Although asset valuations across the broader markets are largely down in 2024, this presents a favorable time to invest for those with suitable capital.

After all, many investors will double down when the stock and property markets are on the decline, with the view of entering positions at a major discount.

In this guide, we take a comprehensive look at the best way to invest £500k in the UK – across a diversified range of markets.

With an investment capital of £500k, investors might consider gaining exposure to the following assets: When evaluating the best way to invest £500k in the UK, the key strategies to incorporate include diversification and an assessment of financial goals and risk tolerance.Best Ways to Invest £500k in the UK in 2024

A Closer Look at the Top Ways How to Invest £500,000

It remains to be seen how the wider financial markets will perform in the coming months and years – considering that a global recession is more of a probability than a possibility.

With that said, irrespective of broader market trends, there are always investment opportunities to consider.

In this section, we explore the best way to invest £500,000 in the UK in 2024 across 10 strategies.

1. Crypto Presale Launches – Invest in Top New Crypto Projects Like Dash 2 Trade

Crypto presale launches provide an effective way to reach high-growth markets in a straightforward manner. The key idea is that crypto presales allow investors in the UK to access new projects as they launch. This is somewhat like an initial public offering (IPO) by companies preparing to list on the stock exchange.

Crypto presales, however, provide early investors with digital tokens as opposed to stocks. After the initial presale has concluded, the crypto project in question will then list its newly created token on an exchange. This enables investors to trade the token in the open marketplace. In the vast majority of cases, the value of the crypto token will rise after its exchange listing.

Let’s look at some examples to illustrate why crypto presales are growing in popularity with UK investors. In the second half of 2022, Tamadoge – a crypto project that is creating a play-to-earn game in the metaverse, offered its TAMA token at approximately $0.01 during its presale.

When TAMA is listed on an exchange after the presale, it did so at a price of $0.02. Not only that, but in the days to follow, TAMA reached heights of $0.20 – representing gains of 20x for early presale investors. This is the case even though broader crypto prices have remained stagnant since the turn of 2022.

One of the best short-term investments in the UK right now from within the presale segment is Dash 2 Trade. This brand-new project is building an analytics platform that focuses exclusively on crypto assets. Dash 2 Trade will be fueled by its own native crypto token – D2T, which will be utilized by investors that wish to access the analytics platform via a subscription model.

The platform will offer a full suite of high-level services and tools that will appeal to both beginners and professional traders alike. This includes crypto signals, which for all intents and purposes are trading suggestions. The signals available to D2T holders will highlight which crypto asset to buy or sell, alongside the suggested entry and exit prices.

The Dash 2 Trade platform will also offer guidance on upcoming presales, new exchange listing alerts, project ratings, professional-grade data and technical indicators, social trading, and an in-house strategy builder. All in all, the Dash 2 Trade analytics terminal aims to become the go-to platform for outperforming the crypto markets.

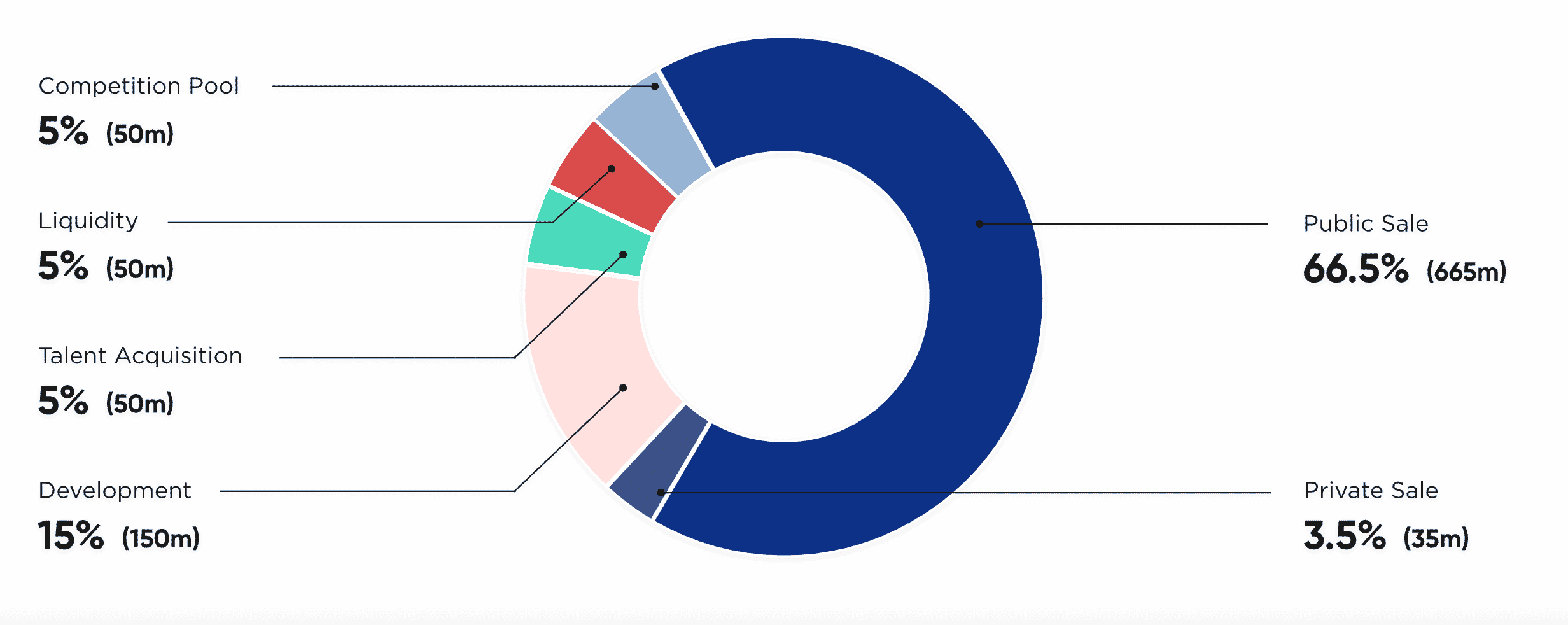

To invest in the Dash 2 Trade project while it is still in its infancy, investors in the UK can now purchase D2T tokens via the presale launch. The presale will raise $40 million across nine stages. After each stage is completed, the price of D2T tokens will increase. This means that the earlier an investment is made, the lower the price paid for D2T.

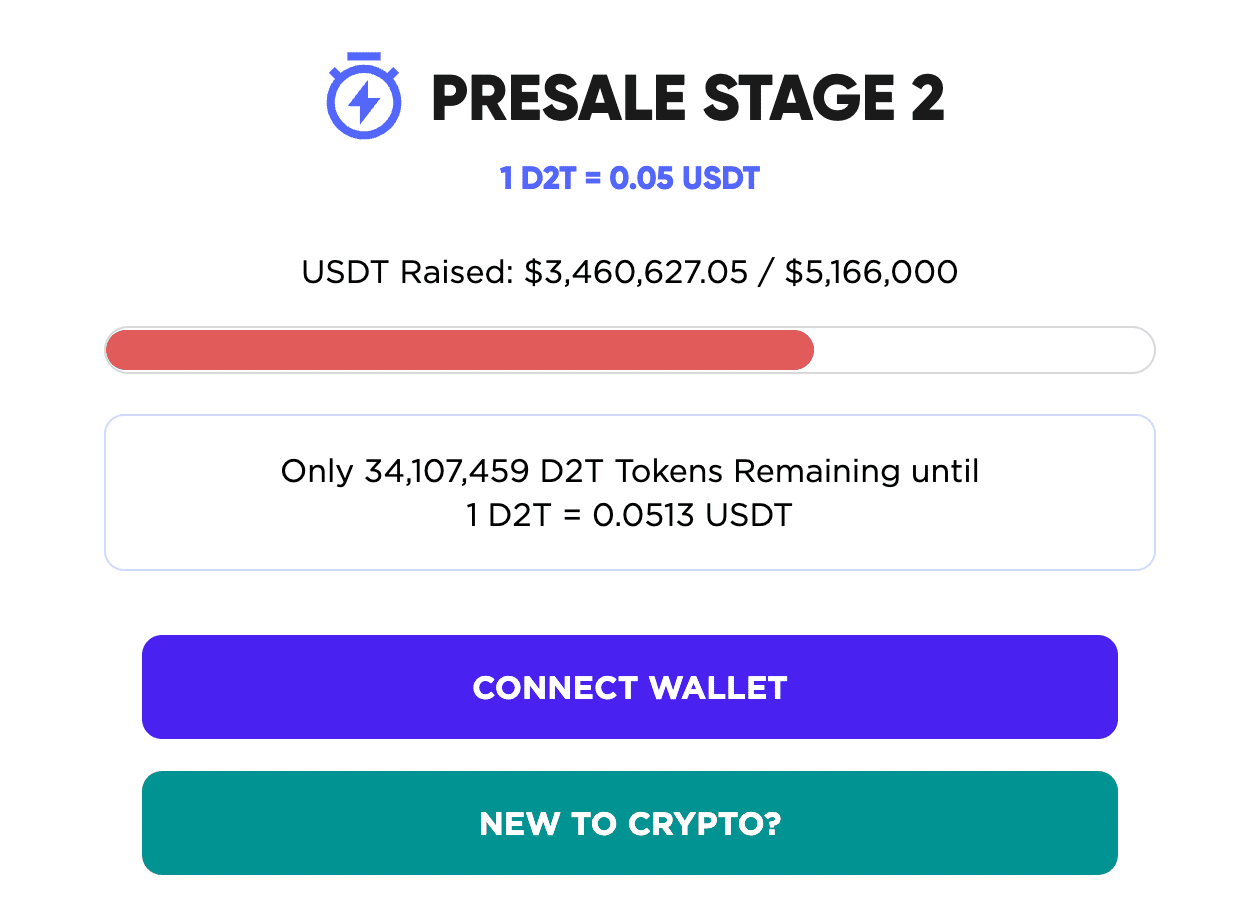

As of writing, Dash 2 Trade is in stage two of the presale, which means that D2T tokens are priced at just $0.05. By stage nine, the price will increase to $0.0662 – offering an upside of nearly 40%.

Here’s some more information on Dash 2 Trade for those looking to perform additional research:

- The Dash 2 Trade whitepaper is a comprehensive document that explains each and every aspect of the project

- The Dash 2 Trade Telegram group is where the team makes core project announcements to the D2T community

- Dash 2 Trade is also offering a $150k giveaway and there are multiple ways to get tickets to the draw

2. Individual Savings Accounts (ISAs) – Maximize Annual Allowance for Tax Efficiency

Individual Savings Accounts (ISAs) allow investors in the UK to invest on a tax-free basis. However, the scheme only permits a maximum investment of £20,000 in the 2022/23 tax year. While this is just a fraction of a £500k capital balance, it is worth taking advantage of nonetheless.

After all, none of the investments within the ISA will be liable for dividends or capital gains tax. This can be highly advantageous for long-term investors, considering that over the course of many years, investments held in an ISA will grow tax-free. Investors are, however, advised to perform research on their chosen ISA provider before proceeding.

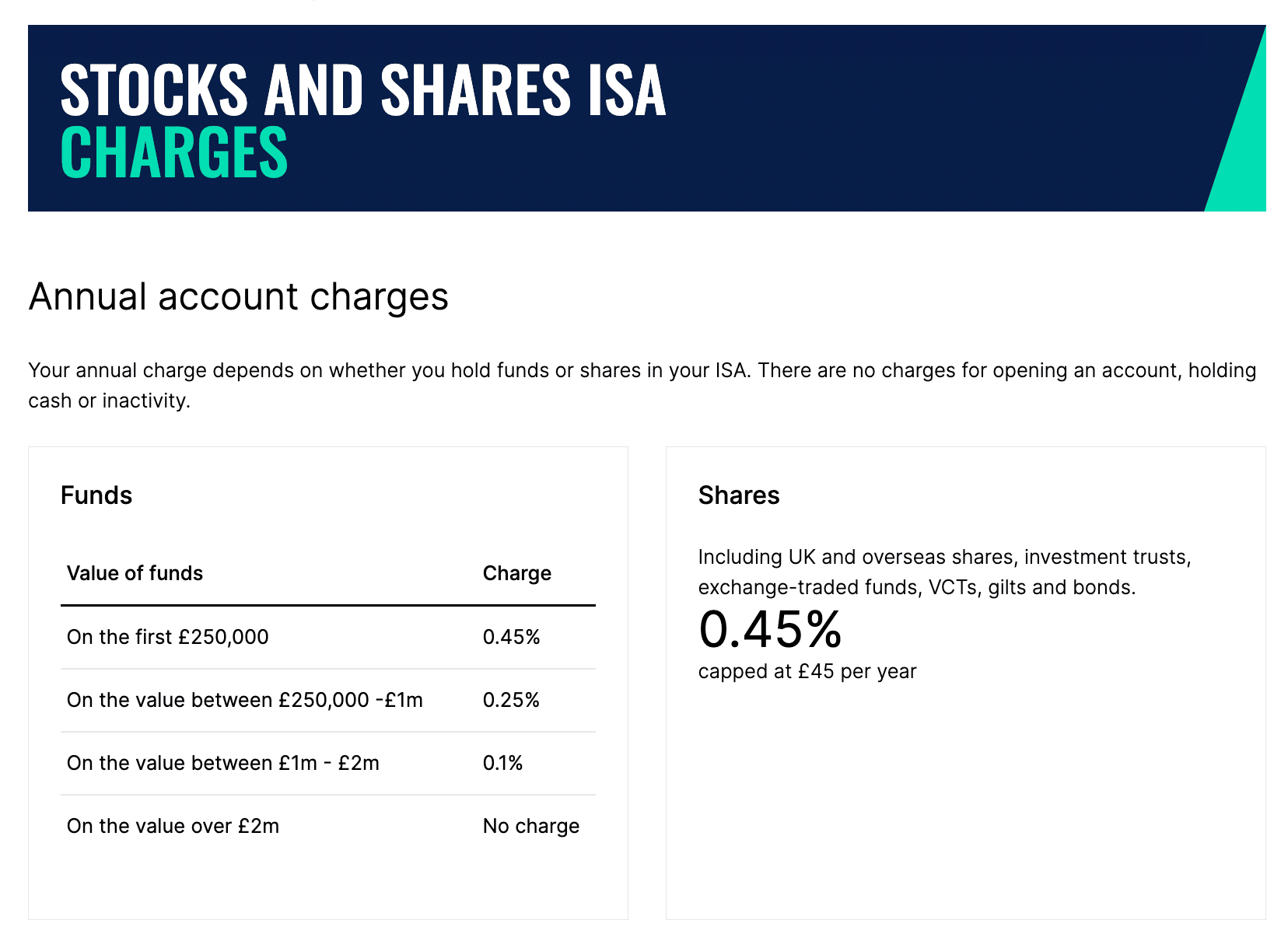

The reason for this is that ISAs are offered by traditional online stock brokers and fees can therefore be excessive. For example, many investors in the UK will opt for Hargreaves Lansdown. This popular broker is expensive, however, charging 0.45% annually on ISAs. Not only that, but when electing to buy shares via the ISA, Hargreaves Lansdown charges £11.95 per trade.

3. Stock Index Funds – Invest in the Entire Stock Market Through One Trade

Perhaps the best way to invest £500k in the UK is through the stock market. However, beginners will often find it challenging to make consistent gains when selecting individual stocks for their portfolio. This is also the case for experienced investors that simply do not have the time to research the stock market day in, day out.

The best solution to this is to instead invest in a popular index fund. In a nutshell, index funds will track some or even all of a particular stock exchange. This means that investors in the UK can gain exposure to large segments of the stock market, rather than attempting to hand-pick a small section of companies.

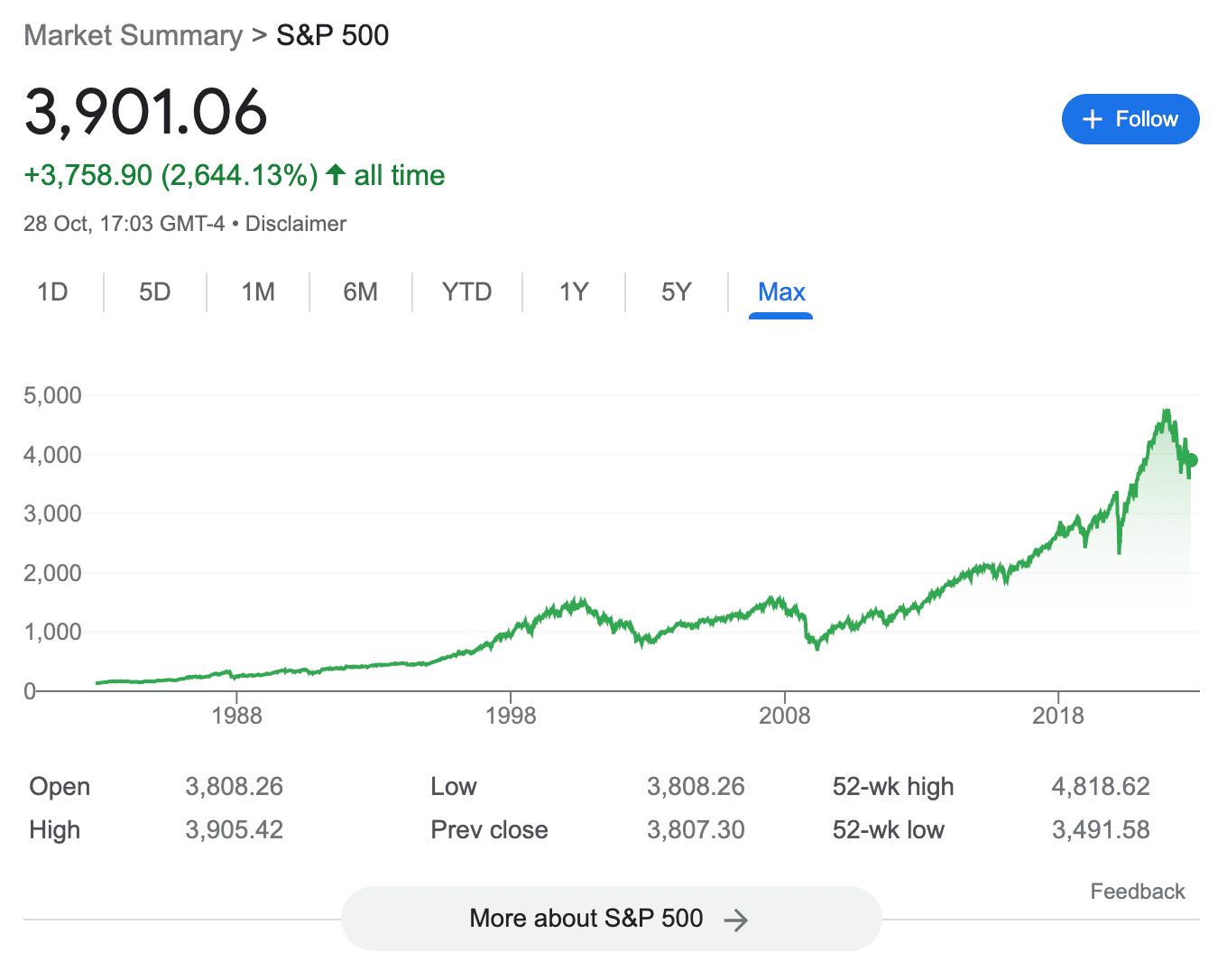

The FTSE 100 is often the go-to index fund for beginners in the UK, not least because it enables investors to buy shares in 100 different companies that are listed on the London Stock Exchange. In reality, however, the FTSE 100 consistently falls behind the US markets and crucially, has remained stagnant for many years.

For example, those investing in the FTSE 100 in the 15 years prior to writing this guide will now be looking at gains of just 5.79%. This means that the FTSE 100 hasn’t even outpaced the rate of inflation. Over the very same period, the S&P 500 – which tracks the 500 largest stocks in the US, has grown by 149%.

To invest in a US-focused index fund like the S&P 500 or Dow Jones, it is best to use a low-cost broker that does not charge a premium for accessing foreign markets. At eToro, for instance, UK residents can invest in their chosen US-based index fund from a minimum of $10 (about £8) and without paying any trading commissions. For more details about this social trading platform, users can read our eToro review UK.

4. Staple Stock ETF – Allocate Funds to Established Companies That Make Money in All Economic Environments

Another option to consider when assessing the best way to invest £500k in the UK is to focus on staple stocks. Many analysts argue that with an extended bear market all but certain to begin in the coming months, it is wise for investors to focus on established companies that generate consistent revenues irrespective of broader economic conditions.

Staple stocks do exactly this, with their products and services remaining in demand in both bearish and bullish environments. Think along the lines of industries such as food and beverage, household products, pharmaceuticals, and even tobacco. One of the best ways to access this market is to invest in an ETF that is specifically tasked with tracking staple stocks.

The iShares Global Consumer Staples ETF, for example, enables access to 95 different staple stocks through a single, managed investment. Its portfolio holds household names such as Procter & Gamble, Unilever, Diageo, British American Tobacco, Coca-Cola, and Walmart.

Historically, the aforementioned companies perform well during a recession – considering the products that they sell. Since its inception in 2006, the iShares Global Consumer Staples ETF has generated average annualized gains of 7.14%. Moreover, investors in the UK will pay iShares an expense ratio of just 0.4%.

5. Dividend Stocks – Invest in Stocks With a Dividend Program of at Least 25 Years

In a similar nature to staple stocks, dividend stocks are often highly sought-after by risk-averse investors. The reason for this is that the investor will receive a share of cash distributions made by the company, usually every three months. However, when building a portfolio of dividend stocks, it is wise to focus on ‘aristocrats’.

Put simply, aristocrats are companies that have paid and increased the size of their dividends for no less than 25 consecutive years. This means that regardless of the wider economic outlook, aristocrats continue to reward shareholders with a quarterly payment. This highlights that dividend aristocrats have solid business models and highly robust balance sheets.

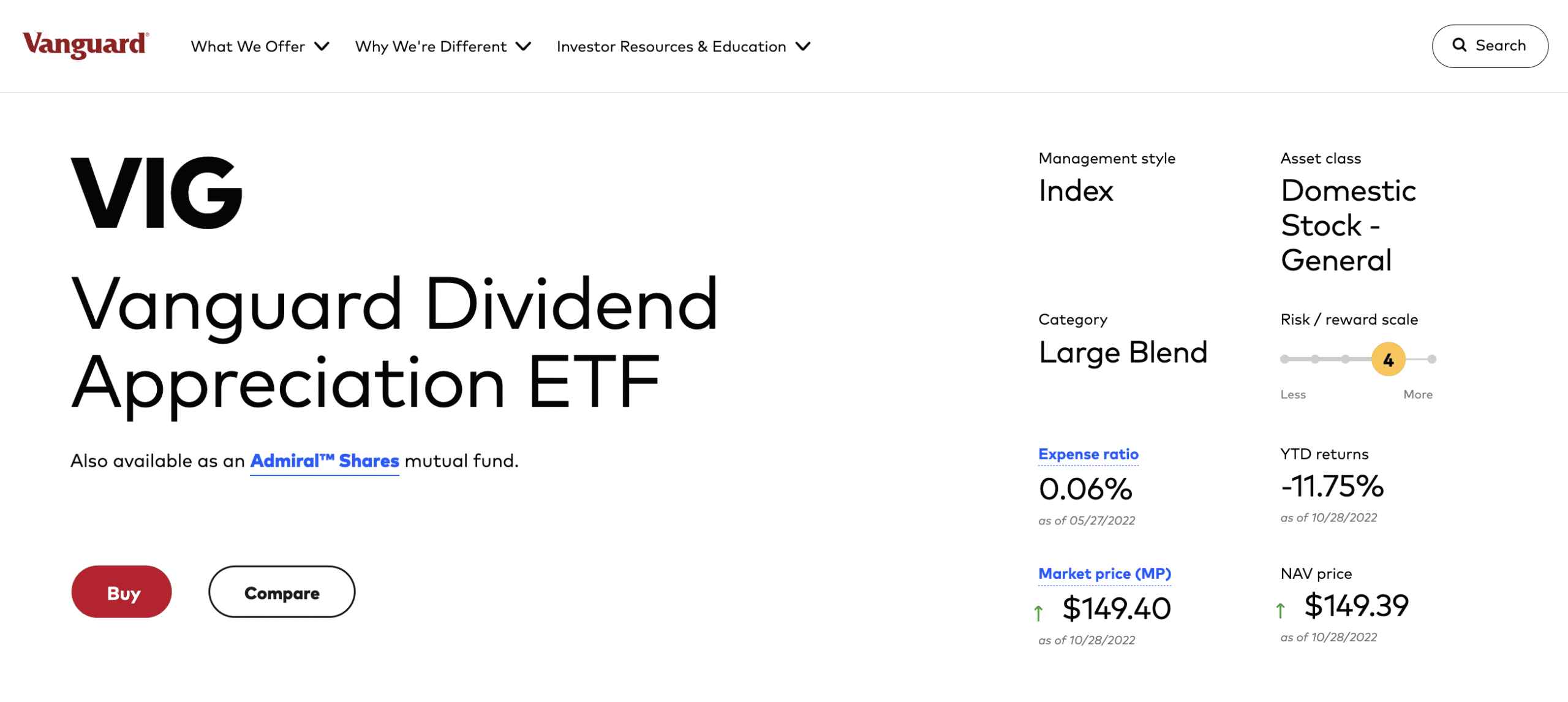

Once again, when assessing how to access dividend stocks, one of the best ways to invest £500k in the UK is to opt for an ETF. For example, the Vanguard Dividend Appreciation ETF offers investors access to 289 dividend stocks across a wide range of sectors – including energy, consumer staples, industrials, materials, financials, and more.

Some of the leading dividend stocks in this portfolio include Visa, Microsoft, Johnson & Johnson, Pepsi, Home Depot, and JPMorgan Chase. over the prior 10 years of trading, the Vanguard Dividend Appreciation ETF has generated average annualized gains of 10.74%. At an expense ratio of 0.06%, UK investors will pay just 60p for every £1,000 invested.

6. Gilts – Yields of 3-4% on Ultra-Low-Risk Government Bonds

Although it can be tempting to focus exclusively on high-growth markets, it is also wise to consider low-risk assets when evaluating the best way to invest £500k in the UK. After all, low-risk assets offer portfolios some much-needed stability during g times of economic uncertainty.

In this regard, perhaps the best place to invest £500,000 in the UK is government bonds – more commonly known as gilts. In a nutshell, gilts enable investors to lend money to the government in return for interest payments that are paid every six months. The yield on gilts is dependent on broader economic conditions.

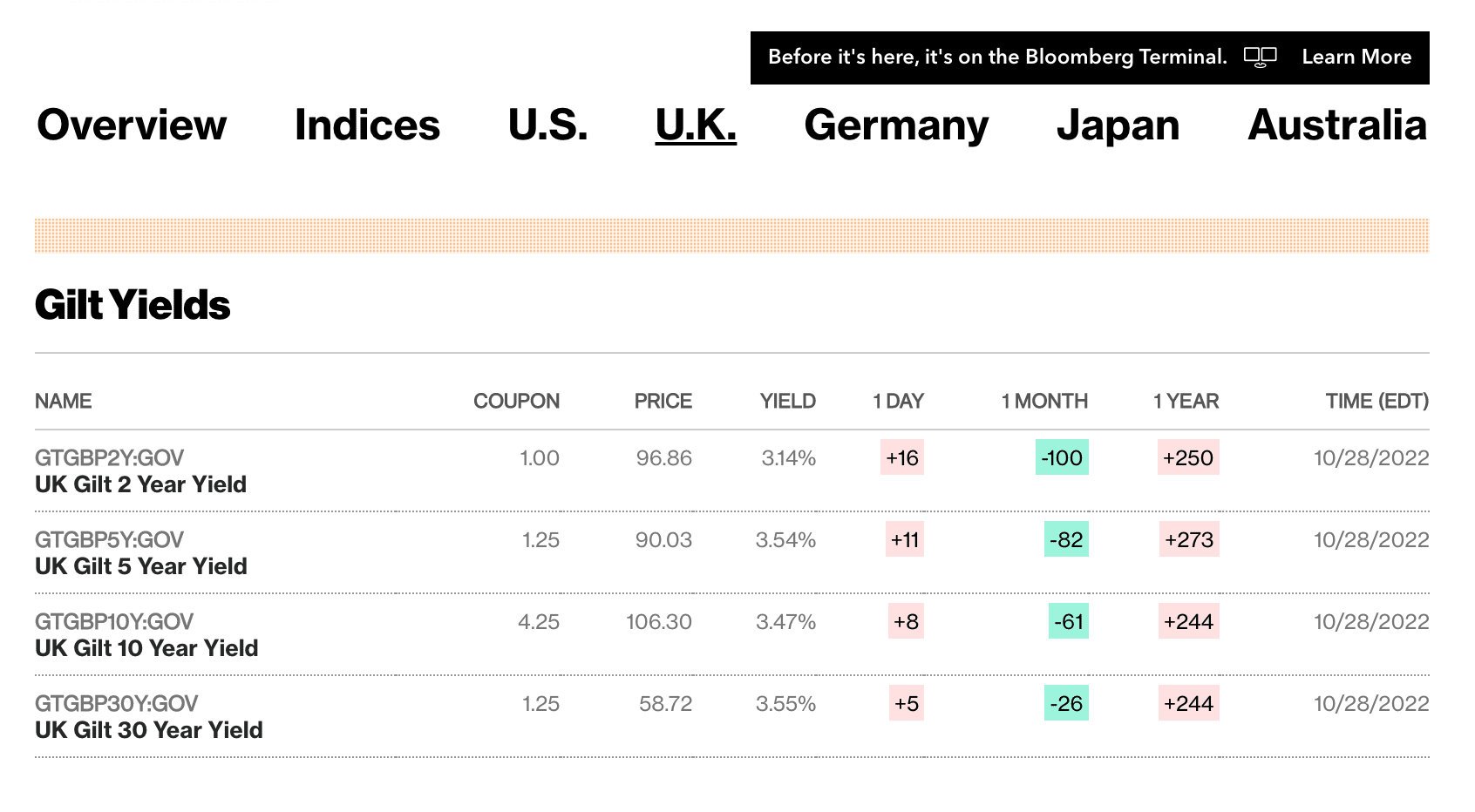

Due to rising inflation rates, gilts are now paying between 3-4% annually – the highest they have been for many years. As of writing, 5-year gilts are offering a yield of 3.54%. Although this is still below the current rate of inflation, it is important to remember that gilts are ultra-low-risk.

The UK government will likely never default on its interest payments, considering that shortfalls can simply be covered by further ‘money printing’ via the Bank of England. Although bonds are typically viewed as illiquid, UK gilts operate in a multi-billion pound market. Therefore, it is often possible to cash out gilts via the secondary market prior to the maturity date.

7. NFTs – Get in Early on a Rising NFT Marketplace

In stark contrast to government bonds, NFTs operate in a high-growth market that many believe is still heavily undervalued. NFTs – or non-fungible tokens, are digital assets that operate on the blockchain. But unlike conventional players in this space – such as Bitcoin and Ethereum, each NFT is unique from the next – hence its non-fungible status.

This makes NFTs highly conducive for storing digital value in a low-cost, secure, and transferable manner. For example, NFTs can represent ownership of fine art, property, precious metals, securities, and more. Although NFT sales have dropped considerably in 2022, NFTs still operate in a multi-billion pound market.

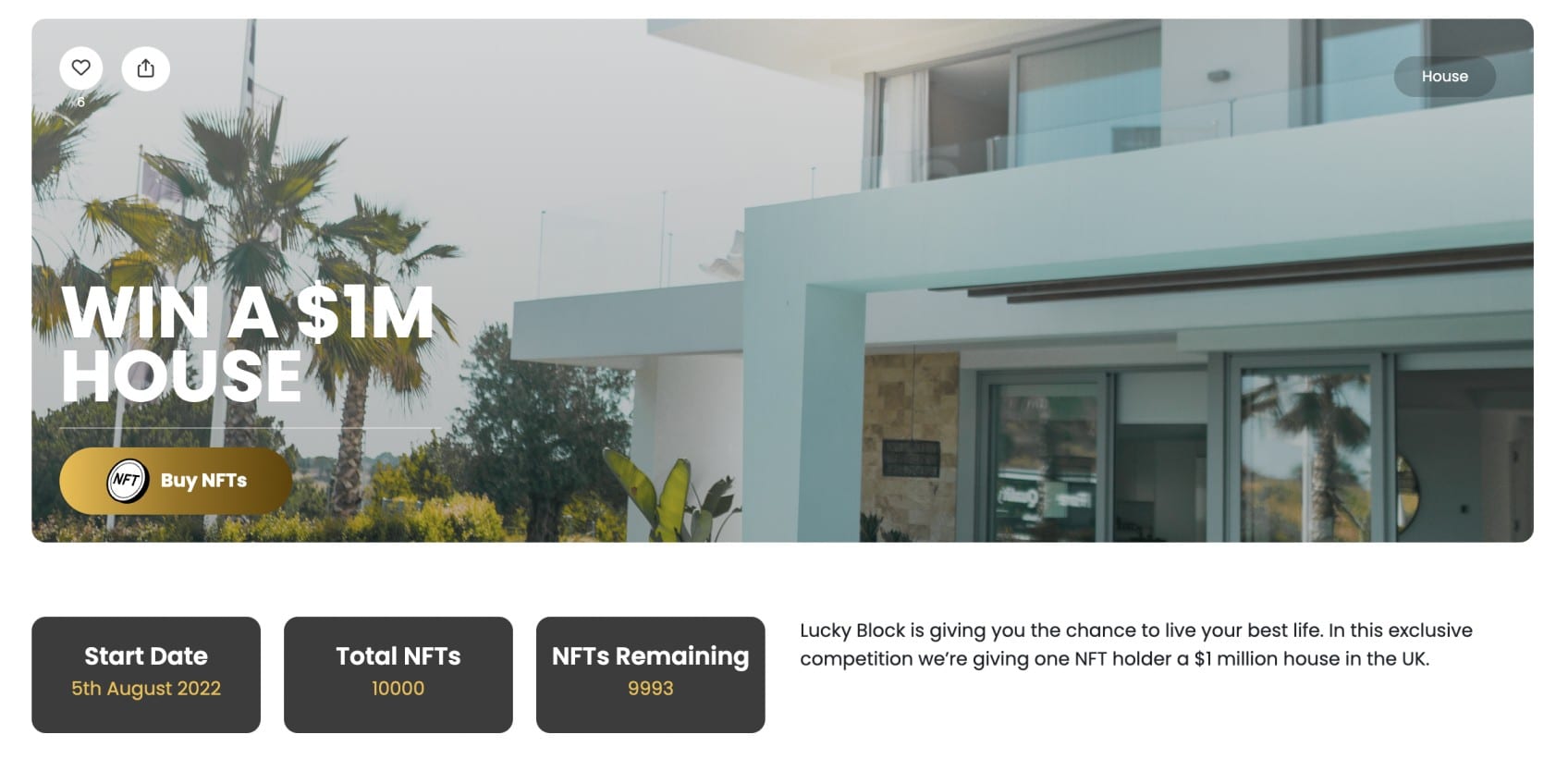

Moreover, the NFT decline in 2022 is largely due to the broader crypto bear market. As such, investors now have the chance to build a portfolio of NFTs at an attractive entry price. One of the best NFT projects in the market right now is Lucky Block. The project offers a collection of NFT series – each of which represents entry to a specific competition.

Competitions include $1 million worth of Bitcoin, a $1 million home, 5-star holidays, and more. Buying an NFT not only offers entry to the chosen competition but ongoing crypto rewards. The previously mentioned Tamadoge has also launched its own NFT collection. If its NFTs are as successful as its TAMA token, the upside potential could be notable.

8. Crypto Staking – Outpace Inflation Through Passive Crypto Rewards

Another way to outpace inflation is to consider crypto staking. This phenomenon operates in a very similar nature to traditional savings accounts. This is because staking offers interest on any deposits that are made. However, instead of earning interest in pounds and pence, staking rewards investors with additional cryptocurrencies.

Let’s take the Crypto.com exchange as an example. Across dozens of different cryptocurrencies and stablecoins, investors can opt for an interest account across three different terms – flexible, 1-month, and 3-month. The latter two options offer the highest yields, albeit, withdrawals cannot be made until the term concludes.

Nonetheless, interest rates of up to 14.5% APY can be accessed on Crypto.com. Stablecoins attract a maximum APY of 8.5%. When staking, the interest is paid in the same digital currency that has been deposited. For example, let’s say that the investor gets an APY of 10% on BNB and they deposit 1,000 tokens. At the end of the term, the investor will receive 1,100 BNB tokens.

9. Property – Take Advantage of a Broader Market Correction

While the future cannot be predicted with any certainty, the general consensus is that the UK property arena is due for a market correction in 2023. This means that across the broader property market, there is an expectation that house prices will temporarily decline.

This is due to rising Bank of England interest rates, which makes new mortgage applications less attractive. When fewer people are applying for mortgages, demand for property purchases declines, and thus – this impacts the wider housing market. Nonetheless, with capital of £500,000, this presents an opportunity to enter the market at a favorable time.

The safest option is to focus on stable housing markets in and around city center locations. This will enable investors to continue generating solid monthly rental payments while the market is being corrected. However, just remember that real estate is highly illiquid, meaning that property investments should be viewed as a long-term play.

If liquidity is a major concern, then it might make sense to instead opt for a real estate investment trust (REIT). Trading on stock exchanges via ETFs, REITs can be cashed out at any given time.

10. Smart Portfolios – Track Selected Stock Markets via a Low-Cost Managed Portfolio

The final option to consider when assessing how to invest £500,000 in the UK is Smart Portfolios. Offered by the FCA-regulated broker eToro, Smart Portfolios offers access to dozens of niche markets in a low-cost and completely passive nature. Each Smart Portfofolio will subsequently track a segment of the stock market across a diversified basket of companies.

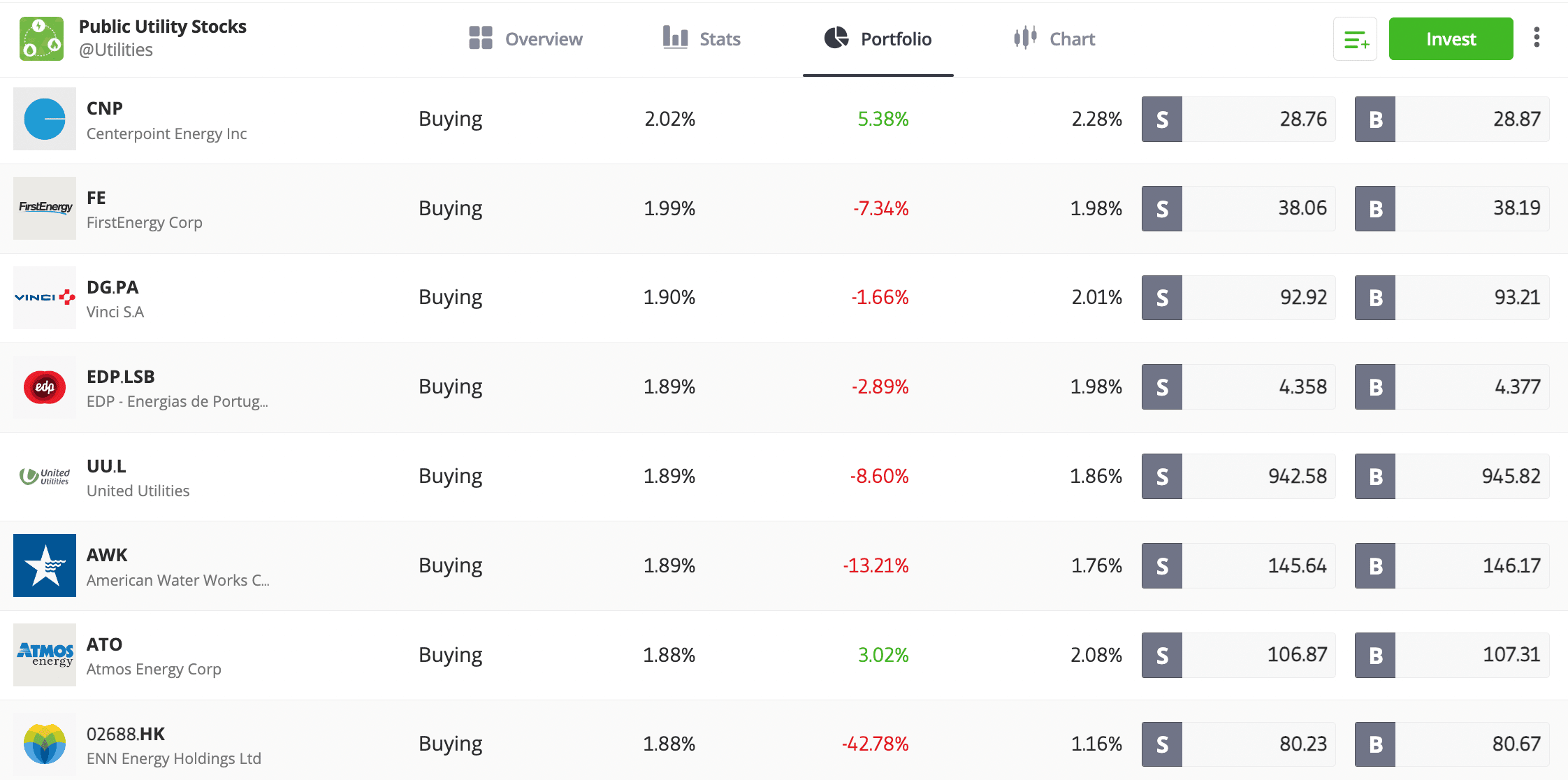

For example, This includes companies operating in industries such as the metaverse, semiconductor chips, autonomous cars, gaming, Chinese tech, and oil. The Public Utility Stocks Smart Portfolio, for example, offers access to 41 companies from within the water, oil, gas, and broader energy spaces.

Holdings include everything from PetroChina and CMS Energy to National Grid and American Water Works. Not only can Smart Portfolios be accessed without additional fees, but the minimum investment requirement is just $500 (about £430). This means that those with £500,000 to invest in Smart Portfolios can diversify into other assets and markets with ease.

How to Choose the Best £500k Investments For You

Ever-changing economic conditions continue to make the investment decision-making process even more challenging.

Therefore, in this section, we offer further insight into how to invest £500,000 in the UK.

Balance the Portfolio Risk

The first strategy to consider when evaluating how to invest £500k in the UK is the breakdown of the portfolio. After all, we discussed 10 different ways to invest £500k across a variety of risk-reward ratios.

For instance, while crypto presales and stocks offer the greatest upside potential, this comes at the cost of added risk. Government bonds, on the other hand, are potentially the safest option to consider, but returns will be limited.

Therefore, it is wise to allocate a certain percentage of the portfolio to each risk level.

For instance, a conservative investor might allocate 75% of their portfolio to government bonds, real estate, and dividend stocks, and the rest split between crypto presales and NFTs.

Diversify Across Multiple Markets

Diversification will enable investors in the UK to target their desired financial returns in a more risk-adjusted way. This is because the portfolio will contain multiple asset classes from a variety of markets.

For example, those wishing to invest in stocks might consider the FTSE 100, not least because it offers access to 100 different companies. A more diversified approach, however, would be to also consider stocks from international markets.

Similarly, when investing in crypto assets, it is wise to diversify across many different projects. For instance, in addition to Dash 2 Trade, investors might also consider DeFi Coin, IMPT, and Lucky Block.

Market Liquidity

Another crucial consideration to make when assessing the best way to invest £500k in the UK is how much liquidity there is in the chosen markets.

For example, major stock exchanges offer huge levels of liquidity, meaning that investors in the UK can sell their shares whenever the market is open.

This will come in handy if the investor needs fast access to cash. This is often the case with crypto assets too, especially if the project trades on major exchanges.

On the other hand, other asset classes operate in an illiquid market. This means that the process of selling the asset is both cumbersome and time-consuming.

Real estate is a great example here, as it can often take several months or even years to complete the list-to-sale process.

Gain Exposure to Both Growth and Income

Another metric to consider when choosing the best way to invest £500k in the UK is how returns will be generated. Seasoned investors will often look to build a portfolio that targets a good blend of growth and income.

Growth means that the primary focus is on appreciation, such as the value of a share price rising. Income, on the other hand, refers to passive returns, such as monthly rental payments of quarterly dividends.

This once again refers back to the importance of diversification.

How to Invest £500k in the UK

Looking to get the ball rolling by investing some or even all of a £500k capital allowance today?

In this section, we offer insight into how to access the previously discussed Dash 2 Trade presale, where early investors can secure a price of $0.05 on D2T tokens.

Step 1: Get a Crypto Wallet

Experienced investors in this space will likely already have access to a crypto wallet.

Newbies that are investing in a crypto presale for the first time, however, may need some guidance. The best crypto wallet in the UK to access the Dash 2 Trade presale is MetaMask.

MetaMask is free to download and maintain and can be accessed via a web browser extension for Google Chrome, Edge, and Firefox. Alternatively, those that prefer investing via a smartphone can download the MetaMask app for Android or iOS.

Open MetaMask and elect to create a new wallet by choosing a strong password. Next, MetaMask will display a backup passphrase via 12 randomly generated words.

Write this down and keep it somewhere safe and private – the backup passphrase is used to access MetaMask in the event the password is forgotten.

Step 2: Buy Ethereum

Now that MetaMask has been installed and set up, the next step is to buy Ethereum. This is because the Dash 2 Trade presale accepts Ethereum as a means of payment (in addition to Tether).

There are many UK crypto exchanges that support Ethereum purchases via debit/credit cards and bank transfers, such as Binance, Coinbase, and OKX.

Step 3: Transfer Ethereum to MetaMask Wallet

The next step is to transfer the purchased Ethereum tokens over to MetaMask. The transfer will be conducted on an exchange-to-wallet basis.

Copy the unique MetaMask wallet address from the main interface and elect to withdraw Ethereum from the chosen exchange. When asked for the destination wallet, paste the MetaMask address.

Step 4: Connect MetaMask to Dash 2 Trade Presale

On average, it takes 5-10 minutes for the Ethereum tokens to arrive in MetaMask after requesting a withdrawal from the crypto exchange.

A notification will appear via the MetaMask wallet when the funds arrived. When they do, visit the Dash 2 Trade website and click on ‘Connect Wallet’.

Choose MetaMask and confirm the wallet connection.

Step 5: Buy D2T Tokens

Dash 2 Trade will now populate an order box. This is where the total investment stake needs to be entered.

Type in the number of D2T tokens to buy and the equivalent amount in Ethereum will update in real-time. If the dashboard notes that the MetaMask wallet does not contain enough funds, reduce the number of D2T tokens slightly.

Finally, another notification will appear via the MetaMask wallet. This will ask to confirm the transfer of ETH tokens. After confirming, the presale investment will be processed instantly and the D2T tokens can be claimed after the fundraising campaign has finished.

Conclusion

This guide has taken a deep dive into the best ways to invest £500,000 in the UK. We have covered both low and high-risk assets, inclusive of property, dividend and staple stocks, NFTs, and real estate.

One of the overall best options to consider right now is the Dash 2 Trade crypto presale, which is selling D2T tokens at a discounted price.

Once the presale has finished, D2T tokens will be listed on a major exchange.