With NASDAQ growth stocks like Alphabet and Meta on the ropes since the New Year, investors are looking for a less risky way to invest. Value stocks are one solution. And investors are asking in particular: what is dividend investing?

Below we look into dividend investing for beginners. Outlining common dividend investment strategies, we focus on how to start investing in dividend stocks. We review two brokers that charge zero commission on stock trades and – in stop press news – highlight an exciting growth opportunity in the cryptocurrency sector.

What is Dividend Investing?

Dividend income investing means investing in stocks that pay a regular dividend. This is a long-term strategy. The best dividend stocks either pay a high dividend, or have a record for increasing their dividend payouts every year.

- A key term here is ‘dividend yield’. This calculates the annual dividend payment per share as a percentage of the share price. The higher the dividend yield, the more the company is paying out per share.

- Companies with high dividend yields can often be established companies which can afford to return some of their profits to shareholders. Such companies may not be very well-known.

- High dividend investments in the S&P 500 currently include Texas-based exploration company Pioneer Natural Resources (PXD) with a dividend yield of 10.8%, telecom operator Lumen Technologies (LUMN) with a dividend of 10.2%, and tobacco producer Altria Group (MO) with a dividend of 8.3%.

- ‘Dividend Aristocrats’ are S&P 500 firms which have increased their dividend payments for twenty five years or more. Examples are wireless giant AT&T (T), oil behemoth Exxon Mobil (XOM) and computing veteran IBM (IBM).

80.61% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

How does Dividend Investing Work?

A dividend is a periodic payment made to shareholders by a company. The amount of the dividend is calculated as a proportion of the share value.

The simple formula is: dividend yield = annual dividend payout/share value.

- So the dividend yield of a company with a share value of $1 that pays out four quarterly dividends of $0.025 is 10% = (4 x 0.$025)/1.

Dividends are commonly paid out every quarter. Dividend yield is calculated on an annual basis by adding the four quarterly dividend payouts and then dividing by the share value.

If an investor is holding a stock that does pay dividends, they will receive dividend payments automatically via their online brokerage account.

Past Performance Is No Guarantee of Future Performance

An important thing to understand about investing for dividend income is that companies are not obliged to pay dividends. This has two key implications:

- Not all companies pay dividends – although 75%+ of stocks in the influential US S&P 500 do.

- Whatever a company’s record in paying dividends, it can stop paying dividends at any time – this is an important risk factor to bear in mind.

Do Bonds Pay Dividends?

No. Strictly speaking, bonds pay interest whilst stocks pay dividends. Investors wanting to learn how to invest in bonds will soon discover that many online brokers do not provide access to bonds anyway – despite them being recognized as a low-risk generator of fixed income.

A Closer Look at Dividend Investing

In answering the question: what is dividend investing? let us take a real-life example.

Oil and

This dividend rise will not go live until March 2023. In the meantime, investors can still benefit from the upcoming Q3, 2022 payout.

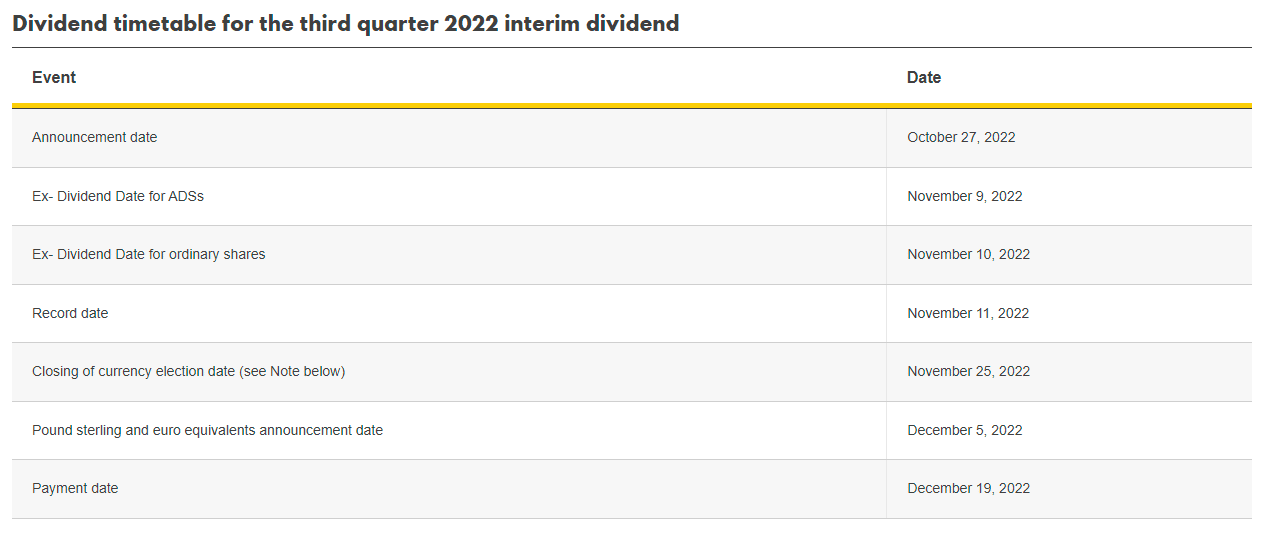

Let us look below at Shell’s dividend timetable. Most companies display dividend information in this manner.

From this timetable, we can learn some key dividend investing information.

- The ‘Announcement Date’ is when companies announce the dividend for the next quarter.

- The ‘Record Date’ is when companies see what shareholders are owed a dividend for this quarter.

Particularly important is the ‘ex-dividend date’. This is the last day on which investors need to buy Shell shares to be eligible for the Q3 dividend. If they buy after this date, they will miss out.

- The ex-dividend date in this example is November 10th, 2022 for ordinary shares, and November 9th, 2022 for American Depositary Shares.

Investors can buy Shell stock with brokers including Capital.com and eToro.

Best Assets for Dividend Investing

In answering the question: what is dividend investing? a key issue is what assets are involved.

Dividend investing relates to company shares.

There are at least four popular routes by which high dividend investments in shares can be made:

1. Buy Shares

Investors can do their own research and screen share for suitability using a dividend investing calculator (many are available online).

We can buy dividend stocks with online brokers like Capital.com and eToro by getting online, signing up with the broker, getting our ID validated, and depositing funds.

Commonly investors choose either a growth or yield strategy (see below) and hold the dividend stock over the long-term.

2. Buy Mutual Funds

Mutual funds are a good way of diversifying a stock portfolio in order to minimize risk. Some mutual funds are set up to focus on dividends, like the Vanguard High Dividend Yield Index Admiral Shares (VHYAX). This tracks the FTSE High Dividend Yield Index.

- And thus, incidentally, we can note that there is no contradiction when it comes to dividend investing vs. index funds; some index funds like this one are set up specifically to return dividends.

3. Buy ETFs

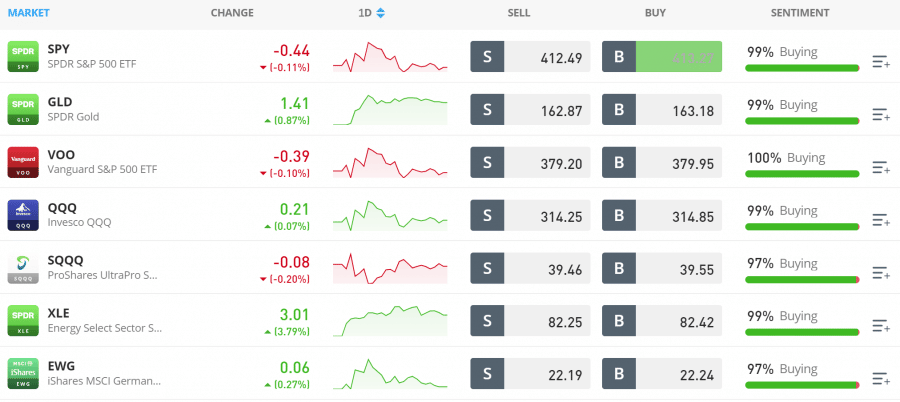

Many ETFs focus on dividend stocks – whether following a growth or yield strategy:

- Two ETFs which follow a dividend growth strategy are the S&P 500 Dividend Aristocrats ETF (NOBL) and the SPDR S&P Dividend ETF (SDY).

- Two ETFs which pursue a dividend yield strategy are the Invesco KBW High Dividend Yield Financial ETF (KBWD) and the MSCI SuperDividend EAFE ETF (EFAS); the latter is available with Capital.com and other brokers.

ETFs offer the same advantage as mutual funds in spreading risk but can be more accessible and cheaper to access. Investors interested in how to trade ETFs will discover that they can be bought and sold as easily as shares via an online broker.

4. Take Advantage of Broker Offerings

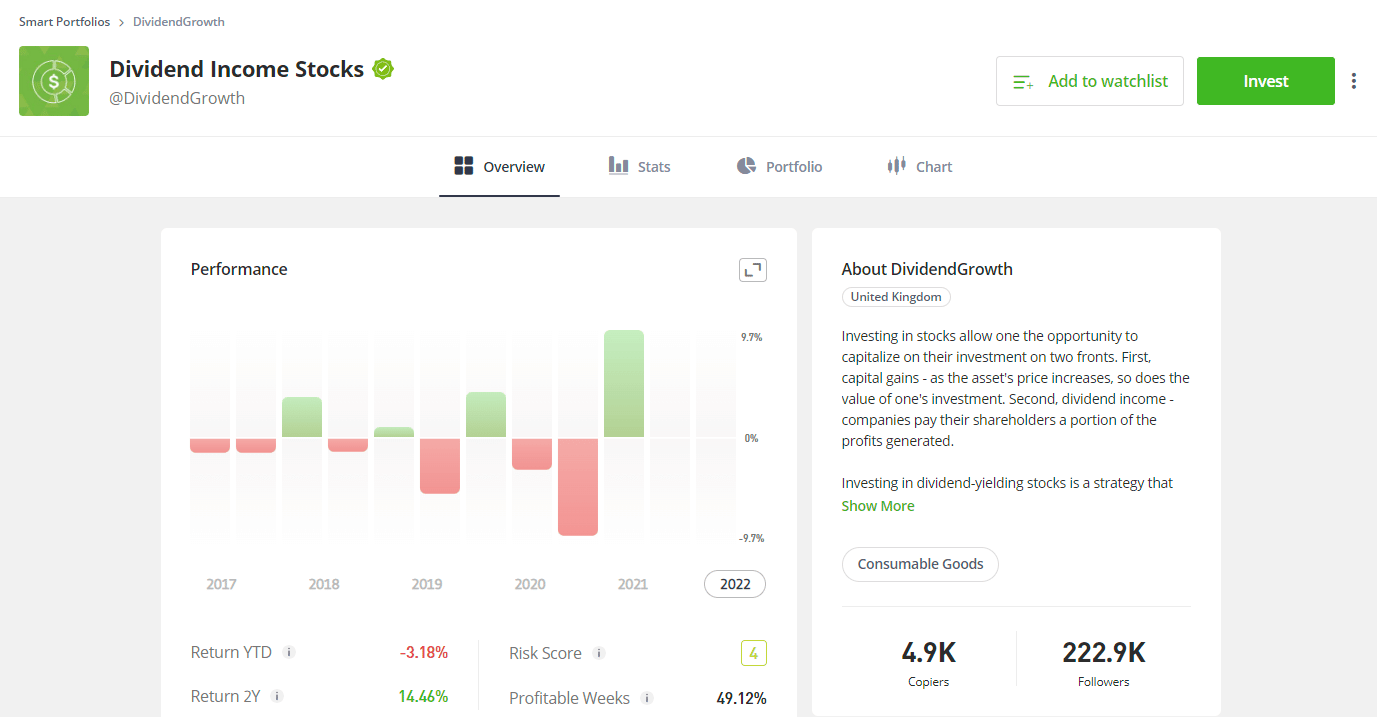

Some brokers offer packages or strategy templates which focus on dividend assets. One such template is eToro‘s DividendGrowth Smart Portfolio. This invests in 40 companies which have paid an increasing dividend for over 20 years.

Top stocks include:

- AT&T (T): 3.46% allocation.

- Lockheed Martin Corporation (LMT) – 3.26% allocation.

- IBM (IBM): 3.00% allocation.

Best Strategies for Dividend Investing

What is dividend investing? Well, when it comes to dividend investing strategy, there are three common routes:

1. Dividend Yield Strategy

This means investing in high dividend stocks – i.e. firms which have either recently paid out a high dividend, or have announced that they will do so in future.

Investors can check a company’s dividend arrangements by checking on their website’s Investor Relations page.

2. Dividend Growth Strategy

What is dividend growth investing? This strategy centers on picking stocks which have a track record in increasing their dividend payments every year. These companies may offer high dividend yields right now – or they might not. The emphasis here is on companies which have shown a commitment to improving their dividends. But where does the investor find such companies?

Look for Dividend Aristocrats. These are firms considered to be top dividend growth prospects. To qualify, companies must:

- Be a member of the S&P 500 Index.

- Have raised their dividend every year for the last 25 years.

- Boast a market capitalization of at least $3bn.

- Feature an average daily trading volume of at least $5 million.

3. Dividend Capture Strategy

This strategy is all about timing. Instead of buying stock in companies that pay dividends and then holding that stock indefinitely, this strategy centers on buying the stock just before the Record Date to secure a dividend payment, and then selling the stock shortly afterwards.

The aim here is to ‘capture’ the dividend at no extra cost.

But what often happens just prior to Record Date is that the price of a stock falls by the amount of the dividend. If the price does not recover, then the investor will have failed to capture the dividend at no loss – as the fall in stock price will cancel out the gain in dividend.

However, often the fall in stock price will vary – and, of course, the stock price can recover over time.

Let us take two simplified examples based on the following scenario:

- Stock A is priced at $1 a share.

- The dividend payout for stock A is $0.10 per share.

- The investor buys 1 share of stock A prior to the Record Date.

- Just before its Record Date, the price of stock A falls to $0.90.

Successful Dividend Capture

- The price of stock A then rises back to $1.00 on the back of market developments.

- The investor sells their 1 share of stock A for $1 – and keeps the dividend payment of $0.10.

- Net gain: 10% – $0.10.

Failed Dividend Capture

- The price of stock A stays at its new lower level of $0.90.

- The investor sells their 1 share of stock A for $0.90 – keeping the dividend payment of $0.10, but making a loss of $0.10 on the share sale.

- Net gain: 0%.

Dividend capture is not a recommended strategy for beginner investors, not least because income from shares held for short periods of time attract more punitive taxation in the US.

Dividend Reinvestment Plan (DRIP)

One way to maximize returns on dividend income investing is to re-invest dividend payments immediately in stock that pays dividends.

This is a popular way of dividend investing for retirement.

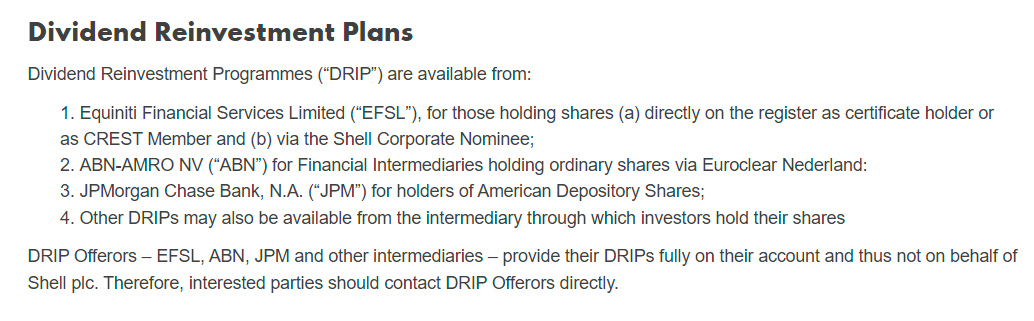

Companies will often advertise which banks and brokers offer a Dividend Reinvestment Plan (DRIP). Below, for example, is oil giant Shell’s DRIP information:

Mutual funds often give their investors the option to have their dividends reinvested. Many ETFs do so automatically.

How to Start Dividend Investing With Little Money

Even the highest dividends rarely exceed 10% of the value of a single share. So investors wondering, for example, how to invest $1,000 may find it more worthwhile to wait until they have amassed more significant funds before diving into dividend investing.

Risks of Dividend Investing

Dividend stocks tend to be what are called ‘value stocks’. These are well-established firms with large market capitalizations. They may have limited growth prospects – often because they have already eaten up a large market share – but they are often considered to be steady.

But even steady companies do not come without risks.

Dividends Are Not Compulsory

Companies can stop paying dividends at any time. In hard times, cutting the dividend payment is often a key way that a firm can control costs.

- For example, global mining giant Rio Tinto (RIO) more than halved its dividend payout in July 2022 – from $5.61 per share to $2.67 per share year-on-year – as a result of a drop in iron ore prices and labor shortages.

- A common scenario in dividend reduction is when interest rates rise. This increases the cost of borrowing. And thus companies with high debt-to-equity ratios may then seek to slash their dividend yield.

High Dividend Yield Can Be Misleading

Commonly a high dividend yield is taken to be a sign of good financial health. The assumption is that, if a company can afford to pay a dividend, it means it has money to spare.

But sometimes a high dividend yield signals rather that a company is in bad shape. How does that work? It is all in the math.

To take a theoretical example, a company may have a stunning dividend yield of 10%, for example, because it is paying 10c on every share, with each share valued at a dollar:

Dividend yield = annual dividend payout/price per share.

10% = $0.10/$1.

10% is a high dividend yield certainly. But the calculation takes into account not only the dividend payout, but also the share price. And suppose the share price has recently dropped? Supposing it has fallen to $1 from $5 last week?

That would mean that the stock’s dividend yield was actually 2% ($0.10/$5) until the share price fell by 80%.

The key question in this circumstance is: why did the share price fall? An 80% reduction in share price is often a sign of acute trouble with a company. Even a 20% fall in share value signals trouble – and then should the investor proceed with a long-term dividend investment?

- Just this week, over 20% was wiped off the value of tech giant Meta shares (owner of Facebook and Instagram) overnight on investor fears over declining revenues and the firm’s involvement with unproven metaverse and AI technologies. (Investors can buy Meta stock with brokers like Capital.com and eToro).

Margin Dividend Investing

More experienced investors may choose to borrow money ‘on margin’ from their broker and then invest in dividend stocks. This is a high-risk strategy, and certainly not recommended for beginners.

- The risk is that the value of the stock will fall, and the broker will then make a ‘margin call’, which means that the investor will have to supply more money to secure their leverage.

Where to Start Dividend Investing

Having gone some way to answer the question: what is dividend investing? investors may arrive at the point at which they can safely take action. The next question is: how to start dividend investing?

As with all investing, there are 3 key rules to staying safe:

- Investors should never commit more than they can afford to lose.

- Investors should get every planned asset purchase approved by an Independent Financial Advisor (IFA).

- Investors should only trade with brokers which have gained regulatory approval.

Two popular regulated brokers where investors can obtain dividend assets include Capital.com and eToro.

1. Capital.com – CFD Broker Offering Dividend Stocks at Zero Commission

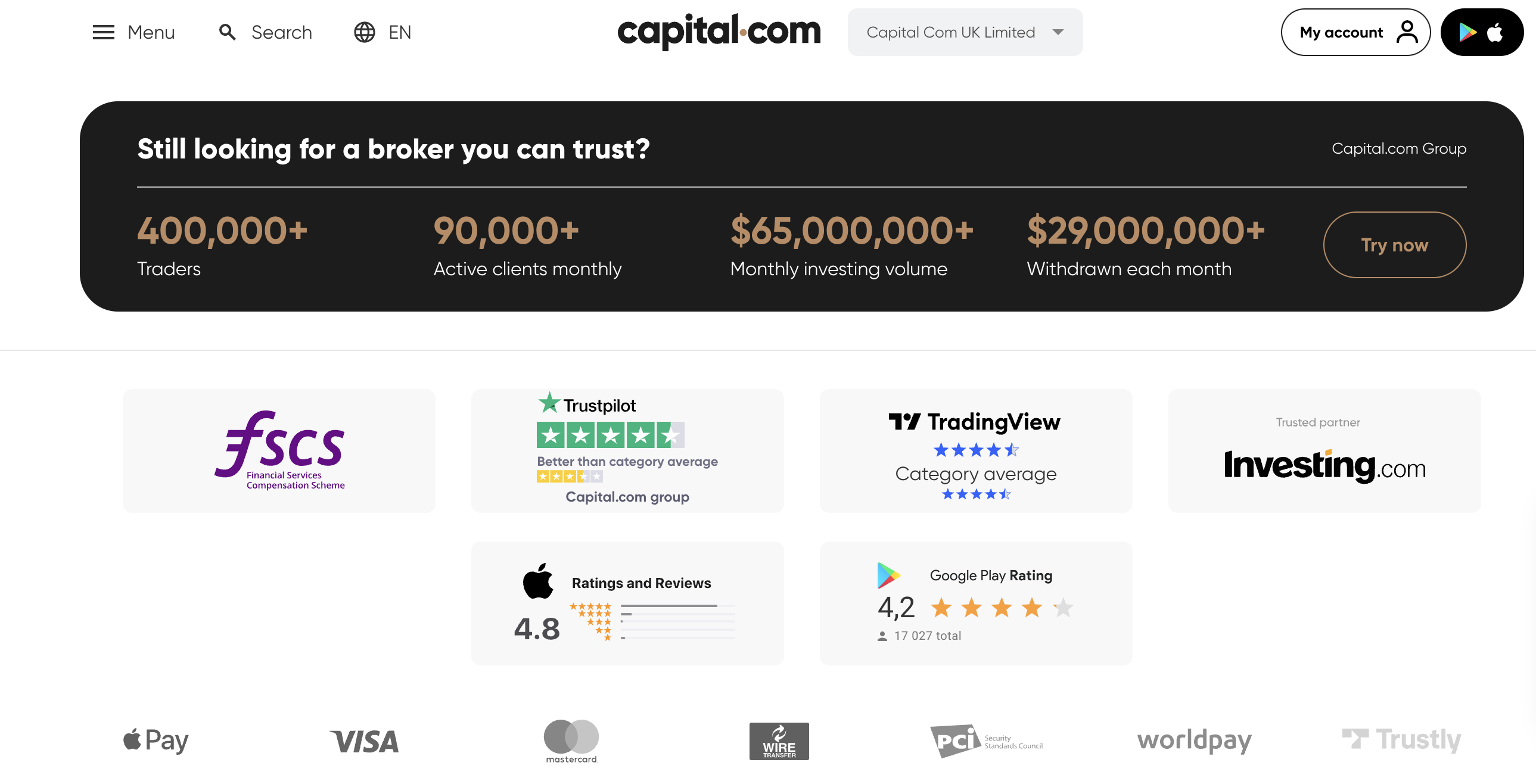

Considered by some to be one of the best CFD brokers, Capital.com offers access to over 5,000 markets including stocks, co![]() mmodities, indices and forex. An established presence in the brokerage space, Capital.com operates from ten global offices and serves 90,000+ clients every month.

mmodities, indices and forex. An established presence in the brokerage space, Capital.com operates from ten global offices and serves 90,000+ clients every month.

This broker deals only in the powerful and versatile format of Contracts-For-Difference (CFDs). CFDs arm investors with two special trading options:

- Investors can leverage their trades. This means amplifying the potential gains/losses by borrowing money from the broker.

- Investors can go ‘short’ on assets. This is a useful tool to have in bear markets, because ‘going short’ means betting that the price of an asset will fall rather than rise.

Capital.com provides plenty of opportunities for investing in dividend stocks as well as ETFs – although, because overnight fees apply, CFDs are better suited to short-term trading positions than long-term investing in dividend stocks.

Capital.com has received an average rating of 4.3/5 from 7,000+ reviews on Trustpilot. The Capital.com app has received an average rating of 4.8/5 on the App Store and 4.2/5 on Google Play. Find out more in our full Capital.com review.

What We Like

- Regulation by the FCA, CySEC and ASIC

- No commission on stock trades

- Account Manager assigned to new users free of charge

- Powerful charting tools

- Extensive market analysis and news features

| Approx Number of Stocks: | 5,000+ |

| Trading Fees | No commission, but spread fees plus CFD overnight fees apply |

| Non-Trading Fees | No deposit or withdrawal fees; currency conversion fees apply |

| Payment methods: | Buy stocks with credit card or use wire transfer, Trustly, ApplePay, Worldpay |

| iOS and Android Free App: | Yes |

80.61% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

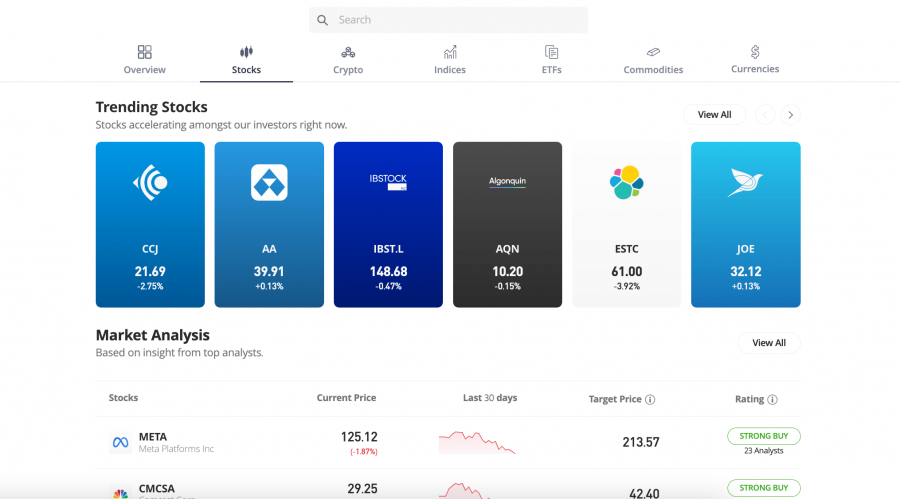

2. eToro - Copy Trading Platform Offering Dividend Stocks at Zero Commission

eToro is an established broker regulated by a raft of authorities including the SEC, ASIC, CySEC and the FCA. Founded in 2007, eToro has served over 28m investors worldwide.

As a full-service broker, eToro offers conventional trading as well as CFDs on a broad range of assets including stocks, ETFs, commodities, indices, forex and crypto. Over 3,000+ stocks curated from 16 international exchanges are available, as well as 260+ ETFs.

Like Capital.com, eToro charges no commission on stock/ETF trades - but, as with all brokers, a spread fee applies.

This broker has a reputation for being one of the popular copy trading platforms. eToro's CopyTrader tool is potentially a real boon for beginners. It allows investors to allocate some funds and copy the trading activity of more experienced traders in real-time. The service is free, and well-supported by a range of search filters to pin down investors worth copying.

Another potential help to beginners is eToro's growing range of 70+ Smart Portfolios. These are strategic templates for buying many shares at once. Each takes a particular theme - such as the DividendGrowth Smart Portfolio, for example, which invests in 40 companies which have increased their dividend for twenty years running or more. A minimum investment of $500 applies.

It is worth noting that now, in the US, eToro customers can trade only Bitcoin, Bitcoin cash, and Ethereum on the platform. Read more about this broker in our full eToro review.

What We Like

- Minimum stock investment of just $10

- Regulated by CySEC, ASIC and the FCA

- Beginner-friendly: Smart Portfolios and CopyTrader

- No deposit fee plus only $5 flat withdrawal fee

- Conventional trades plus CFDs

| Approx Number of Stocks: | 3,000+ plus 260+ ETFs |

| Trading Fees | No commission on stock/ETF trades but spread fees apply |

| Non-Trading Fees | $5 flat withdrawal fee, currency conversion fee plus inactivity fee |

| Payment methods: | Wire transfer, credit card plus some payment wallets |

| iOS and Android Free App: | Yes |

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

Dividend Investing vs. Presale Cryptocurrencies

Investing for dividend income is all about aiming for steady - but unspectacular gains - over the long-term. If dividend investors are lucky, the value of the underlying stock will rise. But dividend stocks tend not, by definition, to be growth stocks; if they were growth stocks, the companies would be investing their profits into growth opportunities.

Cryptocurrency is different. With the best emerging cryptos, growth opportunities over the short-term are up for grabs. And smart investors know to get in early.

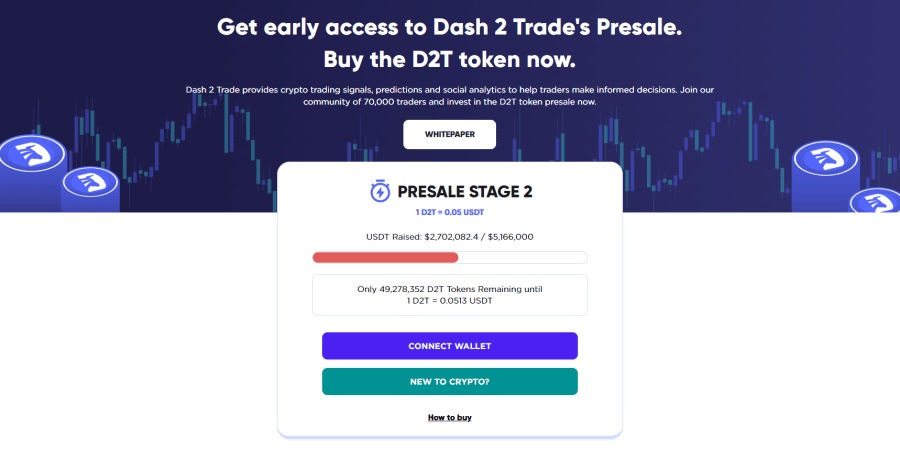

Introducing then one of the best crypto presales of 2025 - centered on the D2T token of Dash 2 Trade. Already eagle-eyed investors have pumped over $2.7m into this superb presale opportunity. And there is time left to buy whilst the price of one D2T token equates to $0.0513 (o.o513 USDT).

Dash 2 Trade is a highly-promising crypto analytics and social trading platform developed by the team behind industry stalwart Learn 2 Trade.

With the crypto sector coming out of the doldrums, it is more important than ever that crypto investors get good market intelligence. And Dash 2 Trade provides an array of world-class features, including:

- Trading signals to alert investors to hot trading opportunities in real-time.

- Social sentiment analysis to identify trending tokens.

- Strategy and social trading tools for investors to construct their own trading style

- News alerts for new crypto listings and presales.

Dash 2 Trade users will pay on a subscription model using in-house token D2T - which could well be the next crypto to explode if the pre-sale carries on pumping at the rate has been.

How to Buy D2T

Investors can get hold of D2T in just three easy steps:

- Set up a MetaMask crypto wallet.

- Connect the wallet to the Dash 2 Trade presale platform.

- Purchase using Tether (USDT) or Ethereum (ETH).

For a more detailed tutorial read our guide on how to buy Dash 2 Trade tokens in 2025.

| Min Investment | 1000 D2T |

| Max Investment | NA |

| Purchase Methods | ETH, USDT |

| Blockchain | Ethereum (ERC-20 token) |

Conclusion

Above we have aimed to answer the question: what is dividend investing? We have outlined some key aspects of dividend investing for beginners, and shone the spotlight on two brokers - Capital.com and eToro - where dividend stocks are available.

Hot off the press is news of the Dash 2 Trade crypto presale. D2T is one of the hottest crypto right now.

The Dash 2 Trade platform is set to be one of the best crypto signals platforms as well as one of the best crypto alert sites. With over 22,000 crypto on the market, investors need high-quality market analysis and data to pick winners and trade successfully - and Dash 2 Trade, founded by the experienced team behind Learn 2 Trade - is filling that gap in the market.

Visit Dash 2 Trade and get D2T at exclusive presale prices. Or enter the Dash 2 Trade $150k giveaway competition.

Dash 2 Trade - New Gate.io Listing