The increase in the Earth’s temperature has become a major concern today. As people and businesses need more energy than ever, the search for alternatives to fossil fuels is at an all-time high. Fortunately, clean energy can provide a solution, making this sector ready for significant growth in the coming years.

With that in mind, this guide takes an in-depth look at how to invest in clean energy. We’ll cover what clean energy is, why this energy source is so important, and how investors can purchase clean energy assets today – with low trading fees.

How to Invest in Clean Energy – 4 Easy Steps

Those wondering how to invest $1,000 (or any amount) in clean energy must first understand the investment process. Detailed below are the four simple steps investors can take to start investing in clean energy today:

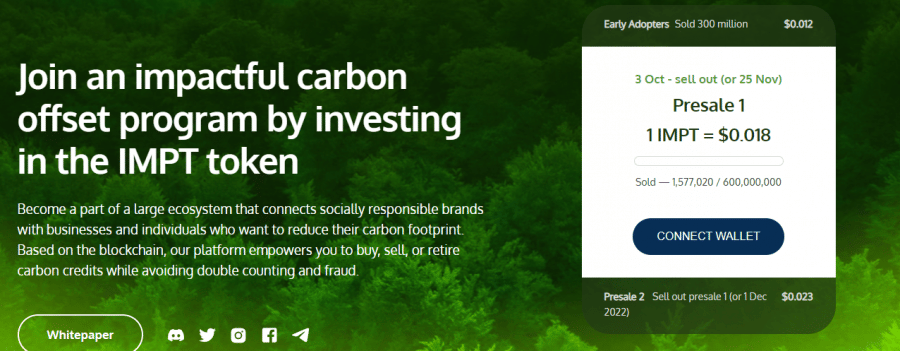

- Step 1 – Identify a Clean Energy Asset like IMPT: The first step is to find a suitable clean energy investment. An example would be the blockchain-based platform IMPT, which looks to improve the accessibility of the carbon credits market to individuals and companies worldwide.

- Step 2 – Set Up a Crypto Wallet: Those who wish to invest in IMPT must then set up a cryptocurrency wallet. There are many to choose from, although since $IMPT tokens use the ERC-20 standard, MetaMask is an excellent option.

- Step 3 – Link Wallet to IMPT Presale Platform: Investors must link their MetaMask wallet by clicking the ‘Connect Wallet’ button on the homepage and then following the on-screen instructions.

- Step 4 – Buy IMPT Tokens: Once the wallet is connected, investors can buy $IMPT tokens through the presale using their credit/debit card or several supported cryptos (e.g. BTC, ETH, SOL).

The Basics of Investing in Clean Energy

To grasp clean energy investing, investors need to know what ‘clean energy’ really means. According to the National Grid, clean energy is an energy source that does not harm the atmosphere and produces minimal or no greenhouse gas emissions. Thus, the term ‘clean energy’ is frequently used in place of ‘green energy’ or ‘renewable energy.’

There is a slight difference between clean energy and green energy, since green energy is derived from natural sources, whereas clean energy doesn’t have to be. However, most clean energy sources do come from the planet itself, with some common examples being:

- Wind power

- Solar power

- Hydroelectric power

- Geothermal energy

- Tidal energy

- Biomass energy

The future of this energy source looks exceptionally bright, as TWI Global reports that over 100 cities worldwide now generate at least 70% of their energy from clean, renewable sources. This growth in clean energy production has also provided the potential for financial gain – leading to the emergence of ‘clean energy investing’.

Investing in clean energy is a relatively simple concept to understand, as it refers to purchasing financial instruments that have exposure to this energy source in some way. For example, an investor can buy stocks in a solar power company or invest in a clean energy ETF.

Since these financial instruments have their values tied to the demand for clean energy, investors can benefit as the world gradually shifts away from fossil fuels. This demand is expected to rise dramatically in the years ahead, so clean energy investments have become more popular than ever.

How Does Investing in Clean Energy Work?

Like sustainable investing, clean energy investing requires in-depth research and analysis to ensure that the chosen asset fits the individual’s investment criteria. In general, there are three key steps to follow for those wondering how to invest in clean energy:

Research Potential Assets

The first step is to find a clean energy investment opportunity. As noted in the section above, there are various asset classes that investors can choose from during this step of the process. However, the vital thing to bear in mind is that the asset must relate to clean energy generation in some way.

For example, investors may wish to consider green investment funds, as these tend to contain a selection of stocks from companies operating in the clean energy sector. Another option is to purchase individual stocks that derive some (or all) of their revenue from clean energy sources – for example, a wind power company.

Analyze Returns Potential

Once a clean energy asset has been found, it must also be analyzed to ensure it’s a suitable opportunity from a financial perspective. Investors can complete this analysis in many ways, such as by reviewing the price chart (technical analysis) or considering the asset’s fundamentals.

Those looking to invest in stocks can also find analyst estimates on many leading financial reporting sites. Although these estimates aren’t gospel, they do provide insight into the sentiment that certain ‘market experts’ have on an asset. If these are combined with other forms of research, it can help clarify whether a security could provide returns or whether that’s unlikely.

Partner with a Trading Platform to Invest

Finally, once an asset has been found and its investment prospects have been analyzed, it’s time to make the investment. Many trading platforms now offer assets for those interested in socially responsible investing, meaning that investing in clean energy is more accessible than ever.

Platforms like eToro offer a range of stocks, ETFs, and cryptocurrencies to trade, meaning investors can construct a well-diversified portfolio. However, the key thing to remember is that the chosen trading platform must be regulated by a reputable entity such as the FCA, ASIC, CySEC, or FinCEN – as this will help protect investors from fraudulent activity.

Why Do People Invest in Clean Energy?

So why are clean energy investment funds (and other eco-friendly instruments) so popular in today’s world? To answer this question, detailed below are four popular reasons why people invest in clean energy:

Makes a Positive Environmental Impact

Naturally, one of the main reasons people invest in clean energy is because it helps promote positive environmental change. By purchasing clean energy assets, investors can help raise publicity and drive the share price higher, allowing clean energy companies to expand.

As they expand, these companies can use their capital to increase their positive impact on the environment. So for investors looking to begin ESG investing, these clean energy assets are a great starting point.

Potential for Financial Gain

Although some investors may purchase clean energy assets for altruistic reasons, most will still be looking to generate a return on their investment. Interestingly, many clean energy assets have produced exceptional returns in recent years due to the rapid rise in demand for this energy source.

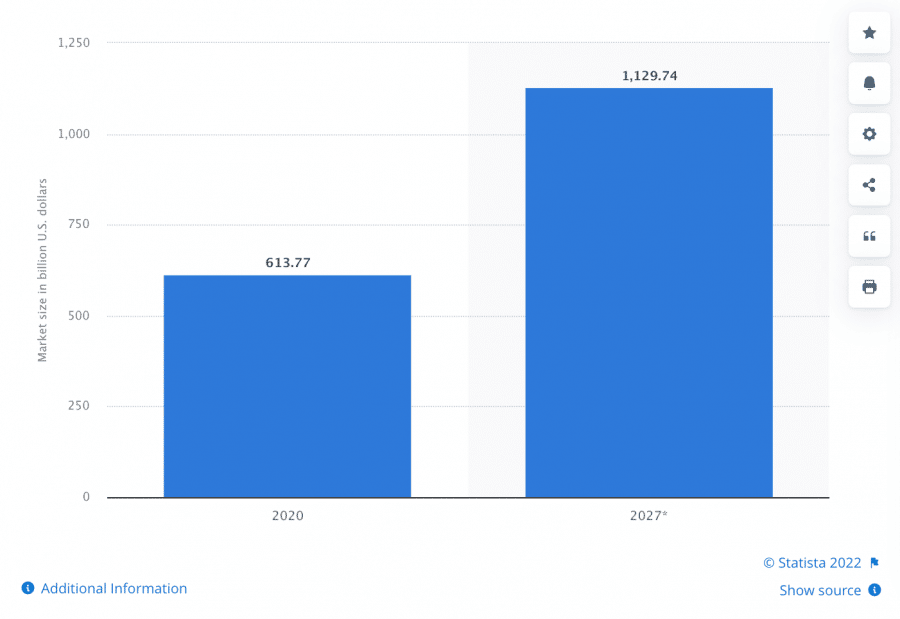

According to Statista, the renewable energy market is expected to value over $1.1 trillion by 2027 – nearly double what it was in 2020. As a result, we’ll likely see more companies launching that look to leverage the popularity of clean energy, which will provide an array of possibilities for investors.

Helps Promote Technological Innovation

Most of the popular clean energy companies to invest in utilize cutting-edge technology to remove any carbon dioxide emissions related to the energy-generation process. However, there are always ways these technologies can be improved and made even more efficient.

That’s where clean energy investing comes in, as companies will strive to be at the forefront of the sector to entice investment. To achieve this, companies must ensure their clean energy technology is better than their competitor’s – a process which helps promote innovation across the entire sector.

Can Aid in Portfolio Diversification

Finally, purchasing renewable energy stocks can be a great way to increase portfolio diversification – especially if the portfolio is tilted toward stocks that rely on fossil fuels. Although the reputation of fossil fuels is overwhelmingly negative these days, many companies worldwide still depend on them – or even generate revenue from them.

Thus, if an investor has exposure to fossil fuel-based companies (e.g. BP, Royal Dutch Shell), they can boost their portfolio diversification by purchasing some clean energy assets – helping optimize their risk/return profile.

Types of Clean Energy Investments

A key consideration for those researching how to invest in clean energy is the type of asset to be purchased. Detailed below are five popular asset classes that clean energy investors may wish to consider:

Stocks

There are now hundreds of clean energy stocks to invest in, thanks to the rapid growth in the sector as a whole. Climate change stocks and renewables stocks are just two types to consider, both of which tend to have exposure to clean energy sources.

There are also several clean coal companies to invest in, which is another option for investors. These companies use technology that allows them to burn coal without polluting the atmosphere. Although emissions can’t be removed entirely, these companies are far more eco-friendly than ‘traditional’ coal companies.

Cryptocurrency

Those who invest in cryptocurrency will be glad to know that this asset class has also improved its reputation regarding energy use. Projects like Ethereum, Solana, and Tezos now use technologies that mean energy requirements are minimal.

Moreover, many crypto projects, such as Algorand, actively purchase carbon offsets to remove their carbon footprint – making them an option for crypto investors focused on clean energy.

ETFs

Exchange-traded funds (ETFs) are pooled investment vehicles that are publicly traded, meaning investors can buy shares in them and benefit from price fluctuations. These clean energy investment funds are an excellent way for investors to gain access to a diversified portfolio without worrying about composition or re-balancing.

Those interested in ETF trading can find an abundance of clean energy ETFs, with many focusing solely on one power source. For example, the Invesco Solar ETF invests at least 90% of its capital in solar power companies.

Futures

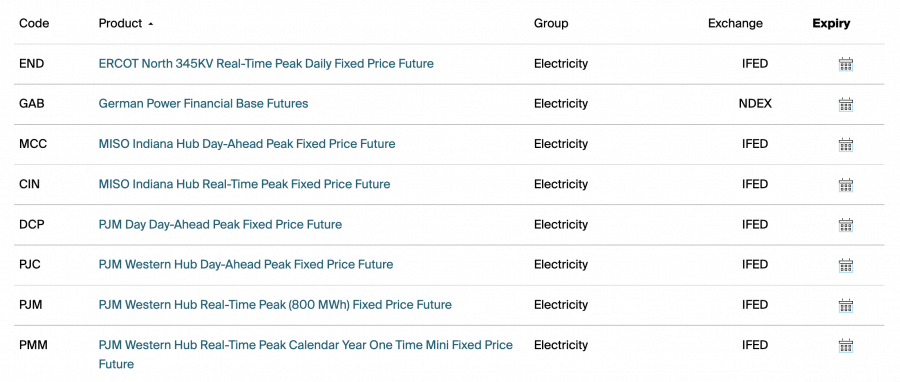

Experienced investors may wish to purchase futures contracts based on renewable energy sources. The Intercontinental Exchange (ICE) offers over 1,000 futures contracts on commodities such as natural gas and renewables.

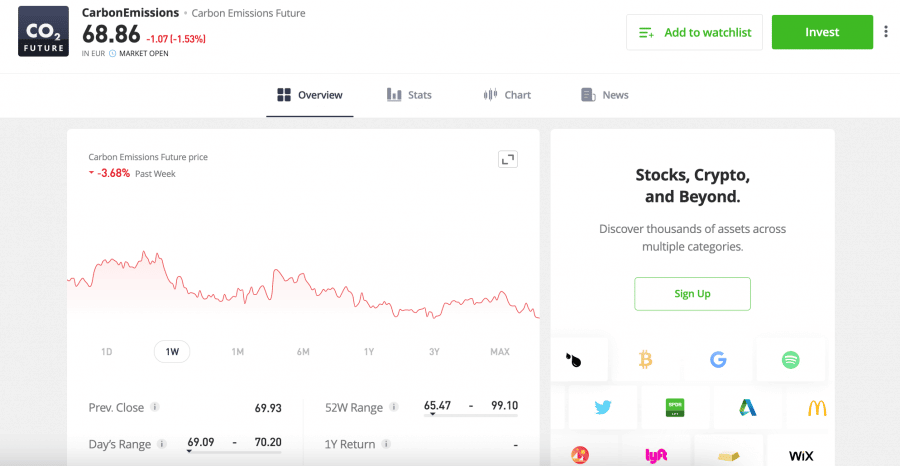

Some of the best futures trading platforms may also offer clean energy futures. For example, eToro users can invest in the platform’s ‘Carbon Emissions Future’ contracts to gain exposure to CO2 prices in Europe.

Pre-made Portfolios

Finally, clean energy investors can also place their capital in pre-made portfolios. These portfolios contain some of the most popular clean energy stocks to invest in, offering an option for those looking to invest passively.

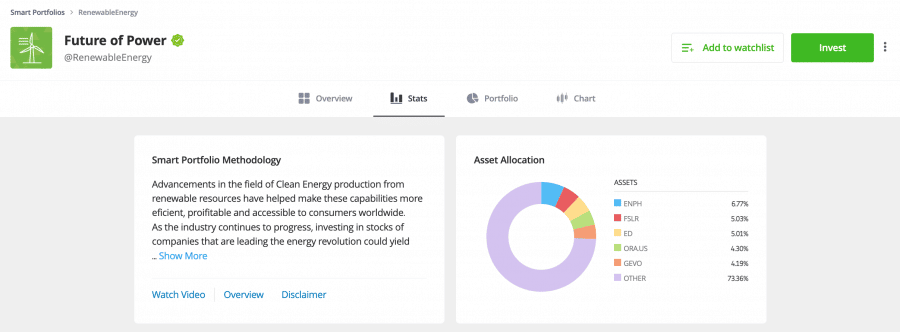

An example of a pre-made clean energy portfolio is the ‘Future of Power’ Smart Portfolio by eToro. This portfolio invests in 30 renewable energy companies, such as Gevo Inc and FuelCell Energy, providing exposure to the clean energy sector’s growth.

Popular Clean Energy Investments

Those interested in green energy investing will be glad to know that there are now hundreds, if not thousands, of assets to consider. However, due to the number of potential investments, it can be challenging to narrow down the selection.

To help streamline this process, detailed below are five popular clean energy investments to consider in 2025:

1. IMPT (IMPT)

One of the most popular clean energy investments on the market right now is IMPT. IMPT is a blockchain-enabled carbon credits ecosystem that aims to make buying, selling, and acquiring carbon credits accessible to the masses. Through IMPT’s groundbreaking approach, individuals can earn carbon credits through everyday shopping activities.

This is achieved through IMPT’s partnership with 10,000+ leading brands, such as Apple, Hugo Boss, and Forever 21. When an individual shops with one of these brands, they earn $IMPT tokens, which they can then exchange into carbon credits. Since these carbon credits are structured as NFTs, they can be easily traded on IMPT’s marketplace.

According to IMPT’s whitepaper, these credits can also be ‘retired’, which helps reduce the holder’s carbon footprint. In return, the holder will receive a unique digital art NFT, shared with its creator. These NFTs can also be traded on the secondary market, providing another way to generate income.

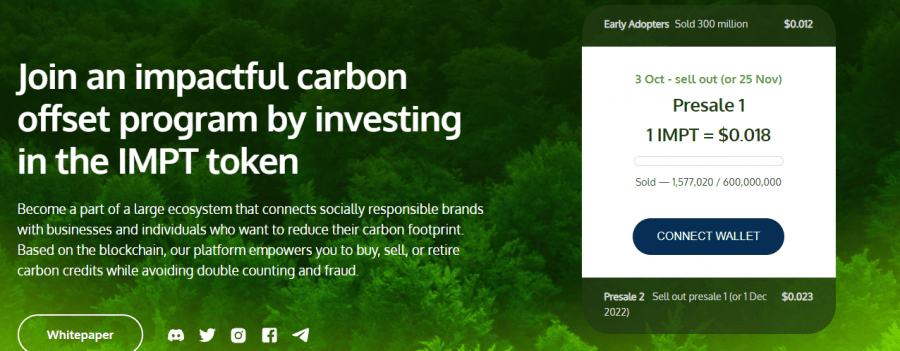

These features simply scratch the surface of this new platform, which is currently going through its presale phase. During this phase, investors can buy $IMPT tokens for just $0.018 – the lowest price they will be available. Given that only 600 million tokens are allocated to this phase, it’s widely expected that IMPT’s presale could sell out in record time.

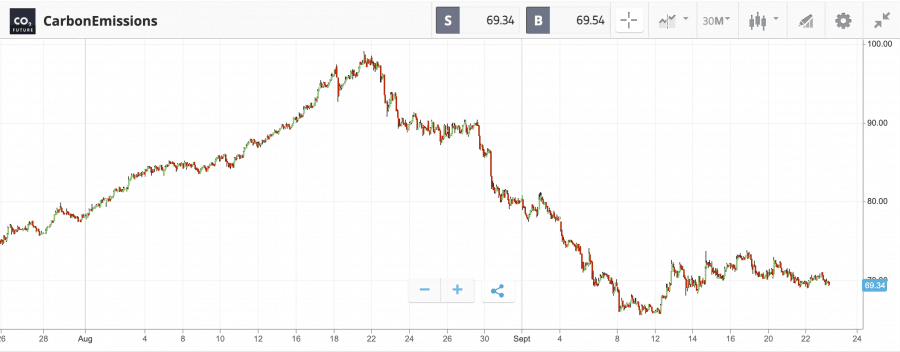

Carbon Emissions Futures

Online trading platform eToro has begun offering a ‘Carbon Emissions Future’ contract, which provides exposure to the price of carbon credits in the EU. As the demand for these credits rises, so does the value of the Carbon Emissions Future contracts, providing scope for capital gains.

The minimum investment size for a non-leveraged position in these contracts is $1,000. However, eToro users can invest from just $100 if they opt to use 10X leverage.

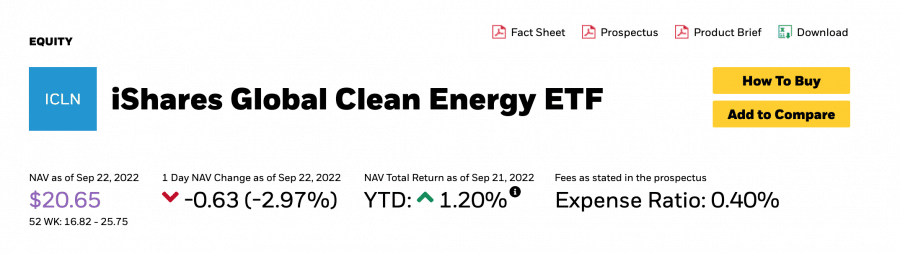

iShares Global Clean Energy ETF (ICLN)

The iShares Global Clean Energy ETF contains a selection of clean energy companies to invest in, offering an easy way for investors to gain exposure to the sector in a passive manner. Those wondering how to trade ETFs will be glad to know that this ETF is readily available through many leading trading platforms.

This ETF is so popular with clean energy investors because it only invests in companies involved in clean energy production or in developing clean energy equipment and technologies. The ETF has also returned 27.64% in the past three years, highlighting its effectiveness from a financial perspective.

Ethereum (ETH)

Clean energy investors looking to enter the crypto market may wish to buy Ethereum. The Ethereum network recently transitioned to a Proof-of-Stake (PoS) consensus protocol, which removed the need for energy-intensive ‘mining’ and drastically reduced the network’s energy requirements.

To put this into perspective, the Ethereum network now uses over 99% less energy than before. So, although Ethereum isn’t actively involved in clean energy generation, it does provide a ‘greener’ option for crypto investors.

Brookfield Renewable Partners (BEP)

Brookfield Renewable Partners is a Canada-based company that operates a range of hydroelectric plants, wind farms, and solar facilities. This makes it one of the world’s largest renewables companies, capable of generating 21,000 megawatts of energy.

The BEP share price rose by 212% between March 2020 and February 2021, yet has been ranging ever since. Although the price has undoubtedly been affected by rising inflation and interest rate hikes in the US, many believe this company has a bright future ahead.

eToro ‘Future of Power’ Smart Portfolio

Finally, clean energy investors may also wish to consider the ‘Future of Power’ Smart Portfolio by eToro. As mentioned earlier, this portfolio contains 30 companies involved in the renewables sector, making it easy for investors to gain exposure to the sector’s growth.

Although 2022 has been challenging for the portfolio, it did return an impressive 71.09% in 2020. Moreover, the minimum investment in this portfolio is only $500, making it more accessible than most mutual funds.

78% of retail investor accounts lose money when trading CFDs with this provider.

Where to Invest in Clean Energy?

However, one popular platform that investors may wish to consider is eToro. eToro is an online broker serving over 28 million clients worldwide. One of the reasons eToro is so widely used is its strict regulation from tier-one entities like the FCA, ASIC, CySEC, FinCEN, and FINRA.

Clean energy investors will be glad to know that eToro offers a variety of asset classes to trade, including stocks, ETFs, currencies, cryptos, and more. It is worth noting that now, in the US, eToro customers can trade only Bitcoin, Bitcoin cash, and Ethereum on the platform. Since eToro is primarily a CFD broker, positions can be opened with no commissions, as eToro’s fee is included in the spread. Moreover, eToro clients can also employ up to 30:1 leverage on certain assets.

The minimum investment in stocks and ETFs is just $10, although this rises to $500 for eToro’s ‘Smart Portfolios’. These pre-made portfolios are popular with investors who aim to invest passively and don’t have the time or know-how to pick their own assets. Another benefit of these portfolios is that no management fees are charged, making them highly accessible.

Those searching for the best investment apps may also find eToro appealing since the minimum deposit requirement is just $10. Deposits can be made via credit/debit card, bank transfer, or e-wallet – with full support for PayPal, Skrill, and Neteller. Finally, investors can even begin with eToro’s free demo account feature to gain experience before trading with real money. eToro also offers one of the best investment apps for beginners with the same functionality as the website platform.

| Pricing Structure | 0% commission + variable spread; 1% flat-fee on crypto trades |

| Deposit Fees | Free for USD deposits; 0.5% conversion fee for non-USD deposits |

| Tradable Assets | Stocks, indices, ETFs, currencies, commodities, cryptocurrencies |

| Cost of Investing in Carbon Emissions Future CFDs | 0% commission + market spread |

| Supported Deposit Methods | Bank transfer, credit/debit card, PayPal, Skrill, Neteller, Rapid Transfer, Payoneer |

78% of retail investor accounts lose money when trading CFDs with this provider.

How to Invest in Clean Energy – Tutorial

Before concluding this guide on how to invest in clean energy, let’s take a closer look at the investment process itself. As mentioned earlier, $IMPT tokens are a popular asset amongst clean energy investors, as they provide exposure to the growth of the IMPT platform, which looks to revolutionize the carbon credits market.

With that in mind, the steps below highlight how investors can buy $IMPT tokens through the project’s presale phase using a laptop, smartphone, or tablet.

Step 1 – Set Up a Crypto Wallet

Since $IMPT is an ERC-20 token, investors must set up a crypto wallet to store tokens post-purchase. We recommend using the MetaMask wallet, as it’s free to download and can be set up in minutes.

Simply head to MetaMask’s website, click ‘Download’, and follow the on-screen instructions to open the wallet.

Step 2 – Acquire Cryptocurrency (Optional)

Investors can buy $IMPT using a credit/debit card, meaning there is no requirement to own crypto beforehand. However, investors who prefer to use crypto can acquire some from many of the best altcoin exchanges.

IMPT’s platform allows investors to buy $IMPT tokens using BTC, ETH, MATIC, SOL, and BNB. However, it’s vital to purchase slightly more crypto than is necessary to cover any associated network costs.

Step 3 – Link Crypto Wallet to Presale

Navigate to IMPT’s homepage and click ‘Connect Wallet’. In the pop-up that appears, choose the relevant wallet provider and follow the on-screen instructions to make the link.

Step 4 – Buy IMPT Tokens

Once the crypto wallet has been connected, investors are all set to buy IMPT. This is simply a case of entering the number of $IMPT tokens to be purchased and choosing the desired approach, whether that be through FIAT currency or crypto.

After everything has been double-checked, confirm the exchange, and the corresponding number of $IMPT tokens will be transferred to the linked crypto wallet.

How to Invest in Clean Energy – Conclusion

In conclusion, this guide has provided a comprehensive overview of how to invest in clean energy, diving into what clean energy is, the importance of this energy source, and the various assets that investors may wish to consider.

There’s no doubting that the demand for clean energy sources will continue to rise in the years ahead, due to the huge damage that fossil fuel-based processes are causing to the world’s atmosphere. In turn, this should create an abundance of opportunities for clean energy investors – making this an exciting time for environmentally-conscious individuals.