Investing is one of the best ways to build wealth over time and save up for big financial goals like retirement. Have $2,000 to invest and need to know what to do with it? In this guide, we’ll explain how to invest $2,000 and explore the 10 best 2,000 dollar investments for 2025.

10 Best Ways to Invest $2,000 in 2025

Want to know how to invest $2,000? Here are the 10 best ways to invest $2,000 in 2025:

- High Potential Crypto Presales Like Love Hate Inu – Our top $2k investment for 2025

- Stocks – Invest in the World’s Biggest Companies

- ETFs – Invest in a Market Sector or Country

- 401(k) Plans – Put Money Away for Retirement

- Crypto Interest Accounts – Earn Ultra-high Interest on Crypto

- Index Funds – Match the Performance of the Stock Market

- Crypto Staking – Earn Crypto Rewards while Supporting Blockchains

- Copy Trading – Trade Stocks, Crypto & More on Autopilot

- NFTs – Invest in the Next Big Digital Artwork

- Commodities – Trade Oil, Gas, Coffee & More

A Closer Look at the Best Examples of How to Invest 2,000 Dollars

We’ll explain more about how to invest $2,000 and explore the best sectors for investing 2,000 dollars today.

1. High Potential Crypto Presales Like Love Hate Inu – Our Top $2k Investment for 2025

Crypto presales are a great way for investors to get in on the ground floor of an exciting new coin. The presale period allows early adopters to purchase tokens, usually at a reduced price, before the official launch. It’s kind of like buying shares in a company before the IPO. Of course, like buying shares of a company pre-IPO, there are risks involved, but the potential upside is massive.

Some of the biggest gains in crypto in recent years have come from buying into a coin during its presale. A recent example is Lucky Block. This popular crypto began selling for $0.00015 during its presale period, so a $1,000 investment would have purchased more than 6.6m tokens. Then, shortly after the official launch in 2022, the price accelerated all the way up to a peak of $0.009.

Those were massive gains for presale purchasers, with the aforementioned 6.6m coins being worth around $60,000 at the peak. That represents a 6000% return on investment within just weeks of purchasing the initial coins.

The tricky part is identifying which presale crypto will be the next big thing. We think our top crypto presale, Love Hate Inu, could be that coin.

Love Hate Inu – The Top Crypto Presale and Best Way to Invest $2,000

Love Hate Inu is easily the best crypto presales around right now. This meme coin meets utility crypto looks set to take the markets by storm.

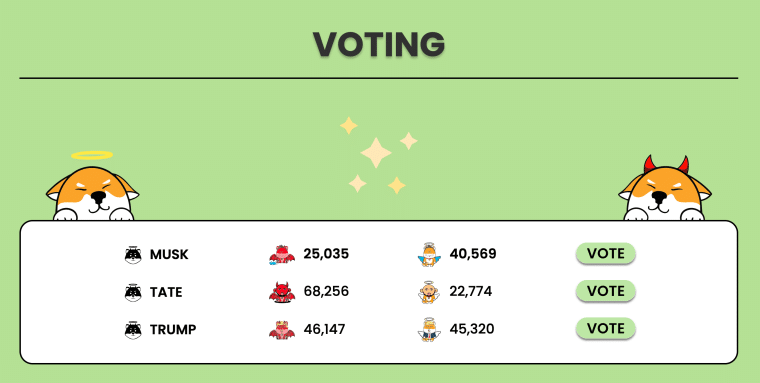

Love Hate Inu is a meme coin at heart, but where it differs from its ancestors like Dogecoin, LHINU utilizes vote-to-earn as a way to achieve real-world usage. Most meme coins have to rely entirely on popularity and virality to become popular, even Dogecoin rode that wave to success. By using vote-to-earn as the basis for Love Hate Inu, the founders have come up with a way to combine the incredible popularity of this type of coin with the utility of Ethereum.

The popularity of Love Hate Inu has been instantaneous. Just two days after presales went live, over $250,000 has been raised from presale purchases. During the presale phase, Love Hate Inu will gradually increase in value. Those who invest during the opening week will be able to purchase coins at the lowest price of $0.000085.

From there, the presale price will gradually increase weekly until it launches at a price of $0.000145. For investors looking to buy $2,000 during week one, they would get just over 23.5m coins of Love Hate Inu. Once the coin launches at the $0.000145 price, those 23.5m coins will be worth around $3,400, which is a massive 70% return on investment in just two months.

Love Hate Inu is also resistant to the rug pull scams that can be unfortunately common with nefarious crypto coins these days. During the two-month presale period, 90% of LHINU coins will be made available for sale. The remaining 10% will be held back to cover listing fees, community rewards, and to ensure liquidity.

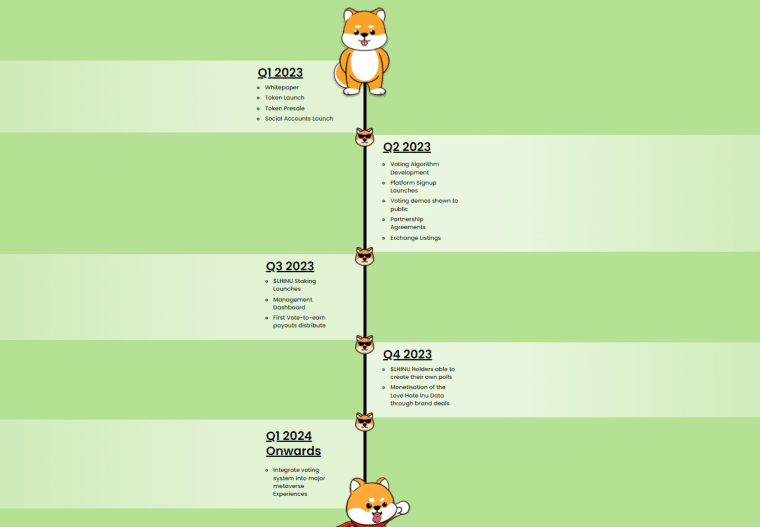

The official road map for Love Hate Inu has community voting slated to go live, with the vote-to-earn rewards, in Q3 2023. Once that is live, holders of LHINU will be able to stake their coins to take part in votes which will earn them even more tokens. Making it a great way to earn free crypto. Going forward, the plan is for Love Hate Inu to become a source of trusted voting, where all votes are verified via the blockchain.

Since there’s no way to cheat with blockchain-verified voting, Love Hate Inu could become one of the most popular and trusted ways to vote on a variety of topics. There are even talks of using blockchain-verified voting in official government elections. Although that likely wouldn’t use LHINU, the goal is for this vote-to-earn crypto to eventually be embedded within the metaverse, which is something it would be very suited for.

| Presale Started | March 8, 2023 |

| Purchase Methods | ETH, USDT, Credit/Debit card. |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

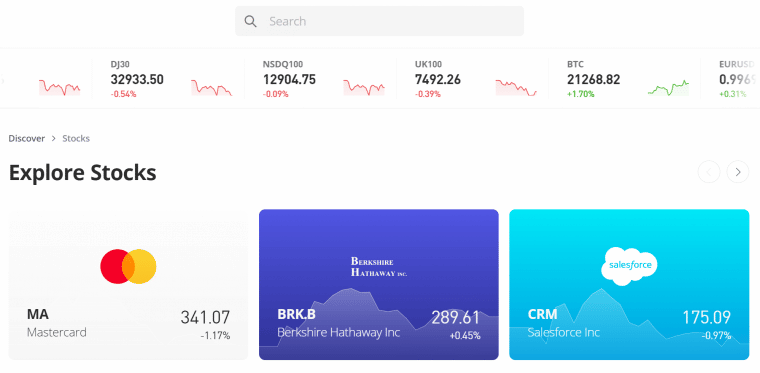

2. Stocks – Invest in the World’s Biggest Companies

Whether it’s investing in startups, blue-chip stocks are one of the most common types of investment, and they’re an important part of any investment portfolio. Stocks offer exposure to the biggest companies in the US and around the world. Some even pay a dividend to offer investors steady income.

When investing in individual stocks, it’s important to choose shares of companies that investors know and like. If there’s a company that seems to be doing particularly well or that everyone is talking about, for example, that could be a stock worth investing in. Alternatively, investors can look at specific market sectors that they think are hot, like biotech stocks or 5G stocks, and invest in stocks from those sectors.

As for how to invest 2,000 dollars in stocks, it’s important that investors have a reliable stock brokerage. Finding cheap stocks and investing early is one of the most popular strategies traders use when learning about value investing.

Additionally, you might be interested in reading our guide on how to invest in the best pre-IPOs for 2025.

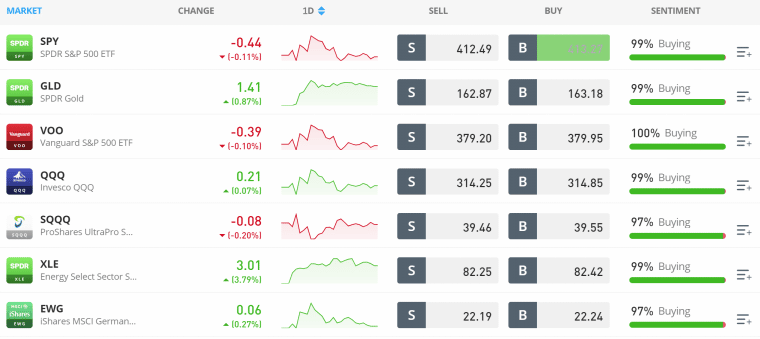

3. ETFs – Invest in a Market Sector or Country

ETFs, or exchange traded funds, are baskets of stocks or other assets that investors can buy in a single transaction. When an investor owns an ETF, they have financial exposure to everything inside the ETF – whether that’s hundreds of stocks, dozens of cryptocurrencies, or something else entirely.

ETFs are often considered the best way to invest $2,000 because they provide built-in diversification. Instead of risking $2,000 on a single stock, investors can invest across an entire market sector, industry, or country. There are even themed ETFs that invest in topics like blockchain technology, space exploration, or renewable energy – such as sustainable investing funds.

In fact, there are so many ETFs that it can be hard to know where to start. Investors should first have an idea of what sector or topic they want to invest in, and then find an ETF that fits their needs. Be sure to check an ETF’s expense ratio, which is an annual fee that the fund charges in order to pay for management expenses. ETFs also provide access to a wide range of sectors, including the energy sector. Many investors are looking to invest in carbon credits as the price of fuel and carbon continues to rise.

4. 401(k) Plans – Put Money Away for Retirement

A 401(k) plan isn’t an investment in and of itself, but it’s worth including in our list of how to invest $2,000 because it’s so important for retirement. With a 401(k) plan, investors can put money into an investment account tax-free. All profits they make from investments in the 401(k) account are also tax-free. Investors only pay tax when they take money out of the account.

The catch to a 401(k) is that there are restrictions on when investors can withdraw money. These accounts are designed to promote retirement savings, so there are penalties if money is withdrawn before investors turn 55. So, any money investors put in a 401(k) plan should be invested for the long term.

Most investors receive 401(k) plans through their employer, and the options for investment may be limited. For example, many 401(k) plans only offer ETFs or mutual funds and don’t allow investors to pick individual stocks or invest in cryptocurrency. Investors have the option to open an Individual Retirement Account (IRA), which functions similarly to a 401(k) and offers more flexibility when it comes to choosing investments.

5. Crypto Interest Accounts – Earn Ultra-high Interest on Crypto

Crypto interest accounts are interest-bearing accounts where investors can earn money just by holding cryptocurrencies. They work similarly to savings accounts at traditional banks, except that the interest rates offered on cryptocurrency can be 10-100 times higher than what investors would typically receive for holding US dollars.

One of the nice things about crypto interest accounts is that they support a wide range of popular cryptocurrencies. So, investors can hold Bitcoin, Ethereum, Tether, or any other top altcoins and earn interest on them. Different coins have different interest rates, so it’s up to investors to build a portfolio of interest-earning tokens.

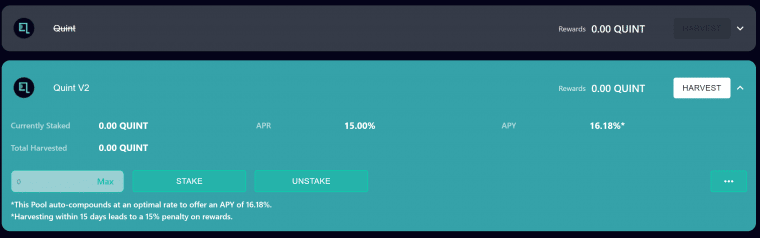

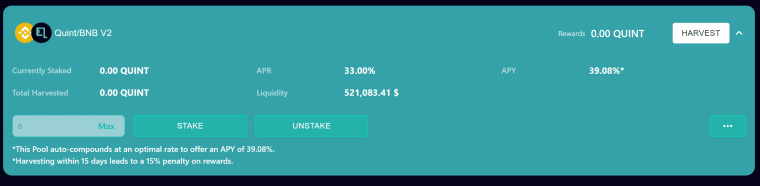

Investors who want to know where to invest 2,000 dollars in a crypto interest account should check out Quint. Quint is a new crypto project that offers up to 16.18% APY interest when investors hold Quint’s token or 39.08% APY when they hold a combination of Quint and BNB tokens. Interest payments compound automatically, leading to even more interest in investors’ accounts over time.

6. Index Funds – Match the Performance of the Stock Market

Index funds are ETFs or mutual funds that are designed to track major stock market indices like the S&P 500 or NASDAQ. Index funds are widely used for retirement investing because they’re seen as a relatively safe bet – history has demonstrated that the stock market, on average, goes up by about 10% per year.

Index funds work by simply mirroring the composition of the indices they track. For example, the S&P 500 includes the 500 largest stocks in the US by market cap. So, an S&P 500 index fund includes shares of those 500 companies in the same proportions as they are represented by the index. If the S&P 500 goes up 1%, the index fund should also go up 1%.

When investing in index funds, be sure to check the expense ratio. The best index funds have expense ratios of 0.5% or less, and some offer expense ratios of 0.2% or less. Investors can find a wide range of popular index funds at brokerages.

7. Crypto Staking – Earn Crypto Rewards while Supporting Blockchains

Proof of stake (PoS) blockchains like those used by Cardano, Solana, and other major crypto projects require users to stake tokens to the blockchain. These users validate transactions and forfeit their stake if they act maliciously on the chain. If they act in good faith and keep the blockchain flowing, stakeholders are rewarded with more tokens.

Crypto staking, as this process is known, offers a way for investors to earn rewards from this process. When staking crypto, individual investors can contribute their cryptocurrency to a pool of tokens that are used to keep a blockchain running. That pool then distributes rewards to everyone who contributed tokens.

Crypto staking rewards are often expressed as interest rates, and these accounts have a lot in common with crypto interest accounts. At projects like Quint, investors can stake crypto and earn rewards up to 39.08% APY. Other crypto staking platforms offer staking on a wider variety of tokens and variable interest rates for each coin.

8. Copy Trading – Trade Stocks, Crypto & More on Autopilot

Copy trading is a feature offered by some brokerages that let investors automatically copy the portfolios of more experienced investors. This can be a suitable option for beginner investors who aren’t sure what to invest in but want to try to beat the market using advanced trading strategies.

With copy trading, investors can see an experienced trader’s strategy, trade history, and performance. If they like what they see, they can invest a certain amount of money to copy that trader’s moves. Whenever the trader buys or sells, the investor’s account will also buy or sell the same assets. Copy trading can be used for everything from stocks to ETFs to crypto.

9. NFTs – Invest in the Next Big Digital Artwork

NFTs, or non-fungible tokens, are unique tokens that offer ownership over a digital asset. NFTs are frequently used to buy and sell digital artwork, but they can also be used to provide exclusive membership in virtual clubs or to give players a financial stake in play-to-earn crypto games.

Some of the best NFT projects today include Bored Ape Yacht Club, Nouns, VeeFriends, and others. These projects have seen the value of their NFTs skyrocket since they were first minted, generating windfalls for early investors. While many new NFT projects flop, savvy investors can pick out top projects and potentially make a lot of money as demand for the NFT collection grows.

One of the best NFT collections to check out in 2025 is Lucky Block. Lucky Block is a play-to-earn crypto game that offers daily prize drawings. Investors in Lucky Block’s Platinum Rollers Club NFTs have a 1-in-10,000 chance of winning $10,000 every single day. Even those who don’t win can make money by loaning out their NFT.

Lucky Block NFTs can be purchased today at Launchpad, one of the top NFT marketplaces.

10. Commodities – Trade Oil, Gas, Coffee & More

Commodities are physical goods like oil, gas, coffee, wheat, sugar, gold, copper, and more. They include energy materials, precious metals, building materials, and food supplies that are traded around the world. The market for commodities is typically global, so the price of these products depends on markets all over the world.

Investing in commodities can be tricky, especially for beginners. However, commodities trading can be potentially lucrative for those who understand how these markets work. It’s usually a good idea to focus on one specific commodity so that investors understand all of the dynamics behind it, as opposed to trying to trade multiple different commodities.

The simplest way to trade commodities is by using a broker that offers commodity CFDs (contracts for difference).

How to Choose the Best $2k Investments For You

Investors need to know the best way to invest $2,000 for their specific needs. In this part of our guide, we’ll explain how to invest 2,000 dollars based on several key factors.

Financial Goals

Before investing any money, investors should always think carefully about what their goals are. Some investors want to build up a nest egg for retirement, others want to invest to save up for a house, and others want to invest as a side hustle that supplements their income.

Each of these financial goals has a different timescale and may be better suited to investments with more or less risk. So, investors need to match their goals with their investment strategy and always keep an eye on how their investments get them closer to reaching their goals.

Risk vs. Return

One of the most important things investors need to consider when investing $2,000 is how they want to balance risk and return. In general, generating greater returns requires taking on more risk. If an investor wants to double their money in just a few months, they’ll probably need to invest in a high-risk asset that could also go to zero.

High-risk, high-reward assets include cryptocurrencies, individual stocks, and commodities. Lower-risk assets include ETFs and index funds, which spread out risk across many different stocks.

Volatility

Another thing to consider is volatility. Volatility is a measure of how much the price of an asset swings up or down over a given period of time. More volatile assets may hit an all-time high one day and an all-time low the next, whereas low-volatility assets have more stable prices.

High-risk assets often tend to have high volatility, in part because investors can be jittery about their performance. For example, cryptocurrencies are known for being highly volatile compared to stocks. Importantly, this volatility can be an advantage for aggressive investors who want to try to time a big upswing.

Diversification

Long-term investors may want to consider investing in multiple different assets when investing $2,000. In other words, they can build a diversified portfolio that balances risk and reward.

The advantage of this approach is that investors don’t have to put all their eggs in one basket. They might invest $500 in a high-risk, high-return cryptocurrency project like Love Hate Inu. They might invest another $500 across several of the best stocks to invest $2,000 and another $500 in index funds. Finally, they might invest $500 in crypto staking, which offers a steady income over time.

Where to Invest $2,000 – the Best Option?

Choosing where to invest $2,000 is a major part of investing. Investors need to decide whether to invest in one or more crypto projects, whether to use a crypto exchange or what stock or ETF brokerage to use. Investors may also decide to split up their $2,000 and invest smaller amounts of money in multiple places.

We think the best place to invest $2,000 in 2025 is in Love Hate Inu. This project offers a revolutionary vote-to-earn/meme coin combo that could prove incredibly popular. It also has a great roadmap for the years ahead, which can solidify it as a must-own crypto of the future.

Conclusion

There are many approaches to investing $2,000, but we think the best way to invest 2,000 dollars in 2025 is to buy Love Hate Inu.

This new cryptocurrency project has unique features that help users to earn rewards from voting in polls and provides a framework for fun and secure voting of all kinds. Love Hate Inu is currently in its first presale week, so it can be bought for $0.000085. This price will increase each week in the run-up to the official launch in May.

Love Hate Inu - Next Big Meme Coin

FAQs

What should I invest $2k in?

What is the best way to invest 2,000 dollars?

How much can you earn by investing $2,000?

Where to invest $2,000 a month?

How can I double my money in a few years?

How can I grow my money fast?

References

- https://www.ameriprise.com/financial-goals-priorities/taxes/how-are-investments-taxed

- https://www.investor.gov/introduction-investing/investing-basics/role-sec/laws-govern-securities-industry

- https://www.irs.gov/retirement-plans/401k-plans