Researching how to invest in ETFs? Exchange-Traded Funds (ETFs) have rocketed in popularity over the last 20 years by over 3000%. There are now over 8,500 ETFs to invest in. Offering the low-risk growth potential of mutual funds, ETFs are as easy to invest in as individual shares.

Below we review two brokers which offer zero commission on investing in ETFs. We look into how ETFs work, and explore five popular ETFs of different types. And, as stop press news, we further shine the spotlight on an exciting opportunity in the world of crypto.

How to Invest in ETFs – 5 Easy Steps

An ETF investing strategy is simple to implement. This is because ETFs are traded every day on international stock exchanges – just like conventional stocks. So, if an investor knows how to trade in stocks, they are well-placed to figure out how to invest in ETFs:

- ✅Step 1: Open a trading account with a regulated broker – Go to the online platform of your preferred broker. Supply a few simple details to get started.

- Step 2: Verification – Provide some proof of ID and address to get verified and ‘KYC-d’.

- Step 3: Deposit – With Capital.com, investors may deposit funds into their account via credit/debit card, bank transfer and a range of e-wallets.

- Step 4: Search for ETFs – Investors can browse through ETFs and drill down to stats, research and charting tools.

- Step 5: Buy ETF stock – Have you done your research? Spoken to an investment professional too? If so, use your broker’s online platform to execute a trading order.

Your capital is at risk. 80.61% of retail investor accounts lose money when trading CFDs with this provider.

Where to Invest in ETFs in 2025

In deciding on the best place to buy ETFs, three key factors to look for are:

- Top regulation by recognized sovereign financial authorities.

- No commission fees.

- Wide choice of ETFs.

The broker we review below – Capital.com – satisfy these criteria.

Capital.com – Regulated Broker with ETFs and Zero Commission Fees

A total of 5,600 markets are offered by this broker – including ETFs, individual shares, forex, commodities and indices. Capital.com serves 427,000 clients with offices in 9 countries and is regulated by the FCA in the UK, CySEC in Cyprus and ASIC in Australia.

Although Capital.com has a forex focus – as one the popular low spread forex brokers available – it offers over 150 ETFs. Most importantly, Capital.com charges no commission on ETF trading. But investors should be aware that spread fees, as well as overnight fees, apply.

Capital.com conducts all trades as Contracts-For-Difference (CFDs). This has the advantage that investors can go short on ETFs as well as leverage their trades. The downside comes in the form of CFD overnight fees, which makes short-term ETF trading – rather than long-term positions – a key option.

Popular ETF brands like ARK, Vanguard, SPDR, iShares, Invesco, Fidelity and ProShares are available with this broker in a range of formats:

- Sector-specific ETFs like the ARK Fintech Innovation ETF (ARKF).

- Country-specific index funds like the SPDR S&P 500 ETF (SPY).

- Bond ETFs like the iShares 20+ Year Treasury Bond ETF (TLT).

With Capital.com, some ETF trades are automatically leveraged. This means that Capital.com automatically lends the investor money and adds it to the trade. Leveraged trading heightens risk (as well as potential reward), and is not suitable for beginners. Check the ‘market info’ section to the right on each ETF’s homepage.

| Approx Number of ETFs | 150+ |

| Pricing System | Spread fee and overnight fees on ETFs |

| Cost of Investing in S&P 500 | Spread on S&P 500 ETF ‘SPY’ = 0.61% |

| Payment Methods | Buy stocks via credit card, wire transfer, Worldpay, Trustly, ApplePay |

| Non-Trading Fees |

No withdrawal fee, no deposit fee |

Dive deeper into the possibilities offered by this broker with our full Capital.com review.

Pros

Cons

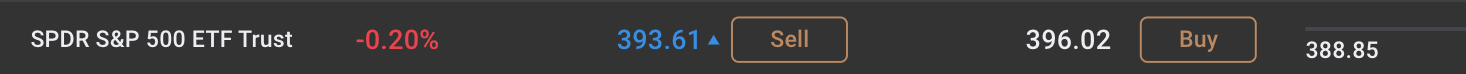

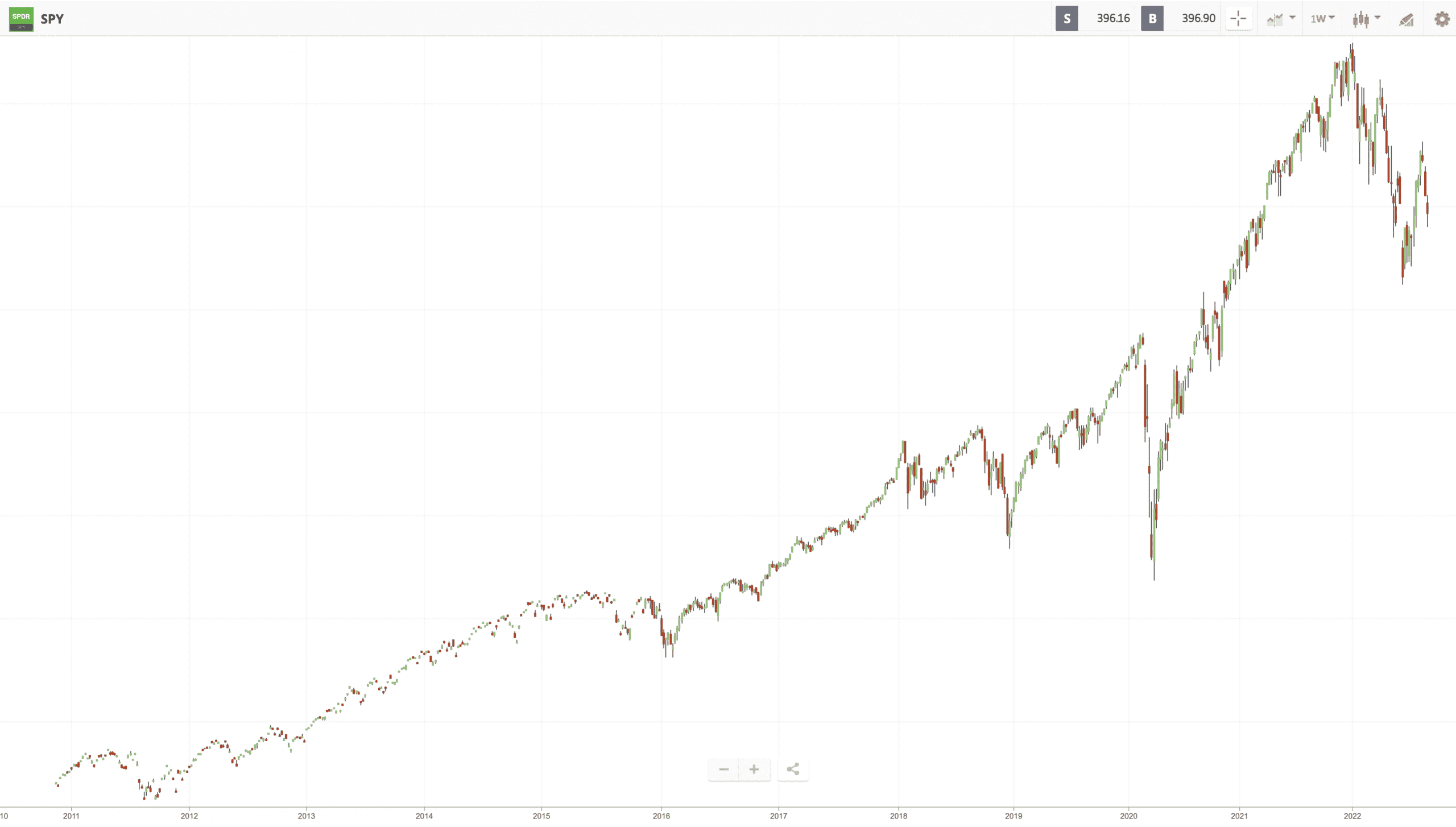

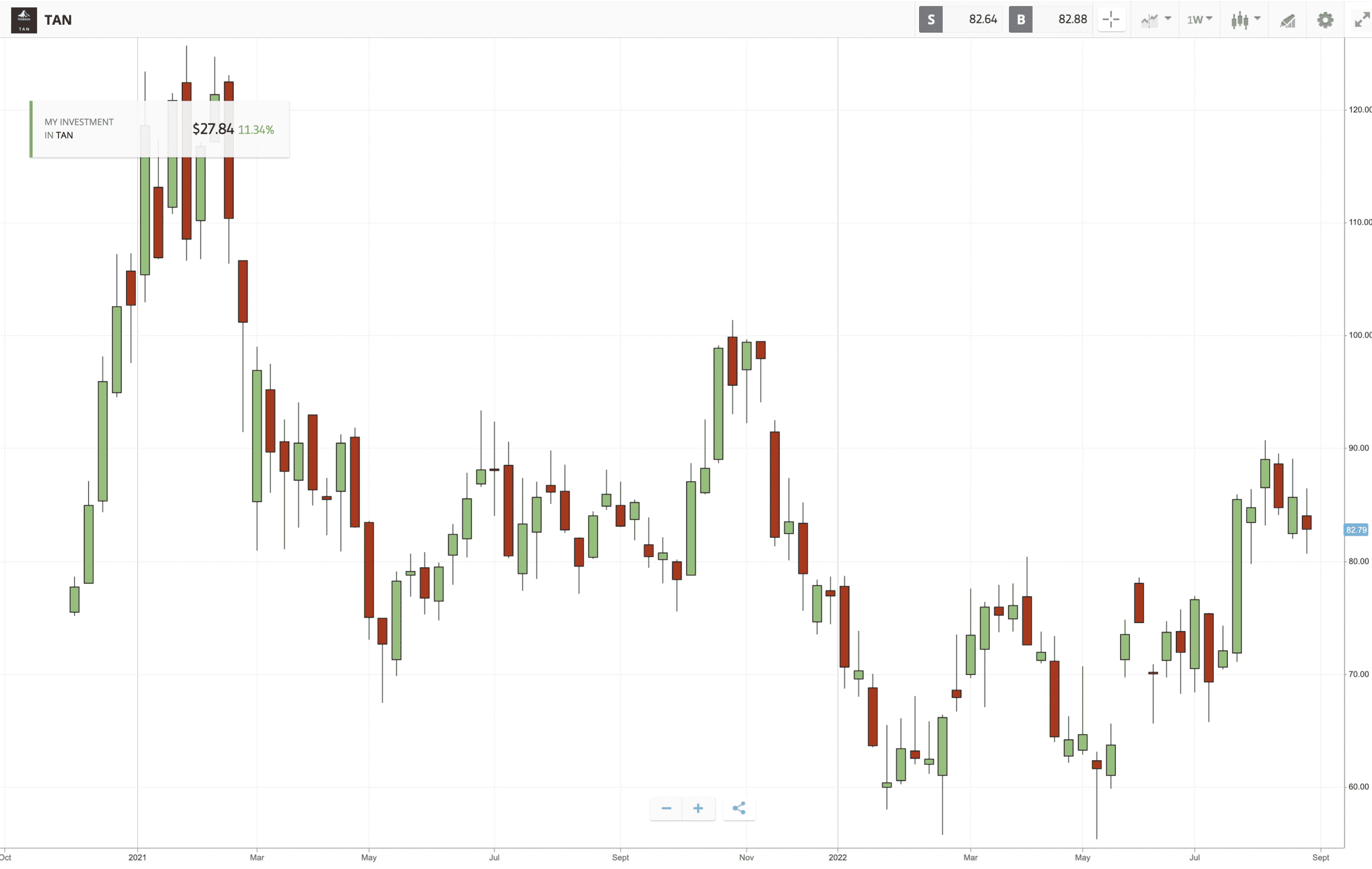

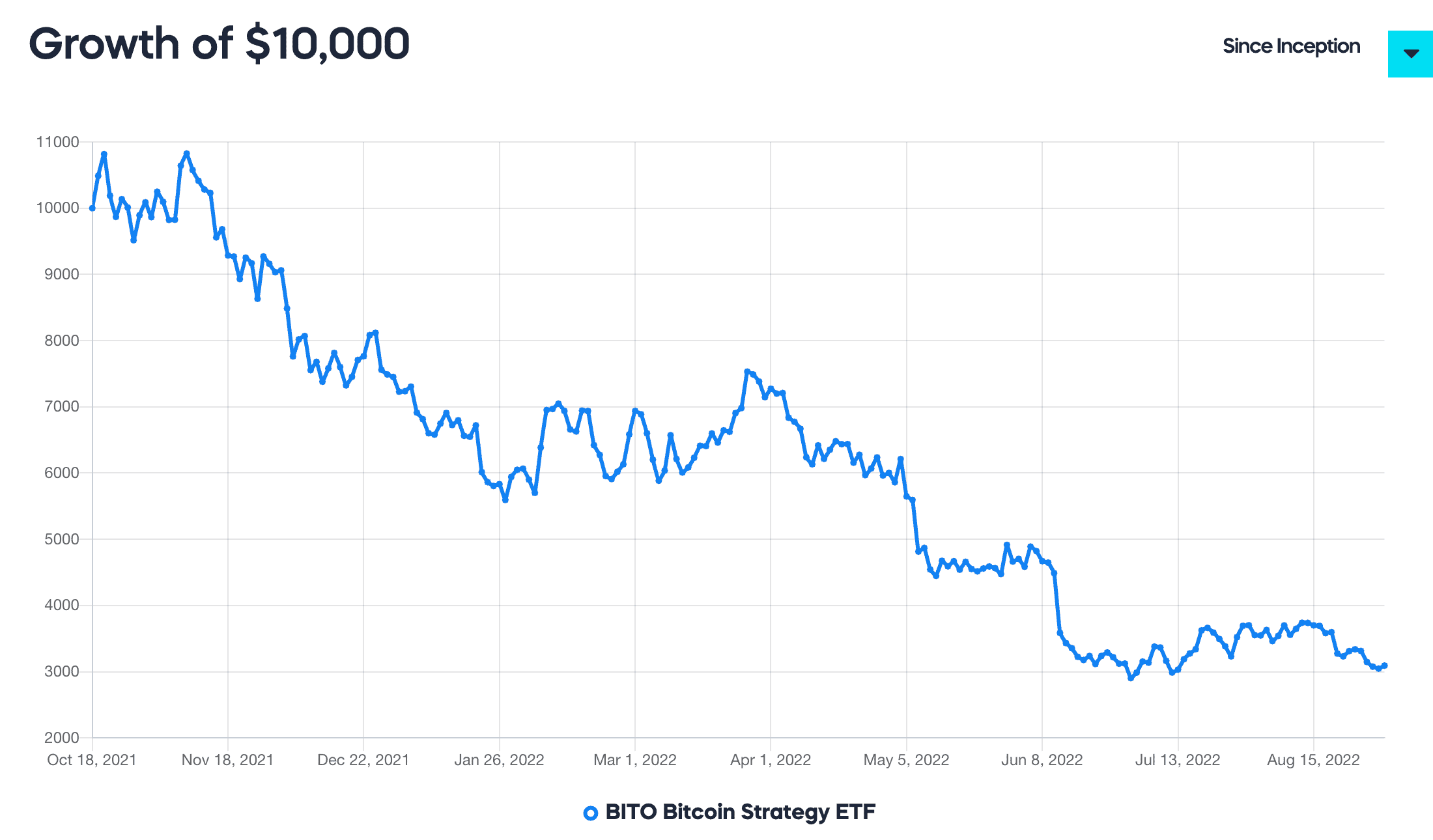

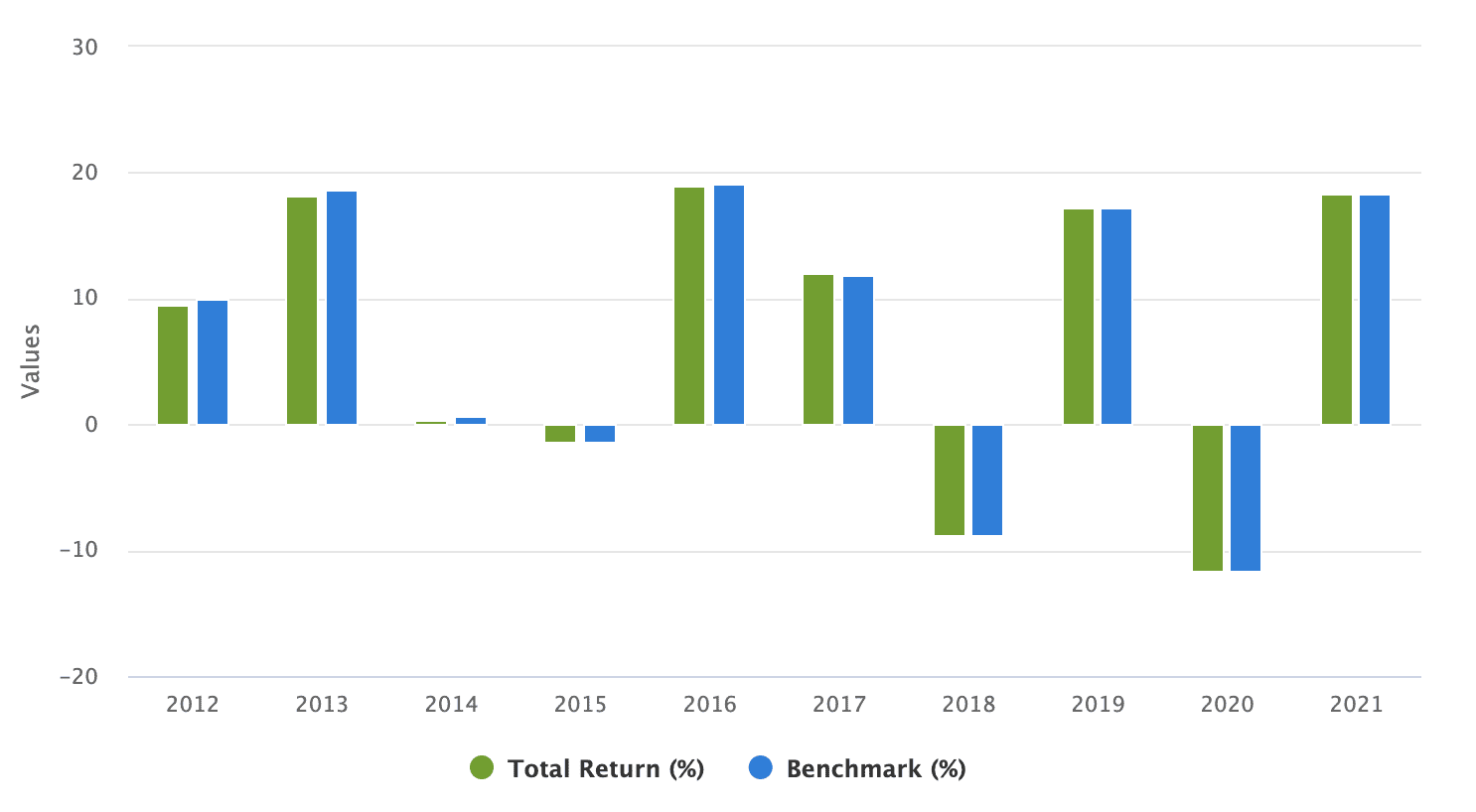

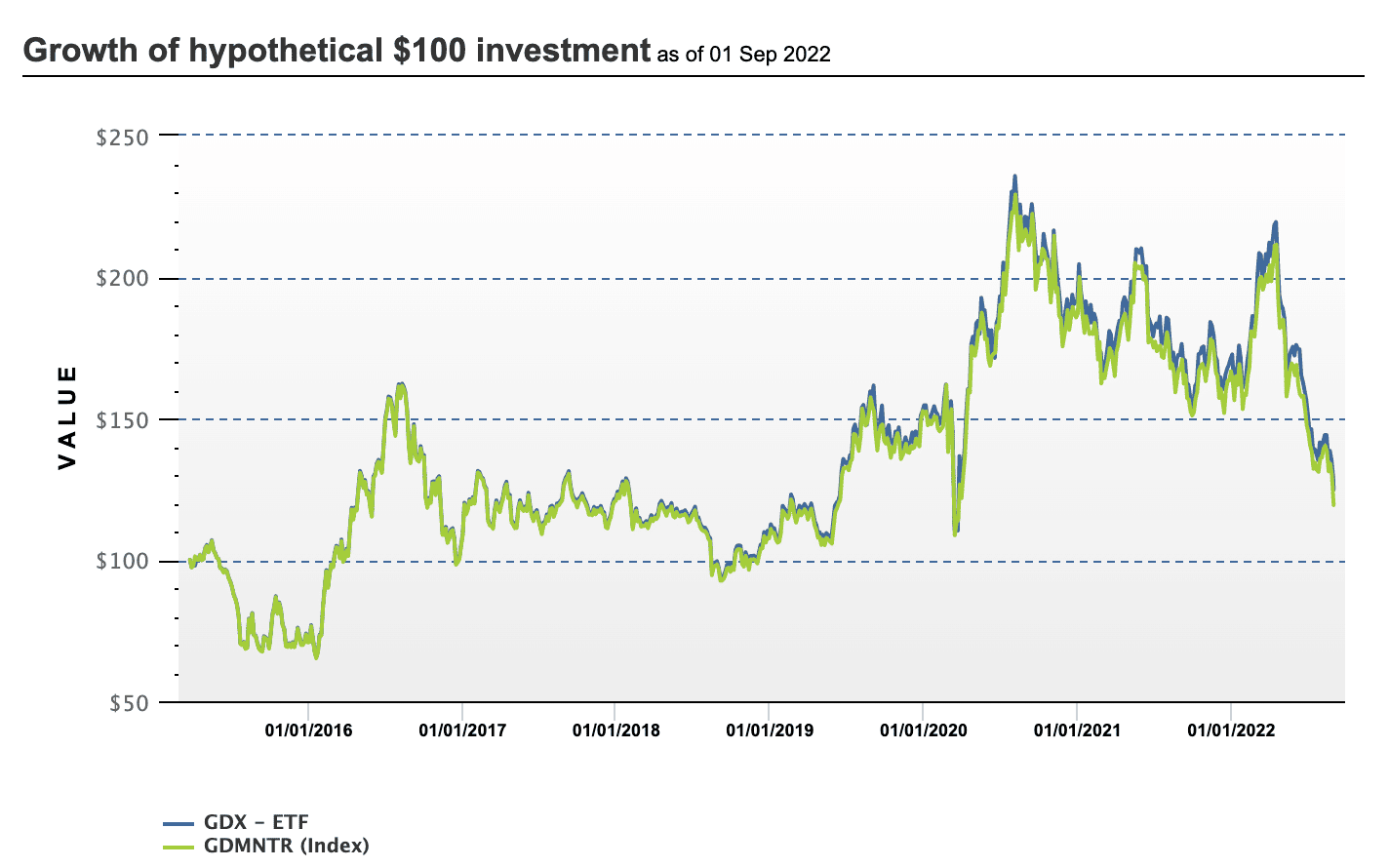

80.61% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider. Buying into an ETF is as easy as buying individual shares. Investors can buy shares in an ETF with an online broker. ETF shares can be traded whenever the markets are open, just as with company shares. Note that a spread fee will usually be applied to the market price by the broker. A spread fee means that there is a 'spread' between the price the broker will sell the ETF for, and the price the broker will buy it back from the investor at. To generate income, the broker will sell the ETF to an investor at a price slightly above its market price, and buy it back slightly below its market price. Spread fees are ubiquitous among brokers; we can't get away from them! Let us look at the example of the giant SPDR S&P 500 ETF (SPY), the first ETF to come into existence and still the biggest. SPY is available with Capital.com, as well as other brokers. With Capital.com, we can see that: Generally, Spread Fee Percentages differ from broker to broker. Their impact should be weighed up against any other fees and concessions. Also, Spread Fee Percentages sometimes differ over the course of a day owing to fluctuations in liquidity. When an ETF is bought as a Contract-For-Difference, overnight fees apply. These are charges which are levied for every 24hrs that the ETF position is held. With Capital.com, these overnight fees apply to the borrowed part of a leveraged trade - not the 'margin' which the investor puts up themselves. With Capital.com, the long position overnight fee for SPY is -0.023%. The short position overnight fee is -0.022%. All ETFs are funds made up of different company shares in different proportions. Deciding the ETF portfolio is up to the ETF provider. The investor simply buys a share of the ETF, and stands to gain from fluctuations in the ETF's market price. Over 95% of ETFs are index ETFs. This means that they buy shares which make up a particular market index. The advantage of an index ETF is that the ETF does not need to be actively managed by a fund manager charged with selecting the shares. They know which shares to pick from the index the ETF is tracking. This reduces the cost (Expense Ratio) of running the ETF, which translates to a better market price for the investor. The focus with stock index ETFs is on national stock market indices like the US's S&P 500 Index, the UK's FTSE 100 Index and the German DAX 40 Index. These ETFs track indices which focus on a particular business sector. Style ETFs focus on companies grouped around a particular theme. These ETFs focus on bonds. Bonds are issued by sovereign governments and corporations and offer fixed returns. These ETFs feature shares in companies related to a particular commodity, like gold or oil. Often, they are index funds which track a commodity index. Many investors looking to gain exposure to the real estate sector have started investing in REITs. Most real estate ETFs track a real estate index. For those who know how to trade ETFs, this section will explore some of the best ETFs that most investors are adding to their watchlists in 2025. SPY is an index tracker. It tracks the US S&P 500 Index. This index tracks the 500 biggest companies in the US. SPY has shares in 505 companies in all, with Apple taking pole position with 7.39% of the portfolio. Information Technology is the biggest sector covered, with 28% of the portfolio. Given its primacy in the sector, SPY is likely to be the most popular ETF to invest in 2022. Founded in 2008, TAN is up 10%+ this year, and 32% up from five years ago. Keen-eyed investors will note from its stats that it invests in pricey companies - with an average Price/Earnings Ratio of 69.11. Just 55 firms are invested in, with almost 60% involved in IT, and just under 20% in utilities. This ETF is available with Capital.com. Rather than invest in Bitcoin directly, BITO invests in Bitcoin futures. Why not just buy Bitcoin, an investor might ask? Well, BITO aims to deliver tax efficiencies. Thanks to the current 'Crypto Winter', the value of BITO has suffered this year, falling 49% since the end of 2021. BITO has an Expense Ratio of 0.95%. This makes it relatively expensive for an ETF. If ETF legislation in the future allows for investment in multiple crypto - rather than just Bitcoin - crypto ETFs will be more attractive. ISF tracks the UK's leading market index, the FTSE 100 Index. This tracks the 100 biggest companies in the UK. ISF is out of the Black Rock stable of ETFs. Black Rock is one of the US's big three fund providers. ISF has £10.4bn of shares under management. But, because it is a tracker fund and tracks only 100 companies, it boasts a low Expense Ratio of just 0.07%. Having had poor years of negative return in 2018 and 2020, ISF returned 18.3% in 2021. ISF is available with Capital.com. Founded in 2015, GDX does not invest in the commodity gold directly (as some ETFs do). Rather, it tracks the Amex Gold Miners Index. GDX has investments in 216 companies involved in gold mining globally with total net assets of $593m. 41% of companies covered are based in Canada, 17% in the US, 14% in Australia, 7% in Brazil, 5% in South Africa, 5% in China, and 9% from elsewhere. GDX's Expense Ratio is 0.53%. Since its inception, this ETF has returned 4.84%. GDX's top holding is in Newmont Corp, which claims 12.58% of the total portfolio. ETFs are considered to be lower risk investments than buying individual shares. This is because ETFs are diversified: their value is derived from many hundreds of shares, and thus the impact of a nasty plunge in an individual share value is much reduced. For those interested in value investing, ETFs are a popular asset to gain exposure to a wide range of investment opportunities. ETFs are considered to usually be more tax-efficient than mutual funds. This is because ETFs tend not to involve as many 'taxable events' (as tax professionals call them) as mutual funds. And, in the US at least, ETFs are taxed broadly the same as shares: with ETF dividends taxed as income, and profits on ETF trades subject to capital gains tax. But investors should note that differences in taxation apply to different structures of ETF. Currency and commodity ETFs, for example, can be structured as trusts or limited partnerships. These are taxed differently from equity ETFs. We strongly recommend that investors consults with a tax professional before investing in any ETF. ETFs are generally classed as low-risk investments suitable for long-term holding. Many investors anchor their portfolio with a clutch of ETFs, and diversify with higher-risk assets like individual stocks, commodities and crypto. When it comes to growth potential, on the other hand, few asset classes can beat the best crypto presales. When a crypto is in its presale phase, it means it can be bought before its Initial Coin Offering (ICO). ICO is to the crypto world what IPO is to the stocks world: the official release of the asset onto the market. Still available in its presale phase is Tamadoge (TAMA) - one of the most promising crypto of 2025. Billed as the new Dogecoin, TAMA is an exciting cross between cute memecoin and top video game crypto. In the Tamadoge metaverse, players own a unique NFT virtual pet. They can train and accessorise their pet to compete on the Tamadoge leaderboard and earn TAMA. The 'Tamaverse' combines compelling play-to-earn gameplay with the satisfaction of NFT ownership and trading. And TAMA's presale phase this year has exceeded expectations. The $2m Beta sale is now sold out. And so far in the presale phase almost $10m has been invested. With each new tranche of TAMA made available, the price is going up - so it pays to get in quick. Those with an eye for long-term crypto investment can get hold of TAMA right now in just 4 easy steps: As well as the exhilarating potential for skyrocketing rewards, presale crypto investment comes with some risk. What is reassuring for investors is the certainty that Tamadoge is no rug-pull scam. The smart contracts for TAMA have been audited by Solid Proof. And the Tamadoge team has been KYC-vetted by CoinSniper. TAMA has its first CEX listing confirmed on LBank. And a listing on Uniswap is to follow. Check out our expanded guide to how to buy Tamadoge.

Above we have looked at how to invest in ETFs. We have sought the best place to invest in ETFs by reviewing two brokers that charge zero commission on ETF trades. Also we have given a brief overview of 5 popular ETFs. In stop press news, we have turned our attention to a different asset class altogether: the hottest crypto right now. With the roaring success of the Tamadoge (TAMA) presale, TAMA is looking set to be one of the best emerging cryptos of 2025. Tamadoge - The Play to Earn Dogecoin

How Does Investing in ETFs Work?

How Much Does a Share in an ETF Cost?

What is the Spread Fee?

What are Overnight Fees?

How to Find the Best ETFs to Invest in

Index ETFs

Stock Index ETFs

Sector ETFs

Style ETFs

Bond ETFs

Commodity ETFs

Real Estate ETFs

5 Popular ETFs to Watch Right Now

1. SPDR S&P 500 ETF (SPY)

2. Invesco Solar ETF (TAN)

3. ProShares Bitcoin Strategy ETF (BITO)

BITO was first among Bitcoin ETFs.

4. iShares Core FTSE 100 UCITS ETF GBP (ISF)

5. VanEck Gold Miners UCITS ETF (GDX)

Are ETFs a Good Investment?

How are ETFs taxed?

ETFs vs Presale Cryptos - Which is the Better Investment in 2025?

Min Investment

1,000 TAMA (∼$10+ gas fee)

Max Investment

NA

Purchase Methods

ETH or USDT now; fiat currency soon

Blockchain

Ethereum (ERC-20 token)

Presale Ends

Q4 2022

Conclusion

FAQs

How do I buy ETFs?

Can I invest in an ETF directly?

Are ETFs good for beginners?

Is it smart to just invest in ETFs?

What is the safest ETF to invest in?