£50k can be the start of a strong nest egg if invested properly. But with so many different ways to invest in the UK today, it can be hard for new investors to know where to start.

In this guide, we’ll help investors find the best way to invest £50k in the UK in 2025. We highlight 10 investments to add to a new portfolio and explain everything investors need to know about how to invest £50k in the UK.

10 Best Ways to Invest £50k in the UK in 2025

The best way to invest £50k in the UK is to build a strong and diversified portfolio. Here are 10 investments that investors can consider including in their portfolio in 2025:

- New Crypto Projects – Invest in Fast-growing Projects like Dash 2 Trade

- Stocks – Invest in the Biggest Companies in the UK and US

- Themed ETFs – Build a Portfolio of Stocks around an Investing Idea

- Bitcoin – ‘Digital Gold’ as a Hedge against Inflation

- Index Funds – Copy the FTSE 100, NASDAQ, and More

- Crypto Staking – Earn Interest on Crypto Holdings like TAMA

- Treasury Bonds – Earn Yield with Relatively Low Risk of Default

- NFTs – Invest in Digital Art and Revenue-generating Collectibles

- Copy Trading – Actively Participate in the Market Alongside an Experienced Trader

- REITs – Invest in Real Estate in the UK and Beyond

A Closer Look at the Top Ways How to Invest £50,000

Want to learn more about these 10 UK investments? We’ll take a closer look at the best ways to invest £50,000 in the UK and explain how each of these investments could fit into a new portfolio.

1. New Crypto Projects – Invest in Fast-growing Projects like Dash 2 Trade & IMPT

Cryptocurrency is one of the fastest-growing asset classes in the world. For investors who are comfortable taking on high-risk, high-reward investments, it’s hard to find assets with more growth potential than new crypto projects.

There are dozens of new cryptocurrency tokens launching in 2025, including 2 that investors may want to take a closer look at: Dash 2 Trade and IMPT.

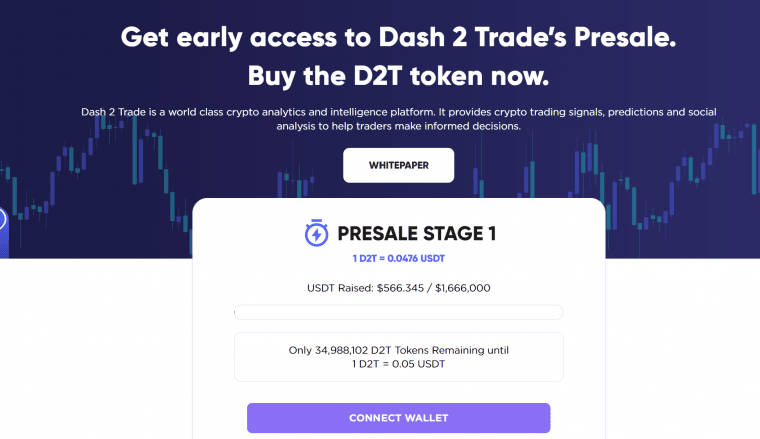

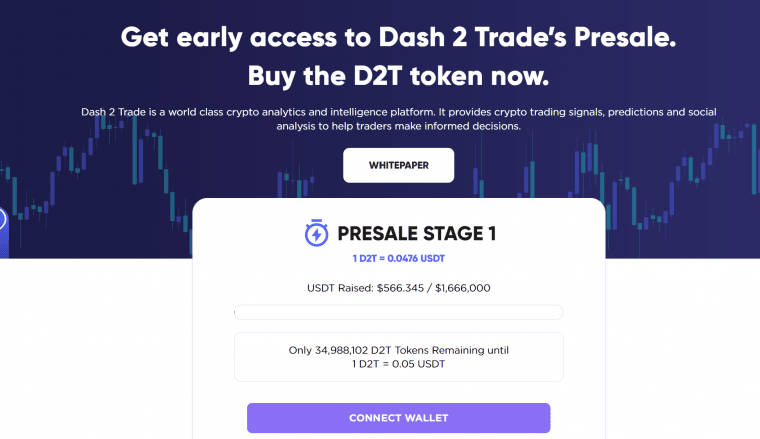

Dash 2 Trade: High Potential for Early In

Some of the key features of Dash 2 Trade will include metrics that display social sentiment about certain cryptocurrencies and real-time updates on the top IEO cryptos that investors might want to watch. Dash 2 Trade also aims to host trading competitions to help users improve their crypto trading skills.

Dash 2 Trade’s crypto presale just launched this month and could be the best way to invest £50,000 in the UK in 2025. Stage 1 of the presale aims to raise $1.66 million, and the price of Dash 2 Trade tokens will rise in later stages of the presale.

Update – the early level of interest has been high as stage one of its presale has now sold out, however its remaining eight stages are still ongoing. The Dash 2 Trade Telegram has now grown to over 15,000 members.

Prospective investors can check out Dash 2 Trade at the official website via the link below to get a discounted price on this new token.

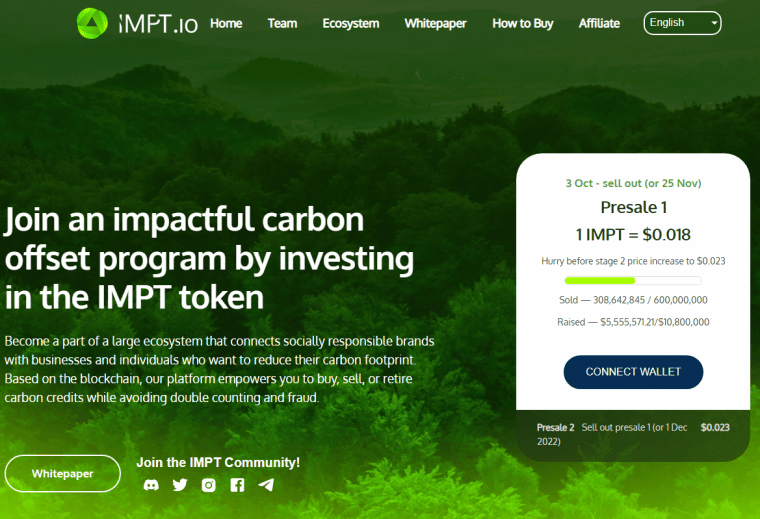

IMPT: Sustainability on the Blockchain

Investors who hold IMPT tokens can convert their holdings into carbon credits. From there, they can either sell their carbon credits on carbon markets. Alternatively, investors can burn their IMPT to offset their own carbon emissions. Investors who burn IMPT receive a limited-edition NFT, which itself can be held in a portfolio or sold on NFT marketplaces.

IMPT is also creating more options for sustainable investing. The platform is hosting a marketplace for environmentally-friendly brands, and individuals who make purchases on the marketplace can earn IMPT as a reward.

Individuals can track their carbon offsets through an IMPT score. This project incorporates a social community where investors can compare IMPT scores, encouraging everyone to work towards more carbon credits and emissions reductions.

The IMPT Telegram channel has now grown to over 4,000 active members.

IMPT is currently holding one of the best crypto presales of 2025. The project has already raised around $6 million out of a Phase 1 goal of $10 million. Investors still have a chance to purchase IMPT at the lowest possible price, so check out the presale today via the link below.

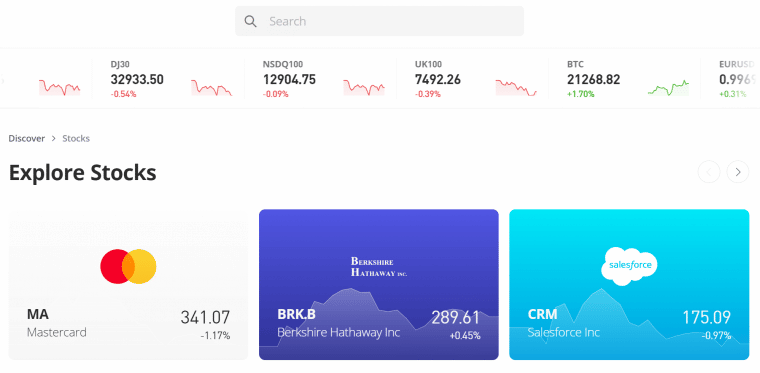

2. Stocks – Invest in the Biggest Companies in the UK and US

Investing in individual stocks is a popular way to invest and puts investors in total control of their own portfolios. When investing in individual stocks, investors get to choose which companies they like best and which ones they want to skip. That’s distinct from investing in an exchange-traded fund (ETF) or index fund, in which investors simply invest in everything in the fund.

Broadly speaking, investors can divide stocks into a few different types: growth, value, and dividend. Growth stocks are typically young companies that are growing their revenue or customer base rapidly. They may have high price-to-earnings ratios with the expectation that their earnings will increase later.

Value stocks are typically mature companies that have steady, strong revenue and reliable earnings. They may have lower price-to-earnings ratios than growth-focused companies.

Dividend stocks are stocks that pay dividends to investors, usually on a quarterly or annual basis. These stocks can be a source of cash income within a portfolio.

One way investors can diversify their portfolios by investing in a mix of growth, value, and dividend stocks. Most UK brokerage platforms allow investors to buy and sell individual stocks.

3. Themed ETFs – Build a Portfolio of Stocks around an Investing Idea

Themed ETFs, also known as thematic ETFs, are funds that include stocks relevant to a specific investment idea. For example, there are themed ETFs around blockchain technology, around green energy technology and sustainable investing, around 5G technology, and around space exploration. There are also sector-specific ETFs focused on financial companies, healthcare companies, automakers, and more.

Themed ETFs enable individuals to invest in an idea without putting all their money into a single company. If an investor is bullish on the potential of blockchain technology, for example, a blockchain ETF might give them exposure to crypto exchanges, semiconductor manufacturers, and even traditional banks that are experimenting with blockchain tech. This can potentially spread out an investor’s risk and make their portfolio more resilient.

Themed ETFs are available to buy and sell from most UK brokerage platforms. Keep an eye on each ETF’s expense ratio, which is the annual management fee investors must pay to hold the ETF.

4. Bitcoin – ‘Digital Gold’ as a Hedge against Inflation

Bitcoin is the world’s largest cryptocurrency by market cap and it’s attracted a lot of investment from major hedge funds and financial institutions. But you don’t need a major financial institution or even a UK brokerage to own Bitcoin. Anyone in the UK can buy Bitcoin through a UK Bitcoin exchange.

Many financial analysts still consider Bitcoin to be risky relative to stocks. However, Bitcoin is also widely seen as a hedge against inflation in ways that are similar to gold. The supply of Bitcoin is capped, and once that cap is reached there can be no more new Bitcoin minted. So, some investors see Bitcoin as a relatively steady asset compared to stocks, which typically lose value when inflation is high.

Keep in mind that even as an inflation hedge, the price of Bitcoin can be volatile. So, investors who have £50,000 to invest in a portfolio need to be ready for ups and downs in the crypto market when holding Bitcoin.

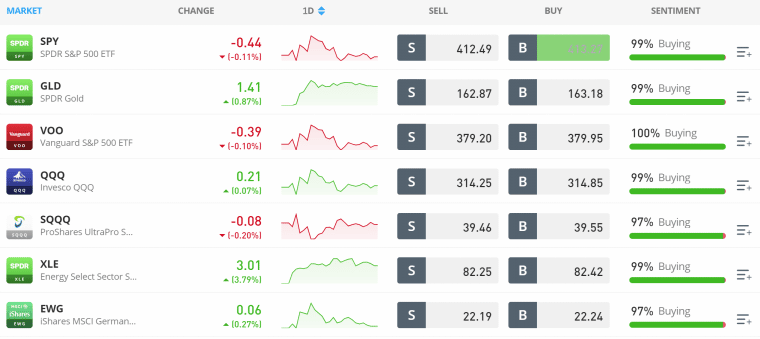

5. Index Funds – Copy the FTSE 100, NASDAQ, and More

Index funds are mutual funds and ETFs that aim to mimic the performance of a major stock market index, such as the UK’s FTSE 100 or the US’s S&P 500. By investing in the best index funds in the UK, investors can essentially match the performance of the overall “stock market” for the index they choose.

Index funds can include hundreds of individual stocks, held in the same proportions as they appear in market indices. They typically have lower expense ratios than themed ETFs, making them one of the most affordable ways for investors to build a diversified portfolio in just one or two trades.

Many analysts recommend index funds as a way to passively invest in the market. Historically, the major market indices, especially those in the US, have outperformed most active investors.

See our comprehensive guide to UK daily trading platforms.

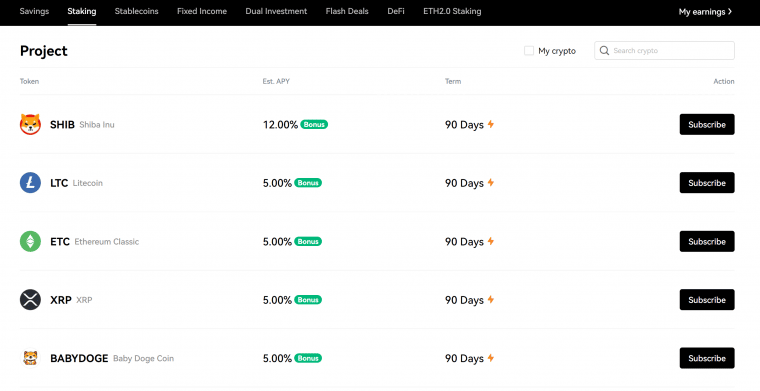

6. Crypto Staking – Earn Interest on Crypto Holdings like TAMA

Crypto staking offers a way for crypto investors to earn interest on their token holdings while helping blockchains run smoothly. With staking, crypto investors lend their tokens to a blockchain so that they can be used to verify transactions. As transactions are verified, the blockchain releases rewards, which are distributed to stakers.

Crypto staking can be flexible or locked-in – that is, crypto investors commit to stake their token for a period of days, weeks, or months. Locked-in staking typically offers higher interest rates, but there’s more risk for investors that the price of their coins will fall while they are still staked and cannot sell.

Crypto investors can start staking their crypto through crypto staking platforms, which include major UK crypto exchanges like OKX. The selection of coins to stake and the interest rates available vary by platform, so it’s worth shopping around the find the best staking terms.

It also helps to have the best coins to stake. Right now, Lucky Block (LBLOCK) and Tamadoge (TAMA) are earning some of the highest interest rates and the coins themselves are seeing strong price appreciation.

7. Treasury Bonds – Earn Yield with Relatively Low Risk of Default

Treasury bonds are bonds issued by governments like the UK government or the US government. When investors buy treasury bonds, they earn a fixed interest rate for the duration of the bond and then receive back the amount they paid for the bond at the end of its term.

Treasury bonds are considered by many financial analysts to be among the lowest-risk investments in the UK. The US, in fact, has never defaulted on the country’s debt, so bondholders can feel confident that they’ll receive their principal back. Developing countries that have a higher risk of default may offer treasury bonds with higher interest rates.

Investors who want to buy treasury bonds can do so directly from the government. Alternatively, many brokerages in the UK enable investors to buy treasury bonds or bond ETFs.

8. NFTs – Invest in Digital Art and Revenue-generating Collectibles

Non-fungible tokens (NFTs) are unique digital assets like artworks, collectibles, tickets, and more. They’re usually one-of-a-kind or limited-edition digital items, so they’re strictly limited in supply.

Like traditional artwork, NFTs can represent an alternative investment to stocks, cryptocurrencies, and other financial instruments. Their value is based primarily on how much someone else is willing to pay for a one-of-a-kind collectible. Artists can gain popularity or specific types of art can come into vogue, boosting the value of an NFT in an investor’s portfolio.

There are also NFTs that offer utility. Lucky Block, a crypto competitions platform, offers the Platinum Rollers Club NFT collection. These NFTs offer entry into a daily $10,000 giveaway – and since there are only 10,000 Platinum Rollers Club NFTs, each NFT offers a 1-in-10,000 chance of winning every single day.

Another NFT collection worth exploring is the Tamadoge NFT project. This collection features thousands of unique pieces of artwork showcasing colorful, pixelated dogs in trading card format. The NFTs also have impacts on the Tamadoge play-to-earn crypto game – each card offers boosted stats that can help a player earn TAMA tokens in the game.

NFTs can be purchased directly from project developers or on NFT marketplaces.

9. Copy Trading – Actively Participate in the Market Alongside an Experienced Trader

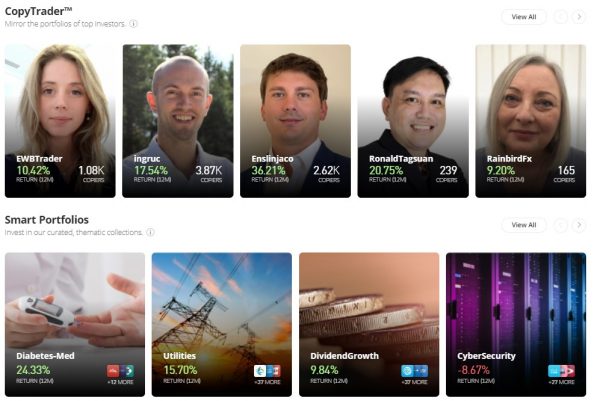

Copy trading is a form of social investing in which individuals can mimic the trades of a more experienced trader. Every position that a copy trader opens or closes will be mimicked in the copier’s portfolio, and their profit or loss on each trade will be matched.

Copy traders can specialize in different strategies. For example, one copy trader might focus on stocks, while another could focus on commodities or forex trading. Copy traders can be day traders, swing traders, or active investors aiming to build diverse portfolios.

For many investors, the easiest way to start copy trading is to use a brokerage that offers this feature. Some brokerages that offer copy trading in the UK include eToro, AvaTrade, and FXTM. Note that there may be a minimum investment of several thousand pounds to begin copy trading.

10. REITs – Invest in Real Estate in the UK and Beyond

Real estate investment trusts (REITs) are a little bit like ETFs, but for real estate: they invest in baskets of real estate holdings. Some REITs invest in residential properties like rental homes and apartments. Others invest in commercial properties like office buildings and industrial parks. Still others invest in developing new land for building.

Many REITs earn money by collecting rent or selling properties they develop and then pay dividends to investors. For many in the United Kingdom, investing in REITs offers a simple way to gain exposure to the real estate market without necessarily buying an expensive home or becoming a landlord.

REITs can be bought and sold just like stocks or ETFs. They are available through most major UK stock brokerages.

How to Choose the Best £50k Investments For You

Figuring out the best way to invest £50k in the United Kingdom requires investors to think about what financial goals are important to them and how comfortable they are with market movements. Here are some of the key things to consider when deciding on the best place to invest £50,000 in the UK.

Financial Goals

A good place for investors to start with £50,000 to invest in the market is to figure out their financial goals. Investing for retirement is very different from investing for steady income or explosive growth.

Investors should figure out what their investing timeframe is and how comfortable they are with the risk of a market downturn during that timeframe. Investors who are closer to retirement age and want to be conservative may build a less risky portfolio. Younger investors who are more focused on growing their wealth quickly may want to be more aggressive and focus on high-risk, high-reward assets like individual stocks and cryptocurrencies.

For those on a lower budget, see our guide to investing with £25,000 in the UK.

Volatility

A key aspect of building a diversified portfolio is to manage volatility. Volatility is a measure of how quickly the prices of assets go up or down. More volatile assets can rise in value quickly, but they can also fall in value quickly.

Many financial experts recommend having a balance of high and low-volatility assets in a portfolio. That way, if volatility increases and the market declines, investors have low-volatility assets that they can lean on to keep their portfolio afloat.

In a portfolio that’s filled with high-volatility assets, it can be difficult to predict how much money an investor will have in their portfolio 6 months or a year into the future.

Risk vs. Return

Another important thing to consider when choosing the best ways to invest £50,000 is to think about risk vs. return. Higher-risk assets – including cryptocurrencies – tend to offer the greatest potential rewards. But, there’s also a greater chance that they will lose value, and perhaps a lot of value.

Many financial experts recommend having a mix of low-risk and high-risk assets in a portfolio. More conservative investors may choose to invest only a small portion of their portfolio in high-risk assets, and set a clear timeframe as to how long they will hold an asset. Also see our guide to short term UK investments.

Alternatively, investors with a larger budget might be interested in reading our article on the best ways to invest £100k in the UK right now according to market analysts and traders.

How to Invest £50k in the UK

Now that investors know how to invest £50,000 in the UK, it’s time to start building a portfolio. We’ll walk investors through how to invest in Dash 2 Trade through this new cryptocurrency’s ongoing presale.

Step 1: Download a Crypto Wallet

Investors who are new to cryptocurrency will need a crypto wallet. MetaMask is free and supports most ERC-20 tokens, including Dash 2 Trade. Investors can download MetaMask for their browser from the MetaMask website.

Step 2: Connect to Dash 2 Trade Presale

Visit the Dash 2 Trade presale site and click ‘Connect Wallet.’

Step 3: Buy Dash 2 Trade

Investors can now buy Dash 2 Trade using Tether (UDST) or Ethereum (ETH) in their MetaMask wallet, or simply by using a credit card.

Step 4: Claim Dash 2 Trade

All Dash 2 Trade tokens purchased during the presale will be released to investors at the end of the presale. Claim purchased Dash 2 Trade to transfer it to the MetaMask wallet for safekeeping.

Conclusion

Finding the best way to invest £50k in the UK can help investors build wealth and reach their financial goals. There are many ways to invest, and many financial experts recommend taking advantage of a wide range of investments to build a diversified portfolio.

One investment to consider when deciding how to invest £50,000 in the UK in a new portfolio is Dash 2 Trade, a promising new cryptocurrency for 2025. Dash 2 Trade’s presale is live now so investors can buy this crypto at the lowest possible price before it launches, and generate a high return on investment (ROI).