In the modern world, the focus on sustainability is greater than ever. This has led companies and financial products to get rated based on whether they meet specific environmental, social, and governance (ESG) principles, causing some investors to solely invest in ESG funds.

Throughout this article, we’ll be taking a look at 10 of the most popular ESG funds, discussing exactly what an ESG rating is, and explaining why so many investors are choosing to invest in ESG-focused assets. Let’s get started.

10 Popular ESG Funds to Watch in 2025

Below, we’ve included a quick overview of 10 popular ESG funds. We dive into more detail during the section that follows.

- iShares Global Clean Energy ETF – A Collection of Sustainable Energy Companies

- Utilities Select Sector SPDR Fund – ESG Fund Investing Heavily in the Utilizes Sector

- Invesco Solar ETF – Environmental, Social, and Governance Stocks with a Focus on Clean Energy

- SPDR S&P 500 ESG ETF – Providing Exposure to High ESG Rating S&P Assets

- WisdomTree International ESG Fund – Fund Containing a Collection of Sustainable Foreign Companies

- 1919 Socially Responsive Balanced Fund – Fund Bundling Socially Responsive Stocks and Debt

- iShares MSCI USA ESG Select ETF – U.S. Companies with High ESG Ratings

- iShares MSCI World ETF – ETF Containing ESG-Favorable Companies in Developed Markets

- Vanguard Global ESG Select Stock Fund – Mutual Fund Aligned with Sustainable Development Goals

- iShares ESG Aware 1-5 Year USD Corporate Bond ETF – Tracking an Index Composed of Corporate Bonds

A Closer Look at ESG Funds

In order to ensure the assets we’re discussing is sufficiently aligned with social goals, almost all of the ESG investment funds we’ll be taking a look at is considered a leader, meaning it has been rated either AA or AAA by MSCI.

1. iShares Global Clean Energy ETF – A Collection of Sustainable Energy Companies

The iShares Global Clean Energy ETF (ICLN) is a Blackrock ESG fund that provides investors with exposure to companies focused on generating clean energy. As such, the fund contains companies like SolarEdge and Enphase Energy that focus on finding clean energy solutions.

The fund mirrors the S&P Global Clean Energy Index. However, it’s important to understand that as with any ETF, ICLN does not offer investors ownership of the underlying assets, just a portion of the fund containing them. While 37% of the companies contained within the iShares Global Clean Energy ETF are considered ESG Leaders (rated AA or AAA), around 5% are dubbed Laggards (rated CCC or B).

With many companies and governments looking toward alternative energy solutions, the iShares Global Clean Energy ETF is in an interesting spot. It’s perhaps the most popular Blackrock ESG fund, so it’ll be interesting to see how it performs over the coming years.

ESG Rating: AA

2. Utilities Select Sector SPDR Fund – ESG Fund Investing Heavily in the Utilizes Sector

The Utilities Select Sector SPDR Fund (XLU) is an ESG index fund designed to replicate the performance of the Utilities Select Sector index by investing a minimum of 95% of its assets into securities within the index. As insinuated by the name ‘Utilities Select Sector’, the majority of the funds it holds comprise assets within the electric, water, power, gas, and renewable energy sectors.

While the Utilities Select Sector SPDR Fund is among the most popular and highest-rated ESG index funds, it does produce a massive amount of carbon when compared to other ESG investment funds. While maintaining an MSCI ESG rating of AA, it requires around 2246.8 tons of carbon to generate $1 million in revenue, placing it firmly in the ‘Very High’ category for carbon emissions.

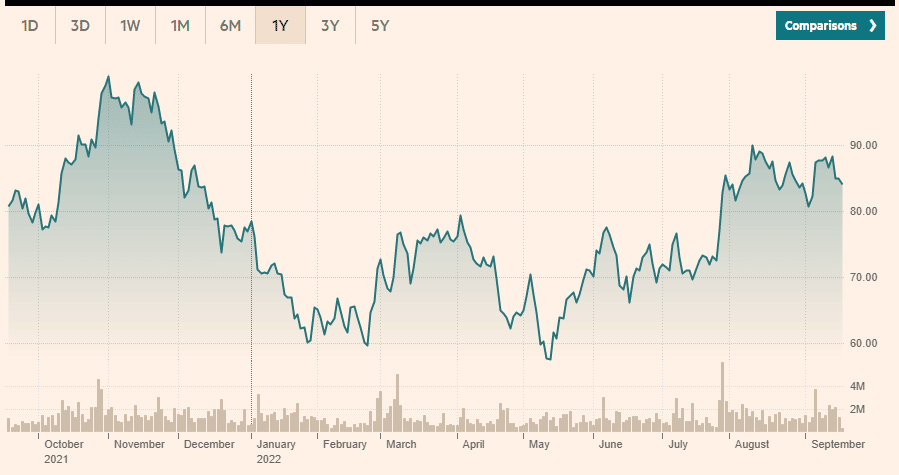

While it cannot compete with some of the other ESG index funds we’ve mentioned in terms of carbon output, the Utilities Select Sector SPDR Fund has yielded some of the most impressive historical returns at 17.63% over the past year and 44.45% over the past 5 years.

ESG Rating: AA

3. Invesco Solar ETF – Environmental, Social, and Governance Stocks with a Focus on Clean Energy

With alternative energy sources being a favorite among investors at the moment, it’s of little surprise that the Invesco Solar ETF Fidelity (TAN) ESG fund has been so popular. Focusing on providing investors with simple access to a wide range of green energy stocks, the Invesco Solar ETF contains a myriad of assets related to the production of green energy, including distributors, utility providers, and manufacturers.

While this Fidelity ESG fund cannot quite be considered a Leader due to its A rating, it does provide ample exposure to green energy stocks. Approximately 63.3% of the revenue generated by companies within the fund can be considered green, whereas only 0.2% is the product of fossil fuels.

Although the Fidelity ESG fund has a heavy preference for companies focused on green energy, its carbon output does leave something to be desired. For every $1 million in revenue, an average of 259.7 tons of carbon is produced, likely primarily as a result of mining and manufacturing.

ESG Rating: A

4. SPDR S&P 500 ESG ETF – Providing Exposure to High ESG Rating S&P Assets

The SPDR S&P 500 ESG ETF (EFIV) is an exchange-traded fund (ETF) containing companies present within the S&P 500 with a focus on ESG principles. As such, companies operating within sectors like gambling, tobacco, and fossil fuels have been omitted. However, the weighting of assets within the ETF is still proportionate to the S&P 500. This makes it worthy of consideration for investors looking to invest in stocks that are ESG compliant.

The S&P is generally considered to be a fairly low-risk asset as it contains some of the largest companies on the planet. However, it’s important to understand that anything can happen when investing and as such, returns are not guaranteed. EFIV is currently trading for $36.75, over 1-year it’s down by 4.83% whereas over a 5-year period it’s up 22.21%, meaning it has averaged a 4.442% average yearly return.

As an ESG ETF tracks a specific index (in this case the S&P 500), it can be an excellent tool to get exposure to exclusively ESG-friendly assets within a popular index.

ESG Rating: AAA

5. WisdomTree International ESG Fund – Fund Containing a Collection of Sustainable Foreign Companies

While the SPDR S&P 500 ESG ETF provides exposure to U.S. companies, the WisdomTree International ESG Fund (RESD) offers investors exposure to the price movements of international companies adhering to ESG principles. The fund’s top 10 holdings are primarily composed of UK and Swiss companies, with its overall highest weighted holding being food and beverage giant Nestle.

In total, the WisdtomTree International ESG fund contains 230 assets, covering a multitude of industries and countries. Of those assets, a large 68% have earned an MSCI ESG rating of AA or AAA, with only 1% being awarded a CCC or B rating.

While RESD does offer a glimpse into the global ESG market, it does lack exposure to certain sectors like clean energy (4.1% green energy revenue), meaning it’s better used as an addition to a diversified portfolio rather than a standalone investment.

ESG Rating: AAA

6. 1919 Socially Responsive Balanced Fund – Fund Bundling Socially Responsive Stocks and Debt

Joining the list of ESG investing funds is the 1919 Socially Responsive Balanced Fund (SSIAX). It contains mostly U.S.-based assets and investment-grade debt but also foreign stock and debt to a lesser extent. While only 27% of assets in this ESG investment Fund boast MSCI ESG fund ratings of AA or AAA, none of its assets have been flagged for social safeguarding issues like UNIGC or OECD violations, securing its AAA ESG rating.

Despite taking a fairly aggressive approach in comparison to other ESG investing funds, the 1919 Socially Responsive Balanced Fund has yielded a return of -14.15% over the past year, likely as a result of this year’s severe market downturn. With that said, on the broader 5-year timeframe it has yielded 30.37% in gains, equating to just over a 6% yearly return.

Being a ‘Balanced Fund’, it makes sense that SSIAX contains assets comprising a large range of sectors. Some of its most notable holdings include industry giants like Amazon, Alphabet, and the Bank of America.

ESG Rating: AAA

7. iShares MSCI USA ESG Select ETF – U.S. Companies with High ESG Ratings

Coming next on our ESG funds list is the iShares MSCI USA ESG Select ETF (SUSA). As the name implies, it has a distinct focus on companies based in the U.S. Therefore, those looking for ESG ETFs that track the performance of global stocks will likely be better served by another investment vehicle, such as the iShares MSCI World ETF.

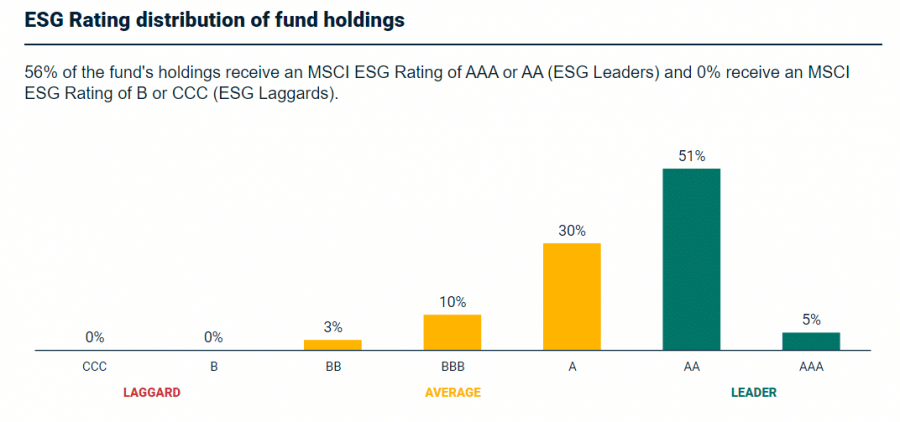

In keeping with environmental, social, and governance guidelines, a huge 75% of assets within this Blackrock ESG fund have been awarded MSCI ESG fund ratings of AA or AAA, with 0% of assets being classed as Laggards. Furthermore, the fund’s weighted average carbon intensity is considered low at 55.2 tons per $1 million in sales.

With the iShares MSCI USA ESG Select ETF, boasting such impressive statistics, it’s no surprise that it’s one of the most popular ESG ETF funds currently on the market.

ESG Rating: AAA

8. iShares MSCI World ETF – ETF Containing ESG-Favorable Companies in Developed Markets

While the iShares MSCI World ETF (URTH) is similar in name to the iShares MSCI USA ESG Select ETF, it provides exposure to international markets rather than solely U.S. companies. Although some global ESG investing funds offer access to developing economies, the iShares MSCI World ETF only tracks assets from developed countries.

While the WisdomTree International ESG Fund we discussed earlier on our ESG funds list contains purely foreign assets, the iShares MSCI World ETF included prominent U.S. companies like Apple, Microsoft, and Tesla in conjunction with international companies like Roche Holding and Nestle. In total, 1,540 assets are included in this ETF.

As the iShares MSCI World ETF is one of the largest ESG funds in terms of holdings, it can be an excellent tool for diversification, likely a reason for its popularity amongst ESG ETF funds.

ESG Rating: AAA

9. Vanguard Global ESG Select Stock Fund – Mutual Fund Aligned with Sustainable Development Goals

The Vanguard Global ESG Select Stock Fund (VEIGX) is one of the most popular Vanguard ESG funds available. It is an ESG mutual fund that invests in global mid to large-size companies (in terms of market capitalization) that are compliant with ESG standards. Being available on Vanguard, it has become a popular asset with investors trying to find out how to invest in mutual funds.

In contrast to some of the other ESG funds we’ve mentioned, VEIGX comprises only a select few ethical stocks that will typically be held for longer than average periods. In total, the fund aims to hold between 35 to 45 stocks, a far cry from other Vanguard ESG funds that range from around 450 to 1500 assets.

Currently, this ESG mutual fund consists of 38 different companies with the top three by weight being Microsoft, Starbucks, and AIA Group. With 69% of assets within the fund being considered as ESG Leaders, 27% being dubbed average, and 0% falling into the Laggards category, VEIGX has the highest of all MSCI ESG Fund ratings at AAA.

ESG Rating: AAA

10. iShares ESG Aware 1-5 Year USD Corporate Bond ETF – Tracking an Index Composed of Corporate Bonds

The iShares ESG Aware 1-5 Year USD Corporate Bond ETF (SUSB) is the first ESG bond fund we’re taking a look at. It is solely focused on investing in corporate bonds that will mature in between 1 to 5 years, meaning it has a relatively quick turnaround time compared to other bond-based ESG ESG ETFs.

While the fund primarily invests in bonds from large-cap companies such as Morgan Stanley and Microsoft, it also contains over 1,100 other bonds from both large and small companies. In order to manage risk, the holding distribution is weighted somewhat proportionate to the size of the bond issuer.

This ESG investment fund has only been around for less than 5 years so it’s one of the younger funds we’ve discussed. However, with a triple-An MSCI ESG rating, it’s worthy of consideration for investors looking for a mid-term ESG bond fund.

ESG Rating: AAA

What are ESG Funds?

Investors wondering what is ESG investing needn’t worry. Simply put, ESG funds are a fund that primarily invests in companies that adhere to environmental, social, and governance (ESG) principles. As a fund can contain between tens and thousands of assets, they don’t necessarily have to contain solely ESG-focused companies, however, doing so will help to improve the fund’s overall ESG rating.

There are a few sectors generally considered as mainly following ESG standards including, green energy and sustainable utilities. With that said, ESG investment funds can be rather diverse with assets spanning a wide range of sectors as each company is given an individual rating from an authority like MSCI.

On the other hand, there are also some industries generally considered as not being ESG compliant, including tobacco, cannabis, and oil stocks.

ESG Ratings Explained

Almost every asset is awarded an ESG rating based on how closely it follows environmental, social, and governance principles. Perhaps the largest and best-known provider of ESG scores is MSCI.

In total there are 7 different ESG ratings that can be bundled into three categories. CCC and B-rated assets are considered as Laggards (the lowest rating), BB, BBB, and A-rated assets are Average, and any asset rated AA or AAA is considered an ESG Leader (the highest rating).

There is a multitude of factors that MSCI uses to offer ESG fund analysis and an ESG rating. For funds, perhaps the most crucial is the assets it contains. The number of Laggard, Average, and Leader assets within a fund has a heavy impact on ESG rating.

Another key metric used by MSCI is carbon output per $1 million in sales. This is scored between Very High to Very Low, with the latter, of course, having a positive impact. Next, the revenue generated from green sources and fossil fuel-based sources plays a role. Additionally, the independence of a board of directors as well as its diversity is another important factor.

Lastly, the MSCI uses a few safeguarding screens to flag companies that engage in certain activities. These include UNGC violations, very severe controversies, controversial weapons, and tobacco.

Why do People Invest in ESG Funds?

As with every asset, there are a plethora of reasons why people choose to invest in ESG funds.

Ethics

Perhaps the most common reason why people decide to invest in ESG funds or highly-rated ESG stocks is ethics. Many people simply don’t want to invest in things they don’t agree with. As such, ESG-focused funds that mostly follow typical ideals can make for an attractive proposition to ethics-centric investors.

Sustainability

Another key factor that influences people to invest in ESG funds is sustainability. This is for two reasons. Firstly, if a company uses unsustainable methods to generate revenue or create products, then a timer is placed on the longevity of the company; far from ideal for long-term investments. Furthermore, companies using unstainable production methods inflict heavy damage on the planet, something that many investors would rather avoid.

Future

Companies that focus their efforts on ensuring that they cause minimal harm to the world are more likely to stick around over the coming years and decades. People are becoming increasingly concerned about doing their part to ensure our planet remains healthy. With large companies making up the majority of emissions, those following ESG guidelines are far more likely to stand the test of time. With that said, it’s always crucial to do the proper ESG fund analysis before investing.

Types of ESG Funds

There are quite a few different types of ESG funds that people can invest in. Below, we’ve summarized the most popular.

Exchange Traded Funds (ETFs) – An exchange-traded fund or ETF is bundled together by a fund manager, typically with the goal of mirroring a certain index. An ETF doesn’t offer investors ownership of the underlying asset but does provide exposure to price action.

Mutual Funds – While ESG mutual funds are similar to an ETF in the sense that they both pool the resources of investors, there is a key difference. While an ETF tends to follow a passive strategy, mimicking an index, ESG mutual funds will typically be actively managed and can comprise multiple funds.

Index Funds – An ESG index fund will commonly follow the performance of a specific index like the S&P 500, offering slow but more dependable returns when compared to other types of ESG funds.

Bond Funds – An ESG bond fund will invest in bonds from companies or governments with a high ESG rating. A bond is essentially an IOU from an entity. As such, every bond has a maturity term with the company required to pay back its debt after an agreed-upon date. Typically, bond funds are viewed as low-risk, although it’s important to understand that this will vary based on the rating of the aforementioned bonds.

Hedge Funds – An ESG hedge fund is a partnership of private investors that pool money together which is then managed by a professional fund manager. As such, an ESG hedge fund will typically have far higher entry requirements than other types of funds.

Conclusion

Throughout this guide, we’ve taken a look at 10 of the most popular ESG funds on the planet, discussed what an ESG fund is, how they’re rated, why people invest in them, and explored 5 different types of ESG funds. While we’ve covered all the basics, it’s always important to perform the proper due diligence before investing to avoid anything unexpected.