Moomoo is a well-rounded online trading platform that does an excellent job of balancing valuable tools for both beginners and advanced investors. This online broker is regulated by the SEC and FINRA and gives its users access to stocks, ETFs, and options.

In this Moomoo review, we take a closer look at the features of this online broker – in terms of supported markets, fee structure, trading tools, customer support, and more.

Moomoo Review: Pros & Cons

Before we go ahead with our detailed Moomoo review, here is a quick glimpse of the pros and cons of this online trading platform:

Pros

- Regulated by the SEC and FINRA

- Provides access to stocks listed on US, Hong Kong and China A-share markets

- Get up to 15 free stocks as a new user

- No minimum deposit requirement

- A wide range of advanced trading tools

- Available via desktop software and an ios/Android app

Cons

- No support for cryptocurrencies or commodities

- Commission-free trading only available in the US

- Live chat support only available to registered users

Tradable Assets

We will start our Moomoo review with an overview of the different types of assets available for trading at this broker.

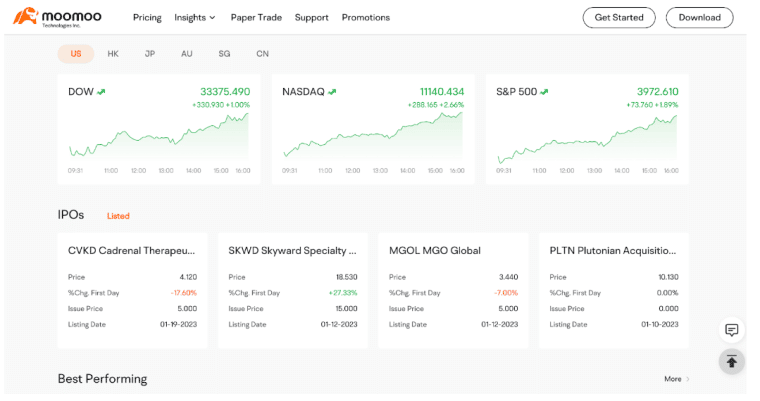

Stocks

Moomoo lists more than 13,000 US stocks, covering companies listed on NYSE, NASDAQ, and AMEX. In addition to this, users can also access stocks on foreign exchanges in China and Hong Kong.

ETFs

Like stocks, US-based ETFs and ETNs are available at 0% commission on Moomoo for US residents. The platform offers hundreds of ETFs belonging to multiple sectors.

Moomoo users can also invest in ETFs from international markets such as Hong Kong and China.

Options

Options trading is another popular feature of Moomoo. When trading options, US-based users aren’t charged a per-trade commission. Instead, there is a flat contract fee.

In addition to stocks, ETFs, and options, Moomoo also offers support for REITs. US-based users can also access foreign stocks via American Depository Receipts (ADRs).

Moomoo Fees & Commissions

As this Moomoo review has already established, this platform facilitates zero-commission stock trading to US clients.

Additionally, we found that Moomoo also has a competitive fee structure across most chargeable products.

Read on to learn more about the fee schedule of Moomoo.

Commission

US residents can use Moomoo to invest in US stocks, ETFs, and options on a commission-free basis. However, the broker charges US-based clients a 0.03% commission when trading stocks listed in Hong Kong and the China A-shares market.

Bear in mind that this zero-commission policy applies only to US residents. Non-US residents have a slightly different fee schedule. Moreover, US residents and other traders will also have to consider the spread when trading stocks and ETFs.

Margin Rates

Moomoo’s margin rates are quite high compared to the broader market. For instance, the margin rates for going long on shares can go as high as 8.8%, depending on the chosen market.

Once again, fees are also different for US and non-US residents.

Asset

US-Residents

Non-US Residents

US Stocks and ETFs

$0

$0.0049 per share/ min $0.99 per order

Options

$0 + $0.65 per contract

$0.65 commission + $0.65 per contract

Hong Kong

0.03% or HK$3, whichever is higher

0.03% or HK$3, whichever is higher

China A-Shares

0.03% or 3CNH, whichever is higher

0.03% or 3CNH, whichever is higher

Long margin for US stocks

6.8% p.a

4.8% p.a

Long margin for Hong Kong stocks

6.8% p.a

6.8% p.a

Long margin for China-A market

8.8% p.a

8.8% p.a

Short margin

Varies daily

Varies daily

Platform fees

Unlike the majority of online brokers, Moomoo charges a platform fee. With that said, Moomoo doesn’t levy any platform fees from US residents when trading domestic stocks or ETFs.

However, when trading in the Hong Kong or China A-shares market, US residents will have to pay $15HKD and 15CNH, respectively.

For non-US residents, the fees for stocks are $0.005 per share, with a $1 minimum requirement. However, non-US residents can also choose a tier-based fee system based on their monthly transaction volume. This will range from $0.010 to $0.003 per share.

Regulatory Fees

While compiling this Moomoo review, we also found that this platform charges a regulatory fee for both US and non-US residents. This fee applies to all markets – the US, Hong Kong, and China.

For US stocks, ETFs, and options, all customers will have to pay an SEC-regulatory fee of 0.0000229, multiplied by the transaction amount.

Deposit Fees

Moomoo also charges fees for processing payments. The fee varies depending on the payment method and whether it is a deposit or withdrawal.

Type

Deposit

Withdrawal

ACH

Free

Free

Wire transfers

$10

$20

International Wire transfers

$10

$25

Moomoo Charting and Analysis

Moomoo offer a highly customizable trading platform that comes with the following features.

Screener

The Moomoo website comes with an in-built screener that is not only accessible to registered users but also all visitors.

It allows investors to screen stocks on multiple markets based on indicators, as well as financial and technical data.

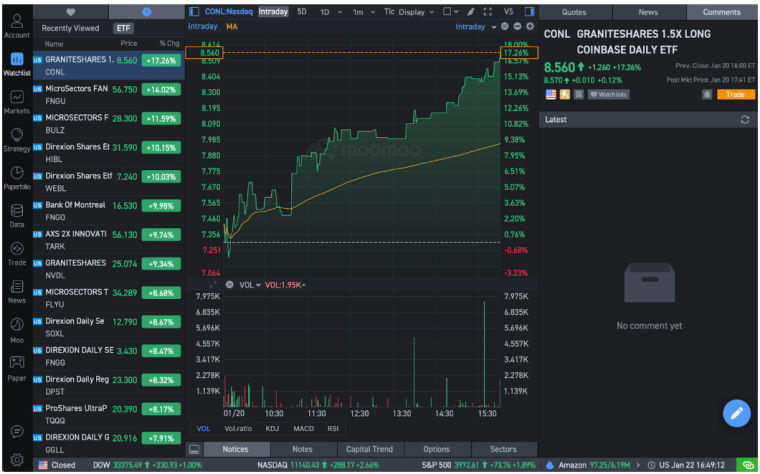

Charts and Technical Indicators

Moomoo also comes with a wide range of charting tools that appeal to traders. The platform supports 38 drawing tools that can help investors easily identify new trends.

On top of this, users also have access to 63 technical indicators that investors can deploy to spot what to invest in right now based on market trends.

Level 2 Data

Another plus point of Moomoo is that it offers free Level 2 data to all users with an approved US brokerage account. This offers users access to 60 levels of bid/ask prices, which offers insight into an asset’s supply, and demand in real time.

News and Feed

Moomoo also keeps its users updated with the latest news and events in the financial market. This means that investors need not scour the internet to find relevant financial news. Instead, everything is available a few clicks away at Moomoo.

Our Moomoo review also found the platform’s feed to be a useful addition – allowing users to engage with each other and share unique insights.

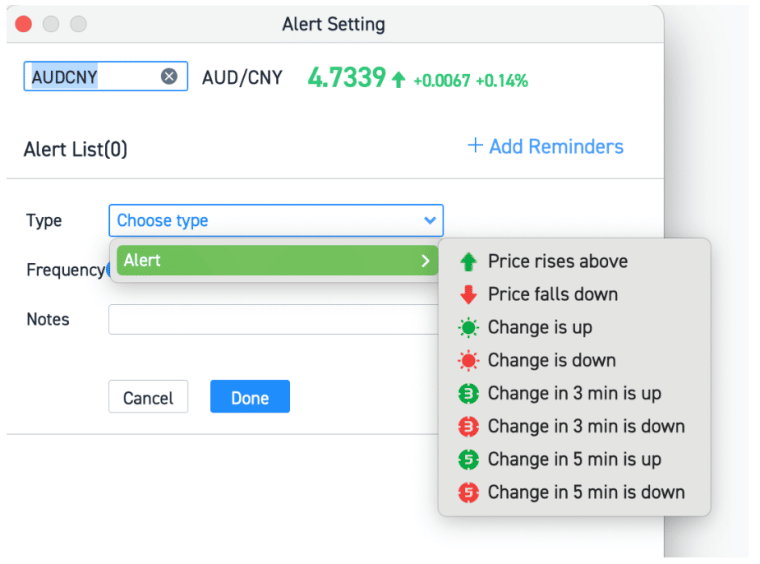

Alerts

Another useful tool offered by Moomoo is the option to set alerts. Moomoo allows its users to set reminders when the price of an asset increases or decreases – at their chosen intervals.

Interestingly, although Moomoo doesn’t support crypto or forex trading, its app can be used by traders to perform a market analysis of these assets. Similarly, the platform offers insight into the market performance of hundreds of stocks listed on exchanges in Japan, Singapore, Australia, and Canada.

Lessons and Library

Moomoo has also developed a wide range of how-to guides and tutorials with beginners in mind.

These are highly comprehensive and make it easy for newbies to learn how to use the platform and understand different trading strategies.

Moomoo Payment Methods

Moomoo only accepts funding via ACH as well as wire transfers. There is no support for payments via credit/debit cards or e-wallets.

No matter the payment method, it can take up to three days for the funds to appear in the Moomoo account. Withdrawal processing times can also go up to three days, depending on the bank.

However, Moomoo grants instant buying power to its users to start trading when an ACH deposit is on the way.

Moomoo Minimum Deposit

Moomoo is one of the few online brokers that does not stipulate any minimum deposit requirements.

However, Moomoo does not support fractional investments. This means that users will have to pay the full price of a stock/ETF when making a trade.

Moomoo Bonuses & Promos – Get up to 15 Stocks for free

Our Moomoo review found that this is one of the best investment apps in terms of promotions.

New Moomoo users can get up to 15 stocks for free by creating an account and making a deposit.

This is an incredible offer – albeit, it comes with certain conditions.

Upon creating an account with Moomoo, users will get one free stock.

If the user makes a minimum net deposit of $100 during the promotion period, they can get four additional free stocks.

Furthermore, by depositing $1,000 during the promotion period, new users can get 10 more free stocks from Moomoo.

After fulfilling the requirement, users can head over to their account settings and click on the ‘Draw’ button to claim their reward. The stocks offered are worth between $3 and $2,000.

Moreover, after drawing the free stocks, users must maintain a certain average asset balance to unlock the equity.

- For the $100 net deposit promotion, users need to maintain an average asset balance of $100 or more for 60 days.

- On the other hand, the $1,000 net deposit promotion requires users to maintain a 60-day average asset balance of $2,000 or more.

Even with these conditions, Moomoo appears to be offering a good deal – especially when considering that the value of the free stocks can go as high as $2,000.

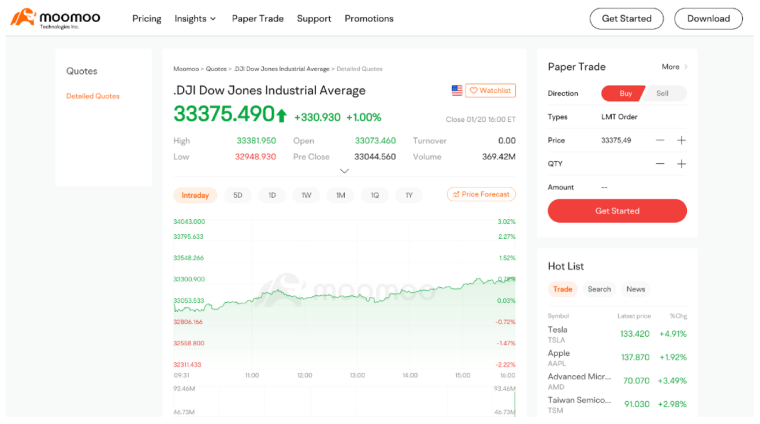

Moomoo Paper Trading

Moomoo also offers one of the best demo stock trading accounts – a useful tool for both beginners and experienced traders.

The platform provides simulated funds, allowing users to try different strategies, practice investing, and familiarize themselves with trading rules without using real money.

Paper trading is available on the desktop and mobile versions of Moomoo. Users can get up to $10 million in virtual funds to practice trading via their demo account.

Moreover, it is also possible to access pro-level tools, charts, and indicators.

Moomoo Customer Support

Moomoo comes with an easily-navigable website. It also makes sure that FINRA-licensed specialists are available during trading between 8:30 am–4:30 pm ET to offer answers to any queries or concerns of its users.

There is also an in-built live chat option available around the clock; however, it is accessible only to registered users.

Nevertheless, the platform also offers customer support via email and telephone. There is also a well-curated Help Centre that investors can use to find answers to the most common queries.

Moomoo Licensing & Security by an Affiliate

The Moomoo app was launched in 2018 Securites and brokerage services are offered on the app by Moomoo Financial Inc. which is a broker-dealer registered with the SEC and is a member of FINRA as well as SIPC.

This indicates that Moomoo abides by regulatory laws in providing a credible service to its users.

Moomoo Accepted Countries

Moomoo offers its services to residents of the US, Hong Kong, Macao, Taiwan, Singapore, and Malaysia. US residents with citizenship in other countries can also use Moomoo to trade.

How to Start Trading with Moomoo

To conclude our Moomoo review, we will now explain how to open an account with the broker and start trading.

Step 1: Sign up as a User on Moomoo

Start by visiting the Moomoo website and clicking on the ‘Get Started’ button on the upper right corner.

Next, provide an email address and assign a password for the account.

Moomoo also lets users join the platform by linking their social media accounts.

Step 2: Apply for a Brokerage Account

In the next step, users can click on their user profile ID and find the ‘Open an account’ option.

This requires users to provide some personal information such as a full name, address, date of birth, social security number, etc.

New users will also have to provide supporting documents, such as a government-issued ID. It can take up to three days for the broker to approve the account.

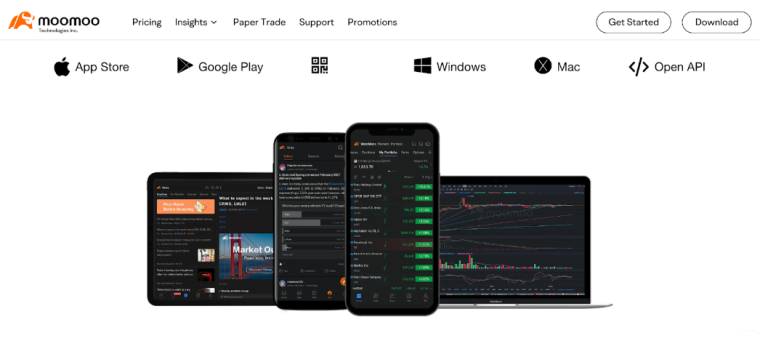

Step 3: Download App

Moomoo doesn’t support web trading. Instead, users will have to download the app for their desktop or mobile devices. The Moomoo app is compatible with Windows, Linux, Mac, Android, and iOS.

Next, proceed to download the Moomoo app directly from the website. Users can choose the version specific to their device and follow the instructions to complete the installation.

Then, sign up by providing the Moomoo user account details.

Step 4: Deposit Funds

As noted earlier, Moomoo users can fund their accounts using ACH or wire transfer.

There is no minimum deposit amount required. However, users will have to wait for up to three days for the funds to appear.

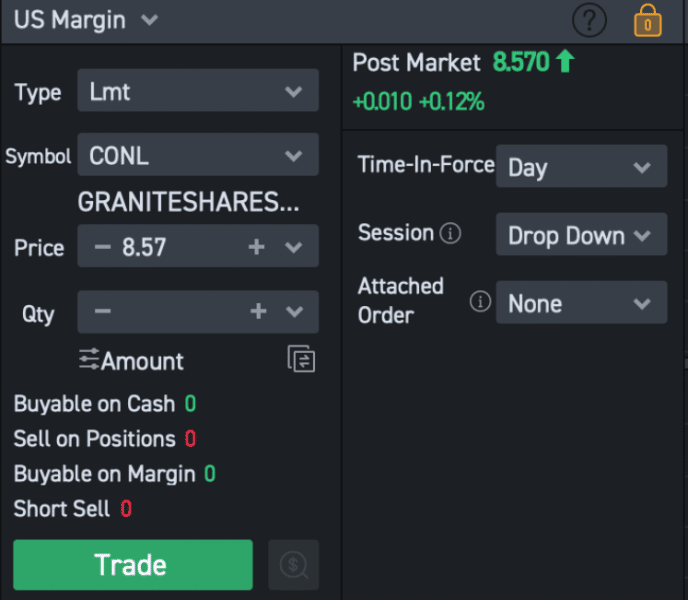

Step 5: Find Assets and Start Trading

The Moomoo app clearly lays out different asset classes on its homepage.

Investors can find an asset and click on the ‘Trade’ button to proceed.

Then specify the required details, such as the type of order and the number of shares to buy. Users can also deploy additional orders, such as a stop-loss and take-profit, before entering the market.

Click ‘Trade’ to finalize the order.

Moomoo Review – Conclusion

Moomoo is a zero-commission, SEC-regulated broker that offers investors access to stocks, ETFs, and options. It allows users to directly trade in the US and Hong Kong, as well as the China A-shares markets.

Moreover, Moomoo comes with robust mobile and desktop trading platforms that offer sophisticated market analysis tools and indicators to monitor market trends.

Check out this broker now to take advantage of its welcome bonus offer and get up to 15 stocks for free.

FAQs

Is Moomoo any good?

Is Moomoo regulated?

Can you use Moomoo in the US?

Moomoo is a financial information and trading app offered by Moomoo Techonologies Inc. Securities are offered through Moomoo Financial Inc., Member FINRA/SIPC. The creator is a paid influencer and is not affiliated with Moomoo Financial Inc. (MFI), Moomoo Technologies Inc. (MTI) or any other affiliate of them. The experiences of the influencer may not be representative of the experiences of other moomoo users. Any comments or opinions provided by the influencer are their own and not necessarily the views of MFI, MTI or moomoo.

They do not endorse any trading strategies that may be discussed or promoted herein and are is not responsible for any services provided by the influencer. This advertisement is for informational and educational purposes only and is not investment advice or a recommendation to engage in any investment or financial strategy. Investing involves risk and the potential to lose principal. Investment and financial decisions should always be made based on your specific financial needs, objectives, goals, time horizon and risk tolerance. Any images shown are strictly for illustrative purposes.