Researching how to invest in commodities? Commodities are raw materials or primary agricultural products which can be traded for profit. With the global shortage of natural gas, commodities are big in the news. And it is a little-known fact that investors can buy into natural gas directly via an online broker. But is commodity investing worthwhile? We find out below.

Our focus is on how to invest in commodities for beginners. With our reviews of two relevant brokers, we look at where to invest in commodities easily. We delve into how investing in commodities works generally and check out the best commodities to invest in.

How to Invest in Commodities – 5 Easy Steps

How to invest in commodities? Begin by getting online and finding a regulated broker to invest with.

- ✅ Step 1: Open a trading account with a regulated broker – Many online stock brokers allow investors to try out their service with free demo accounts. We suggest you shop around. Then pick a broker (below we review Capital.com and eToro). Open an account. Supply a few personal details.

- 🔑 Step 2: Verification – Regulations mean new investors must provide proof of ID and address.

- 💳 Step 3: Deposit – Most brokers provide plenty of ways to deposit funds. Credit/debit card, bank transfer and a range of e-wallets are accepted.

- 🔎 Step 4: Search for Commodities – Browse commodities and then view stats and research on individual assets.

- 🛒 Step 5: Buy Commodities – Have you done your research? Spoken to an investment professional to confirm the tax implications? If so, use your broker’s online platform to execute a trading order.

78% of retail investor accounts lose money when trading CFDs with this provider.

Where to Invest in Commodities in 2024

Investors researching how to buy commodities online have plenty of options. Most full-service brokers offer a range of the best commodities to invest in.

Below we outline the services offered by two popular brokers. Both Capital.com and eToro are fully-regulated. And, when it comes to investing in commodities for beginners, both brokers offer friendly layout, plenty of market news and transparent fee structures.

1. Capital.com – Regulated CFD Broker Offering Zero Commission

With 5,600 markets to trade, Capital.com is a CFD (Contracts-For-Difference) and spread-betting specialist. This broker serves 70,000 clients a month from offices in nine countries.

As well as commodities, Capital.com allows its users to invest in stocks, ETFs, forex, and indices. When it comes to investing in commodities, 20 assets are on offer including crude oil, natural gas and gold. Futures are offered in crude oil and carbon emissions. 45% of all assets traded on Capital.com are commodities.

Capital.com charges no commission on investment in commodities. But spread fees apply as well as CFD overnight fees.

All trades with this broker are conducted as Contracts-For-Difference (CFDs). This has the upside of investors being able to go short on assets as well as leverage trades. The downside is overnight fees, which can mount up. CFDs are not suitable therefore for holding long-term positions.

Read more about this broker in our full Capital.com review.

| Number of Commodities | 20 |

| Pricing System | 0% commission + spread fee + CFD overnight fees |

| Cost to Trade Natural Gas | 0% commission + 20 pip spread fee + CFD overnight fees (long: -o.033% short: +0.016%) |

| Deposit Methods | Credit card, wire transfer, Worldpay, Trustly, ApplePay |

| Non-Trading Fees |

No withdrawal fee, no deposit fee |

Pros

Cons

80.61% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider. Like Capital.com, eToro offers a range of top commodities to invest in. 23 are available in all, with futures on offer in palladium, oil, cocoa and wheat. All commodity trades with eToro are conducted as CFDs, and a minimum trade of $1,000 applies (including leverage). CopyTrader is one of eToro's tools that makes it one of the popular social trading platforms across all assets. Investors can copy other, more experienced traders for free with funds they allocate. 150+ commodity traders are available to copy. Also potentially of interest to beginner investors are eToro's Smart Portfolios. These provide a template for diversified investment arranged around a single theme. It is worth noting that now, in the US, eToro customers can trade only Bitcoin, Bitcoin cash, and Ethereum on the platform. Find out more about this broker with our expanded eToro review. Pros Cons

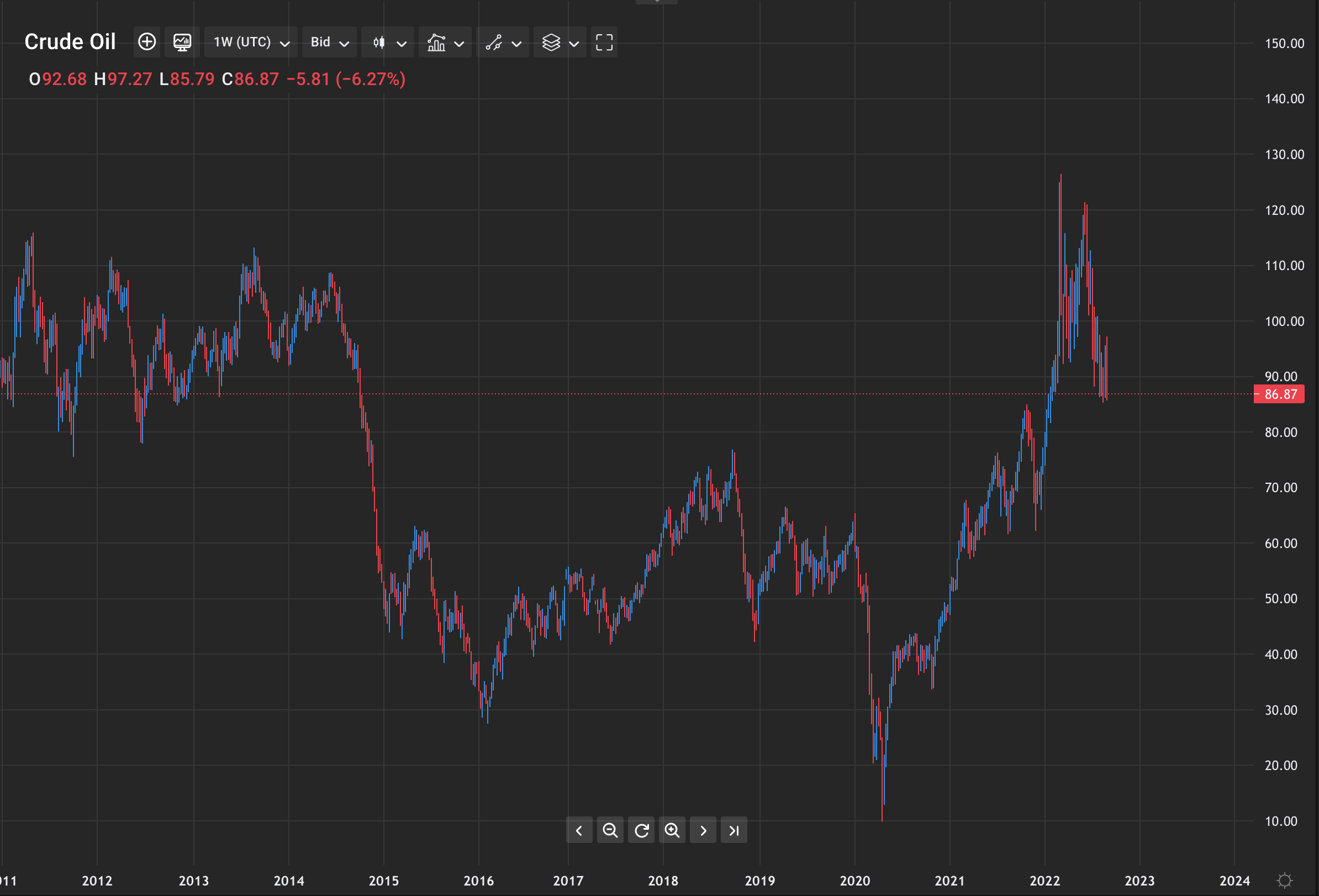

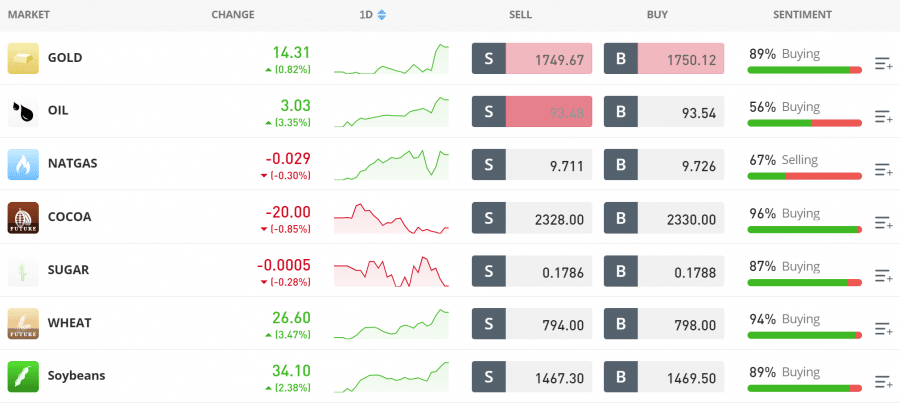

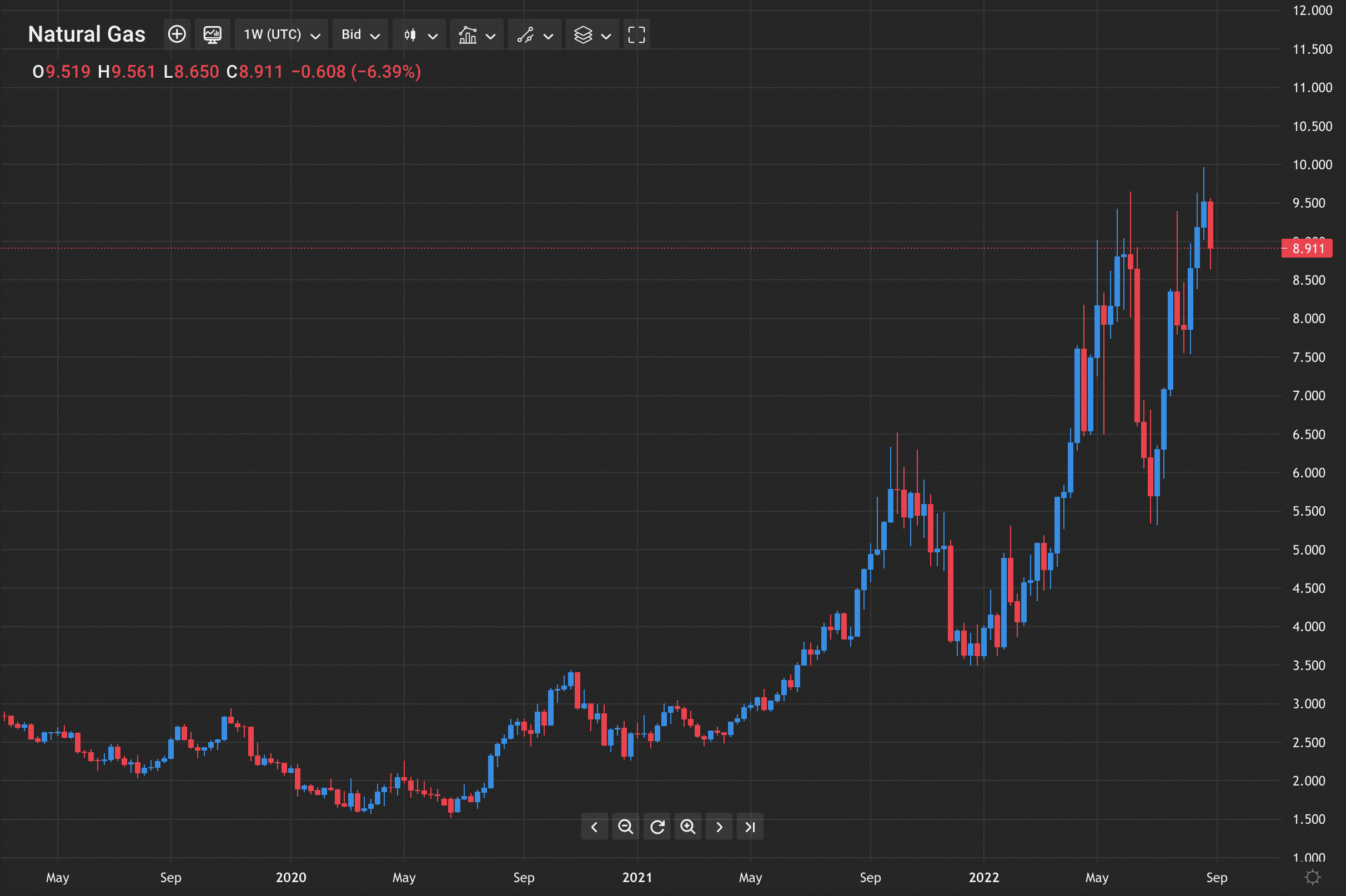

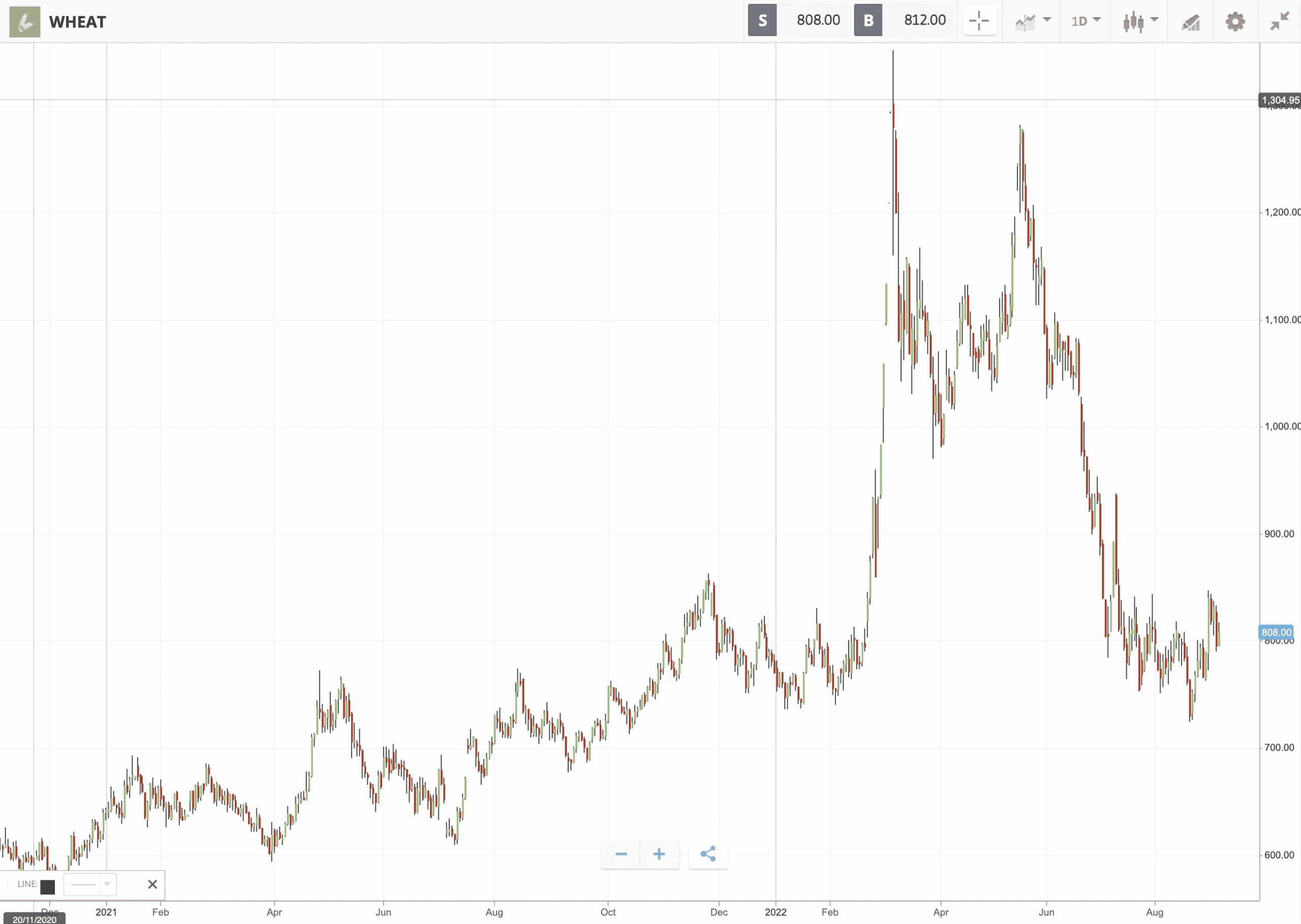

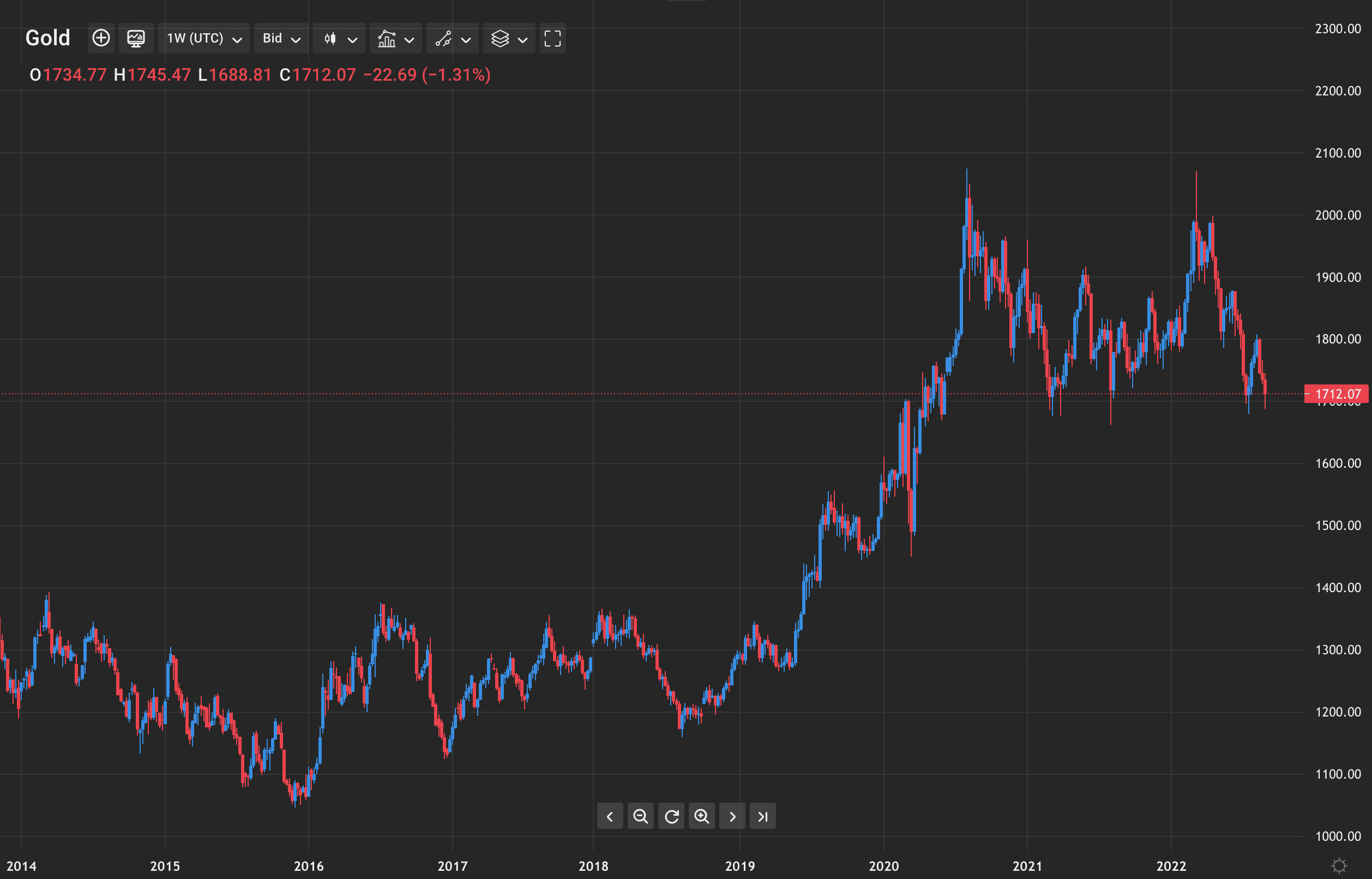

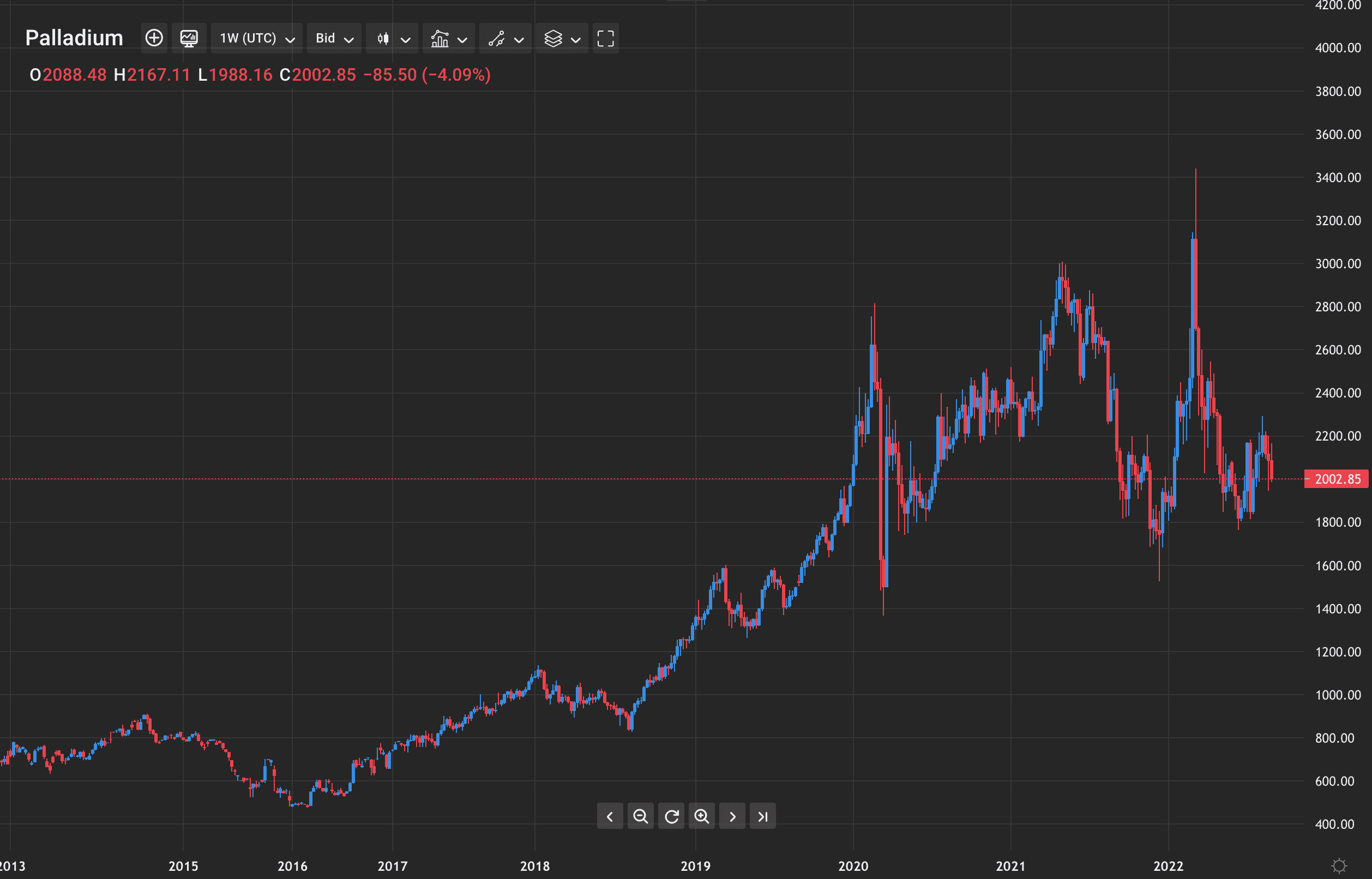

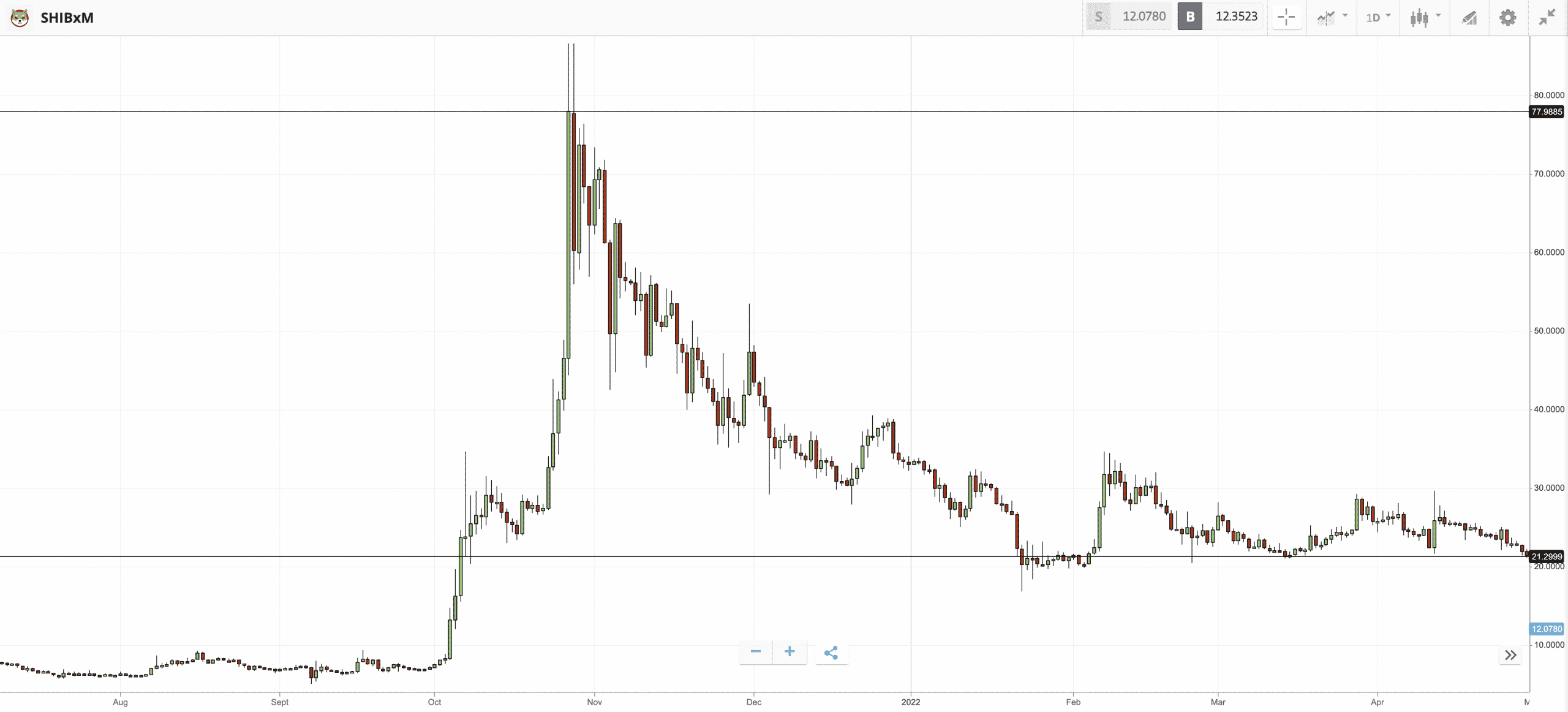

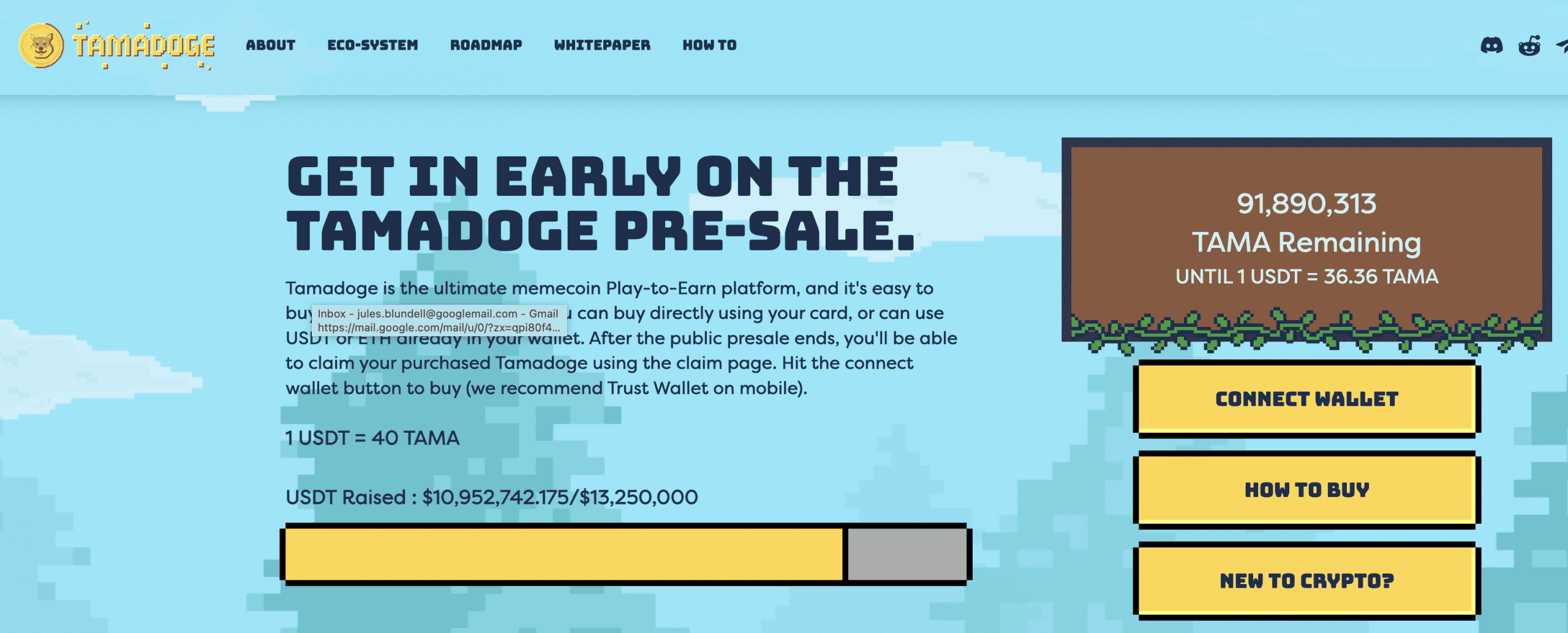

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider. Why invest in commodities at all? Investors scouring the best commodities to invest in should be clear about their priorities. The best way to invest in commodities depends on whether the investor is looking for short-term or long-term gains. For short-term gains, CFDs offer a way to benefit from day-to-day fluctuations in the price of assets. CFDs come with overnight fees which makes them unsuitable for long-term positions. For long-term gains, 'paper commodities' offer lower-risk options. These include stocks of companies that are related to commodities, or ETFs which include these stocks. Or, in the case of precious metals, investors can invest directly in bullion. Investors researching how to trade gold will discover that, in the US, the IRS authorizes precious metal IRAs (Individual Retirement Accounts). These come with strict rules, but offer tax advantages. Investing in commodities means making a selection. Fortunately, there are only roughly 20 commodities available to retail investors. To minimise risk, diversification is a popular strategy. This means: Because commodities are used as raw materials in industry and food preparation, their prices tend to be very sensitive to geo-political events. The Ukraine Crisis, for example, has sent the natural gas and oil sectors into massive volatility. Investors should never assume that a quiet period in a commodity's price history means that the future price will remain stable; this is what makes investing in commodities a high-risk/high-reward enterprise. Below we cast an eye over 5 popular commodity investment choices. Natural gas is The Ukraine Crisis has propelled this commodity onto the news headlines. With Russia blocking gas supplies to Europe, fears over supply have skyrocketed the price of natural gas by 365% since the new year. But, as we can see from the chart below, volatility works both ways. A long investment in natural gas is not a sure thing right now. The price may plummet as geo-political circumstances change: in which case, the CFD option offered by some brokers (like Capital.com and eToro) to go short on commodities would be attractive. With Capital.com, 70% of natural gas traders are buying and 30% are selling. With eToro, 56% have buy positions, and 34% are selling. Along with natural gas, this commodity has hit the headlines recently too, with Europe's G7 leaders trying to reduce their dependence on Russian oil. Behind Saudi Arabia, The second-largest crude oil exporter in the world is Russia. As Russia invaded Ukraine, the price of Brent crude oil surged to $126 a barrel by March, 2022. Since then it has fallen back to $86 a barrel over fears that global demand for oil will be slack. This is because China's influential economy is not firing on all cylinders thanks to Covid industry shutdowns. Investors can trade directly in oil using CFDs. But beginners might choose to buy oil stocks instead and gain more limited exposure to this volatile commodity. Find out more with our full guide on how to trade oil. The Ukraine Crisis impacted wheat prices dramatically. February 2022 saw the price of wheat soar from under $800 to top $1,000 until the third week of June 2022. As we can see from the price chart below, the price has since fallen just as dramatically to its original channel around $750-$800 mark. Gold is unusual as a commodity as it used as a currency in its own right. It also has industrial applications and is, of course, worn as jewellery. Gold is commonly held to offer a safe haven in times of economic turmoil. It is also believed to offer a solution to how to invest during inflation. In February, 2022, the price of gold rose from under $1,800 an oz to almost $2,000 by late March. However, since then the price has fallen back to the $1,700 mark. Meanwhile, inflation continues to soar globally. Over the long term, gold has offered excellent price performance. $100 invested in gold in 1973 would now be worth around $1,800. And, with only 57,000 metric tons of gold left in the earth to mine, investors might expect upwards price pressure to increase in the future as the world's gold mines deplete. Since 2016, the price of palladium has risen from around the $600 mark to top $3,000 earlier this year. That is an increase of roughly 500%. Now the price has fallen back to just above $2,000. 40% of global palladium production is handled by Russian firm Nornickel. So expect further price volatility as the Ukraine crisis plays out. Sensible investing means understanding that all financial assets have risks. A common way to assess an asset is to look at its risk profile. To judge whether commodities are a good investment, risk is the factor to bear in mind. There is no getting around this simple relationship between risk and reward. At the high-risk end of the spectrum, even the most profitable crypto come with the highest risk profile of any asset. (See below for stop press news on a new crypto called TAMA - billed as the next doggy crypto to follow in Shiba Inu's footsteps and perhaps one of the best crypto to trade for long-term growth. Investors can buy Tamadoge now in its presale phase.) At the low-risk end of the spectrum, money market mutual funds come with a very low risk profile. This type of mutual fund invests in high-quality, short-term debt and aims to return a fixed income of a couple of percent per annum. Commodities are considered to offer a high risk/reward profile. They are not as risky as financial options or crypto, but are more risky than shares, bonds and ETFs. As with crypto, volatility is the name of the game with commodities. It is therefore important to balance investing in commodities with other asset types. It is also worth observing that some commodities are historically less volatile than others. Gold, for example, has a reputation for steady-ish long-term growth, although its price has fallen back recently. The three most important things to understand about commodity taxation are that: Broadly, commodities investing is taxed according to how the commodity is held and what investment vehicle is used. Exchange-Traded Funds, for example - which can track commodity indices or hold commodity-related companies - are structured in different ways. And different structures - like Commodity Grantor Trusts or Limited Partnerships - offer different taxation schemes. In the US, a precious metal IRA (Individual Retirement Account) offers tax relief on funds invested in bullion - provided the bullion is kept in an IRS-approved repository and a legal custodian is appointed. In the UK, CFD commodity trades may offer tax advantages. For those figuring out how to invest in commodities, it is important to consult a tax professional before taking the plunge. General guidance on the taxation of investment is provided online by sovereign authorities: Investments in commodities are a reasonable way of diversifying a stock/ETF-based portfolio - as well as gaining exposure to some high-risk/high-reward assets. But, when it comes to growth potential, few assets can match long-term investments in crypto. This is particularly the case with the best crypto presales. A 'presale' is when a crypto is on sale before its Initial Coin Offering (ICO). And right now one of the most promising crypto is available for eagle-eyed investors: TAMA, the meme/utility coin cross that the industry is billing as the next Dogecoin. TAMA is the in-house token for the world of Tamadoge - a play-to-earn/NFT metaverse where players possess their own unique virtual pets, and build them up to compete for TAMA. The 'Tamaverse' draws on the spectacular success of the Tamagotchi virtual pets of the past, as well as the phenomenal cutesy appeal of doggy crypto like Dogecoin and Shiba Inu. The Tamadoge presale is running until Q4 2022. And the earlier investors buy, the lower the price of TAMA. Currently almost $11m has been committed - with just $13m of TAMA available in this phase. Security-conscious investors will be glad to hear that Tamadoge smart contracts have been audited by specialists Solid Proof. And CoinSniper has vetted the Tamadoge team. TAMA has its first CEX listing confirmed on LBank. And a listing on Uniswap is to follow. Check out our expanded guide to how to buy Tamadoge.

Above we have looked at how to start investing in commodities. We have reviewed two popular brokers that offer zero commission on commodity trades, as well as plenty of support for beginners in particular. Further, we have outlined the difference between investing for the long-term with 'paper' commodities, and how to trade commodities over the short-term with commodity CFDs. Commodities are considered to offer a high risk/reward ratio compared to less dynamic stocks, ETFs and bonds. But even more potentially rewarding is, of course, the hottest crypto right now. With its Beta presale having sold out ahead of schedule, we have shone the spotlight on TAMA as one of the best emerging cryptos of 2024. Tamadoge - The Play to Earn Dogecoin

2. eToro - Regulated Broker with Zero Commission and Social Trading

Number of Commodities

23

Pricing System

0% commission + spread fee + CFD overnight fees

Cost to Trade Natural Gas

0% commission + 10+ pips + CFD overnight fees (long: -0.032% short: +0.018%)

Deposit Methods

Wire transfer, credit card, online payment wallets

Non-Trading Fees

Variable currency conversion fee, zero deposit fee, $5 flat withdrawal fee

How Does Investing in Commodities Work?

How to Find the Best Commodities to Invest in

5 Best Commodities to Watch Right Now

1. Natural Gas

2. Crude Oil

3. Wheat

4. Gold

5. Palladium

Are Commodities a Good Investment?

What Risk Profile do Commodities Offer?

How are Commodities Taxed?

Commodities vs. Presale Cryptos - Which is the Better Investment?

Min Investment

1,000 TAMA (∼$10+ gas fee)

Max Investment

NA

Purchase Methods

ETH or USDT now; fiat currency soon

Blockchain

Ethereum (ERC-20 token)

Presale Ends

Q4 2022

Conclusion

FAQs

How do beginners invest in commodities?

How do you directly invest in commodities?

What is the best commodity to invest in?

Is investing in commodities a good idea?

What commodities will rise in 2022?