Those with access to capital of $50k have plenty of options in terms of choosing suitable investment products.

In addition to diversification, the investor should consider adopting a dollar-cost average strategy, rather than investing the entire $50k in one lump sum.

In this guide, we discuss the best way to invest $50k across a variety of assets with various levels of upside potential and risk.

11 Best Ways to Invest $50k in 2022

The 11 best ways to invest $50k are listed below for further consideration:

- FightOut – Best Way to Invest $50k and receive Purchase Bonuses of up to 25%

- Dash 2 Trade – Diversify $50K In a Top Crypto Analysis Platform

- Stocks – Create a Long-Term Portfolio of Stocks

- ETFs – Invest in a Basket of Assets in a Diversified Way

- 401(k)s and IRAs – Maximize the Tax Benefits Available to US Residents

- REITs – Invest in a Diversified Portfolio of Real Estate

- Commodities – Consider Hard and Soft Commodities to Hedge Against Stocks

- Crypto Interest Accounts and Staking – Earn Passive Income on Crypto Investments

- Copy Trading – Day Trade and Invest Passively by Copying a Seasoned Trader

- Bonds – Buy Government or Corporate Bonds and Earn a Fixed Rate of Interest

- NFTs – Flip Popular NFTs via Online Marketplaces

Read on to learn more about the above investments to ensure that suitable assets and markets are chosen.

A Closer Look at the Best Ways to Invest $50,000

$50k is a suitable amount of capital to create a diversified portfolio of assets. As such, in the sections below, we offer insight into the best way to invest $50k across 10 core markets.

1. FightOut – Best Way to Invest $50k and receive Purchase Bonuses of up to 25%

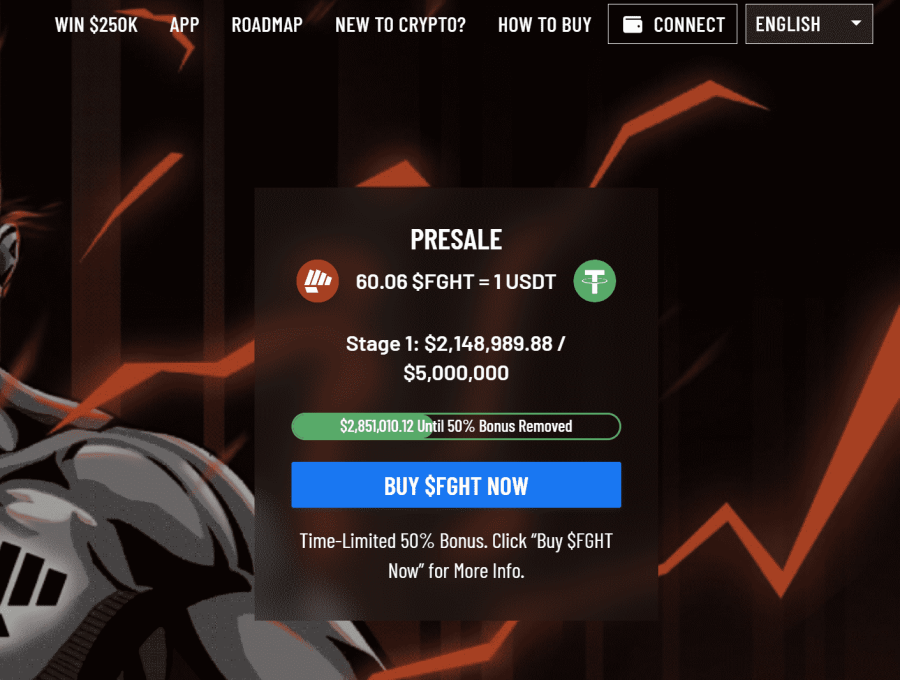

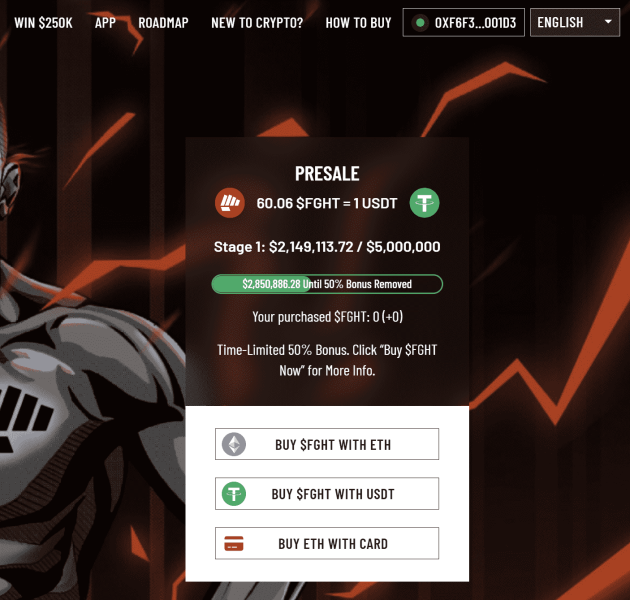

FightOut has already raised over $2.3 million USDT within just a few days of its presale launch. At press time, $FGHT is available for purchase at a low price of $0.0167 per token. While the token price is expected to rise further, investors should consider buying these tokens while they still have a chance.

FightOut has devised an industry-leading fitness app for promoting a fitness lifestyle and ultimately empowers users to earn rewards for doing their workouts.

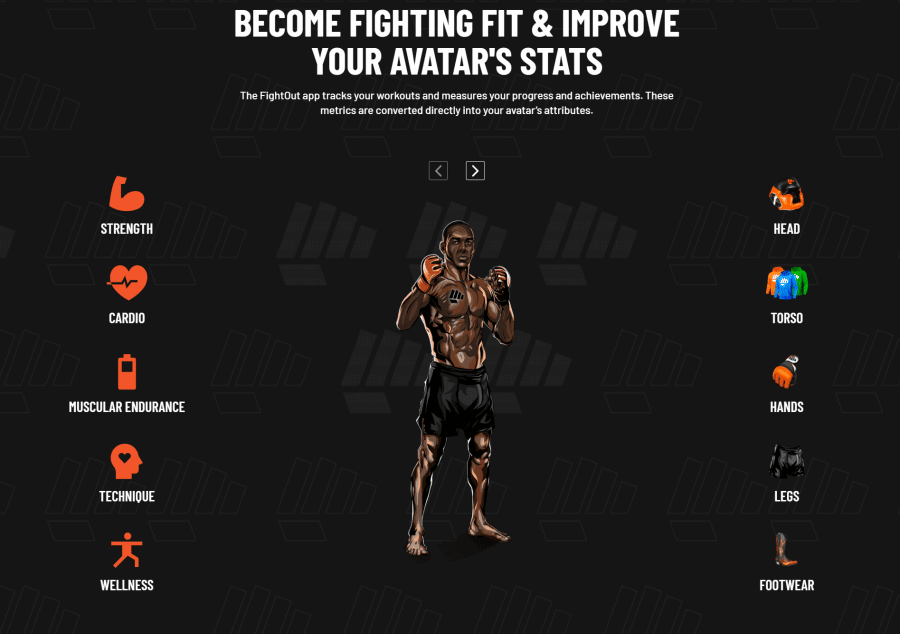

The project also built a new-age metaverse to incentivize users by gamifying fitness. Thus, users can make their own NFT avatars on the project’s metaverse. These soulbound avatars will improve in direct correlation with the users’ real-life fitness metrics. Also, users would have an opportunity to compete with other members of FightOut’s community.

The project uses its in-app, off-chain currency called REPS to reward its users. Investors can use REPS to avail membership discounts, buy cosmetic NFTs, and so on. Buyers can read the project’s whitepaper to get a wider understanding of its features.

Tokenomics & Purchase Bonuses

$FGHT is an ERC-20-based limited supply token that is central to FightOut. From its total supply, 9 billion tokens can be bought via the project’s presale stages.

Investors can use $FGHT tokens to participate in FightOut’s exciting leagues and tournaments. Furthermore, buyers can buy REPS using $FGHT. Investors using $FGHT to buy REPS would receive an extra 25% REPS.

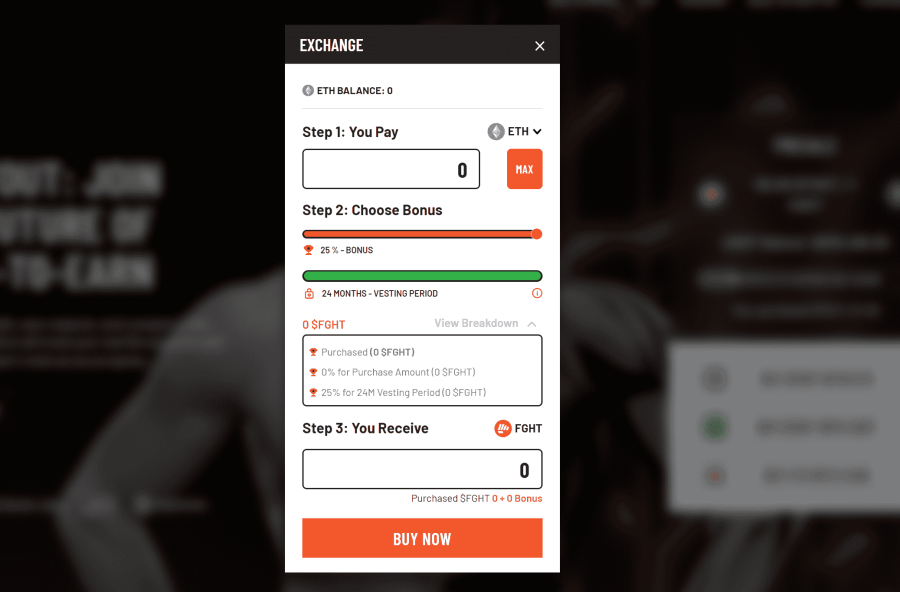

To further incentivize buyers, FightOut has also offered purchase bonuses. Buyers can get bonuses from 10% that only need an investment of $500 along with 6 months of vesting. Also, investors can unlock exciting membership rewards if they stake $FGHT.

Presale Performance

The project’s presale performance thus far has already been quite impressive. FightOut has raised over $2.3 million USDT in just a few days.

Interestingly, investors have a chance to get up to 50% additional tokens as rewards during the ongoing presale stages. Buyers can also join FightOut’s Telegram channel to get the latest updates.

| Presale Started | 14 December 2022 |

| Purchase Methods | ETH, USDT |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

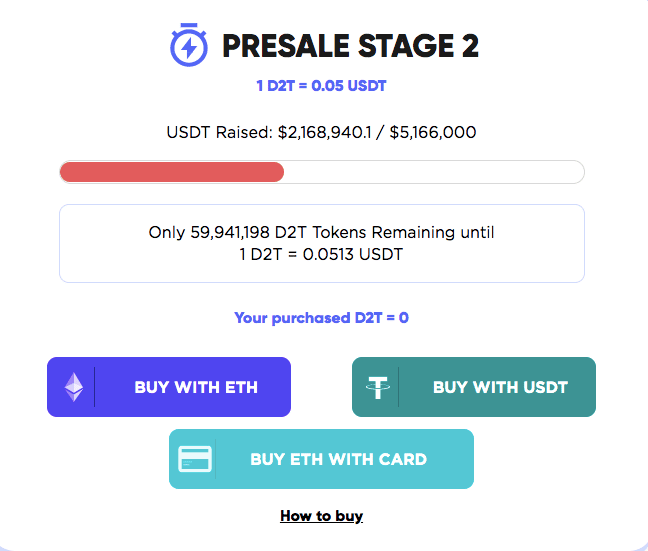

2. Dash 2 Trade – Diversify $50K In a Top Crypto Analysis Platform

Currently trading on presale, D2T will eventually be used to purchase exclusive trading signals and tools on the Dash 2 Trade platform dashboard. Dash 2 Trade will offer exclusive trading indicators, such as socio-cultural price movements, which track real-time social media trends and movements to suggest potentially profitable trades.

The platform looks to incorporate community-wide features, as the Dash 2 Trade whitepaper states that there will be weekly competitions where participants can compete to win free D2T token rewards. One of the key features which beginners may rely on is the backtesting platform – which allows one to practice future trading strategies without risking real funds.

To join the presale, an investor must purchase at least 1,000 D2T tokens. With the current D2T token price set at $0.05, the minimum purchase amount equates to $50. However, D2T will increase to $0.0662 throughout 9 presale rounds, meaning that investors may have to pay $62 to access 1,000 tokens by the end of the presale. To incentivize investors to access the presale, Dash 2 Trade is hosting a $150,000 D2T giveaway to one lucky participant that buys D2T during the presale.

| Presale Started | October 19 |

| Purchase Methods | ETH, USDT, Transak |

| Chain | Ethereum |

| Min Investment | 1,000 D2T |

| Max Investment | N/A |

To stay updated with all the developments of this new cryptocurrency project, subscribe to the Dash 2 Trade Telegram Channel.

3. Stocks – Create a Long-Term Portfolio of Stocks

In addition to crypto, stocks are also worth considering when assessing how to invest $50k. This marketplace offers ample choice in terms of risk and reward, not least because some online stock brokers provide access to thousands of companies both in the US and overseas.

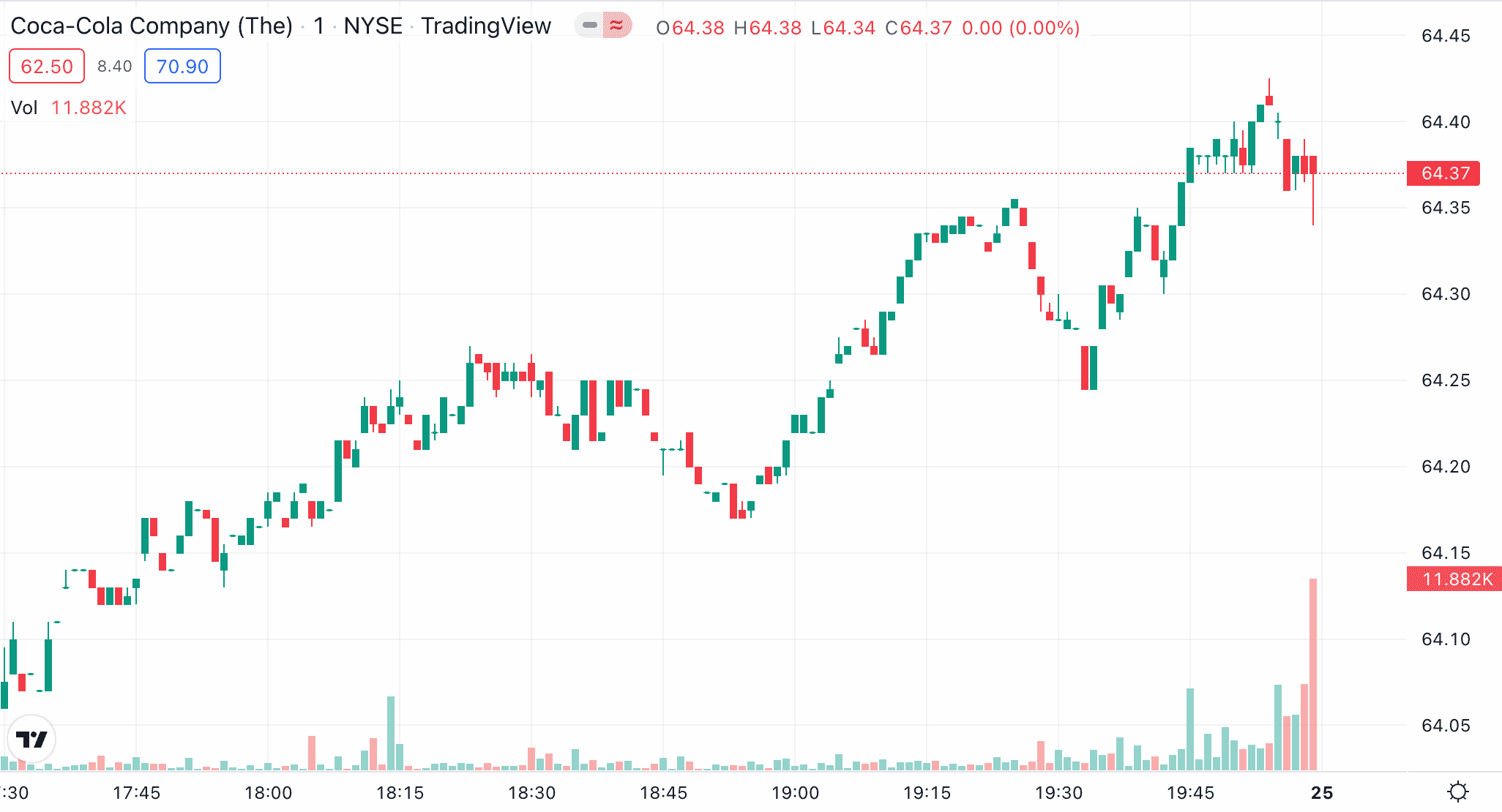

Regarding the latter, investors will often look to focus on leading blue-chip stocks, such as Johnson & Johnson, Coca-Cola, and the Bank of America. Blue-chip stocks carry a large market capitalization and are established in their respective field. While growth is often somewhat slower when compared to growth stocks, blue-chip companies offer consistency.

Tech stocks are popular too, with the likes of Amazon, Apple, Microsoft, and Meta Platforms leading this segment of the stock space. Although tech stocks are considered more volatile than blue chips, the growth potential is much higher. For example, over the prior five years of trading, Apple and Amazon have generated gains of 300% and 170%, respectively.

In comparison, Johnson & Johnson and the Bank of America have grown by 25% and 41% respectively, over the same period. Investors might also consider exploring growth stocks, should they wish to target above-average gains, and are prepared to take on more risk to achieve this goal.

One of the most successful growth stocks of the prior decade is undoubtedly Tesla, which, over the prior five years, has seen its share price value increase by more than 1,000%. Growth stocks are somewhat similar to the previously discussed crypto presales, as they enable investors to gain exposure to a company while it is still young.

Another area of this market to consider when assessing the best way to invest $50k is dividend stocks. This offers the investor an opportunity to generate wealth in two ways. This includes capital gains if the stock price of the company increases, alongside a dividend payment that is typically distributed every three months.

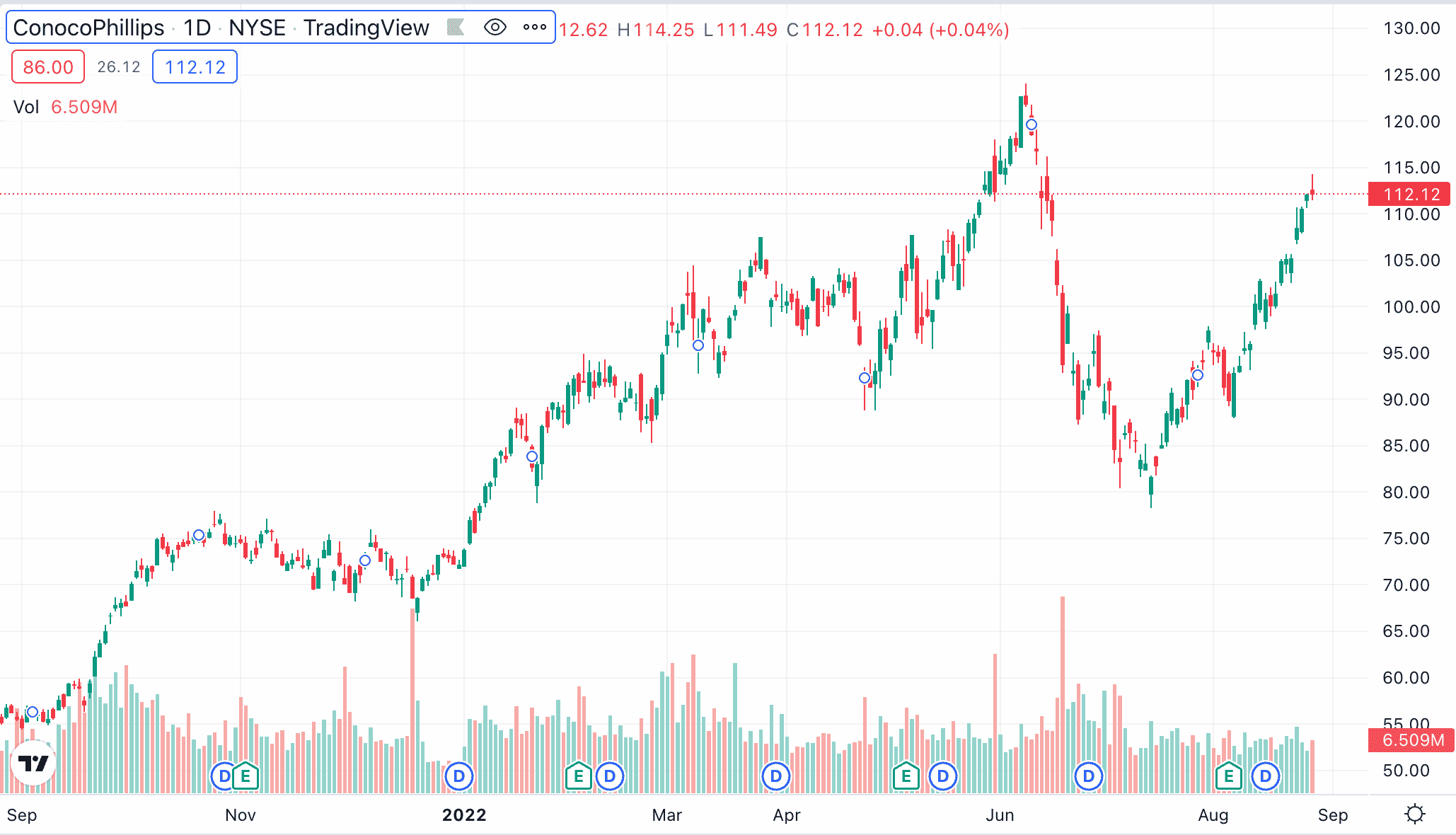

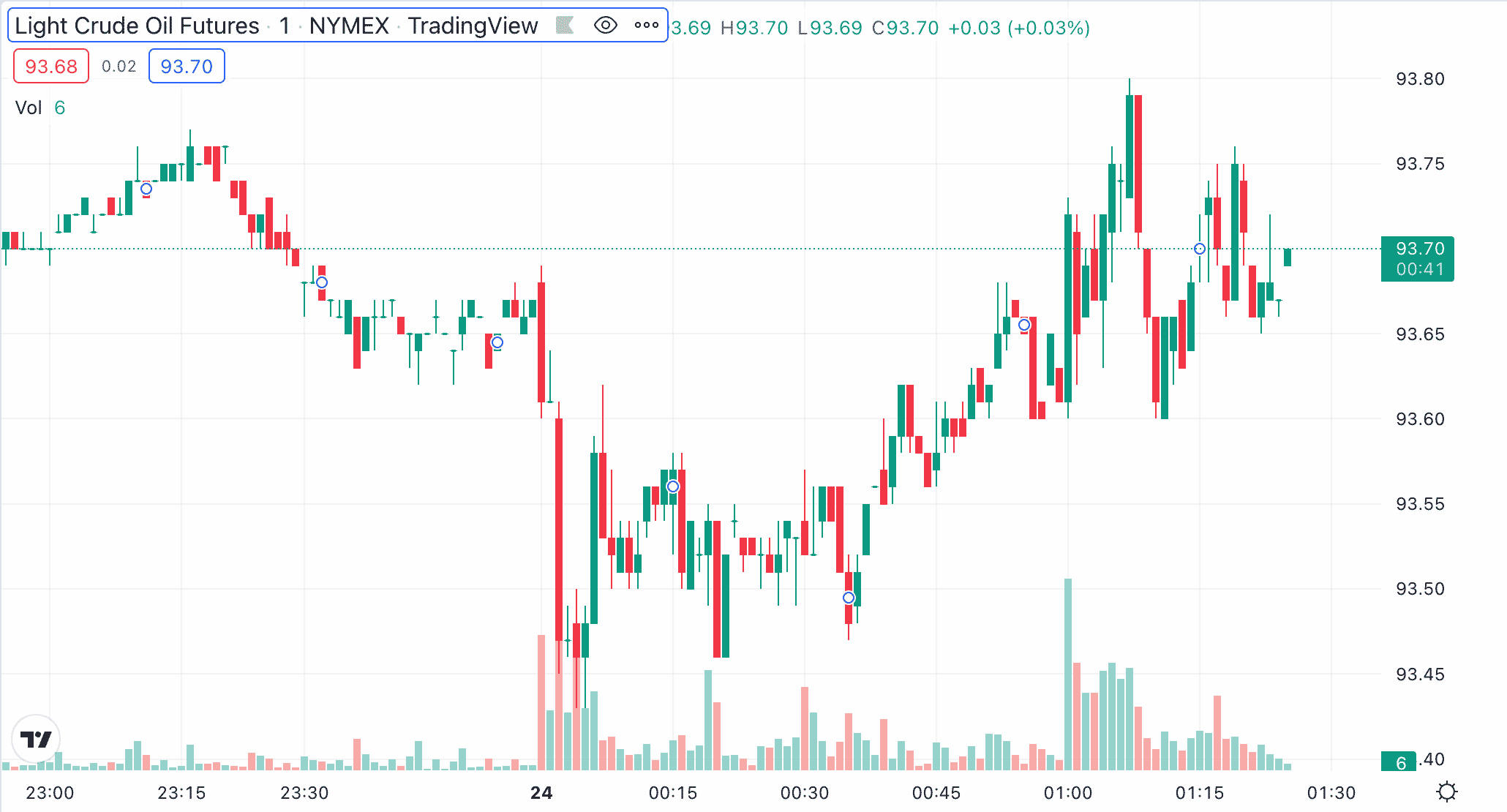

Due to supply chain issues and increasing global tensions, oil stocks are also popular in the current economic landscape. After all, oil prices have remained high throughout 2022. Examples of popular oil stocks include Shell and ConocoPhillips, which have generated growth of 62% and 100% in the prior 12 months of trading.

It is also worth exploring stocks from outside of the US markets to achieve maximum diversification.

Learn More: Those with $50k to invest in might consider reading our guide on demo stock trading accounts.

4. ETFs – Invest in a Basket of Assets in a Diversified Way

ETFs are particularly popular with long-term investors that possess little to no knowledge of how the investment landscape works. Moreover, ETFs are also suitable for those that simply do not have the required time to research the markets actively. In a nutshell, ETFs offer diversified access to virtually any asset imaginable, via a third-party provider.

Some of the largest and most cost-effective ETF providers in this space include SPDR, iShares, and Vanguard. The idea is that by making a single investment, the ETF will track the chosen market on behalf of its investors. The ETF provider will actively manage the basket of assets and, when needed – rebalance and/or weight the portfolio.

For example, we briefly mentioned that when assessing the best way to invest $50,000, a portfolio of dividend stocks might be suitable. However, this would require the investor to spend ample time researching each company and placing suitable orders via their chosen online broker.

Moreover, the investor would need to regularly monitor each company, to ensure that its dividend policy remains attractive. In comparison, ETFs like the iShares MSCI World Quality Dividend offer access to 170 dividend stocks through a single investment. Not only that, but the ETF holds dividend stocks from a variety of domestic and international markets.

This includes the US, UK, Saudi Arabia, Italy, Germany, and more. Some of the most popular holdings in this portfolio include Microsoft, Cisco, Unilever, Qualcomm, and Amgen. This ETF is, however, just one example of an investment product that offers instant diversification without needing to actively manage the portfolio.

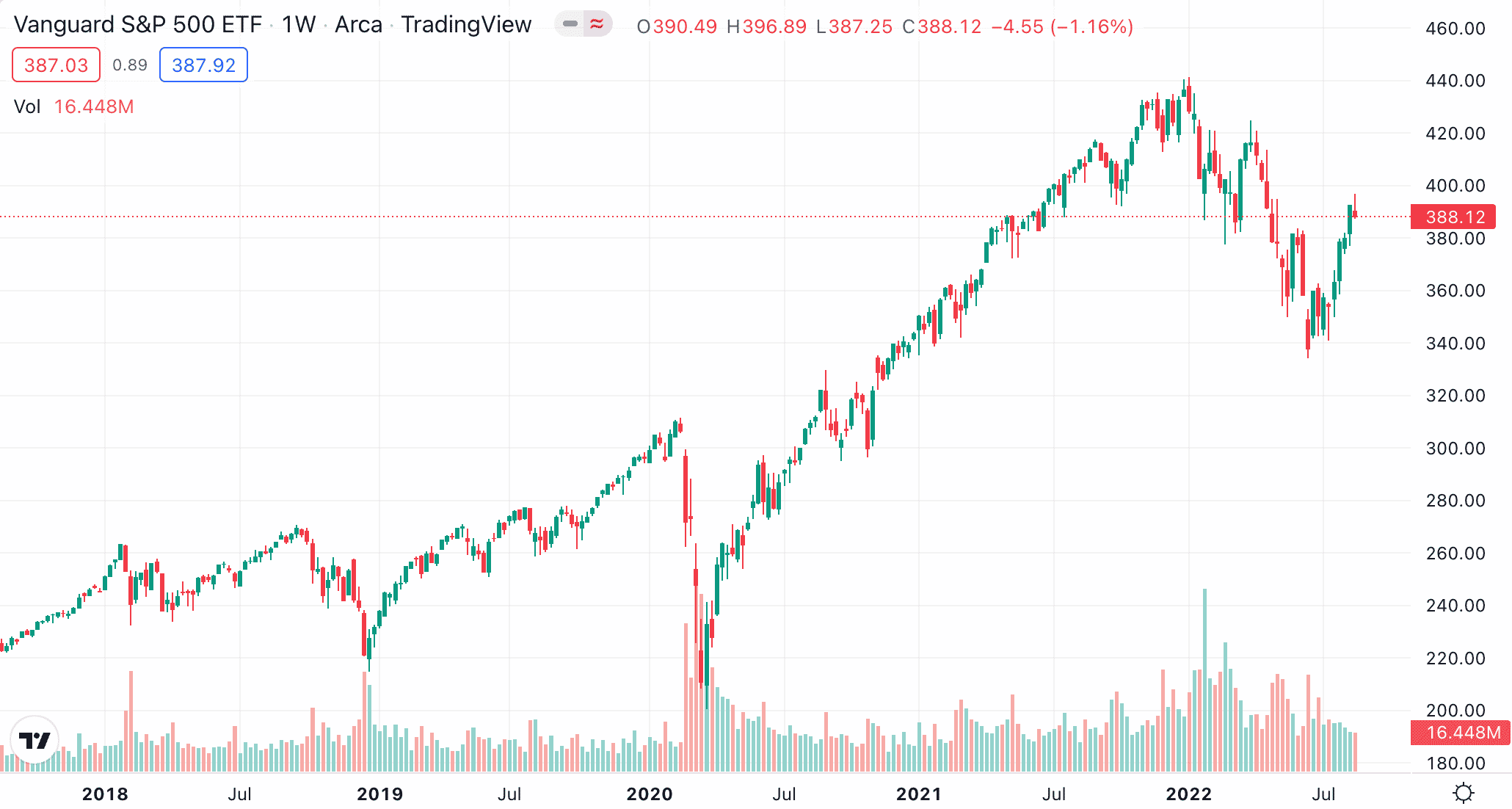

With that said, perhaps the most popular ETFs in this space are those that track the S&P 500. For example, the Vanguard S&P 500 ETF enables investors to gain exposure to 500 different US companies listed on both the NASDAQ and NYSE. Some of the largest holdings on this index fund – which is weighted by market capitalization, include Apple, Tesla, Microsoft, and Amazon.

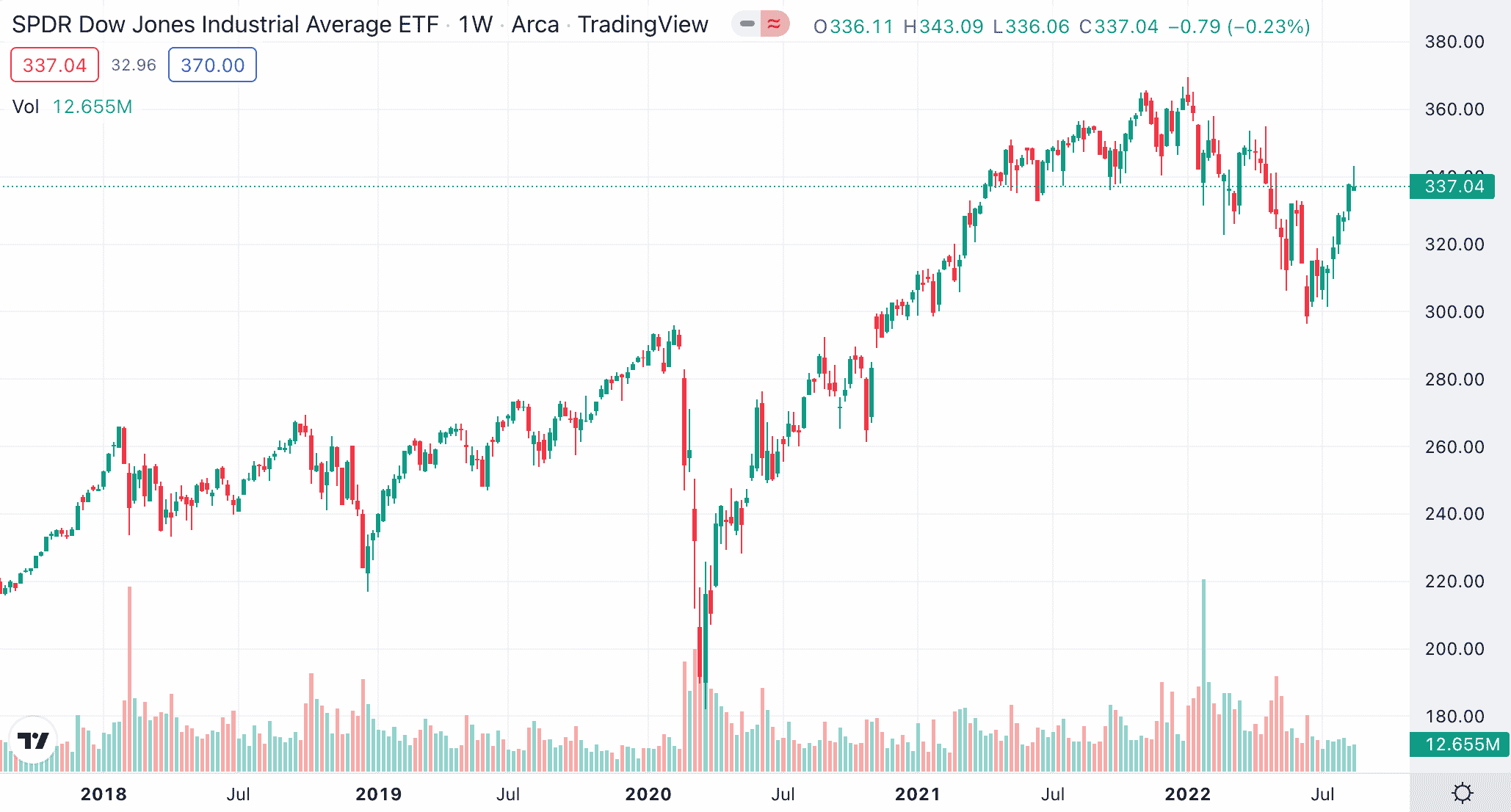

The Vanguard S&P 500 ETF will rebalance the portfolio every three months. Moreover, investors will receive their share of any dividend payments that the ETF collected throughout the respective quarter. Other index funds that are popular with ETF investors include the Dow Jones, Russell 2000, and NASDAQ Composite.

We should also mention that ETFs offer access to asset classes other than just stocks. For example, ETFs are often the go-to instrument for those wishing to gain exposure to precious metals like gold and silver. This is because the ETF will personally invest in the respective commodity, which means its value will be linked to its global spot price.

It is also possible to gain exposure to other commodities through ETFs, with markets covering everything from crude oil and natural gas to wheat and corn. To proceed with an ETF investment, the investor should consider what minimum account balances apply. For example, investing in the S&P 500 directly with Vanguard requires $3,000.

5. 401(k)s and IRAs – Maximize the Tax Benefits Available to US Residents

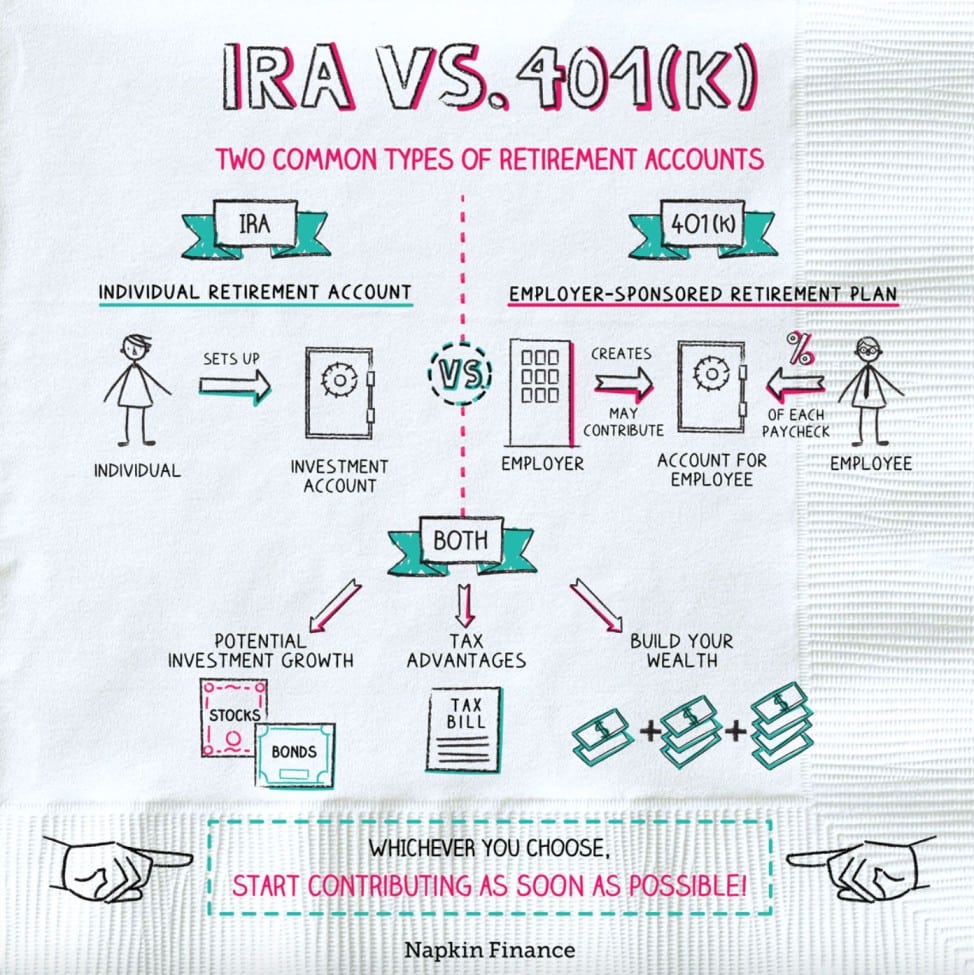

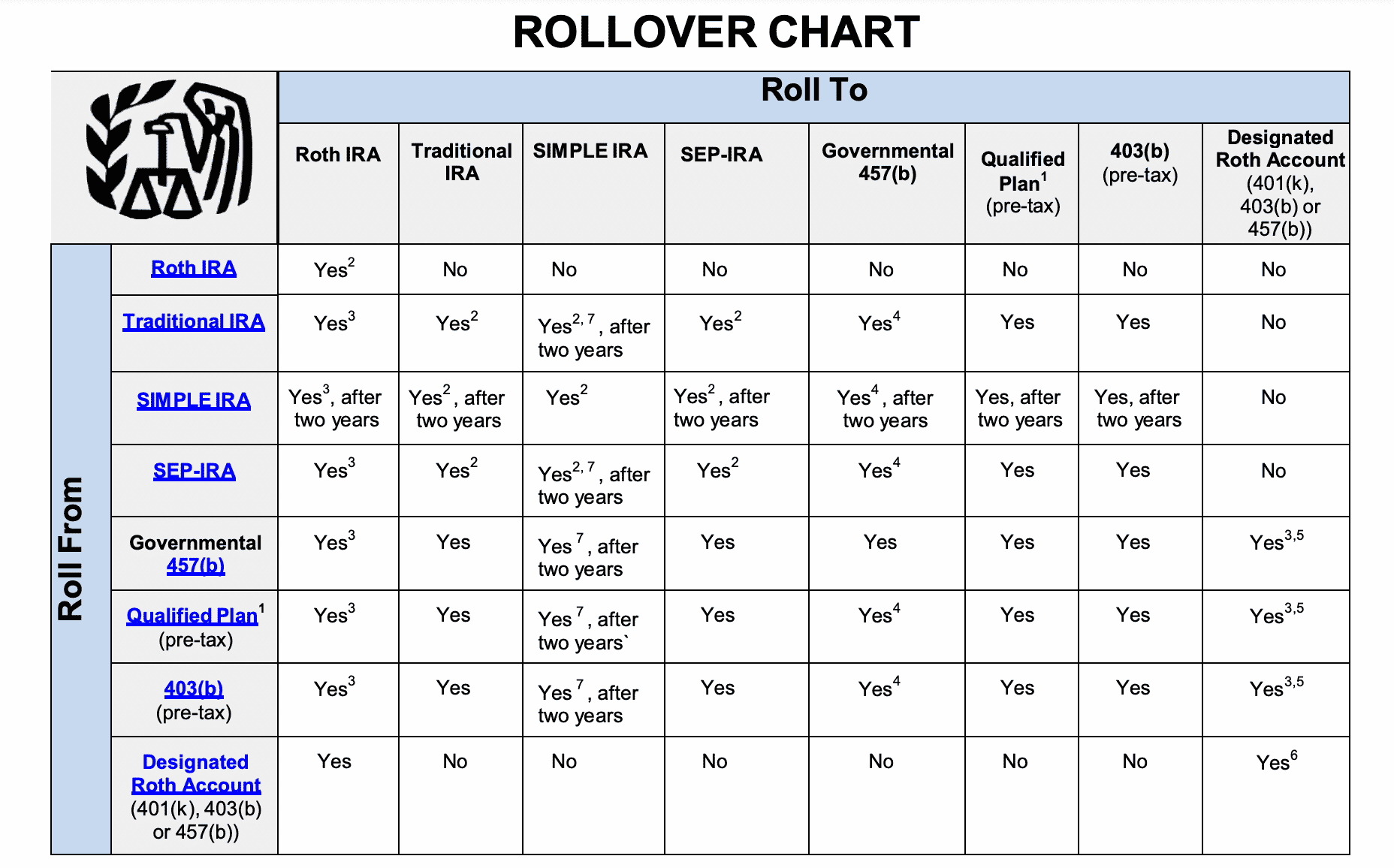

Those based in the US should make it a priority to learn about the benefits of investing $50k into a tax-efficient account. In this regard, there are two core options available to US investors – 401(k)s and IRAs. The latter is offered by many online stock brokers with an annual limit of $6,000, or $7,000 if the investor is aged at least 50 years old.

Either way, by investing via an IRA, this comes with solid tax advantages. The tax efficiency afforded to the investor will depend on whether they opt for a Roth or traditional IRA. The latter enables the investor to defer tax on the investments that they make until withdrawals are made at the age of retirement.

Roth IRAs, on the other hand, enables the investor to pay the tax on their investments at the time of the trade. This option will suit younger investors with time on their side, not least because all withdrawals made from the IRA upon retirement will be tax-free. In other words, over the course of several decades, the growth of investments will likely outpace the contributions made.

Hence, this is why Roth IRAs are favored by long-term investors over their traditional counterparts. When it comes to 401(k)s, this option also comes in the form of a Roth and traditional version. However, 401(k)s are actually offered by US employers. This means that the investor can inject money into the financial markets directly from their salary.

401(k)s come with a much higher annual limit of $20,500, or $27,000 for those aged at least 50s years old. Furthermore, and perhaps most importantly, some employers in the US will match the contributions made by the employee, up to a certain limit. This is often capped at 3% annually – meaning that by maximizing the $20,500 limit, the employer would match $615.

While at first glance this might not sound like a significant amount, it is important to remember that any matching contributions should be viewed as free money. Consider this – based on the matching contributions of $615 annually for 30 consecutive years at a target growth rate of 10% per year (in line with the S&P 500 since 1926), this would be worth over $127,000 at retirement.

Perhaps the only drawback to 401(k)s is that oftentimes, employers offer a very limited number of investment options. This should, however, at the very least include access to leading index funds like the S&P 500 and Dow Jones. If the company is publically listed, the 401(k) will likely also offer access to the respective stock.

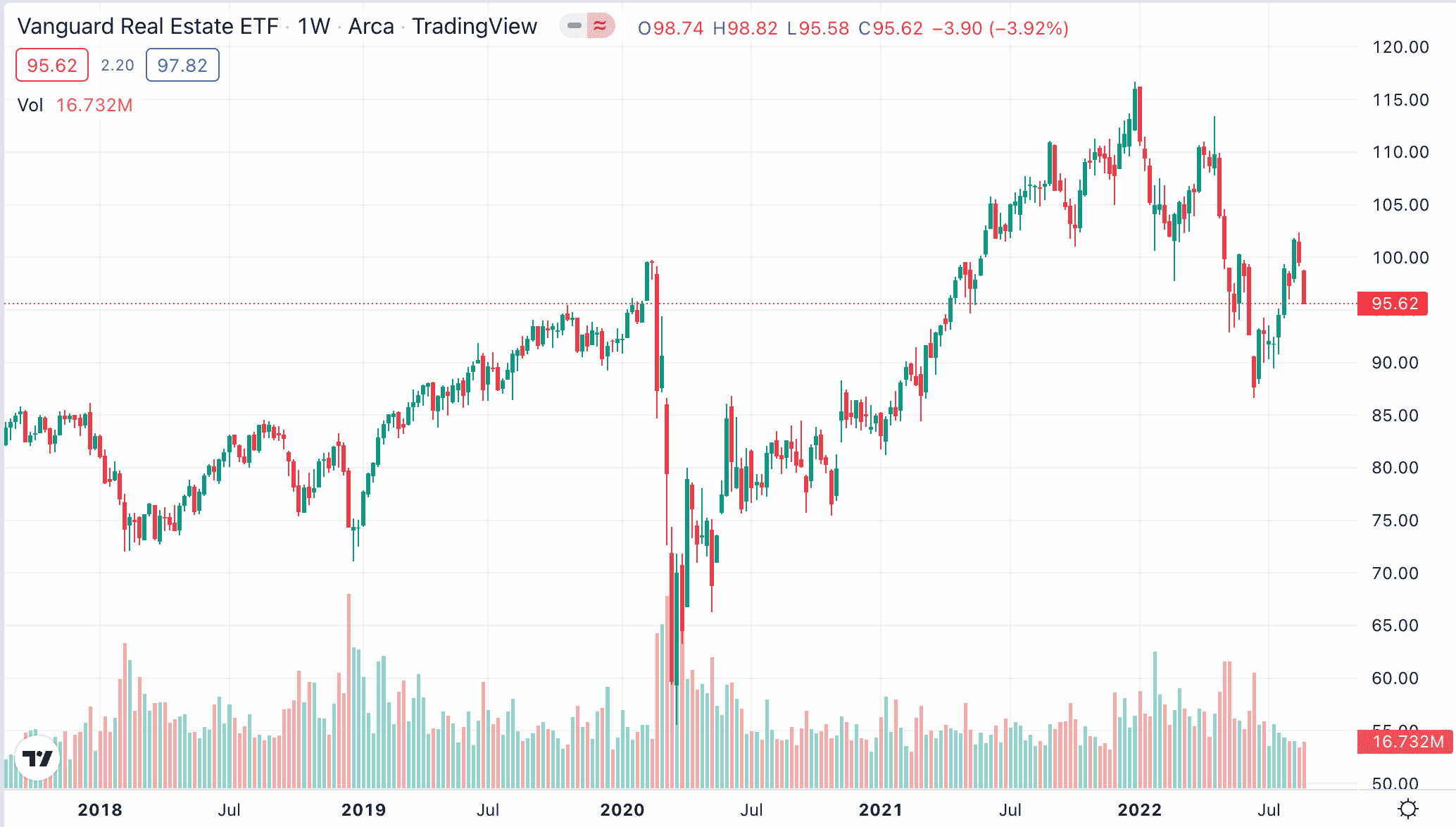

6. REITs – Invest in a Diversified Portfolio of Real Estate

Another option when assessing the best way to invest $50k is to invest in REITs. However, $50k likely won’t cut it in terms of buying a property outright. Even if it did, this would mean that the investor would be overexposed to a single market. And, if the market that the property is located in declines, this will have a major impact on the value of the investment.

With this in mind, a more diversified way to approach this space is through a REIT (real estate investment trust). Backed by ETFs, REITs will build a large portfolio of properties from a variety of target markets. For example, there are plenty of REITs that specialize in residential properties throughout the US.

Alternatively, some REITs focus on commercial properties, such as warehouses, shopping malls, offices, or healthcare facilities. Either way, the value of the REIT will be dictated by whether or not the respective properties appreciate. Moreover, REITs are also suitable for those that seek regular and consistent income flows.

After all, the REIT will lease each property out to tenants, who subsequently pay rent. Furthermore, unlike traditional ETFs – which typically distribute income quarterly, REITs are mandated to do this on a monthly basis. This will appeal to those that wish to maximize the benefit of long-term compound growth.

Another benefit of opting for a REIT over conventional real estate is that the investment is significantly more liquid. In the case of buying a property outright, the investor would only be able to liquidate their investment by finding a suitable buyer. How long this takes remains to be seen – albeit, depending on the market, it can take months or even years to close the deal.

In comparison, REITs trade as ETFs on public exchanges – just like stocks. And therefore, the investor can elect to cash out their REIT position at any time during standard market hours. This subsequently transforms an illiquid asset class into a liquid investment.

7. Commodities – Consider Hard and Soft Commodities to Hedge Against Stocks

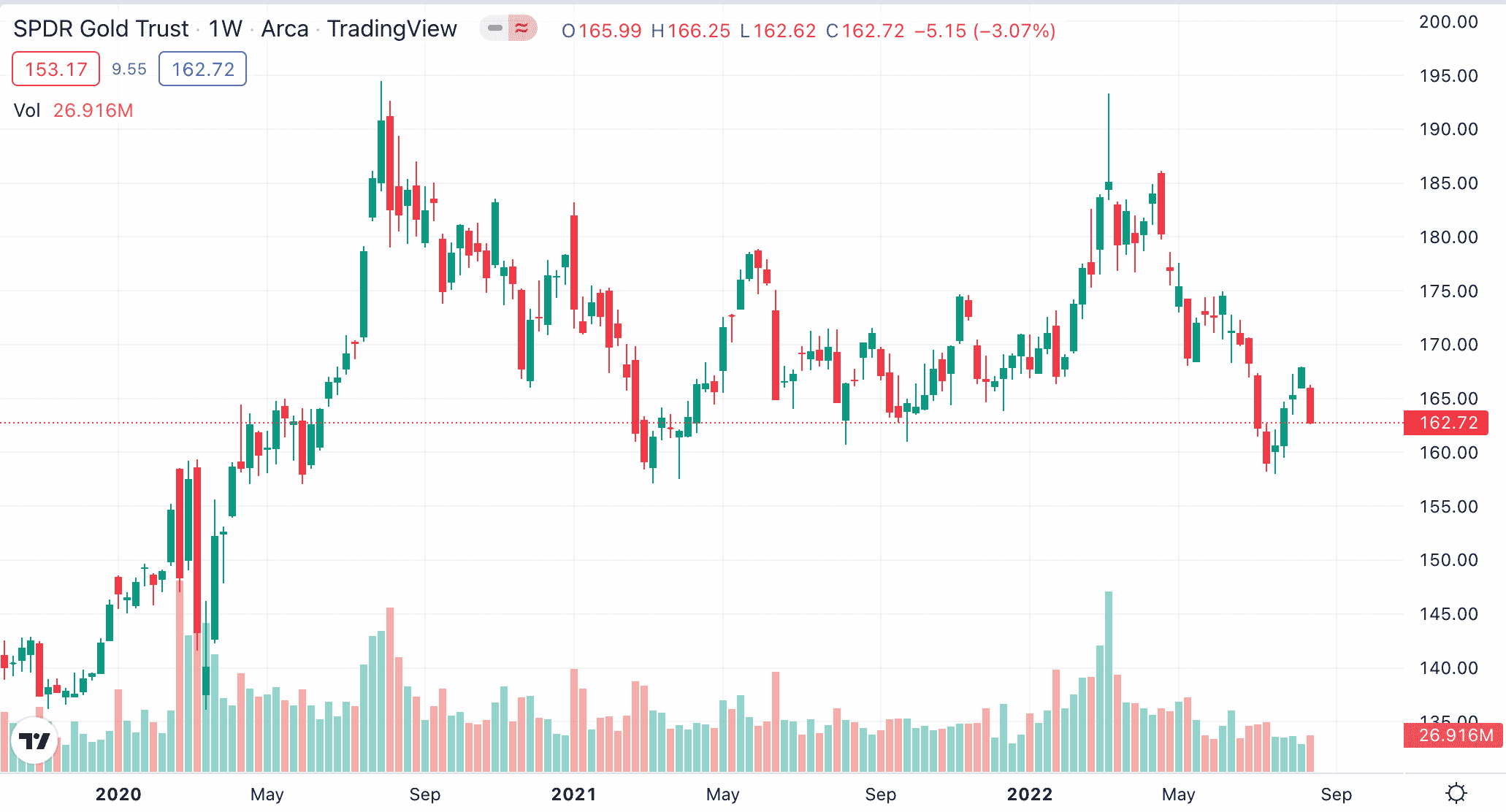

In addition to real estate, commodities are another asset to consider when looking for the best way to invest $50k short-term, outside of the traditional stock market. In doing so, this offers yet another level of diversification to the investor’s portfolio – which is crucial. There are dozens of commodities that are traded in the financial markets, and various ways to access them.

Fortunately, however, across most hard and soft commodities, there is no requirement to actually purchase or store the asset. For example, investing in precious metals does not require the investor to buy gold and silver, and keep the respective bars or coins at home. Similarly, investing in energy products does not require the physical storage of crude oil or natural gas.

On the contrary, asset classes including ETFs and CFDs (contracts-for-differences) enable investors to gain exposure to a full range of commodities from the comfort of home, without worrying about storage or logistics. For example, let’s say that the investor decides to inject capital into a gold ETF.

In the vast majority of cases, the ETF provider will be backed by physical quantities of gold – at an amount that is in line with its NAV (net asset value). For instance, if the ETF has a NAV of $4 billion, it should be backed by a similar amount of gold bullion, less a small holding of cash to facilitate working capital.

And as such, the value of the ETF – which will trade on a public exchange, will rise and fall in line with the global spot price of gold. Another way to gain exposure to commodities is via CFDs. However, we should note that CFDs – which are financial derivatives that track the value of an asset, are not accessible to US clients.

Nonetheless, the investor can speculate on the future value of a commodity via a CFD at the click of a button. CFDs can be traded long and short, which offers the opportunity to profit from rising and falling commodity prices. Moreover, in a similar nature to futures and options, CFDs support leverage.

Irrespective of the financial instrument being traded, commodities offer a way to hedge against the stock market. In fact, when the stock market is bearish and it appears that the broader economy is about to enter a recession cycle, this often goes in the favor of commodity prices – especially in the case of gold.

8. Crypto Interest Accounts and Staking – Earn Passive Income on Crypto Investments

We mentioned earlier that crypto assets like Bitcoin and Ethereum, as well as newly launched projects such as Tamadoge and Battle Infinity, offer the opportunity to target above-average gains. With that said, there is another segment of the cryptocurrency and blockchain technology space that continues to grow in popularity – interest accounts.

Put simply, there are online providers that enable investors to earn interest on any crypto tokens that they deposit. This is usually offered on a fixed-rate basis, which means that the investor knows exactly how much they will make. Interest is usually paid in the same token that has been deposited. For example, depositing Bitcoin would generate BTC tokens.

Depending on the provider, the investor might have access to a variety of terms. For example, Crypto.com offers interest accounts across one and three-month terms, as well as on a flexible basis. The longer the term, the higher the APY. This is because while the crypto tokens are locked, they cannot be withdrawn until the term has reached maturity.

Therefore, investors who might need access to their crypto funds at a moment’s notice might prefer to take a lower yield via a flexible term. Either way, it is important to remember that while the tokens are deposited in a crypto interest account, the investor still retains ownership.

This means that if the respective crypto asset appreciates – the investor will still benefit from this. On the flip side, of course, if the crypto asset goes down in value by more than the APY being earned, this will result in a loss. Nonetheless, crypto interest accounts make sense for investors that wish to keep hold of their tokens in the long run.

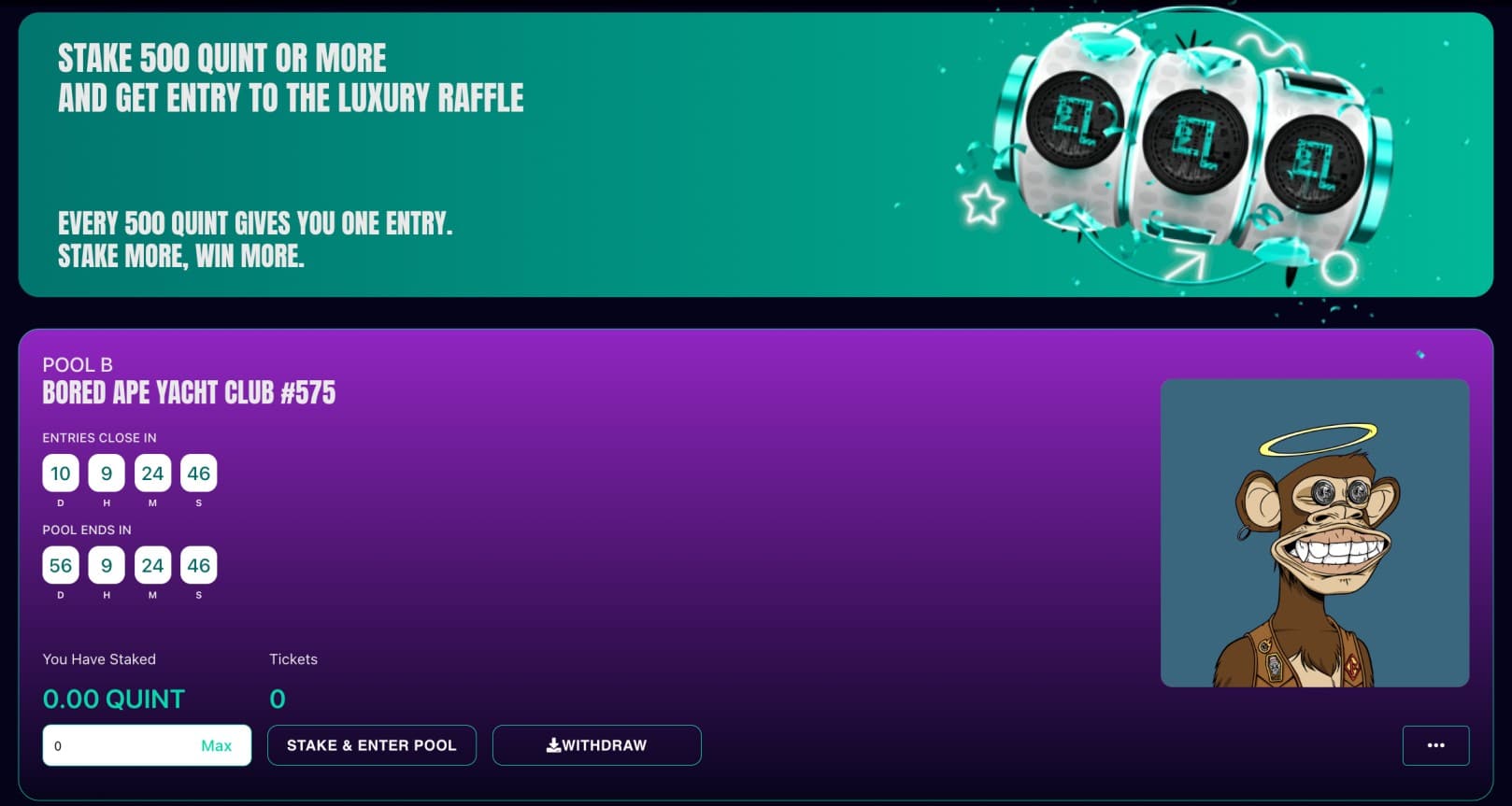

Another segment of the blockchain space that is similar to interest accounts is crypto staking. This will also require the investor to deposit their funds into an account held by a third-party provider. For example, Quint offers a super staking tool within its ecosystem that offers fixed interest rewards in addition to other perks.

At the forefront of this is that depending on how much is being staked and when the deposit is made, the investor will receive ticket entries into a competition. As of writing, Quint is offering a staking competition that will afford the winner a Bored Ape Yacht Club NFT. Some of the NFTs in this collection have sold for many millions of dollars.

9. Copy Trading – Day Trade and Invest Passively by Copying a Seasoned Trader

The next option to consider on our list of the best $50 investments is Copy Trading. This tool is offered by the popular brokerages and it enables account holders to trade and invest passively. As the name implies, users can ‘copy’ the investments made by an experienced trader.

There are traders of all shapes and sizes that have signed up for Copy Trading programs, which offers users the chance to diversify. For example, there are day and swing traders to choose from that focus on volatile markets like forex and crypto. There are also value investors that focus on long-term positions surrounding stocks and index funds.

Either way, after the user has chosen a suitable trader and completed the investment, the position will remain passive thereon. For example, let’s suppose that the investor risks $5,000 on a seasoned stock trader. A few hours later, the trader allocates 15% of their portfolio into Coca-Cola stock.

In turn, the investor will also risk 15% of their $5,000 position, which amounts to a proportionate stake of $750. If the trader decides to close their Coca-Cola stock position once a profit of 30% has been achieved, the user will make gains of $225 (30% profit of $750 stake) on this passive trade.

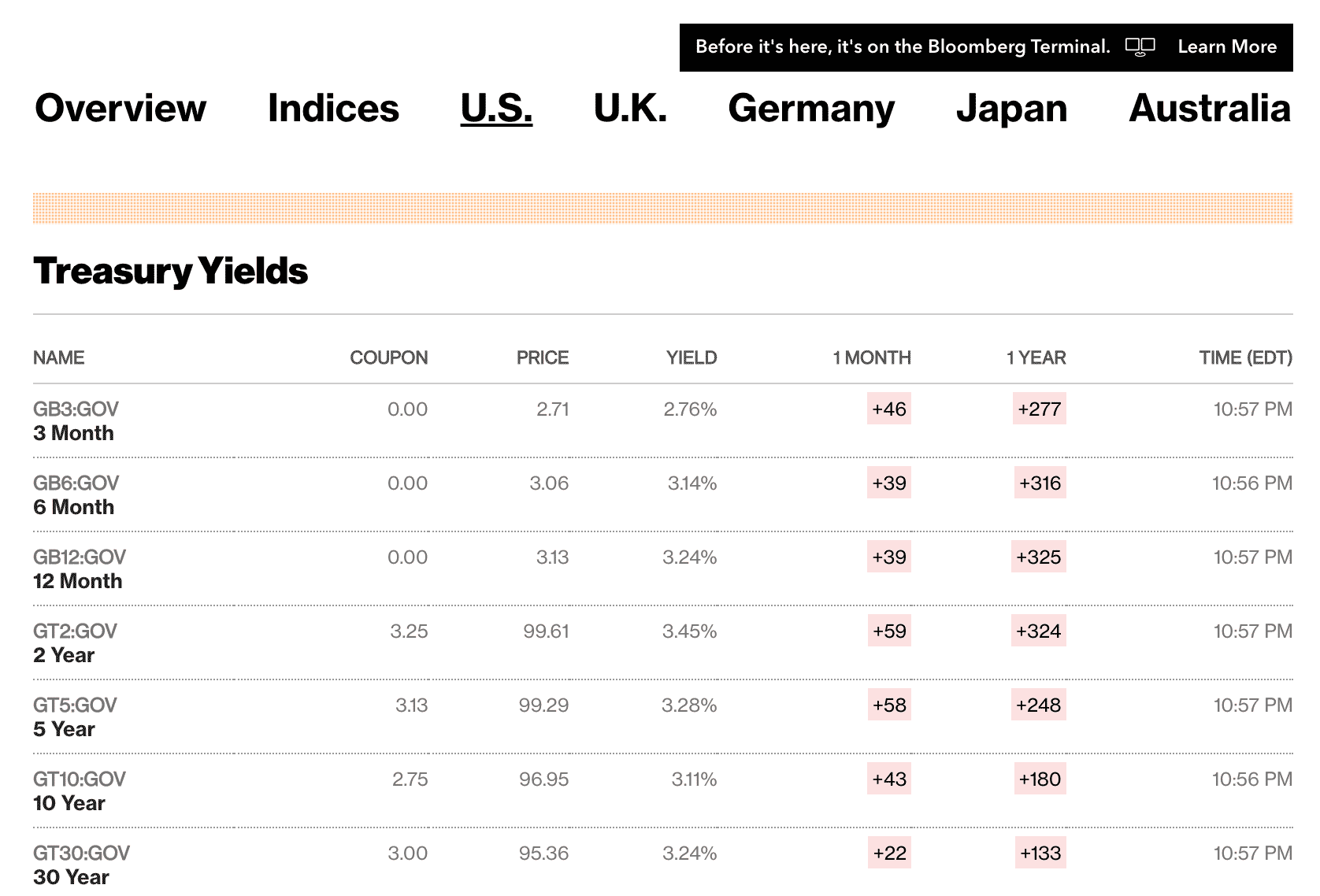

10. Bonds – Buy Government or Corporate Bonds and Earn a Fixed Rate of Interest

In a similar nature to REITs, bonds offer a solid way to secure passive income. This marketplace is vast, not least because investors have thousands of bonds to choose from across a wide variety of markets, risks, and interest rates. The two main types of bonds are issued by governments and corporations.

Regarding the former, the most traded government bond is the US treasury. This type of bond is backed by the government and thus – is often viewed as a safe way to invest. After all, the odds of the US government defaulting are highly unlikely, as it can simply elect to print more money to cover any potential shortfalls.

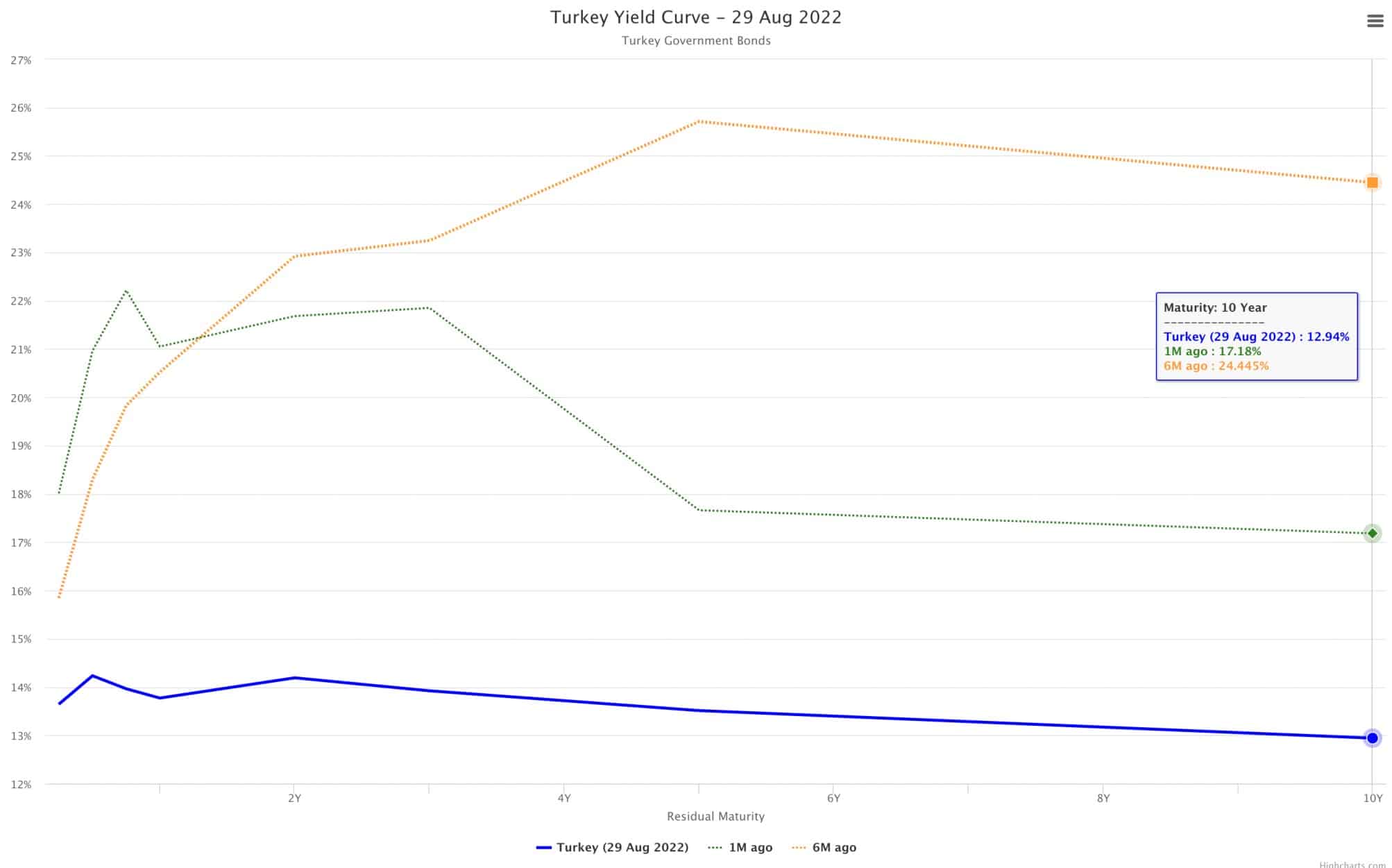

Bonds issued by stable governments and central banks – such as those found in the UK, European Union, Australia, and Japan – are also considered safe. However, those seeking above-average returns might also consider bonds that have been issued by foreign governments.

For example, as of writing, the government of Turkey is offering a yield of over 12% on a 10-year maturity date. The other option is to invest in bonds that have been issued by corporations. This might include a large-cap blue-chip stock like Apple, or a much smaller company that is still in its growth stage.

Irrespective of the chosen bond type, the investment fundamentals remain the same. For instance, the vast majority of government and corporate bonds have a maturity date. This is the date that the issue must repay the principal investment amount. In other words, those buying $10,000 worth of 5-year bonds will not get their investment back until 2027.

In the meantime, the bondholder will be paid interest – which is known as the coupon payment in the world of bonds. Typically, this will be at a fixed rate of interest and the payment will be made every six months. For example, let’s take the case of an investor buying $50,000 worth of corporate bonds, with a yield of 5% and a maturity of 10 years.

Annually, the $50,000 bond investment will yield a coupon payment of $2,500, so the investor will receive $1,250 every six months. This will continue to be the case for 10 years. Once the bonds mature in 10 years, the investor will receive their $50,000 back from the issuer.

Of course, there is risk involved, not least because the issue might not have the capital to repay the funds. Perhaps the less risk-averse approach when investing in bonds is to do so via an ETF. There are many bond ETFs to choose from that track a variety of government and corporate markets, and coupon payment distributions are usually made on a monthly basis.

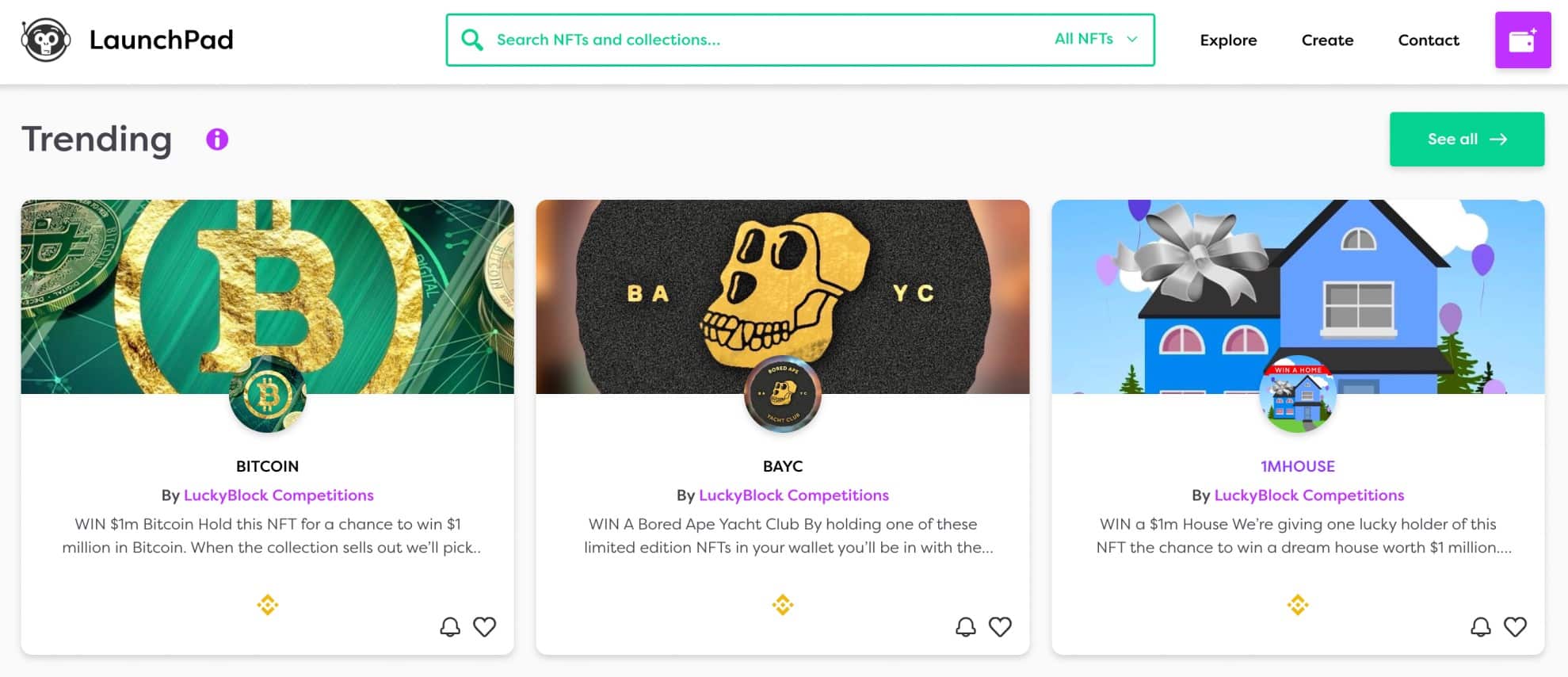

11. NFTs – Flip Popular NFTs via Online Marketplaces

The final option to consider assessing what to invest $50k in is NFTs (non-fungible tokens). In a nutshell, NFTs took the world by storm in 2021 when collections like the Bored Ape Yacht Club and CryptoPunks sold for several million dollars apiece. This encouraged a sizable number of NFT creators to launch their own collections.

An NFT is a digital token that operates on the blockchain and is unique from the next. This means that NFTs can represent ownership of a real-world asset, such as property or gold. With that said, current trends in the NFT space are focused on digital art. In order to profit from this space, investors will need to consider an NFT flipping strategy.

This means searching for a suitable NFT to buy and when the time is right, listing it on an open marketplace for sale. The hope is that the value of the NFT would have since raised, resulting in a profit. Investors might consider the Launchpad.xyz ecosystem when hunting for undervalued NFTs.

This platform lists the Lucky Block NFT collection, for example, which is linked to the blockchain project of the same name. By purchasing a Lucky Block NFT, this affords access to a specific competition. For example, as of writing, there is a competition offering $1 million worth of Bitcoin and in order to participate, the investor needs to buy an NFT.

However, irrespective of whether the investor wins the prize, the NFT that they purchased will continue to generate rewards – even after the respective competition has concluded. Lucky Block rewards are paid in LBLOCK tokens, which is the native digital asset of this up-and-coming project.

How to Choose the Best $50k Investments For You

By reading our guide on how to invest $50k up to this point, investors will now have an idea of the many different asset classes available at online brokers. This should also encourage investors to take a diversified approach across a variety of markets, to help reduce the risk burden. Ever wondered what the best way to invest $100k in 2024 is?

In this section, we will explore what considerations should be made when deciding on the best place to invest $50k.

Risk

Risk should sit at the forefront of all investment decisions. After all, no investment is free of risk. As such, the investor needs to remember that the only way to generate wealth in the financial markets is taking on a comfortable level of risk.

- The amount of risk associated with an investment is often heavily correlated to the chosen market.

- For example, crypto assets are viewed as a high-risk investment class due to their volatile and speculative nature.

- The same could also be said for bonds issued by governments operating in an emerging market like Brazil or South Africa.

The so-called safest assets in the market with the least amount of risk are bonds issued by strong economies such as the US and the European Union.

Upside Potential

Creating a diversified portfolio should see the investor consider the upside potential of each respective asset.

For example, if the investor is looking to allocate 5% of their portfolio into high-growth assets with an attractive upside, they might consider cryptocurrencies.

- BNB, for example, has enjoyed gains of more than 600,000% since it was launched in 2017.

- Terra Luna, on the other hand, recently saw its multi-billion dollar maker capitalization drop by more than 99%.

Major stock market index funds such as the S&P 500 have a long-standing track record that might appeal to investors. Since 1926, this index fund has generated average annualized gains of 10%.

Liquidity

Another important metric to consider when assessing how to invest $50k is how much liquidity the asset attracts.

- For example, we mentioned earlier that purchasing a property outright can result in challenges when it comes to selling.

- This is because the only way to sell the property is to find a suitable buyer.

- But, by instead opting for a REIT that trades on a public exchange, the investor can cash their investment out whenever they see fit.

- This is also the case with crypto assets, which trade on exchanges 24/7.

Bonds are another asset class that operates in an illiquid environment, not least because the investor will need to wait until the maturity date to get their original capital back. There are certain exceptions to this rule, as highly liquid secondary markets typically exist for government-issued bonds.

Where to Invest $50,000 Right Now – The Best Option?

The best way to invest $50k is by creating a portfolio that consists of a wide range of assets and markets, at different risk and reward ratios.

Nonetheless, one of the most notable options that we came across is the FightOut presale campaign. FightOut gives its users an opportunity to make an additional income via M2E rewards by doing their daily workouts. At the time of writing, $FGHT can be bought at just $0.0167.

How to Invest $50k – FightOut Tutorial

In the section above we discussed the FightOut presale and how this offers investors the opportunity to gain exposure to a brand-new growth project.

To conclude, we will now explain how to buy $FGHT in 5 simple steps:

Step 1: Get a Crypto Wallet

Investors should download a crypto wallet. For this, buyers need to install a wallet like MetaMask on their web browsers. (Mobile users are recommended to download the TrustWallet)

Step 2: Connecting the Wallet

Investors must now go to the project’s official presale page. After entering the page, buyers should search for and click on the $buy $FGHT NOW” button. Immediately after, investors can choose the wallet they have installed (like Metamask or TrustWallet) and then log in to their wallets.

Step 3: Add ETH/USDT

For this step, buyers need to have an adequate balance of ETH/USDT in their wallets. Investors also have the option to buy ETH via a credit card.

Now, buyers can go ahead and click either on the “Buy $FGHT with ETH” or “Buy FGHT with USDT” button.

Step 4: Buy $FGHT Tokens

Now, buyers must specify the amount of ETH or USDT they would want to swap in return for $FGHT tokens.

Step 5: Claim the Tokens

In the last step, investors can confirm the transaction after checking the number of $FGHT tokens to be received. Buyers would be able to claim these tokens based on the vesting period they chose in the previous step.

Cryptoassets are a highly volatile unregulated investment product.

Conclusion

An investment budget of $50k offers access to a global marketplace that consists of many asset classes. Whether the investor elects to gain exposure to stocks, crypto, REITs, ETFs, or commodities, the best approach is to diversify.

One of the best ways to diversify your assets is by investing in the FightOut ($FGHT) token presale. Users have an excellent opportunity to gain exciting M2E rewards while leading a healthy lifestyle and completing their daily workouts.

Currently, in the first stage of its presale, FGHT has raised over $2.3 million. Interested readers can buy the token for only $0.0167.

Fight Out - Next Big Train-to-Earn Crypto

FAQs

What is the best way to invest $50k?

What can I invest in with $50k?

What to invest $50k with?

How to invest $50k?

References

- https://www.irs.gov/retirement-plans/401k-plans

- https://www.bbc.com/news/technology-56371912

- https://www.londonstockexchange.com/raise-finance/etps/etfs