Investing is no longer just about making returns. On the contrary, a growing number of investors strive to use their money to fund entities that are trying to make the world a better place.

In this guide, we look into the concept of sustainable investing and explore what strategies can be utilized to gain exposure to this growing phenomenon. We also explore what kind of assets to consider when engaging in sustainable investing and how to identify market opportunities.

Best ESG Investment 2025

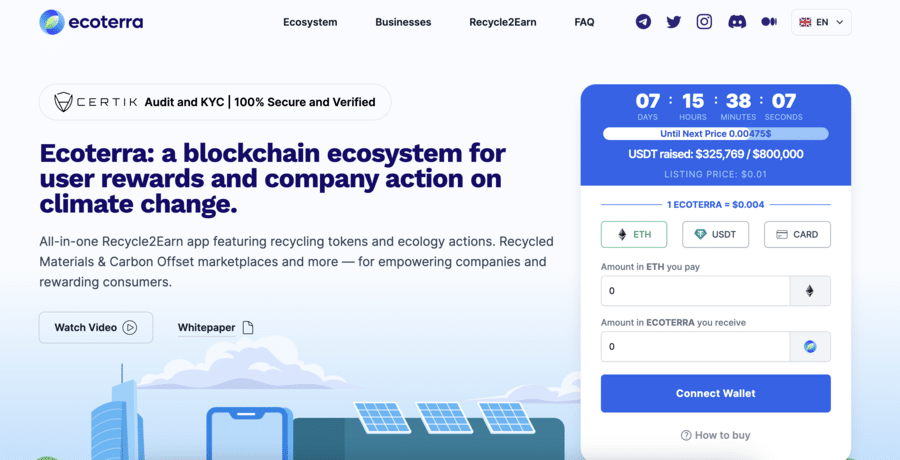

One of the most popular ways to invest sustainably is by using Ecoterra. This innovative platform uses the power of the Ethereum blockchain to allow individuals and companies to earn rewards easily via recycling.

Ecoterra’s groundbreaking platform is still in the development phase, although investors have the exclusive opportunity to buy ECOTERRA tokens through the presale. These tokens can be purchased for just $0.004 USDT at the time of writing. With a tiered pricing model, this rate will gradually increase in the coming weeks.

Sustainable Investing Explained

Sustainable investors select assets by taking into account environmental, social, and corporate governance factors. This way, the investment capital can be used to promote positive societal and corporate responsibility.

Some examples of sustainable investments and green energy investing include:

- Innovative crypto projects like Ecoterra with carbon-offset programs.

- Companies that promote good environmental practices – such as the production and storage of renewable energy.

- Firms that support an ethical corporate culture or human rights initiatives.

- Assets such as carbon credits help individuals and organizations indirectly reduce their environmental footprint.

In other words, a sustainable strategy takes on the view that it is possible to invest ethically and potentially, make a profit at the same time.

Typically, sustainable investing strategies aim to create long-term value. As such, investors should be prepared to wait several years to realize returns on their clean energy investment.

How Does Sustainable Investing Work?

Sustainable investing is practiced across many asset classes, including stocks, ETFs, mutual funds, and even cryptocurrencies. With that said, how an investor approaches this market can vary widely.

For instance, some sustainable portfolios only include investments that make a positive impact. On the other hand, there are also sustainable portfolios that simply exclude negative-impact investments.

To give an example, some might stay away from investments in firearm or oil companies and call their portfolios ‘sustainable’. However, the portfolio might not actually include any sustainable assets that make any verifiable difference to the world.

That being said, investors can combine both inclusionary and exclusionary methods when designing a sustainable portfolio. In other words, the methodology used can determine what assets fall into the category of sustainable investments.

As such, before exploring sustainable options, investors should first consider their motivations and identify which ESG issues are important to them. This will help in narrowing down and identifying the assets that are best suited to their individual preferences.

SRI, ESG & Impact in Sustainable Investing

Sustainable investing is a term that covers a wide range of strategies. Some of the most popular terms in this category include SIR, ESG, and impact investing.

While these terms are often used interchangeably, there are factors that differentiate each sustainable investing method.

SRI Investing

SRI, otherwise referred to as socially responsible investing, is a form of sustainable trading practice. This approach involves choosing investments based solely on specific ethical criteria.

For example, an investor might decide to avoid an ETF because it tracks the stocks of tobacco companies. Often, SRI investments tend to follow the socio-political climate of the time.

ESG Investing

In ESG investing, an investor will select companies that meet certain environmental, social, and governance requirements. There are ESG-based grading systems that allow investors to choose assets that have a strong rating – such as the MSCI framework.

However, the ESG system is also flexible. Instead of only choosing companies that are already sustainable, it also considers assets that are adapting to a new socially-responsible strategy.

For example, when using an ESG investment strategy, one might choose an oil company such as Shell that is shifting towards clean energy.

Impact Investing

Impact investments are not made with the aim to generate a financial return but also with the intention to make a positive, measurable social and environmental effect.

This market tries to address the most pressing global challenges, such as climate change, renewable energy, sustainable agriculture, and more.

In addition to this, traders can also consider companies that aim to provide affordable and basic services in underdeveloped countries. Such investments can be made in the sectors of housing, healthcare, and education.

In many ways, impact investing is often associated with SRI and ESG approaches. However, both SRI and ESG investing focus on business decisions that could affect the value of the asset.

For instance, a company that has a good carbon offset program will be at a competitive advantage when compared to those that do not.

On the other hand, with impact investing, the priority might be given to the goal rather than growth. For this reason, impact investors make it a point to measure the effectiveness of the projects they support.

Types of Sustainable Investments

There are many different categories that fall under the sustainable investing umbrella. This offers investors the flexibility to choose the type of asset they want based on their risk appetite.

Carbon Credits

Carbon credits are an emerging market that goes hand in hand with sustainable investing. In simple terms, carbon credits are permits that allow companies/entities to emit greenhouse gases.

Let us elaborate:

- Governments across the world award companies with a certain number of carbon credits.

- If they manage to bring down their emissions, these companies will have an excess carbon allowance.

- On the other hand, if companies fail to offset their emissions, they will need to buy more carbon credits.

- This has since resulted in a carbon credits market – facilitating the trading of permits.

While carbon credits primarily concern companies and businesses, individuals can also gain exposure to this market in different ways. When researching how to invest in carbon credits, retail investors can opt for stocks, futures, or even the commodity market.

However, the easiest option would be to invest in carbon credits ETFs – which will allow investors to diversify and reduce the overall risk.

Stocks

Stocks are perhaps the most common way to invest sustainably. Investing in sustainable companies allows traders to have full control of the equities they pick.

- For instance, if an investor is passionate about green fuels, they can build a portfolio of renewable energy stocks.

- Similarly, if they wish to support wildlife habitats and biodiversity, there are companies that focus on such aspects.

- Investors can also look for tech stocks that have dedicated carbon offset programs or automobile companies that manufacture only electric vehicles.

In other words, there are different ways to approach sustainable stock investing. However, when considering a stock, investors will want to look at more than its social impact.

Instead, it is also important to assess historical performance, financial stability, as well as growth potential. Moreover, it is crucial to understand how environmental and societal issues can impact how a stock performs in the market.

To learn more about the fundamentals, read our complete guide on how to invest in stocks.

Funds

If selecting individual sustainable investing companies seems too much hassle, trading ETFs can be considered as an alternative. There are several exchange-traded funds that come with sustainable investing certification.

These target a basket of stocks or other financial instruments, such as futures, that have strong sustainability credentials. Sustainable investment funds come in all shapes and sizes.

Some funds are broadly focused, such as the iShares MSCI USA ESG Select ETF – which tracks a selection of US companies that have positive ESG characteristics. This includes energy stocks, tech companies, financial firms, and even those involved in the healthcare and consumer goods sectors.

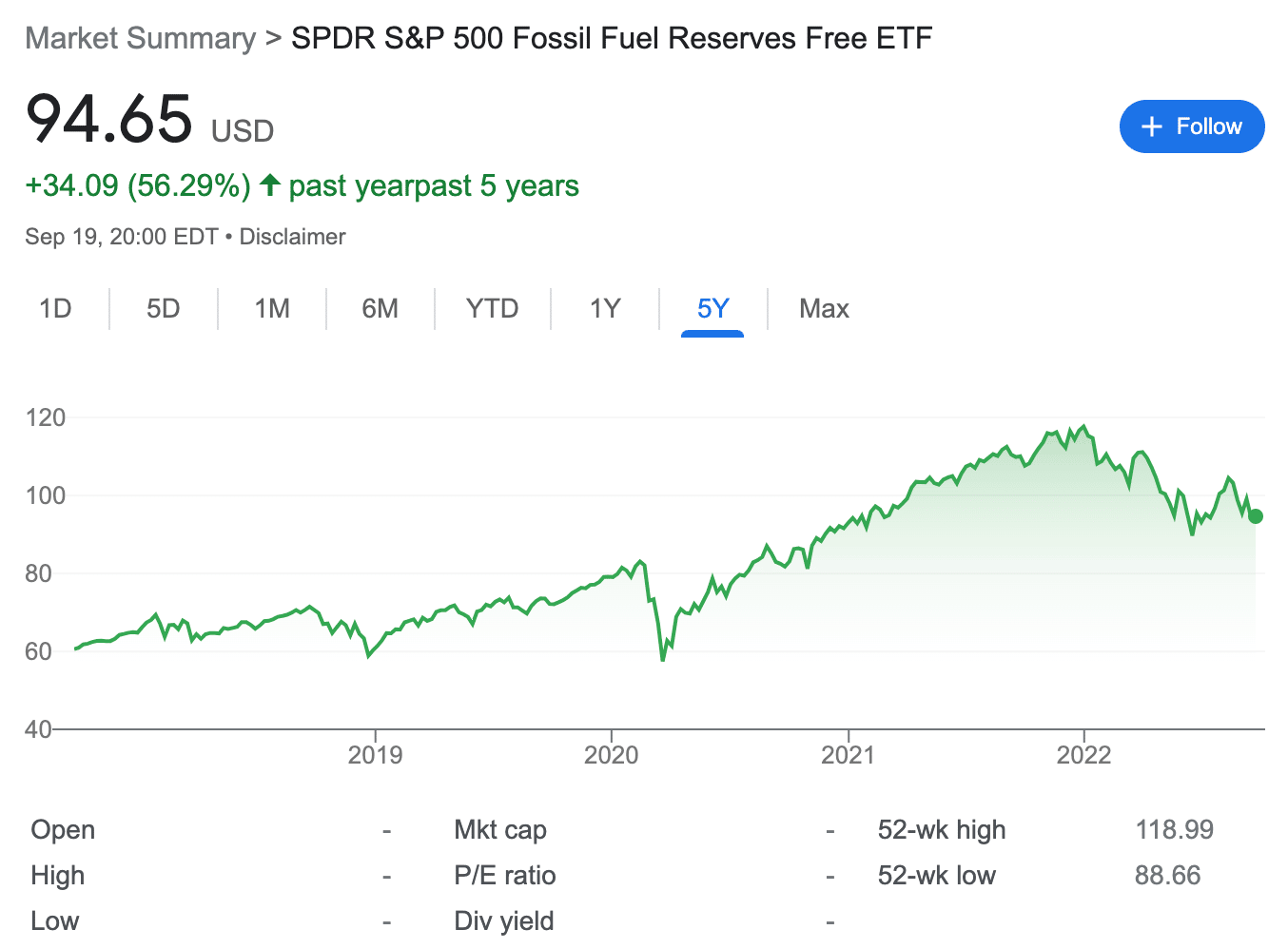

On the other hand, there are also those ETFs that are more specific. For instance, the SPDR S&P 500 Fossil Fuel Reserves Free ETF follows a basket of stocks that do not possess any fossil fuel reserves.

Depending on the underlying assets, some sustainable investing funds carry too much risk, whereas others follow stocks that are relatively stable. Our guide on how to invest in ETFs can offer more insight into this strategy.

Cryptocurrencies

Cryptocurrency is another asset class that is gaining in popularity among sustainable investors. There are several new crypto projects that focus on maintaining the integrity of blockchain technology while being energy efficient.

For example, when compared to Bitcoin, digital tokens such as Cardano, Algorand, and Steller Lumens produce less carbon footprint and are considered more sustainable.

Additionally, crypto developers are coming up with innovative ways to design sustainable projects.

For instance, retail clients can now invest money into carbon offset programs or sustainable organizations using digital tokens – thus helping to make a direct impact.

Examples of Sustainable Investment Assets

In this section, we have prepared a list of assets that might interest those eager to get into sustainable investing.

1. Ecoterra – Crypto Project Supporting Recycling with Industry-Leading Incentives

The new-age system offers monetary rewards to users who actively participate in conserving the environment.

Early investors can buy Ecoterra presale tokens for just $0.004 USDT each. A tiered pricing model provides lower rates for those who invest early. The platform’s presale website also shows a listing price for $ECOTERRA at $0.01 USDT, ensuring users a profit over the current price. The presale platform allows the purchase of tokens using a credit card, Ethereum, or USDT as payment methods.

Users can obtain $ECOTERRA tokens by scanning recyclables with the Ecoterra app. Once earned, these tokens can be held, staked, or donated to organizations that promote ecological sustainability.

The user-friendly Ecoterra app empowers individuals to profit from recycling while monitoring their environmental footprint and acquiring carbon offsets. When combined, these aspects establish a comprehensive, sustainable strategy that fosters ethical behavior on a global scale.

As outlined in Ecoterra’s whitepaper, upon scanning a recyclable item, the platform’s AI-driven database determines the most suitable recipient for the material. To promote responsible waste management, the app displays the closest Reverse Vending Machine (RVM) location. Users must photograph and upload their receipts to the app to claim their rewards.

The adaptable platform can be utilized across various industries, including consumer goods, IT, fashion, and hospitality. It addresses the demands of diverse recycling operations by accommodating various RVMs.

As the world becomes more conscious of the need for sustainable practices, Ecoterra’s innovative approach holds immense potential to drive positive change.

Investors eager to learn about the platform are encouraged to join the Ecoterra Telegram group.

Hard Cap

$6,700,000

Total Tokens

2,000,000,000

Tokens available in presale

1,000,000,000

Blockchain

Ethereum Network

Token type

ERC-20

Minimum Purchase

$10

Purchase with

USDT, ETH, Bank Card

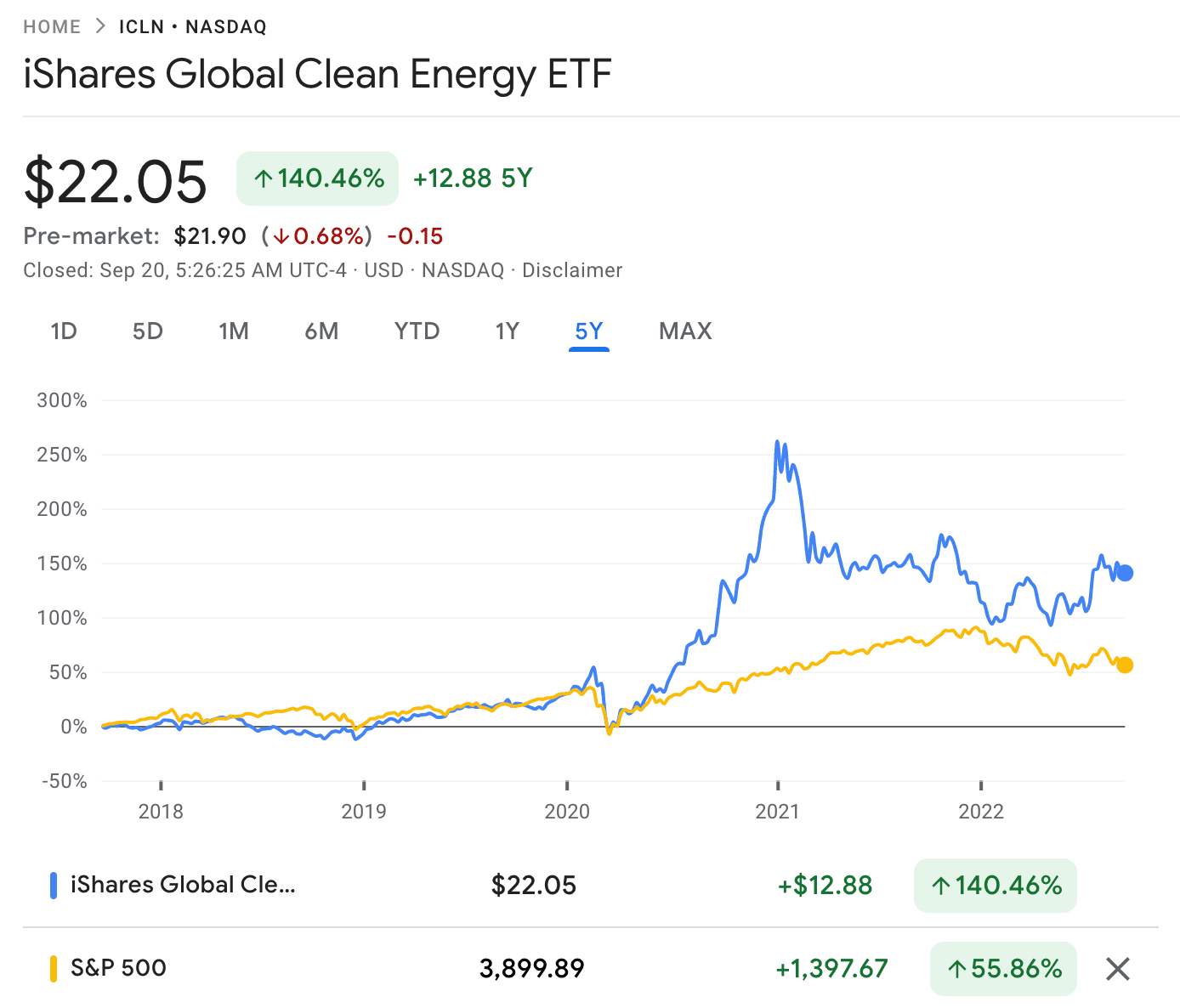

2. iShares Global Clean Energy ETF – Fund Tracking Leading Energy Companies

Investing in sustainable energy is one of the easy ways to build a socially responsible portfolio. A notable option in this category is the iShares Global Clean Energy ETF, an exchange-traded fund that tracks several global equities in the clean energy sector. It offers exposure to companies that produce energy from solar, wind, and other renewable sources.

As of writing, the fund has holdings in 124 energy companies – out of which about 50% are large caps. And the majority of these stocks are based in the US, while the rest operate in the Chinese and European markets. The three largest holdings of this ETF are Enphase Energy, Solaredge Technologies, and Plug Power.

The iShares Global Clean Energy ETF could be suitable for investors looking for greater diversification – not only within this sector but also across different global markets. Although this ETF was launched in 2008, it only began gaining traction in 2020 – when the concept of sustainable investing become more mainstream.

Since January 2020, the value of this ETF has increased by 110%. At the time of writing, this Blackrock sustainable investing fund has a five-year return of around 180%.

3. Stem – First Publicly-traded Smart Energy Storage Company

The majority of sustainable investing markets lean towards green energy companies or related funds. Stem, however, is slightly different. This is one of the most popular tech stocks to operate in the green energy sector. Stem’s proprietary software Athena uses machine learning algorithms to generate forecasts about the weather, energy prices, demand, and more.

It then analyzes the data, formulates a strategy to maximize its value, and then implements a strategy in different ways. For instance, during peak hours, it can release more energy to meet the demand and mitigate the higher costs involved.

Similarly, Stem’s software can decide when to charge and discharge batteries and automate many processes by monitoring system performance. Stem is unquestionably the market leader among providers of energy storage technology.

Its clients include popular brands including the likes of Amazon, Walmart, Adobe, UPS, and more. Given the growth expected in the green energy space, an innovative company like Stem might be worth considering for a sustainable portfolio. However, bear in mind that the company lacks financial stability – which might make it a risky choice.

Although Stem was founded in 2009, it only went public in 2021. Over the past twelve months of trading, Stem stock has declined by about 30%.

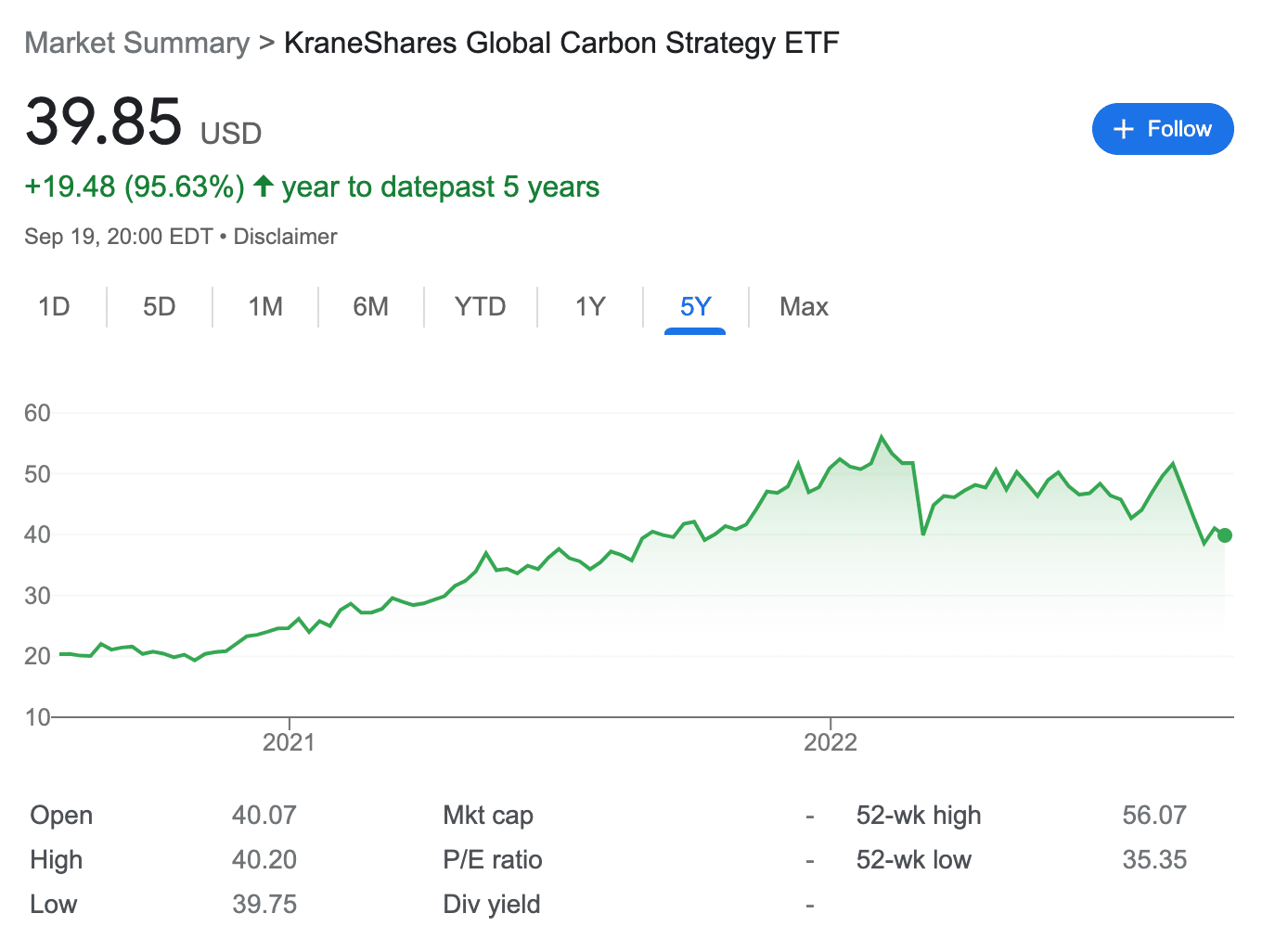

4. KraneShares Global Carbon Strategy ETF – Exchange-Traded Fund Offering Exposure to Carbon Credits

As we mentioned above, one way to take on sustainable and responsible investing is via carbon credits. Since it can be difficult to buy and sell carbon credits directly, retail investors often consider ETFs that are linked to funds in this sector. KraneShares Global Carbon Strategy is one such ETF that allows investors to speculate on the price of carbon credits in the global market.

It is linked to the IHS Markit Global Carbon Index, which tracks carbon credits futures traded on major exchanges, including Europe, the UK, and California. Due to its diversified nature, this ETF minimizes the risk involved.

The KraneShares Global Carbon Strategy ETF was launched in July 2020 at a price of just over $20. Since then, it has made gains of nearly 100%. The all-time high price of this ETF was achieved in February 2022, at around $56.

As of writing, this ETF trades at around $40. The KRBN ETF was designed for investors who are concerned about the ever-rising carbon emission prices. In other words, this ETF can be used to hedge a portfolio with stocks that have heavy carbon footprints – thus making it more sustainable.

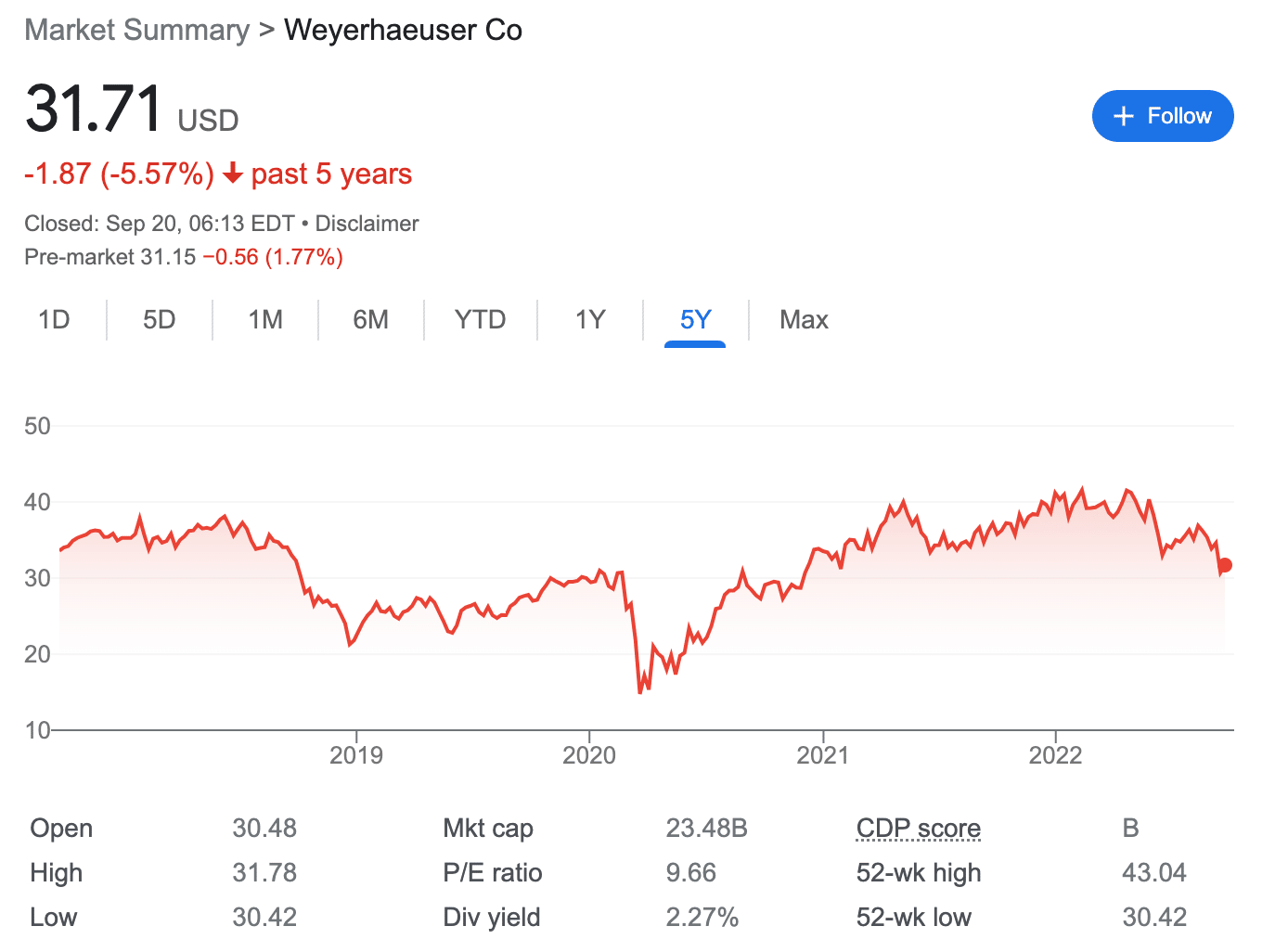

5. Weyerhaeuser – Sustainable Stock in the Paper & Forest Products Industry

As a timber real estate trust, Weyerhaeuser might not initially strike as a sustainable investing firm to pay attention to. After all, its core business involves cutting down trees for lumber construction purposes. However, in order to make up for this, Weyerhaeuser has launched a commendable sustainability program.

The company has devised a sustainable strategy that focuses on three areas – contributing to climate change solutions, building sustainable homes, and helping rural communities.

Over the past decade, it has planted over one billion trees and is also committed to using clean energy. Weyerhaeuser also does well in terms of governing principles and diversity and inclusion in the workforce.

In addition to this, Weyerhaeuser also offers dividends. As of writing, the company pays out a running yield of around 2.5%. Over the past few months, Weyerhaeuser has faced challenges due to the declining lumber prices. As such, Weyerhaeuser stock has declined by nearly 20% since the beginning of the year.

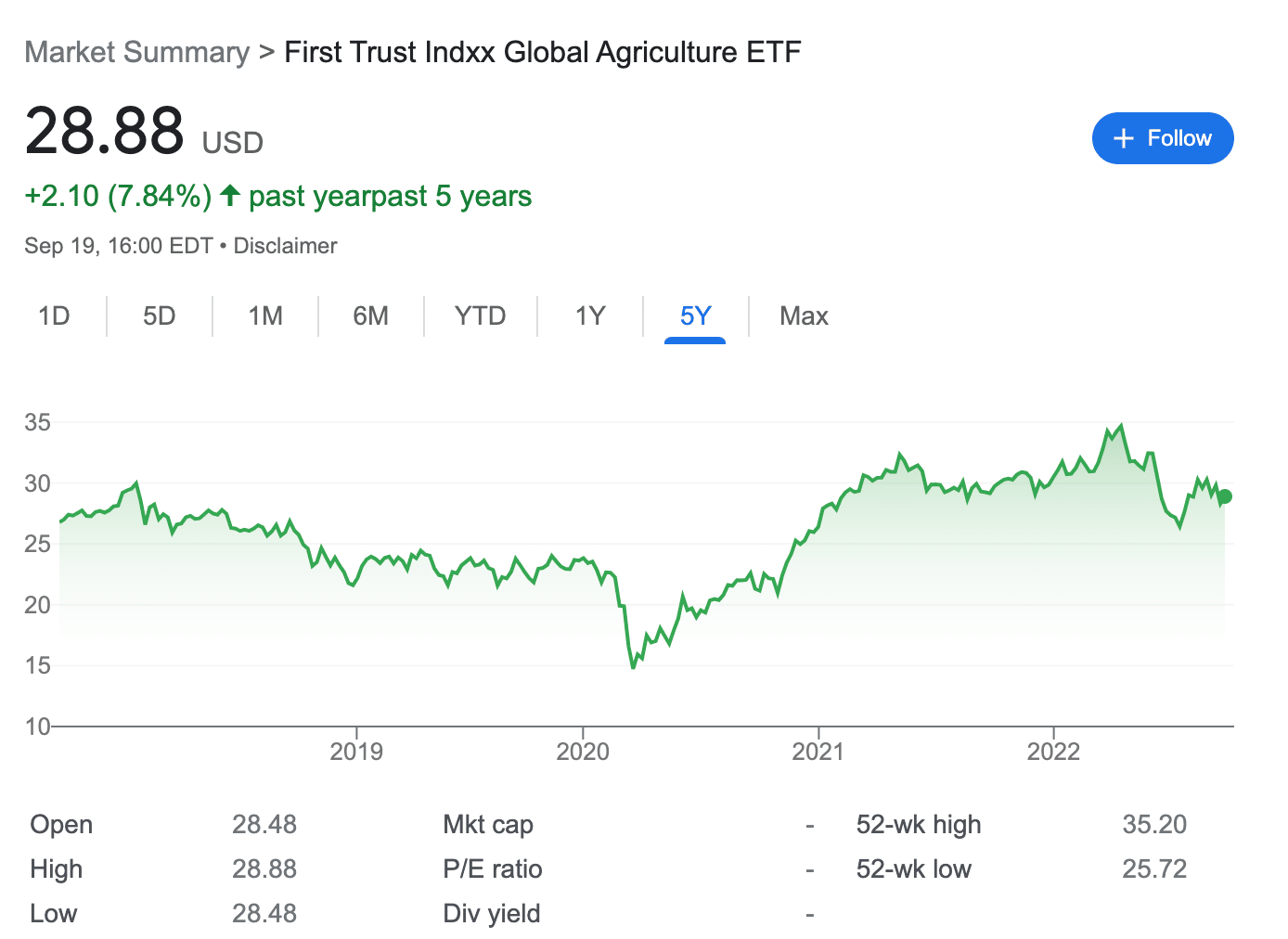

6. First Trust Water ETF – Leading Water Sustainability Fund

In addition to energy, water is another natural resource that is not being well-managed in several parts of the world. This growing spotlight on water sustainability has also opened up opportunities for investors to help different communities. The First Trust Water ETF is one such asset.

It is benchmarked to the ISE Clean Edge Water Index. This fund has holdings in companies operating in the potable water and wastewater industry, specifically, the top 36 companies in the sector by market capitalization.

The top three holdings include Xylem Inc – which offers water technology products; IDEX Corporation – which designs and builds water-related specialty engineering products; and Danaher Corporation – a company with a diversified portfolio of consumer goods and services.

As the world is struggling with a rising population, safe and clean drinking water will become one of the top priorities. In that regard, this sustainable investment fund can help traders gain exposure to a growing sector that is high in demand. As of writing, the First Trust Water ETF is trading at around $30 – and has a five-year return of 8%.

Why do People Make Sustainable Investments?

The motivation to adopt a sustainable strategy might vary from one investor to another.

Nevertheless, sustainable investing comes with a few advantages – let us take a look at what they are.

Making an Impact

There are long-held views that social and environmental issues can only be addressed by making philanthropic donations. Sustainable investing challenges this misconception.

Today, investors have the opportunity to make a difference and use their money to help companies reduce their carbon footprint or become more environmentally friendly.

For instance, suppose a retail investor is searching for sustainable companies to invest in. Instead of choosing an oil company, they decide to purchase stock in First Solar – a renewable energy firm that builds and sells solar power panels.

By making this choice, investors can rest assured that their money is being used for developing sustainable energy sources.

Potential Returns

Needless to say, an important motivation for investors to consider when making sustainable investments is the financial return on offer.

Over the last decade, sustainable assets and funds have made similar or even superior returns when compared to the wider market.

For instance:

- The iShares Global Energy ETF has generated a return of over 140% over the past five years.

- It has, in fact, outperformed the S&P 500 – which yielded returns of around 55% during the same period.

- Similarly, companies with high ESG scores have also performed well and are deemed to be better protected against the negative effects of the pandemic.

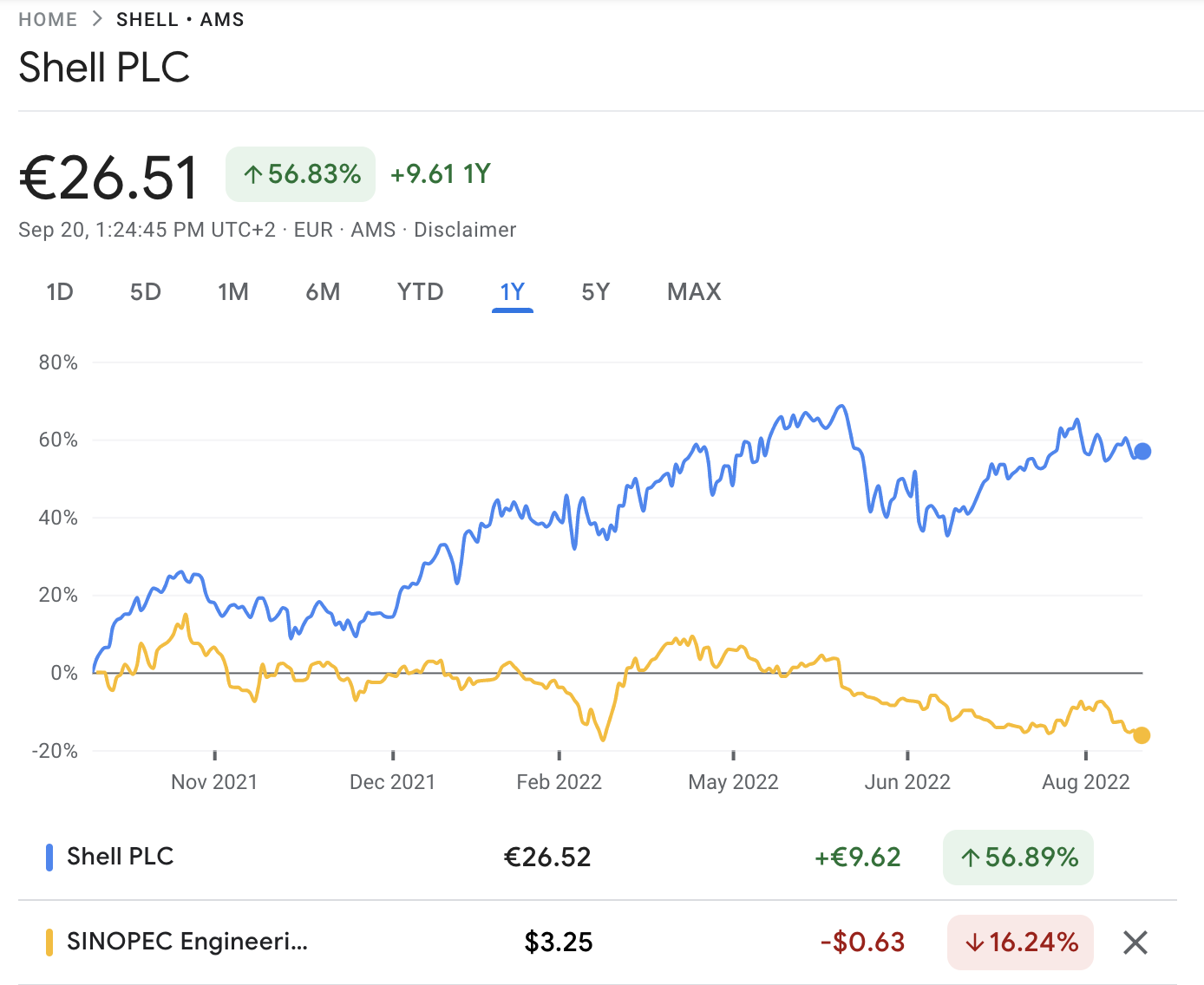

- For example, let’s take the case of two oil stocks – Shell (ESG rating: AA) and Sinopec ((ESG rating: BB).

When comparing the performance of these two companies, it is evident that Shell stock was significantly more profitable in this timeframe.

Of course, the case might differ from one asset to another. However, the general consensus is that sustainable companies are more appealing in the general market.

And as such, this can help the company sell more of its products/services and, therefore, generate more attractive returns.

Diverse Investment Choices

Choosing sustainable investing as a strategy might seem restrictive at first. However, the choices are no longer limited. A growing number of companies ate committing to sustainably and responsibility – not only in their operations but also governance.

- Moreover, the trend is growing year by year.

- In order to build a sustainable portfolio, investors can choose between ETFs, stocks, mutual funds, and even cryptocurrencies.

- Furthermore, instead of making long-term investments, there is also scope to trade sustainable assets in the short term.

All that being said, it is crucial to remember that sustainable investing is a market that is still in its infancy.

After all, sustainable investing funds and stocks tend to be volatile. Therefore, when choosing an investment, individuals should carefully read through the philosophies of the asset, along with the potential profitability on offer.

How to Find Sustainable Investment Assets

Despite the growing opportunities in sustainable impact investing, understanding how to pick the right assets can be a challenge.

In this section, we will consider what frameworks investors can use to identify sustainable assets for their portfolio.

Get Educated

To make responsible investment decisions, individuals should have a clear idea of what the focus should be.

To gather more information, investors can refer to guides like ours or take insight from reputed financial websites. The likes of MorningStar, MSCI, and Yahoo Finance provide plenty of information regarding sustainable investing.

It is also wise to spend time understanding how ESG ratings work and what can be accounted for as a sustainable investment.

Follow Financial News and Brokerage Platforms

Companies making a strategic shift to sustainability are also likely to hold a press release or make an announcement. Such events will often make headlines on financial media platforms.

Following these sources will allow investors to keep track of new sustainable investing opportunities emerging in the market.

Similarly, many brokers also feature sustainable investments available on their platforms.

Some platforms take things one step further to offer managed portfolios that focus on sustainable and ESG investing. Sustainable investors can go through these listings to figure out if a specific asset fits their portfolio.

Check Out Online Forums

These days, discussions happening on online forums can also be a useful source to identify potential investments.

Companies engage with their investors and buyers via social media accounts, so it would be a good idea to keep an eye out for updates via social media.

In addition to this, company representatives have been known to start conversations on online forums such as Reddit in order to stir engagement and generate publicity.

Investors can thus scour these platforms to find information about sustainable companies and then perform due diligence to arrive at decisions.

Brokers Offering Sustainable Investments

In order to invest in sustainable assets, retail investors should have a brokerage account. This requires finding a trustworthy and regulated broker that offers access to different sustainable asset classes and markets.

Conclusion

Sustainable investing is a strategy that allocates capital to assets that meet high environmental and social standards. Investing in sustainable assets is a way of supporting a cause without sacrificing financial returns.

There are plenty of ways to add sustainable investments to a portfolio. As we have discussed, investors can choose between stocks, ETFs, and even digital tokens that focus on sustainability.

However, those interested in sustainable investing may wish to consider Ecoterra. This unique platform allows individuals to locate the nearest reverse vending machine and recycle items in simple steps while earning exciting rewards for the same. At press time, investors can buy $ECOTERRA tokens at a discount through the project’s presale, providing an easy way to gain exposure to its growth.