Looking for the best way to invest £20k in the UK? With capital of this magnitude, there are many investment options to consider.

In this guide, we offer insight into the best place to invest £20,000 in the UK – covering everything from stocks and bonds to gold and cryptocurrencies.

Investors searching for the best way to invest £20k in the UK might consider one of the 10 options listed below: It is important to consider the risk of each investment before allocating any capital. Moreover, diversification is the best approach to take, which means building a portfolio that contains a wide range of financial instruments.Best Ways to Invest £20k in the UK in 2024

A Closer Look at the Top Ways How to Invest £20,000

Investors with access to £20,000 can diversify their portfolio with ease. Many online brokers in the UK support everything from stocks, index funds, and ETFs to commodities, cryptocurrencies, and even contracts-for-differences (CFDs). For those with a lower risk tolerance, our article on the best ways to invest £5k in the UK is a must read.

As such, we will now discuss 10 popular options to consider when assessing how to invest £20k in the UK.

1. Cryptocurrencies – Allocate Funds to New Crypto Projects and Presale Launches

For maximum upside potential, many investors in the UK are turning to cryptocurrencies. The overarching reason for this is that although speculative and volatile, cryptocurrencies continue to outperform traditional marketplaces – such as stocks, bonds, and gold. With that said, it would be wise to only allocate a small amount of the £20,000 to cryptocurrencies, as per the added risk.

After all, many cryptocurrencies have since lost more than 90% in value, with there being no guarantees that the respective tokens will ever recover. As such, taking a diversified approach is once again of the utmost importance. Many first-time investors in the UK will look to buy Bitcoin, considering that it is the largest and most popular token in this space.

Bitcoin has increased by many millions of percentage points since it was launched in 2009. Over the prior five years alone Bitcoin investors have witnessed growth of over 235%. This is the case even though as of writing, Bitcoin is trading 70% below its former all-time high of $68,000.

Ethereum is another option for UK investors to consider when creating a diversified crypto portfolio. The world’s second-largest cryptocurrency by market capitalization has increased by more than a million percentage points since entering the market in 2015.

Thousands of cryptocurrencies exist in this marketplace, with other popular options including Ripple, Bitcoin Cash, Solana, BNB, and Dash. However, perhaps the greatest upside potential can be found with newly launched cryptocurrencies that have a small market capitalization. This is somewhat similar to investing in growth stocks, which we cover later in this guide.

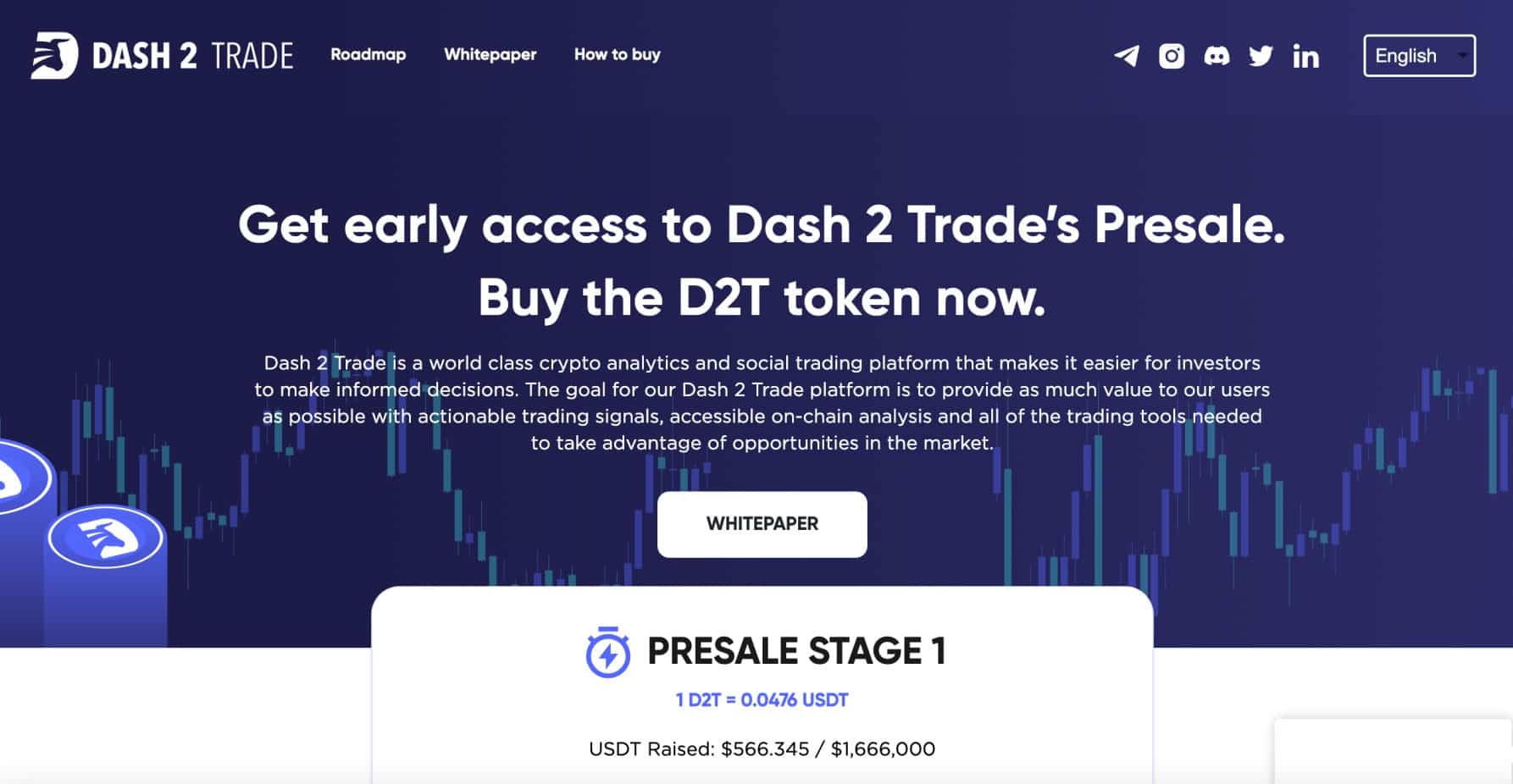

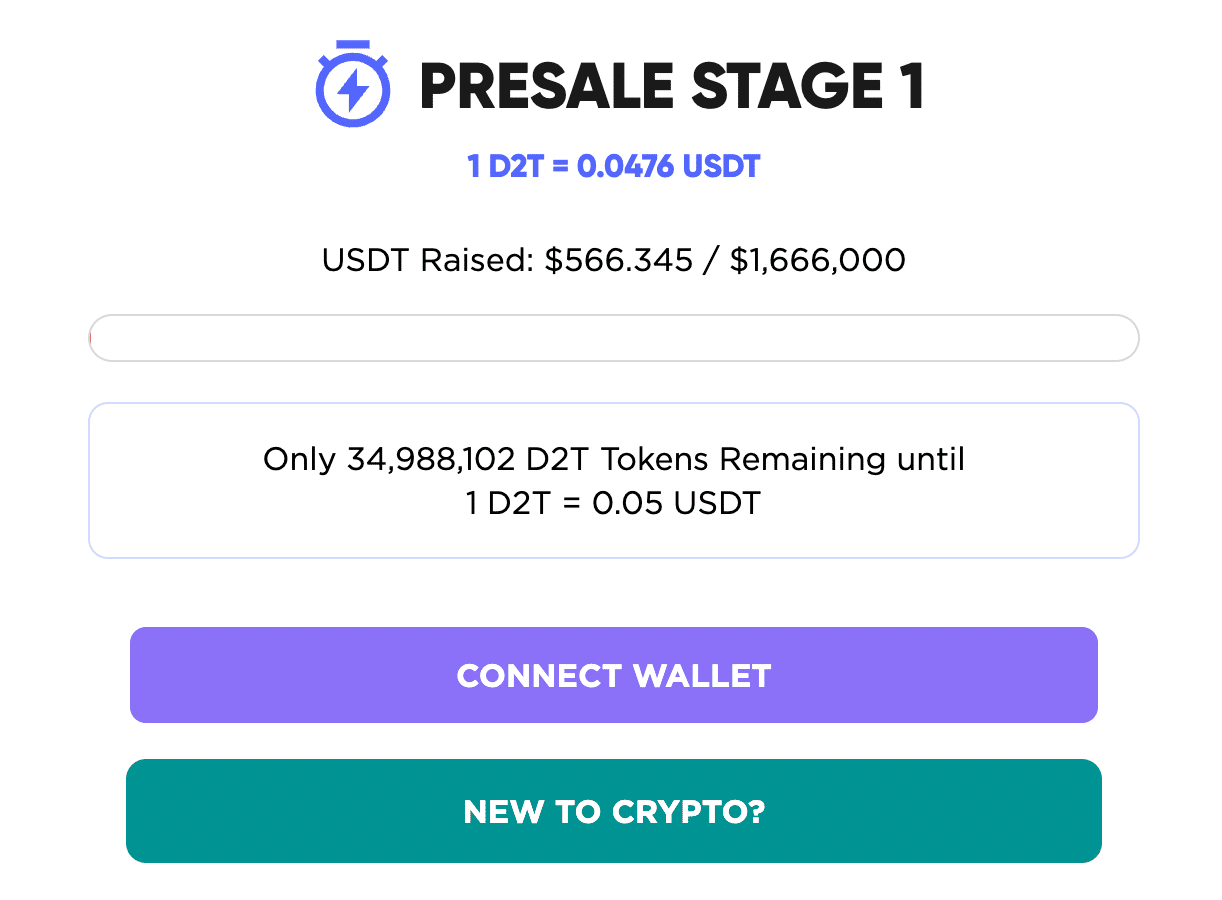

Back to cryptocurrencies, one of the much-anticipated launches of the year is Dash 2 Trade. This project is building a Bloomberg-style analytics dashboard that will provide everything from trading signals and professional-grade charts to social media metrics and on-chain indicators. In the coming days of writing, Dash 2 Trade will launch its presale campaign.

This means that investors in the UK can buy into the project at the very start of its journey. Presale investors will be offered the best price possible on the D2T token – which fuels the Dash 2 Trade terminal. For more details reads can refer to the Dash 2 Trade whitepaper as well as subscribing to the Telegram group.

Dash 2 Trade is also featured in our list of the best ways to invest £25k in the UK in 2024.

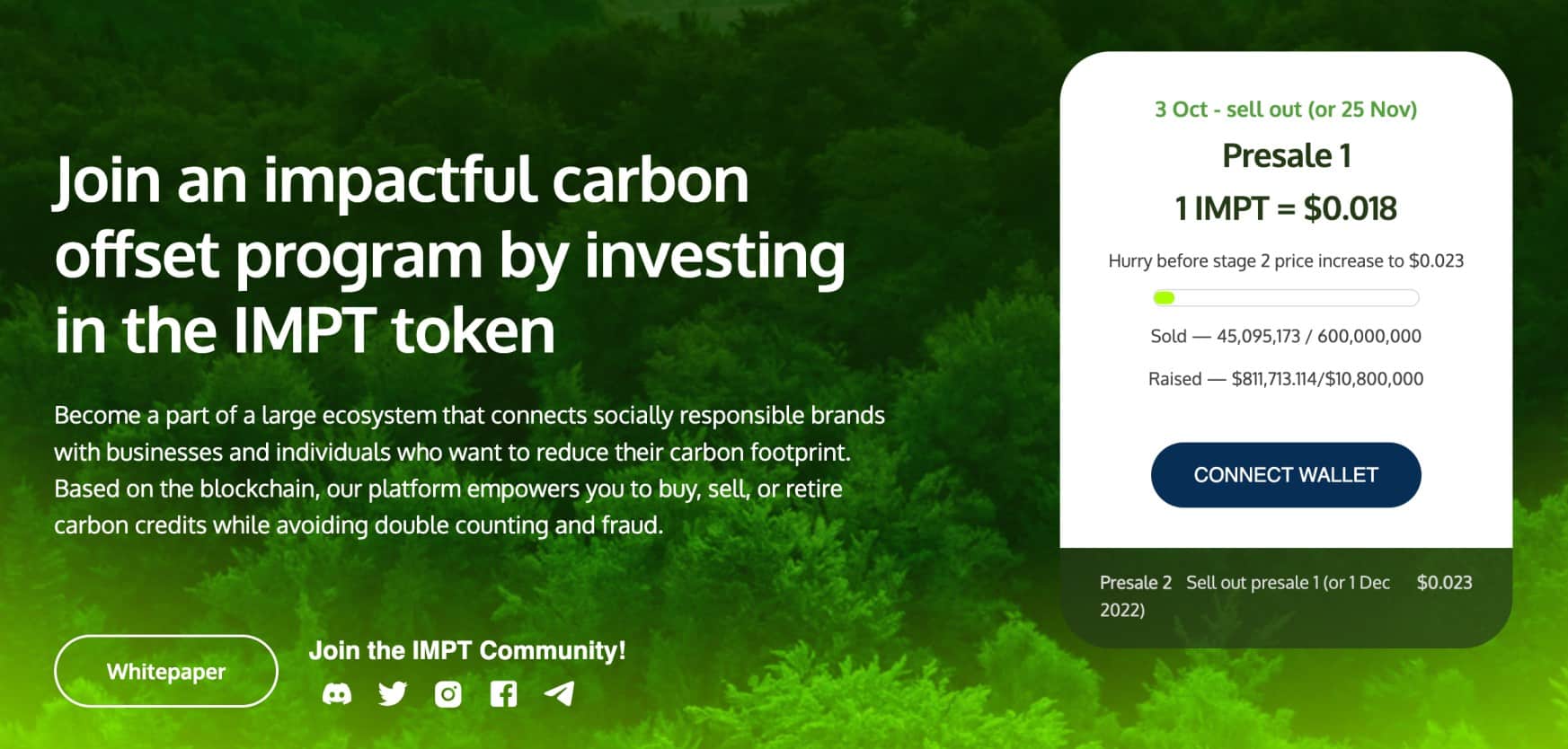

Another cryptocurrency that is in the midst of its presale campaign right now is IMPT. This is a green crypto project that is building a carbon credits dashboard. Companies will be able to buy carbon credits from the IMPT marketplace when they have reached their annual allocation.

Carbon credits can also be offset for those that wish to reduce their environmental footprint. The IMPT token is currently available to purchase at just $0.018 and more than $5.7 million has already been raised during the presale. Therefore those looking for the best way to invest £10k in the UK could consider adding IMPT to their crypto portfolios.

2. Real Estate – Gain Exposure to Real Estate via a REIT

Real estate offers investors the opportunity to gain exposure to bricks and mortar. Over the course of time, real estate – especially in the UK market, has produced attractive long-term returns for homeowners. Not only in terms of property price growth, but passive income in the form of monthly rental payments.

However, opting to enter into a new mortgage right now might not be the best course of action to take. The reason for this is that the Bank of England continues to hike interest rates with the view of fighting ever-growing inflation levels. In turn, this will result in monthly mortgage payments that could become unaffordable.

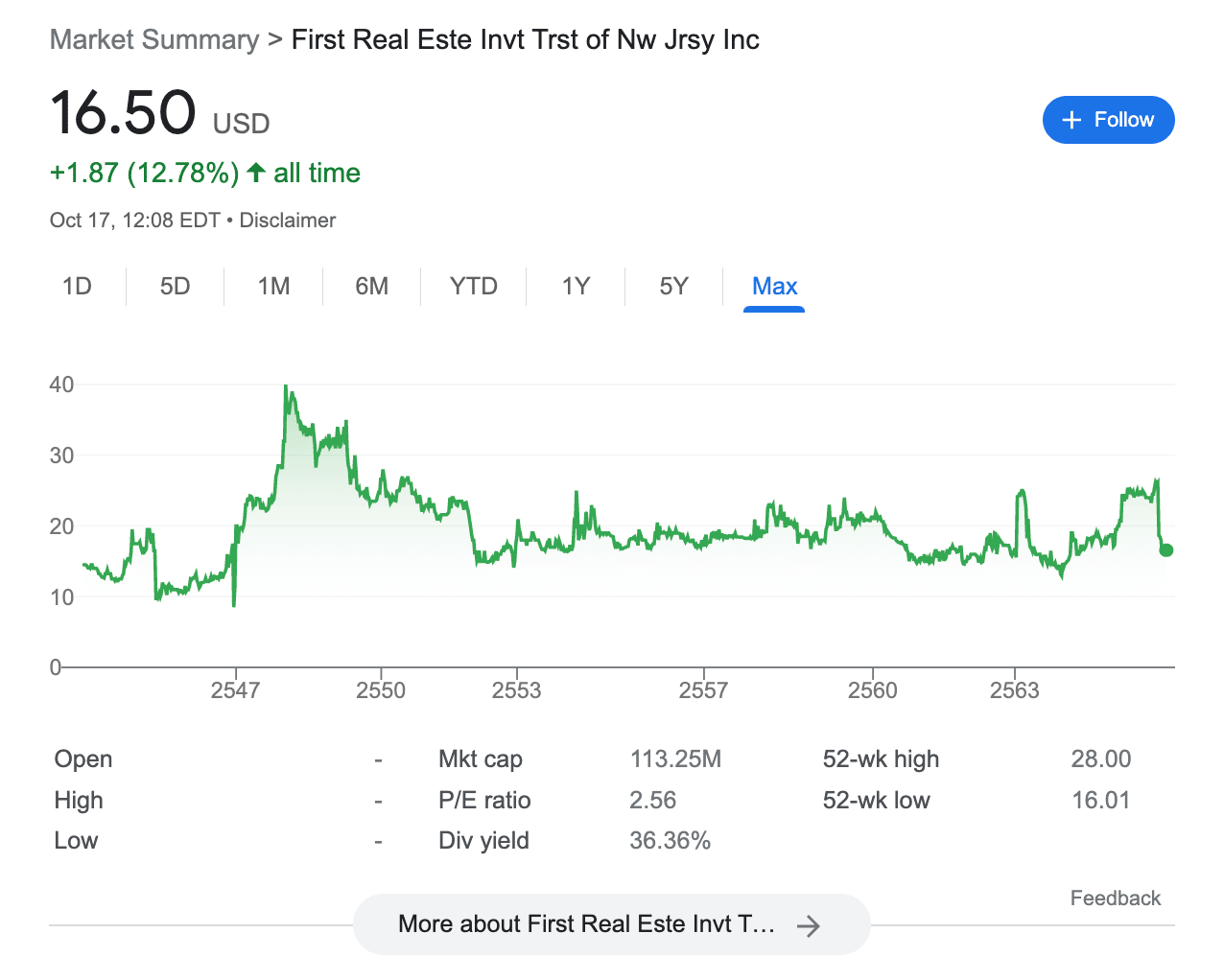

Instead, those with £20,000 to invest in might consider a REIT (Real Estate Investment Trust). REITs are large companies that collect funds from investors and subsequently purchase a wide portfolio of properties. Not only will the REIT find suitable properties on behalf of investors, but manage them too.

This means that investors can benefit from long-term appreciation and monthly rental income but in a passive way. Best of all, unlike traditional property investments, REITs offer near-instant access to liquidity. This is because REITs are traded on public stock exchanges via an ETF. REITs also make it a seamless process to invest in international real estate markets, such as the US.

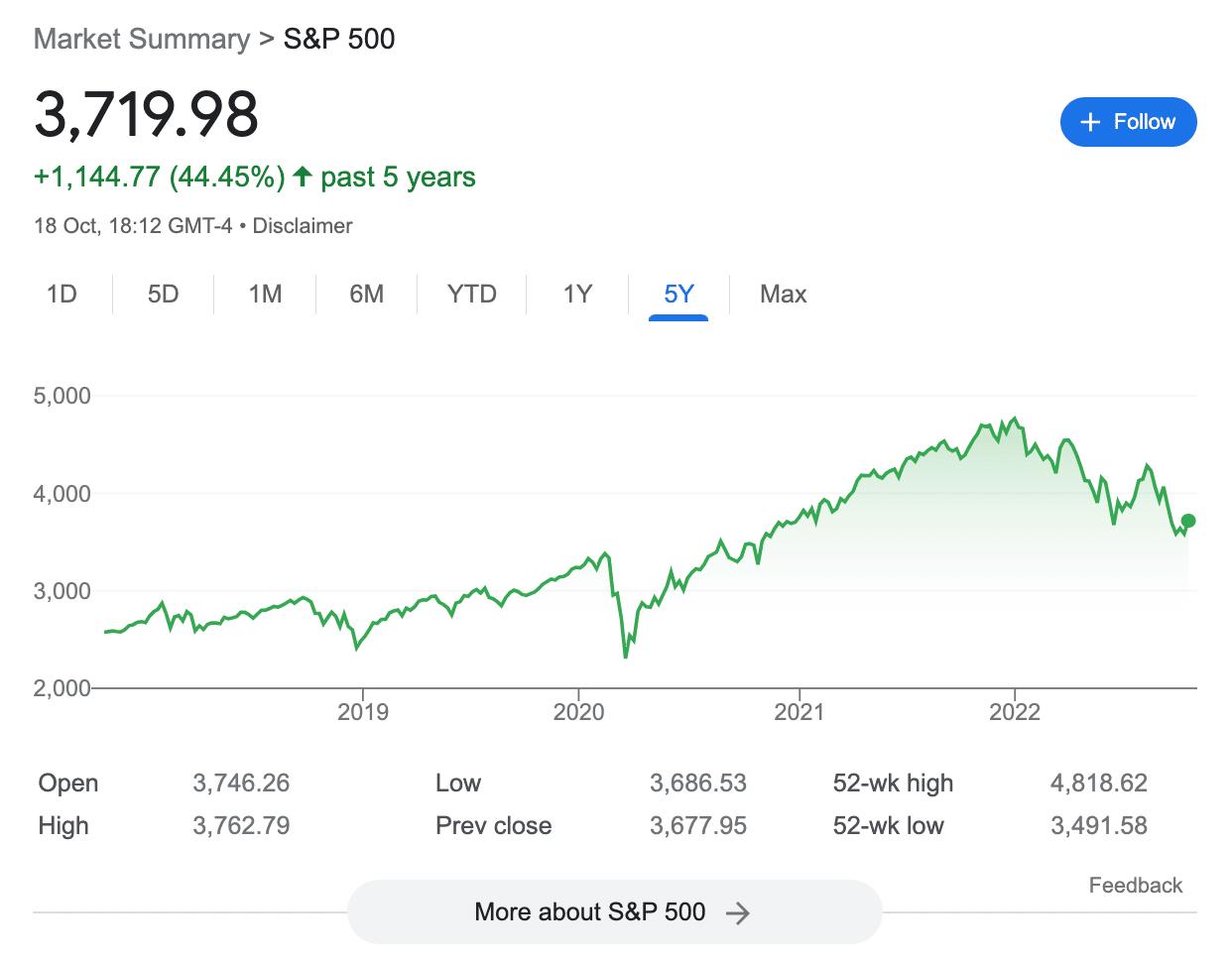

3. S&P 500 – Invest in 500 Large US Companies via a Single Trade

One of the best ways to invest £20k in the stock market in a diversified and passive way is via an index fund. While some UK investors might be looking to explore the FTSE 100, this is one of the worst-performing index funds globally. In fact, the FTSE 100 has lost nearly 8% value in the prior five years.

Taking into account inflation levels and opportunity costs, the losses are much higher. In comparison, the US stock markets continue to lead the way. And in this regard, one of the most popular index funds to consider today is the S&P 500. As the name suggests, this index fund tracks the performance of 500 large US-listed companies.

This includes virtually every US brand that has a global presence and examples include Amazon, Apple, Twitter, the Bank of America, McDonald’s, IBM, Microsoft, and Tesla. Furthermore, and perhaps most importantly, the S&P 500 enables UK investors to gain exposure to all 500 companies via a single investment.

The S&P 500 portfolio is broken down by the market capitalization of each company. For example, as of writing, the Vanguard S&P 500 ETF – which charges an annual fee of just 0.03%, weighs Apple and Microsoft stocks at 6.85% and 5.70% respectively. This means that a £20,000 investment would result in £1,369 worth of Apple stock (6.85%).

Similarly, the portfolio would hold £1,140 worth of Microsoft stock (5.70%). Every three months, the S&P 500 is rebalanced to reflect current market conditions. This means that the stocks held within the S&P 500 index fund will be reweighted. This is conducted by the chosen ETF provider on behalf of investors.

At FCA-regulated broker eToro, it is possible to invest in an S&P 500 ETF from a minimum of $10 (about £8) without paying a single penny in commission.

4. Growth Stocks – Buy a Basket of Growth Stocks While Prices are Cheap

Are growth stocks the best shares to buy in the UK right now? Growth stocks are perhaps the best way to invest £20,000 in the UK in 2024 to target higher-than-average returns. Put simply, growth stocks refer to companies that have the potential to outperform the broader market, not least because they operate new and innovative products/services, they carry a small valuation, and/or they are considered young.

On the flip side, growth stocks typically operate business models and ideals that are yet to be proven by the mass markets, so the risk profile is much higher. As a result, it is wise to keep stakes conservative when investing in growth stocks. Due to the uncertainties of the wider economy, leading growth stocks have taken a major hit.

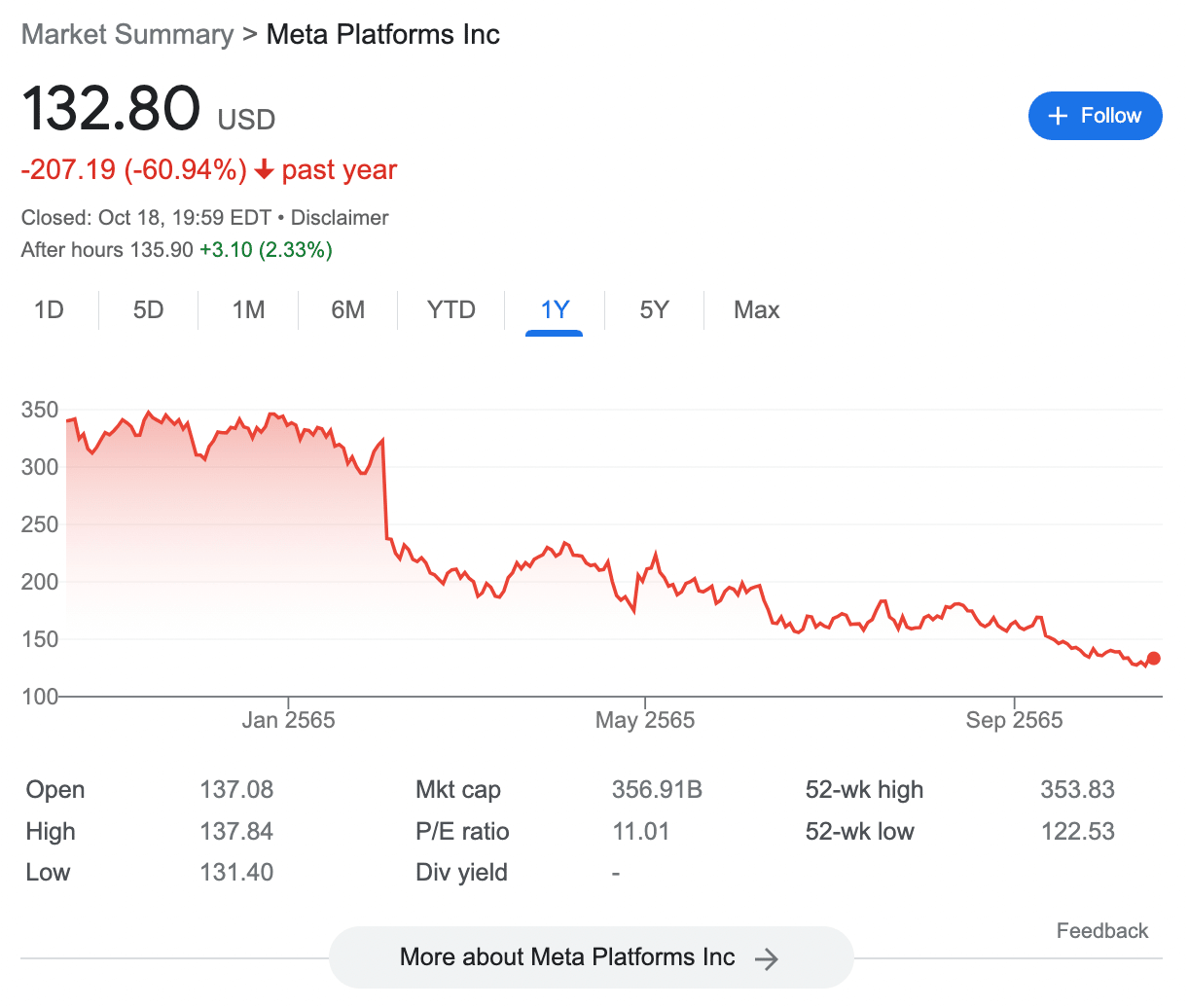

For example, although Tesla has increased by over 850% in the prior five years, on a 12-month basis, the stock is down 23%. Similarly, Meta Platforms – which owns Facebook, Instagram, and WhatsApp, is down 60% for the year. There are many other examples of growth stocks that have witnessed a major value decline, such as Coinbase, Grab, and Uber.

With all that being said, seasoned investors will view this as an opportunity to buy into high-growth companies at a huge discount. This is in the belief that once investor confidence returns and the broader markets are on the up, growth stocks will follow suit. For more details about how to invest in stocks without having to pay income tax or capital gains tax, read our article on the best stocks and shares ISAs in the UK.

5. Dividend Stocks – Explore Dividend Kings for Quarterly Income

During times of economic uncertainty, investors will often turn to dividend stocks. This refers to publicly listed companies that distribute cash to shareholders – usually every three months. On the one hand, as we saw in the midst of the pandemic, companies will often suspend dividend payments.

This is because companies prefer to preserve cash reserves when the short-to-medium economic outlook remains unclear. With that being said, there are a number of companies – referred to as Dividend Kings, that have increased the size of the quarterly payment for no less than 50 consecutive years.

This means that even during the most catastrophic economic periods – such as the Dot.com bubble and 2008 financial crisis, Dividend Kings not only continued to pay dividends, but they actually increased them. Best of all, diversification is still possible, as there are over 40 Dividend Kings in the market as of writing.

Examples include Dover (66 years), Procter & Gamble (66 years), 3M (64 years), Johnson & Johnson (60 years), Coca-Cola (60 years), and Colgate-Palmolive (59 years). Another factor to consider is that because Dividend Kings are typically established, blue-chip stocks that dominate their respective markets, they often perform well during a recession.

6. NFTs – Consider Buying NFTs for Future Growth

During the crypto bull run of 2021, NFTs were a huge success. Some of the most popular collections – such as the Bored Ape Yacht Club and CryptoPunks, saw individual NFT sales surpass the £1 million mark. Although valuations have since declined as per the broader bear market, many believe that NFTs could play a major role in the future of web 30.

For those new to NFT, the phenomenon refers to non-fungible tokens. NFTs are stored and transferred via the blockchain – usually Ethereum. Each NFT is unique from the next, which makes them ideal for proving ownership and transferring value. This could include anything from a digital art piece to physical real estate.

Perhaps the most challenging part is knowing which NFTs to buy. After all, there are many thousands of collections to choose from and more are being created as each week passes. Nonetheless, we scoured the market and came across a couple of options for investors to consider. First, there is the Tamadoge NFT collection.

This collection forms part of the Tamadoge ecosystem, which recently launched its native TAMA token. After its presale, TAMA generated gains of 1,000%. Due to this success, its NFT collection – which offers 1,000 rare editions, is providing very popular with market speculators.

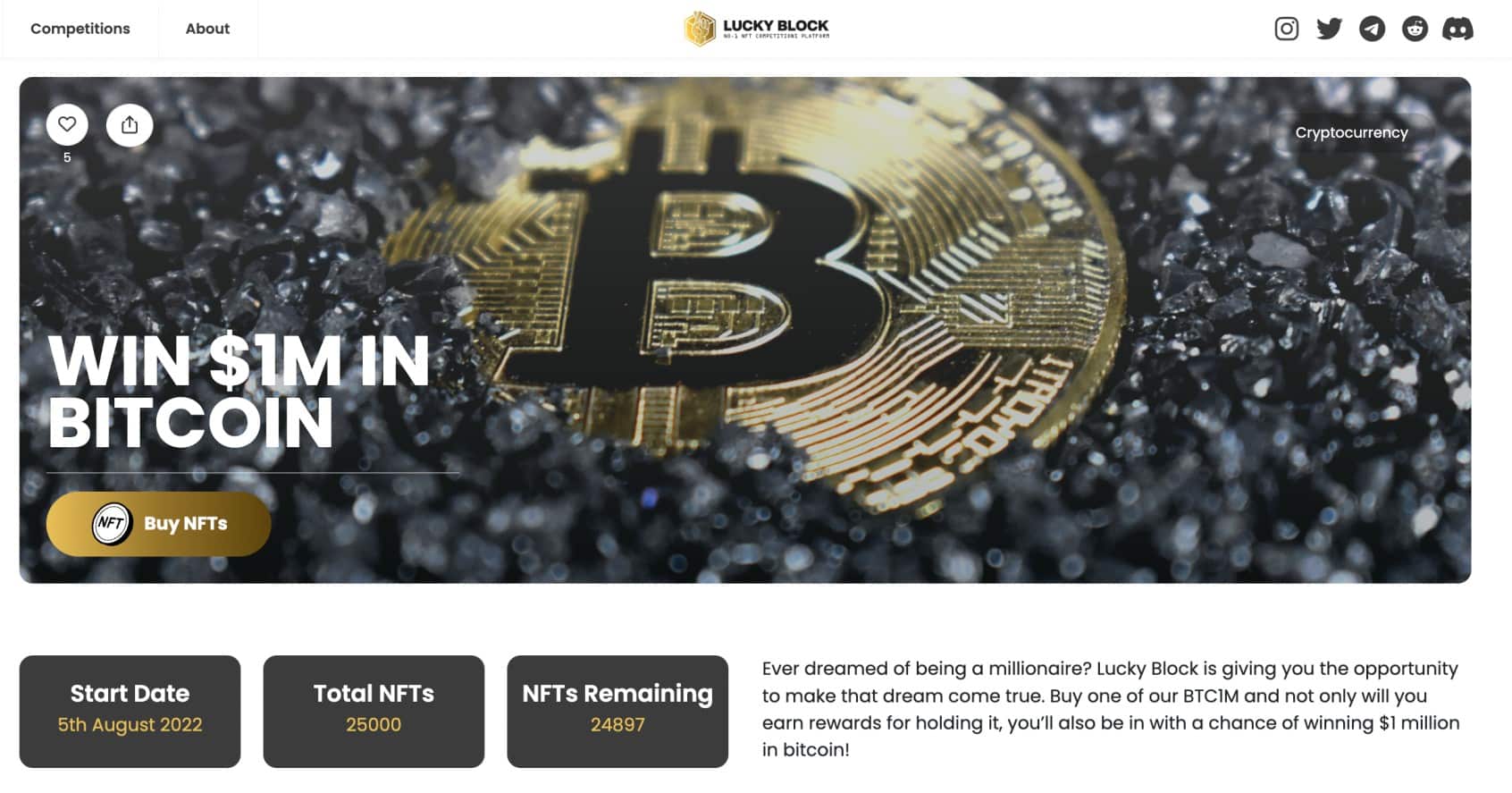

The second option to explore is the Lucky Block NFT collection. This collection is backed by the Lucky Block ecosystem, which runs competitions and daily prize draws. Each NFT offers access to a competition, with prizes including $1 million worth of Bitcoin and a Lamborghini car. Simply for holding a Lucky Block NFT, investors receive crypto rewards.

7. Crypto Staking and Interest Accounts – Earn Passive Income on Crypto Investments

In addition to NFTs and presale launches, another angle of this industry that proving popular is DeFi (decentralized finance). Two options in particular – crypto staking and interest accounts, enable investors to earn passive income simply for holding digital assets. Staking, for example, requires investors to lock their tokens for a certain number of days.

During the specified timeframe, the investor will earn interest and then receive their tokens back at the end of the term. With that said, some staking platforms offer flexible withdrawals, albeit, at a lower rate. Nonetheless, interest will be generated irrespective of the chosen period. For example, let’s suppose that an investor decides to stake Ethereum via a six-month period.

The staking blockchain offers an annualized interest rate of 10% This means that over the course of six months, the investor will generate interest of 5%. This is in addition to any gains (or losses) that Ethereum generates over the six-month period. Another option is crypto interest accounts. These are generally offered by third-party platforms and crypto exchanges.

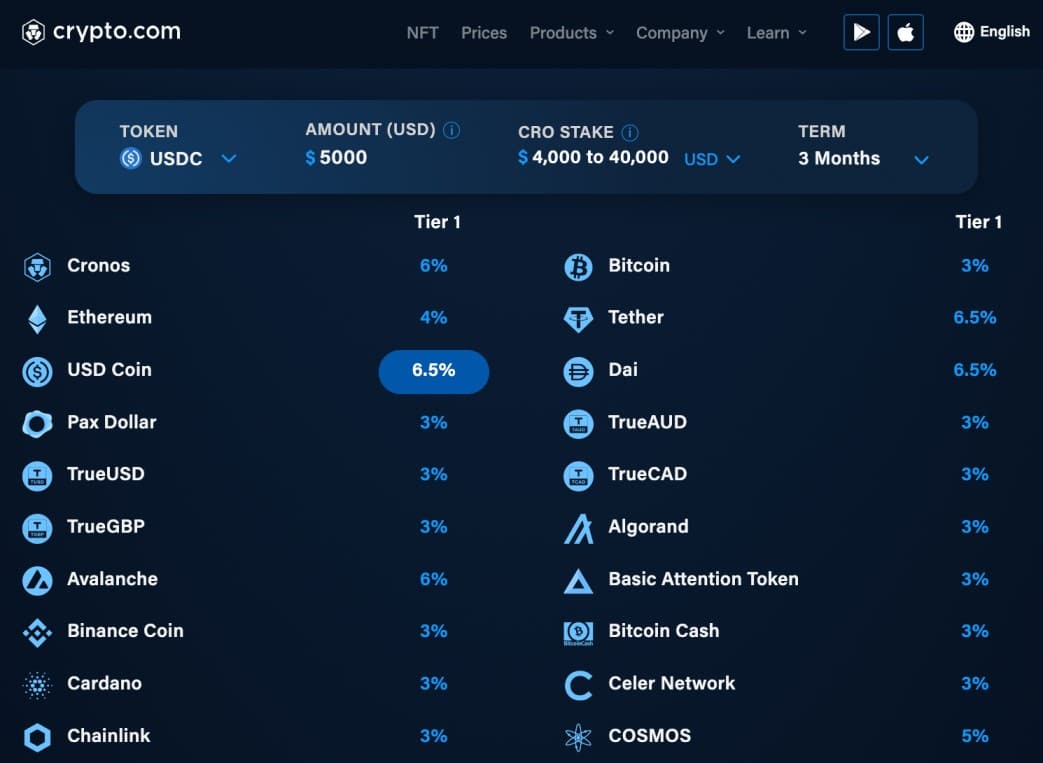

For example, Crypto.com offers interest accounts on a flexible, one-month, and three-month period. The longer the chosen term, the higher the interest rate. Rates at Crypto.com go as high as 14.5% on standard digital assets and 8.5% on stablecoins. Ultimately, staking and interest accounts are suited for long-term crypto investors that wish to maximize their gains.

8. Smart Portfolios – Track a Specific Stock Market Niche in a Diversified Way

One of the best ways to invest £20,000 in the UK without any prior trading experience is eToro Smart Portfolios. In a nutshell, Smart Portfolios will aim to replicate the performance of a certain niche within the stock market. The portfolio of assets will be hand-picked by eToro and regularly rebalanced and reweighted.

As such, this offers a passive way to invest in the stock markets as a beginner. Let’s look at a couple of examples to help clear the mist. The NordicEconomy Smart Portfolio tracks leading stocks from within the Nordic region – including Iceland, Denmark, Sweden, Norway, and Finland.

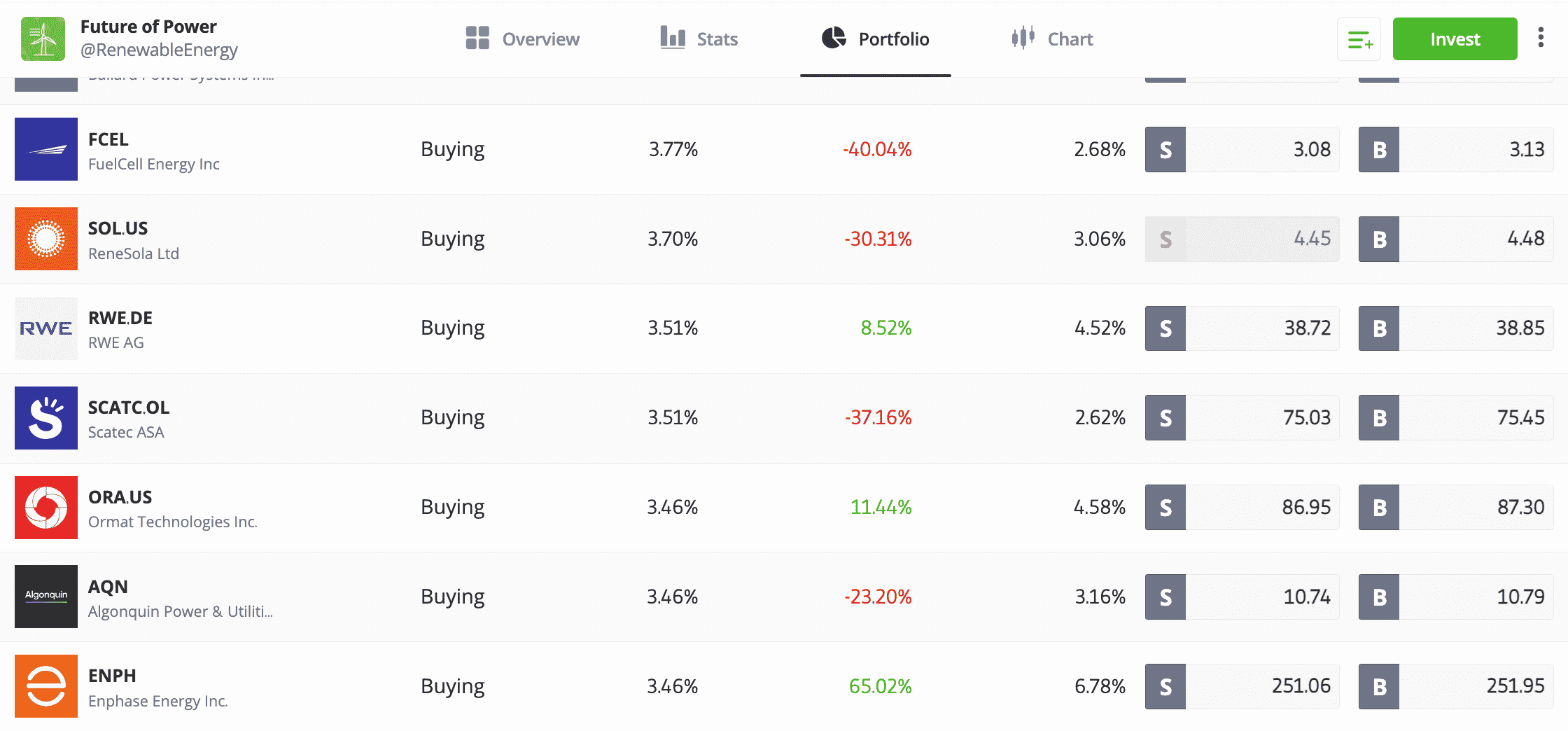

Stocks within this Smart Portfolio include Spotify, Nokia, Volvo, Swedbank, Sandvik, Aker BP, and Embracer Group. In another example, The Future of Power Smart Portfolio tracks a basket of stocks operating within the renewable energy sector. Its basket of assets covers everything from Gevo, RWE, and FuelCell Energy to Ballard Power Systems, Consolidated Edison, and SolarEdge.

In terms of the specifics, the minimum investment in eToro Smart Portfolios is just $500 – or about £440. This offers plenty of ways to diversify with an investment of £20,000. Furthermore, eToro does not charge any additional fees when investing in its Smart Portfolios. This means that UK investors will still benefit from 0% stock trading and competitive spreads.

9. Gold and Silver – Invest in Precious Metals to Hedge Against Recessionary Fears

Precious metals often perform very well in the lead-up to and during a broader recession. This is because as confidence in more speculative stocks declines, investors turn to stores of value like gold and silver. Both of these precious metals have been used for thousands of years, traditionally as a medium of exchange.

As such, gold and silver have a solid reputation – not least because they are finite resources that are utilized globally. Gold, in particular, is seeing record purchases being made by central banks – especially in China. In terms of the investment process, newbies often make the mistake of thinking that the best option is to buy physical gold/silver bars and coins.

However, a much more efficient and not to mention liquid process is to opt for an ETF. For instance, the SPDR Gold Trust ETF is physically backed by gold bullion on almost a like-for-like basis. This means that if the value of gold increases, so will the ETF. Crucially, this ETF trades on other stock exchanges, so investors can cash out their gold at any time during standard trading hours.

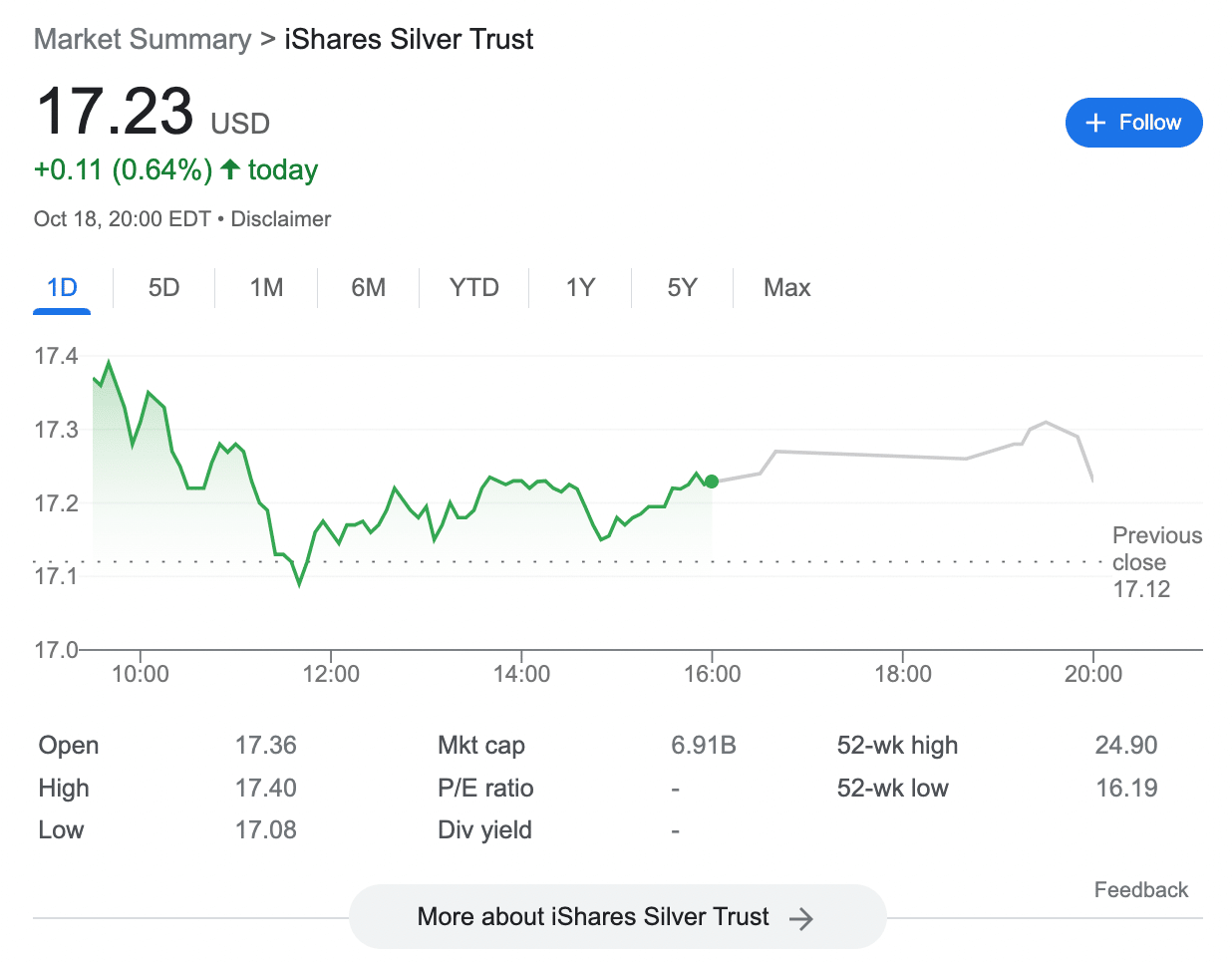

Those with an interest in silver might consider the iShares Silver Trust – which is one of the largest physically-backed ETFs in this space. This ETF offers direct exposure to silver and in terms of fees, investors will pay just 0.50% annually. Just remember that there will always be a slight disparity between the spot price of gold and silver when compared to ETFs.

10. Corporate and Government Bonds – Lend Money to Companies and Governments for Passive Returns

Passive income seekers might view bonds as the best way to invest £20k in the UK. This industry is largely split into two segments. First, there are corporate bonds. These are issued by companies that wish to raise capital from the open markets, rather than giving away more equity. This means that investors will lend money to the company and in return, receive a bond.

The bond will come with an interest rate and a maturity date. For example, this might be a 5-year bond that pays an interest rate of 7% annually. This means that by investing £20,000, the bond will yield interest of £1,400 yearly. This will continue for seven years until the bonds mature. At the point of maturity, the investor will receive their £20,000 investment back.

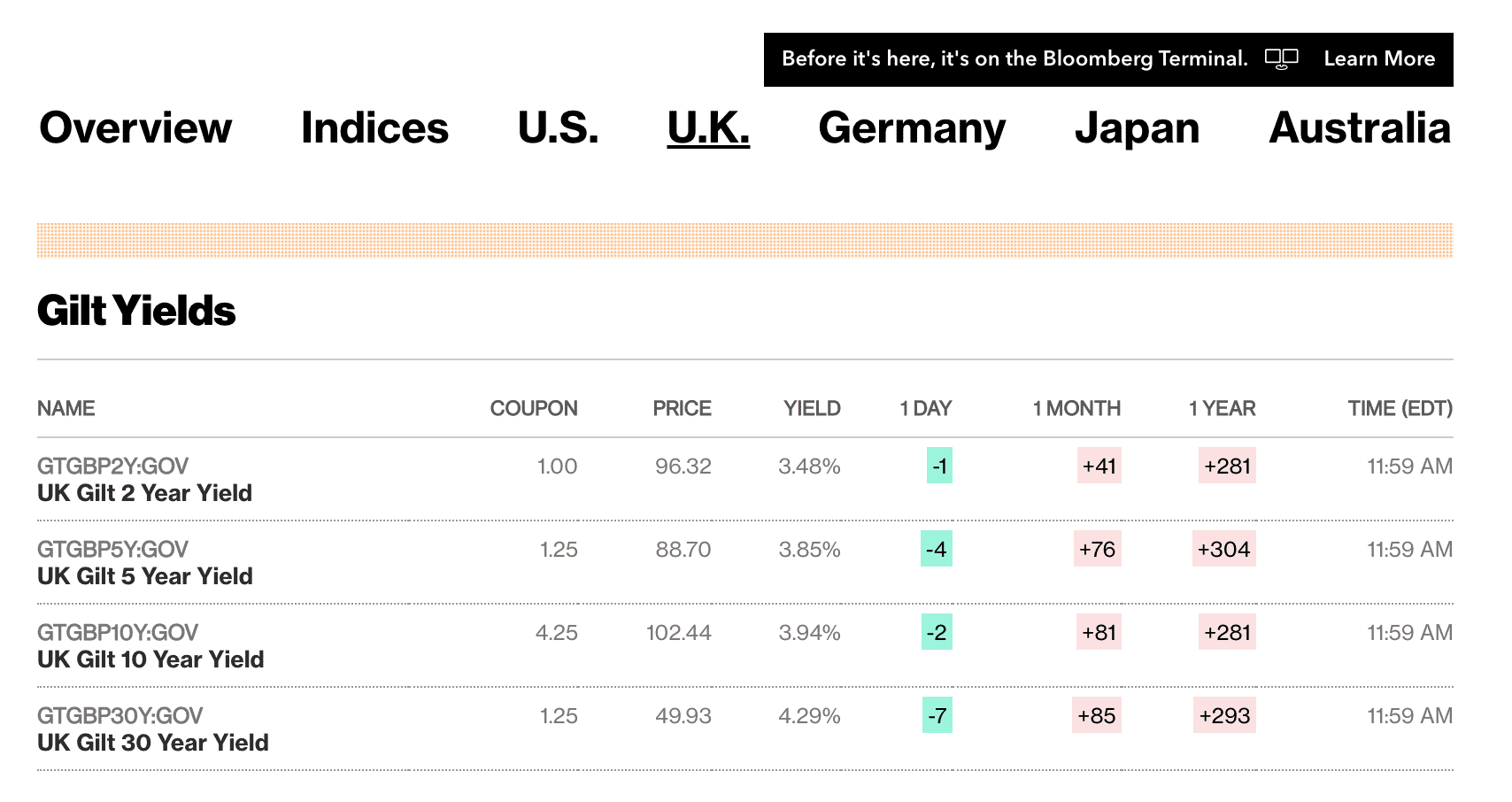

The second option is government bonds. In the UK, bonds issued by the government are called gilts. Although interest rates are lower than their corporate counterparts, so is the risk. After all, it is unlikely that the UK government is going to default on its bond repayments. Bonds come with both benefits and drawbacks.

On the one hand, bonds enable investors to have a predictable flow of income. This is because the investor knows exactly how much interest they will receive and when. This is, of course, on the proviso that the bond issuer doesn’t default. The main issue with bonds is that they are not overly liquid. This means that investors might find it difficult to sell the bonds before maturity.

How to Choose the Best £20k Investments in 2024

The best way to invest £20k in the UK is to diversify across many different markets. This does, however, still require investors to pick suitable investments for their financial goals and risk tolerance.

UK investors that are still pondering about the best place to invest £20,000 in the UK can consider the guidance discussed below.

Target Returns and Risk

One of the most important metrics for beginners to understand when considering how to invest £20,000 in the UK is the concept of risk and reward. In a nutshell, the higher the desired investment returns, the more risk that typically needs to be taken.

- For example, Bitcoin and other cryptocurrencies continue to offer the best returns in the investment space.

- But, the cryptocurrency arena is perhaps the riskiest asset class to invest in.

- This is also the case with small-cap and growth stocks, in addition to NFTs and crypto staking.

Investors with a very low appetite for risk will likely need to consider other options, such as bonds or blue-chip stocks. However, in turn, the growth potential of low-risk assets is going to be limited.

Liquidity

Focusing on assets that operate in a liquid market has never been more important, considering the state of the broader economy. Liquid assets are simply markets that enable investors to cash out their holdings quickly and without financial penalty.

For example, both stocks and large-cap crypto assets are liquid, as investors can sell their investments at any time. On the other side, real estate and bonds are illiquid, as cashing out can often take a long time.

Active or Passive

Some asset classes require investors to take an active role in the decision-making process. For example, by trading stocks, the investor will need to conduct research and analysis almost on a day-to-day basis.

Those without the required time to research the markets might need to consider passive investment streams. Examples here include the best index funds UK and bonds.

How to Invest £20,000 in the UK

One of the hottest markets right now is the crypto presale space.

This enables investors in the UK to gain exposure to newly launched crypto projects at the earliest stage possible. This results in early-bird pricing before the cryptocurrency is listed on an exchange.

With this in mind, we will now explain how to invest in the Dash 2 Trade presale.

Step 1: Download a Crypto Wallet

The first step is to get a suitable crypto wallet that connects to the Ethereum blockchain. This is because Dash 2 Trade operates on the Ethereum network and thus – its presale accepts ETH tokens.

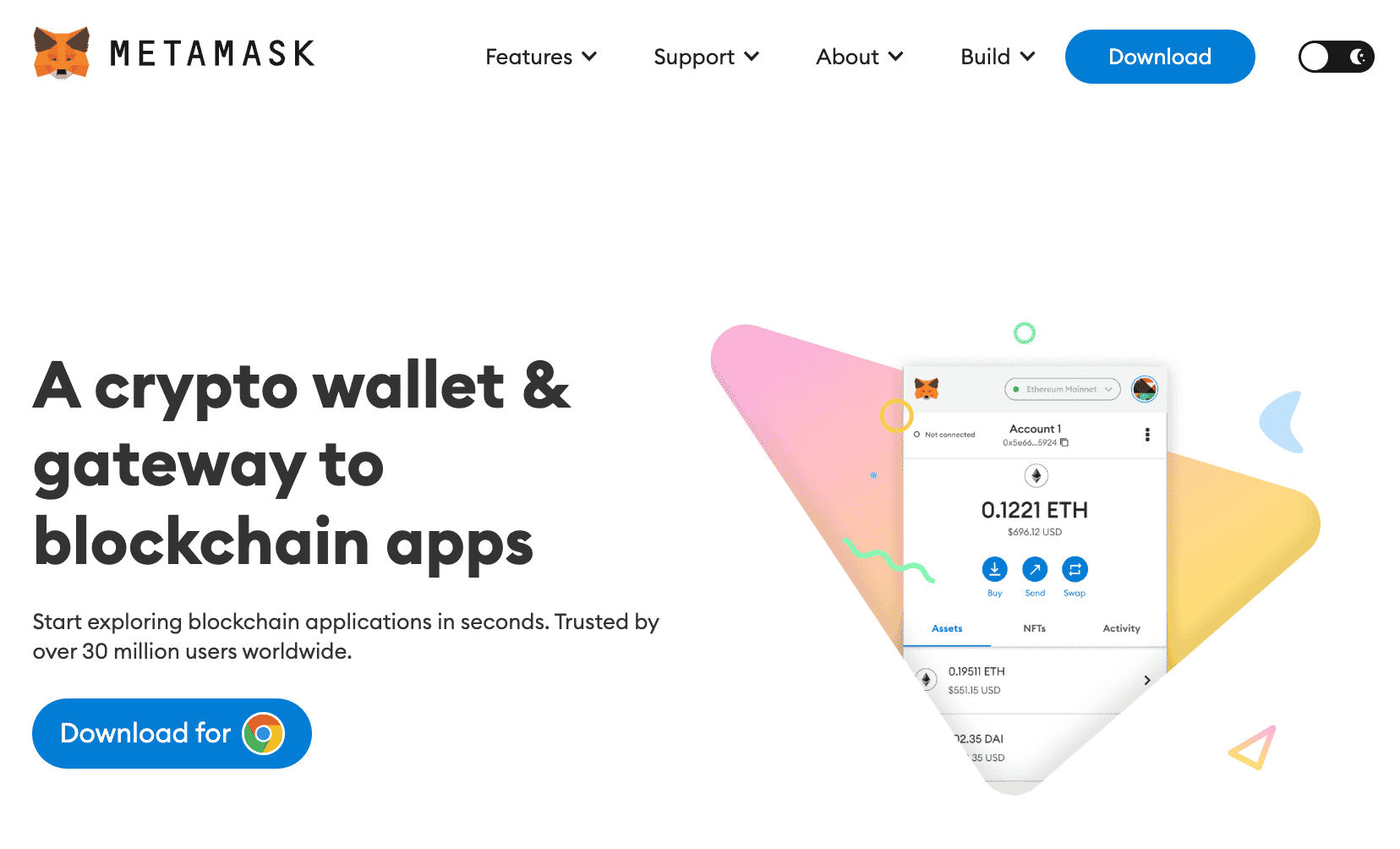

One of the best crypto wallets in the UK is MetaMask, not only in terms of user-friendliness but security too.

Head over to the MetaMask website and download the wallet via its mobile app or browser extension. The latter is compatible with Google Chrome, Firefox, Brave, and Microsoft Edge.

Tip: First-time presale investors might consider the browser extension when downloading the MetaMask wallet. This will enable the process to be completed on a laptop or PC.

Step 2: Buy ETH Tokens

As noted above, investors will need ETH tokens to participate in the Dash 2 Trade presale campaign. Those with ETH tokens to hand can proceed to the next step.

Investors that are yet to buy Ethereum can do so via a wide variety of crypto exchanges. The fastest way to get ETH is to open an account with Binance and pay for the investment with a UK debit/credit card.

Step 3: Transfer ETH Tokens to MetaMask Wallet

The next step is to transfer the ETH tokens to MetaMask. The MetaMask wallet will have its own unique wallet address, which can be found at the top of the main interface.

Copy the wallet address and transfer the tokens from the exchange where Ethereum is located. Expect the tokens to land in the MetaMask wallet in a couple of minutes.

Step 4: Connect MetaMask to Dash 2 Trade Presale

Visit the Dash 2 Trade website and click on ‘Connect Wallet’.

When the list of wallet providers appears, select ‘MetaMask’. Open the MetaMask wallet and confirm the connection to Dash 2 Trade.

Step 5: Invest in Dash 2 Trade Presale

Now that MetaMask is connected to the Dash 2 Trade website, the investment can be completed.

Specify the number of ETH tokens to be converted to D2T. Reopen the MetaMask wallet and confirm the purchase. The underlying smart contract will then exchange ETH for D2T.

However, the D2T tokens cannot be claimed until the presale has ended. Authorization for the transaction will need to be confirmed via the pop-up notification that appears in the MetaMask wallet.

Conclusion

This beginner’s guide has discussed 10 of the best ways to invest £20k in the UK. We have covered various assets and risk/reward opportunities, inclusive of dividend and growth stocks, an S&P 500 index, corporate and government bonds, and NFTs.

However, overall, one of the most popular investment options in the market right now is the Dash 2 Trade presale. This enables early investors to purchase D2T tokens at the lowest price possible before the project launches to the public.