While Web1 could be viewed as the original internet – think 56k modem speeds, Web2 refers to the growth of social media and mobile data.

Web3 is the next generation of the internet and covers a range of innovative and emerging technologies – such as crypto, blockchain, NFTs (non-fungible tokens), decentralized finance (DeFi), and the metaverse.

In this beginner’s guide, we explore how to invest in Web3 right now across a selection of different asset classes.

How to Invest in Web3 – Top Methods

To get a first-mover advantage in this growing phenomenon, the best Web3 investment opportunities are listed below:

- Web3 Tokens – Overall Best Way to Invest in Web3

- Web3 Stocks – Simple Way to Gain Exposure to Web3 Companies

- MetaverseLife Smart Portfolio – Invest in a Managed Portfolio of Web3 Stocks and Crypto

- ARK Fintech Innovation ETF – Diversified Capital Into Web3 Technologies

- NFTs – Invest in the Future of Digital Ownership

- DeFi – Invest in Decentralized Finance

- Crypto Staking – Earn Interest in the Future of Finance

- Buy Land in the Metaverse – Own a Stake of Web3 via Popular Metaverse Projects

- Crypto Loans – Raise Capital by Putting Crypto up as Collateral

- Internet of Things – Global Connectivity Through IoT

We explain how to invest in Web3 across the above methods in the subsequent sections of this guide.

A Closer Look at the Best Ways to Invest in Web3

When learning how to invest in Web3, it is important to have a firm grasp of the many different entities operating in this space.

It is also favorable when investors know how each asset class and financial instrument works, to ensure that the Web3 investment aligns with their long-term goals.

Below, we discuss the best way to invest in Web3 today.

1. Buy Web3 Tokens – Overall Best Way to Invest in Web3

We discovered that the best way to invest in Web3 is by buying the right crypto tokens. Cryptocurrencies and blockchain technology are set to lead the Web3 revolution. One of the toughest parts is figuring out which Web tokens to purchase. A smart approach is to spread your investments across various projects that are likely to shape the next generation of the internet.

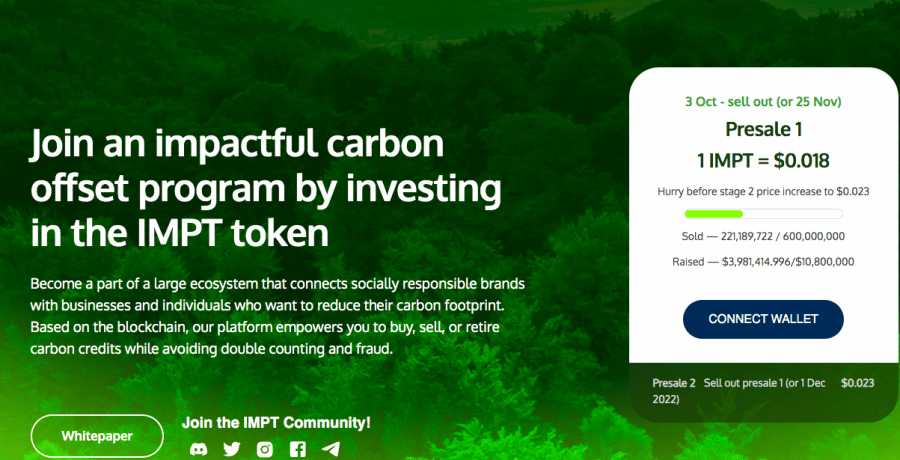

It’s also important to look into new projects that want to contribute to the Web journey. We found IMPT to be notable, as it is just starting to create a blockchain-based Carbon Offsetting program. As one of the top Carbon Offset programs, IMPT links businesses and individuals to help lower their carbon footprint on the planet.

IMPT tokens are the native cryptocurrency, which can be leveraged to purchase Carbon Credits – NFTs representing a certain amount of CO2 emissions to be removed. Businesses have partnered with IMPT to contribute to raising Carbon Credits by setting aside a part of their sales margin for environmental projects. The sales margin is offered as IMPT tokens to buyers who shop with these businesses on the IMPT shopping platform.

The IMPT whitepaper states that IMPT tokens can be collected to buy Carbon Credits – which can be burnt on the IMPT platform to effectively eradicate the CO2 emissions they represent. IMPT tokens can also be bought directly through the IMPT website via Transkar – which offers fiat-based payment methods.

Right now, IMPT is in the first stage of its token release – the presale. 600 million tokens are available to buy during the first presale stage – for just $0.018 per token. In total, IMPT will host 3 presale rounds, with the second round offering IMPT at an increased price of $0.023 per coin.

Get in early by purchasing IMPT on the first round – which will end either on 25th November 2022, or when the project collects $10.8 million worth of IMPT. Follow the IMPT Telegram Channel to stay updated with the recent developments surrounding this new project.

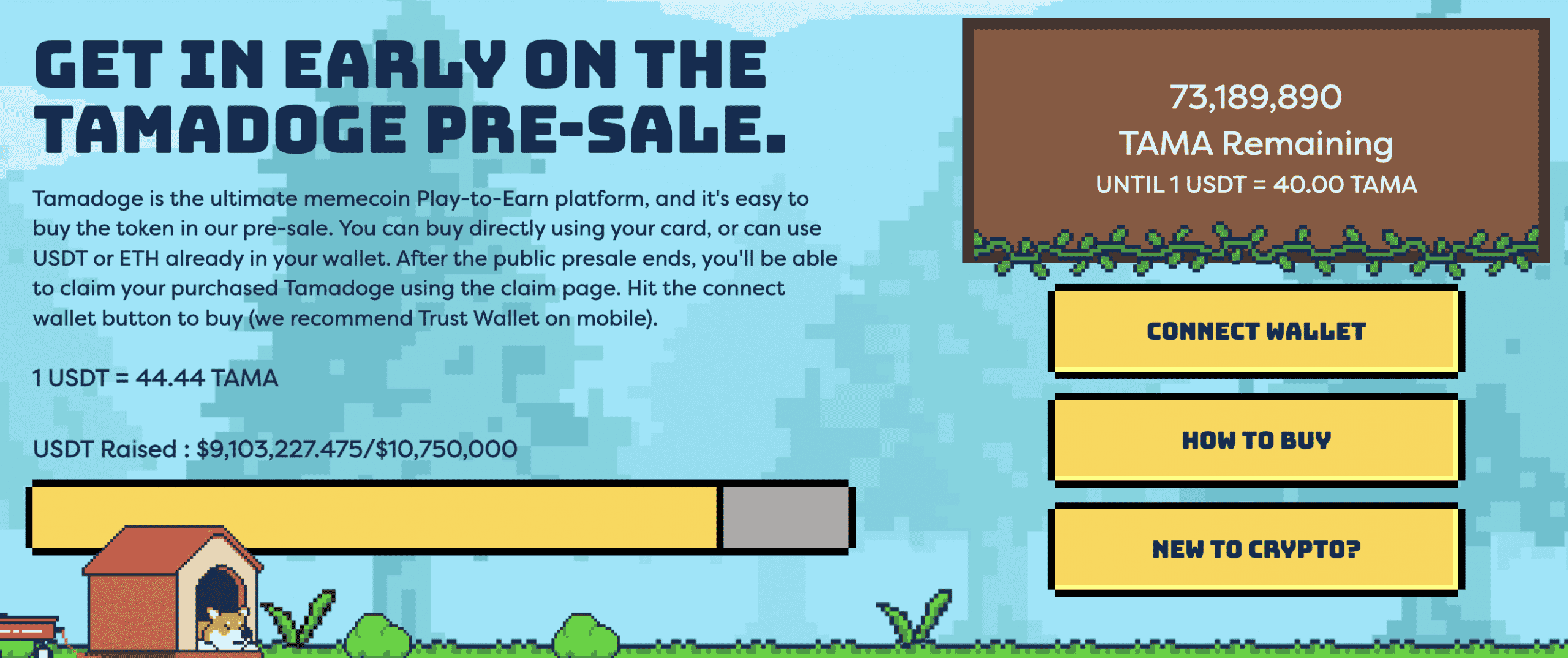

Another interesting Web3 project is Tamadoge – which features a virtual environment where players can compete in multiple play-to-earn games. Once the ecosystem is launched, players will be able to mint an NFT, which represents a virtual pet.

The traits, characteristics, and rarity of each minted pet NFT will vary. Nonetheless, this is generated by the underlying smart contract, which, in the case of the Tamadoge project, operates in conjunction with the Ethereum network. Once the player has minted their NFT, they can then win crypto rewards by completing tasks – such as entering battles.

To ensure that the project incorporates emerging Web3 technologies, Tamadoge is also building a mobile app that will offer augmented reality experiences. After raising $19 million in its presale, Tamadoge is currently trading on popular exchanges such as OKX, Uniswap and LBank.

2. Web3 Stocks – Simple Way to Gain Exposure to Web3 Companies

As is to be expected, the stock market offers a way to invest in Web3. However, we should note that there are no ‘pureplay’ Web3 companies listed on public exchanges. On the contrary, investors will need to pick stocks that are exploring Web technologies, alongside their core business model.

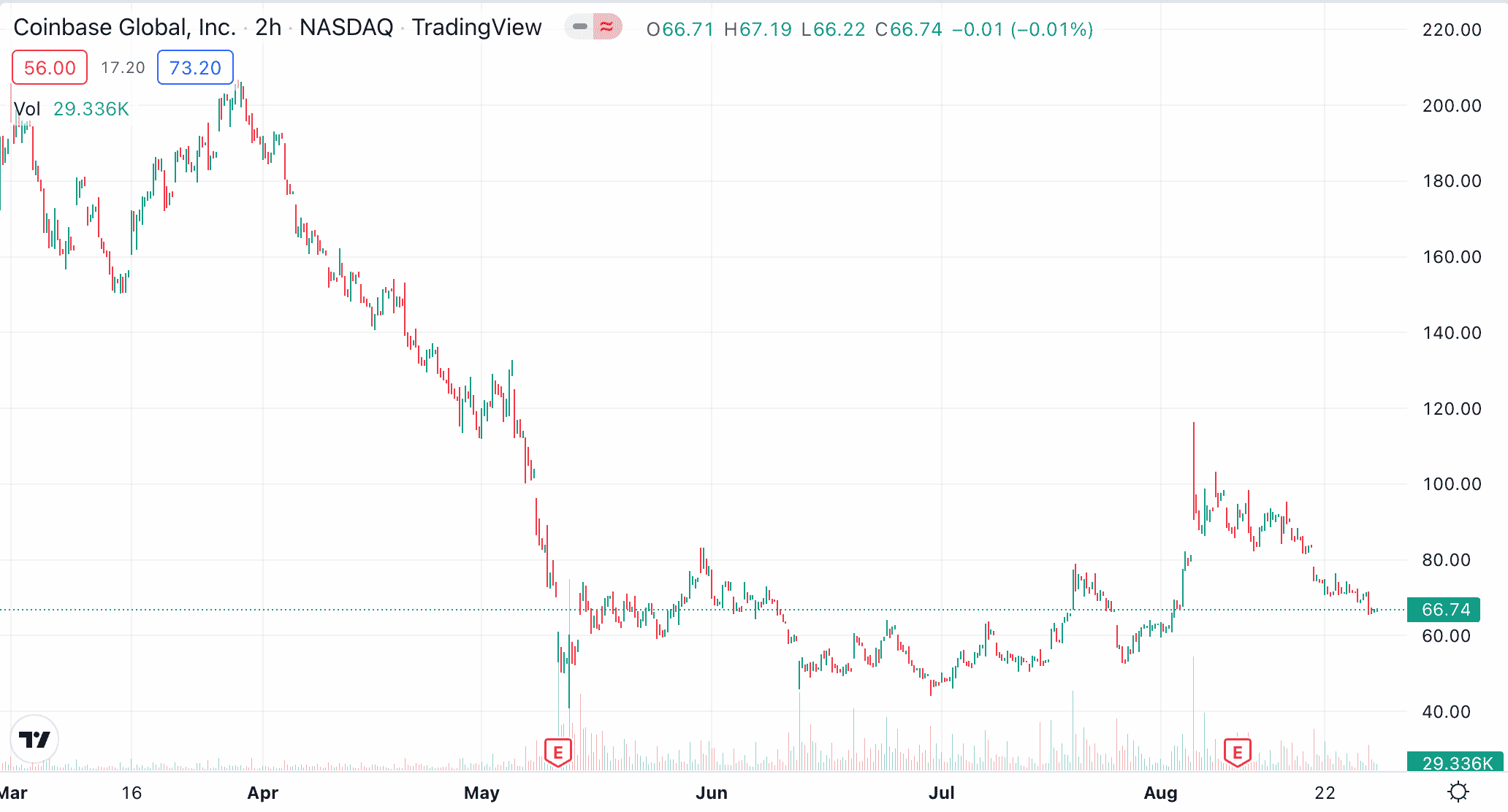

For example, Coinbase is perhaps the most obvious choice, as the popular crypto exchange is directly involved in digital currencies and the blockchain revolution. In addition to serving nearly 100 million traders, Coinbase also offers staking services and an NFT marketplace, both of which we explore in more detail later.

Nonetheless, Coinbase stock could be attractive to those that wish to invest in undervalued companies. The reason for this is that since its 2021 IPO, Coinbase stock has declined by more than 80%. Therefore, those of the viewpoint that Coinbase is undervalued have the opportunity to invest in this Web3 stock at a huge discount.

Another option to consider when learning how to invest in Web3 stocks is Nvidia. The reason for this is that Nvidia is a global leader in the supply of GPUs and other chip-related products. And, in order for Web3 to function on a global scale, these core components will fuel the smartphone and laptop devices required to access the next generation of the internet.

In addition to Nvidia, investors might also consider Advanced Micro Devices from the semiconductor industry. Another angle of investing in Web3 is by buying stocks in 5G companies. Once again, for Web3 to operate in an efficient manner, devices will require next-level connection speeds. In this regard, 5G is expected to play a major role.

Examples of companies heavily active in the 5G space include American Tower Corporation, AT&T, and Verizon. These stocks cover a good blend of 5G technologies, such as telecommunication tower infrastructure and network operations. Meta Platforms might also be worth exploring for its desire to dominate the metaverse.

In terms of where to buy Web3 crypto and stocks, it is wise to select a low-cost broker that offers fractional ownership.

Learn More: Read our market insight on the best Web3 stocks to buy.

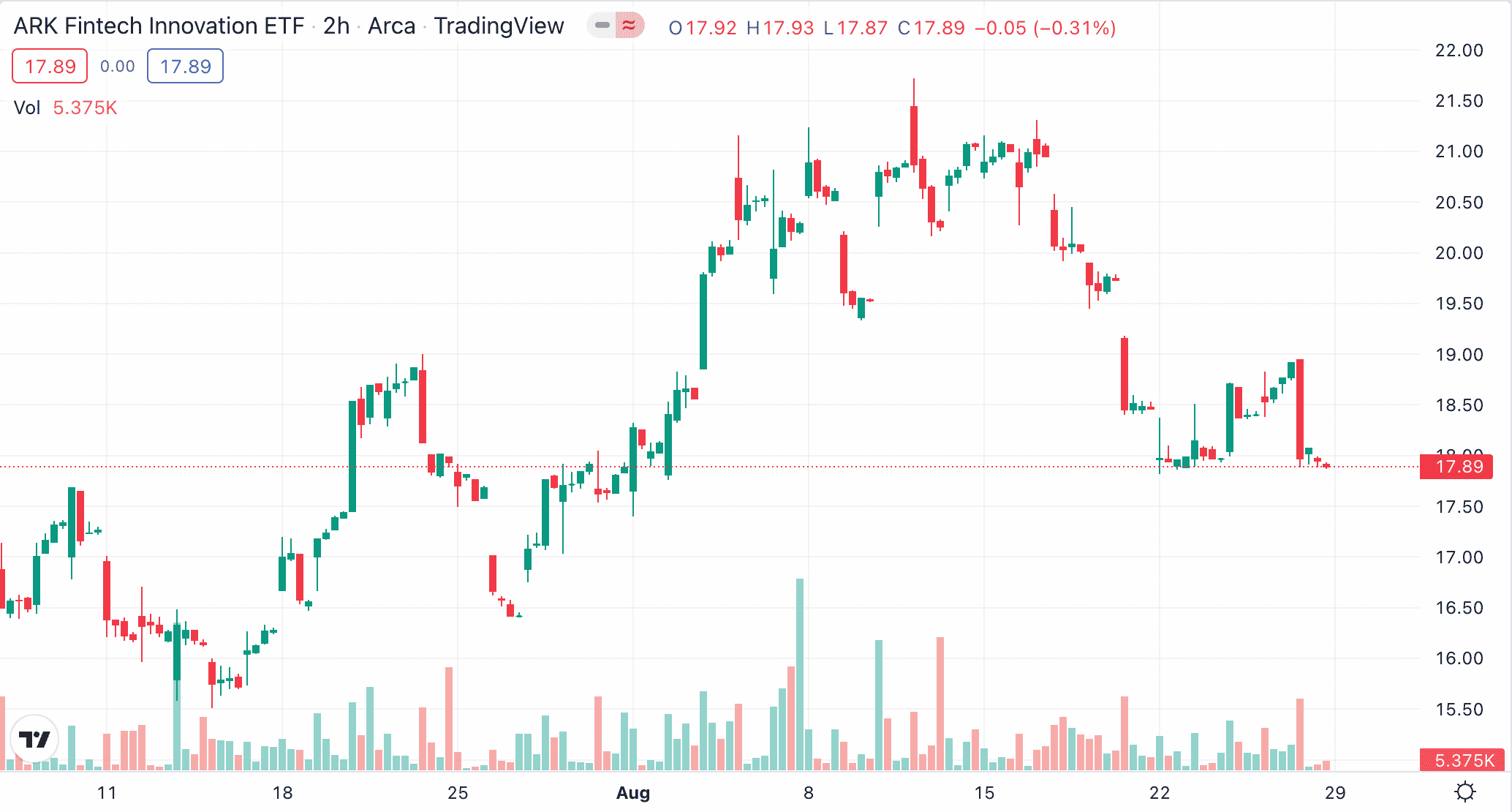

3. ARK Fintech Innovation ETF – Diversified Capital Into Web3 Technologies

Another option to consider when assessing how to invest in Web3 is to consider trading ETFs. Similar to the previously discussed Smart Portfolio, this option enables investors to gain exposure to Web3 in a passive nature. Perhaps the most relevant ETF in this regard is the ARK Fintech Innovation – which is run by Cathie Wood.

According to the fund description, this ETF aims to invest in the long-term growth of technologies that “potentially change the way the financial sector works”. This includes everything from blockchain technology and frictionless funding to customer-facing platforms and new intermediaries.

The ARK Fintech Innovation ETF – which as of writing carries a NAV of just under $1 billion, typically holds between 35-55 stocks. Examples include everything from Block, Shopify, and Coinbase to Twilio, Mercado Libre, and Draftkings.

4. NFTs – Invest in the Future of Digital Ownership

In addition to the metaverse and crypto tokens, NFT is another major pillar of Web3. As such, NFTs represent a viable way to gain exposure to the growth of Web3 early. For those unaware, NFTs are similar to crypto tokens like Bitcoin and Ethereum, insofar that they are digital assets built on top of the blockchain network.

However, the key difference is that NFTs are non-fungible. This means that no two NFTs are the same. For example, let’s say that somebody sends 1 Bitcoin to another person. The person that received the funds now has 1 Bitcoin and can subsequently use it in the same way. This is an example of a fungible asset – just like traditional money.

An NFT, however, represents ownership of a specific asset and thus, it cannot be replicated. For example, an NFT could prove ownership of a hotel. If the owner sought to sell their hotel or perhaps raise finance, the transaction could take place in the form of the NFT.

Although this marketplace is still young, current trends are notable. For example, it is estimated that throughout 2021, NFTs generated over $25 billion in sales. Much of this was based on non-tangible goods and services, such as digital art and virtual real estate. In particular, the Bored Ape Yacht Club NFT collection caught the attention of A-list celebrities.

As such, some NFTs in this collection sold for 7-figure sums. In order to make money from this space, an investor will first need to find a suitable NFT to buy within budget. This is the tricky part, as the internet is now oversaturated with NFT collections. To get the ball rolling, investors might consider checking out the Launchpad.xyz marketplace as well as the Crypto.com NFT marketplace.

This marketplace offers access to a broad selection of up-and-coming NFTs, such as the Lucky Block NFT collection. The Lucky Block NFT collection – which consists of 10,000 unique numbers, offers access to the project’s Platinum Rollers Club. This offers lifetime entry into prize draws that pay rewards in LBLOCK tokens – which is the underlying asset backing Lucky Block.

Lucky Block has also since launched an NFT competition platform. Each prize draw – which includes everything from FIFA World Cup tickets to a $1 million property, requires a specialist NFT to gain access. Lucky Block NFT holders will still earn ongoing rewards for as long as they remain a holder – irrespective of whether or not they win the competition.

Learn More: Read our beginner’s guide on how to flip NFTs.

5. DeFi – Invest in Decentralized Finance

DeFi is yet another segment to consider when assessing how to invest in Web3.0. The main concept with DeFi is that finance should be decentralized. This means that people should be able to access core financial services without needing to go through a centralized operator – such as a bank or credit institution.

For instance, in today’s marketplace, savers will deposit their money into a bank account and in doing so, will be paid a rate of interest. In most Western countries, interest rates amount to a small fraction of 1%. In comparison, DeFi platforms enable investors to earn an attractive rate of interest in a decentralized manner.

The DeFi Swap exchange is a great example. This decentralized platform offers staking services that yield an annualized interest rate of 75% on its native token – DeFi Coin. The DeFi Swap exchange also offers decentralized trading services. This means that without needing to open an account, investors can swap one Web3 token for another at the click of a button.

DeFi Swap will also be launching a yield farming platform that enables investors to earn passive income via liquidity pools. Put simply, by providing the DeFi Swap exchange with liquidity, investors will receive a share of any collected fees. Other decentralized products and services are being lined up by the team behind DeFi Swap – which includes NFTs and a knowledge hub.

In the meantime, investors can gain early exposure to the project via DeFi Coin – which trades on PancakeSwap.

6. Crypto Staking – Earn Interest in the Future of Finance

We briefly mentioned staking just a moment ago when discussing DeFi Coin. However, staking is expected to play such a major role in the future of Web3, that it deserves its own section. In a nutshell, crypto staking was originally associated with blockchain networks built with a proof-of-staking consensus mechanism.

This meant that in order to keep the network safe, investors were encouraged to deposit their crypto tokens into the blockchain. And in doing so, investors would receive a yield. However, the staking space has since moved on, as more competitive rates of interest are now offered by third-party platforms.

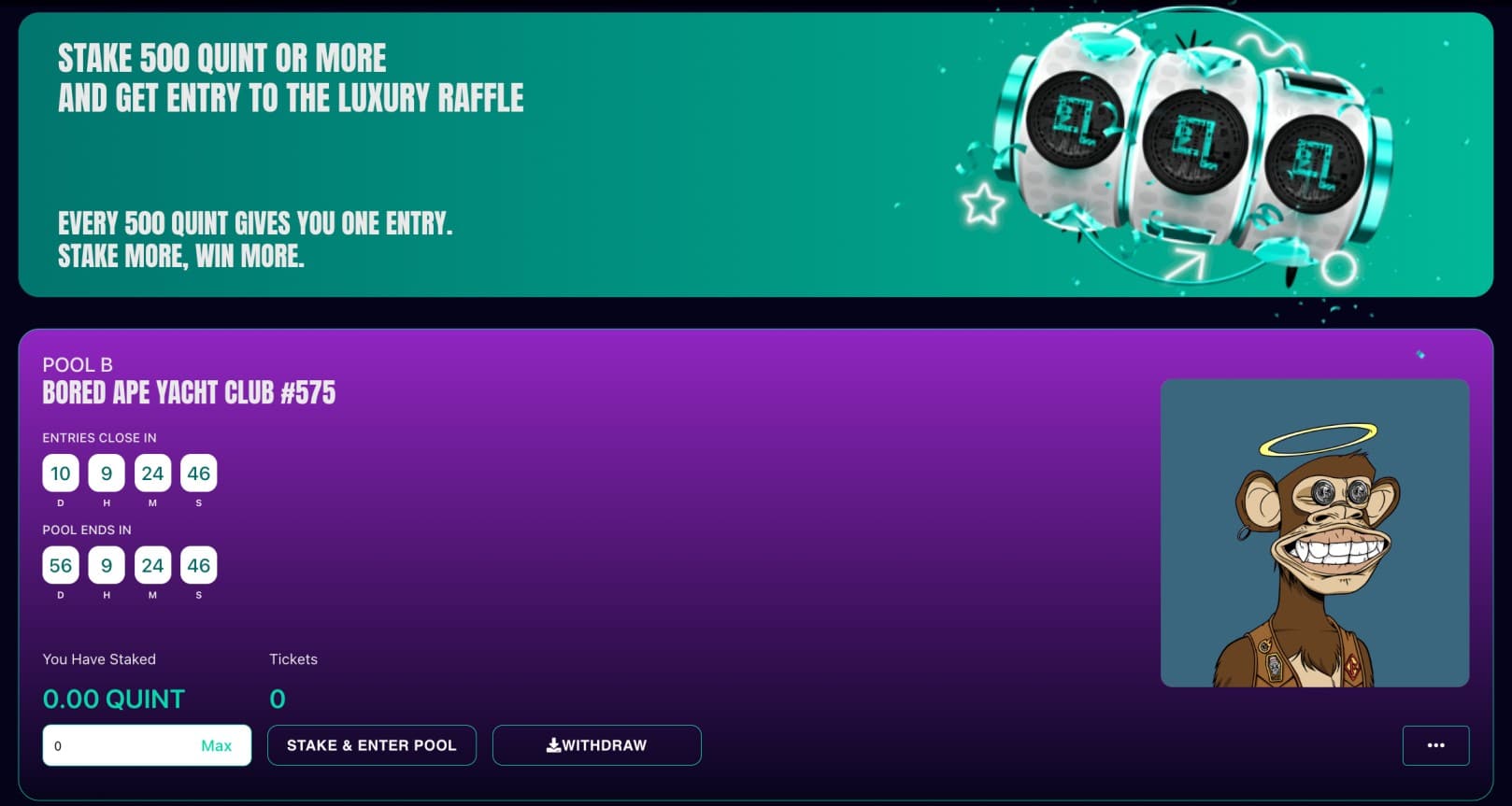

Let’s take Quint as a prime example. This project is offering a ‘super’ staking concept that amalgamates rewards with competitions. For instance, when depositing tokens into a Quint super staking pool, a rate of interest will be paid – as is standard. However, the super staking pool will also offer access to a competition.

As of writing, the most valuable competition at Quint offers the chance to win a Bored Ape Yacht Club NFT. As we mentioned earlier, this NFT collection has since witnessed sales of over a million dollars. In terms of the fundamentals, 1 ticket entry into the competition is offered per 500 Quint tokens staked.

The respective competition draw takes place 61 days after the staking pool commencement date. After the competition has been drawn, the staking investment plus any subsequent rewards will be paid to the investor. This is the case regardless of who won the competition.

Learn More: Read our guide on how to buy Quint to benefit from super staking rewards.

7. Buy Land in the Metaverse – Own a Stake of Web3 via Popular Metaverse Projects

Another option to consider when assessing how to invest in Web3 crypto is to buy virtual land within a popular metaverse project that already exists. To offer some insight, projects like Decentraland and the Sandbox enable users to buy land within their respective metaverse worlds.

In doing so, the investor will own a stake in the metaverse and potentially – Web3. After buying a plot of land, the investor will then have the freedom to build real estate projects on top. For instance, the investor might decide to build a virtual hotel and rent each room out to residents of the metaverse community.

Or, the investor might decide to build a virtual experience on top of their plot of land, such as a casino or stadium. Either way, although this concept might appear far-fetched, it is important to note that metaverse land sales are already a serious industry of their own.

For example, in late 2021, it was reported that an investor paid over $4 million to buy a segment of land within the Sandbox metaverse. Just a week prior to this sale, a land plot was sold within Decentraland for over $2 million. This shows that just like traditional real estate, land within the metaverse has the potential to appreciate as demand increases.

In order to gain exposure to metaverse land, the investor will first need to choose a suitable project. Then, they will need to obtain the native token of the respective project – such as MANA for Decentraland or SAND for the Sandbox.

8. Crypto Loans – Raise Capital by Putting Crypto up as Collateral

Web3 – in conjunction with blockchain technology, is also expected to revolutionize the global lending space. Once again, in its current form, loans must go through centralized operators – such as banks. This often requires the borrower to go through a stringent application process, which includes a credit check and financial documents.

In comparison, platforms working towards Web3 technology enable borrowers to apply for a crypto loan without needing to go through financial background checks. On the contrary, platforms like Crypto.com support instantly approved loans in return for putting digital assets up as collateral.

Crypto.com operates on an LTV (loan-to-value) ratio of 50% -meaning that for every $1,000 deposited as a security, the borrower can obtain a credit line of $500. In many cases, long-term investors will utilize this strategy to increase their exposure to Web3 products.

For example, let’s say that a long-term Bitcoin investor has $5,000 worth of BTC tokens. They could deposit the BTC tokens into Crypto.com and obtain an instant loan worth $2,500. The investor would then have $7,500 worth of tokens at their disposal. Should the value of Bitcoin increase, this offers amplified gains.

9. Internet of Things – Global Connectivity Through IoT

The final option to consider on our list of the best Web3 investments is the Internet of Things – or IoT. This is another concept that remains popular with Web3 innovators, alongside the previously discussed metaverse, NFTs, and crypto assets. In a nutshell, the IoT concept aims to create a world where each and every aspect of our lives is connected through Web3.

An example of this in its current form is a smart home. Whether that’s running a bath prior to getting home or switching the heating on remotely, smart homes utilize the IoT concept by ensuring that appliances can be controlled via a single hub – e.g. a smartphone device.

IoT will continue to take things to the very next level and likely operate alongside the metaverse world. In order to invest in this segment of Web3, perhaps the best option is to explore the Global X Internet of Things ETF. This ETF covers a diversified range of stocks that are linked to both the IoT and Web3.

Examples of holdings in this ETF include Dexcom, Skyworks Solutions, Garmin, ADT, and Ememory Technology. Another option is to explore the popular cryptocurrency project IOTA. This project utilizes distributed ledger technology to facilitate IoT data feeds and transactions.

What is Web3.0? Is Web3 a Good Investment?

One of the most important factors to consider when learning how to invest in Web3 is whether or not this industry has the potential to generate suitable returns in the long run.

After all, Web3, at this stage, is only really a concept that has amalgamated various emerging technologies into one brand – namely crypto, blockchain, NFTs, DeFi, metaverse, and more.

In this section, we take a much closer look at whether or not Web3 represents a viable investment.

First-Mover Advantage

We briefly mentioned the first-mover advantage earlier in this guide – and for good reason. Put simply, investing in the Web3 concept today would enable exposure to a concept that is still in its absolute infancy.

Let’s look at some Web3 examples to offer some context:

- Web1 refers to the so-called original internet in the 1990s.

- Those that invested in Web1 technologies back then would now be looking at an attractive portfolio valuation.

- This might have consisted of companies focusing on increased bandwidth speeds or perhaps GPU and CPU manufacturers.

- Either way, investing in this niche market while it was still young would have been a major risk that eventually paid off.

The same could be said for Web2 – which consists of smartphone internet access, apps, and social media. As we now know, these once-emerging technologies are now the norm – even in developing nations.

Crucially, this highlights the potential upside of investing in Web3 early.

Sure, many market commentators are still bearish on the likes of the metaverse and NFTs. However, the very same commentators likely thought that the internet was just a fad when it first came to fruition.

Another great place to find cryptos that are still in their infancies are via online discussion forums such as Reddit. For more information you could read our guide on how to invest according to Reddit.

Gain Exposure to Various Emerging Technologies

As noted, Web3 is more of a concept than a specific technology or product. This is because Web3 incorporated a full range of innovative technologies, such as:

- Cryptocurrency

- NFTs

- Blockchain

- Metaverse

- Internet of Things

- DeFi

Now, by building a position in various Web3 concepts, will enable the investor to create a diversified portfolio.

Diversification – No Pureplays

Leading on from the above section, diversifying Web3 investments can be achieved from the comfort of home.

This guide, for example, has discussed 10 of the best ways to invest in Web3 – covering everything from crypto tokens and stocks to Smart Portfolios and ETFs.

As there are no pure plays in this industry, this ensures that the investor is not over-exposed to a small number of entities.

Moreover, this means that the respective crypto project, stock, or project will not have Web3 as its core business concept. Instead, Web3 ideas will run in conjunction with its long-term goals.

Crypto Bear Market

Many of the Web3 investment products discussed today are actively involved in the crypto industry. Since Bitcoin and the broader markets hit all-time highs in late 2021, the industry has entered a bear cycle.

This is typical not just with crypto assets, but in all investment markets. This does, however, mean that many of the crypto-centric Web3 products in the market can be purchased at a discounted price.

An even shrewder way to approach a bear market is not only by buying the dip but doing so via a dollar-cost average strategy. This will ensure that risk is reduced as best as possible as well as avoid the need to try and predict the bottom.

Established Brands are Already Investing in Web3 Products

A major sign that an emerging concept like Web3 is here to stay becomes clearer when established companies begin to execute a financial stake of their own. In this regard, there are already many examples of blue-chip firms investing in Web3 products.

For example:

- IBM is also using the Stellar blockchain network to facilitate cross-border payments.

- More than 200 regulated financial institutions are either using or trialing Ripple’s network system to facilitate interbank transactions.

- Samsung has invested in multiple blockchain ventures, including the Decentraland metaverse and offering support for TRON dApps.

Crucially, this highlights that big brands are taking the future of Web3 seriously by getting a first-mover advantage.

Small Minimum Investments to Suit All Budgets

There is often a misconception that in order to invest in Web3, a large amount of capital is required.

Similarly, there is a misunderstanding that Web3 technologies are only accessible by angel investors and venture capitalists – which is often the case with emerging concepts. However, this couldn’t be further from the truth.

Put simply, virtually all of the Web3 investments that we have discussed today offer exposure to this marketplace with a small amount of capital.

In the case of Web3 tokens like Tamadoge, the TAMA presale requires a minimum investment of approximately $20, plus network gas fees.

As such, Web3 investment products are available to investors of all budgets.

How to Invest in Web3 – TAMA Tutorial

To conclude this guide on how to invest in Web3, we will explain the process required to gain exposure to the Tamadoge presale.

As we noted earlier, Tamadoge is building a gaming ecosystem that incorporates a variety of Web3 products – including the metaverse, augmented reality, blockchain, smart contracts, NFTs, and its own native crypto coin – TAMA.

Here’s how and where to invest in Web3 in just five minutes:

Step 1: Get MetaMask

TAMA is the native Web3 token of the Tamadoge ecosystem (otherwise referred to as the Tamaverse), which operates on top of the Ethereum blockchain. This is the case with many of the Web3 projects discussed today.

As such, in order to buy TAMA tokens via the presale, the first step is to set up a crypto wallet. This will enable the investor to connect their wallet to the TAMA presale and exchange Ethereum or USDT tokens to pay for the purchase.

We would argue that MetaMask is the best crypto wallet for this purpose. It offers a simple user interface across both its mobile app and browser extension, alongside high-grade security tools. Moreover, MetaMask is free to use.

Step 2: Transfer ETH or USDT to MetaMask

After downloading and setting up MetaMask, the next step is to go and buy Ethereum or USDT from a crypto exchange. Then, the investor can transfer the purchased tokens over to MetaMask.

Here’s how the process works:

- Open an account with a crypto exchange like Binance and upload some ID

- Buy Ethereum with a credit/debit card

- Copy the MetaMask wallet address and paste it into Binance when requesting a withdrawal

The Ethereum/USDT tokens should appear in the MetaMask wallet in approximately 10 minutes after withdrawing them from an exchange.

Step 3: Connect MetaMask to Tamadoge Presale

With a funded MetaMask wallet, now it’s time to visit the Tamadoge website. Click on the ‘Buy’ button to be taken to the Tamadoge presale dashboard.

Click on the ‘Connect Wallet’ button and select MetaMask. A notification will then pop up via the MetaMask app or browser extension – depending on where the wallet has been installed.

The investor will then need to confirm that they wish to connect their MetaMask wallet to Tamadoge.

Step 4: Invest in Tamadoge Presale

The final part of the presale investment process is perhaps the most straightforward.

In a nutshell, the investor will need to specify how many Ethereum or USDT tokens they want to exchange for TAMA. This can be any amount from 1,000 TAMA upwards which, at the current exchange rate, amounts to just over $20.

Do note that at any stage, the investor can utilize the Tamadoge telephone support service. This will guide the investor through the presale investment process step-by-step.

After confirming the swap, the investor will need to wait until the Tamadoge presale has finished before being able to claim their TAMA tokens.

This will likely happen soon considering that it has raised more than $9 million in a matter of weeks.

Conclusion

Web3 is expected to take the internet as we know it today to the very next level. In the coming years, this means that the internet will not only offer lighting bandwidth speeds and even greater connectivity, but a new way of performing everyday tasks.

At the forefront of this are emerging technologies such as the blockchain, crypto, metaverse, NFTs, and DeFi. One of the best web3 projects is IMPT – which leverages blockchain technology to offer Carbon Credit NFTs, which can bee burnt to reduce carbon emissions from the atmosphere.

IMPT is available to buy during the ongoing presale round for just $0.018 per token.

IMPT - New Eco Friendly Crypto

- Carbon Offsetting Crypto & NFT Project

- Industry Partnerships, Public Team

- Listed on LBank, Uniswap

- Upcoming Listings - Bitmart Dec 28, Gate.io Jan 1st

FAQs

What crypto is best for Web3?

How do you invest in Web3.0?

What stocks are Web3?

What are the best Web3 crypto?

Is there a Web3 ETF?

Where can I buy Web3 coins?

What coins are Web3?

References

- https://uk.pcmag.com/help/138718/what-is-web3-and-how-will-it-work

- https://www.ft.com/content/1f795e5d-c2cf-4e91-89f1-6d5544a8a3db

- https://www.forbes.com/sites/bernardmarr/2022/01/24/what-is-web3-all-about-an-easy-explanation-with-examples/