Green energy investing includes investing in solar and wind power, hydropower, biofuels, grid infrastructure, and more. It’s often seen as a way to invest that’s beneficial for the environment and offers exposure to new energy technologies.

In this guide, we’ll take a closer look at green energy investing and explain the key aspects of investing in green energy.

Green Energy Investing Explained

Green energy is any form of energy that reduces or eliminates carbon dioxide emissions. Also known as renewable energy, green energy includes power sources like solar power, wind power, and more. Green energy offers an alternative to the traditional fossil fuels used for energy, such as coal, oil, and natural gas.

Green energy investing is a type of investing that revolves around renewable energy and related technologies. Green energy investments can include investments in companies working on solar, wind, or hydroelectric power. They can also include investments in nuclear power or newer technologies like hydrogen power or biofuels.

Green energy investing isn’t limited to investing directly in power generation technologies, either. Many investors consider investments in battery technology, electrical grid infrastructure, electric vehicles, and even mining companies that produce raw materials for batteries and solar panels to be green energy investments.

78% of retail investor accounts lose money when trading CFDs with this provider.

How Does Green Energy Investing Work?

Investing in green energy is a lot like investing in anything else. Investors need to identify assets to invest in, research them, and then make an investment, often using a stock broker or another investment platform. The only major difference is that the assets targeted for green energy investing have some connection to renewable energy technology.

Importantly, there are no strict rules around what investments are green energy investments and what investments aren’t. For example, some investors might consider a nuclear power company a green energy investment because it is a carbon-free source of electricity. Others investors may not because of the potentially negative environmental impacts of nuclear power.

Ultimately, it’s up to each investor to decide what assets they consider to be green energy investments.

SRI & ESG Ratings in Green Energy Investing

Green energy investing is often considered a form of socially responsible investing or environmental, social, and governance investing.

Socially responsible investing (SRI) is a form of investing in which investors focus first and foremost on putting their capital towards companies and assets that are doing good for the world. Investment profits come second.

Environmental, social, and governance (ESG) investing is a form of investing in which investors balance profits and the environmental impact of the companies or assets they invest in. ESG investors typically believe that pro-environment investments will offer better payoffs in the long run.

Many investment firms issue SRI and ESG ratings or rankings for individual companies to advise investors on how “green” they are. SRI and ESG ratings can be especially applicable to green energy investing companies, which have a clear social and environmental impact.

However, note that SRI and ESG ratings can vary widely between investment firms, and each firm uses its own rating system. So, it can be difficult to compare ratings from different sources for different green energy companies to invest in. Investors who want to know more about how sustainable a green energy company is may want to check out the company’s annual sustainability report or environmental impact report.

Types of Green Energy Investments

There are several different ways to invest in green energy. We’ll take a closer look at some of the most popular types of green energy investments.

Carbon Credits

Carbon credits have quickly gained popularity as a way to invest that’s good for the environment. Carbon credits are traded in places like the European Union, California, and New Zealand, where there are limits on how much carbon each company is allowed to emit.

Companies that emit less than their limit can sell excess carbon credits to companies that emit more carbon than they’re allowed to. Carbon credits trade on an open market, so individual investors can buy and sell them through futures contracts just like they can buy and sell other commodities.

Investing in carbon credits is an indirect but potentially powerful way to invest in green energy. When investors buy carbon credits, they push up the price of these credits. That creates a more favorable economic environment for green energy companies because it encourages all companies to switch to renewable energy sources to cut their emissions. It also directly benefits green energy companies that have carbon credits to sell, while pushing up the cost of business for fossil fuel-based energy companies.

Green Energy Stocks

Green energy stocks are shares of companies that are involved in producing renewable energy, developing renewable energy technology, electrifying traditionally fossil fuel-powered products like cars, or mining the resources needed for renewable energy technology.

Green energy stocks, sometimes called climate change stocks, can be quite different from one another. For example, this category could include stock of an electric vehicle manufacturer as well as stock of a biofuel company.

Investors can buy and sell renewable energy stocks through most major stock brokerages. It’s possible to build a diverse portfolio by investing in green energy companies from a variety of market sectors.

Green Energy Investment Funds

Green energy investment funds include green energy ETFs (exchange-traded funds) and mutual funds. These funds invest in multiple green energy stocks or a mix of other assets related to green energy.

A sustainable investing fund can be a relatively fast way for an investor to build a portfolio of green energy stocks. However, funds cannot be customized like a portfolio of individual stocks can be, so there is less flexibility in choosing what companies and other assets to invest in.

Green Energy Bonds

Many companies involved in developing green energy issue bonds to raise funds. Investors loan the company a sum of money to buy a bond and receive interest for a fixed period of time. At the end of the bond’s term, investors receive their loaned money back.

Investors can buy green energy bonds from individual companies, but there are also green energy investing funds that focus on bond investments. Investors may also consider government bonds that are issued to fund green energy-related programs.

Examples of Green Energy Investment Assets

Let’s take a look at 5 examples of green energy investments available today. These represent just a small sample of the many green energy investments that investors can choose from.

1. iShares Global Clean Energy ETF (ICLN)

The iShares Global Clean Energy ETF is one of the largest green energy investing funds on the market today. Launched in 2008, it now has more than $5.4 billion in assets under management.

This green energy ETF invests in some of the largest solar and wind technology companies, including Enphase Energy, Solaredge Technologies, Plug Power, and First Solar. It’s not strictly confined to energy technology companies, as it also invests in several electric vehicle manufacturers, grid operators, and semiconductor manufacturers.

The ICLN ETF has produced an annual average return of 19.1% over the past 5 years.

78% of retail investor accounts lose money when trading CFDs with this provider.

2. First Solar (FSLR)

First Solar is one of the largest solar panel manufacturers and solar power providers in the US. This green energy company controls the full life cycle of its solar power projects, from producing the panels to operating solar energy fields to recycling panels when they reach the end of their lifespans. First Solar has more than 17 Gigawatts of installed solar power.

First Solar stock is up 55% so far in 2022. The stock trades at a price-to-earnings (P/E) ratio of 78 and does not pay a dividend.

78% of retail investor accounts lose money when trading CFDs with this provider.

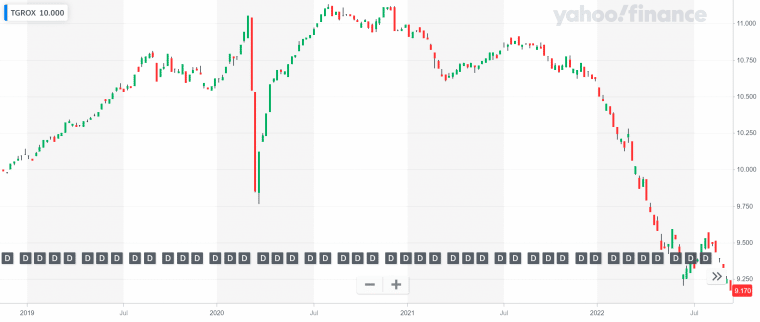

3. TIAA-CREF Green Bond Fund (TGROX)

The TIAA-CREF Green Bond Fund is a green energy mutual fund that invests in bonds from companies and governments focused on environmental sustainability. Some of the top holdings in the fund include the New York State Energy Research & Development Authority, Interstate Power and Light Co., Hydro-Quebec, and Sunnova. The fund is actively managed, so the holdings can change frequently over time as new green energy bonds are issued.

The fund pays a dividend of 3.29% to investors. It has an average annualized return of -1.35% over the past 3 years and has $100 million in assets under management.

78% of retail investor accounts lose money when trading CFDs with this provider.

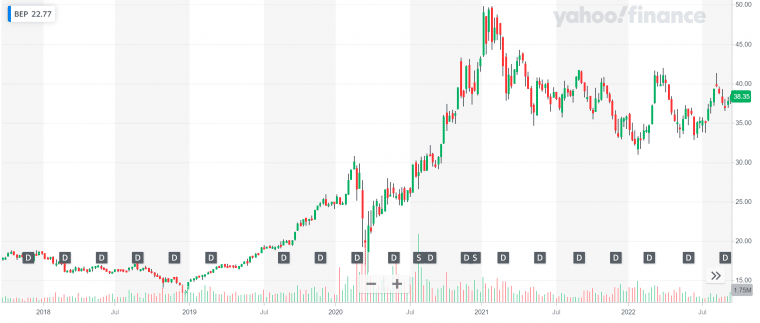

4. Brookfield Renewable Partners (BEP)

Brookfield Renewable Partners is a Toronto-based renewable energy company and one of the world’s largest producers of hydroelectric power. Hydroelectric power makes up half of the company’s energy portfolio, with most of the remaining power coming from wind and solar sources.

BEP stock pays a dividend yield of 3.36%, so it may be attractive to income investors as a green energy dividend stock. The stock is up 5.0% so far in 2022.

78% of retail investor accounts lose money when trading CFDs with this provider.

5. Invesco Solar ETF (TAN)

The Invesco Solar ETF is a green energy investing fund that invests primarily in solar panel manufacturers and electrical utility operators that are increasing their use of solar power. Some of the fund’s top holdings include Enphase Energy, Solaredge Technologies, First Solar, and Sunrun. Just under half of the fund’s holdings are in the US, while 21% are in China.

The TAN ETF has an average return of 32.0% over the past 5 years. Holdings in the fund have an average P/E ratio of 69.1 and the fund has $2.9 billion in assets under management.

78% of retail investor accounts lose money when trading CFDs with this provider.

Why Do People Make Green Energy Investments?

Green energy stock investing is popular for several different reasons, and an individual investor may have multiple reasons for choosing green energy investments.

Many investors look to green energy assets because they want to support the environment with their investments. Investing in green energy funds and companies supports the transition to renewable energy and can ultimately reduce carbon dioxide emissions that are responsible for climate change. So, investors see green energy investments as in line with their values and doing good for the world.

Many investors also invest in green energy because they see it as a good financial move. While experts debate how long a transition to renewable energy will take, relatively few doubt that it will happen.

So, green energy companies have an opportunity to become major energy producers or suppliers for a world in need of green energy technology. Investors watching this transition see an opportunity to invest and make money as these green energy companies grow in size and importance.

Green energy investments can also be a form of diversification, particularly for investors who are invested in traditional fossil fuel-based companies like oil stocks. Many green energy companies are small and mid-cap stocks, whereas oil companies are typically large-cap stocks.

How to Find Green Energy Investment Assets

There are several ways to find clean energy investments. One of the easiest ways to start is to look at what companies are held in large green energy investing funds such as the iShares Global Clean Energy ETF (ICLN). Another option is to look at lists of companies in the energy and technology sectors on major exchanges like the New York Stock Exchange and NASDAQ.

Investors can do more research on green energy investments by reading the annual sustainability reports that companies publish. Many investment firms also publish lists of top-rated SRI and ESG investing stocks, which often include green energy companies to invest in.

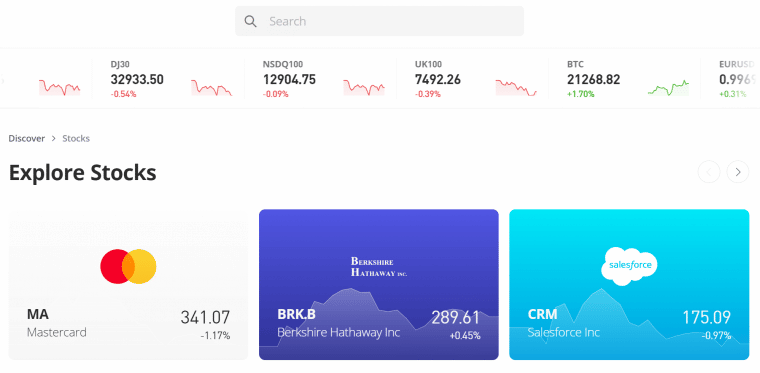

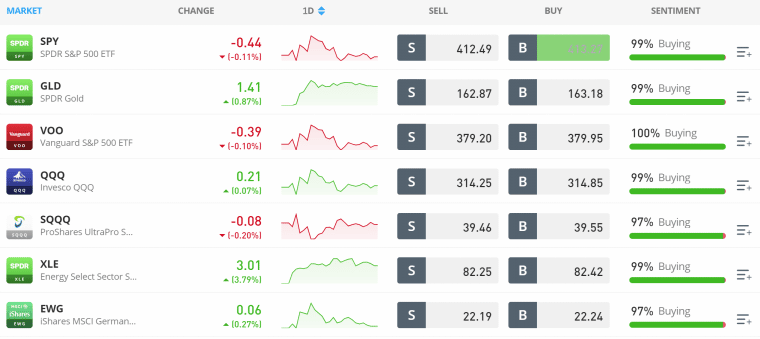

Brokers Offering Green Energy Investments

One brokerage that investors can consider for green energy investing is eToro. eToro is a global investment platform with more than 20 million users. It offers 0% commission trading on stocks and ETFs from the US and around the world. eToro also offers trading on carbon credit futures contracts, cryptocurrencies, and more. It is worth noting that now, in the US, eToro customers can trade only Bitcoin, Bitcoin cash, and Ethereum on the platform.

eToro has a number of features for traders and investors. The platform includes a technical charting interface with dozens of built-in indicators and drawing tools. In addition, eToro offers a market news feed, professional analysis of popular stocks, and price alerts.

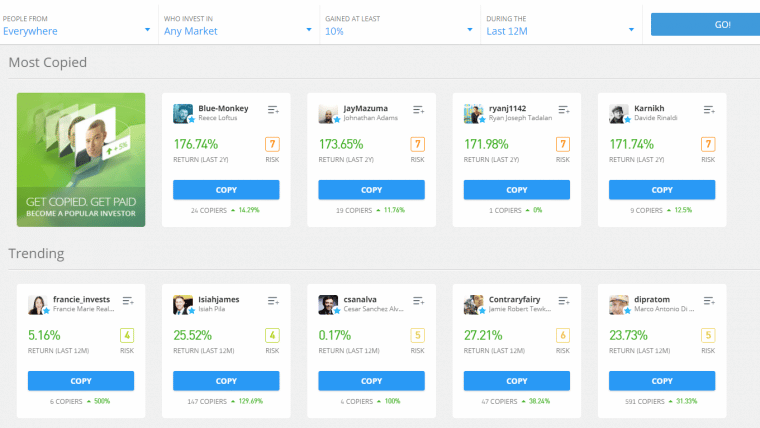

This brokerage also has social trading features. Investors can see whether users on eToro are buying or selling a particular green energy stock or fund. They can also ask questions and start conversations with other green energy investors.

eToro also has a copy trading platform, which allows investors to mimic the positions of more experienced investors. Some copy investors on the platform focus specifically on green energy and ESG stocks.

New investors can open an account with eToro with just a $10 deposit. Copy trading requires a minimum of $2,000 per copied portfolio. eToro offers 24/5 customer support.

78% of retail investor accounts lose money when trading CFDs with this provider.

Conclusion

Investing in green energy is a way for investors to get exposure to companies involved in developing or deploying renewable energy technology. It is often seen as both a way for investors to support the environment and to invest in companies that are leading the transition to renewable energy.

Investors can use a variety of brokerage platforms, including eToro, to invest in green energy.