Want to find out how to invest in mutual funds? Mutual funds are an investment vehicle that allow investors to save for the long term as well as benefit from fund manager expertise. Nowadays, Exchange-Traded Funds (ETFs) are considered to be a key competitive alternative to mutual funds.

Below we investigate how to invest in mutual funds online. We also look at the advantages of investing in mutual funds as well as ETFs, and review two brokers which offer ETFs at zero commission.

How to Invest in Mutual Funds/ETFs – 4 Easy Steps

The investor’s journey begins by understanding a simple distinction: mutual funds are available directly from fund providers, whereas ETFs are available with online stock brokers like Capital.com.

- Step 1: Choose a Provider/Broker – Ensure that your fund provider or ETF broker is regulated. And watch out for fees!

- Step 2: Research the Mutual Fund Market – Be a well-informed investor. Get to the bottom of the difference between mutual funds and ETFs.

- Step 3: Deposit Funds – with an established online broker, depositing funds is easy: many accept wire transfer, credit cards, and a range of online payment wallets.

- Step 4: Buy into a Fund – how much to invest in mutual funds or ETFs? Consider multiple investments in different types of funds to diversify and spread investment risk.

Step 1: Choose a Broker for Mutual Fund/ETF Investing

Where to invest in mutual funds? The answer is simple: with a fund provider.

- Almost half of all assets held in mutual funds globally is held by the 7,500+ mutual funds in the US.

- The top three fund providers in the US are recognised to be Vanguard, Black Rock and State Street.

Whereas mutual funds are not available with online stock brokers, Exchange-Traded Funds (ETFs) are. And, according to data from Statista.com, ETFs have grown in popularity at a much faster rate than mutual funds:

- 100%: the approx. rate of increase in the number of mutual funds available between 2009 and 2021.

- 3000%: the approx. rate of increase in the number of ETFs available between 2003 and 2021.

Below we review a regulated broker which offers zero commission on ETF trades.

Capital.com – Popular CFD Trading Platform Offering a Wide Range of ETFs

Capital.com offers 5,600 markets to trade across shares, ETFs, forex, commodities and indices. The broker serves 427,000 clients with offices in 9 countries. And Capital.com offers extensive regulation with sovereign authorities: the FCA, CySEC, FSA, NBRB and ASIC.

With Capital.com, investors interested in mutual funds may explore investing in ETFs using Contracts-For-Difference (CFDs).

Suitable for short-term trading, CFDs allow traders to go short on ETFs – which means speculating that their value will fall, rather than rise – which is very useful in bear markets.

What’s more, traders can leverage their trades up to 5:1. CFD fees apply, but no commission is charged on stock or ETF trades.

Capital.com has a good reputation for being quick off the mark with the most popular IPOs. It was quick, for example, to offer shares in EV manufacturer Rivian after its stellar IPO in 2021. Investors can buy Rivian stock with Capital.com

Capital.com offers a free smartphone trading app. It has achieved an average score of 4.8/5 on the Apple App Store and 4.2/5 on Google Play.

Learn more about this broker with our full Capital.com review.

| Approx Number of ETFs | 100+ |

| Pricing System | Spread fee and overnight fees on ETFs |

| Cost of Investing in S&P 500 | Spread on S&P 500 ETF ‘SPY’ = 0.61% |

| Payment Methods | Wire transfer, credit card, Apple Pay, Worldpay and Trustly |

| Non-Trading Fees |

No withdrawal fee, no deposit fee, variable currency conversion fees |

Pros

Cons

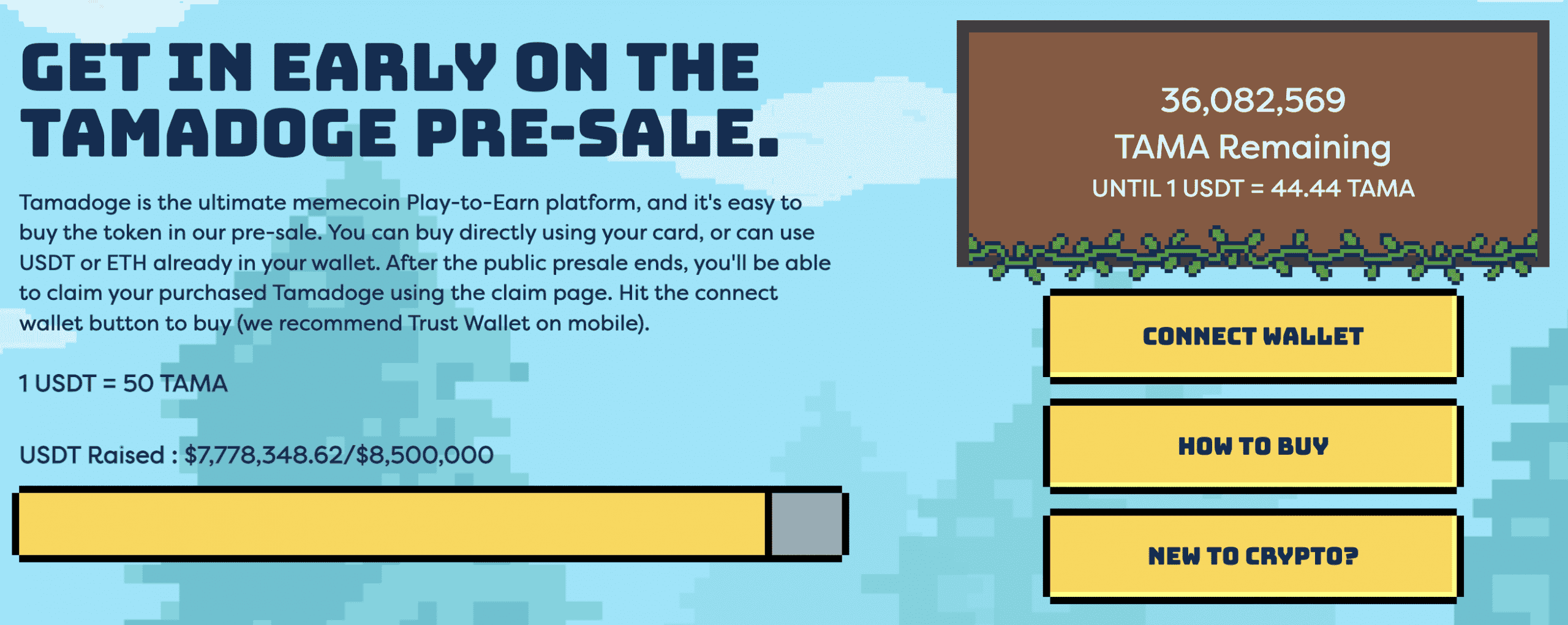

80.61% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider. With data from Statista.com, we can confirm that the number of mutual funds available globally doubled in the 2010s. 131,000 funds to choose from? That's quite some researching the investor is faced with! Some investors limit their research to finding out how to invest in mutual funds in the US. That is because the US dominates the mutual fund market, with roughly 7,500 funds accounting for 40% of all global funds under management. The aim of all mutual funds is to reduce investment risk by investing in many assets at once. An investor might want to buy Apple shares, for example. When we look at investing in mutual funds vs. stocks individually, risk is the issue. It is far less risky to buy Apple shares along with almost 500 other large-cap shares - as is possible with a US large-cap tracker fund. Diversification spreads risk. Analysts sometimes organise mutual funds into four main types: These are the lowest-risk option. These funds are classed as fixed-income, which means the fund pays out regular distributions, but may not appreciate in capital worth. Money market funds invest in high-quality debt and aim to return 1%-3% interest a year. They are intended for retirement savers with virtually no appetite for risk. 2) Bond Funds A fixed income product, a bond fund invests in bonds only. Bond funds are considered to be less risky than stock funds. But the risk rating of bonds varies enormously, from Treasury bonds to junk bonds, so a bond fund is not necessarily entirely low-risk. 3) Stock Funds Probably the most well-known form of mutual fund, stock funds invest in stocks only. The most popular form of stock funds are index funds, which track an existing index. This is because a) indices tend to rise in value over time and b) following an index is less costly than making innovative stock selections. Aimed at retirement planners, target date funds change the exposure of the holder over time to reduce risk as they near retirement. These funds mix equities (for long-term growth) with inflation-protecting REITs and commodities as well as fixed income assets like US government bonds. Mutual fund investing works best for investors who want to lock money away for the long-term. An investor might be figuring out, for example, how to invest $20k for retirement. Mutual funds would be an obvious primary option. Mutual funds are considered to be less flexible than ETFs (Exchange-Traded Funds). And figuring out how to trade ETFs is easy, because online brokers supply them. With a mutual fund, on the other hand, the investor has to contact the fund provider directly and buy into a fund - as well as often pay account fees. Mutual funds with no minimum investment are few and far between, and a minimum holding period sometimes applies. ETFs, though, do not require a minimum investment. And ETF shares may be traded in normal trading hours as if they were normal shares. Most of the most popular trading apps stipulate an investment minimum. Nowadays the norm is to invest in mutual funds online. To track down the most popular mutual funds, simply use a search engine. We recommend searching for 'most popular mutual funds.' Alternatively, you could also read our guide on how to invest according to Reddit. The investor's research will be much assisted by the fact that there are three recognized leaders in fund provision. All are based in the US: The mutual funds that have shown the best returns over the last 5 years tend to be ones which look for steady long-term growth from baskets of large-cap US companies - sometimes following large-cap indices similar to the S&P 500 Index. Big US firms have continued to grow in the face of the economic woes caused by the Pandemic. Note that a 'tracker' fund which focuses on US or European large-cap companies is considered to be a good anchor for a portfolio, particularly if the aim is retirement planning. Overseen by fund manager Adam Benjamin since 2020, FSELX is a sector-specific mutual fund focussed on large-cap growth stocks. Not unusually for an 'active' fund - ie. one which is actively managed by a human expert - FSELX features a relatively-high expense ratio of 0.68%. FSELX focuses on the electronic components sector, covering top companies involved in design, manufacture, distribution and sales. FSELX is ranked in the top 1% in its Morningstar category for 1 year, 3 year and 5 year average returns. As we can see from the chart below, FSELX (purple line) has out-performed several relevant indices including the S&P 500 Index (blue line). 83% of the FSELX portfolio comprises semi-conductor companies. Just under 10% is made up of semiconductor equipment companies. The top 3 holdings are chip manufacturers: Rather than invest in a fund, investors can buy the most popular tech stocks like NVIDIA and Marvell individually with a broker. But investing in a fund is about diversification: buying into many stocks at once to spread risk. SSDWX aims to provide a low-risk haven for retirement savings. And since its inception in 2014, the fund has averaged a return of 7.51%, with an expense ratio of 0.29%. In common with other target date funds, the SSDWX portfolio comprises a mix of equities, fixed income assets (bonds): 91% equities, 7% fixed income, with 2% is left unassigned. The fund splits its portfolio between State Street's own indices, ETFs and the US Dollar: As a fixed income fund, JGIAX offers an average return far less impressive than the stock funds we review here. The fund boasts a 5-year average annual return of 2.73%. But investors should remember that this low return is the price that must be paid for investment in lower-risk assets like bonds. Distributions are paid monthly and re-invested automatically. A minimum investment of $1,000 applies, with a minimum for subsequent investments of $50. Vanguard is one of the top three US fund providers, along with Black Rock and State Street. Vanguard founder John Bogle pioneered the index investment fund back in 1974. This fund is an index fund. This means that it chooses its stocks on the basis on an existing selection covered by an index: in this case, the FTSE Emerging All Cap Index. 2,980 stocks are covered by this index. They are companies of all sizes operating in emerging market countries. With this fund in particular, only companies which have been screened for ESG compliance are included. 'ESG' means 'Environmental, Social and Governance'. Companies with high ESG ratings are considered to be more ethical than other companies - treating their employees fairly, avoiding scandal, avoiding environmental despoliation and steering clear of 'vice' products like weapons and alcohol. As we can confirm from the graph above, the Net Asset Value (NAV) of this fund rose by 11.34% between 2020 and 2021. But, reflecting a general downturn in the markets, it returned -6.64% between 2021 and 2022. Another index fund, FNILX is unusual amongst funds because it charges no fees: hence the 'ZERO' in the name. FNILX tracks the Fidelity US Large Cap Index. This is effectively the same basket of stocks that makes up the influential S&P 500 Index, which tracks the 500 biggest US companies. This fund was founded relatively recently - in 2018 - and features a 3-year trailing return on 12.1%. Its portfolio is capitalization-weighted. This means that shares are held in proportion to the value of the company they represent. It is no surprise then, that Apple - the biggest company in the US - takes the top spot with 6.46% of the $5.5bn portfolio. Fidelity call FNILX a 'Large Blend' fund. 'Large' denotes that it features large-cap stocks. 'Blend' shows that it combines growth stocks (with high P/E ratios and high growth potential) as well as value stocks (with lower P/E ratios and steady earnings). Yes. Taxation rules for mutual funds differs from country to country: Investing in mutual funds comes with costs: management costs and account fees. These apply to individual funds. Costs come in three types: These are charges levied on all investors when the fund pays transaction fees on buying or selling shares. A common type of one-off cost is a spread fee. This applies to EFT trades only, and reflects the broker's margin. Other fees sometimes apply to enter and exit a fund. A 'performance' fee sometimes applies too. Otherwise known as a 'hurdle rate', this is a fee which applies when the fund generates a better-than-expected return. The account fee is what an investor pays to have an account with a particular fund manager. It covers access to a range of financial products including cash accounts and funds. (Note that, with ETFs, an account fee is not payable because ETFs are traded like stocks on the open market.) Account fees differ among fund providers. Vanguard, for example, charges an account fee of 0.15% per annum on accounts holding less than £250,000. Investors may be surprised how little they need to get started with mutual funds. Supposing an investor were researching how to invest $1,000. This is enough to get started with a mutual fund. Effective investment is all about matching assets to your risk profile. If an investor is young, they may have more appetite for risk/reward. More senior investors may be more interested in risking less and, in return, missing out on high potential gains. Mutual funds and ETFs are considered to be low-risk investments; money market and fixed income mutual funds offer the lowest risk of all. If an investor is investing in mutual funds, they should be looking at a timeline that is measured in decades, rather than years. Sure, investors may trade ETFs over the short-term. But mutual funds in particular are designed for investors to hold a position for many years and benefit from the slow, but steady, increase in value across entire markets. As investment guru Warren Buffett famously remarked, 'time in the market beats timing the market'. In other words, the way to make money is to invest in the long-term. Resist the temptation to try and time the entry into the market as even the trading algorithms of investment banks and hedge funds get this wrong. With over 100,000 mutual funds and approaching 10,000 ETFs to choose from worldwide, how does a beginner know where to start? All investment should ideally be handled with the aid of a professional Independent Financial Adviser (IFA). But IFAs can be expensive. Mutual funds are low-risk investments offering low rewards. Offering high potential rewards and risks, on the other hand, is the asset class of cryptocurrency. Almost 20,000 crypto coins and tokens are now available. So picking a winner is tricky. With exchanges and full-service brokers, investors can buy into the big blockchains like Bitcoin and Ethereum as well as DeFi, metaverse and meme coins. Investors could buy Dogecoin, for example, the dog-themed meme crypto that did so well in 2021. But why have sleeping dog Dogecoin when the coin billed as the new Dogecoin is available? Tamadoge (TAMA) is a dog-themed crypto that merges the fun and popularity of doggy meme coins with the utility of a top video game crypto. In the 'Tamaverse', players can breed cute virtual pets and compete for TAMA by having them fight other Tamadoge pets. This is a play-to-earn metaverse and meme coin rolled into one. And investors can benefit from the explosion of interest in TAMA without getting involved in the gaming side at all. Having raised $7.8m of its planned $8.5m target way ahead of schedule, the Tamadoge presale phase is turning out to be one of the best crypto presales of 2025. Investors can buy Tamadoge right now directly from the Tamadoge platform. All that is needed is a Metamask/Trust wallet and some Ethereum (ETH) or Tether (USDT). As the presale progresses, the price of TAMA is going up. So those who got in early have already made a paper profit. And - if TAMA is anything like Lucky Block, the NFT competition crypto - its value will rocket when it starts being listed on exchanges.

Above we have looked at investing in mutual funds for beginners in particular. Our conclusion, which is not unusual in the industry, is that mutual funds offer advantages for the long-term investor - but that many investors understandably prefer the flexibility of ETFs. Hence we have reviewed a popular ETF provider: Capital.com. For investors with an eye on short-term gain, we have shone the spotlight on Tamadoge (TAMA), one of the best emerging crypto. With mutual funds, there is generally no rush to invest, as long-term growth is the objective; when to invest in mutual funds is thus a moot question. But, with the most promising crypto, it pays to get in early. The price of TAMA rises with each new phase of the presale - which ends in Q4, 2022. Tamadoge - The Play to Earn Dogecoin

Step 2: Research the Mutual Fund Market

What is a Mutual Fund?

What Types of Mutual Funds are there?

1) Money Market Funds

4) Target Date Funds

How does Investing in Mutual Funds Work?

Mutual Funds vs. ETFs

How to Find the Most Popular Mutual Funds to Invest in?

Black Rock

The Vanguard Group

Founded by the inventor of index funds, John Bogle, Vanguard is based in Pennsylvania, US. The firm has roughly $7 trillion under management.

State Street

5 Popular Mutual Funds to Watch Right Now

Fidelity Select Semiconductors Portfolio (FSELX)

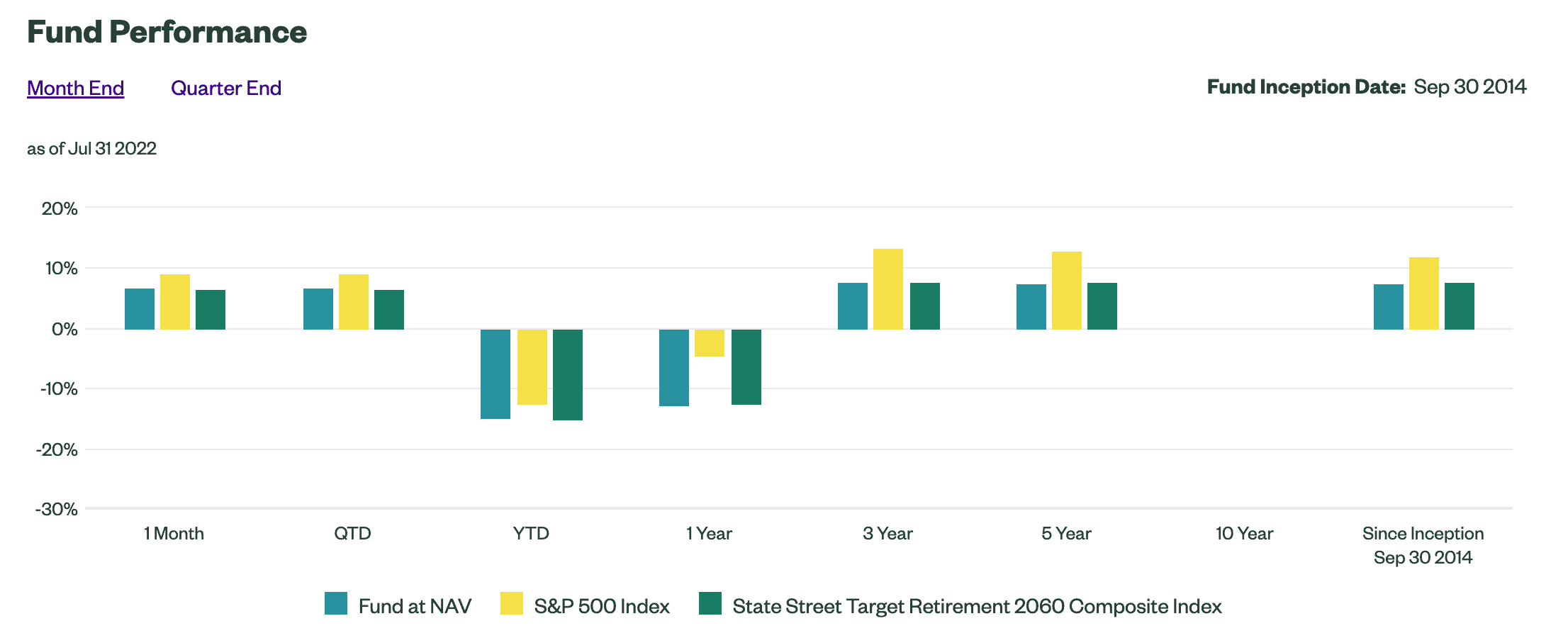

State Street Target Retirement 2060 Fund - Class I (SSDWX)

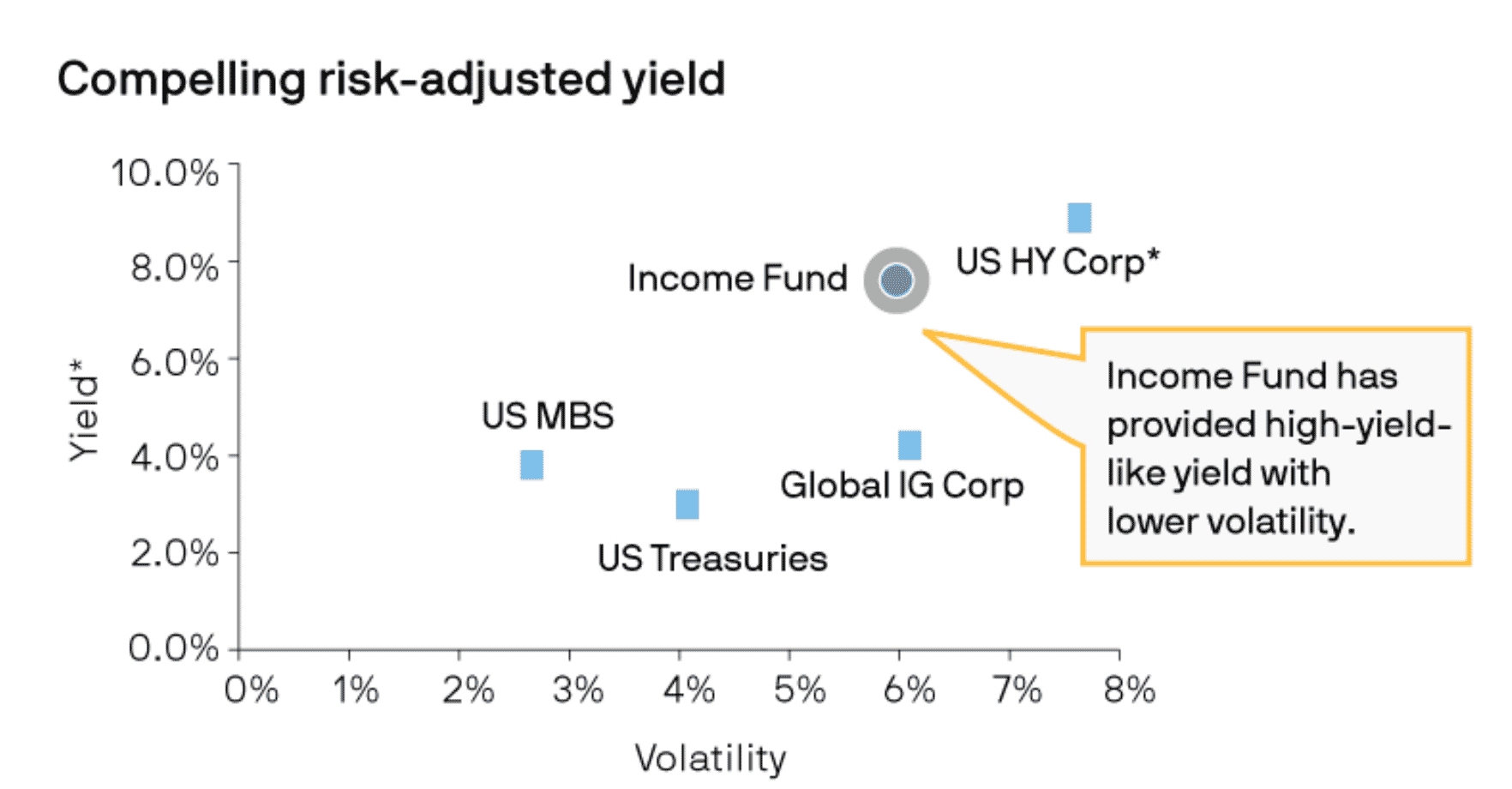

JP Morgan Income Fund (JGIAX)

ESG Emerging Markets All Cap Equity Index Fund

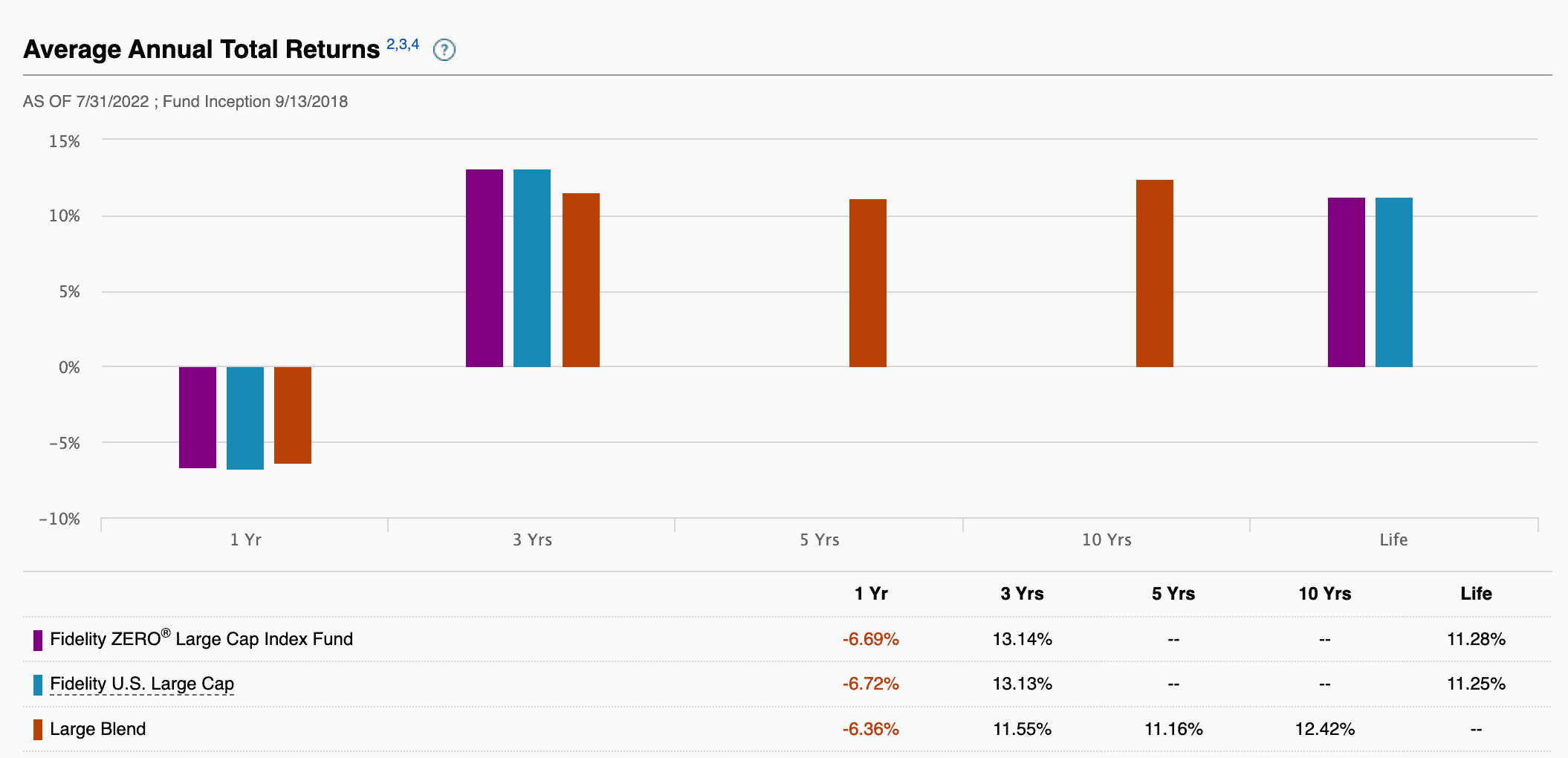

Fidelity ZERO Large Cap Index (FNILX)

Are Mutual Fund Investments Taxed?

International Official Guidance on Taxation of Mutual Funds

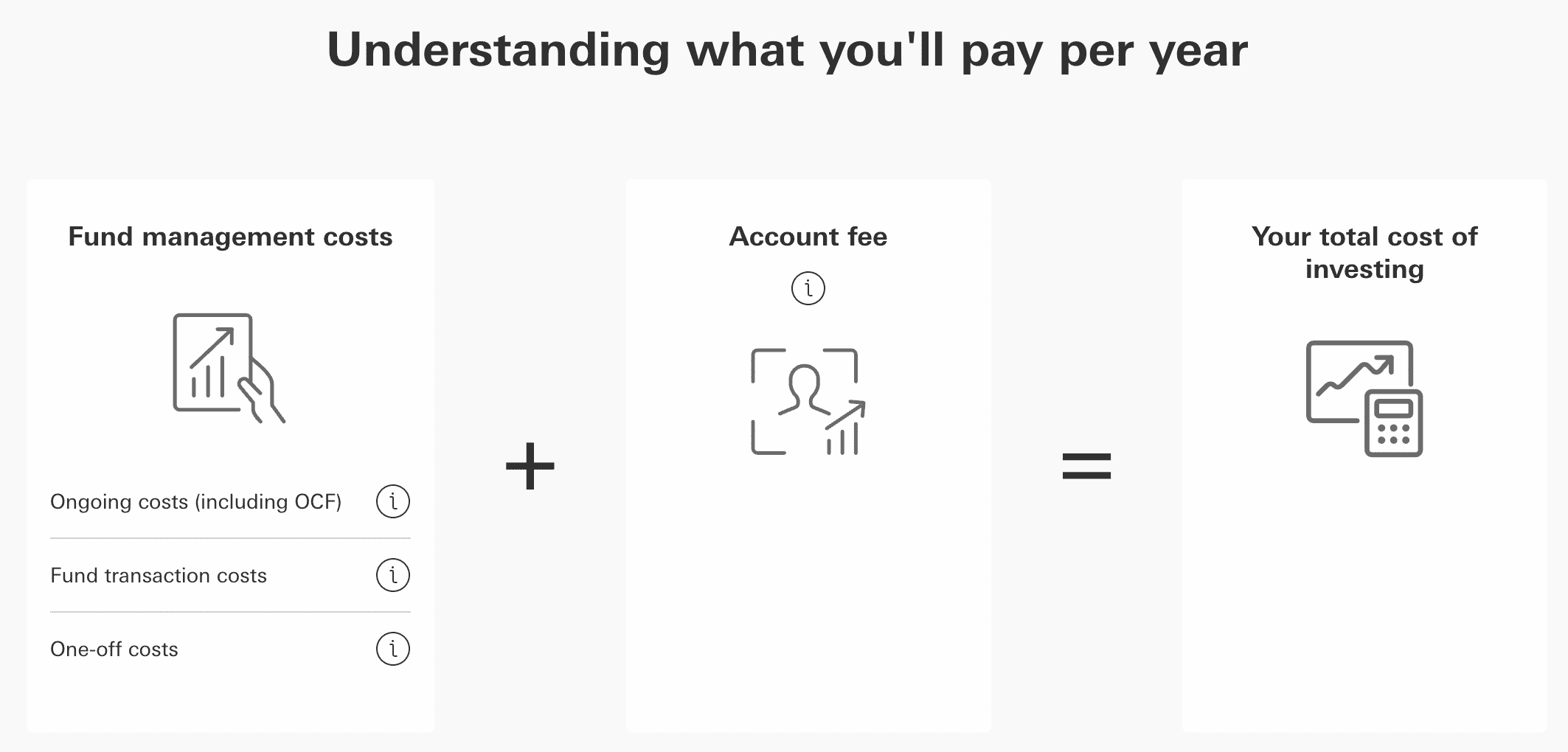

How Much Does it Cost to Invest in Mutual Funds?

Management Costs

1) OCF (Ongoing Charges Figure)

2) Portfolio Transaction Costs

3) One-off Costs

Account Fees

How Much Money Do You Need to Invest in Mutual Funds?

Three Top Tips for Investing in Mutual Funds for Beginners

1) Pick Funds to Suit your Risk Profile

2) Don't Chop and Change

3) Why Go it Alone?

Are Mutual Funds the Best Investment for 2025?

Min Investment

1,000 TAMA (∼$10+ gas fee)

Max Investment

NA

Purchase Methods

ETH or USDT now - fiat currency soon

Blockchain

Ethereum

Presale Ends

2nd September 2022

Conclusion

FAQs

How do you invest in mutual funds?

Who can invest in mutual funds?

Is it safe to invest in mutual funds?

Should I invest in mutual funds or ETFs?

What is better than mutual funds?

What are the 4 types of mutual funds?

References