Saving up thousands of dollars is a good first financial step. But to make the most out of those savings, it’s important to invest them.

If you’re wondering, ‘What can I invest in with 25k?’ then this guide is here to help. We’ll explore how to invest $25k and help readers decide where to invest $25,000 right now.

11 Best Ways to Invest $25k in 2025

$25k is a lot of money to invest, so it’s important to understand how to invest $25k safely and effectively. Here are the 10 best ways to invest $25k in 2025:

- FightOut – Best Way to Invest $25K in a Breakthrough Move-to-Earn Project

- Dash 2 Trade – Overall Best Way to Invest $25K in 2025

- Stocks – Own a Piece of the World’s Best Companies

- REITs – Invest in Real Estate through the Stock Market

- Crypto Staking – Earn High Interest on Crypto Holdings

- ETFs – Invest in a Specific Themes or Market Sectors

- Index Funds – Passively Match the Market’s Return

- NFTs – Invest in One-of-a-kind Digital Artwork and Games

- Copy Trading – Mimic the Moves of Experienced Traders and Investors

- Commodities – Trade Metals, Food Supplies & More on the Global Market

- Bonds – A Relatively Safe Investment to Balance a Portfolio

Investing in new high potential crypto projects like Tamadoge is our number one pick – click below to learn more.

A Closer Look at the Best Ways to Invest $25,000

With so many $25k investment options to choose from, it’s important to pick the right ones to build a diversified and profitable portfolio. Let’s take a closer look at how to invest $25,000 today.

1. Best Way to Invest $25K in a Breakthrough Move-to-Earn Project

After successfully identifying and filling the gaps in the Move-to-Earn industry, FightOut has created a one-of-a-kind fitness app. The project enables users to earn rewards for completing workouts and other in-app tasks.

After successfully identifying and filling the gaps in the Move-to-Earn industry, FightOut has created a one-of-a-kind fitness app. The project enables users to earn rewards for completing workouts and other in-app tasks.

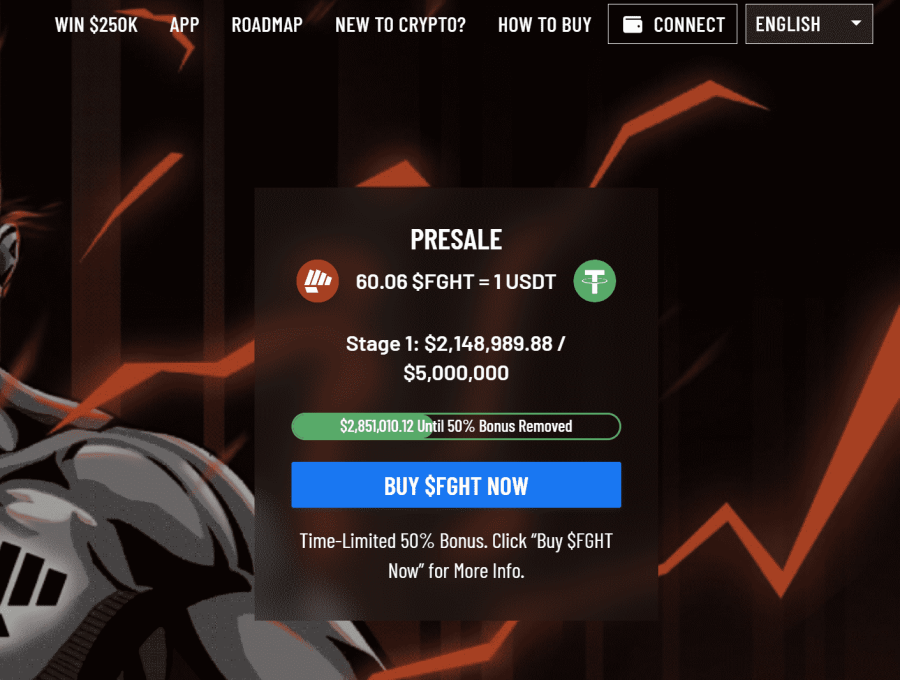

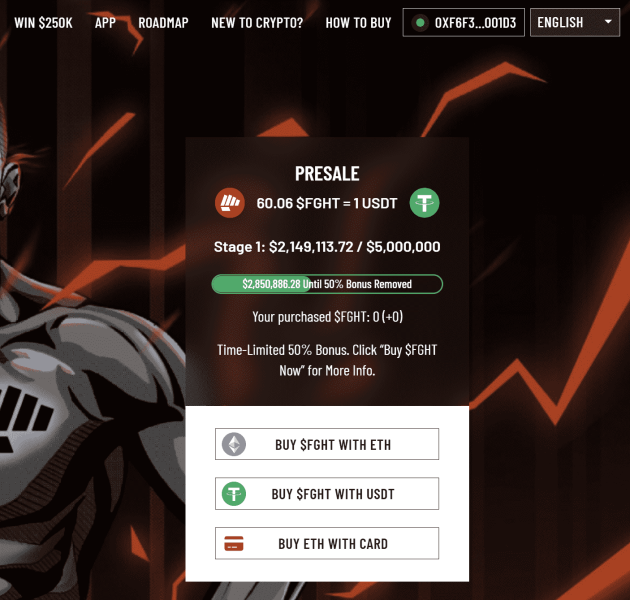

After its recent presale launch, the project has already raised over $2.1 million USDT within just a few days. At press time, $FGHT can be bought at a discounted price of $0.0167. Buyers can consider grabbing these tokens while they still have a chance.

FightOut is a next-gen fitness app that enables users to earn rewards while doing their daily workouts, fitness challenges, and other in-app challenges.

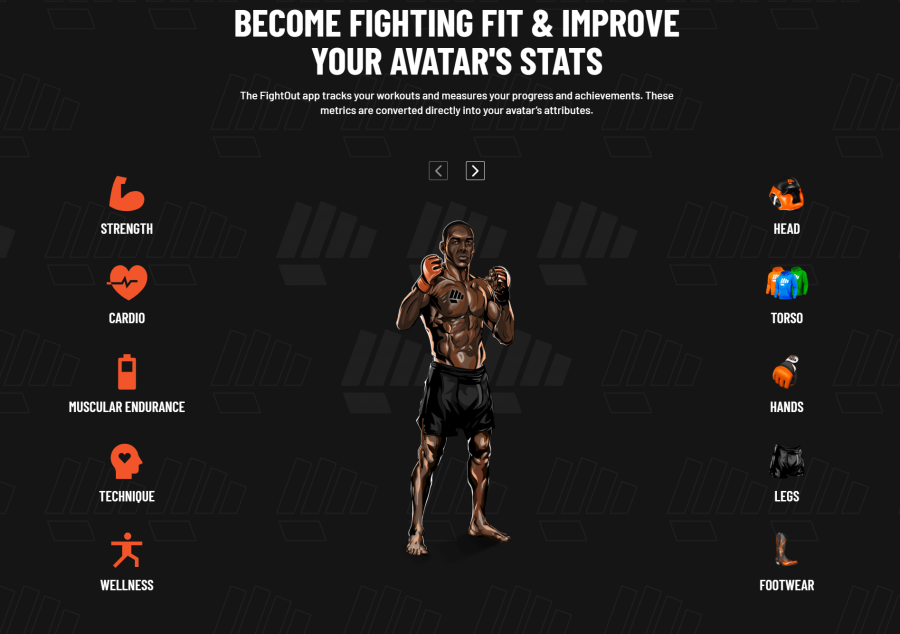

In the process of gamifying the fitness lifestyle for its users, FightOut has created an exciting metaverse. Users have the opportunity to create their own unique NFT avatar and progress their fitness journey in the project’s metaverse. These soulbound NFT avatars will enhance in direct relation to the user’s real-life fitness performance. Also, FightOut enables users to compete with other members of its community.

To effectively reward its users, the project has created its own in-app currency known as REPS. These REPS can be used for buying cosmetic NFTs for their avatars, membership discounts, and similar products. Furthermore, investors can view the project’s whitepaper to get a better understanding of its numerous features.

$FGHT Tokenomics & Purchase Bonuses

FightOut’s native token $FGHT deploys Ethereum’s ERC-20 standard and is a limited supply token. From its total supply, 9 billion tokens will be sold through the project’s presale stages.

Investors can use these tokens to take part in FightOut’s tournaments and leagues. Buyers can also use $FGHT to buy additional REPS. Investors using the tokens to buy REPS would receive an additional 25% REPS.

Moreover, buyers purchasing $FGHT tokens during the presale stages will get bonuses that start at 10% with an investment of just $500 and 6 months of vesting. Additionally, investors are entitled to membership rewards when they stake more $FGHT tokens or stake them for a longer timeframe.

Presale Performance

The new crypto project has already witnessed impressive traction while raising over $2.1 million USDT in a relatively short time. Investors also have a chance to get up to 50% additional tokens as rewards during the ongoing presale stages.

Investors can consider entering FightOut’s telegram to stay updated on the project’s latest developments.

| Presale Started | 14 December 2022 |

| Purchase Methods | ETH, USDT |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

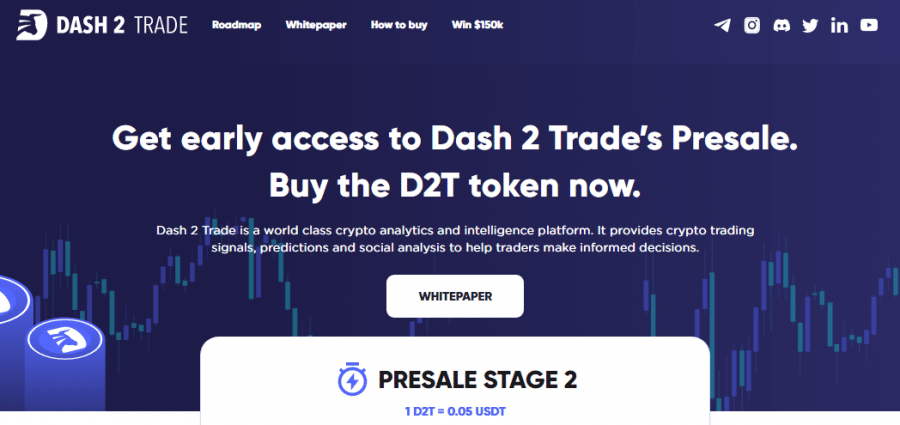

2. Dash 2 Trade – Overall Best Way to Invest $25K in 2025

D2T will distribute 700 million tokens in 9 presale rounds as it looks to raise more than $40 million. With a minimum buy requirement of 1,000 D2T, the current token price of $0.05 makes it a $50 investment for interested readers. However, this minimum investment will be increased by 32% by the last presale round – as the D2T price will increase to $0.0662 per token.

By Q1 2023, Dash 2 Trade will release its dashboard and integrate several trading signals and tools to offer investors the opportunity to make well-informed trading decisions.

Among the available features are presale listing projects, new crypto listing alerts, social & technical indicators and individual risk profilers. Dash 2 Trade will offer a backtesting platform to test-out potential trading strategies and integrate weekly trading competitions to distribute free token rewards. These exclusive features can be accessed by purchasing one of the subscription packages via D2T. While the premium package will cost a monthly fee of 1,000 D2T, investors can buy the starter tier for just 400 D2T per month.

Having raised $2.1 million during the ongoing second presale round, the D2T token price will increase to $0.0513 after the presale raises $5.1 million. Read the Dash 2 Trade whitepaper to learn more about this exciting new project, and join the Dash 2 Trade Telegram channel to stay updated with the latest developments.

| Presale Started | October 19 |

| Purchase Methods | ETH, USDT, Transak |

| Chain | Ethereum |

| Min Investment | 1,000 D2T |

| Max Investment | N/A |

Join the D2T token presale to stand a chance to participate and win a $150K D2T giveaway.

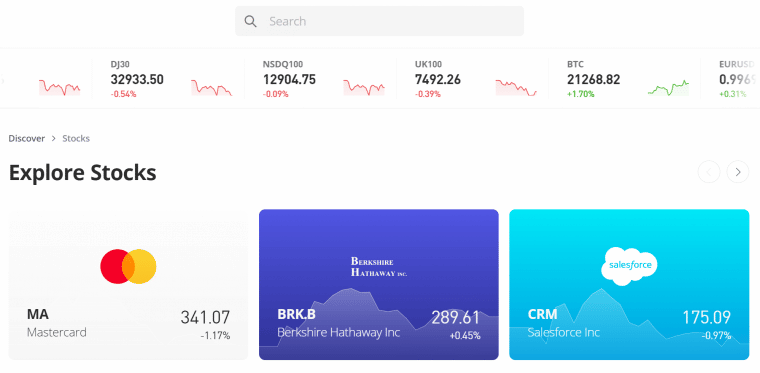

3. Stocks – Own a Piece of the World’s Best Companies

Stocks are among the most common types of assets in investors’ portfolios. Stocks represent fractional ownership in some of the world’s biggest and best companies. Did you know that some investors consider the stock markets to be the best way to invest $100k in 2025?

There are several different types of stocks investors can choose from. Growth stocks are shares of companies that are growing rapidly. Often, the prices of these stocks are high relative to earnings right now because investors are looking towards the future. Value stocks are the opposite. They offer low prices relative to earnings, and they often represent shares in well-established companies who have reliable but slow-growing businesses.

Dividend stocks are stocks that pay investors a dividend each month, quarter, or year. Dividends are a form of recurring income, which can be important for some portfolios.

When investing in stocks, it’s important for investors to look carefully at the company behind the ticker symbol. The best companies have strong and growing earnings as well as a moat that protects them from competition.

Importantly, investors will need a stock brokerage in order to invest in individual stocks.

4. REITs – Invest in Real Estate through the Stock Market

REITs, or real estate investment trusts, are companies or funds that enable anyone to invest in real estate. Individual investors can purchase REITs just like stocks – so there’s no need to take out a mortgage or identify the perfect piece of land to start investing.

There are many different types of REITs for investors to choose from. Some invest in residential homes and generate returns by renting them out. Others develop commercial buildings or lease out commercial space. Some REITs even invest in valuable farmland. This diversity means that investors who want to start investing $25k can create a portfolio of different real estate holdings.

When investing in REITs, be sure to look at the fees the fund charges and how much money is reliably returned to investors. Some REITs offer high dividends and don’t reinvest much in their properties. Others offer minimal dividends, but work on appreciating their share price by investing funds in new property,

5. Crypto Staking – Earn High Interest on Crypto Holdings

Many of the blockchains that popular cryptocurrencies run on use a security protocol known as proof of stake. With proof of stake, crypto holders need to stake some of their tokens in order to validate transactions on the network. If they act faithfully and keep the network running smoothly, they’re rewarded with new cryptocurrency,

Individual crypto investors can use crypto staking to earn interest on their crypto holdings. There are many platforms that facilitate staking on top altcoins and offer double-digit interest rates.

Even better, many crypto interest accounts pay out token rewards on a daily or weekly basis, enabling investors to compound their returns.

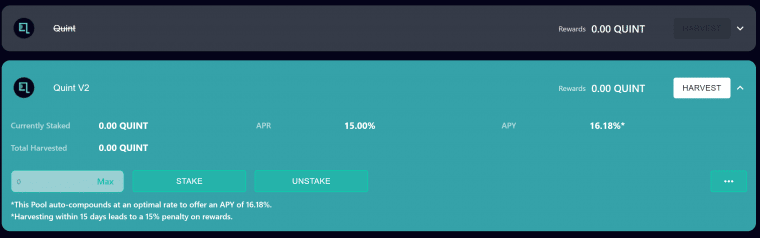

One of the best crypto staking platforms in 2025 is Quint. This is a beginner-friendly cryptocurrency that enables investors to stake QUINT tokens and earn interest of 16.18% APY. Quint also enables investors to stake a combination of QUINT and BNB to earn interest of 39.08% APY. That’s hundreds of times higher than the interest available at most banks.

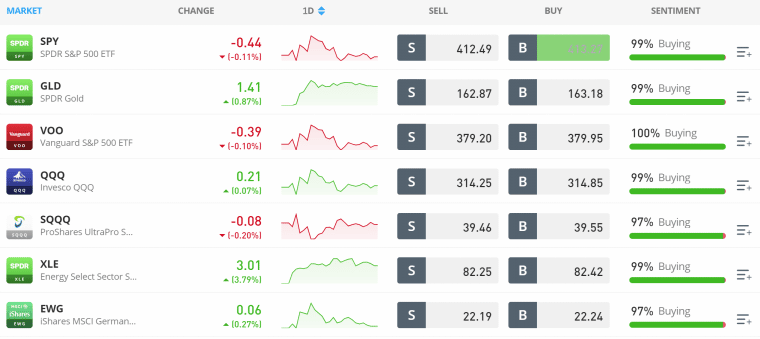

6. ETFs – Invest in a Specific Themes or Market Sectors

ETFs, or exchange-traded funds, are baskets of stocks or other assets that investors can purchase in a single trade. A single ETF might contain dozens or even hundreds of different stocks, all in different proportions. They offer a simple way to build a diversified portfolio.

One of the neat things about ETF investing is that ETFs can be used to invest in specific market sectors or themes. For example, there are ETFs that include all of the stocks in the US transportation sector. There are also ETFs that bring together 5G stocks from many different market sectors for investors who think 5G technology is the next big thing.

When investing in ETFs, be sure to look at the fees a fund charges. This is known as the fund’s expense ratio. Expense ratios are generally under 1% even for actively managed ETFs, making them a cost-effective way to invest in a wide variety of stocks.

ETFs trade on stock exchanges, so they’re available from most stock brokerages.

7. Index Funds – Passively Match the Market’s Return

Index funds are a type of ETF or mutual fund that mimic the composition of a major stock market index. For example, there are index funds for the S&P 500 and the NASDAQ 100.

These funds contain the same stocks, in the same proportions, as those market indices. That means that if the S&P 500 rises by 1%, an S&P 500 index fund will also rise by 1%.

Many investment experts recommend index funds as the best place to invest $25k. Index funds are passively managed and typically have expense ratios of 0.25% or less, making them very inexpensive. In addition, since index funds typically contain dozens or hundreds of stocks, they’re relatively well-diversified. Finally, the S&P 500 has historically gone up by around 10% per year and few people have been able to beat the market by stock trading.

8. NFTs – Invest in One-of-a-kind Digital Artwork and Games

NFTs, or non-fungible tokens, are a type of unique digital token that lives on blockchains. NFTs aren’t cryptocurrencies. Whereas every token of a specific cryptocurrency is the same, every NFT is completely unique. Investors can think of the best NFTs somewhat like digital art or digital collectibles.

The NFT market has skyrocketed in value in recent years, and hot new NFT projects are being released all the time. While recent performance is no guarantee that NFTs will continue to gain value, there are many signs that investors are still eager to buy NFTs from top collections.

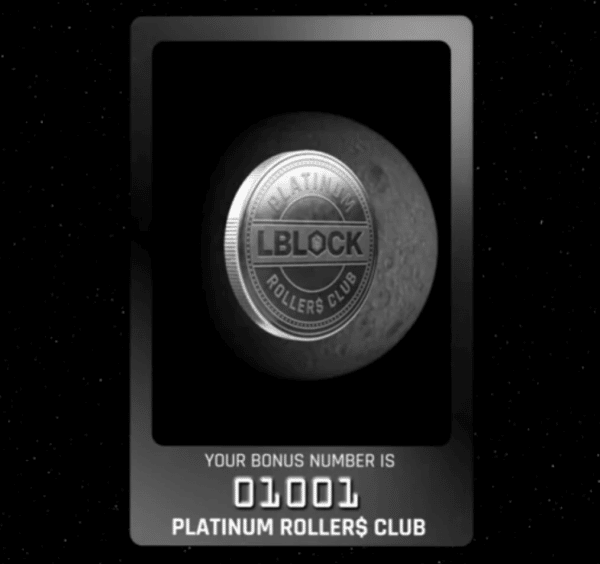

One of the best NFTs to buy in 2025 is the Lucky Block Platinum Rollers Club NFT. This digital collectible isn’t a piece of art, but rather an entry ticket into a daily giveaway. Every day, Lucky Block gives away $10,000 to one lucky NFT holder.

Since there are only 10,000 Platinum Rollers Club NFTs, each NFT holder has a 1-in-10,000 chance of winning $10k every day. Investors who don’t want to take their chances can also lend out their NFT and earn steady income on it.

Investors can buy Lucky Block NFTs at Launchpad, an online NFT marketplace.

9. Copy Trading – Mimic the Moves of Experienced Traders and Investors

Copy trading platforms offer a way to actively trade stocks and other assets without having to put in a lot of work. It’s considered by some to be the best way to invest $25k for the short term. With copy trading, investors simply set aside some money in their portfolios to mimic the moves of a more experienced trader. When the trader buys or sells a stock or other asset, the investor’s account will copy the trade automatically.

Investors can see a trader’s performance, recent trades, and some basic details about their strategy. There are thousands of traders to potentially copy, so investors have the ability to pick and choose who they want to copy or to copy multiple traders.

Copy trading can also be used to build a more diversified portfolio when investing $25k. Many of the investors available to copy focus on specific market sectors or asset classes. So, investors can simply spread their $25,000 investment across multiple traders.

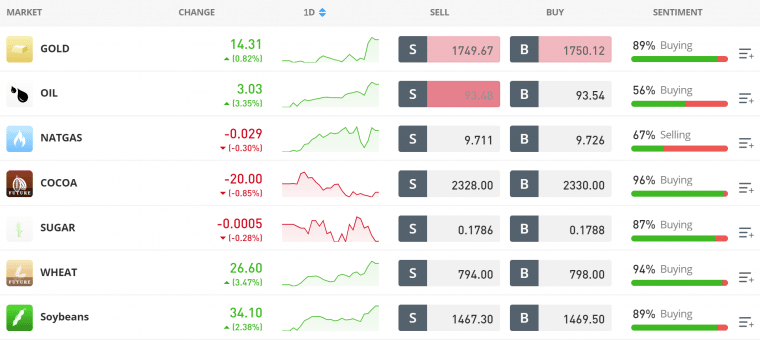

10. Commodities – Trade Metals, Food Supplies & More on the Global Market

Commodities are an asset class that includes precious metals like gold and silver, food products like cacao and soybeans, and energy supplies like crude oil and natural gas. Commodities trade on the global market, and their prices can go up or down in response to a variety of different global events.

One of the key reasons to trade commodities is that their prices are uncorrelated with the stock market. That is, the price of stocks may fall across the board, but that won’t impact the price of most commodities much. So, commodities can provide a hedge for investors who are heavily invested in stocks or cryptocurrencies.

However, keep in mind that trading commodities can be complex. Many commodities trade with futures contracts, although some platforms allow commodities trading through simpler contracts for difference (CFDs). Many investors prefer to focus on just 1 or 2 commodities that they research deeply rather than attempt to invest in dozens of different commodities.

11. Bonds – A Relatively Safe Investment to Balance a Portfolio

Bonds are essentially IOU slips. They represent ownership of debt owed by governments or companies. Typically, when an investor buys a bond, they receive regular interest payments over the life of the bond at the bond’s preset interest rate. When the bond expires, the investor receives the amount that they originally paid for the bond back.

Bonds aren’t the most exciting investment most of the time. However, it’s important to think about bonds when deciding how to invest $25k. That’s because bonds represent a relatively low-risk asset class that can balance out a portfolio. This may be especially important for investors who put most of their $25k investment in stocks and cryptocurrencies.

Keep in mind that bonds aren’t risk-free. Companies and governments can default on their bonds, in which case investors may not get all of their money back. In general, riskier bonds pay higher interest rates, so investors can choose the risk-reward balance that best suits them.

How to Choose the Best $25k Investments for You

A major part of learning how to invest $25k is figuring out how to identify which investments make sense for a portfolio. It rarely makes sense to invest $25,000 in a single asset or even a single asset class, so investors will typically choose several options for what to invest $25k in.

Here are some of the things to consider when choosing the best way to invest $25k.

Investment Goals

An investor’s goals are foundational to their investing strategy. The best way to invest $25k for retirement is very different from the best way to invest $25k to supplement short-term income.

Investors should start by thinking about what they hope to achieve by investing $25,000. Based on that, they can decide what investment timeframe they’re interested in and what amount of risk they’re willing to take on. Every investor will be different and what to invest $25k with will depend on their goals.

Risk

Risk is a natural part of investing, but not every asset involves the same amount of risk. Some investments are more risky, meaning that they have a higher chance of losing money. In general, cryptocurrencies are considered very risky, stocks moderately risky, and bonds not very risky.

The flip side to risk is that higher-risk assets generally offer higher potential returns. New cryptocurrency projects might return thousands of percent in a single year, for example, while low-risk bonds might only return 1-5% per year.

Volatility

Volatility is a measure of how quickly the price of an asset changes. A stock that shoots up in value one day and then crashes the next is considered much more volatile than a stock that only changes in value by a fraction of a percent each day.

Volatility matters because it can affect the timeframe of an investment. If an investor has all the time in the world to hold something, they might not mind volatility – there’s no pressure to sell at a moment when the asset might be crashing, and they can wait until it skyrockets again. If an investor has a set timeline, they could be forced to sell while an asset is down.

Diversification

One of the most important things to keep in mind when deciding on the best way to invest $25k is diversification. Diversification means having multiple assets that move in different directions inside a portfolio.

Diversification is important because it protects investors from market downturns. Say the stock market crashes. If an investor put all of their $25k in stocks, then they are going to be stuck holding for a while or selling investments while the market is down.

On the other hand, say an investor split their money between stocks, cryptocurrencies, bonds, and commodities. Even though the stock market crashes, bonds and commodities are doing well. Investors can sell these high-performing assets if they need cash and potentially use that cash to invest in undervalued stocks while the stock market is down.

How to Invest $25k – FightOut Tutorial

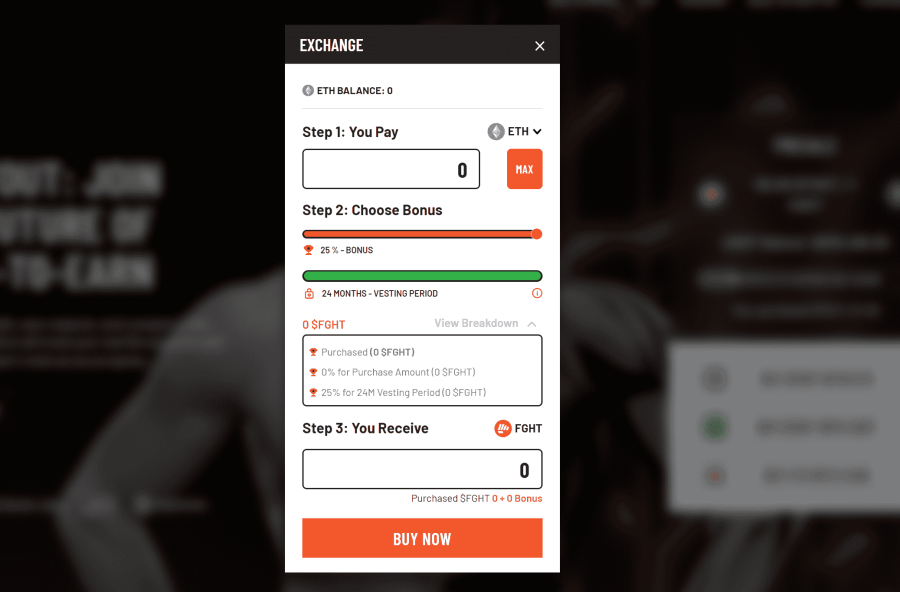

Now that investors know the best way to invest $25k, it’s time to get started. We’ll walk through the steps to invest in FightOut (FGHT), of the best new crypto projects for 2025.

Step 1: Get a Cryptocurrency Wallet

At first, interested users must download a cryptocurrency wallet. Buyers should install a wallet like MetaMask on their browsers. (Mobile users are recommended to download the TrustWallet)

Step 2: Connect Wallet to Presale

In the next step, investors should go to FightOut’s official presale page.

After locating the presale information on the project’s presale page, investors should click on the “BUY $FGHT NOW” button. Now, buyers should choose the wallet they have installed (eg Metamask or TrustWallet) and then login to their wallets.

Step 3: Buy ETH/USDT

After logging in to the wallet, buyers need to top up adequate ETH/USDT to buy $FGHT.

Buyers also have the option to buy ETH with a credit card via Transak. After ensuring enough balance of ETH/USDT, buyers should click either on the “Buy $FGHT with ETH” or “Buy FGHT with USDT” button.

Step 4: Buy $FGHT

In this step, buyers should specify the amount of ETH or USDT they would want to exchange in return for $FGHT tokens.

Step 5: Claim $FGHT

In the final step, investors can confirm the transaction after rechecking the number of $FGHT tokens to be received. Finally, investors can claim these tokens based on the vesting period they opted for.

Cryptoassets are a highly volatile unregulated investment product.

Conclusion

Our list of the 10 best ways to invest $25k can help investors decide where to invest $25,000 right now. For investors in search of top crypto projects, it’s worth checking out FightOut ($FGHT). The project’s effective use cases and successful first presale stage has set the stage for solid growth in the coming times. Currently, FGHT is available to buy for $0.0167 per token.

Fight Out - Next Big Train-to-Earn Crypto

FAQs

What is the best way to invest $25k?

How much money can I make if I invest $25k?

References

- https://www.ameriprise.com/financial-goals-priorities/taxes/how-are-investments-taxed

- https://www.finra.org/investors/

- https://www.reit.com/investing/