Deciding which assets to invest in can be challenging, especially given today’s volatile economic environment. However, by conducting extensive research and employing proper risk management techniques, investors can ensure they have the highest chance of generating a positive return – even with amounts as high as £100,000.

With that in mind, this guide discusses the best way to invest £100k in the UK by presenting 10 asset classes that are popular with high-net-worth investors. We’ll also look at the factors that investors must consider when adding an asset to their portfolio before showcasing how to invest in a top asset today.

Listed below are 10 of the best ways to invest £100k in the UK, each offering a different level of risk and returns potential. In the following section, we’ll analyze these asset classes, covering what they are and how they can benefit an investment portfolio.10 Best Ways to Invest £100k in the UK in 2024

A Closer Look at the Top Ways to Invest £100,000 in the UK

Investors looking to invest £5k in the UK may have some leeway when it comes to taking risks – but this luxury isn’t as apparent for those with £100k. Although the investment fundamentals are the same for both amounts, investors possessing the latter may wish to consider more ‘stable’ assets since small value fluctuations can produce a sizeable drawdown.

With that in mind, let’s take a closer look at the best ways to invest £100,000 in order to gain the highest chance of success:

1. Top New Crypto Projects – Invest in High-Potential Projects like Dash 2 Trade

Our pick for the best way to invest £100,000 in the UK in 2024 is to invest in new cryptocurrency projects with high growth potential. As most investors will know, cryptocurrency has emerged as a viable alternative to ‘traditional’ asset classes like equities and bonds. Although it tends to be more volatile, crypto can offer returns that other assets cannot.

Those wondering how to invest £100,000 in the UK may wish to consider crypto projects in the presale phase. Development teams use crypto presales to raise capital and boost awareness of an upcoming project by offering tokens at a discounted rate. Since tokens are discounted, early investors can often put themselves in line to generate considerable returns in the future.

Two of the most exciting new crypto projects on offer right now are Dash 2 Trade and IMPT. Although these projects are considered by many as the best way to invest £100k in the UK, it’s crucial that investors purchase a variety of assets for diversification rather than just one or two. This will ensure a more suitable risk/reward ratio and helps balance out price volatility.

Having said that, let’s take a closer look at these two projects:

Dash 2 Trade

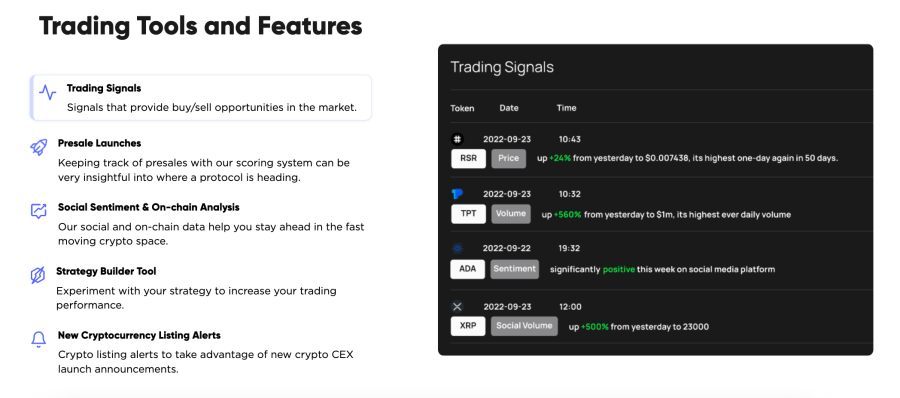

The fact that all of these tools are located in one platform has made the Dash 2 Trade project appealing to beginners and experienced investors alike. At present, investors must use multiple sources to conduct analysis, increasing the chance of inaccurate data or mistakes. Dash 2 Trade solves this by offering an all-in-one solution to empower investors within the crypto market.

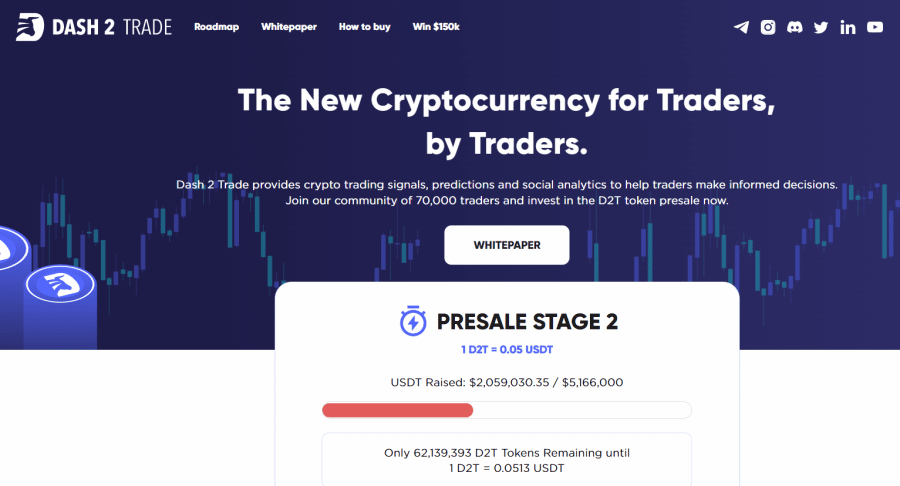

Investors must buy Dash 2 Trade tokens (D2T) to access the ‘Starter’ and ‘Premium’ tiers, both of which contain the platform’s top features. However, D2T can also be used as an investment vehicle since its value will be tied to the platform’s growth.

As noted in the Dash 2 Trade whitepaper, the development team will offer nine presale stages, each with a specific price point and token allocation. At the time of writing, Dash 2 Trade is in Stage 2 of its presale and has raised over $2.5m in less than two weeks. Since tokens are priced at just 0.05 USDT, now is the ideal time for investors to acquire D2T at a discount.

Those looking to learn more about the project can do so by joining the official Telegram channel. Dash 2 Trade is also considered by some to be the best way to invest £500k in the UK right now.

IMPT

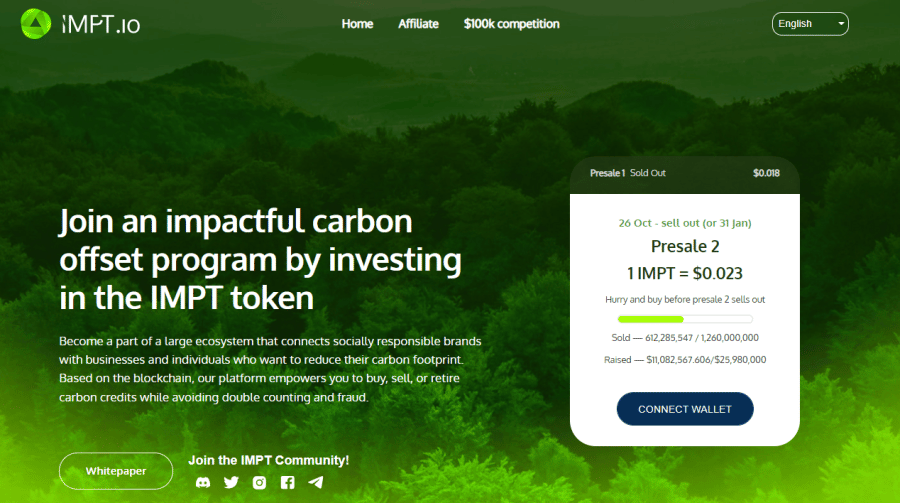

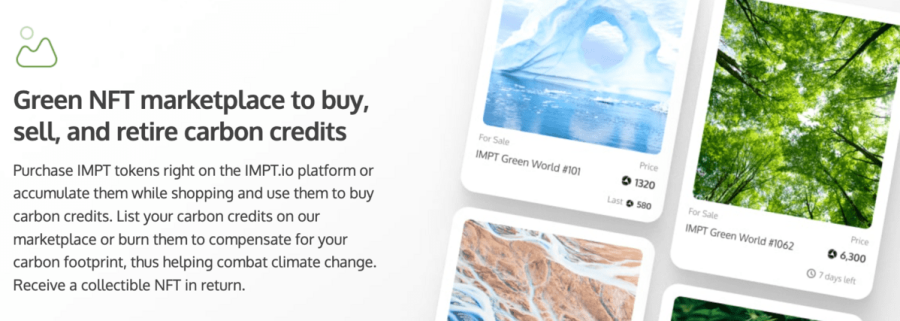

These carbon credits provide an effective way of reducing (or removing) CO2 emissions, meaning that IMPT looks set to become one of the most eco-friendly crypto projects of 2024. The carbon credits on IMPT’s platform are structured as NFTs, meaning users can easily buy, sell, trade, and speculate on them.

Moreover, IMPT’s users can acquire carbon credits through everyday shopping activities. This is achieved through the platform’s partnerships with thousands of leading retail brands, meaning that whenever a user shops with one of these brands, they will earn IMPT tokens. Once enough tokens are acquired, users can instantly exchange them for a carbon credit.

Those interested in sustainable investing can ‘retire’ their carbon credits, effectively eliminating CO2 from the atmosphere. IMPT will even have a groundbreaking social platform that tracks the positive impact of individuals and businesses – incentivising users to make better choices.

Investors can now buy IMPT tokens through the presale phase, which has raised over $10 million in a matter of weeks. Tokens are priced at just $0.023 at the time of writing – providing a discounted rate for investors to buy in ahead of future CEX/DEX listings. Those looking to learn more about IMPT can do so through the official Telegram channel.

For more details on gaining exposure to the best crypto presales, read our article on how to invest UK according to Reddit.

2. Value Stocks – Purchase Undervalued Stocks and Hold Long-Term

According to many financial experts, the best way to invest £100k in the UK in 2024 is to purchase value stocks. As defined by Forbes, value stocks are stocks that analysts and investors consider to be ‘undervalued’ relative to their earnings and growth potential.

The most famous supporter of value stocks is Warren Buffett, who has amassed a fortune over the past 60 years by investing in companies he deems to be trading at a discount relative to where they should be. By doing this, Buffett was able to purchase stocks at a low price and then sell them years (or decades) later – generating enormous returns in the process.

Those with £100k to invest can adopt a similar approach, yet it’s vital to conduct in-depth research to ensure a potential investment is actually undervalued. This involves analyzing the company’s business model, revenue, earnings, and future plans, along with reviewing its competitors to see how it shapes up.

A final point to note is that investors who buy shares in the UK must ensure they are diversifying effectively. By doing this, investors can reduce value fluctuations in their portfolios and increase their longevity in the market.

3. Crypto Staking – Generate a Passive Income Stream Through Staking

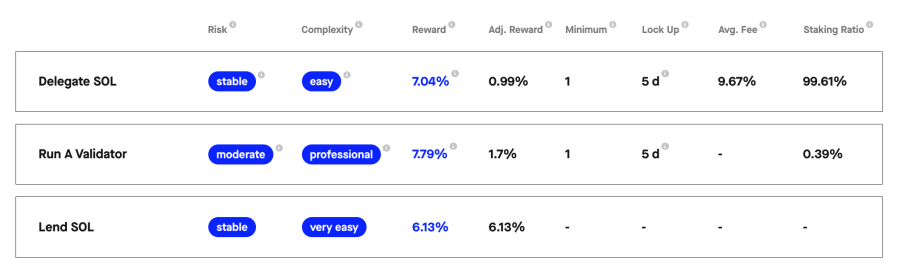

Another option for those wondering how to invest £100k in the UK is crypto staking. Staking refers to the process of ‘locking up’ crypto tokens to support a blockchain network in the transaction verification process. This staking mechanism is available in all blockchains utilizing a ‘Proof-of-Stake’ consensus protocol.

By staking their tokens, crypto investors can earn ‘staking rewards’, which are essentially interest payments on the staked amount. The yields on offer will vary depending on the blockchain but tend to be far higher than investors can attain through traditional bank accounts.

For example, those who opt to stake their SOL tokens on the Solana network can generate an APR of 7.04% at the time of writing. However, this return is balanced by the fact that SOL’s price has fallen drastically over the past year – so ‘total returns’ may actually be negative.

Those looking for alternative staking tokens may wish to consider Lucky Block (LBLOCK) or Tamadoge (TAMA). Although these tokens don’t provide staking in the traditional sense, they do offer unique ways for holders to generate a yield on their investment – whilst also delivering scope for vast price appreciation.

4. Exchange-Traded Funds (ETFs) – Invest in ETFs That Track Market Indices

Exchange-traded funds (ETFs) are pooled investment vehicles that emulate a specific equity index, commodity, or industry. Investors can place their capital in these funds and benefit from their value fluctuations without worrying about asset selection or portfolio rebalancing.

Opting to invest in ETFs can be ideal for those with a long-term investment horizon. This is especially true for ETFs that track equity indices like the FTSE 100 or the S&P 500, as these indices have a solid track record of producing positive annual returns.

Many financial experts believe that the best way to invest £100k in the UK is to buy an ETF that tracks one of these indices and then leave it for years or even decades. The combination of positive annual performance and compound returns is deemed the perfect recipe for generating substantial gains over the long term – which can be hugely beneficial to those saving for retirement.

5. Non-Fungible Tokens (NFTs) – Buy Popular NFTs with Valuable Utility

Those with £100,000 to invest in financial assets may also wish to consider non-fungible tokens (NFTs). Many investors opt to buy NFTs in the hope that their value appreciates over time, similar to other assets like equities and commodities.

Since NFTs are ‘non-fungible’, each one is unique and cannot be replaced with another. This feature means that many top NFT collections have attained high valuations – for example, several Bored Ape Yacht Club (BAYC) NFTs have sold for over $1m.

Although the NFT market has taken a sizable dip over the past year, there are still collections with high value potential. Lucky Block NFTs are a prime example of this, as they offer the holder an opportunity to win exclusive prizes, such as luxury holidays, a Lamborghini, and even $1m worth of BTC.

Another collection with high value potential is the one offered by Tamadoge. These Tamadoge NFTs act as the user’s gateway to Tamadoge’s play-to-earn (P2E) features since each has its own lineup of skills and attributes. Various rarities are on offer, meaning that users who own the most exclusive Tamadoge NFTs will have the best chance of winning battles and earning TAMA.

6. Commodities – Speculate on Commodities like Oil and Gold

Another option regarding the best place to invest £100,000 in the UK is commodities. Commodities are raw materials used in production processes, such as coffee, corn, or gold. Investors can speculate on the value of commodities like these through the spot or derivatives markets, making them ideal for portfolio diversification.

There are numerous commodities for investors to speculate on, although oil, gold, and natural gas are three of the most popular. All three of these commodities have values that are influenced by supply and demand effects, meaning they are particularly susceptible to macroeconomic conditions.

For example, CNBC recently reported that OPEC had decided to cut oil production by two million barrels per day. Since the oil supply is now lower, the oil price naturally increased. As such, investors benefited by going long on oil derivatives (e.g. CFDs, futures, options) following OPEC’s announcement.

7. Real Estate – Gain Exposure to the Real Estate Market through REITs

UK-based investors with £100k to spend can also invest in real estate. There are several ways investors can gain exposure to the real estate market, although the most direct approach is purchasing a property. Once a property has been purchased, the owner can rent it out to generate a recurring income stream or sell it once its value has increased.

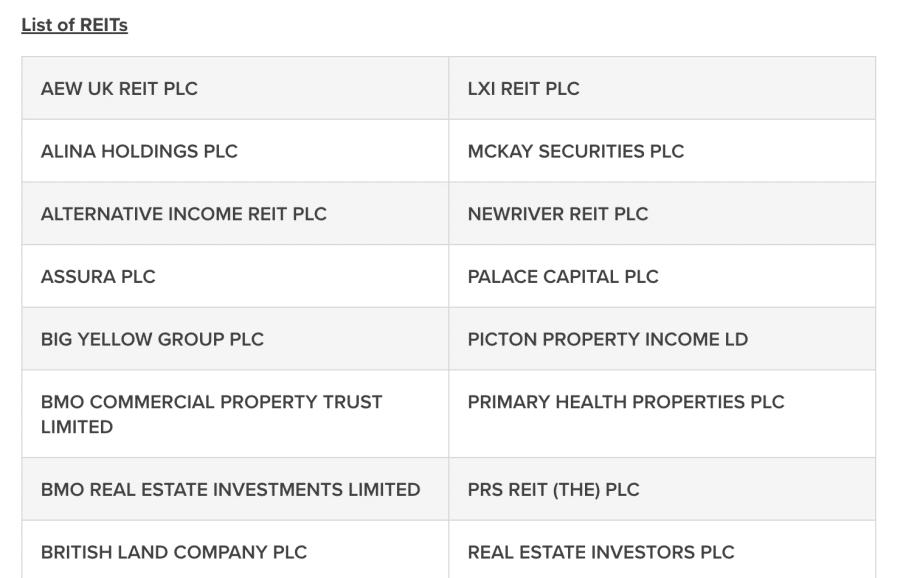

Those looking for a more passive way of gaining exposure to the real estate market can opt to invest in REITs. REITs (real estate investment trusts) are companies that own numerous properties and operate similarly to mutual funds. This means that investors can invest in these REITs and receive a share of the rental income that the company accrues.

According to the London Stock Exchange website, there are over 50 UK-based REITs with a market cap of over $70bn. Many of these REITs are accessible through top online brokers, making it easy for UK-based investors to benefit from growth in the real estate market.

8. Crypto Interest Accounts – Deposit Digital Assets to Generate a Yield

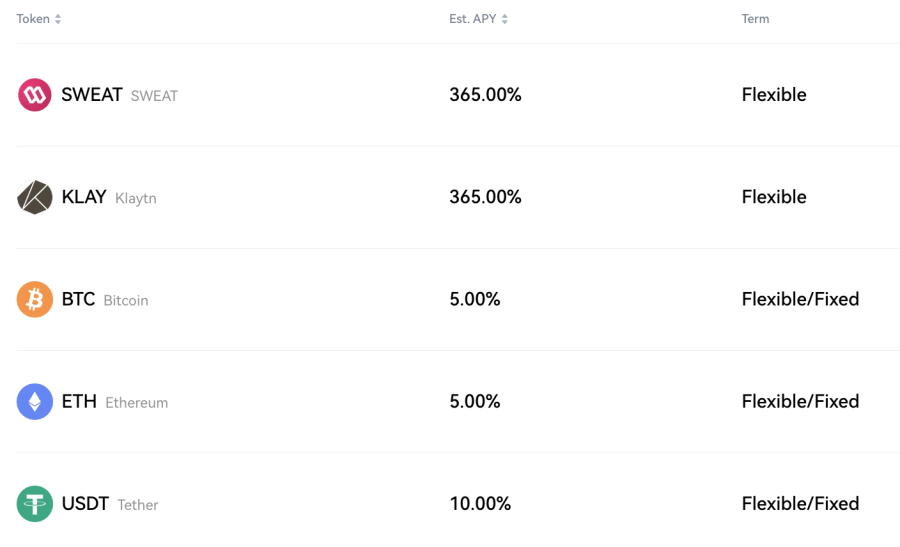

As the name implies, crypto interest accounts are accounts that allow digital asset investors to earn interest on their holdings. They operate the same way as ‘traditional’ savings accounts by accepting deposits and providing a yield on the deposited amount.

There is a wide variety of accounts on offer, some offering flexible deposit terms, whilst others require a ‘lock-up’ period. Moreover, certain accounts only accept specific cryptos and vary their yields depending on the asset. Some crypto interest accounts even offer compound interest with daily payouts.

However, it’s essential to understand that the providers of crypto interest accounts often lend deposited funds to third parties. This adds an obvious element of risk, as if the third party fails to pay back the loan, it can mean the initial depositor may not receive their funds back. Due to this risk, crypto interest accounts often compensate depositors with yields that can sometimes exceed 10% per year.

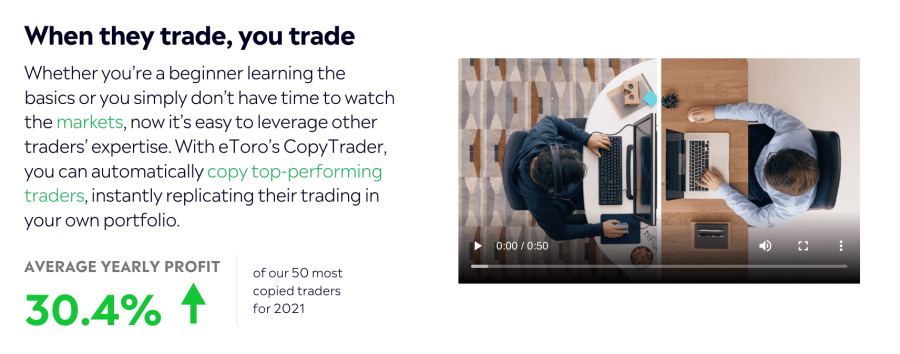

9. Copy Trading – Invest Passively by Copying Other People’s Trades

Copy trading platforms are another popular way that UK-based individuals can invest £100,000. These platforms allow users to automatically copy the trades placed by other users – thereby offering a ‘hands-off’ approach to investing.

There are numerous benefits of copy trading; most notably, the fact that investors do not have to conduct any prior research or analysis since this is all completed by the trader being copied. Copy trading can also benefit those with full-time jobs, as it provides scope for positive returns without having to spend hours per day completing asset research.

Investors using copy trading platforms may need to meet a minimum investment threshold, although this will depend on the specific platform. Moreover, it’s also important to remember that positive historical performance doesn’t necessarily mean that a trader will continue to perform well – so it’s wise to conduct in-depth research on a potential trader’s strategies and market experience.

10. Government Bonds – Buy Long-Term Government Bonds to Generate Regular Interest Payments

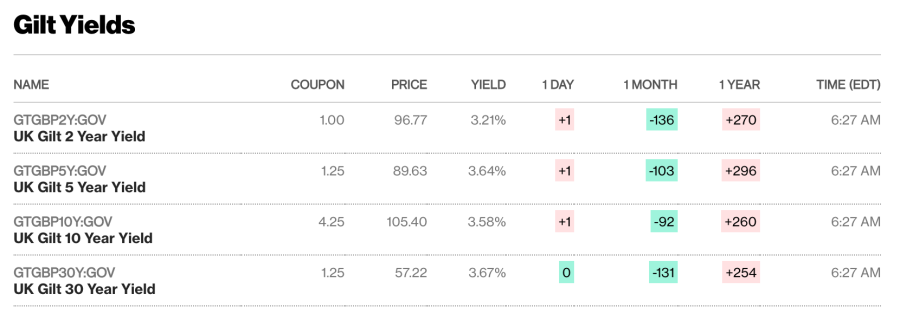

Rounding off our list of the best ways to invest £100k in the UK is government bonds. As defined by Barclays, government bonds are IOUs issued by governments as a way to raise cash. Investors who buy bonds are essentially lending the government money for a set period whilst being compensated through regular interest payments.

At the end of the bond’s lifespan, the principal is also returned, meaning that these assets are a great way to park cash for an extended period. Investors with a low risk tolerance tend to gravitate toward government bonds, as it’s highly unlikely that the government will default – making them the closest thing to a ‘risk-free asset’.

However, the returns offered on these bonds are relatively low, meaning investors may struggle to beat inflation by solely investing in these assets. Due to this, many financial experts advocate using a ‘60/40 split’, meaning investors are advised to invest 60% of their capital in stocks and 40% in bonds.

How to Choose the Best £100k Investments For You

Now that we’ve highlighted some of the best ways to invest £100,000 according to financial experts, let’s focus on the factors that play a role in the decision-making process. Whether investors find short-term investments or long-term investments appealing, it’s vital to ensure that all assets fit with an overarching strategy to reduce the chance of loss.

To help streamline the asset-picking process, detailed below are four factors that investors must bear in mind when creating an investment portfolio:

Risk Tolerance

Investors and traders with £100,000 to invest in the financial markets must be self-aware enough to understand their own risk tolerance. Naturally, those with a higher risk tolerance will have a more extensive selection of assets to invest in, as they’ll be better suited to dealing with value fluctuations and the risk of loss.

On the other hand, those with a lower risk tolerance may be limited to ‘safer’ assets that offer lower rates of return. This ‘risk/return’ trade-off is integral to investing and key to asset selection.

Targeted Returns

Those looking to invest £100,000 must also determine the returns that they’d like to make. Although nothing is guaranteed in the financial markets, investors who have an idea of the returns they wish to make are better placed when constructing a suitable portfolio.

For example, investors looking to generate returns of 7% or more per year may wish to invest in an ETF that tracks the FTSE 100 or S&P 500. In contrast, investors who want to ‘beat the market’ may find crypto an appealing prospect. Although crypto is much riskier than most asset classes, many coins and tokens have produced triple-digit (or even quadruple-digit) gains over the past year.

Portfolio Diversification

When deciding on the best place to invest £100,000 in the UK, investors must also ensure their portfolio will be sufficiently diversified. We briefly touched on diversification earlier in this article, but its importance cannot be understated – especially in today’s challenging economic environment.

Whether individuals are looking to invest £10k in the UK or £100k, it’s crucial to construct a portfolio that has assets with various correlations. By doing this, investors can mitigate risk and ensure that periods of significant drawdown are rare.

Accessibility of Assets

It’s also important to research whether potential assets are readily accessible or not. Although investors can easily access stocks, ETFs, and cryptocurrencies through most top day trading platforms, certain asset classes (e.g. government bonds) are harder to invest in.

Due to this, beginner investors may be put off by the complex process of investing in these asset classes and may instead opt for a more accessible option. However, investors with £100,000 to spend would be wise to understand the investment process for all asset classes to ensure a suitable portfolio composition.

How to Invest £100k in the UK

Before rounding off our discussion of the best way to invest £100k in the UK, it’s crucial to provide an overview of the investment process. As noted earlier in this article, new crypto projects are a popular addition to investment portfolios worldwide – with Dash 2 Trade being the latest project to catch investors’ attention.

So, without further ado, detailed below are the five steps investors can take to buy D2T tokens through the presale at a reduced price point:

Step 1 – Set Up a Crypto Wallet

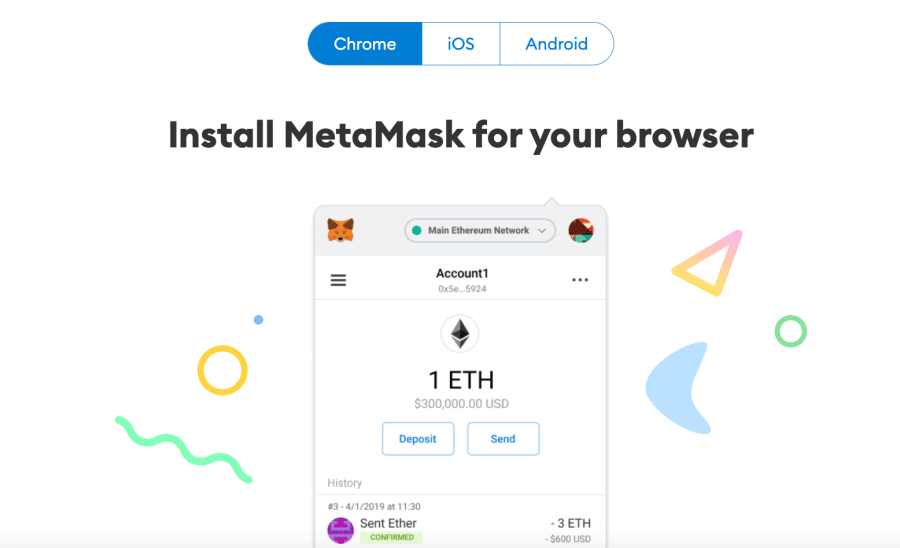

The first thing investors must do is set up a crypto wallet. The wallet must be compatible with ERC-20 tokens, as this is the structure used by D2T. Although many wallets offer this functionality, we recommend MetaMask since it’s free to use and can be set up in minutes.

Go to MetaMask’s website and click ‘Download’. On the following page, choose the relevant operating system (iOS, Android, Google Chrome) and follow the instructions to set up the wallet.

Step 2 – Buy ETH or USDT

Alternatively, investors can buy ETH directly through Dash 2 Trade’s website. This feature is offered via the platform’s partnership with Transak, meaning investors can use a credit/debit card or bank transfer to fund their purchase.

Step 3 – Link Wallet to Presale

Once ETH or USDT has been acquired, investors must navigate to Dash 2 Trade’s website and click ‘Connect Wallet’. A pop-up box will appear, in which investors must choose their wallet provider and follow the instructions to make the link.

Step 4 – Buy Dash 2 Trade Tokens

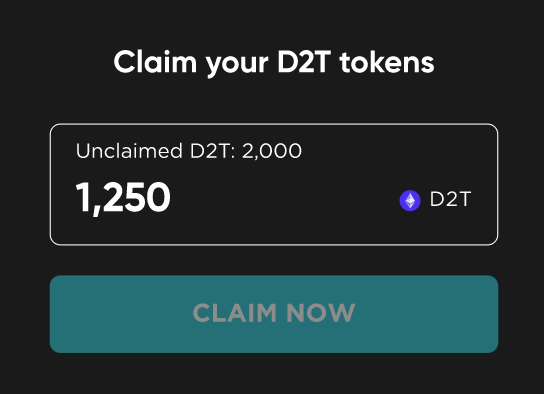

Step 5 – Claim Tokens

After Dash 2 Trade’s presale has concluded, a Token Generation Event (TGE) will occur. Following this, presale investors can obtain their purchased tokens by clicking the ‘Claim’ button on Dash 2 Trade’s website.

Best Way to Invest £100k in the UK – Conclusion

In conclusion, this guide has discussed the best way to invest £100k in the UK by presenting an array of asset classes suitable for use in a diversified investment portfolio.

Those wondering how to invest £100,000 in the UK today may wish to consider Dash 2 Trade. This revolutionary crypto analytics ecosystem offers an abundance of elite tools and features that help investors identify high-potential coins and develop strategies to trade them effectively.

Dash 2 Trade is currently in its presale phase, meaning investors have the opportunity to purchase D2T tokens at a discount. At the time of writing, tokens are priced at just 0.05 USDT – and given that over $2.5m has already been raised for the project, there’s a high likelihood that the remaining allocation could be snapped up before the token price increases.