Although interest rates are rising globally, conventional bank accounts in the US and Europe still only offer a small fraction of 0.1% in annual interest.

As such, those with access to $1,000 worth of savings might consider putting their money to work through an investment strategy.

In this guide, we explore how to invest $1,000 across a variety of asset classes – including but not limited to stocks, index funds, ETFs, commodities, NFTs, and more.

10 Best Ways to Invest $1,000 in 2024

Across a variety of upside potentials and risk tolerance levels, those learning how to invest $1,000 might consider the asset classes listed below:

- High Potential Crypto Presales Like Love Hate Inu – The Best $1k Investment for 2024

- Stocks – Build a Diversified Portfolio of US and International Stocks

- ETFs – Gain Access to Multiple Assets Through a Single Trade

- 401k Plans – Create a Long-Term Investment Portfolio That is Tax-Efficient

- Crypto Interest Accounts – Earn Passive Income on Popular Crypto Assets

- Index Funds – Invest in a Popular Index Fund Like the S&P 500 or Dow Jones

- Crypto Staking – Earn Fixed Rewards for Locking Crypto Assets

- Copy Trading – Automatically Mirror the Trades of an Experience Trader

- NFTs – Join the Non-Fungible Token Revolution by Flipping NFTs

- Commodities – Hedge Against the Stock Markets by Gaining Exposure to Commodities

Investing for the first time can be a daunting task for beginners. As such, when considering where to invest $1,000 right now, it is important for investors to conduct thorough and independent research.

The Best Examples of How to Invest 1,000 Dollars

When injecting money into the financial markets, it is wise to consider a range of asset classes and investment products. This will ensure that the investor is choosing a suitable product for their financial objectives and tolerance for risk The good news is that most investment products can now be accessed online – so diversification can be achieved with ease.

With this in mind, in the sections below, we explore the 10 best ways to invest $1,000 from the comfort of home. We also have guides on how to invest $5,000 and the best ways to invest $10k if you are considering a higher entry point.

1. High Potential Crypto Presales Like Love Hate Inu – The Best $1 Investment This Year

Crypto presales are a great way for investors to invest in a coin before it officially hits the market. Similar to buying stock of a company pre-IPO, buying a new crypto while it’s in presale can potentially offer some of the highest upsides in investing.

It doesn’t come without risks, all cryptos are more volatile than traditional risk-averse investments. There are also some cryptos out there that have been known to pull the rug out from under early investors, causing the price to plummet after launch.

If, however, you can find a legitimate crypto project with real-world usage, investing in it could be one of the best financial decisions of your life. Take Lucky Block as an example, during its presale, coins were sold for $0.00015. That means a $1,000 investment in Lucky Block at its presale price would have netted over 6.6m tokens.

Shortly after its official launch, Lucky Block skyrocketed to $0.009 per coin, making those 6.6m coins worth around $60,000. That’s a 6000% increase in investment within weeks of the presale starting and the launch taking place.

Of course, not all crypto presales have that kind of potential. It’s important when analyzing a crypto presale to make sure that the coin in question has real utility. The key to a successful crypto coin is popularity and real-world utility. That’s where our top crypto presale, Love Hate Inu, comes in.

Love Hate Inu – The Most Exciting Crypto Presale & Best Way to Invest $1,000

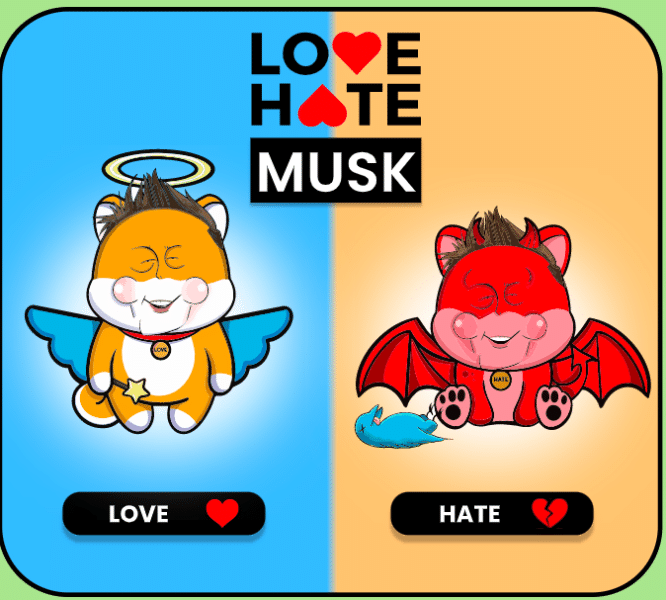

Love Hate Inu is one of the most exciting presales in a long time. This compelling new crypto combines the incredible popularity of meme coins like Dogecoin with the utility of Ethereum.

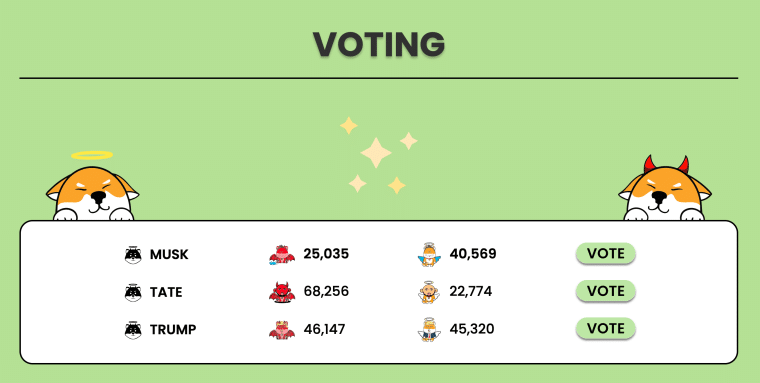

Love Hate Inu is one of the first cryptos to utilize vote-to-earn, a system where users can stake their coins to vote and earn more tokens by doing so. Vote-to-earn uses the blockchain to guarantee the authenticity of each vote, and there are even calls for governments to use this type of technology in elections. Love Hate Inu wants to combine the incredible popularity of meme coins with the utility of being a vote-to-earn coin.

The presale for Love Hate Inu began on March 8 and raised over $200,000 within two days. During the first week of the presale, the price for Love Hate Inu is $0.000085 and will rise each week for two months until launch, when it will go on sale for $0.000145. That means a $1,000 investment in LHINU during the opening week of presale will garner over 11.7m coins which will be worth around $1,700 at launch.

The success of any meme coin essentially boils down to popularity. The more popular a meme coin, the more widespread its usage will be, and it will have a stronger community of supporters standing behind it.

That bodes well for Love Hate Inu, as the community will have direct influence over the coin. In the beginning, LHINU owners will be able to stake their coins to vote in polls on created by the founders. However, according to the official roadmap, users will be able to create their own polls by the end of this year. That will allow the community to have a say in the direction of content for Love Hate Inu.

Eventually, the idea is for Love Hate Inu to be used as a secure voting platform for the metaverse. Since all voters must first stake, and therefore own, LHINU tokens, that gives the coin nearly limitless upside potential.

During the presale period, 90% of the 100 billion LHINU coins created will be made available to buy. This is to ensure that the Love Hate Inu community holds the majority of tokens and also guarantees that there will be no rug pull as some now infamous projects have pulled on users. 10% of the coins will be held back for community rewards, to cover listing fees, and for liquidity.

| Presale Started | March 8, 2023 |

| Purchase Methods | ETH, USDT, Credit/Debit card. |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

2. Stocks – Build a Diversified Portfolio of US and International Stocks

The next asset class to consider when assessing how to invest $1,000 is stock investing. This is perhaps the go-to option for first-time investors, not least because the stock markets are accessible to all. In fact, since the age of online brokerage accounts that are aimed largely toward retail clients, investors can get started with a stock portfolio for just a few dollars.

This is possible through ‘fractional ownership’ – which means that investors can buy a small fraction of a stock. Let’s take UnitedHealth Group stock as a prime example. At this moment in time, the popular healthcare stock is trading for over $500 per share.

This means that by meeting the minimum of $10, investors would be purchasing approximately 2% of a stock. This might appeal to those on a budget of $1,000 – as it would enable the investor to diversify across multiple sectors from many different sectors – such as retail, tech, banking, oil and gas, consumer goods, and more.

Another benefit of investing in the stock market is that investors have thousands of companies to choose from. In the US, for instance, the two primary exchanges as the NASDAQ and the NYSE. However, many online brokers now offer seamless access to foreign stock exchanges at the click of a button. This means that some brokers allow their users to invest in startups.

Popular examples include the London Stock Exchange, Tokyo Stock Exchange, and Euronext. Crucially, this enables the investor to diversify their $1,000 capital into international markets to ensure that they are not overexposed to the US economy. Furthermore, and perhaps most importantly, it is now possible to invest in stocks without paying any commissions.

In terms of seeing growth on the $1,000 investment, this can come in two forms when investing in stocks.

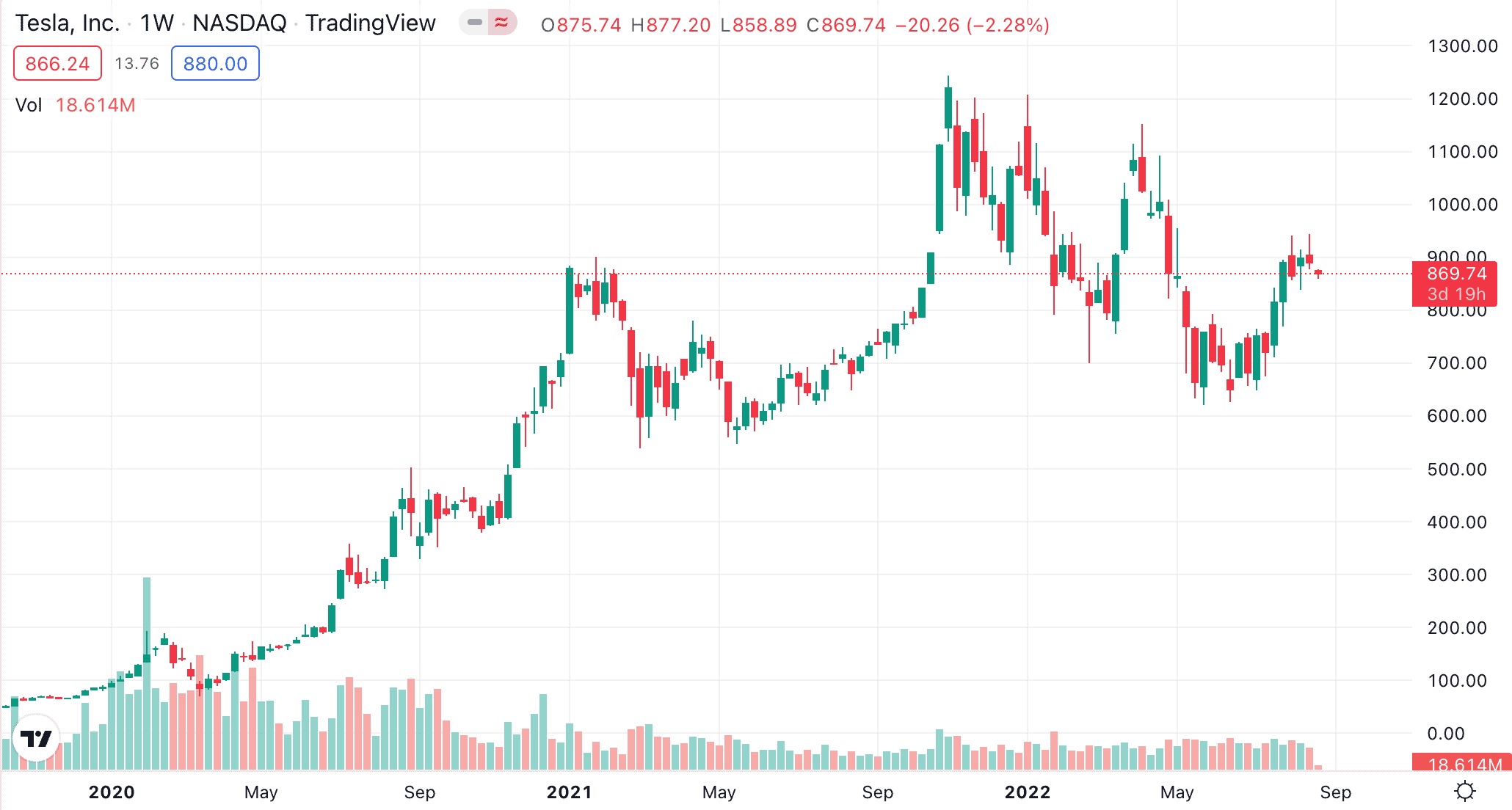

First and foremost, the primary objective for most investors is to see the value of the stock increase over a period of time. For example, over the five years of trading, Tesla stock has increased by more than 1,000% On a $1,000 investment, this would translate into returns of over $10,000. Tesla is, therefore, one of the best stocks to invest $1,000 in recent times. Some investors are also looking to invest in pre-IPOs. Simply put, these are stocks that have yet to go public but can be purchased on a presale-type basis.

The second way to see growth when investing in stocks is via dividends. Many stocks pay dividends, and when this is the case, investors should expect an average yield of between 2-4%. Dividends are typically distributed by companies every three months, and seasoned investors will often reinvest the funds to benefit from long-term compound growth.

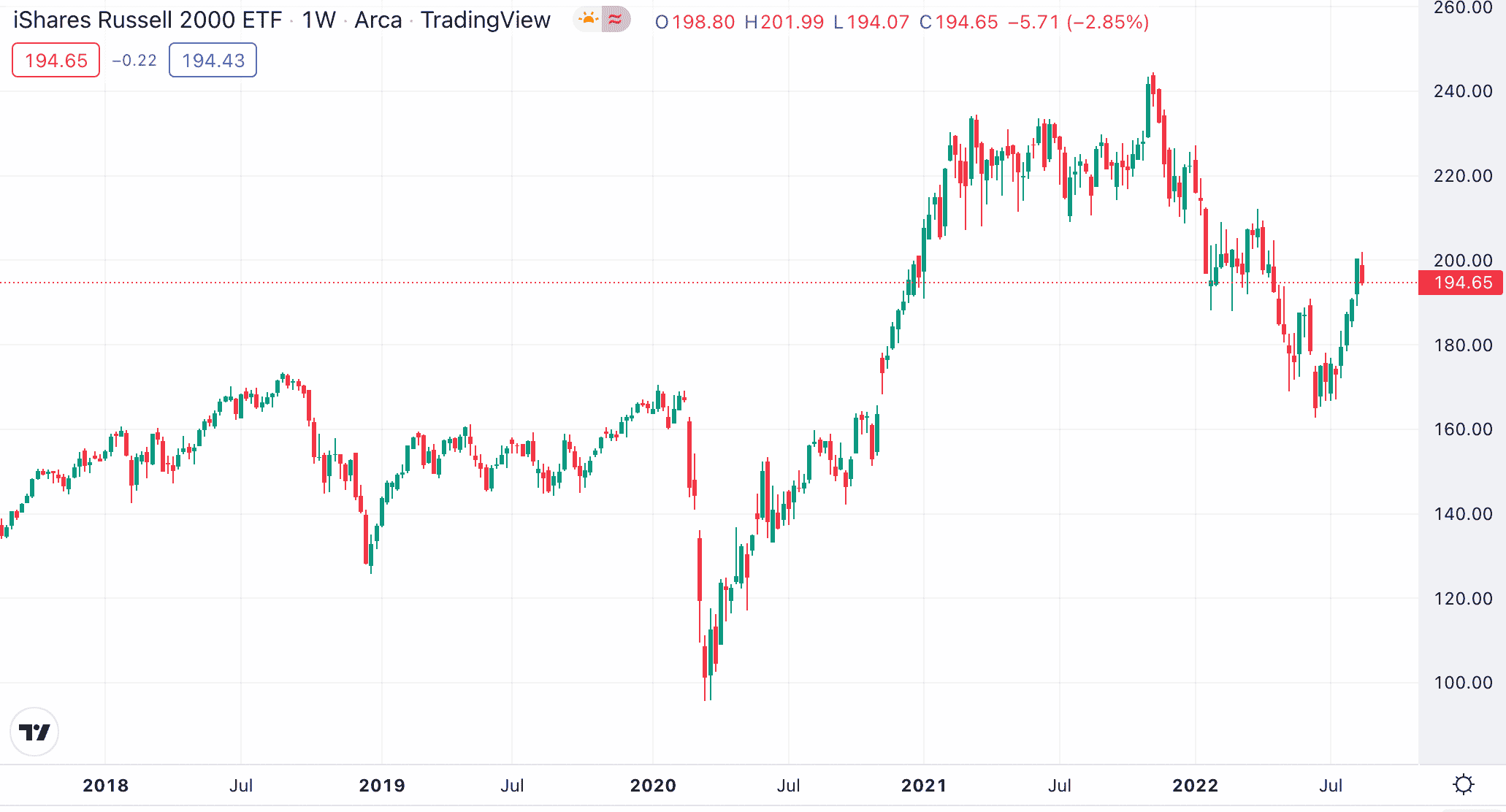

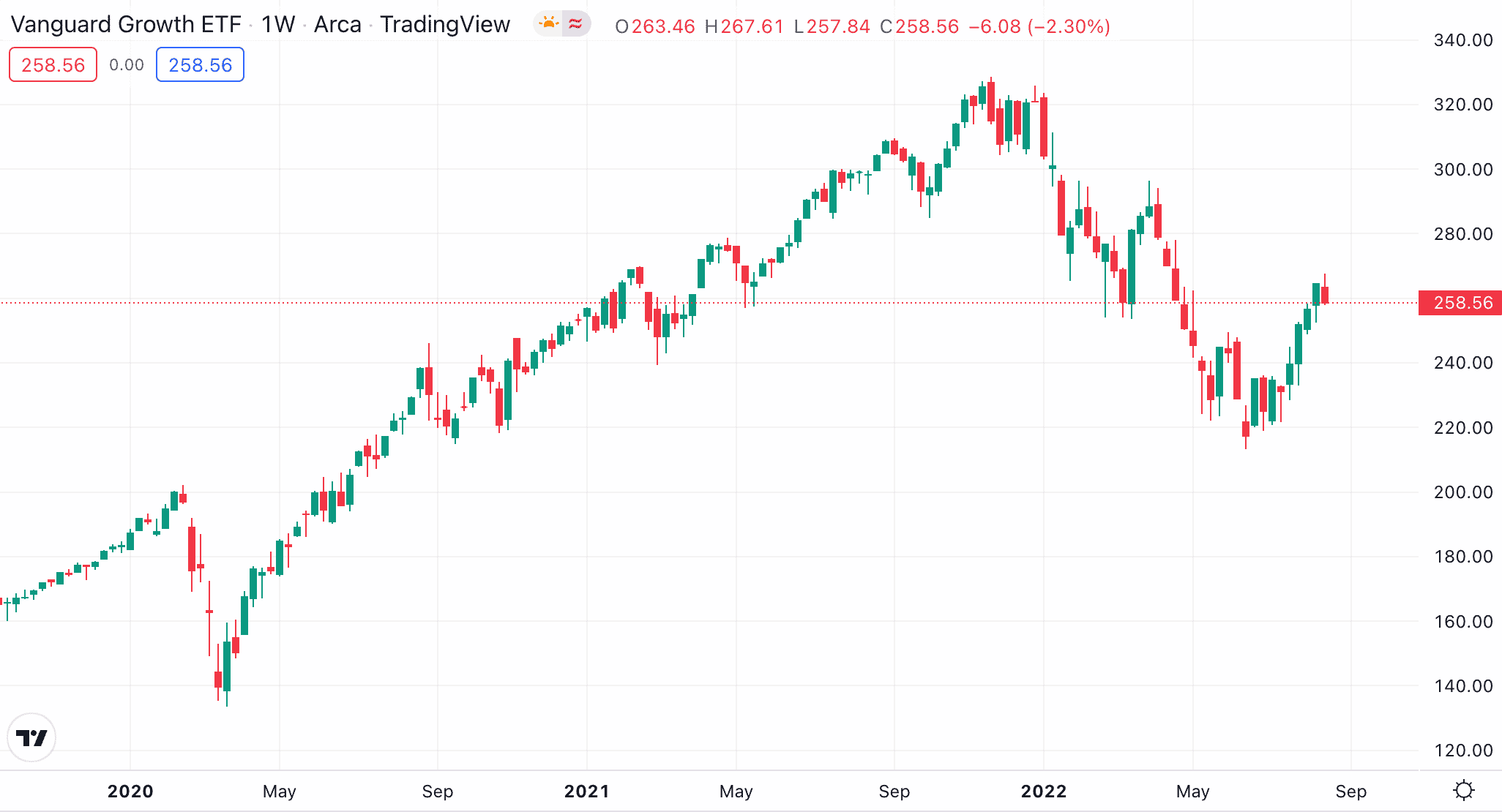

3. ETFs – Gain Access to Multiple Assets Through a Single Trade

Many investors of all shapes and sizes will turn to ETFs (exchange-traded funds) in the search for growth in a diversified manner. But what is ETF trading? In their most basic form, ETFs are financial instruments that enable investors to gain exposure to a group of assets via a single trade. In most cases, ETFs will look to track a benchmark index like-for-like.

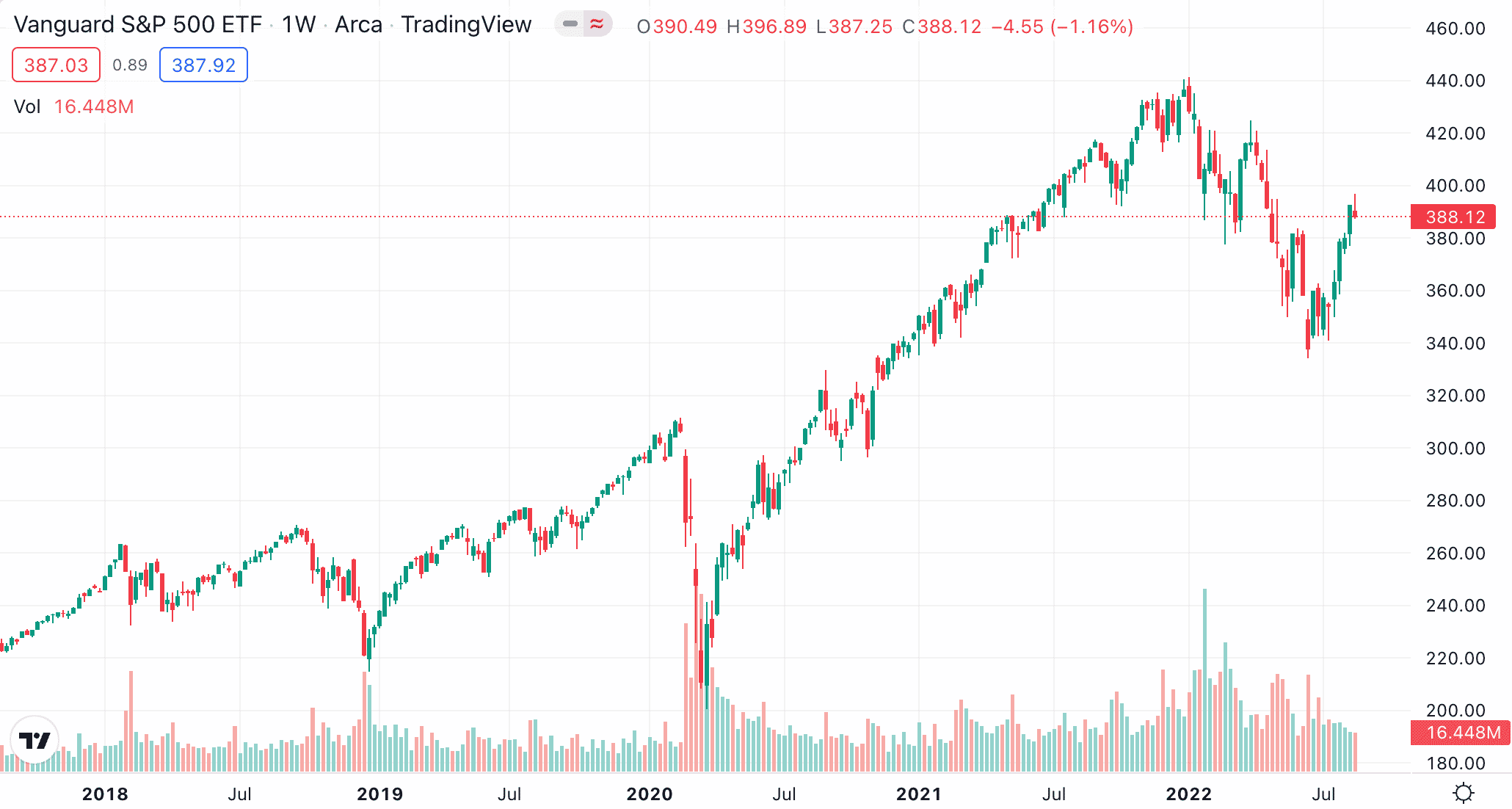

For example, one of the most popular ETFs in this market is the Vanguard S&P 500. This ETF will track the performance of all 500 stocks that form the S&P 500 by purchasing each equity at the correct weight. Another example of a popular ETF is the iShares Core Dividend Growth.

This ETF tracks the performance of solid dividend stocks, such as Coca-Cola, Cisco Systems, Johnson & Johnson, and Microsoft. Crucially, ETFs can track just about any asset class or market – from stocks and index funds to gold and crude oil. From the perspective of the investor, this enables access to a basket of assets in a passive way.

The reason for this is that the ETF provider – whether that’s the likes of iShares, Vanguard, or SPDR, will manage its portfolio on behalf of its investors. This means that the provider will regularly rebalance and reweight its holdings. Unless the ETF is holding non-income-yielding assets like commodities, investors will also receive a regular dividend payment.

This is usually paid every three months by the ETF provider and will reflect the share that the investor has in the fund. Another benefit of considering ETFs when learning how to invest $1k is that the investment is highly liquid. This means that investors can turn their ETF position back to cash at any given time – as long as the market is open.

This is because the vast majority of ETFs in the US trade on the NYSE Arca. When it comes to returns, this will vary considerably depending on the chosen market that the ETF is tracking. For example, an ETF tracking government bonds will likely offer less competitive yields but, equally, a lower amount of risk exposure.

On the other hand, while a growth stock ETF will come with greater risk levels, it will also offer higher upside potential. In terms of gaining access to ETFs, the investor will need to go through a traditional stockbroker.

Investors looking for exposure to green energy and the move to net-zero emissions might be interested in reading our article on how to invest in carbon credits via futures and ETFs.

4. 401k Plans – Create a Long-Term Investment Portfolio That is Tax-Efficient

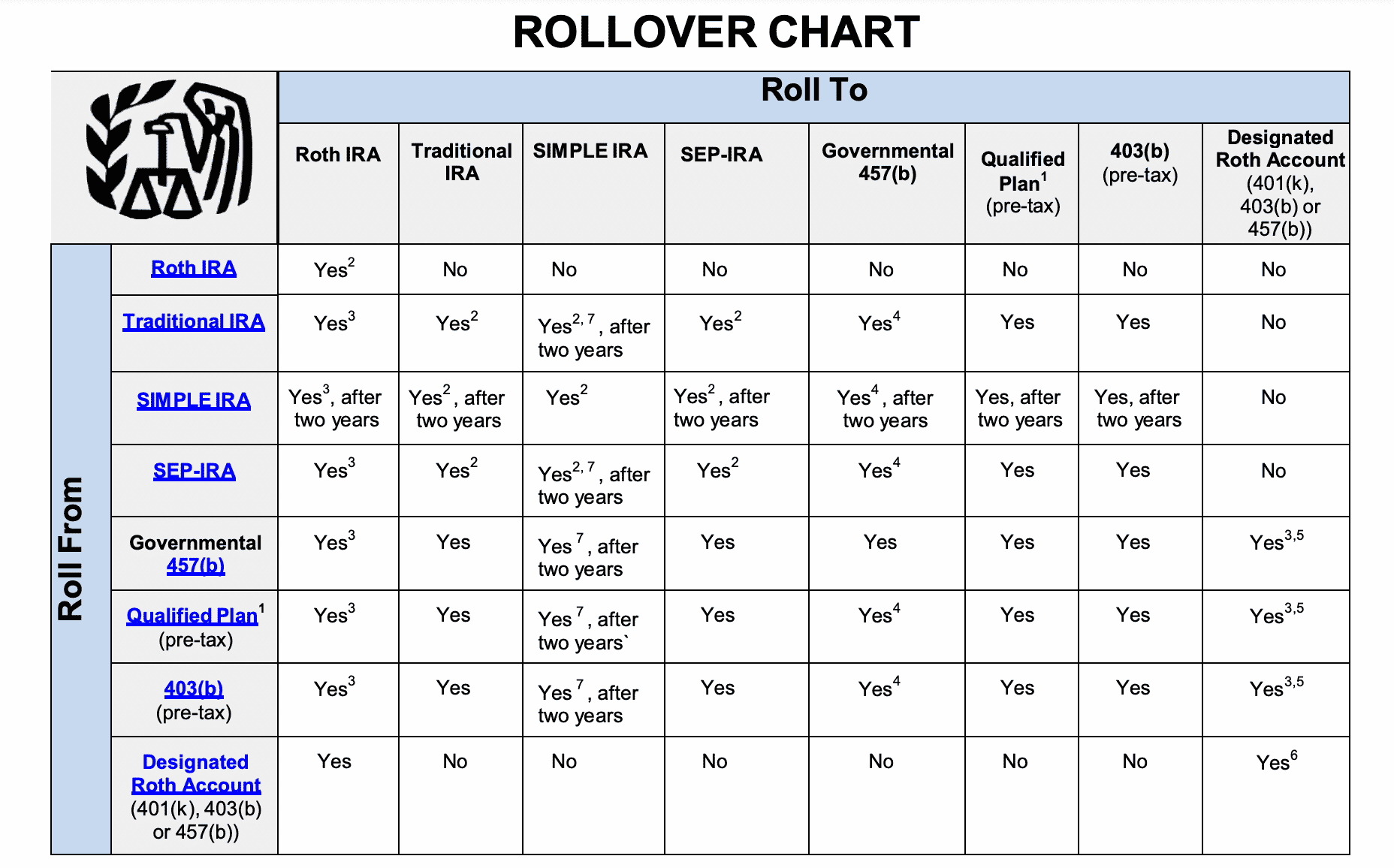

It goes without saying that US-based investors should consider opening a 401k plan with their employer at the earliest opportunity possible. The reason for this is that all investments going through a 401k – up to a certain limit each year, are tax-free. However, it is important to remember that not all employers in the US offer a 401k plan.

If this is the case, investors might consider an IRA – which is offered by many online brokers in the US. Nonetheless, for those new to employer-backed 401k plans, this enables employees to invest some of their paycheck into a select number of markets. The availability of investment products will vary from one employer to the next but will almost always include index funds.

Now, one of the best benefits of opting for a 401k plan is that many employers offer matching contributions. Once again, this will vary from one employer to the next, but the average matching contribution is 50 cents on the dollar, up to 6% annually. In other words, the employer will match 3% of any 401k contributions made by the employee.

For example, if the employee were to invest $10,000 into their 401k plan over the course of the year, the employer would match $300. This is essentially free money, as the contributions made by the employer are in addition to any investments that the employee would have made anyway.

In terms of limits, in 2022, employees can add $20,500 to their 401k plan or $27,000 if the investor is over 50 years old. Furthermore, some employers offer both a traditional and a Roth 401k. This decision will determine whether tax is paid on the 401k investments now or when the investor eventually retires.

Many market commentators will suggest that young employees are better suited for a Roth 401k, not least because they have time on their side. The reason for this is that by paying the tax now, the investments have a long time to mature and grow. And thus, at the time of retirement, the investor can withdraw their 401k contributions and earnings tax-free.

5. Crypto Interest Accounts – Earn Passive Income on Popular Crypto Assets

Investors in the market for passive income will likely know that traditional savings accounts still pay a pittance. For example, at the time of writing, the average interest rate on savings accounts throughout the US is just 0.13%. This means that by investing $1,000 over the course of 50 years, the savings account would yield returns of $1,067.11.

This is why many investors are looking for alternative ways to secure a regular, passive income. One option for investors to consider is a crypto interest account that is backed by crypto assets as opposed to US dollars or other currencies. The concept is largely the same as a conventional savings account insofar as the investor will be paid a rate of interest on their deposits.

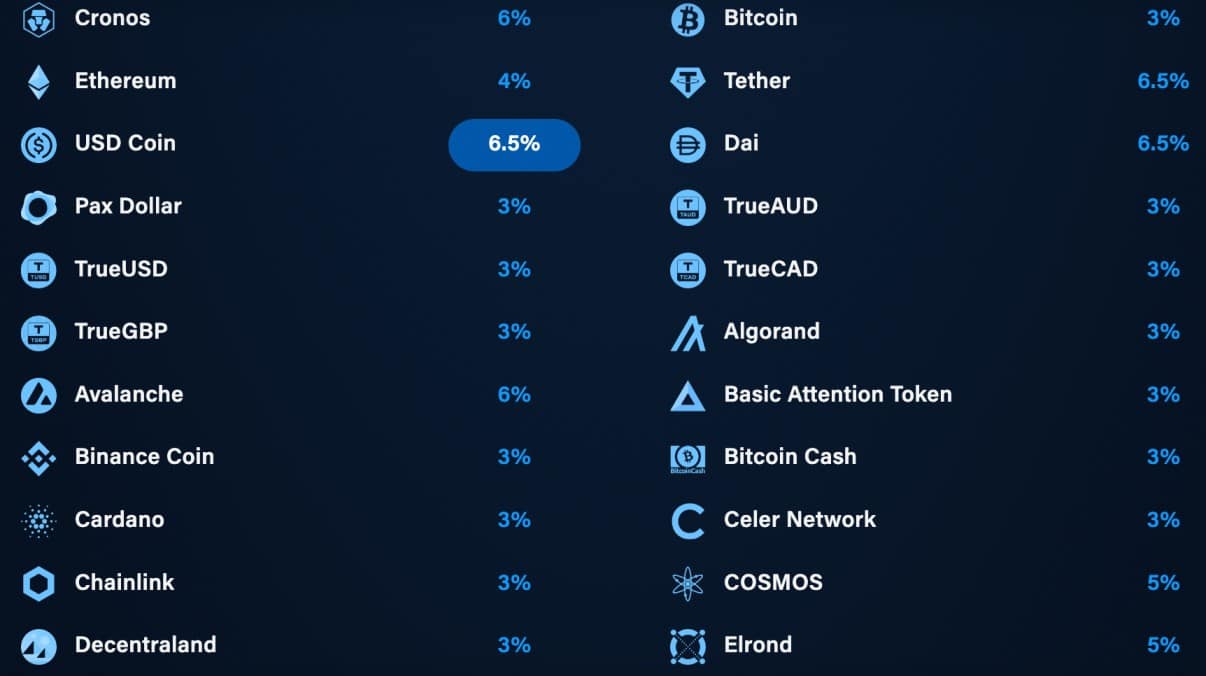

However, in the case of crypto interest accounts, many providers in this space offer an attractive rate of interest. For example, Crypto.com – which is one of the largest crypto exchanges in the US, offers interest accounts that pay up to 14.5%. The interest on offer to the investor will depend on whether they opt for a flexible, 1-month, or 3-month lock-up term.

Moreover, APYs vary depending on the chosen crypto asset. For instance, Bitcoin pays up to 3% on a 3-month interest account, while Polygon yields 7%. Stablecoins like Tether and Dai – which aim to remain pegged to the US dollar, offer a maximum APY of 6.5%.

This might appeal to investors who wish to earn interest without experiencing the volatility that standard crypto assets typically present. With that being said, crypto interest accounts often appeal to long-term investors that wish to generate income on their favorite projects while still benefiting from capital appreciation.

6. Index Funds – Invest in a Popular Index Fund Like the S&P 500 or Dow Jones

Index funds are another option to consider when assessing the best $1,000 investments. Index funds are a benchmark that track a specific market – and this can be anything from stocks and bonds to commodities. However, the most popular funds in this space are those that track the two primary US indices – the S&P 500 and the Dow Jones.

As we briefly mentioned earlier, the S&P 500 is an index that tracks the performance of 500 large companies that are listed across the NASDAQ and NYSE. Crucially, however, this index fund is ‘weighted’ based on the market capitalization of each listed company.

This means that large-cap companies like Amazon, Apple, and Tesla will have a much larger weighting than, say, Paypal and Coinbase. The reason for this is that the S&P 500 aims to replicate the broader US stock markets as best as practically possible. The main benefit for investors is that the S&P 500 offers a long-term, passive approach to the stock market.

After all, the S&P 500 is reweighted and rebalanced every three months. This ensures that the index continues to mirror wider market sentiment. For example, if Google increases its market capitalization and Apple does the opposite, then a higher weighting will be given to the former when the quarterly adjustment is made.

Since the inception of the S&P 500 in 1926, the index fund has generated average annualized gains of 10%. This offers a consistent track record that spans nearly 100 years. Moreover, when investing in the S&P 500 via an ETF that is managed by the likes of iShares or the SPDR, quarterly dividends will be received.

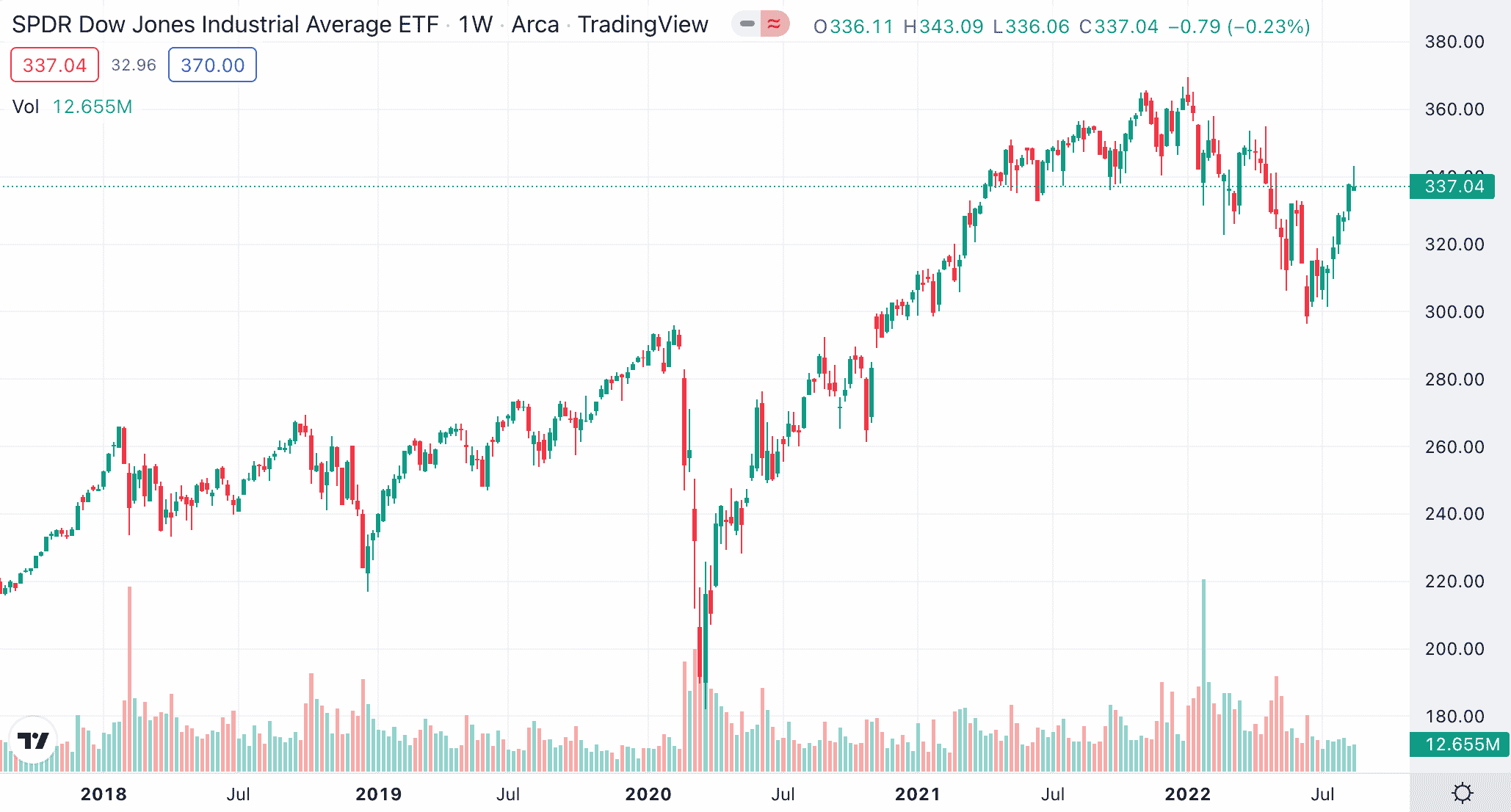

This will reflect any dividend payments that S&P 500 companies made during the quarterly period. Another popular index fund to consider is the Dow Jones. While the S&P 500 is home to 500 companies, the Dow Jones has just 30 constituents. Each constituent represents a blue-chip company from a specific stock market sector.

Furthermore, each Dow Jones company has a long-standing track record of paying dividends. Over the course of time, the Dow Jones has performed similarly to the S&P 500, which illustrates that the index is also indicative of the broader US economy.

If you’re interested in adding index funds to your investment portfolio, you should read our guide on how to invest in index funds right now. Alternatively, you might find our article on how to invest in mutual funds equally as interesting.

7. Crypto Staking – Earn Fixed Rewards for Locking Crypto Assets

Crypto staking is another popular DeFi (decentralized finance) tool that enables investors to generate a yield on their idle digital assets. The main concept is that investors will deposit their crypto assets into a staking pool, which will lock the tokens away for a predetermined number of days.

During this period, the investor will be paid a competitive rate of interest. Once the staking term has concluded, the investor will receive their initial deposit plus any interest earned during the period. This means that if the value of the crypto asset increases while it is locked, the investor will still benefit from this.

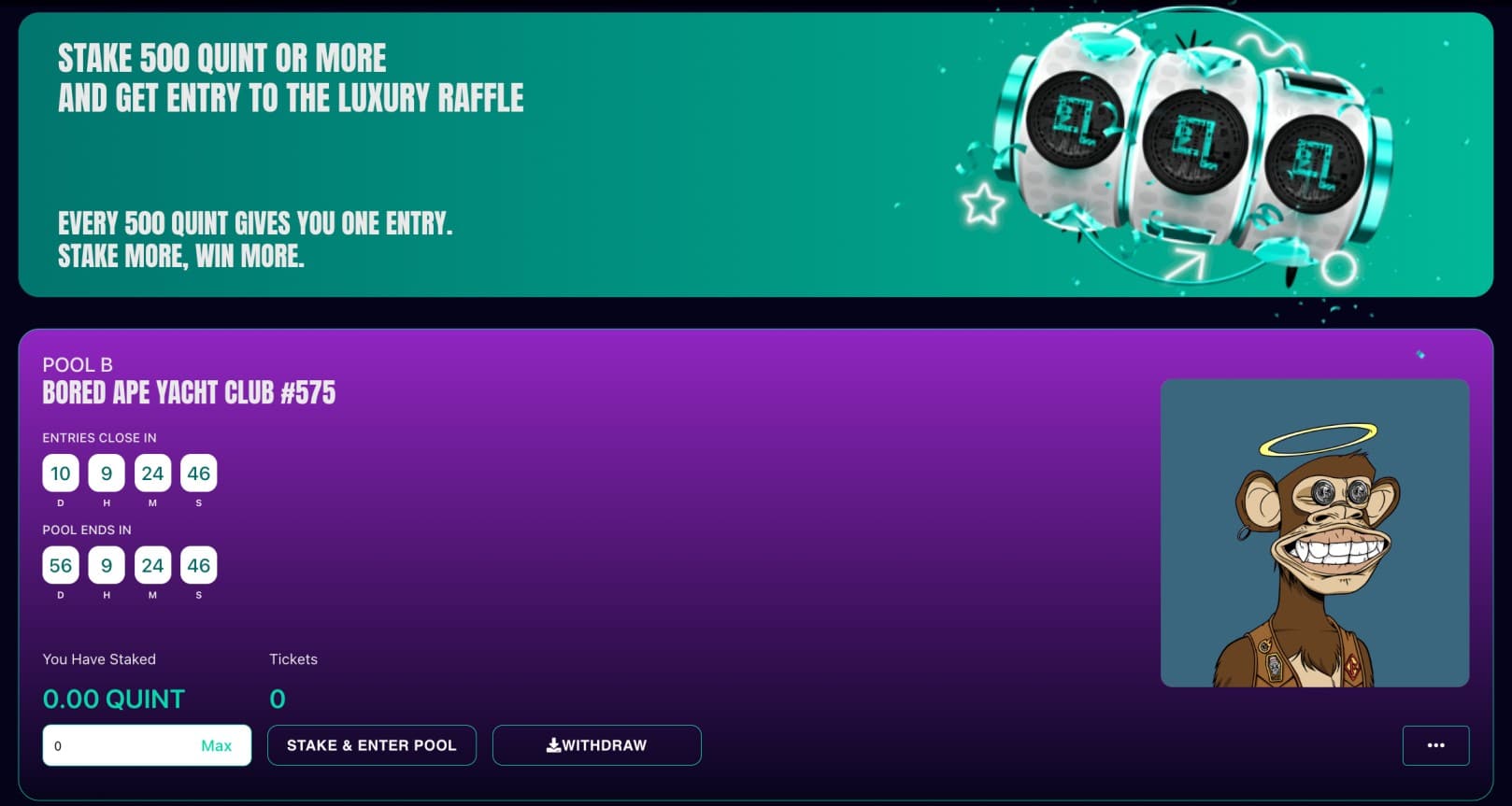

With that said, this benefit is amplified, as the investor will walk away with more crypto assets than they originally started with. One such provider in this space is Quint, which offers an innovative product called ‘super staking’. This follows the main principles of staking but takes the reward distribution process to the next level.

Put simply, by depositing crypto assets in a Quint super staking pool, the investor will receive a ticket entry into a competition. The more tokens that are deposited and the earlier that the investor joins the pool, the more tickets will be earned. The winning ticket will subsequently go on to win a prize.

As of writing, for example, there is a Quint super staking pool offering the chance to win a Bored Ape Yacht Club NFT. At its peak, this NFT collection was attracting a minimum floor price of over $1 million. Prior to this, Quint was offering a super staking pool with the opportunity to win one of two luxury watches worth more than $100,000.

Crucially, irrespective of whether the investor wins the respective competition, they will still earn interest on the Quint tokens that were staking. This means that investors are incentivized to join a super staking pool, as they will still get their original deposit back after the competition is drawn.

8. Copy Trading – Automatically Mirror the Trades of an Experience Trader

Another angle to consider when assessing the best way to invest $1k is Copy Trading. This option will suit investors that wish to actively trade the financial markets but have little to no experience in doing so. For those unaware, Copy Trading is an innovative tool offered by brokers that enables users to mirror the investments of another trader.

The trader in question will use their chosen platform themselves to invest, and there are thousands of verified investors to choose from. The decision-making process when selecting a trader to copy might be surrounding the individual’s historical returns, average monthly ROI, risk rating, preferred market, and typical trade duration.

After the user has picked an investor to copy, all future investments will automatically be copied over to their portfolio. This will, however, be at a stake that is proportionate to the Copy Trading investment.

The chosen trader decides to risk 10% of their capital into Microsoft stock and 5% into iRobot stock. In turn, the user will automatically see $100 worth of Microsoft and iRobot stock in their account, totaling $200. If the chosen investor then decides to sell their iRobot stock, this would also be reflected in the trading account.

9. NFTs – Join the Non-Fungible Token Revolution by Flipping NFTs

Non-fungible tokens (NFTs), alongside the metaverse and P2E gaming, are fast-growing markets within the crypto and blockchain spaces. In particular, NFTs represented a huge success story last year, with collections like the Bored Ape Yacht Club and Crypto Punks selling for 7-figures.

However, investors are not required to risk significant amounts of capital when trading NFTs, there are many collections accessible for just a few dollars. Nonetheless, from an investment perspective, the primary objective is to buy an NFT and then flip it for a higher price.

Whether or not this can be achieved will require the investor to conduct in-depth research into the respective NFT to determine its future potential. For example, when early investors purchased a Bored Ape Yacht Club NFT when the collection was launched in April 2021, they would have paid the equivalent of just $200.

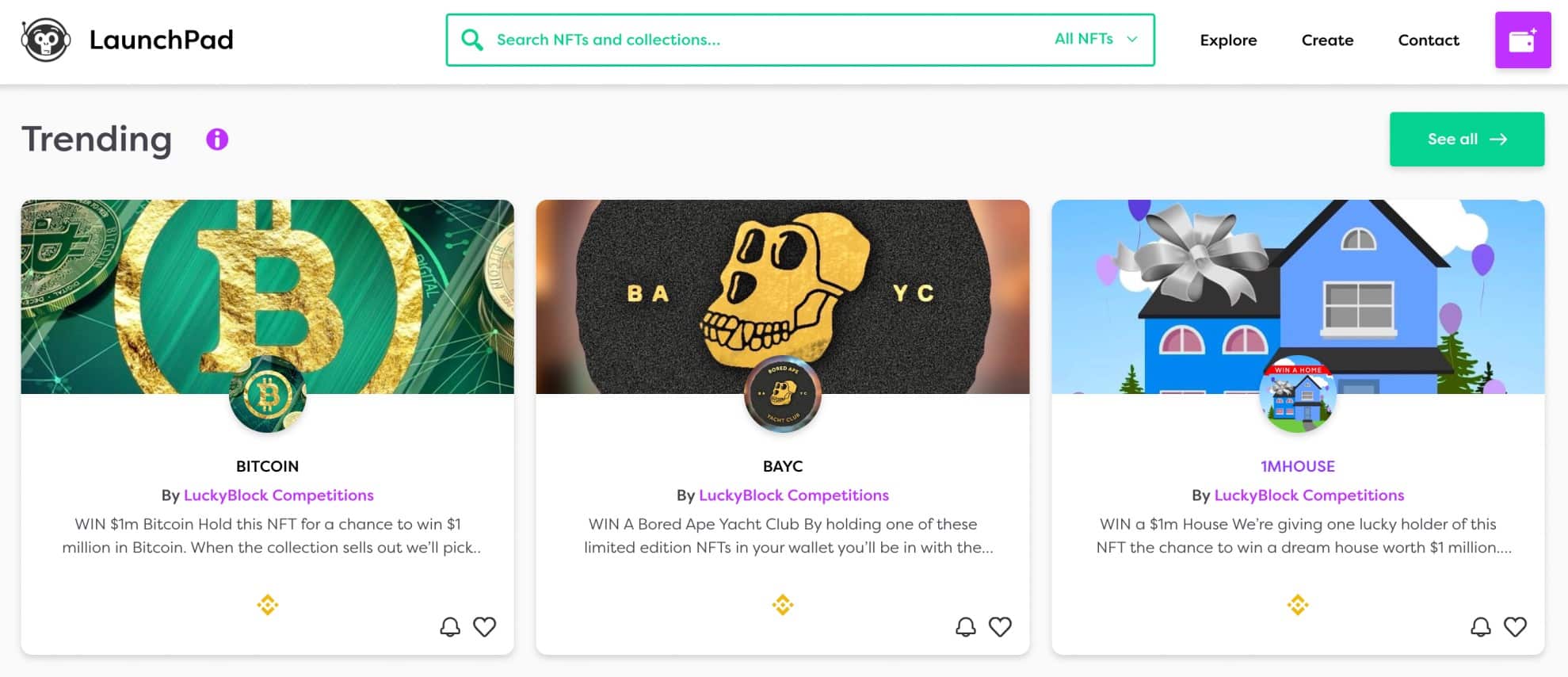

Later in the same year, an NFT from the Bored Ape collection sold for more than $3 million. In order to find suitable collections to flip, investors might consider checking out the NFT Launchpad website. This online marketplace enables creators and up-and-coming collections to launch their NFT series to the public.

One such example of a collection that we came across is the Lucky Block NFT series. In a nutshell, each Lucky Block NFT is connected to a competition, prizes such as winning $1 million worth of Bitcoin or a luxury 5-star vacation package. As soon as an NFT is purchased, the investor will begin receiving rewards.

These rewards are paid in the LBLOCK token, which is native to the Lucky Block competitions ecosystem. Irrespective of whether the investor wins the respective competition, they will continue receiving LBLOCK rewards for as long as the NFT is held. With that said, investors will also have the opportunity to list their NFT on a marketplace for the purpose of flipping.

10. Commodities – Hedge Against the Stock Markets by Gaining Exposure to Commodities

Ever wondered how to trade commodities in 2024? The final asset class to consider when assessing the best way to invest 1,000 dollars is commodities. There are many different types of commodities to consider in this marketplace, most of which are either soft or hard. The former includes energies like oil and natural gas, while the latter covers everything from gold and silver to platinum.

Either way, commodities typically serve a purpose, which ensures that they have intrinsic value. Some commodities – especially gold, are viewed as stores of value and, thus – are often attractive to investors during times of economic uncertainty. For example, gold has historically performed well when the broader stock markets are bearish.

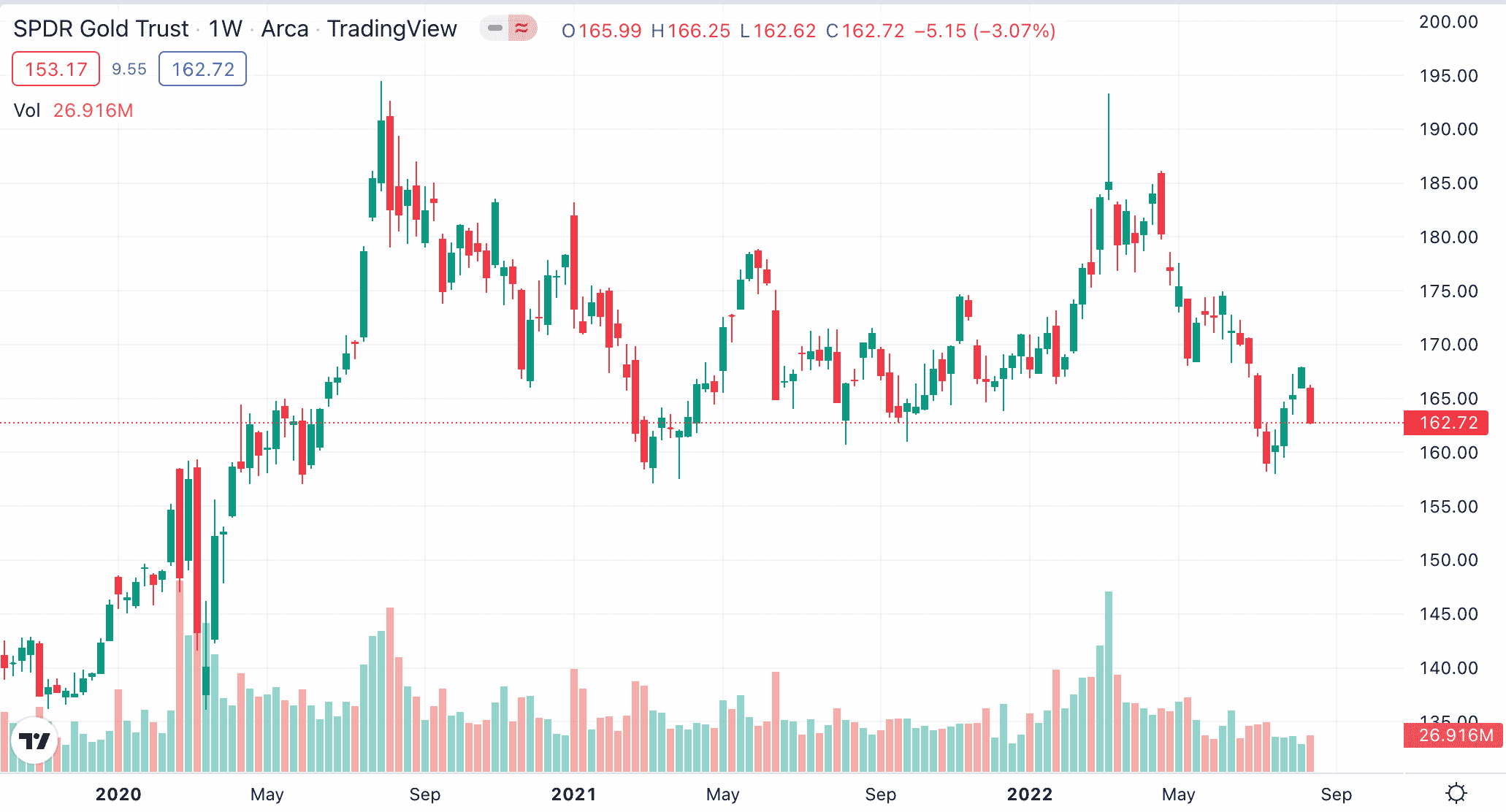

There is often a misconception that in order to invest in commodities, there is a requirement to actually purchase physical bars of gold or barrels of crude oil. However, this isn’t the case at all – as many retail clients will invest in commodities via an ETF. The SPDR Gold Trust, for example, is a large-cap ETF that is physically backed by gold.

This means that the price of the ETF will rise and fall in line with the spot value of the precious metal. Moreover, taking the ETF route means that investors do not need to worry about storing physical gold, and when it comes to cashing out, this can be done any time that the respective market is open.

How to Choose the Best $1k Investments For You

This guide has discussed 10 popular methods to consider when assessing how to invest $1,000. With that said, no two financial markets are the same – each of these will come with various levels of risk and upside potential.

Below, we explore some of the key ways that investors can determine the right investment products for their $1,000 capital allocation.

Risk

The most important metric to consider before choosing a $1,000 investment is the level of risk involved. While it is true that all investments carry an inherent level of risk, some assert classes offer greater exposure to financial loss.

On the flip side, the more risk that an investor is willing the take, the more gains that they should expect.

For example, we mentioned cryptos like Lucky Block went up 6000%. However, cryptocurrencies are still considered a high-risk asset class by many – largely because of their speculative nature.

On the other hand, bonds issued by the US government are considered virtually risk-free, but, in turn, investors should expect a modest yield of 1-2% annually.

Nonetheless, it is imperative that investors only risk an amount that they are comfortable losing.

Returns

In addition to risk, investors should also consider the level of returns that they seek on their $1,000 investment. For example, it is all well and good to invest in a low-risk bond fund that averages 3% annually in returns.

However, on a $1,000 investment, this will amount to just $30 per year. In comparison, the S&P 500 index fund has averaged annual gains of 10% since its inception in 1926.

In order to assess what returns are suitable, the investor might consider creating a long-term investment plan.

For example, while $1,000 worth of capital might be available now, the investor might choose to allocate a further $50 each month moving forward.

Volatility

Some asset classes are a lot more volatile than the market average. For example, crypto assets are overly volatile – which is even the case with dominant tokens like Bitcoin and Ethereum.

Although the broader crypto industry has always recovered from previous bear markets, the level of volatility witnessed in this trading space might make beginners somewhat uncomfortable.

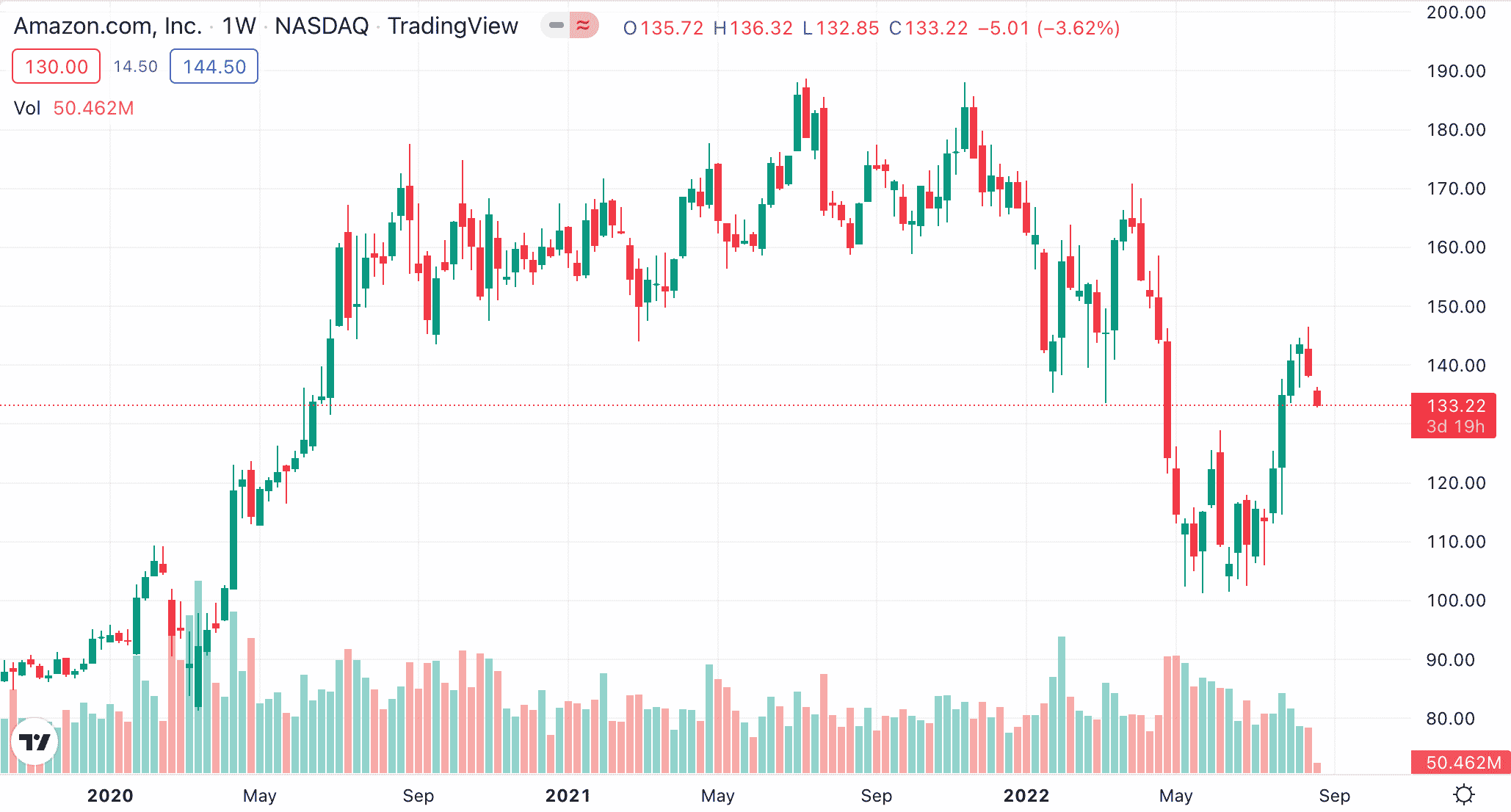

With that said, even large-cap stocks experience volatility.

- For example, Tesla stock, over the past 52 weeks of trading, has experienced a low and high of $101 and $384.

- As of writing, Tesla is trading 55% below its 52-week high.

Nonetheless, when zooming out and looking at the broader picture, Tesla stock is up 707% over the last five years of trading.

Minimum Outlay

Another factor to consider when looking for the best 1,000-dollar investments is that some asset classes come with higher outlay requirements.

For example, when investing in an ETF directly with Vanguard, the minimum requirement is often $500. This means that the investor will need to allocate 50% of their $1,000 investment fund to just one asset.

Similarly, when buying Goldman Sachs stock at Ally Invest, the broker does not support fractional shares. This means that the investor will need to buy at least one stock, which, as of writing, trades at over $342.

In comparison, brokers that support fractional ownership are a lot more conducive to creating a long-term investment plan with $1,000. A top trading platforms require minimum investments as low as $10 on all stocks and ETFs.

Consider Wider Market Conditions

Another method that enables investors to choose the best way to invest $1,000 is by considering broader market conditions. The reason for this is that depending on the health of the wider markets, certain investment products typically perform better than others.

For example, when the stock markets go through a prolonged bearish cycle – as we saw from late 2007 to early 2009, gold often performs well. This is also the case with US-issued treasuries, which offer a safe haven for risk-averse investors.

On the other hand, when the economy is strong, and consumer confidence is high, this often results in the broader stock market performing well.

Ultimately, when assessing what to invest in right now, it can pay off to focus on assets that have the best chance possible of performing well in the current economic climate. For example, some investors are looking for the best sustainable investing funds.

Where to Invest $1,000

We have discussed a range of options in terms of where to invest $1,000. Many investors will search for the best sectors to invest in to ensure that their portfolio is well diversified.

This might include a basket of stocks, ETFs, and index funds, alongside some higher-risk assets like foreign-issued bonds and crypto.

We think the best asset with the most upside potential right now is Love Hate Inu, especially during its cheaper presale stage.

Conclusion

We’ve looked at 10 different options to consider when investing $1,000 into the financial markets. In addition to stocks, ETFs, and index funds, we have also considered commodities.

With that said, crypto assets are another option to consider, not least because this asset class has outperformed the broader markets by a sizable percentage in recent years.

Love Hate Inu, in particular, is a new crypto project that has gained a lot of investor traction over the course of its presale stages. Investors can purchase the token for only $0.000085 right now.

Love Hate Inu is unique for its meme coin status that has a great underlying fundamental utility. The coin is in presale until May when it will officially launch with a starting price of $0.000145, which means those who buy in first are looking at potential 70% gains in just two months.

Love Hate Inu - Next Big Meme Coin

FAQs

What is the best way to invest $1,000?

How can I invest $1,000 and make money fast?

How much can you earn by investing $1,000?

How do I invest $100 to make $1,000 a day?

How to double $1,000?

How to invest $1,000 for a quick return?

Can I start investing with $1,000?

References

- https://www.investor.gov/introduction-investing/investing-basics/role-sec/laws-govern-securities-industry

- https://www.irs.gov/retirement-plans/401k-plans

- https://www.londonstockexchange.com/raise-finance/etps/etfs