Looking to put together an all-together greener portfolio of assets? Sustainable investments in the financial markets are increasing in popularity and there are plenty of funds to consider in this regard.

Therefore, the purpose of this guide is to explore 11 popular sustainable investing funds to watch in 2024.

Below is a list of popular sustainable funds to watch in 2024: Read on to learn more about each of the above sustainability funds as well as how to invest in clean energy in 2024.

To gain exposure to this industry, investors can take a closer look at a range of funds, including sustainable ETFs, bonds, and indices. Below, investors will find core metrics of each fund, such as its long-term objectives and top stock holdings by weight. Utilizing blockchain, Ecoterra enables individuals and organizations to combat climate change. The platform integrates multiple apps and marketplaces, synergizing to inspire support for environmental causes. Ecoterra’s native token, $ECOTERRA, is now open for investors to buy at only $0.004 USDT per token. The presale website provides the option to procure tokens using a credit card, Ethereum, or USDT. A unique aspect of Ecoterra’s Recycle2Earn app is the ability to compensate users with Ecoterra tokens for their recycling activities. These tokens can be saved, invested in, or utilized for environmentally responsible actions, including clean-up initiatives and promoting renewable energy projects. Similarly to how companies establish “impact trackable profiles,” organizations can implement impact packages to acquire materials from end-users, which in turn helps reduce the negative consequences of their production methods. This strategy encourages transparency and a mutual commitment to sustainability among all participants. Ecoterra also underscores the critical significance of carbon offset and recycled material markets. The Ecoterra whitepaper specifies that by donating Ecoterra tokens to certified global carbon reduction programs, individuals and companies can counterbalance their carbon emissions. Additionally, the recycled materials marketplace facilitates businesses obtaining recycled supplies, fosters cooperation among recycling organizations, and supports related activities. The flexibility of the proposed solution lends itself to broad applicability across various sectors, such as consumer products, technology, fashion, and hospitality. Recycle2Earn operates as a comprehensive platform that can connect with Reverse Vending Machines (RVMs) globally, potentially involving hundreds of millions of individuals. Those interested in staying updated can join the Ecoterra Telegram group to receive the latest news.11 Popular Sustainable Funds to Watch in 2024

A Closer Look at Sustainable Funds

1. Ecoterra – Best Sustainable Investment Asset in 2024 With a Recycle2Earn System

Hard Cap

$6,700,000

Total Tokens

2,000,000,000

Tokens available in presale

1,000,000,000

Blockchain

Ethereum Network

Token type

ERC-20

Minimum Purchase

$10

Purchase with

USDT, ETH, Bank Card

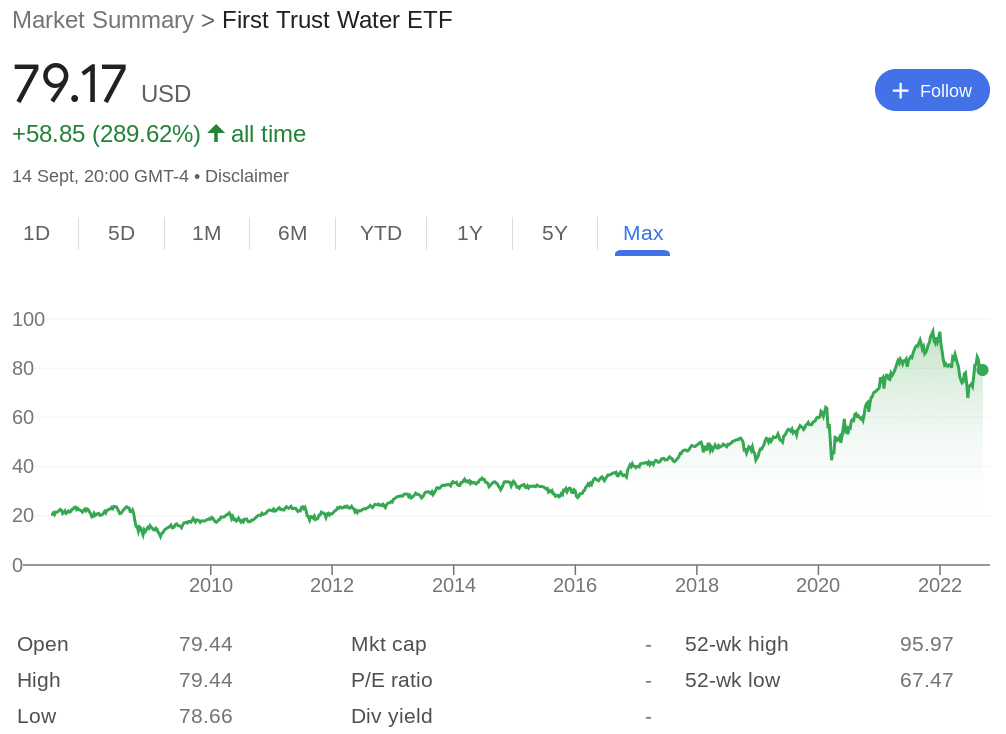

2. First Trust Water ETF (FIW)

The First Trust Water ETF is benchmarked to the ISE Clean Edge Water Index. As such, this is one of the most popular sustainable ETFs to provide investors with a way of gaining exposure to the shortage of drinkable water.

That is to say, a lack of clean water is a sad reality for some parts of the globe and therefore – the companies within this sustainable investment fund aim to help with this problem

This sustainable fund’s list of holdings includes:

- Danaher Corp

- Agilent Technologies

- Pentair

- Xylem

- IDEXX Laboratories

- American Water Works

We’ve listed the top six holdings by the percentage held in the fund. According to MSCI sustainable fund ratings, a total of 49% of First Trust Water’s holdings have an ESG score of AAA or AA, while 2% have a B or CCC. For those asking ‘what is ESG investing?‘ we have a complete article on ESG investments for 2024. At the time of writing, the fund is home to 36 businesses and has net assets of $1.26 billion. This includes sectors such as industrials, technology, utilities, and health care.

These companies make money by offering solutions for things like purification and filtration, infrastructure, water testing, distribution, treatment, and pumps to mention a few. The fund has a remarkably good track record and is well-positioned thanks to its chosen portfolio of firms.

This should assist the earth in reducing the harmful effects of pollution, population expansion, and global warming. The First Trust Water fund was created in 2007. Based on this fund’s price at the time of writing, First Trust Water has gone up by almost 80% over the previous five years of trading.

MSCI ESG Rating: AAA

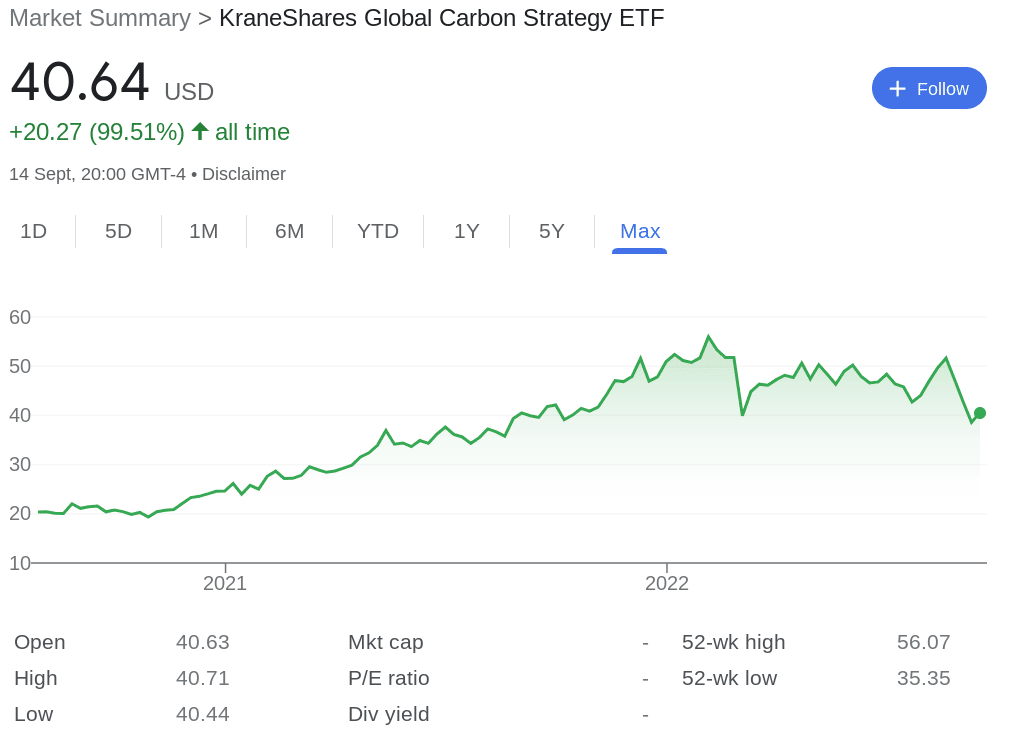

3. KraneShares Global Carbon ETF (KRBN)

Those looking for sustainable ETF funds with a wish to invest in carbon credits might prefer the KraneShares Global Carbon Strategy. This ETF is benchmarked to the IHS Markit Global Carbon Index. The sustainable index fund tracks the most actively traded carbon credit futures contracts and provides comprehensive coverage of cap-and-trade carbon allowances.

Some of the components of the KraneShares Global Carbon fund include:

- KFA Carbon CFC

- Schwab Short-Term US Treasury ETF

The fund holds net assets of over $819 million. The index offers a fresh way to manage risk and gain exposure to carbon futures while promoting ethical investing. The KraneShares Global Carbon ETF now covers the four main cap-and-trade schemes in both North America and Europe.

This comprises the Regional Greenhouse Gas Initiative (RGGI), California Carbon Allowances (CCA), and United Kingdom Allowances (UKA). As such, KraneShares Global Carbon often profits when the price of carbon emissions rises. In contrast, businesses with significant carbon footprints typically suffer.

As we said though, it’s crucial to research any potential sustainability investment fund opportunities in full. Nonetheless we assessed this sustainable fund’s performance on the stock market and found that KraneShares Global Carbon began trading as recently as 2020. Since then, the fund has increased by almost 100%, based on its price at the time of writing.

MSCI ESG Rating: N/A – Undisclosed

4. iShares Global Clean Energy ETF (ICLN)

Ethical investing is also possible with the iShares Global Clean Energy ETF. The goal of this Blackrock sustainable fund is to replicate the investment performance of an index made up of international clean energy stocks.

This includes almost 100 stocks that focus on having a positive impact on the world for future generations. Specifically, iShares Global Clean Energy makes investments in firms operating in the biofuels, geothermal, wind, hydroelectric, ethanol, and solar sectors of the worldwide green power sector.

Furthermore, iShares Global Clean Energy holds enterprises that create the equipment and technology needed in the process. The index committee chooses the holdings of the fund and all must pass strict criteria.

Some of the holdings in this Blackrock sustainable energy fund include:

- Enphase Energy

- Solar Edge Technology

- Plug Power

- Vestas Wind Systems

- Orsted

- First Solar

The iShares Global Clean Energy fund is weighted by market capitalization and exposure score under a number of restrictions. It reconstitutes itself every two years. Moreover, the ETF is one of the largest sustainable funds on this list. At the time of writing, across its 98 holdings, iShares Global Clean Energy has over $5.7 billion in net assets.

According to sustainable fund analysis by MSCI, 38% of this Blackrock sustainable energy fund’s investments have an ESG score of AAA or AA. Only 5% have a B or CCC. This fund was created in 2008. Although this sustainable fund performance in the chart above doesn’t look very appealing, we found that in a shorter timeframe of five years, it has increased by around 147%.

MSCI ESG Rating: AA

5. Invesco Solar ETF (TAN)

The Invesco Solar ETF invests in renewable power and tracks the MAC Global Solar Energy Index (SUNIDX). At least 90% of the fund’s total assets are allocated to securities, global depositary receipts (GDRs), and American depositary receipts (ADRs), which make up the index.

For those unaware, the sustainable index fund SUNIDX focuses on solar and wind energy stocks and Invesco Solar merely tracks it. In order to account for relevant taxes for non-resident investors, the index is calculated using net returns. Furthermore, it is diversified across value chains, locations, and technologies.

We’ve listed some of the components of this ETF below:

- Enphase Energy

- SolarEdge Technologies

- Sunrun Inc

- Xinyi Solar

- Daqo New Energy

The net assets in this sustainable investing fund’s portfolio equate to around $2.7 billion and there are 53 stocks included. Our analysis found that 14% of Invesco Solar’s holdings have an ESG score of AAA or AA. 6% have a B or CCC – as per MSCI ESG ratings.

The inception year for this fund was 2008. In terms of its performance, at the time of writing, Invesco Solar is trading almost 300% higher than it was five years ago.

MSCI ESG Rating: A

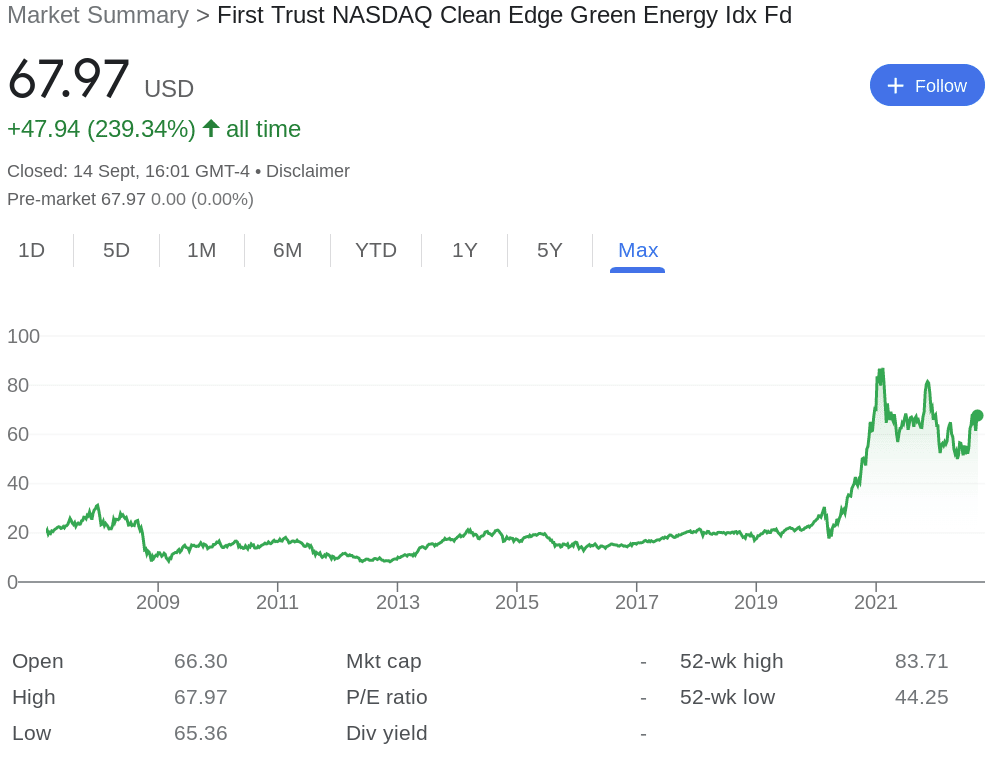

6. First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN)

This is one of the most sustainable index funds in the market for those interested in green investment funds and energy companies within the US. First Trust NASDAQ Clean Edge Green Energy has a sizable portfolio of publicly traded companies in the renewable energy sector.

The eligible US companies included must be in the business of one of the four core subsectors of distributing, producing, developing, or installing. This also considers energy storage and conversion which includes hybrid batteries.

Holdings of First Trust NASDAQ Clean Edge Green Energy also include those within the sustainable energy intelligence industry (for instance, smart grids). Advanced materials that lessen the need for petroleum products or enable clean energy and renewable electricity generation (wind, solar, geothermal) are also included.

Here are some of the stocks included in this sustainable investing fund:

- NIO

- Tesla

- ON Semiconductor

- Albemarle Corp

- Enphase Energy

As with the rest of the reviews in this guide, we’ve also noted the MSCI sustainable fund ratings. Here’s how First Trust NASDAQ Clean Edge Green Energy ranked -an ESG rating of AAA or AA is assigned to 14% of the sustainable index funds holdings, while a B or CCC rating has been given to just 3%.

First Trust NASDAQ Clean Edge Green Energy was made public in 2007. This sustainable investing fund has increased by 254% over the five years prior to writing this guide.

MSCI ESG Rating: A

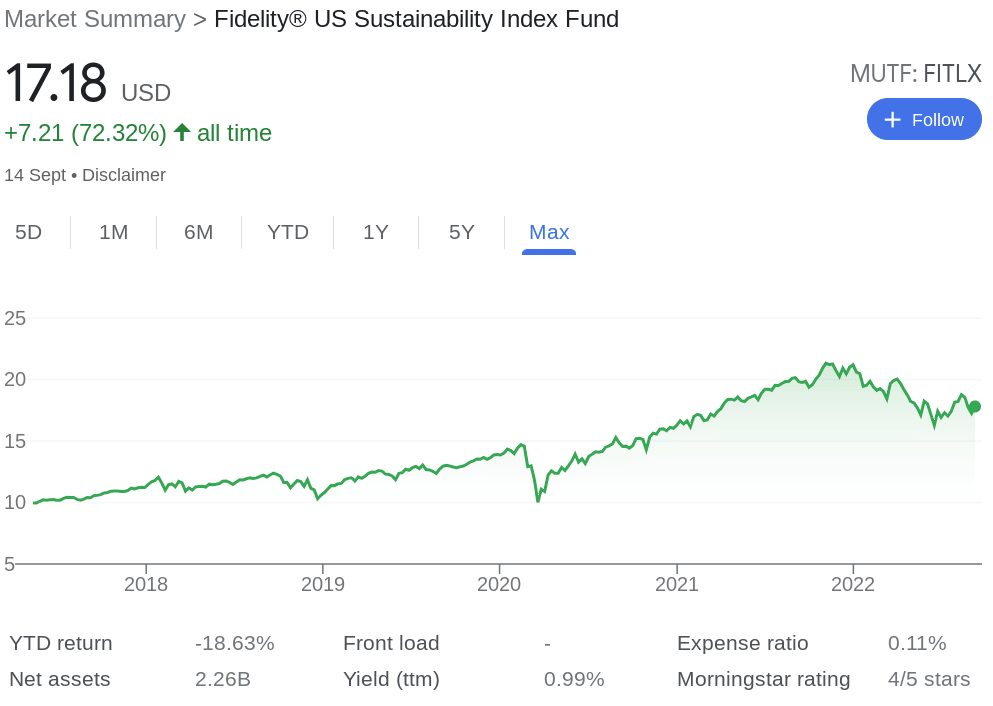

7. Fidelity US Sustainability Index Fund (FITLX)

Fidelity sustainable investment funds such as FITLX are potentially advantageous for investors who are drawn to firms that are socially or ecologically responsible. The Fidelity US Sustainability Index Fund only holds securities with excellent MSCI ESG ratings. This fund’s benchmark is the MSCI USA ESG Leaders Index.

The rating and weighting of the firms included in this US-focused Fidelity Sustainable fund are diverse and are made up of large and mid-cap US companies. To be included in the Fidelity US Sustainability Index Fund, companies must be both ecologically and socially responsible.

Below are just some of the stocks held in this sustainable mutual fund:

- Microsoft

- Alphabet Class A and C (Google)

- Tesla

- Johnson & Johnson

- NVIDIA

There are 25 holdings in this fund. A total of 51% of the Fidelity Sustainable fund’s holdings have an MSCI ESG Rating of AAA or AA, while none have a B or CCC. In terms of performance, this fund has been around since 2017 and has seen an increase of over 72% as of the time of writing.

MSCI ESG Rating: AAA

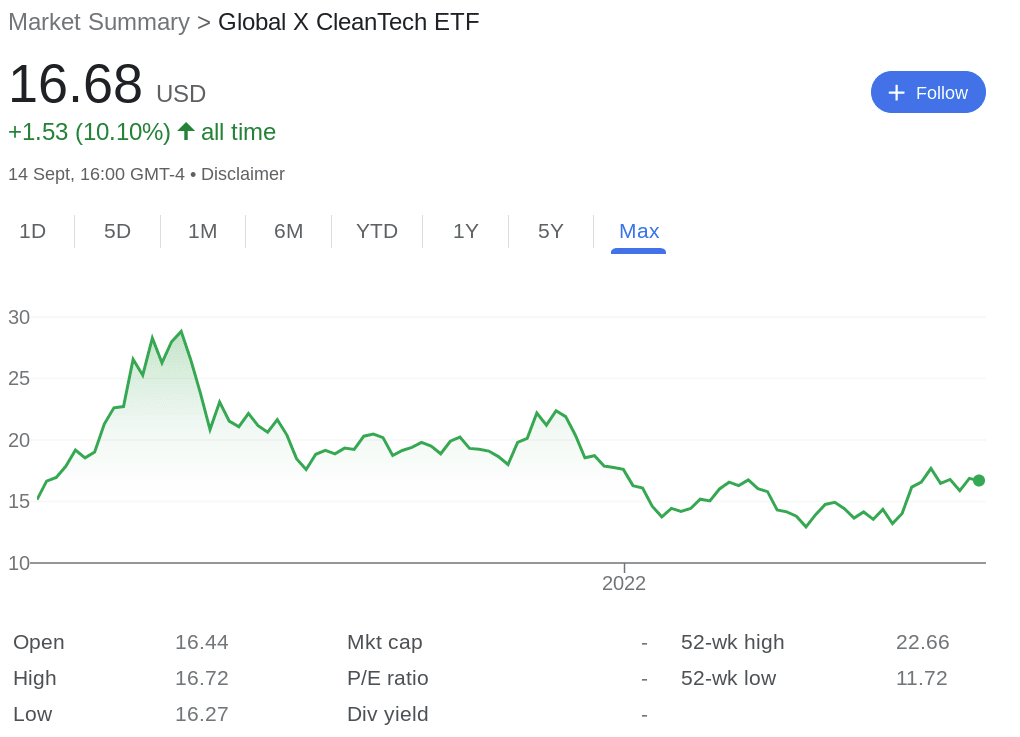

8. Global X CleanTech ETF (CTEC)

Global X CleanTech ETF aims to mimic the Indxx Global CleanTech Index’s price and yield performance, prior to fees and charges. In a nutshell, the Global X CleanTech ETF seeks to invest in businesses that stand to gain from the rising use of technology that prevents or lessens adverse environmental effects.

This comprises businesses engaged in the improvement of home and commercial energy efficiency and those that specialize in the creation of renewable power. Other holdings in Global X CleanTech concentrate on the creation and distribution of pollution-reducing goods and services and the deployment of smart grids.

Some of the largest holdings in this fund can be seen below:

- Enphase Energy

- First Solar

- Plug Power

- Samsung SDI

- Solar Edge Technology

The CTEC fund holds net assets worth just $124 million. Nonetheless, 22% of the holdings within the CTEC portfolio have an MSCI ESG score of AAA or AA. Meanwhile, 9% of the stocks in this portfolio of assets have a B or CCC.

The Global X CleanTech ETF has been listed since 2020. It has increased a little over 10% since its inception.

MSCI ESG Rating: A

9. BGF Sustainable Energy A2 USD

Launched in 2001, this BGF sustainable energy fund invests at least 70% of its total assets internationally. Notably, there are numerous different units, albeit, for the purpose of this analysis we focus on A2 USD. Some of the sustainable energy businesses included in this fund are those that work with alternative energy sources and clean power-related technology.

This covers suppliers and creators of renewable energy technologies, as well as those for infrastructure, alternative fuels, and energy efficiency.

Some of the holdings in this BGF sustainable energy fund include:

- NextEra Energy

- RWE AS

- ENEL SPA

- Samsung

- LG Chem

There are 49 holdings in this Blackrock sustainable fund. According to MSCI, 0% of the holdings in the fund have an ESG score of B or CCC, while 56% have a rating of AAA or AA. Moreover, this is another example of one of the largest sustainable funds on the market, not least because it has an asset net value of over $6.3 billion.

This fund adheres to the Global Industry Classification Standard. This means it will not invest in businesses that fall within certain industry classifications. This includes any companies that focus on the exploration and production of oil and gas, or coal and consumables.

MSCI ESG Rating: AA

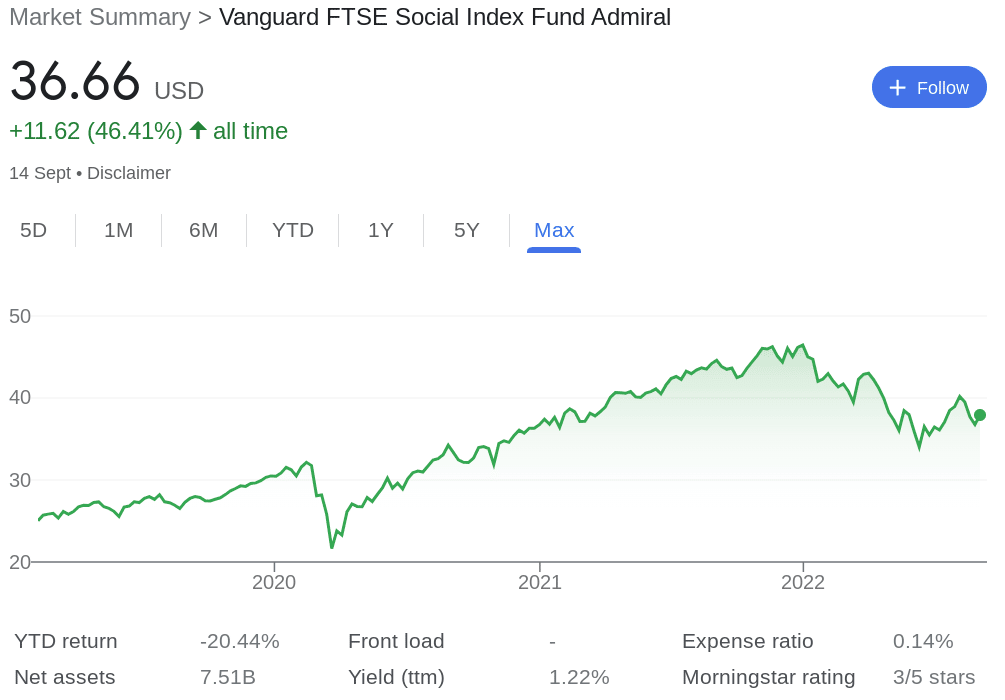

10. Vanguard FTSE Social Index Fund (VFTAX)

The Vanguard FTSE Social Index Fund tracks the FTSE4Good US Select Index. Notably, the ethical stock investing objectives of this mutual fund are met without losing the advantages of a market-cap-weighted, broadly diversified portfolio.

Strict exclusionary ESG filters are applied by the Vanguard FTSE Social Index Fund in order to cull out firms engaging in contentious industries. This prevents it from failing to meet the diversity standards of the FTSE or bypassing the corporate sustainability principles of the UN Global Compact.

This Vanguard sustainable fund’s holdings include:

- Apple

- Microsoft

- Amazon

- Alphabet Class A and C

- Tesla

The net assets in this sustainable investment fund have a value of almost $14 billion. The ESG rating of 32% of Vanguard FTSE Social Index Fund’s holdings are AAA or AA. Only 2% of stocks were given a B or CCC ESG Score.

Vanguard FTSE Social Index Fund has been around since 2019. Based on its price at the time of writing, the fund’s price has increased by over 46% since its inception.

MSCI ESG Rating: AAA

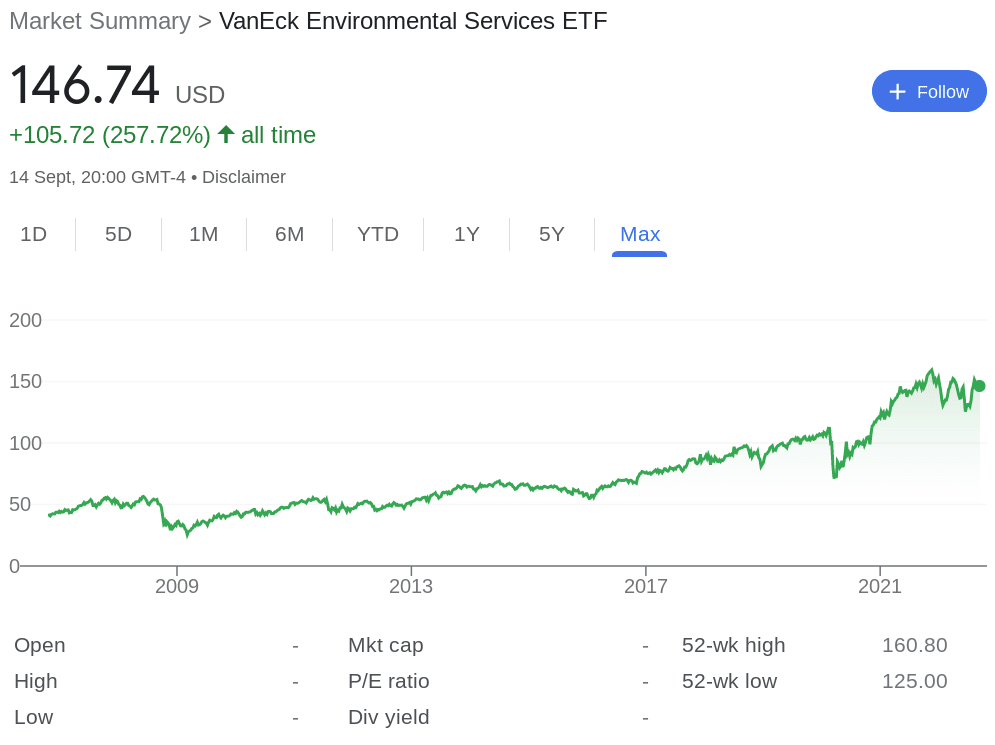

11. VanEck Vectors Environmental Services ETF (EVX)

The VanEck Environmental Services ETF closely monitors, before fees and costs, the price and performance of the NYSE Arca Environmental Services Index (AXENV). The fund monitors the overall performance of businesses engaged in soil remediation, wastewater management, trash collection, transfer, and disposal, recycling, and environmental consultancy.

Only businesses that adhere to the UN Global Compact’s principles for human rights, labor, the environment, and anti-corruption are included in VanEck Vectors Environmental Services ETF portfolio.

We’ve listed a handful of VanEck Vectors Environmental Services ETF holdings below:

- Republic Services

- Waste Management

- Ecolab

- PureCycle Technologies

In total, there are 22 holdings in the VanEck Vectors Environmental Services ETF. The sustainable index fund holds net assets of $72 million. In terms of MSCI ratings, 26% have an ESG score of AAA or AA, while 14% have been rated a B or CCC.

Based on the price of the fund at the time of writing, VanEck Vectors Environmental Services ETF has risen by over 78% over five years.

MSCI ESG Rating: AA

What are Sustainable Funds?

Most sustainable funds include investments based on their social impact using environmental, social, and corporate governance standards.

This falls back to the ESG ratings we’ve talked about throughout this guide.

- The sustainable investing fund in question might focus on a specific theme such as a certain industry or companies that consciously seek to have a measurable social impact.

- There are undoubtedly ethical components to a sustainable index fund.

- For instance, there is the understanding that investors may be able to play a part in influencing the development of a low-carbon, inclusive global economy.

Due to the growing need for societal and environmental change, sustainable investing is becoming more and more popular.

Since this pattern doesn’t appear to be slowing down, sustainable investors could expect to see an increase in the number of such funds as time goes on.

How Sustainability is Ranked in Investment Funds

ESG ratings/scores provide traders and investors with access to additional information that is typically not taken into account in conventional financial research.

The success of most sustainable funds will be greatly impacted by factors like their exposure to human rights and climate change for instance.

Here’s some more information about how MSCI sustainable fund ratings work:

- The most common way to rank sustainable investment funds is via Morgan Stanley Capital International, better known as MSCI.

- MSCI adheres to independent research and it also offers institutional investors and hedge funds governance tools, portfolio performance and risk analytics, and stock indexes.

- The primary factor for MSCI sustainable fund ratings is using the weighted average score to determine the grade.

- In order to learn more about the fund’s ESG history, the organization then evaluates ESG momentum.

- This is intended to show how much exposure the sustainable investment fund has to holdings with improving or deteriorating rating trends over time.

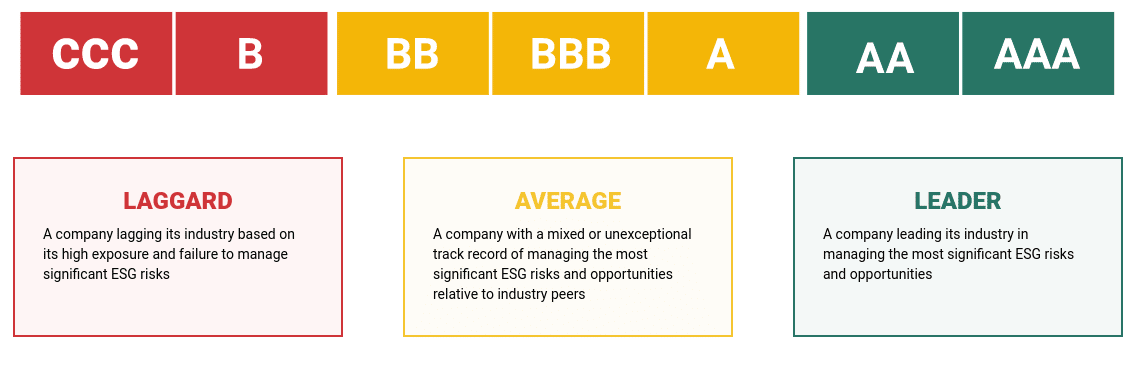

- Sustainable investing funds are rated on a scale from AAA (leader) to CCC (laggard) – as seen in the image above.

More than 8,500 firms use MSCI ESG Ratings (an estimated 14,000 issuers including subsidiaries) to develop ESG scores and measures for over 53,000 multi-asset class sustainable mutual funds and ETFs globally.

More than 680,000 equity and fixed income instruments are used in the process.

Why do People Invest in Sustainable Funds?

ESG has advanced from the marginal to the mainstream in the last 10 years in the same fashion that socially responsible investing has.

Investors and businesses have noticed requests for transparency, more regulation, and a general demand for better standards. As such, a higher number of sustainable funds have been created in recent years.

- The human conscience plays a part in creating a sustainable future. Many investors are more socially aware and wish to be more environmentally responsible.

- The more they increase in popularity, the higher the chance that sustainable investing funds will create gains for the people buying and trading them.

- A company’s dedication to preserving suitable working conditions for its employees, as well as its commitment to diversity and the local community, are also strongly suggested by a solid ESG track record.

- Having reputation for upholding socially and ecologically responsible practices and having transparent governance structures can help a company to grow over time and be included in more sustainable investing funds.

A sustainable investing fund is something to think about including in portfolios for those who are interested in both financial performance and being socially responsible.

Types of Sustainable Funds

The capital of multiple investors is combined when they invest in a sustainable fund.

Depending on the type, on their behalf, a fund manager buys, sells, or holds investments. All funds are composed of a variety of investments, in this case, sustainable assets.

Here are some types of sustainable funds:

- Sustainable ETFs – Exchange-traded funds, or ETFs, track an underlying index to offer investors access to a broad range of markets. Sustainable ETF funds are listed on stock exchanges and subsequently – online trading platforms. They tend to mimic indices with a positive ESG score or a basket of securities that generally fits the criteria of being clean or offsetting their carbon footprint.

- Sustainable Hedge Funds – A hedge fund is a limited partnership made up of private investors whose money is managed by experienced fund managers. These fund managers usually employ a variety of tactics, such as trading in non-traditional assets and borrowing money. The aim is to generate returns on investments that are higher than average. Importantly, in their decision-making process for new projects, sustainable hedge funds take ESG and impact factors into account. However, hedge funds are typically reserved for investors with access to at least $1 million in capital.

- Sustainable Bond Funds – In the same way that investors pool their money with others in mutual funds for stocks, they do the same with bonds. A professional manages the fund and invests accordingly. Some bond funds invest in both short, and long-term bonds from a range of issuers in an effort to replicate the broader market. A sustainable bond fund will hold corporate, municipal, mortgage- and asset-backed fixed income securities that have been issued as ‘Green Bonds’ or those that meet the ESG requirements.

To offer some insight into what’s available, this guide has analyzed a wide variety of sustainable investing funds.

This ranged from mutual funds like Fidelity US Sustainability and Vanguard FTSE Social, to ETFs like First Trust Water and iShares Global Clean Energy. Scroll up for a recap on the 11 sustainability funds that have been analyzed.

Conclusion

In summary, this guide has talked in detail about the most popular sustainable investing funds to watch in 2024. To name a few, this included First Trust Water ETF, First Trust NASDAQ Clean Edge Green Energy Index Fund, and Fidelity US Sustainability.

Sustainable funds allow investors to create a diverse and socially and environmentally conscious portfolio. Diversification is, however, important in this growing marketplace.

Although not a fund, we rank Ecoterra as the best sustainable investment asset right now. The platform has created a unique mechanism wherein users get rewarded for recycling several items in just a few simple steps. The platform’s presale has been gaining a lot of traction as it raised over $326K USDT in just a few days since its presale launch.