Looking into how to invest in index funds? An index fund is a type of investment that tracks a specific market index, such as the US S&P 500 or the UK FTSE 100. Investors can access certain index funds directly through a fund manager, or they can choose from a wide range of newer Exchange-Traded Funds available through online brokers.

Here’s a guide on how beginners can invest in index funds. We look at the best options for investing in index funds by reviewing two online brokers that offer various index ETFs. Plus, we address the key question: how does investing in index funds actually work?

How to Invest in Index Funds with a Regulated Broker – 4 Steps

Let’s look at how to start investing in index funds with four simple steps:

- Step 1: Choose a broker or fund provider – scope out what brokers and fund providers have to offer.

- Step 2: Research the Index Fund Market – learn what index funds are available and how they work.

- Step 3: Deposit Funds – Add funds to your trading account. Many leading trading platforms accept wire transfers, credit cards and a range of payment wallets for deposits.

- Step 4: Buy into a Fund – Looking to invest $25k? choose from your preferred broker’s range of index ETFs, or invest directly with a fund provider.

Step 1: Choose a Broker for Index Fund Investing

Where to invest in index funds? Investors have two choices:

- Invest directly in an index fund with a fund manager.

Well-known fund managers include Vanguard and Fidelity, for example. - Invest in an index Exchange-Traded Fund (ETF) with an online broker.

Below we review two brokers that offer index ETFs.

1. Capital.com – CFD Broker Offering Index ETFs

Capital.com is a popular CFD (Contract-For-Difference) broker with 5,600 markets on offer.

All market activity with Capital.com is conducted using CFDs, including trading in index ETFs. This means that when users trade CFDs they’re not taking ownership of the underlying assets, but instead they’re speculating on market performance and price movements.

Using CFDs, investors may go short on assets/indices as well as leverage their trades. That means that if an investor thinks an index is going to fall, they can go short on the appropriate ETF and benefit if it does.

CFDs come with overnight fees, however – which can mount up if a position is held for long. CFDs are therefore suitable for investors looking to trade over the short-term, rather than invest in cheap stocks, for example, and hope they fulfil their potential over the long-term.

| Approx Number of Index ETFs | 50+ |

| Pricing System | Spread fee and overnight fees on ETFs |

| Cost of Investing in S&P 500 | Spread on S&P 500 ETF ‘SPY’ = 0.61% |

| Payment Methods | Credit card, wire transfer, Apple Pay, Worldpay and Trustly |

| Non-Trading Fees |

No deposit fee, no withdrawal fee, variable currency conversion fees |

Pros

Cons

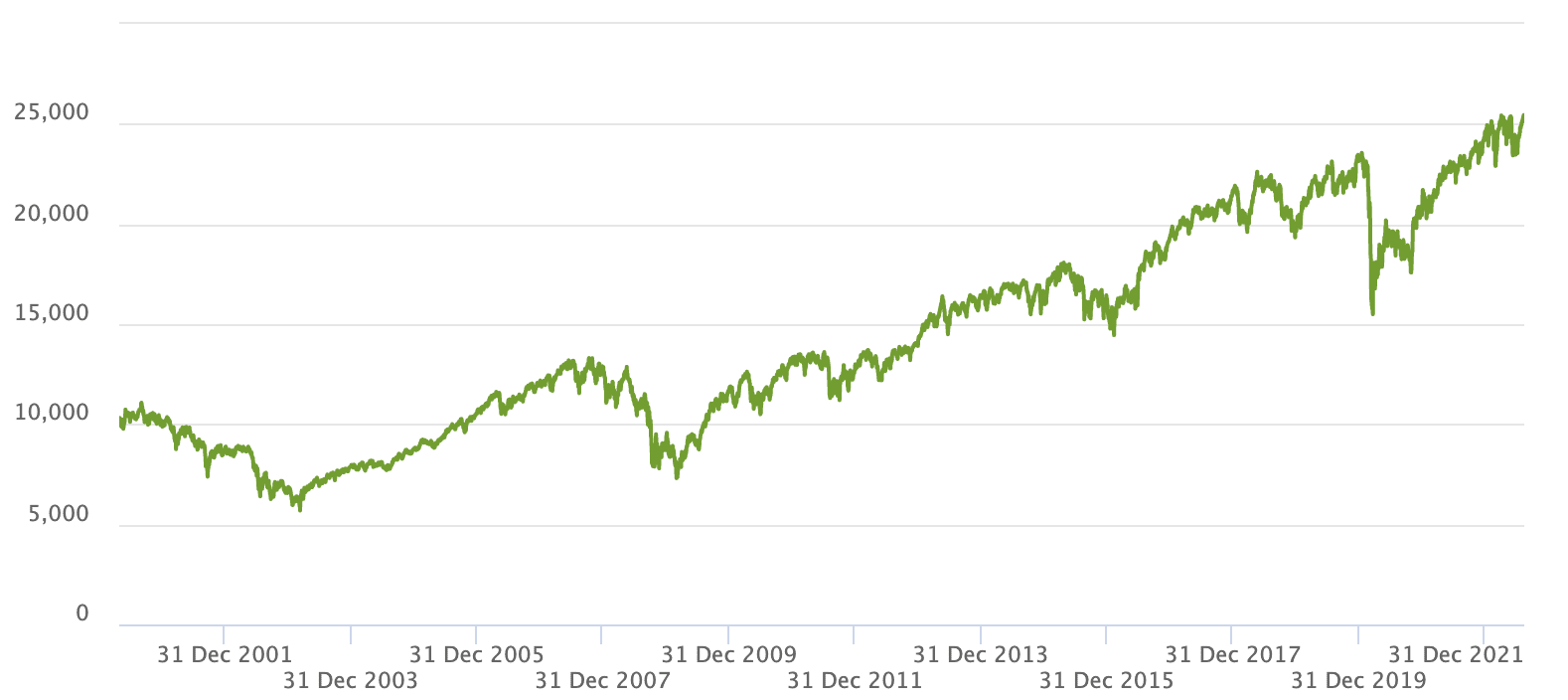

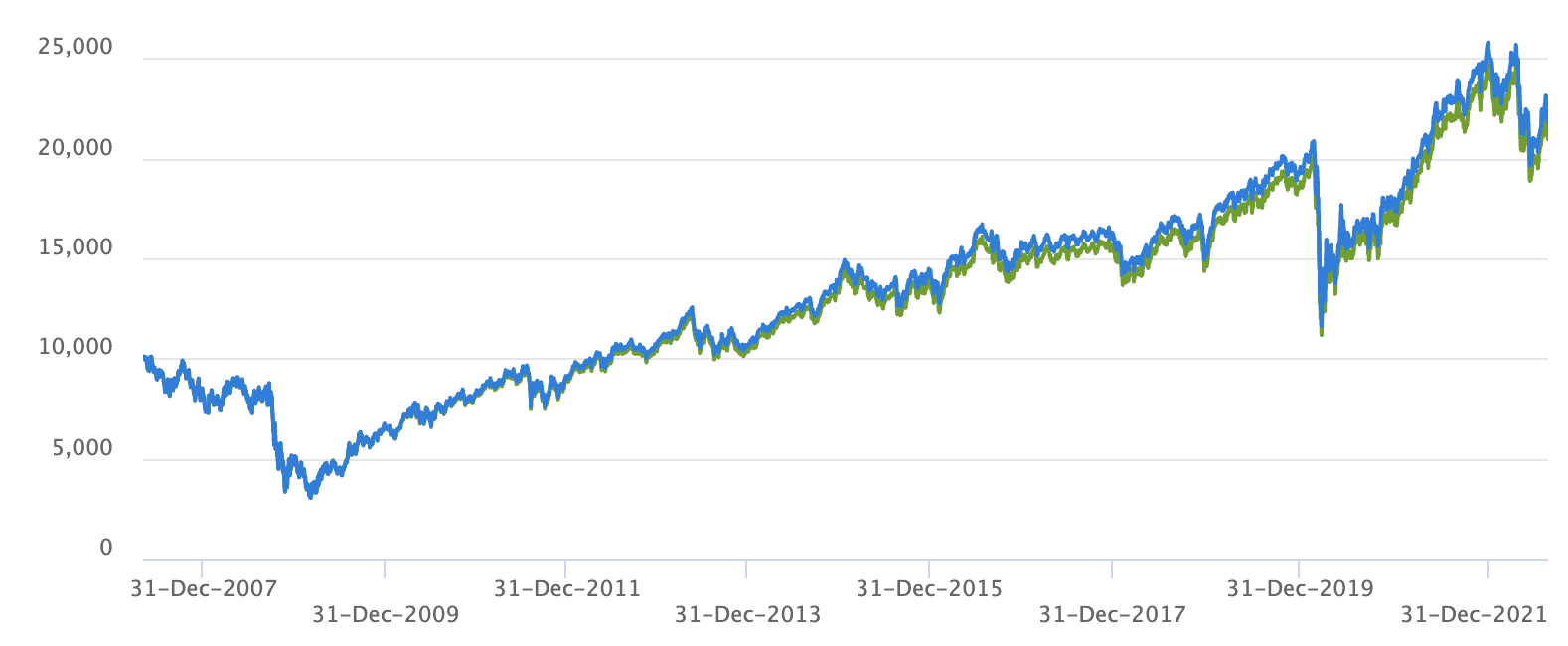

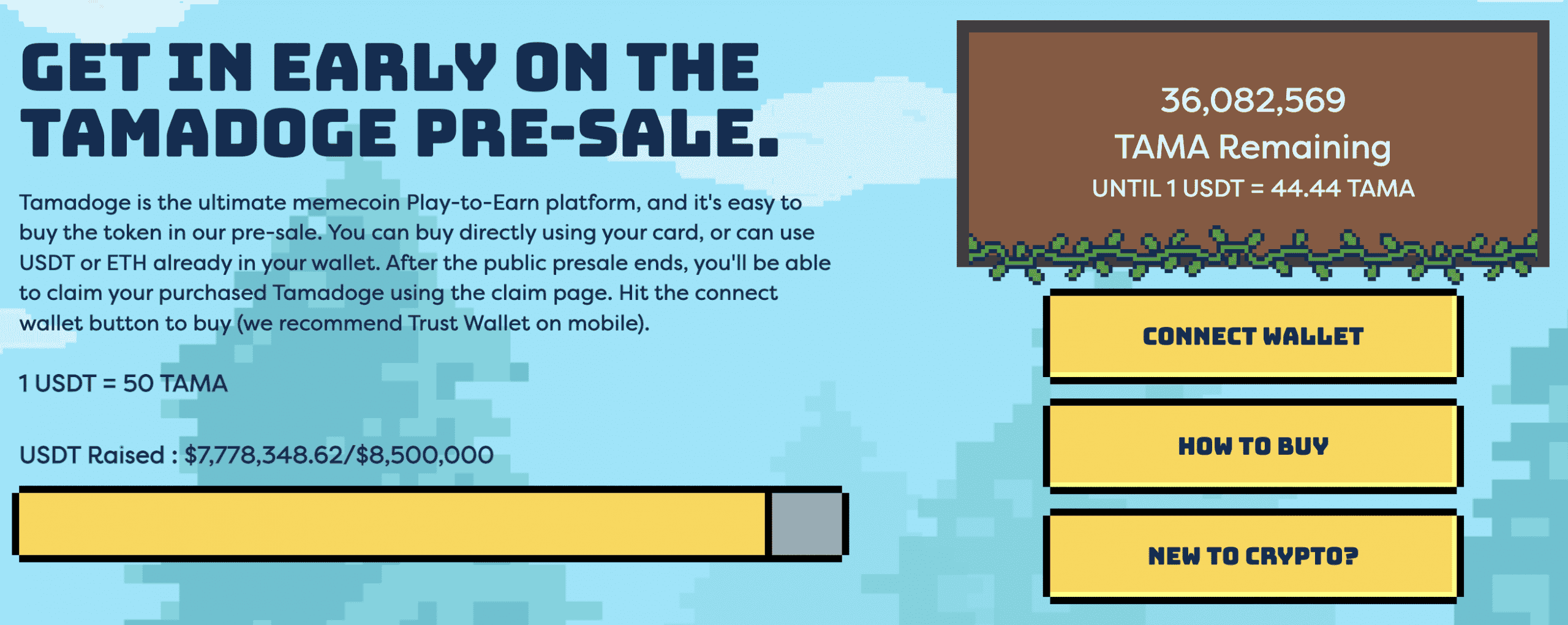

80.61% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider. Index funds allow investors to invest in stocks that reflect a certain index. An index is a benchmark used to summarize the performance of a particular market. Indices (which is the plural word for 'index') focus on 4 main types of market: These indices focus on the economic performance of an entire country at once. Stock Exchange indices track the performance of individual stock exchanges. Regional indices track the economic performance of entire geographical regions. Sector indices track performance in particular sectors, like financial stocks or healthcare stocks. Some index funds track the indices for particular types of company, rather than markets. Some funds focus on size of company (small, mid or large cap) or on investment type (growth or value). Alternatively, investors can now gain exposure to the best crypto index funds such as Bitwise 10 Crypto Index Fund (BITW) and Bitwise DeFi Crypto Index Fund. Index Funds are available in two formats: Investors should note that both mutual funds and ETFs focus on a variety of strategies, of which index tracking is just one. In other words, if the strategy is to track a particular stock index, then that mutual fund or ETF is called an index fund. If an investor puts money into an index fund with a fund provider, they will often be expected to hold their position for a certain period and make periodic investments. Then they can cash out of their position, receiving cash from the fund provider. Penalties may apply for cashing in before an agreed period. With index ETFs, the process is different. With index ETFs - as provided by Capital.com and other brokers - the investor buys a share in the ETF from the broker and then sells it back to the broker whenever they like. Whilst an investor holds an ETF, any distributions paid out by the ETF will automatically be paid into their brokerage account. In both cases, taxes will apply to any profits made in selling or cashing in a fund. Taxation will also apply to any distributions made by the fund. Index funds form the anchor for many retirement planning portfolios. There are two reasons behind their popularity in this regard: 'Active' funds feature a selection of shares that is hand-picked by a fund manager. This usually comes at a financial cost which is called the Expense Ratio. This is a percentage fee deducted when the investor buys into the fund. The Expense Ratio reflects how expensive the fund is to run on a yearly basis. 'Passive' funds, on the other hand feature a share selection that has been chosen largely automatically. This is the case with index funds. Index funds usually own the stocks whose performance is tracked to generate the index. With stock selection therefore handled, index funds therefore generally feature lower Expense Ratios than 'active' funds. If we compare investing in index funds vs. stocks, we can conclude that investing in many stocks at once with a fund spreads risk better than buying individual stocks. An investor might, for example, buy Apple stock. If instead, they were to invest in the Invesco QQQ Trust ETF, for example, then they would be investing in Apple as well as 101 other large-cap companies represented by the NASDAQ 100 Index. New index funds are coming onto the market the whole time. To find the most popular index funds: As we have noted above, index funds are available in mutual fund format as well as ETF format. Below we give an overview of: FNILX is an index fund run on the mutual fund model. This means investors cannot buy a share of it via a broker, but must deal directly with Fidelity. This fund tracks the Fidelity US Large Cap Index. This is effectively the S&P 500 index. Not using the S&P 500 name means that Fidelity can avoid paying licensing fees, and thus provide this fund with an expense ratio of zero (hence the name of the fund). Founded in 2018, FNILX has a 3-year trailing return of 12.1%. It holds 515 stocks covered by the Fidelity US Large Cap Index. FNILX is capitalization-weighted, which means that stocks are held in proportion to their market capitalization. Hence Apple - the biggest company in the US - is the top holding, comprising 6.46% of the entire $5.5bn portfolio. A word on index fund jargon: It tracks the FTSE Emerging All Cap Index. This is composed of 2,980 stocks of companies in emerging market countries which are then screened for compliance with certain 'ESG' criteria. 'ESG' means Environmental, Social and Governance; it is the finance industry's latest initiative to offer investors ethical investing. So, with this fund and other ESG-rated products, investors can be sure they will not be investing in any companies which deal in vice products like alcohol, weapons or dirty energy. Vanguard gives this fund a risk rating of 6/7. This reflects its focus on emerging, rather than established, economies. An ongoing charge of 0.25% applies, as well as occasional transaction costs which apply when the fund changes its stock selection (which, with an index fund, is rarely). As we can see from the graph above, this fund's net asset value rose by 11.34% last financial year, but - like all most financial assets - took a hit recently. Founded in 1993, SPY is considered to be the most accurate tracker of the influential S&P 500 index, which tracks the biggest companies in the US. SPY has a staggering $378bn of shares in its portfolio. 505 companies are covered in all, with Apple taking top spot with 7.39% of total coverage. Information Technology is the leading sector covered, with 27.8% weight, followed by healthcare with 13.98% and discretionary consumer companies at 11.52%. The price of one SPY share is calibrated to be one-tenth of the price of the S&P 500. This index ETF tracks the FTSE 100 index. The FTSE 100 index tracks the performance of the UK's largest 100 listed companies. Launched in 2000, ISF.L has grown to feature over £10bn worth of shares in its portfolio. Of the 100 companies featured - including big UK names like oil giants Shell, healthcare behemoth Astra Zeneca and top 4 UK bank HSBC - the average P/E ratio is 13.63. ISF.L offers a low expense ratio of 0.07%. In terms of performance, the fund achieved a total return of 18.3% in financial year 2021. This was after a bad year in 2020 when it recorded a loss of 11.6% thanks to the body blow to the UK economy brought by the Pandemic. REITs pool funds from investors and invest in real estate. They are considered to be a less risky way of investing in real estate than actually buying into bricks and mortar. So an ETF comprised of many REITs represents a particularly low-risk approach. Although REITs are not famed for stellar share price performance, they are associated with regular dividend payments. This ETF pays distributions on a quarterly basis. The last payment was $0.26 on each share, paid on June 15th, 2022; a USRT share is currently worth $56.61. Taxation of funds is complicated and varies from country to country. It is therefore important to consult a taxation expert to learn how to invest in an index fund tax-efficiently. Broadly speaking, watch out for taxation on: Capital gains tax applies when a share in an index fund or ETF is sold or cashed in. Also watch out for unexpected capital gains taxation when a fund sells shares in a particular company – even if your share in the fund drops in value. Fortunately, index funds tend to sell equities less often than other types of funds, because the index on which they are based tends not to vary. Explore official guidance from the IRS. Capital gains tax applies to fund distributions and selling or cashing in a share of an index fund. Head here for official guidance from the HRMC. Investors’ marginal tax rate is used to tax income from distributions as well as profitable selling of shares. Head to the official AU government site for help. Taxation applies to fund distributions as well as any gain made when selling or cashing in your shares. Head here for information on fund taxation from the Canadian Revenue Agency. With a range of brokers, investors in UK and Europe pay no commission when buying or selling index ETFs. Note that a spread fee will apply. The spread is the difference between the price that a broker will sell a share for, and the price it will buy it back for. All ETFs sold by Capital.com incur CFD overnight fees. Index funds run along the traditional mutual fund format usually come with a hefty minimum investment. Index funds structured as ETFs, on the other hand, do not stipulate a minimum investment themselves - but the stockbroker selling a share in the ETF will do so. How much to invest in index funds is up to the individual investor to decide. But it is always sensible to diversify and spread risk by investing in different asset classes. When to invest in index funds is also a question to which there is no certain answer. Investment guru Warren Buffett said famously that, 'time in the market beats timing the market'. In other words, the only right time to invest is now - because timing the market to invest before a big price surge is impossible, and what really brings returns is long-term exposure. If an investor wants to trade indices for short-term gain, then the good news is that brokers like Capital.com offer index trading via Contracts-For-Difference (CFDs). Short-term trading of ETFs is possible with brokers Capital.com. But, a more popular strategy is to buy into index funds and hold them for a long period. This is because history has shown that stock market indices generally rise over time. Exchange-Traded Funds offer investors a more flexible way of investing in indices than mutual funds. With an online broker, investors can trade ETFs as if they were conventional shares. Mutual funds cannot be traded in this way, and thus offer less flexibility. ETFs are also generally more tax-efficient than mutual funds. Copy trading goes back to the mirror trading of 2005, when investors would copy trading algorithms from each other. Investors generally look to populate their portfolio with assets of different risk types. Whereas index funds are a low-risk type of fund - with funds being generally low-risk anyway - the opposite end of the risk spectrum is embodied by crypto. Even long-term investments in the crypto world are considered to be high risk compared to other asset types. One of the most promising crypto right now is Tamadoge (TAMA). Remember Dogecoin, the doggy-themed meme coin that enjoyed such spectacular price performance in 2021? Tamadoge is set perhaps to be the next Dogecoin - by taking the popularity of fun doggy crypto and adding to it some genuine usefulness. TAMA is more than a meme coin. It is a central part of Tamadoge's compelling play-to-earn metaverse. Drawing on the historic success of Tamagotchi virtual pets, Tamadoge allows players to breed cute NFT pets, accessorise them and pitch them against each to compete on the Tamadoge leaderboard. The aim of Tamadoge is to have fun and earn TAMA along the way. Proving itself to be one of the best crypto presales of 2022, so far the Tamadoge presale has raised $7.8m of its planned $8.5m target - and that's way ahead of schedule. Investors can buy Tamadoge direct right now using a Metamask or Trust wallet, hooking up to the Tamadoge site and exchanging some ETH or USDT for TAMA.

Above we have looked at how to get started investing in index funds. We have noted that index funds are considered to be a low-risk investment, particularly suitable for anchoring retirement investments over the long-term. At the other end of the risk spectrum, the crypto Tamadoge (TAMA) offers investors an opportunity to get some exposure to crypto - an asset with a higher potential for short-term rewards than index funds (but more risk). Still in its exciting presale phase, Tamadoge is considered to be one of the hottest crypto right now. TAMA is the in-house crypto for the burgeoning Tamadoge Play-to-Earn/NFT ecosystem, in which players develop, train and fight virtual pets. Drawing on the historic commercial success of Tamagotchi virtual pets, TAMA has a bright future as one of the best emerging cryptos. Tamadoge - The Play to Earn Dogecoin

Step 2: Research the Index Fund Market

Types of Index

1) Sovereign Market

2) Stock Exchange

3) Regional Market

4) Sector-based Market

Types of Index Fund

1) Mutual Fund Format

2) Exchange-Traded Fund (ETF) Format

How does Investing in Index Funds Work?

Advantages of Index Funds

1) Index Funds can be Cheaper than other Types of Funds

2) Index Funds Reduce Risk

How to Find the Most Popular Index Funds to Invest in

5 Best Index Funds to Watch Right Now

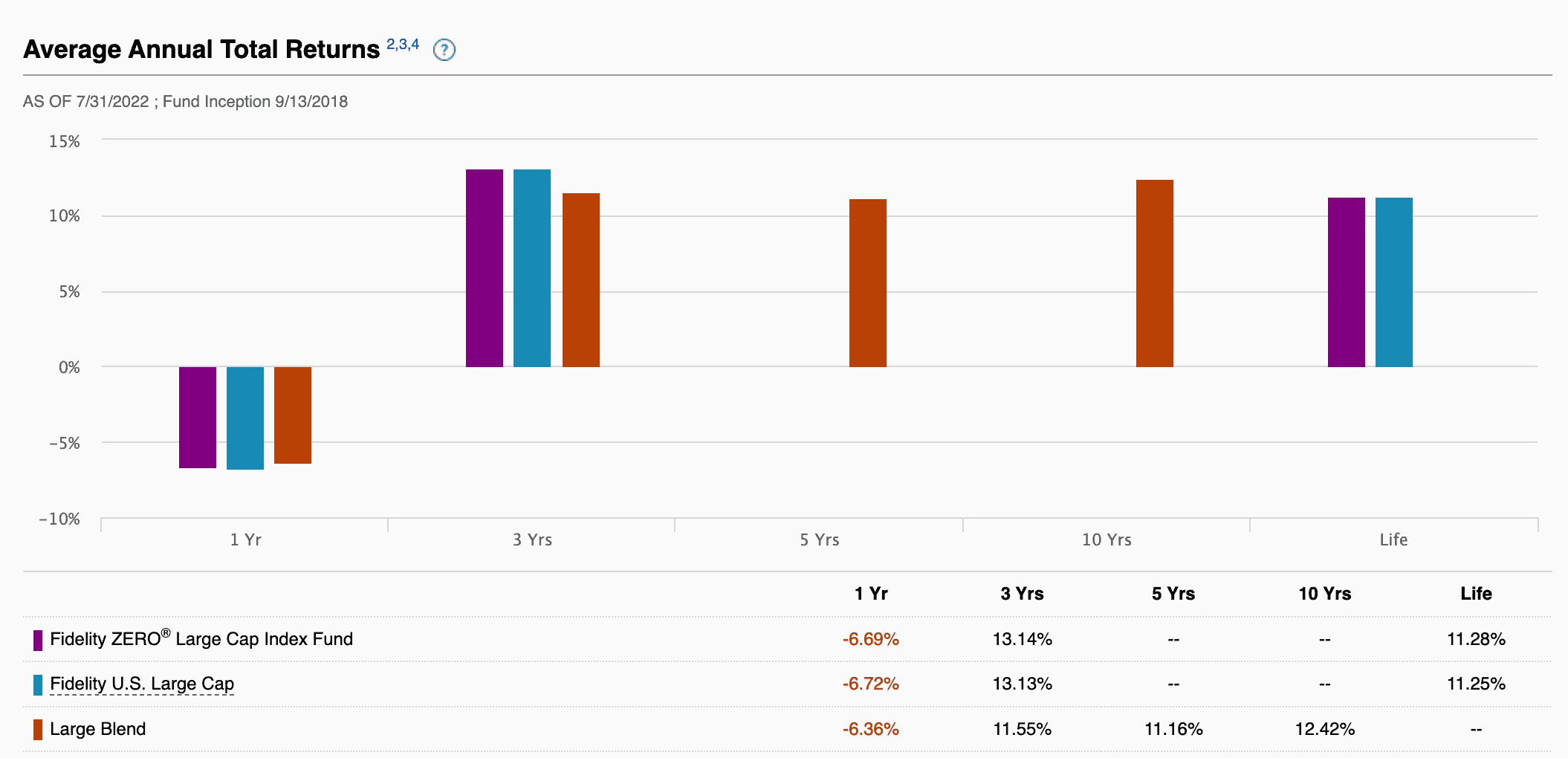

1. Fidelity ZERO Large Cap Index (FNILX)

This fund is described as a 'Large Blend' fund. If a fund is described as a 'Blend' it means that it only contains stocks, which are a blend of growth and value stocks. If, conversely, a fund is described as 'balanced' it means that it contains a balance of stocks and fixed income assets like bonds.2. ESG Emerging Markets All Cap Equity Index Fund

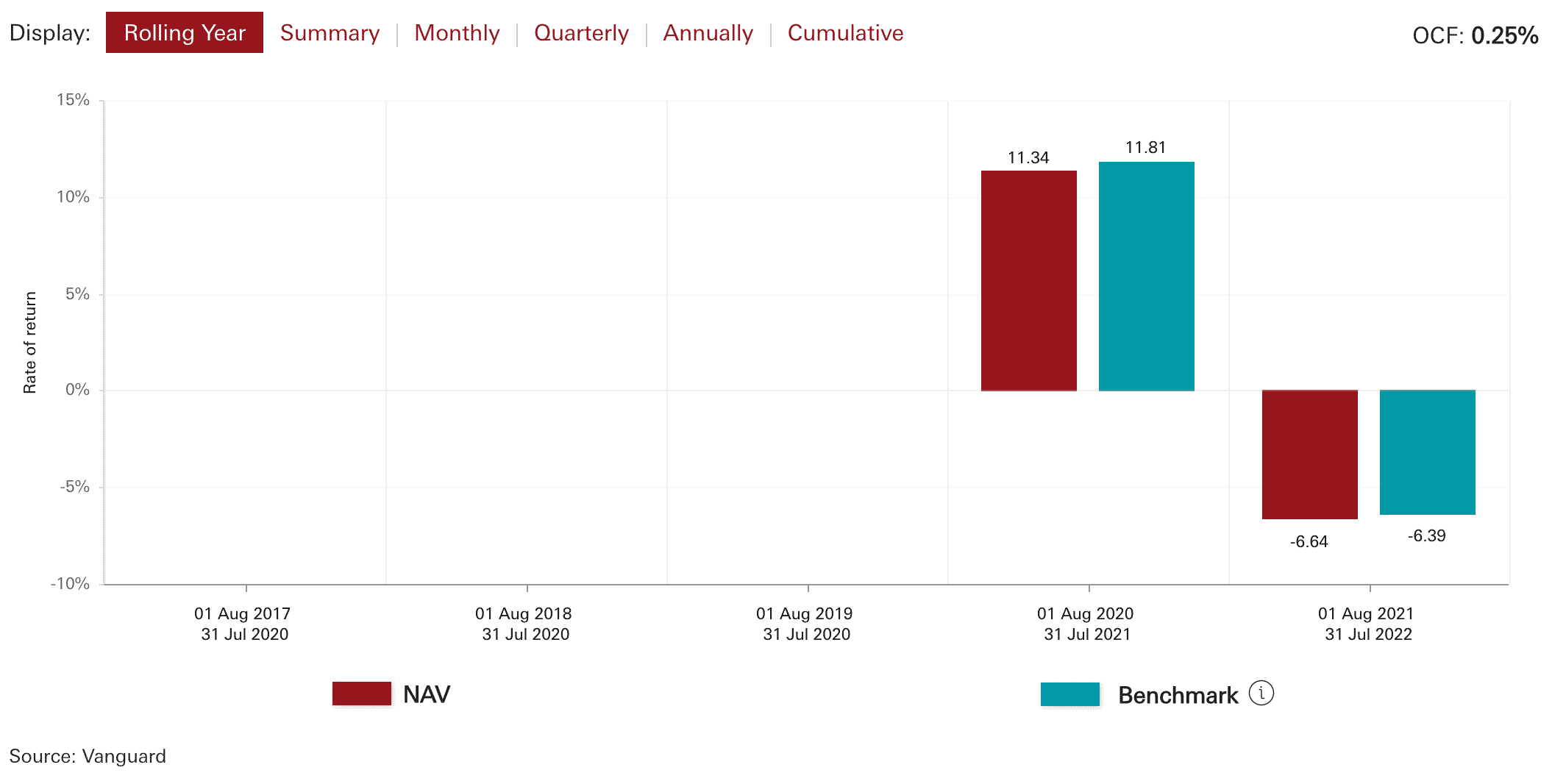

This fund is offered by Vanguard, a large US company considered to be a key stalwart of the fund markets.

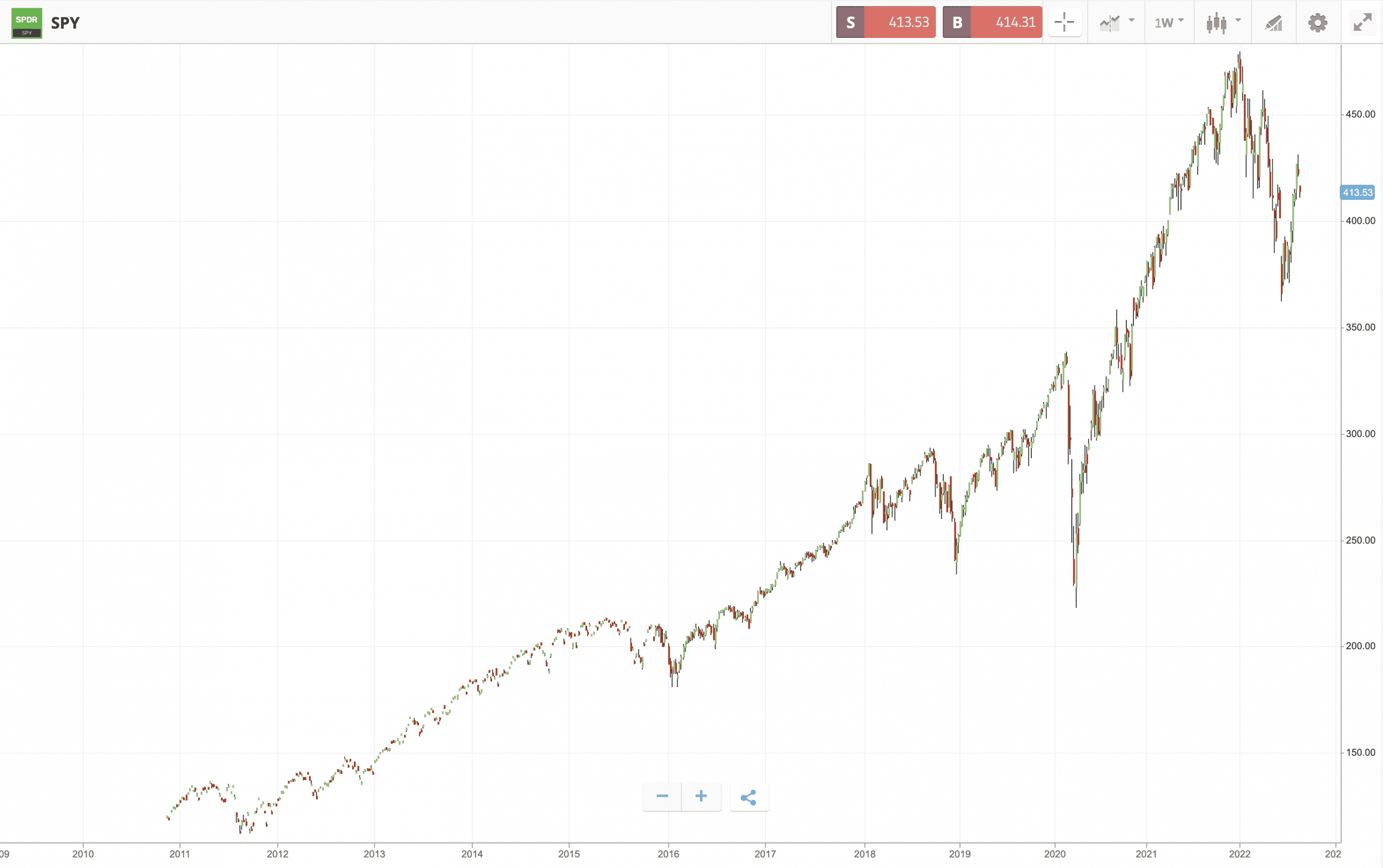

3. SPDR S&P 500 ETF (SPY)

4. iShares FTSE 100 UCITS ETF (ISF.L)

5. iShares Core US REIT ETF (USRT)

This index ETF focuses on the area of US Real Estate Investment Trusts (REITs). It tracks the performance of the influential FTSE Nareit Equity REITs Index.

Are Index Fund Investments Taxed?

US

UK

Australia

Canada

How Much Does it Cost to Invest in Index Funds?

How Much Money Do You Need to Invest in Index Funds?

Three Top Tips for Investing in Index Funds for Beginners

1) Do not Confuse Investing vs. Trading

2) Use ETFs for Convenience

3) Consider Copy Trading

Are Index Funds the Best Investment for 2025?

Min Investment

1,000 TAMA (∼$10+ gas fee)

Max Investment

NA

Purchase Methods

ETH or USDT now; fiat currency soon

Blockchain

Ethereum

Presale Ends

2nd September 2022

Conclusion