exists in deciding what is impact investing.

- Investing in one of the popular green investment funds could, for example, be considered an impact investment. Green stocks and ETFs are available online via brokers (an example of which is Capital.com who we review below).

80.61% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

How Does Impact Investing Work?

For the retail investor, impact investing means investing in ways which will (hopefully) have a positive social impact.

Technically, impact investing is part of a cluster of investment strategies that come under the umbrella of sustainable investing.

What is Sustainable Investing?

Sustainable investing is a broad term. It means aiming for the ‘double bottom line’ of i) achieving profits and ii) paying attention to ethical concerns.

Investors can get involved by investing in one of the many popular sustainable investment funds. New options are coming onto the market regularly with carbon credits structured as NFTs available via pioneering crypto platform IMPT, for example.

Generally sustainable investing includes ESG investing, socially-responsible investing and impact investing. These terms are often used interchangeably, but there are subtle differences.

| Type of Investing | Broad Definition | How Can the Retail Investor Get Involved? |

| Sustainable investing | Investing with an eye on ethical concerns. | Use crypto platform IMPT to buy carbon credits as NFTs. |

| ESG investing | Investing while taking into account the Environmental, Social and Governance (ESG) risks and opportunities facing a company. | Invest in popular ESG stocks. |

| Socially-responsible investing | Stock-picking on the basis of ethical concerns: screening out companies with dubious ethical links, while backing those with laudable motives. | Invest in renewable energy stock Gevo Inc. (GEVO) rather than in weapons manufacturer Lockheed Martin (LMT). Gevo stock is available with online brokers including Capital.com and eToro. |

| Impact investing | Investing in companies with the dual purpose of i) making some financial return and ii) facilitating direct benefits to the society (including the environment). | Use one of the popular carbon offset programs, invest in one of the popular carbon credit ETFs or invest in one of the growing number of impact funds like the Bain Capital Double Impact Fund or the Goldman Sachs Social Impact Fund. |

What is Social Impact Investing?

‘Social impact investing’ is another term for ‘impact investing’.

What is Responsible Investing?

‘Responsible investing’ is another term for ‘impact investing.’

A Closer Look at Impact Investing

In the professional sector, impact investors must track the impact of their investments. This is so they can be sure that their investment is having a positive effect in the real world.

For retail investors looking to make a positive ethical difference, the need to track positive impact is not so great.

Certainly we want to be sure that our impact investment is making a difference; but we do not have to prove to anybody else that it is, like the professionals. Hence the individual investor has much flexibility in deciding for themselves what is, and is not, an impact investment.

Best Assets for Impact Investing

The Global Impact Investing Network confirms that ‘impact investments can be made across asset classes.’

Typically, institutional investors make impact investments through different types of fund:

- Private Equity (PE)

- Venture Capital (VE)

- Fixed Income (i.e. funds made up of bonds and other fixed income instruments)

- Hedge Funds

- Real Estate

29,000 institutions choose impact investments using the IRIS+ System provided by GIIN.

Individuals may find IRIS+ useful too.

We can use IRIS+ to check areas where positive social impact can be made, and pinpoint the sort of outcomes we might expect from our investment. The system outlines 17 common areas of impact investment (in bold below) and relevant positive outcomes:

- Agriculture – Food security, smallholder agriculture, sustainable agriculture

- Air – Clean air

- Biodiversity and Ecosystems – Biodiversity and ecosystem conservation

- Climate – Climate change mitigation, climate resilience and adaptation

- Diversity and Inclusion – Gender lens, racial equity

- Education – Access to quality education

- Employment – Quality jobs

- Energy – Clean energy, energy access, energy efficiency

- Financial Services – Financial inclusion

- Health – Access to quality healthcare, nutrition

- Infrastructure – Resilient infrastructure

- Land – Natural resource conservation, sustainable land management, sustainable forestry

- Oceans and Coastal Zones – Marine resource conservation and management

- Pollution – Pollution prevention

- Real Estate – Affordable quality housing, green buildings

- Waste – Waste management

- Water – Sustainable water management, Water/Sanitation/Hygiene (WASH)

Best Strategies for Impact Investing

Ideally, investors might want to pinpoint a fund that specializes in impact investing and is also available via online brokers (like Capital.com and eToro).

Plenty of designated impact investment ETFs are available. But investors might have difficulty in tracking down a broker that provides them.

Impact Investment ETFs

There remains plenty of generalization in the impact industry at the level of Exchange-Traded Funds (ETFs). Investors can invest in baskets of firms which are held to be heading in the right direction when it comes to positive social impact. But pinning down deliverable metrics is a different matter.

ESG considerations remain the chief way of judging the impact status of an ETF. But research from Influencemap shows that over 70% of ESG funds fall short of Paris Agreement goals. What is more, only 21% of weighting is given by these funds to ESG priorities.

Below are 3 ETFs considered to be impact ETFs:

Invesco Global Clean Energy UCITS ETF (GCLE)

Available with broker Capital.com (and other brokers), this ETF is based on the Winderhill New Energy Global Innovation Index. This index, founded in 2006, was the world’s first-ever global clean energy index. It tracks companies mainly outside the US which are advancing green energy and efficiency.

This ETF is small, with just over $50m invested. It offers a Total Expense Ratio of 0.60%.

L&G Healthcare Breakthrough UCITS ETF (DOCT)

Rather than focus on the environment, this ETF is all about the social aspect of impact investing – and specifically healthcare.

DOCT was launched in 2019 and gives exposure to nine sub-sectors of healthcare innovation.

DOCT tracks the ROBO Global Healthcare Technology and Innovation Index. This covers 84 companies which produce precision medicines, diagnostics, medical instruments and data analytics systems.

Lyxor Green Bond UCITS ETF (CLIM)

Launched in 2017, this ETF invests in bonds rather than stocks. It tracks the Solactive Green Bond EUR USD IG Index which, in turn, tracks 578 investment-grade green bonds.

Green bonds are issued by banks, corporations and sovereign governments to directly fund climate mitigation and decarbonization efforts. The Climate Bonds Initiative has approved all bonds covered by CLIM.

This ETF has $457 under management, and offers a Total Expense Ratio of 0.25%.

Rather than go for ETFs marketed as impact ETFs, Investors may alternatively choose to get creative, and invest in ethical stocks using their own judgement or pursue other avenues.

One popular option is to focus on the area of the environment. The impact investing industry is firming up its foothold in this area. Individuals may:

Offset Their Own Carbon Footprint

Well-established carbon offset platforms are available online, like Ecologi, Climeworks or Wren. Generally, consumers can pay a monthly subscription in return for detailed information on the exact amount of carbon dioxide removal their funding has generated.

Invest in Carbon Futures Directly

Broker eToro, for example, offers investment in a carbon future traded as one of its 20+ commodities. Other brokers provide carbon futures too. But generally the bulk of carbon credit trading in carbon futures is limited to corporations and institutions using exchanges like the Carbon Trade Exchange. Access is permitted to businesses only with a minimum annual fee of $1,250.

Invest in Clean Energy Stocks

Clean energy stocks number those working in the areas of geothermal, solar, wind and more.

Investors can invest in stocks like this individually. They may choose rather to spread their risk by using an ETF – like the Invesco Solar ETF (TAN) – or use broker eToro’s Renewable Energy Smart Portfolio, for example.

Risks of Impact Investing

Two main risks apply with impact investing.

1. Ensuring Impact is Achieved

How do we know that our impact investment has made a positive impact?

This is a major challenge for the investment industry. Bodies like GIIN are at the center of a growing industry intent on delivering ways of tracking the outcomes of impact investing reliably.

2. Missing Out on More Lucrative Opportunities

Although some areas of impact investment can be lucrative, many are not. Climate interventions are recognized as having high return potential, for example. But in the provision of affordable, decent housing, for example, it is recognised that investors generally should not expect too much bang for their buck.

The risk therefore is that the impact investment would have made more profit if invested elsewhere. The solution is for investors to be realistic about their involvement in impact investing, as well as to ensure their portfolio is well-diversified across different assets and investment strategies.

Where to Start Impact Investing in 2025

Two popular online brokers that sell stocks include Capital.com and eToro.

Capital.com – Dedicated CFD Broker Charging Zero Commission on Stocks/ETFs

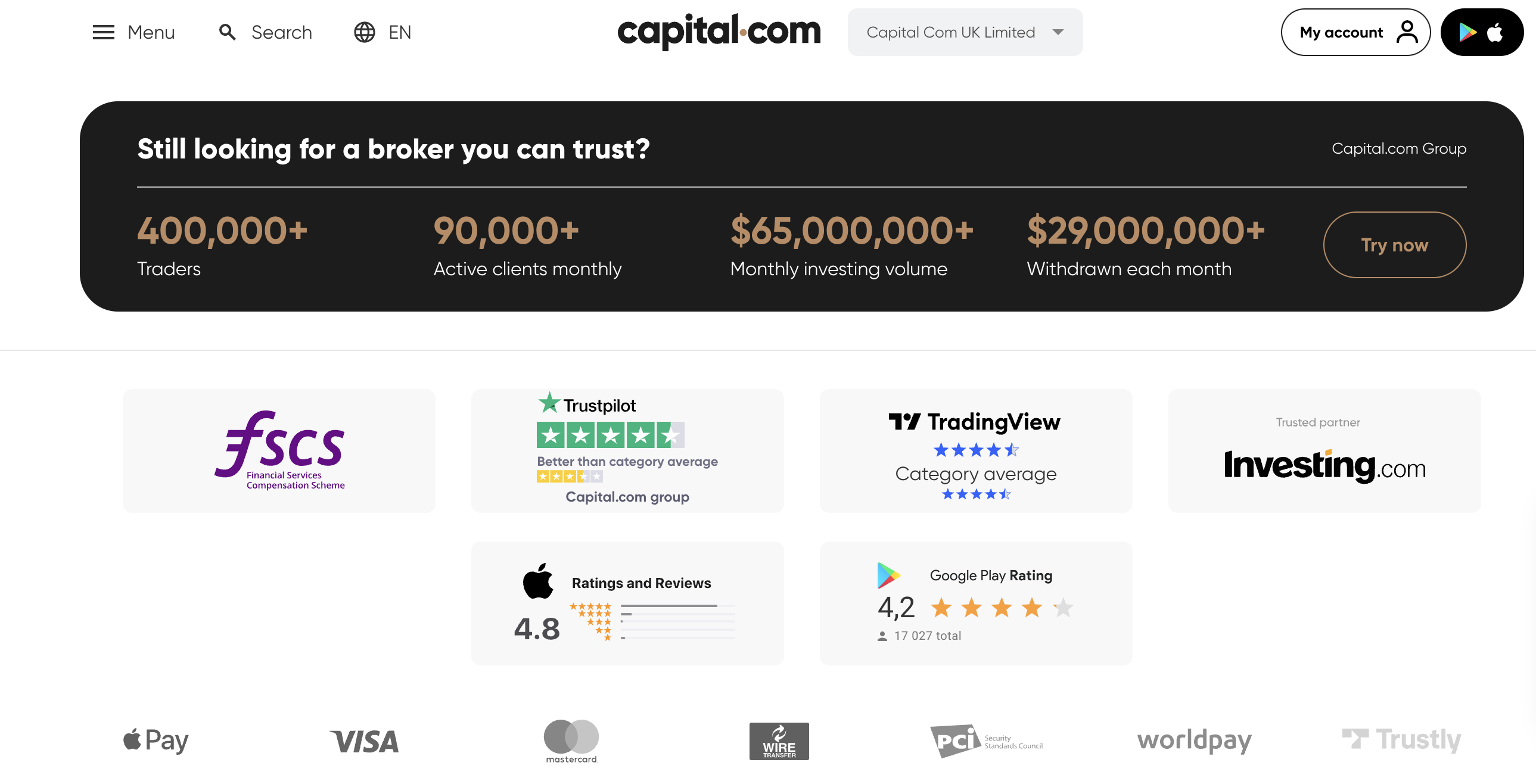

![]() With 90,000 active clients monthly and ten global offices, Capital.com is recognized as one of the most popular CFD brokers.

With 90,000 active clients monthly and ten global offices, Capital.com is recognized as one of the most popular CFD brokers.

Contracts-For-Difference (CFDs) give investors two key options:

- Investors can leverage their trades. This means amplifying the potential gains (or losses).

- Investors can ‘go short’ on assets. This means betting on the price of an asset falling, rather than rising. This is a useful tool to have handy in the current bearish markets.

All 5,900 markets available with Capital.com are traded as CFDs, including stocks, ETFs, commodities, indices, and forex. ETFs to check out for their impact investing credentials include the iShares Global Clean Energy ETF (ICLN).

Capital.com charges no commission on stock transactions. But spread fees apply as well as overnight fees. Conveniently, a range of deposit methods are available including credit card, wire transfer, Apple Pay, Worldpay, and Trustly.

Capital.com offers some key benefits for newcomers including an impressive array of market news and analysis updated every day, powerful charting tools (for technical analysis) and a top-rated smartphone app. The Capital.com app has received 4.8/5 on the Apple App Store and 4.2/5 on Google Play.

Capital.com has received an average rating of 4.3/5 from 7,000+ reviews on Trustpilot.

Learn more about this broker in our full Capital.com review.

What We Like

- No commission on trades

- Deploy CFDs to leverage trades and go short

- Extensive news/analysis support as well as powerful charting tools

- Thorough regulation (FCA, ASIC and CySEC)

- Account Manager assigned to new users for free

| Approx Number of Stocks: | 5,700+ |

| Pricing System: | Spread fee plus CFD overnight fees |

| Cost of Buying Amazon (for example): | 0.12% spread (variable) plus -0.0064% overnight fee charged on borrowed funds |

| Payment methods: | Use wire transfer, Trustly, ApplePay, Worldpay or buy stocks with credit card |

| iOS and Android App: | Both |

80.61% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

eToro - Social Trading Platform Charging Zero Commission on Stocks

eToro is a full-service broker offering 3,000+ stocks, 264 ETFs, commodities, indices, forex and crypto. The broker was founded in 2007 and, since then, it has served over 28m customers. eToro charges zero commission on stock and ETF trades, but does (like all brokers) levy a spread fee.

From our point of view as budding impact investors, eToro's generous selection of 3,000+ stocks from 16 international exchanges is a real help. There are plenty of renewable energy stocks to choose from as well as popular ESG investing stocks. The selection of ETFs is broad, and includes funds related to impact investing like the Invesco Solar ETF (TAN).

As one of the most popular copy trading platforms, eToro's CopyTrader feature may particularly appeal to investment newcomers. The feature allows investors to browse through literally thousands of fellow investors and copy their trades with allocated funds.

Also aimed at helping the newcomer is eToro's growing suite of 70+ Smart Portfolios. Each is a buying template, setting out a selection of shares to buy in specific proportions based around a particular investment theme.

- One Smart Portfolio which may be of interest to impact investors is the Renewable Energy Smart Portfolio, which lays out an investment strategy centered on 30 renewable energy global stocks.

Learn more about eToro with our full eToro review. It is worth noting that now, in the US, eToro customers can trade only Bitcoin, Bitcoin cash, and Ethereum on the platform.

What We Like

- No commission on stock trades

- 3,000+ stocks available plus 264 ETFs

- Many beginner-friendly features including Watchlist, CopyTrader and Smart Portfolios

- Regulated by the SEC, CySEC, ASIC, and the FCA

- No deposit fee and just $5 flat withdrawal fee

| Approx Number of Stocks: | 3,000+ |

| Pricing System: | Buy stocks on eToro commission free: spread fee applies (plus overnight fees if CFD trading) |

| Cost of Buying Amazon (for example): | Spread fee (variable) of 0.3% on trade |

| Payment methods: | Buy stocks with PayPal (Europe only), credit and debit card, wire transfer, payment wallets |

| iOS and Android App: | Both |

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.

Impact Investing vs. Crypto Investing

Impact investing is all about making a social difference. But it rarely involves much excitement. And inevitably too, financial gain is not the main priority.

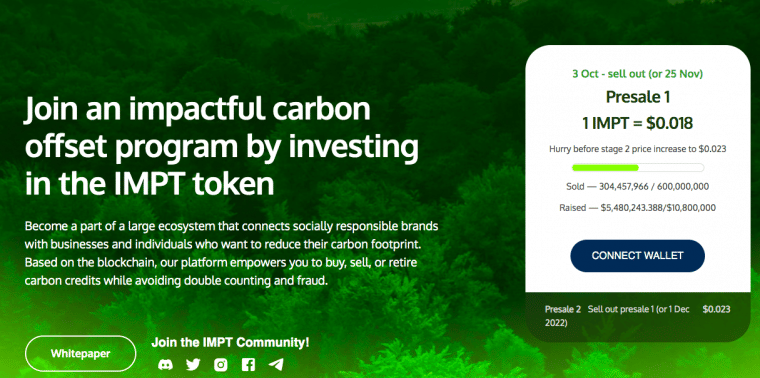

The world of cryptocurrency is a different matter. Crypto is all about the satisfaction of finding winners and the thrill of hitting the jackpot. So we are excited to share news of one crypto in particular that ranks among the most promising crypto of 2025.

First, the IMPT token itself can be converted into carbon credits. Each IMPT token represents an investment in a Global Certification Protocol-approved environmental project,. After converting IMPT into carbon credits, token owners can list their credits on carbon offset exchanges for large companies to buy and offset their carbon footprints. Alternatively, token owners can burn their carbon offsets to offset their own emissions and earn a custom NFT for doing so.

On top of that, IMPT offers a marketplace for sustainable brands. Individuals can earn IMPT tokens for shopping from these eco-conscious brands.

IMPT also makes it easy to track activity on the platform. The project has a social feature where users can monitor their IMPT points - earned by shopping, buying IMPT tokens, and collecting carbon offset NFTs - and see how many points other eco-conscious users have collected.

IMPT is currently holding one of the best crypto presales of 2025 and has already raised near than $6 million out of a Phase 1 goal of $10 million. Here's how crypto investors can get in on the IMPT presale today:

- Set up a Trust crypto wallet.

- Connect the Trust wallet to the IMPT presale platform.

- Purchase IMPT using Tether (USDT), Ethereum (ETH), or a credit card.

| Min Investment | 10 IMPT ($0.18) |

| Max Investment | NA |

| Purchase Methods | ETH, USDT, credit card |

| Blockchain | Ethereum (ERC-20 token) |

Conclusion

Above we have aimed to answer the question: what is impact investing?

We have noted that, for the retail investor, impact investing is easiest to access via established impact investing funds. Other opportunities exist, particularly for investors willing to learn how to invest in carbon credits, for example.

Impact investors must, though, accept that financial return is not the priority with impact investing. So, investors looking for explosive growth opportunities for their money would be well advised to look elsewhere. Happily, among the hottest crypto right now is an absolute gem in the form of IMPT, a new cryptocurrency that can be converted into carbon offsets.

IMPT is bringing eco-consciousness to the blockchain and creating a completely new market for digital carbon credits. It's one of the most promising cryptocurrencies in 2025, and investors have a chance to get in on the ground floor thanks to the ongoing IMPT presale. Check out the IMPT presale to invest today!

IMPT - New Eco Friendly Crypto

- Carbon Offsetting Crypto & NFT Project

- Industry Partnerships, Public Team

- Listed on LBank, Uniswap

- Upcoming Listings - Bitmart Dec 28, Gate.io Jan 1st