Green energy has become an increasingly popular energy source over the past decade due to its significantly-reduced impact on the environment. Many companies now harness the power of solar, wind, and tidal energy, which not only reduces (or removes) their carbon footprint but also provides some enticing opportunities for investors.

This guide discusses how to invest in green energy in detail, covering what this energy source is and the benefits of investing in it. We’ll also explore some popular green energy assets before presenting a step-by-step walkthrough of how investors can purchase these assets today.

How to Invest in Green Energy – 4 Easy Steps

Those looking to invest in clean energy assets will be glad to know that the investment process is relatively straightforward. Detailed below are the four simple steps investors must take to buy these assets today:

- Step 1 – Find a Suitable Green Energy Asset: The first step is to find a suitable green energy asset; for example, investors may wish to buy shares in a wind power company or invest in a green energy ETF.

- Step 2 – Identify a Broker that Offers the Asset: Once an asset has been identified, the next step is to find a broker that offers the instrument. It’s vital to choose a broker that is regulated by top-tier entities such as the FCA, ASIC, CySEC, or FinCEN.

- Step 3 – Open a Trading Account & Make a Deposit: Assuming your chosen platform offers the asset, head to the broker’s website and create an account. After creating an account, deposit at least $10 using a credit/debit card, bank transfer, or e-wallet.

- Step 4 – Invest in Green Energy Responsibly: Type the name or ticker symbol of the asset into the search bar and click ‘Trade’. Enter the appropriate investment amount in the order box and click ‘Open Trade’.

The Basics of Investing in Green Energy

Investing in green energy and impact investing can be a lucrative endeavor if done correctly, as this power source has become increasingly popular over the past decade. This popularity has led to many companies offering services related to green power generation or green power technologies. But what is this power source, and how does it differ from ‘traditional’ energy sources?

As defined by TWI Global, green energy is any energy type that is generated from natural resources. The key feature of this energy source is that it produces minimal (or no) carbon dioxide pollution. Some popular examples of green energy sources include:

- Wind power

- Solar power

- Geothermal energy

- Hydropower

- Biomass

- Biofuels

Green energy has become so popular because it is naturally replenished, which contrasts with fossil fuels, which are finite. Due to this, those interested in sustainable investing tend to gravitate toward green energy investment funds and stocks to ensure their portfolio is as environmentally friendly as possible.

The concept of green energy investing is relatively simple to understand, as it refers to the process of investing in assets related to green energy generation. The most common approach is to buy shares in a company that generates revenue from producing one of the power sources noted above. However, some investors opt to place their capital in green energy ETFs or mutual funds.

Investing in green energy has become more commonplace over the past few years, as a greater percentage of the investment community becomes more eco-conscious. This trend shows no signs of slowing, which is why many believe that green energy assets have a bright future ahead of them.

How Does Investing in Green Energy Work?

Green energy investing works in much the same way as other forms of investing, with some additional research and analysis sprinkled in to ensure the target asset can actually be considered ‘green’. Broadly speaking, there are three main steps investors must follow when looking to begin investing in green energy:

Identify a Green Energy Asset

Those wondering how to invest in green energy must first identify a suitable asset. To be considered a ‘green energy investment’, the asset’s price must be influenced by green energy generation in some way.

An example would be green investment funds, which invest in companies that generate income through solar, wind, and tidal power production. Alternatively, experienced investors may consider buying futures contracts related to clean electricity generation.

Determine Viability as an Investment

Whether the decision has been made to invest in stocks or purchase futures contracts, it’s essential to determine whether the asset has returns potential. This involves analyzing the investment in a financial sense by reviewing the price chart and deciphering its fundamentals.

During this step, investors must also ensure the asset fits with their own unique investment criteria. This includes checking whether their risk tolerance tallies with the asset’s level of volatility and whether its returns potential fits with their investment goals.

Find a Trading Platform to Invest With

The final step is to partner with one of the best trading platforms that offer the target asset. Since there is now an abundance of green energy companies to invest in, most of them listed on leading stock exchanges, it shouldn’t be challenging to find a trading platform that offers a solid selection of tradable assets.

It’s also essential to ensure the chosen broker is well-regulated and has measures in place to protect clients.

Why Do People Invest in Green Energy?

Green energy investment funds and stocks have become increasingly popular in today’s world – but why is this? Presented below are four common reasons why investors opt to add green energy assets to their portfolios:

Potential for High Returns

Those wondering how to invest in green energy will likely be doing so to generate a return in an eco-friendly way. Thus, investors can often put themselves in line to attain substantial returns by opting to buy stocks in green energy companies.

Many green energy companies have grown exponentially in recent years due to the increased demand for clean power sources. An example is Plug Power, which saw its share price increase by over 2,700% between March 2020 and January 2021.

Positive Environmental Impact

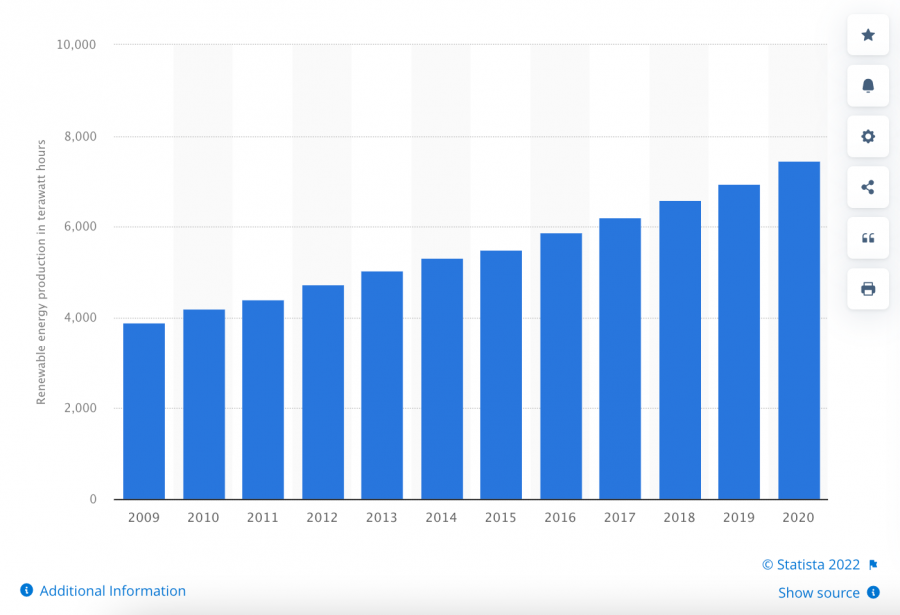

According to the IEA, clean energy investment grew by 2% per year between 2015 and 2020, yet increased by 12% in the following years. This highlights that investors are increasingly keen to add assets to their portfolios that help make a positive environmental impact.

By investing in green energy companies, investors can provide the capital needed for the company to expand and improve its products/services. Green energy investing also raises awareness of these companies, creating a snowball effect that leads to more investment.

Helps Foster Technological Breakthroughs

The rise of sustainable investing funds and green energy stocks has helped promote technological innovation, which benefits the sector as a whole. Companies are in a perpetual battle to outdo one another in order to attain investment, which is why they constantly seek to innovate and improve.

As a result, better technologies are created year-on-year that produce cleaner energy using quicker methods. This innovation cycle will likely continue in the years ahead, causing green energy investing to become even more popular.

Impacts Companies with Adverse Environmental Effects

Finally, investing in green energy naturally draws capital away from alternative investments, such as those that deal in fossil fuels. For example, finding green coal companies to invest in can mean that potential investments in oil or gas companies are passed over, which indirectly harms them.

As more people look for green energy companies to invest in, those that deal in ‘unclean’ power generation will start to feel the effects. This results in them either changing their ways or even falling by the wayside altogether.

Types of Green Energy Investments

Those exploring how to invest in green energy must understand the various assets that they have at their disposal. With that in mind, presented below are five assets that investors may wish to consider:

Stocks

There are now hundreds of energy stocks that deal in green energy, meaning that equities are one of the most popular assets for eco-conscious investors. Many top green energy stocks to invest in are listed on the NYSE, NASDAQ, or LSE, making them easily accessible through leading brokers and exchanges.

The most popular green coal companies to invest in are worth considering, as these companies employ innovative technologies to reduce (or remove) the CO2 produced when burning coal. Alternatively, investors can also buy shares in companies that create wind, solar, and tidal power generation equipment.

ETFs

Those interested in ETF trading will be glad to know that there is now a wide selection of ETFs that focus on green energy assets. The fund manager will often employ strict criteria that ensure the assets included in the fund’s portfolio are either actively involved in green energy generation or create equipment that helps facilitate it.

Those looking to utilize a passive investing approach will naturally gravitate towards green energy ETFs, as they are easily accessible and do not require active portfolio management.

Cryptocurrency

Green energy investors can also invest in cryptocurrency, as many projects have sprung up in recent years with sustainable technologies. Although crypto projects aren’t actively involved in creating green energy, many limit (or remove) their carbon footprint through eco-friendly practices.

For example, leading blockchain Cardano has partnered with veritree to create the ‘Cardano Forest’, which will see one million trees planted to aid reforestation. Other projects have similar practices, which have helped improve the crypto market’s reputation.

Pre-made Portfolios

Another option is pre-made portfolios, which have been created by a third party, making them ideal for beginners or those that lack the time necessary for portfolio creation.

Futures

Finally, green energy investors can also buy futures contracts to speculate on the price of specific power sources. This approach is better suited to experienced investors, as futures contracts are leveraged securities, meaning they have a high level of risk attached.

Many of the best futures trading platforms will offer contracts related to green power generation, which provides a simple way to benefit from increased demand for this energy source.

Popular Green Energy Investments

Investors pondering how to invest $1,000 (or any amount) will have an abundance of assets to choose from that are connected to green energy production in some way. To help streamline the investment process, detailed below are five popular assets that green energy investors may wish to consider:

Carbon Emissions Futures

Although carbon credit trading is a popular approach, it can be inaccessible to some investors. Due to this, carbon emissions futures have emerged as a popular alternative, allowing investors to gain direct exposure to the price of these credits.

First Trust NASDAQ Clean Edge Green Energy ETF (QCLN)

The First Trust NASDAQ Clean Edge Green Energy ETF seeks to track an index composed of companies engaged in manufacturing, developing, distributing, and installing green energy technologies. Most of the equities in this ETF hail from the renewables sector, although some operate in the automobile and semiconductor sectors.

According to the Financial Times, this ETF returned a remarkable 183.43% to investors in 2020. Some of the ETF’s most significant holdings include Enphase Energy, ON Semiconductor Corp, and Tesla Inc.

Plug Power Inc (PLUG)

‘Green hydrogen’ has become an increasingly-popular form of green energy, meaning that an investment in Plug Power can provide a way for investors to make their portfolios more environmentally friendly.

Solana (SOL)

Although most investors buy Solana to gain exposure to the token’s price, many also find the project appealing due to its sustainability practices. Not only does Solana consume minimal electricity, but the development team is also actively involved in reducing its carbon footprint.

Solana is undoubtedly one of the most eco-friendly cryptos due to its investment in refrigerant destruction. This process has been shown to be one of the best ways to offset CO2 emissions, making Solana a viable option for green energy investors.

How to Invest in Green Energy – Conclusion

To conclude, this guide has taken an in-depth look at green energy investing, covering what it is, how it works, and why this approach has become so popular in today’s world.

Given that the earth’s global surface temperature continues to rise, green energy sources are expected to become as popular, if not more popular, than ‘traditional’ fuel sources. Along with being good for the environment, this will also provide an abundance of opportunities for investors – which is why green energy assets are worth paying attention to in the years ahead.