$20,000 is the foundation of a solid investment portfolio. But to build a portfolio that produces returns long into the future, it’s important to put that money towards the right investments.

In this guide, we’ll explain how to invest $20k for short and long-term profits and highlight where to invest $20,000 right now.

11 Best Ways to Invest $20k in 2025

Learning how to invest $20k is easy. We’ve picked out the 10 best ways to invest 20,000 dollars in 2025.

- FightOut – Best Method to Invest $20K in a High ROI Project Building a high-end Fitness App

- Dash 2 Trade – Overall Best Method to Diversify $20K into the Crypto Space

- Stocks – Traditional Investments in Individual Companies

- ETFs – Instant Diversification across Sectors, Countries, and Themes

- Index Funds – Match the Performance of the Overall Stock Market

- Crypto Interest Accounts – Earn Ultra-high Yields on Crypto Holdings

- REITs – Invest in Real Estate without Buying a Home

- NFTs – Buy Digital Artworks with Exclusive Benefits

- Peer-to-peer Lending – Lend Out Your Money and Build a Portfolio of Rates

- Bonds – The Low-risk, Low-reward Approach to Investing

- Copy Trading – Mimic the Portfolios of Experienced Traders

We think investing in cryptocurrency projects with high potential is one of the best things to do with $20k. One great example of such a project is Tamadoge – click below to learn more.

A Closer Look at the Best Ways to Invest $20,000

Want to know more about how to invest 20,000 dollars? We’ll take a closer look at the 10 best places to invest $20k today.

1. FightOut – Best Method to Invest $20K in a High ROI Project Building a high-end Fitness App

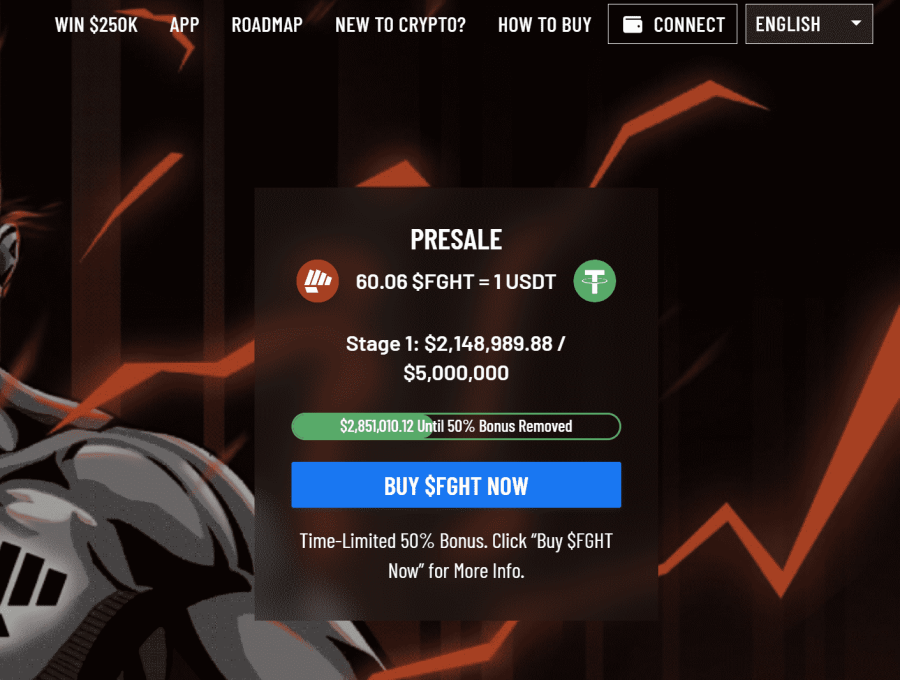

The project has already caught high investor attention while raising over $2.1 million USDT in just a few days after its presale launch.

Currently, FightOut’s native token $FGHT is available for purchase at a discounted price of $0.0167. Investors should consider buying these tokens soon as the price is expected to rise.

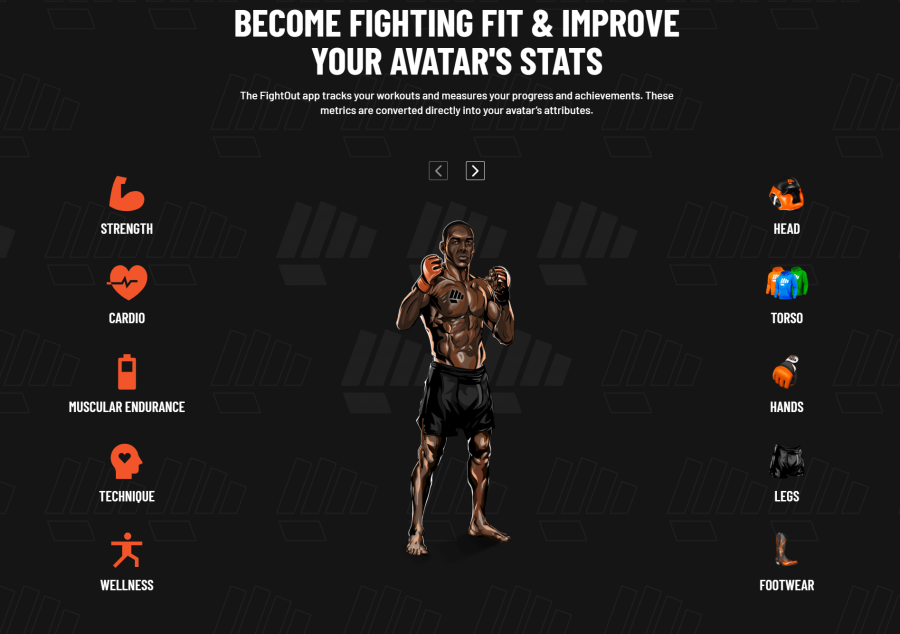

FightOut’s one-of-a-kind fitness app enables users to earn rewards while doing their daily workouts, fitness challenges, and other fitness-related movements.

The project has also created a metaverse for gamifying the fitness lifestyle. While creating a new account, users can create their own NFT avatars in FightOut’s metaverse. These soulbound NFT avatars will correspondingly grow in relation to the user’s real-life fitness performance. Furthermore, members of the FightOut community can also compete with other members in its metaverse.

FightOut has also created its currency called REPS within its app to reward users for doing their workouts. These REPS can be used to buy cosmetic NFTs for their avatars, membership discounts, and so on. Also, buyers can see the project’s whitepaper to get a better understanding of FightOut’s features.

$FGHT Tokenomics & Purchase Bonuses

$FGHT is FightOut’s native token that is based on the ERC-20 standard. These tokens have a limited supply. A total of 90% of the total supply will be sold through the project’s presale stages.

Buyers can use these tokens to take part in several tournaments and leagues. Also, buyers can use $FGHT to buy more REPS. Buyers using the tokens to buy the in-app currency would receive an additional 25% REPS.

Investors buying $FGHT tokens during the presale stages will get bonuses that start at 10% with an investment of just $500 and 6 months of vesting. Additionally, investors are entitled to membership rewards when they stake more $FGHT tokens or stake them for a longer time.

Presale Performance

FightOut has seen a solid investor response in its first presale as it raised over $2.1 million USDT within a few days. Buyers also have an opportunity to get up to 50% additional tokens as rewards during the ongoing presale stages.

Buyers can consider joining FightOut’s telegram to stay always stay updated.

| Presale Started | 14 December 2022 |

| Purchase Methods | ETH, USDT |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

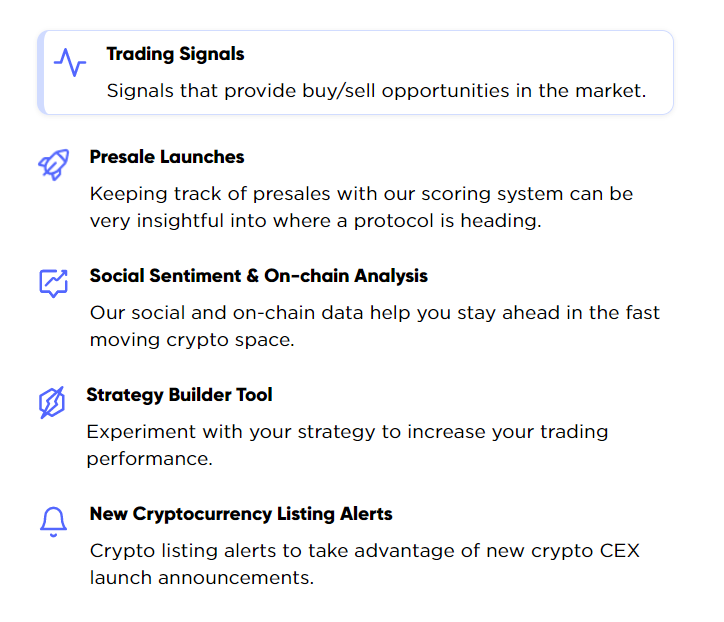

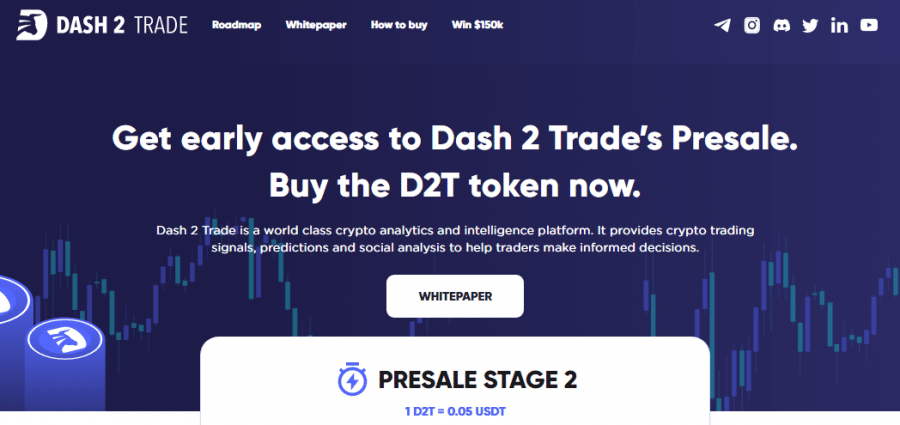

2. Dash 2 Trade – Overall Best Method to Diversify $20K into the Crypto Space

Dash 2 Trade

One such token which can offer returns is D2T – which is currently available on presale for just $0.05. Dash 2 Trade is making the cryptocurrency available through 9 presale rounds, which will offer 700 million coins and will look to raise more than $40 million.

By the end of the presale, the D2T price will increase to $0.0662 – a 32.4% jump compared to the current valuation.

The token can be used to purchase the starter and premium Dash 2 Trade packages – which charge monthly subscriptions in the native cryptocurrency. With the token, you can access exclusive trading signals which analyze potential price movements by studying technical and social indicators. You can also test your trading strategies on a backtesting platform, compete for free crypto rewards in weekly trading competitions and analyze your individual risk scores.

Currently, the D2T token presale has raised more than $2 million in just 5 days. To invest in the presale, interested readers will need to buy a minimum of 1,000 D2T – equating to $50 at the time of writing. However, the cost of purchasing 1,000 tokens will rise to $62 by the last presale round. To learn more about this project, read the Dash 2 Trade whitepaper and join the Dash 2 Trade Telegram channel.

| Presale Started | October 19 |

| Purchase Methods | ETH, USDT, Transak |

| Chain | Ethereum |

| Min Investment | 1,000 D2T |

| Max Investment | N/A |

Join the D2T token presale to stand a chance to win a $150K D2T giveaway.

3. Stocks – Traditional Investments in Individual Companies

The answer to the question, ‘What can I invest in with $20k?’ is stocks for the majority of investors. Investing in individual stocks has long been one of the most common ways to invest. For long-term investors with a moderate risk tolerance, it could be the best way to invest $20k.

There are multiple types of stocks to invest in, including growth, value, and dividend stocks. Growth stocks are those that investors expect will grow rapidly over the coming years. They often have high stock prices relative to their earnings since investors anticipate that earnings will increase quickly. Value stocks are those that have low stock prices relative to their earnings.

Dividend stocks are those that pay dividends, usually on a quarterly or annual basis. Dividend stocks can pay annual yields of up to 10% and they provide steady income that investors can use for everyday expenses or to reinvest.

When investing in stocks, it’s important to research the company behind the stock. Many investors look at metrics like profit and revenue growth, long-term debt, customer acquisition, and more. Investors can also look to Wall Street analysts to find out what professional investors think about specific companies.

4. ETFs – Instant Diversification across Sectors, Countries, and Themes

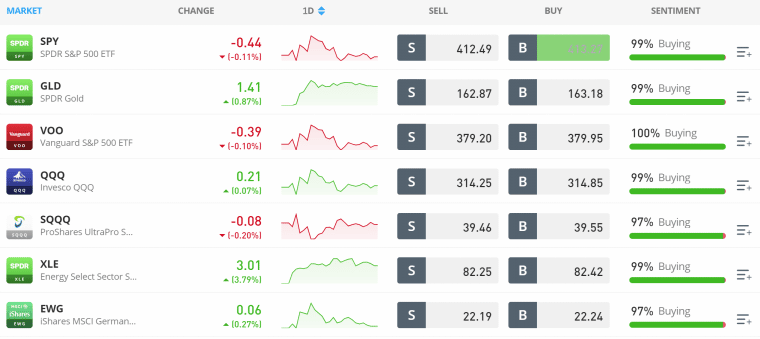

ETFs, or exchange-traded funds, are baskets of stocks or other assets that investors can purchase in a single trade just like stocks. What makes ETFs one of the best $20k investments is that they contain dozens or even hundreds of different stocks. So, investors get instant diversification across multiple companies.

ETFs can contain a wide variety of different assets, but most are focused on specific market sectors or themes. For example, investors can find ETFs for 5G stocks or the energy sector. Some ETFs also offer exposure to specific countries. For example, there are ETFs that focus on Chinese stocks or stocks from emerging economies.

When investing in ETFs, keep in mind that these funds charge fees known as expense ratios. Expense ratios are typically less than 1% for most popular ETFs, but they can be more expensive for niche funds.

Investing $20k with ETFs is simple. Investors can purchase a wide range of ETFs through most stock brokerages.

5. Index Funds – Match the Performance of the Overall Stock Market

Index funds are a lot like ETFs, except they’re designed to mimic the performance of major stock market indices like the S&P 500, NASDAQ 100, or FTSE 100. In effect, index funds enable investors to match the performance of the broader stock market without betting on individual companies or sectors.

Index funds have a major advantage over ETFs as well: they’re low cost. Whereas expense ratios for ETFs are often 0.40% or more, expense ratios for index funds are often less than 0.20% and can be less than 0.10% of the total amount invested. That saves investors a significant amount of money over the long term.

Investing in index funds isn’t always the most exciting, but it can be a good option for long-term investors who want to practice passive investing. Over the long run, major market indices have returned about 10% per year on average. Investors can purchase a variety of index funds from stock brokerages.

6. Crypto Interest Accounts – Earn Ultra-high Yields on Crypto Holdings

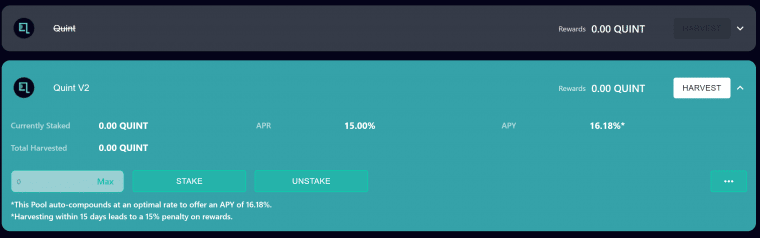

Crypto interest accounts are like traditional savings accounts, but for cryptocurrency holdings. With a crypto interest account, investors can earn high interest rates on a wide variety of coins ranging from Bitcoin and Ethereum to stablecoins like Tether and USD Coin. Whereas interest rates at traditional banks are often below 1% APY, interest rates on top cryptocurrencies can be 20% APY or higher.

Many top crypto exchanges offer crypto interest accounts with varying rates for different coins. Some also require that you hold an exchange’s native cryptocurrency in order to receive the best rates.

One of the best crypto interest accounts today is offered by Quint. Quint has its own cryptocurrency, QUINT, which investors can stake and earn interest rates up to 16.18% APY. Quint also offers combined staking for QUINT and BNB with interest rates up to 39.08% APY. Interest is automatically reinvested, which compounds the returns over time.

7. REITs – Invest in Real Estate without Buying a Home

REITs, or real estate investment trusts, can be thought of as ETFs for real estate. They are funds that own multiple properties and enable investors to buy a share of the overall real estate portfolio. When investors buy a share of an REIT, they benefit whenever the value of the real estate in the REIT goes up.

Many REITs also pay dividends to investors. This money comes from rent or lease payments to the REIT, which then passes that money onto shareholders. Note, though, that REITs can have large operating expenses, so a lot of the money that these portfolios make is reinvested in the real estate itself.

There are many different types of REITs with different areas of focus. For example, some REITs focus on residential homes that can be rented out. Others focus on commercial properties for retail or medical professionals. Some REITs even invest in farmland.

REITs are available at most stock brokerages.

8. NFTs – Buy Digital Artworks with Exclusive Benefits

NFTs, or non-fungible tokens, have seen huge inflows of investment from both crypto enthusiasts and more traditional art lovers. These unique tokens are one-of-a-kind and offer ownership over a digital asset like a work of digital art. As the NFT market has boomed, many NFTs have appreciated in value quickly and achieved strong resale values – making them a potential target for investors.

When investing in the best NFTs, keep in mind that the popularity of the collection matters a lot. Some collections capture the cultural zeitgeist and explode in value. Others fizzle out and lose value. There’s no way to know for sure what the next big NFT collection will be, although some artists have had stronger track records than others.

Perhaps the best place to invest $20k in the world of NFTs is Lucky Block. Lucky Block’s Platinum Roller Club NFTs aren’t digital artworks, but rather offer entry into a daily giveaway with a $10,000 prize. Each NFT holder has a 1-in-10,000 chance of winning each day, and investors can lend out their NFT for steady income as well.

Lucky Block Platinum Rollers Club NFTs are available today at the NFT exchange Launchpad.

9. Peer-to-peer Lending – Lend Out Your Money and Build a Portfolio of Rates

Peer-to-peer lending platforms allow any investor to act like a traditional bank. With one of these platforms, investors can lend out their money to individuals and businesses in need of cash. Investors can see the interest rate they’ll get for their money, the borrower’s risk rating, and more details needed to make a lending decision.

What’s great about peer-to-peer lending platforms is that investors can create a custom portfolio of loans. They may have a few high-risk loans that pay high interest rates and a few low-risk loans with lower interest rates.

There are many peer-to-peer lending platforms in the cryptocurrency world as well. Crypto lending platforms make it easy to lend out popular cryptocurrencies like Bitcoin or Ethereum to other investors. Importantly, many of these loans are overcollateralized, meaning that investors should be protected from losing money even if the borrower stops making payments.

10. Bonds – The Low-risk, Low-reward Approach to Investing

Bonds are one of the least exciting ways to invest $20,000. But, they’re also one of the safest ways to invest. For the most part, bonds pay low interest rates for several years, then repay the entire face value of the bonds at the end of their terms. Bonds are often used by investors to diversify their portfolios away from riskier assets like stocks and cryptocurrencies.

There are several types of bonds available, including government and corporate bonds. Government bonds are issued by national, state, or local governments, while corporate bonds are issued by companies. There are many bond ETFs that give investors exposure to a mix of government and corporate bonds, and investors can find these funds at brokerages.

Keep in mind that some bonds are riskier than others, and offer higher interest rates as a result. For example, bonds offered by the government of a war-torn country may be much riskier than bonds issued by the US government and may offer much more attractive rates to investors.

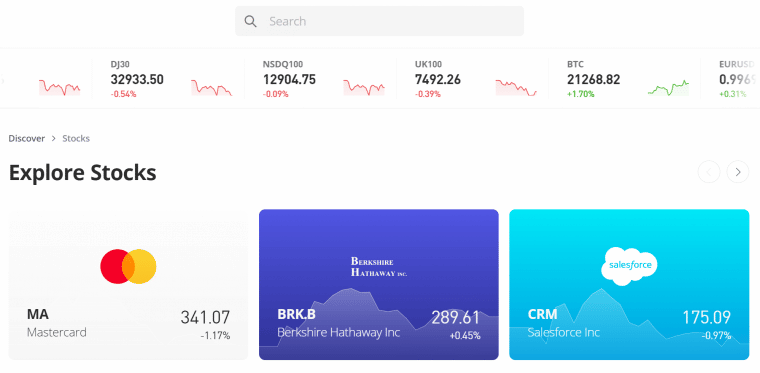

11. Copy Trading – Mimic the Portfolios of Experienced Traders

Copy trading is perhaps the best way to invest $20k for short term profit. With copy trading platforms, investors can automatically copy the portfolio of a more experienced trader or investor. If a trader buys or sells a stock, the investor’s portfolio will automatically buy or sell that same stock immediately.

Copy trading is supported by a variety of brokerages. Investors can see a trader’s portfolio, overall strategy, recent trades, and performance. It only takes $200 to start copy trading, so investors have the option to copy as many as 100 different traders with a $20,000 investment.

Keep in mind that copy trading can be risky, since not all traders will be profitable all the time. The good news is that investors are free to stop copying at any time or can use a portion of their portfolio for self-directed investments in stocks, crypto, or other assets.

How to Choose the Best $20k Investments For You

With so many ways to invest $20,000, it’s important that investors pick the best way to invest $20k to meet their their goals and investing preferences. Here are a few of the key factors to consider when deciding how to invest $20k.

Investment Goals

An investor’s investment goals should be at the center of their investment strategy. Investing for retirement is very different from investing to make a quick profit, after all. Every investor should know what they want to achieve by investing and then choose how to invest $20,000 accordingly.

For investors who want to make a quick profit, more volatility and risk might be worthwhile in exchange for potentially greater returns. For retirement investors, it may be preferable to choose safer investments that are more likely to compound returns over time.

Risk Tolerance

Risk tolerance is an individual preference that every investor should consider. Simply put, some investments are more risky – that is, more likely to lose money – than others. In general, higher risk investments offer higher returns than lower risk investments. That’s what makes taking on extra risk potentially worthwhile.

All investments involve risk, but assets like cryptocurrencies are generally considered high risk. Stocks could be considered moderate risk, while bonds are low risk. However, there are high and low risk assets within each of these categories. Investors should never invest more than they are willing to lose.

Return Targets

How much an investor wants to make from investing will also influence their choice of what to invest $20k in. Investing takes time, so a small return may not be worth the effort involved. In that case, investors might be happy with passive investments like index funds.

On the other hand, investors seeking greater returns may want to spend time researching individual stocks or cryptocurrencies. These assets can offer higher potential returns, although they also involve more risk.

Volatility Tolerance

Volatility is a measure of how rapidly the price of an asset swings up or down. More volatile assets, like cryptocurrencies, can go up several percent one day and down several percent the next. In contrast, low volatility assets like bonds rarely change more than a tenth of a percentage point in value from day to day.

Investors should have a strong stomach if they plan to invest in highly volatile assets. It’s also important to consider the investment timeframe. High volatility can make it more difficult to exit an investment when an investor needs to.

Where to Invest $20k – the Best Option?

Figuring out what to invest $20k with can be a challenge, especially for first-time investors. There are a lot of different asset classes to choose from and tons of options within each asset class.

Based on our research, we think the best way to invest $20k today is in $FGHT – the native cryptocurrency of FightOut. The project offers investors the opportunity to earn Move-to-Earn rewards through its advanced fitness app. Buyers can enter the presale at a low price of $0.0167 per token and diversify their portfolio to minimize risk in the volatile cryptocurrency markets.

How to Invest $20k – FightOut Tutorial

Want to know how to buy FightOut? We’ll walk investors through the steps to buy $FGHT during the project’s ongoing presale.

Step 1- Download a Cryptocurrency Wallet

Buyers should install a download an ERC-20 compatible crypto wallet like MetaMask on their browser. (Mobile users are recommended to download the TrustWallet)

Step 2- Connect the Wallet

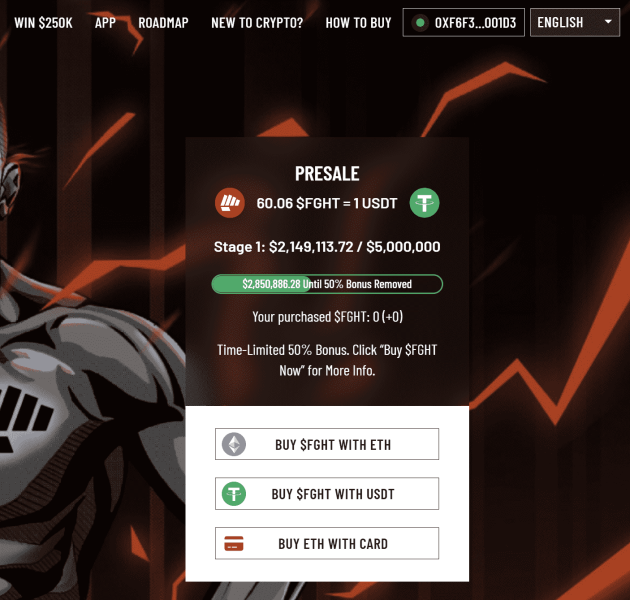

Buyers should now go to FightOut’s official presale page. Then, buyers must click on the “BUY $FGHT NOW” button. After this, investors can select the wallet they have installed (eg Metamask or TrustWallet) and subsequently login to their wallets.

Step 3- Buying ETH/USDT

Once they have logged into their wallets, investors need to check if they have enough ETH/USDT balance.

Buyers can also buy ETH with a credit card via Transak. After ensuring an adequate balance of ETH/USDT in their wallets, investors can click either on the “Buy $FGHT with ETH” or “Buy FGHT with USDT” button.

Step 4- Buy $FGHT Tokens

In this step, buyers should enter the amount of ETH/USDT they would want to swap in return for $FGHT tokens.

Step 5- Claim $FGHT

In the last step, buyers can confirm the transaction after ensuring the number of $FGHT tokens to be received. Buyers can claim these tokens based on the vesting period they choose in the previous step.

Cryptoassets are a highly volatile unregulated investment product.

Conclusion

Now that investors know the best way to invest $20,000, it’s time to get started. With cryptocurrency projects like FightOut (FGHT), investors can begin trading with as little as $0.0167 per token. Given its unique use cases and a successful first presale stage, buyers should consider buying the tokens while they still have a chance.

Fight Out - Next Big Train-to-Earn Crypto

FAQs

What is the best way to invest $20k?

How much money can I make if I invest $20k?

References

- https://www.moneysavingexpert.com/savings/peer-to-peer-lending/

- https://www.bbc.com/news/technology-56371912

- https://www.ameriprise.com/financial-goals-priorities/taxes/how-are-investments-taxed