Building a portfolio of assets with $100k will require some in-depth research, in terms of choosing suitable markets. The best approach is to diversify across multiple asset classes to help reduce the risk and maximize returns.

In this guide, we discuss the best way to invest $100k in 2024across 10 different methods.

12 Best Ways to Invest $100k in 2024

The best way to invest $100k, across 12 methods – can be found in the list below:

- FightOut – Overall Best way to Invest in a Breakthrough Fitness App and get M2E Rewards

- Dash 2 Trade – Invest in an Innovative Crypto Signals and Intelligence Platform

- Crypto – Consider Investing in Crypto Projects Like Tamadoge or Bitcoin

- Stocks – Invest in the Stock Market by Selecting Individual Companies

- Index Funds – Buy a Basket of Stocks via a Single Trade

- REITs – Invest in a Basket of Real Estate Holdings

- Copy Trading – Automated Investing via a Seasoned Trader

- Gold – Store of Value That Performs Well During Uncertain Economic Climates

- Retirement Accounts – Make Investments in a Tax-Efficient Way

- Crypto Staking and Interest Accounts – Earn Passive Income on Crypto Investments

- Bonds – Invest in a Variety of Bonds for Passive Income

- Smart Portfolios – Invest in Curated Portfolios That are Professionally Managed

Be sure to read our comprehensive analysis of the above $100k investments before making a decision.

A Closer Look at the Best Ways to Invest $100,000

Deciding what to invest $100k in is no easy feat. The most important thing to remember is that the investor should avoid injecting a lump sum of $100k into a single asset.

On the contrary, the $100k investment capital should be spread across multiple asset classes and markets – both domestically and overseas.

With this in mind, we will now take a closer look at the 12 best ways to invest $100k.

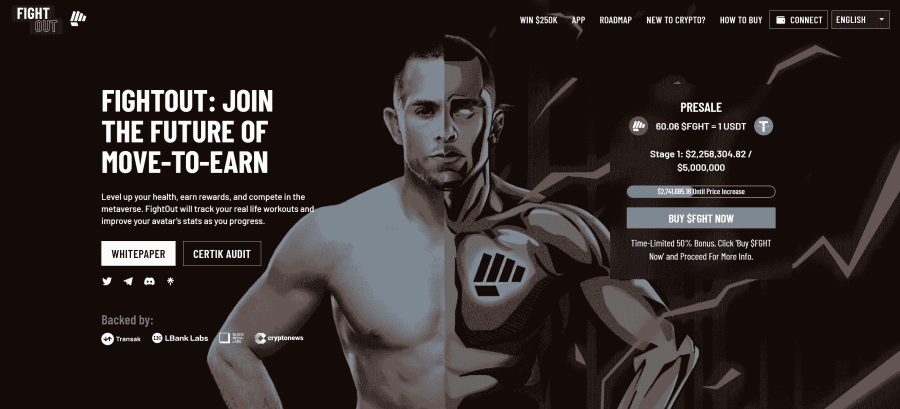

1. FightOut – Overall Best way to Invest in a Breakthrough Fitness App and get M2E Rewards

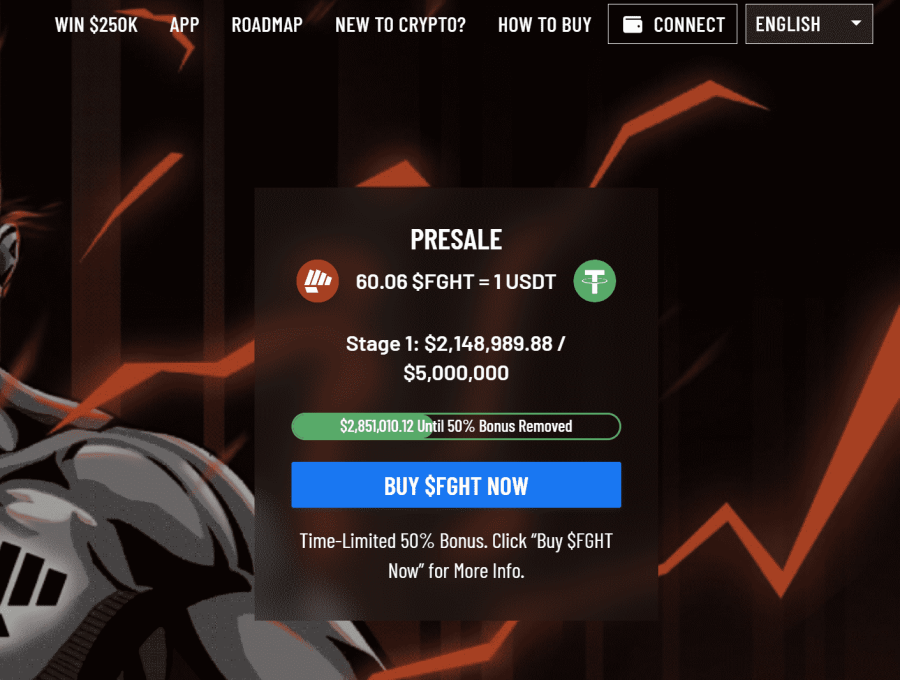

The project has already raised over $2.3 million USDT in just a few days of its stage 1 presale launch. At the time of writing, $FGHT can be bought at $0.0167 per token. Investors should consider buying the token while the prices are still low.

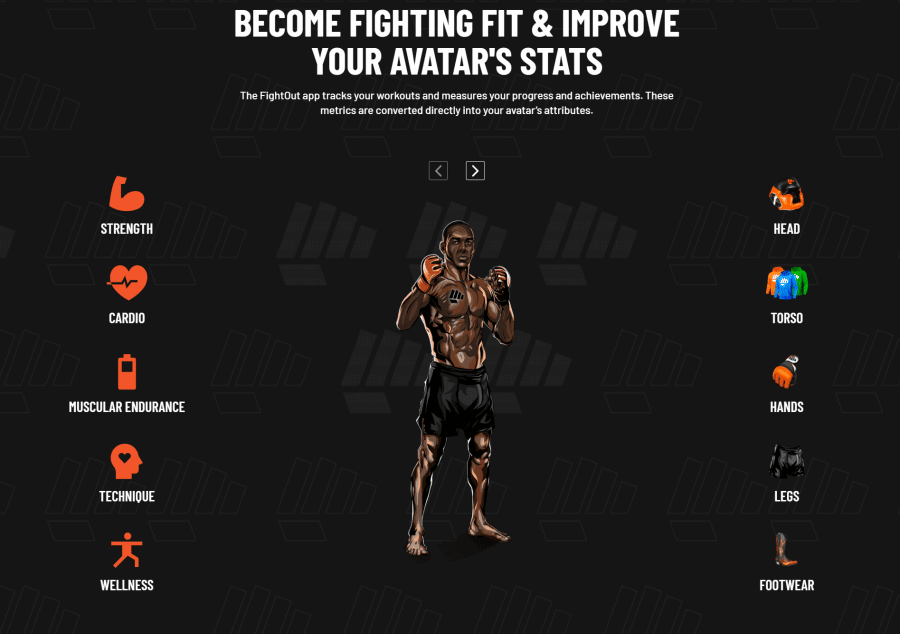

FightOut has created an innovative fitness app that rewards users for completing their workouts and other fitness-related movements. It has also built a metaverse for its users to effectively gamify the fitness lifestyle.

Users can create their own unique NFT avatars on the project’s metaverse. These soulbound NFT avatars will enhance in relation to the users’ real-life fitness performance. Also, FightOut allows users to compete with other community members in its metaverse.

FightOut has gone a step further to create an in-app currency known as REPS. Buyers will receive REPS as a reward for doing their workouts and fitness-related tasks. This currency allows users to buy products from FightOut’s marketplace. Moreover, REPS also allow users to buy cosmetic NFTs for their avatars, membership discounts, and similar products

Investors can go through the project’s whitepaper to know more about the project’s features.

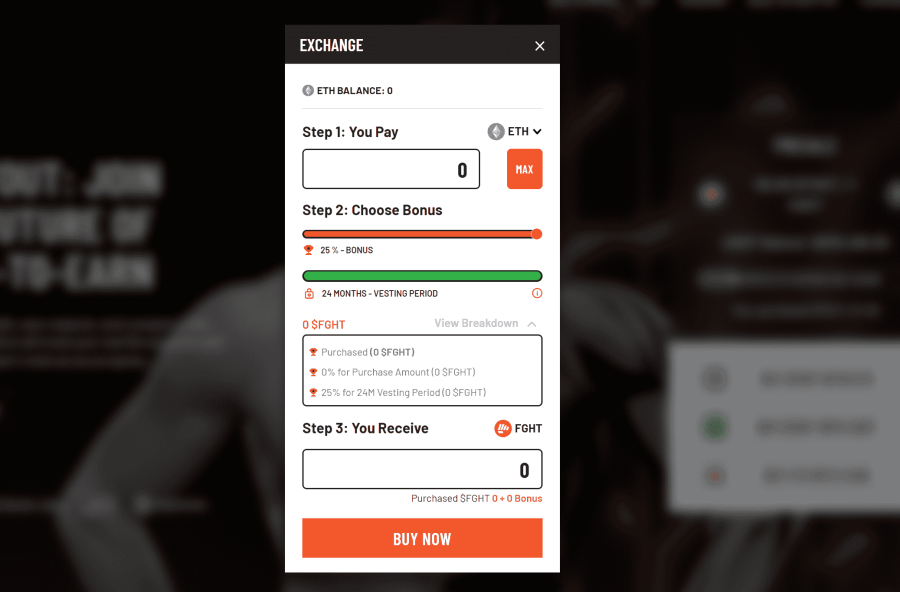

$FGHT Tokenomics & Purchase Bonuses

$FGHT is a limited supply token that is native to FightOut. Out of the ERC-20-based token’s total supply, 9 billion tokens will be sold through FightOut’s presale stages.

Buyers can use $FGHT to take part in several tournaments and leagues. Furthermore, $FGHT can be used to buy more REPS. Buyers would receive an extra 25% REPS if they use $FGHT to buy the in-app currency.

Investors also have an opportunity to receive purchase bonuses during the ongoing presale stages that start from 10%. To avail this, they need just need to invest $500 with 6 months of vesting. Moreover, staking FGHT also allows investors to earn membership rewards.

Presale Performance

FightOut’s presale performance has already been quite exceptional as it raised over $2.3 million USDT within a few days.

Buyers can also receive up to 50% additional tokens as rewards during the ongoing presale stages. Investors can consider joining FightOut’s Telegram channel to always stay updated.

| Presale Started | 14 December 2022 |

| Purchase Methods | ETH, USDT |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

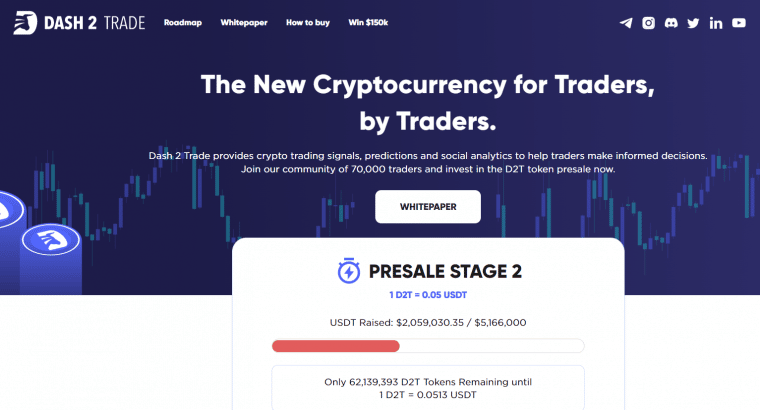

2. Dash 2 Trade – Invest in an Innovative Crypto Signals and Intelligence Platform

Our top way to invest $100,000 is to invest in the new crypto analytics and intelligence platform Dash 2 Trade – which raised nearly $2 million after just three days of its presale launch going live.

The protocol wants to help crypto traders and investors maximize returns on their holdings by using a range of metrics, insights, analytics, and tools to help its users make well-informed decisions and trades.

The Dash 2 Trade presale is now live and presales have been one of the best ways to beat inflation, the wider economic downturn and struggling assets in all markets.

Projects such as Tamadoge, STEPN, Sweat Economy, and Aptos have all launched this year and made massive gains over their presale price, when projects list at below market value to attract early funding.

Historically, crypto projects such as Ethereum, Dogecoin and many others have gone on to make incredible gains after low entry points in their initial coin offering (ICO).

Dash 2 Trade sold out the first phase of its presale in just three days and has now raised more than $2 million.

The presale will have nine phases in total, with each phase seeing a price increase. A total of 700 million tokens (out of a max 1 billion supply) are on sale, with a hard cap of $40 million.

While phase 1 tokens were sold for $0.0467 each, tokens in phase 9 will sell for $0.0662 – an increase of 39% before the coin even reaches the wider market.

For a full guide on how to buy Dash 2 Trade during the presale, click here.

Although some crypto projects are certainly risky, Dash 2 Trade has done a lot to minimize risk.

The project has a public team that is KYC-verified by CoinSniper, while the D2T token’s smart contract has been audited by SolidProof.

Investors are excited by the platform because it will use a range of data points to help crypto traders and investors make better decisions.

The dashboard will send out trading signals to users to take advantage of buying and selling opportunities in the market, as well as track on-chain data and social sentiment to spot trends.

| Price Stage | Amount Raised In Stage | Token Allocation |

| $0.0476 | $1,666,000 | 35,000,000 |

| $0.0500 | $3,500,000 | 70,000,000 |

| $0.0513 | $3,591,000 | 70,000,000 |

| $0.0533 | $4,663,750 | 87,500,000 |

| $0.0556 | $4,865,000 | 87,500,000 |

| $0.0580 | $5,075,000 | 87,500,000 |

| $0.0606 | $5,302,500 | 87,500,000 |

| $0.0635 | $5,556,250 | 87,500,000 |

| $0.0662 | $5,792,500 | 87,500,000 |

Dash 2 Trade is also developing a bespoke scoring system to identify other new crypto presale projects, ranking them with a score out of 100 to ensure investor confidence.

For traders, there will be a range of trading tools and a back-testing tool to optimize and test strategies in real-time without risking capital.

There will also be alerts for new coin listings and exchange offerings to ensure investors don’t miss opportunities.

For more information on the project read through the Dash 2 Trade whitepaper or join the Telegram group.

| Presale Started | October 19 |

| Purchase Methods | ETH, USDT, Transak |

| Chain | Ethereum |

| Min Investment | 1,000 D2T |

| Max Investment | N/A |

3. Crypto – Consider Investing in Crypto Projects Like Tamadoge or Bitcoin

The next market to consider when assessing the best way to invest $100k short-term is crypto. This marketplace is now a multi-billion dollar trading arena that contains tens of thousands of different projects – all with unique traits and features, and some offering exciting ways to change the future and others as purely speculative punts.

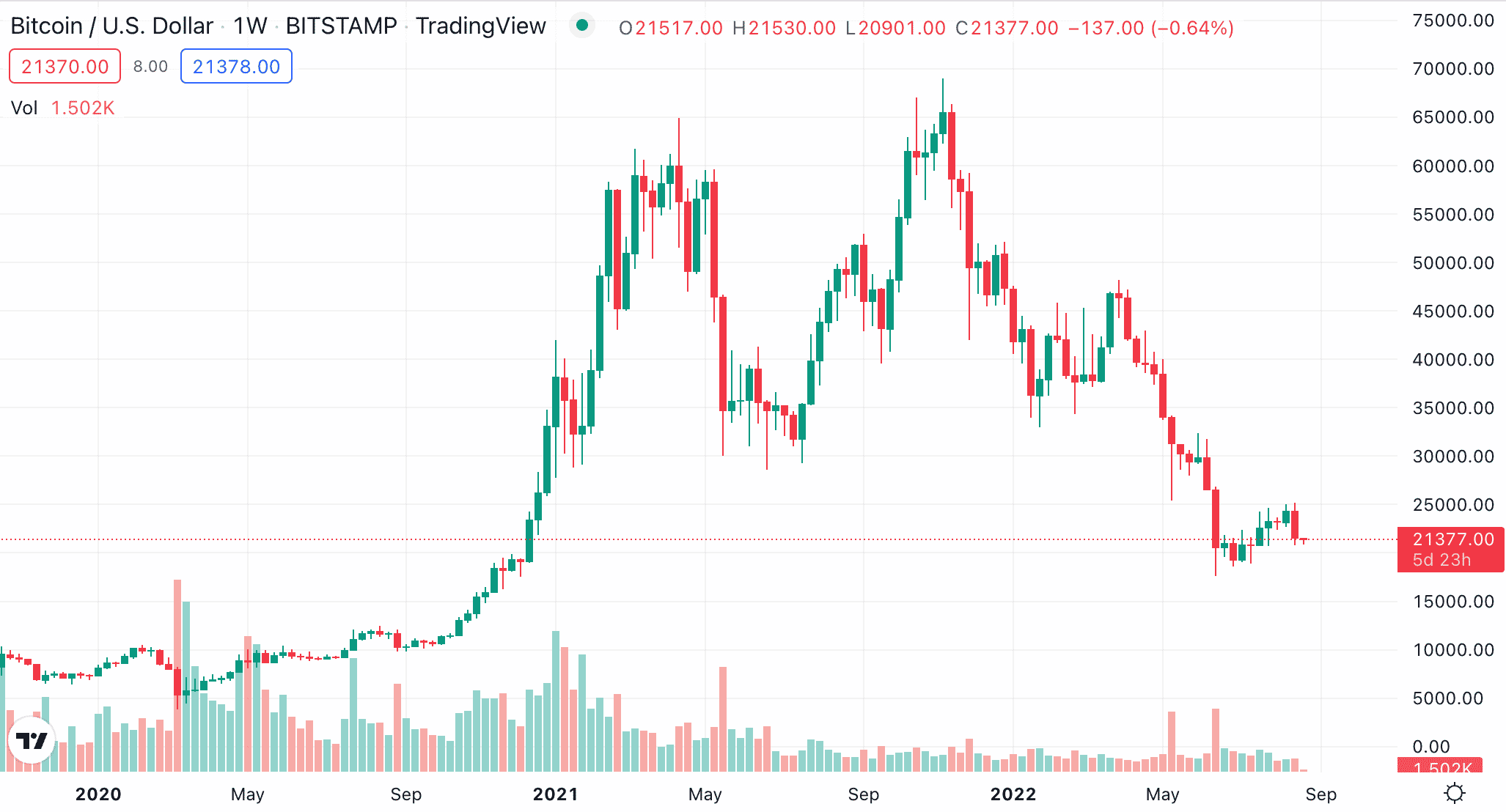

Moreover, when the markets were bullish in 2021, Bitcoin surpassed a value of $1 trillion. This meant that Bitcoin was worth more than the vast majority of S&P 500 companies.

On the one hand, inexperienced investors might be concerned that Bitcoin – now trading around $20,000 – and the broader crypto market have witnessed a major pricing correction. However, crypto assets are just like stocks in that regard, insofar that the markets go through both bullish and bearish cycles. Seasoned traders will look at current pricing levels as an opportunity to buy Bitcoin on the cheap.

For example, at the time of writing, Bitcoin is trading at just $20,000 – which is nearly 70% below the all-time high of $68,000 it achieved in late 2021. This means that in buying Bitcoin at this price, a return to its prior high would result in an upside trajectory of 240%. Another digital currency to explore further is Ethereum.

While Bitcoin is typically viewed as a store of value, Ethereum has a lot more in the way of use cases. For example, Ethereum supports smart contract agreements, which are now used by a multitude of third-party projects. Moreover, there are thousands of digital assets built on top of the Ethereum blockchain – which are otherwise known as ERC-20 tokens.

When transactions are carried out by ERC-20 tokens, fees must be settled in ETH – which is the native digital asset of the Ethereum network. As a result, Ethereum remains one of the most demanded cryptocurrencies in this space. Just like Bitcoin, however, those electing to buy Ethereum at current pricing levels can do so on the cheap.

For example, as of writing, Ethereum is trading at just over $1,500. This represents a price that is nearly 70% below its former high – which was achieved in later 2021. For a return to its prior all-time high at current pricing levels, this would require an upside of over 225%.

In addition to Bitcoin and Ethereum, there are a number of other crypto assets that might be worth considering. In terms of market capitalization, some of the most popular tokens in this space include BNB, XRP, Solana, Polygon, Cardano, Dogecoin, and Shiba Inu. All of these digital assets can be purchased at an online broker.

With that being said, many investors are now looking to gain exposure to newly launched crypto assets with the view of investing before the project explodes, as we’ve written about in the two sections above.

Another of the best new projects that we came across – which only launched at the end of September, is Tamadoge. In a nutshell, Tamadoge is building a play-to-earn game that enables players to win real-world rewards – paid in TAMA tokens. The game revolves around a virtual pet – styled on 90s craze Tamagotchi – which is minted on the blockchain via an NFT.

Players can enter their virtual pets into battles to earn more TAMA tokens, as well as breed, train, and feed them. Tamadoge pets are owned by the player, which means that the respective NFT can be traded on marketplaces – should its value increase. The Tamadoge presale has already raised more than $9.5 million, so investors will need to move quickly on this one before it sells out.

Tamadoge is in the meme coin category, like Shiba Inu and Dogecoin which enjoyed huge ROIs in 2021. However, unlike those two projects it has robust tokenomics and a wider ecosystem that should make it more valuable for long-term investment.

4. Stocks – Invest in the Stock Market by Selecting Individual Companies

Another option to consider when attempting to figure out the best way to invest $100k is the stock market. It is now possible to buy stocks from the comfort of home – oftentimes without paying any trading commission. This is especially the case when buying US-listed stocks. With that said, some brokers also offer commission-free trading on international markets.

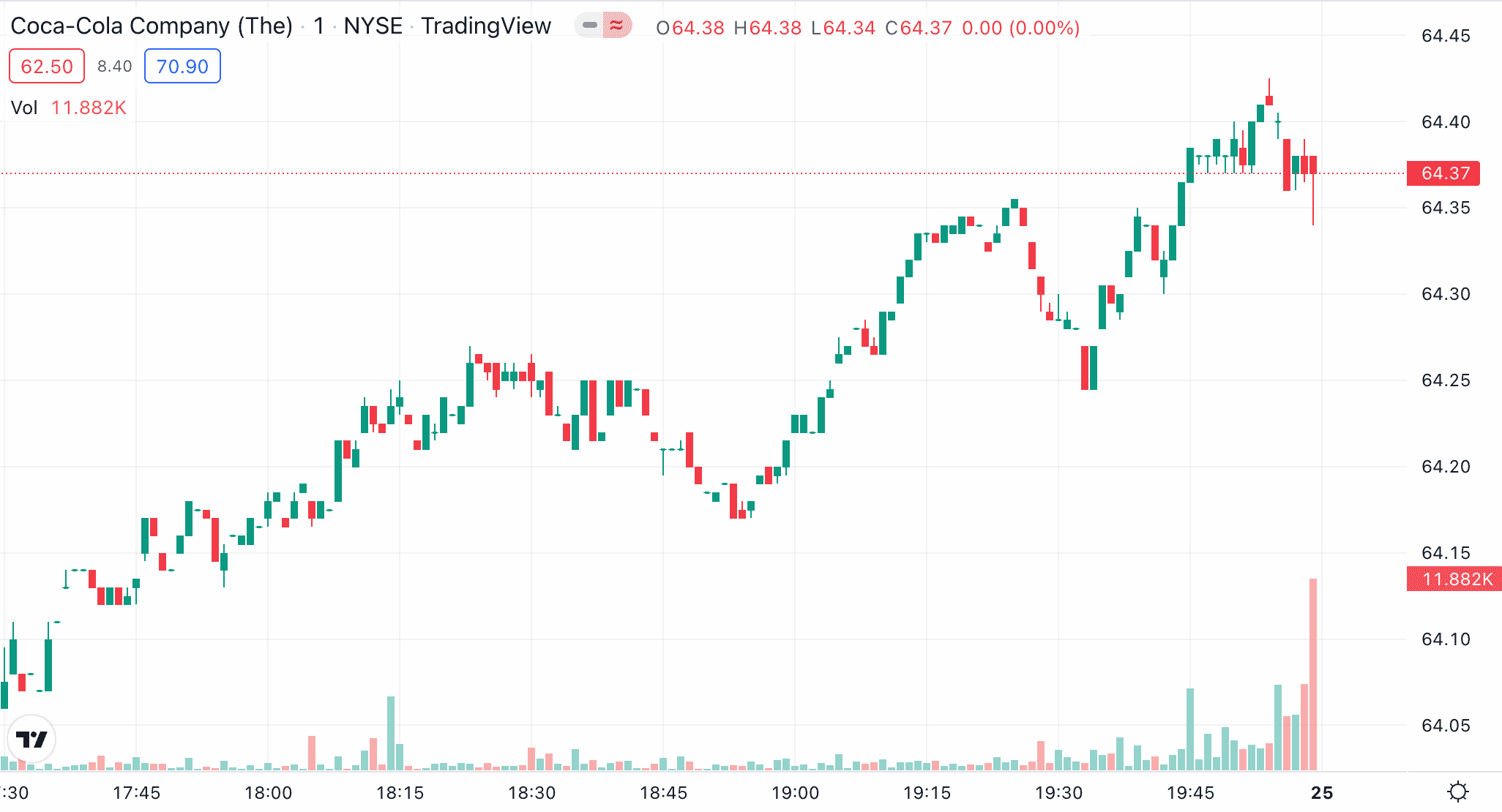

By investing in stocks on a do-it-yourself basis, investors should consider building a diversified portfolio. In other words, the more companies and industries added to a portfolio, the investor can reduce their long-term risk burden. A good starting point is to look at staple stocks. These are companies that generally perform well across all economic climates.

The reason for this is that staple stocks sell products and services that are always in demand. For instance, Walmart is a good example of a staple stock, as is Johnson & Johnson. Even the likes of Coca-Cola and British American Tobacco could be viewed as staple stocks, as demand for their products rarely declines during a recession.

It is also a good idea to spend some time looking for undervalued stocks that have seen their share price unjustifiably decline due to broader market conditions. Examples of stocks that could be too cheap to turn down include Coinbase – which is down 80% from its recent IPO price. Meta Platforms – formally Facebook, is another potential option – 58% over the prior 12 months.

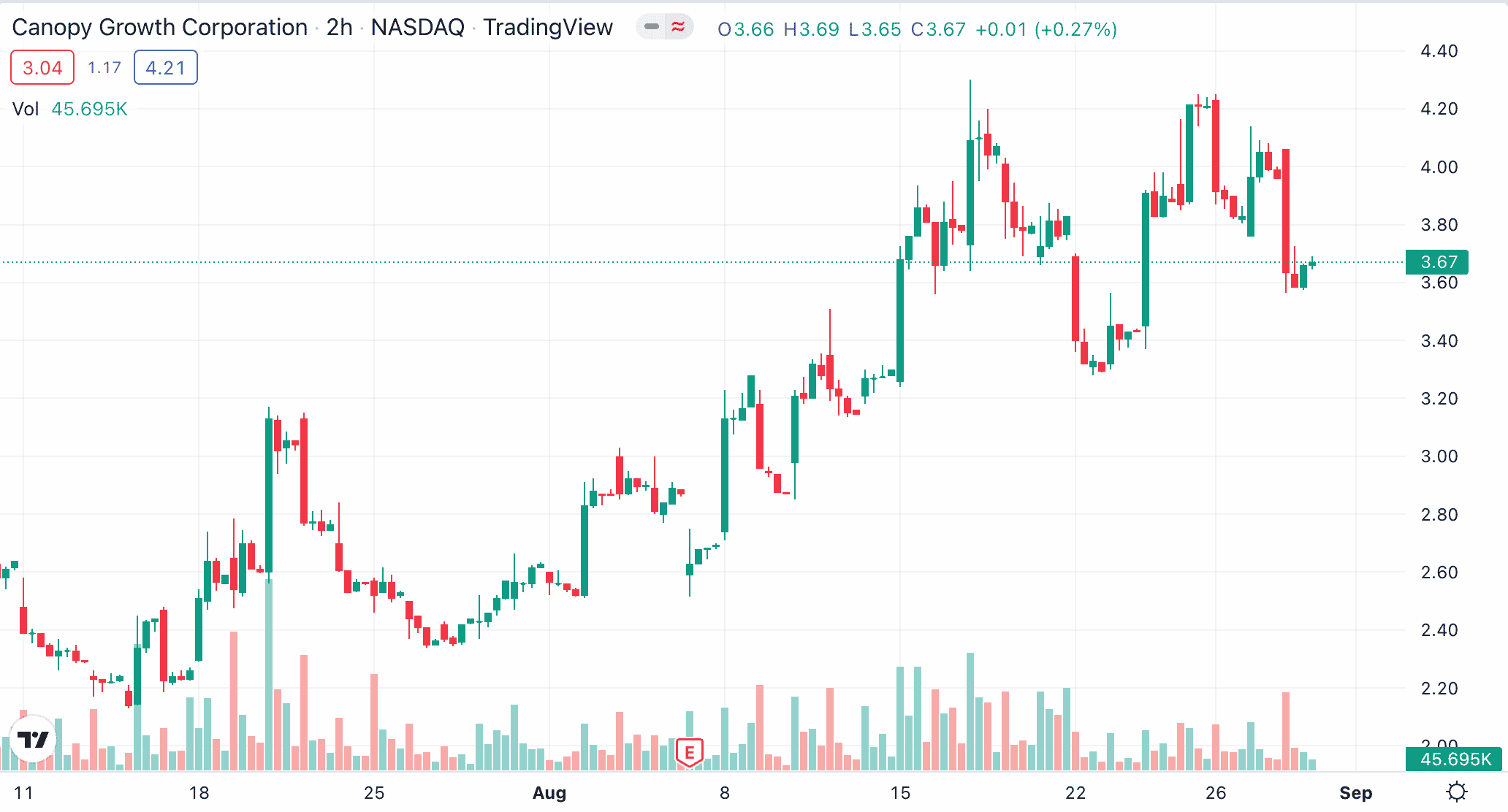

Growth stocks are often favored by investors too, as these companies typically offer an attractive upside. One such growth industry to consider is the legal cannabis space. Leading companies in this industry include Curaleaf, Canopy Growth Corporation, and Aurora Cannabis – all of which are potentially trading at undervalued levels.

While growth stocks and industries offer the opportunity to target attractive gains, a diversified portfolio should also hold a selection of high-grade blue chips. There are many examples of blue-chip stocks that have gone through multiple bear markets but have always recovered and continued to grow.

Examples of popular blue-chip stocks include Procter & Gamble, 3M, Cisco Systems, Intel, and American Express. Some investors will take a more active approach to the stock market by investing in companies that operate in a trending industry. For instance, one of the best-performing industries of 2022 is energy.

This means that many oil and gas companies are now reporting record gains and subsequently outperforming the broader stock markets. The likes of Shell, Devon Energy, and Exxon Mobil have generated gains of 62%, 140%, and 76% over the prior 12 months of trading, respectively.

In addition to capital gains, investors should also consider dividend stocks when assessing the best way to invest $100,000. The aforementioned oil and gas companies offer attractive dividends, with a running yield of 3.59%,6.59%, and 3.65%, respectively – as of writing. With that said, oil and gas companies can be overly volatile, so investors might instead consider dividend kings.

These are stocks that have paid a quarterly dividend for at least 50 consecutive years. Moreover, dividend kings have increased the size of their annual payments each year for at least five decades. This offers a solid way to secure dividend income in addition to capital gains.

Learn More: Those with $100k to invest in might consider reading our guide on how to invest in stocks.

5. Index Funds – Buy a Basket of Stocks via a Single Trade

In the section above, we discussed the many different types of stocks available to investors. However, the process of picking individual stocks to invest in can be a challenging and time-consuming task – especially for newbies. As a result, perhaps the best way to invest $100k into the stock market is via an index fund.

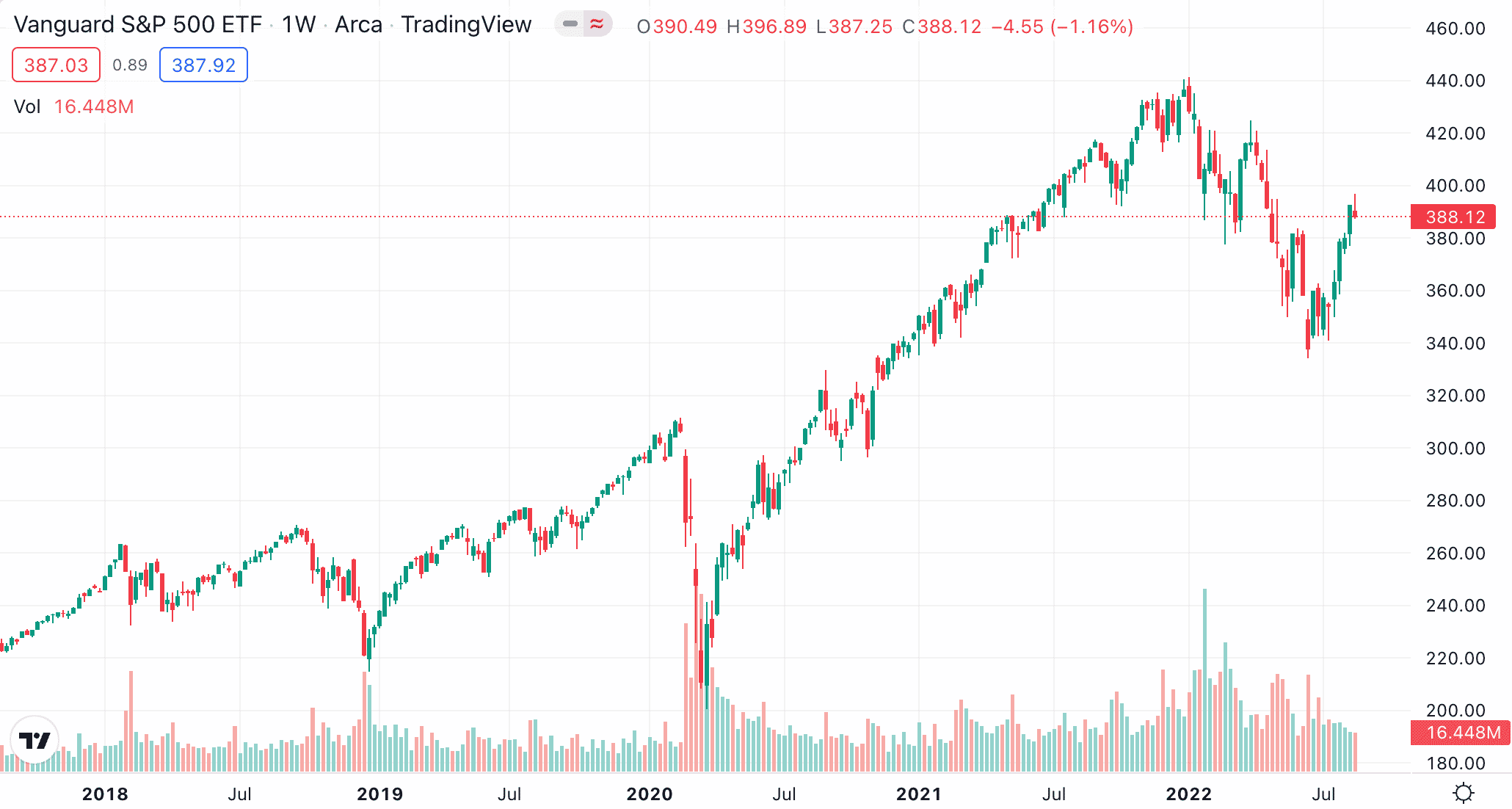

In its most basic form, an index fund tracks a segment of the stock market. They are operated by ETF providers like Vanguard and iShares and enable investors to access a diversified basket of funds through a single trade. The fund provider will buy each of the stocks that represent the index in question, at the correct weight.

Furthermore, the index fund provider will rebalance the portfolio every three months. This means increasing or decreasing the weight of each stock, and perhaps adding or removing companies from the index. Either way, this is all taken care of by the index fund provider on behalf of investors, which ensures a smooth and passive experience.

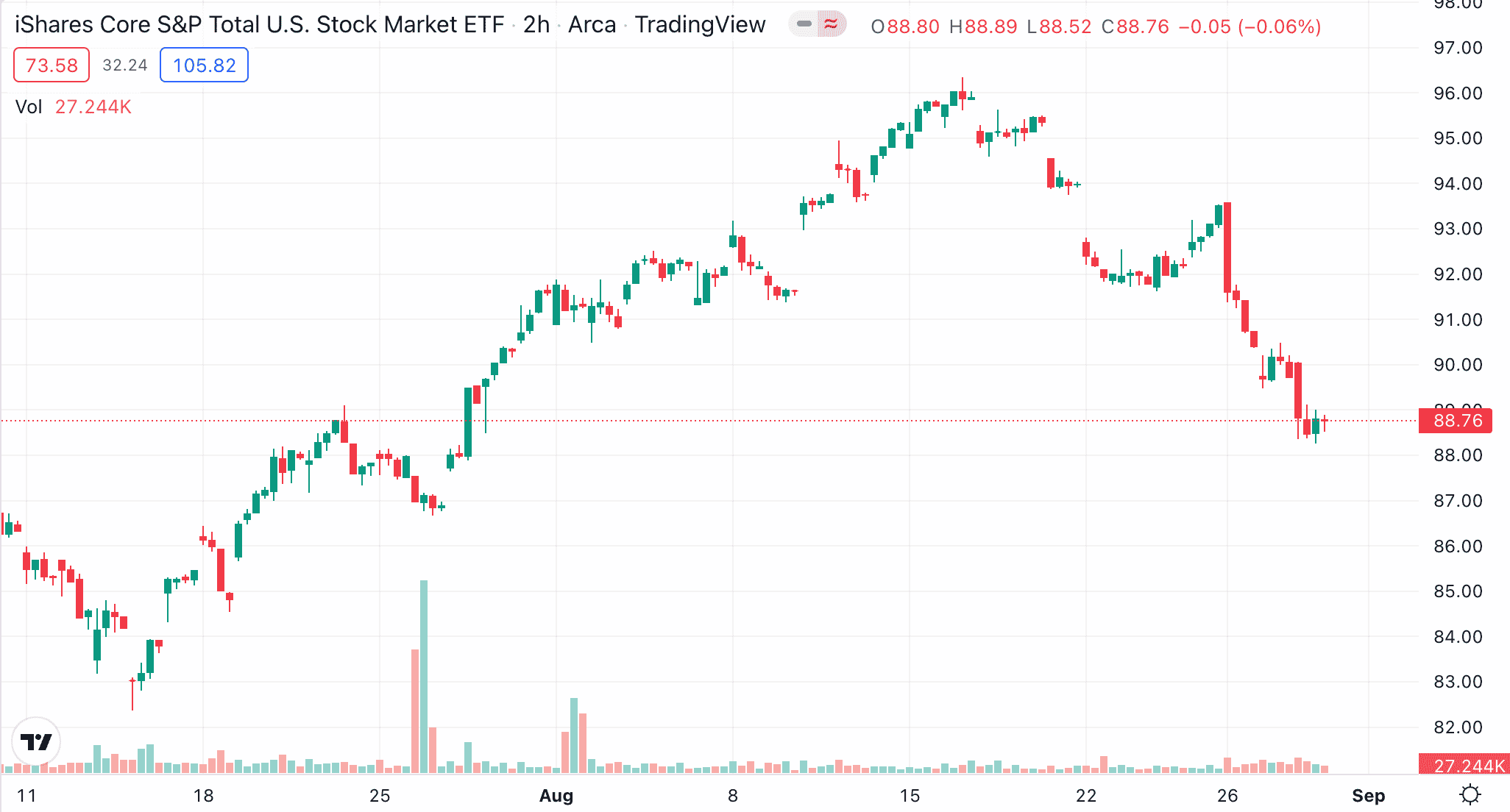

To offer some insight into the most popular funds in the market, the iShares Total Stock Market Index is well worth considering. This index fund – through a single investment, offers exposure to each and every stock that is listed in the US. In other words, the investor will indirectly own more than 4,000 companies at various weights.

The S&P 500 is another popular option, which tracks 500 large companies in the US. The Dow Jones is also worth considering, albeit, this consists of just 30 blue-chip stocks from a wide range of industries. When investing in an index fund, it is important to understand how the weighting system works.

This essentially dictates how much exposure to the index fund will have to each individual stock, based on a percentage amount. Let’s take the previously mentioned iShares Total Stock Market Index as a prime example. Within this portfolio, the index fund has a weighting of 6.1%, 4.9%, and 1.2% across Apple, Microsoft, and Berkshire Hathaway stock.

This means that by investing $100k into the iShares Total Stock Market Index, the investor would indirectly own $6,100 worth of Apple stock, $4,900 in Microsoft, and $1,200 in Berkshire Hathaway. In this example, the index fund weights its companies based on the market valuation of each stock.

In addition to capital gains, most index funds provide investors with quarterly dividend payments. This will be the case when companies held in the index fund make a distribution. When it comes to fees, index funds charge an expense ratio, which is usually small. For instance, the iShares Total Stock Market Index charges an expense ratio of just 0.03% annually.

Those with $250k to invest could consider reading our guide on the best ways to invest $250k in 2024.

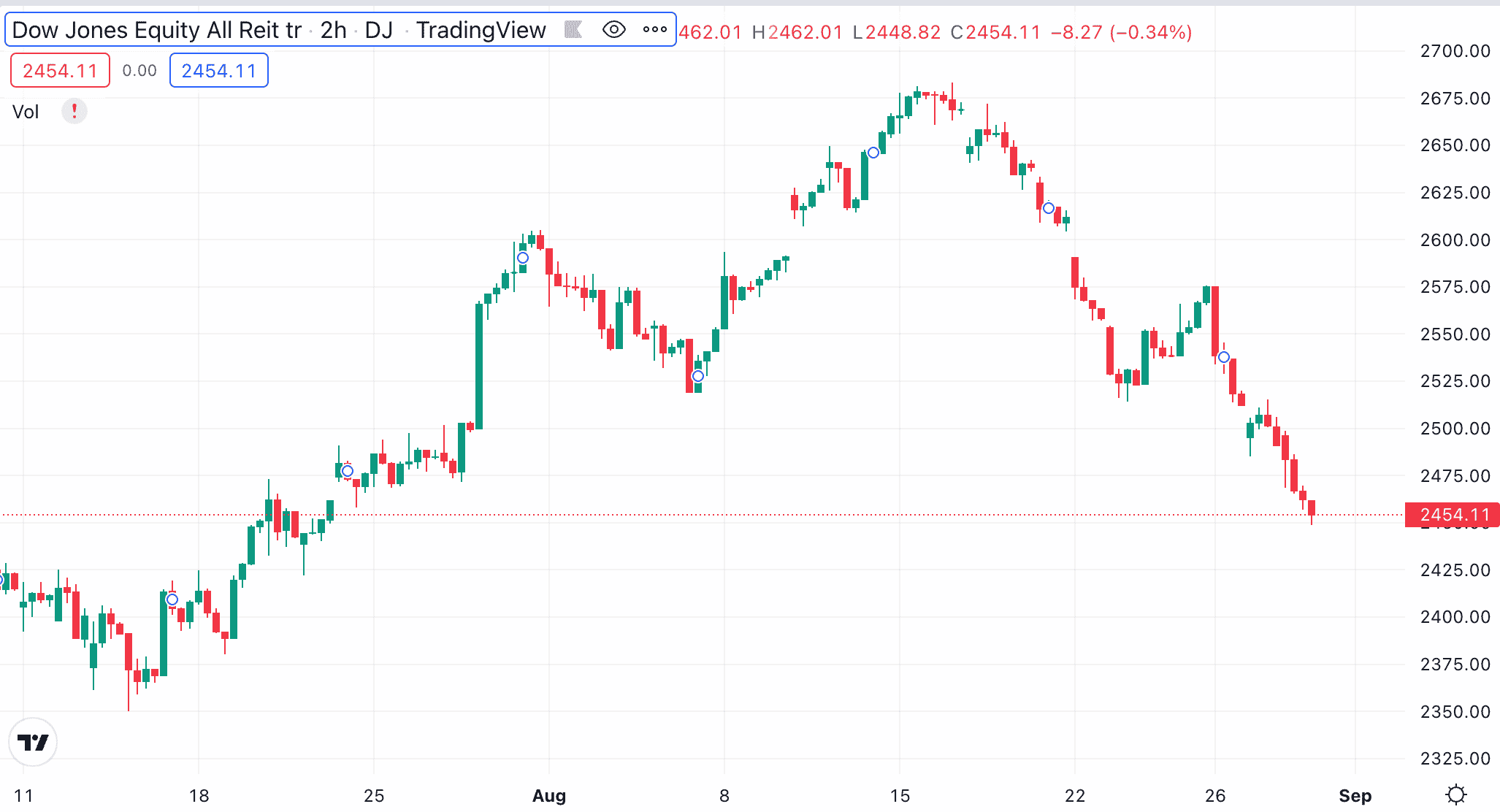

6. REITs – Invest in a Basket of Real Estate Holdings

We would also argue that REITs (real estate investment trusts) represent one of the best ways to invest $100k. In a nutshell, REITs allow investors to gain exposure to real estate, but in a passive and diversified manner. The reason for this is that REITs are managed by ETF providers, so the chosen financial product will trade on a major stock exchange.

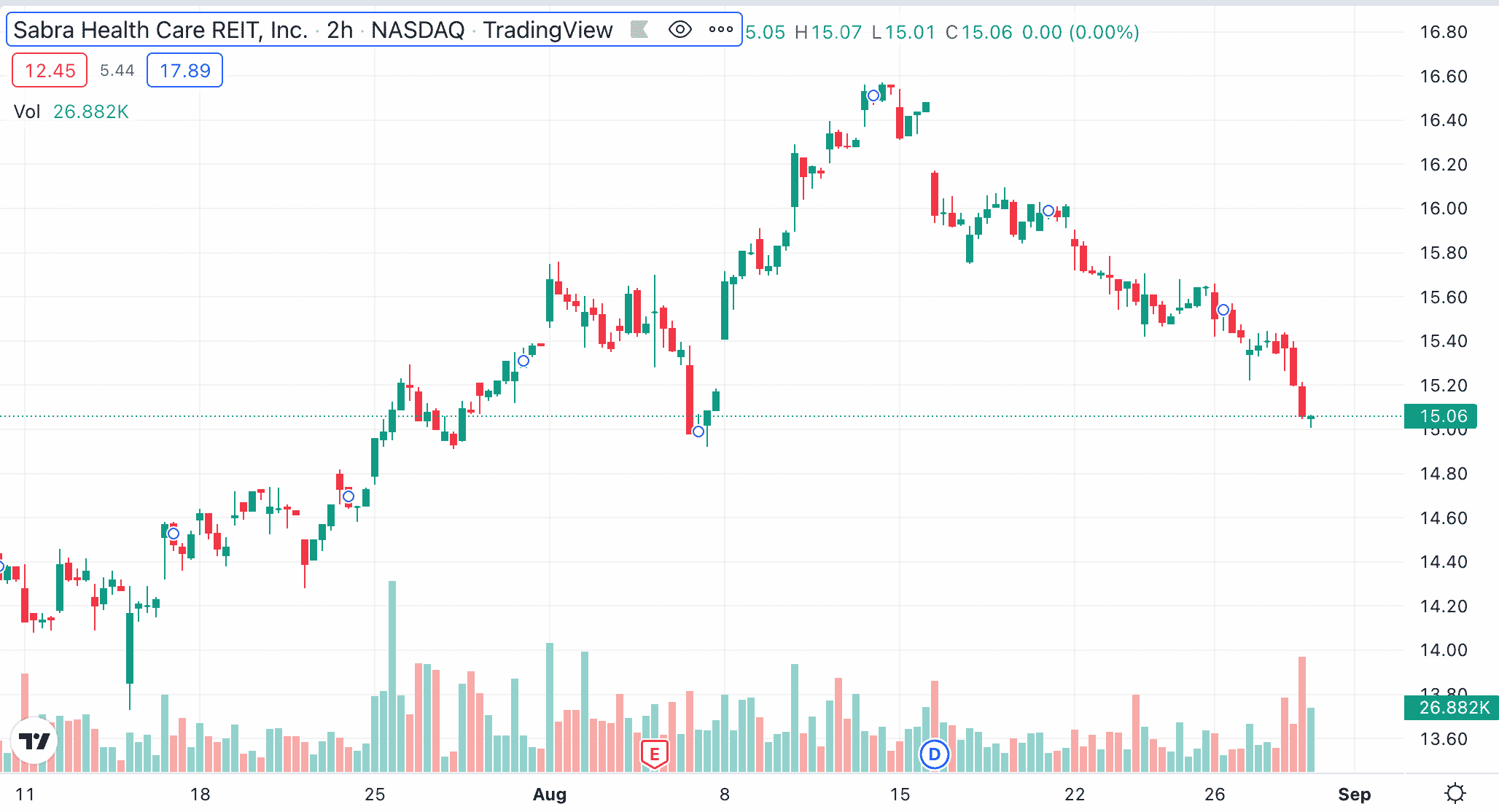

There are many types of REITs and in most cases, the fund will target a specific segment of the real estate sector. For example, the Sabra Health Care REIT specializes in owning and renting hospitals, medical centers, and senior housing communities. Other REITs will focus on commercial operations.

This might include shopping malls, office blocks, or perhaps warehouses and distribution centers. It is also possible to invest in residential REITs. These REITs will typically purchase large multi-family units across a variety of housing markets. Irrespective of the real estate sector being targeted, most REITs work in the same manner.

First and foremost, investing in a REIT is no different from buying stocks in a company. After all, as REITs are traded via ETFs, investments can be made at an online broker at the click of a button.

Another thing to note is that the entire REIT investment process is passive. The reason for this is that the REIT will have its own in-house property management team, which takes care of everything from selecting suitable projects and vetting tenants to collecting rental payments.

This will particularly suit inexperienced real estate investors or those that do not have time to manage properties. Furthermore, REITs offer both income and capital gains. Regarding income, REITs are typically mandated to distribute rental income to shareholders each and every month.

In terms of capital gains, this will depend on the NAV (net asset value) of the portfolio of properties. In theory, when the properties held by the REIT increase in value, so will the NAV. And, when the NAV increases, this should result in the value of the REIT following suit.

7. Copy Trading – Automated Investing via a Seasoned Trader

Copy Trading is still a relatively new concept in the broader brokerage space, albeit, it represents one of the best ways to invest $100k nonetheless. Regulated brokers offer this feature, and it enables investors to copy the positions of a seasoned trader in an autonomous manner.

This means that whenever the selected trader places a buy or sell order, the same position will be carried over to the user’s portfolio. For example, let’s say that $10,000 is invested in a seasoned commodity trader. The trader allocates 10% of their portfolio to gold and 7% to silver.

This means that the user will see $1,000 worth of gold in their portfolio and $700 in silver. Then, let’s say that the trader sells their gold position at a profit of 15%. The user would automatically perform the same action, making a passive profit of $150 along the way (15% of the $1,000 stake).

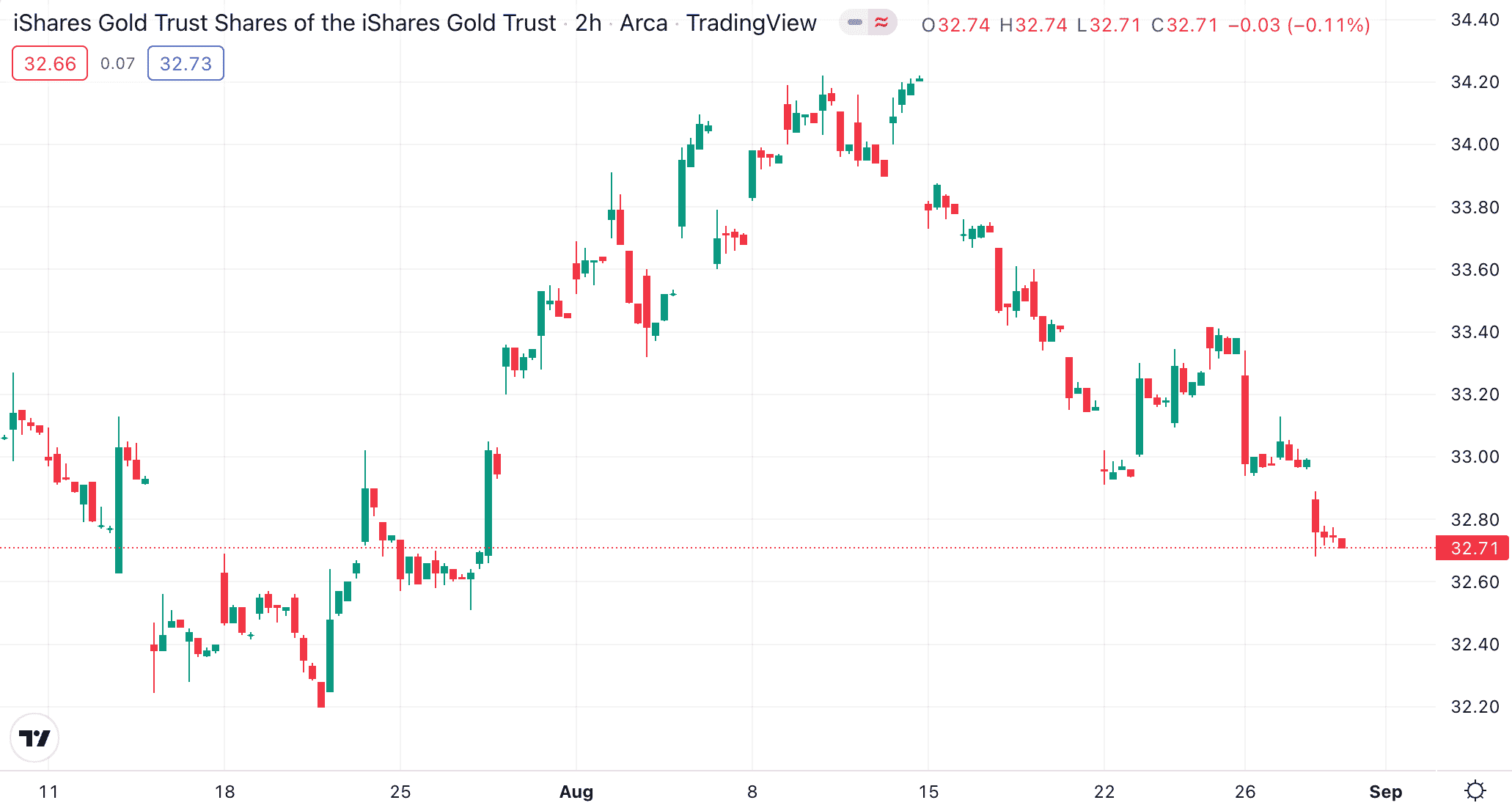

8. Gold – Store of Value That Performs Well During Uncertain Economic Climates

During times of economic uncertainty, investors of all shapes and sizes will often turn to gold. This precious metal has held its own for thousands of years, and will potentially continue to do so throughout the course of time. However, on the one hand, gold hasn’t generated returns anywhere as favorably when compared to the stock market.

With that said, gold operates in an inverse-cyclical market, which means that it generally performs well when the stock market is in a bear market – and vice versa. For instance, during the Great Recession – which began in late 2007, gold went on a prolonged upward trajectory, while the stock markets continued to plummet.

However, once the stock market began to reverse, the same happened to gold. Therefore, gold is the best way to invest $100k during uncertain economic climates. In terms of how to invest in gold, the easiest and most cost-effective way is to go through an ETF. Let’s take the iShares Gold Trust ETF as a prime example.

This ETF is backed by physical gold bullion, which offers direct exposure to the value of the precious metals to investors of all budgets.

In this example, iShares takes care of all required processes when it comes to buying, transporting, storing, and insuring the gold on behalf of investors. Furthermore, as the iShares Gold Trust ETF is backed by actual gold, its value will closely align with global spot prices.

For example, since the ETF was incepted in 2005, it has returned average annualized gains of 8.34%. In comparison, the reference benchmark – the LBMA Gold Price, returned average annualized growth of 8.66%. This offers a superb price-to-benchmark ratio, considering that the iShares Gold Trust ETF has been trading for 17 years.

We should also note that investing $100k in gold via an ETF is very cost-effective. For example, in the case of the iShares Gold Trust ETF, the annual expense ratio amounts to just 0.25%. Another benefit of taking the ETF route when investing in gold is that investors can cash out their position at any time. This is because the ETF will trade on a major stock exchange.

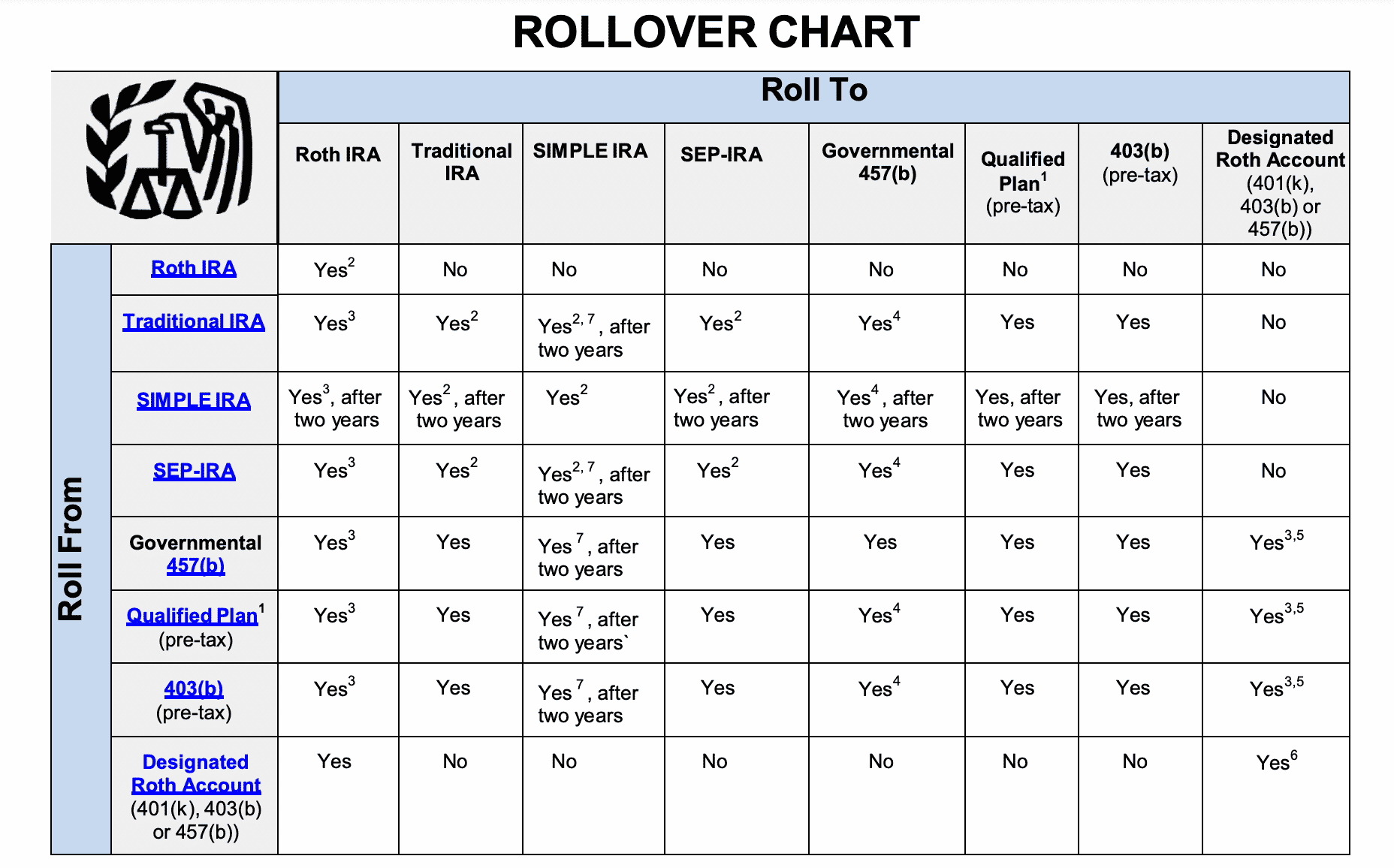

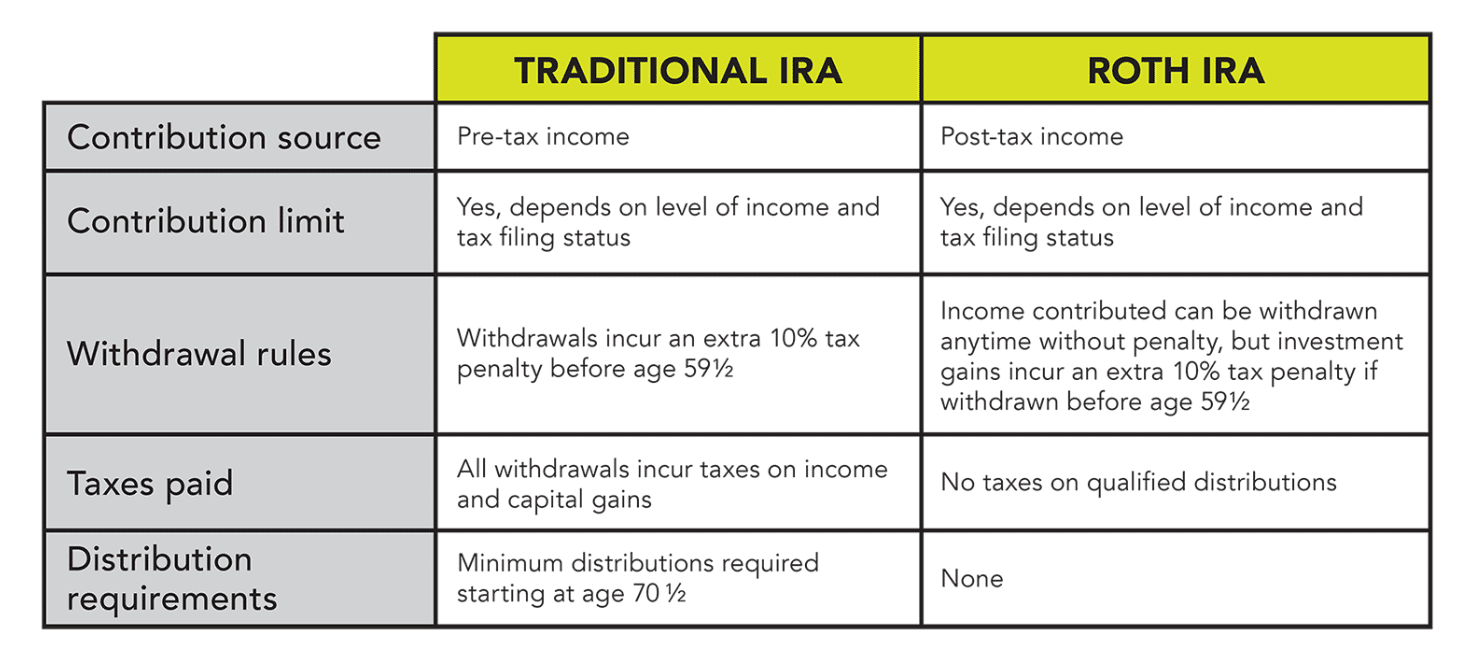

9. Retirement Accounts – Make Investments in a Tax-Efficient Way

Investing will attract unnecessary tax obligations on realized profits. However, one such way for long-term investors to reduce their tax burden is to open a suitable retirement account. In the US, workers often have access to a 401 (k) plan via the company that they work for.

Not all companies in the US offer 401 (k)s, but if this is available to the worker, they should maximize their annual limit – which stands at $20,000 ($27,000 for over 50s). Why? Put simply, 401 (k) investments offer tax advantages across two core options – a Roth and a traditional plan.

A Roth 401 (k) will initially tax the investment as normal. This means that when payroll deducts the funds and allocates this to the 401 (k) plan, the tax will be withheld. However, when it comes to withdrawing funds from a Roth 401 (k) at the age of retirement, no tax will be deducted.

The other option is a traditional 401 (k). This enables the worker to deduct money from their salary in a tax-free manner for the purpose of investing in their 401 (k) plan. The tax will, however, be payable when withdrawals are made from the traditional 401 (k) upon reaching the age of retirement.

Those wondering whether to opt for a traditional or Roth plan should consider how long they intend to make contributions. Typically, those with time on their side will opt for a Roth. Either way, another benefit of both Roth and traditional 401 (k)s is that some companies in the US will match the worker’s contributions.

For instance, if the company matches 5% per year and the worker allocates the full $20,000 into their 401 (k) plan, this will generate an additional $1,000 annually. This is free money that will also generate growth over the course of the 401 (k) plan. After maxing out a 401 (k), investors might then consider opening an IRA.

IRAs are readily accessible at online brokers and they permit a maximum investment of $6,000 ($7,000 for over 50s) per year. IRAs come in the form of Roth and traditional plans, and the fundamentals here work just like a 401 (k). But, because IRAs are offered by online brokers, the investor will have access to significantly more assets when compared to a 401 (k) plan.

10. Crypto Staking and Interest Accounts – Earn Passive Income on Crypto Investments

Both crypto staking and interest accounts are terms used interchangeably but largely refer to the same investment process. In a nutshell, the idea here is that by depositing crypto tokens into a staking pool or interest account, the investor will earn passive income. Interest is paid on the size of the deposit, and APYs vary from one platform to the next.

Moreover, platforms operating in this space will offer various APYs depending on the crypto asset being deposited and the chosen lock-up term. One of the best options in this market is Quint – which offers a ‘super staking’ protocol with attractive rewards. Put simply, by depositing Quint tokens into the pool, the investor will be paid a fixed rate of interest.

Not only that, but for every 500 Quint tokens deposited, the investor will receive a free ticket entry into a competition. As of writing, a Bored Ape Yacht Club NFT is up for grabs which, during the bull market, was trading at over $1 million. The previous competition to this offered the chance to win a luxury watch worth over $100k.

Nonetheless, after the respective draw has been made, the winner will receive their prize. All investors that staked – including the winner, will then receive their original deposit back plus any interest earned. This offers a passive way to generate a yield on crypto investments and also to enter a risk-free competition.

Another platform operating in this space is Crypto.com. This platform offers crypto interest accounts, with the funds subsequently used by the provider for loans and liquidity. In turn, deposits into a Crypto.com account come with attractive APYs and a choice of three terms. The latter includes 1-month and 3-month lockup periods, alongside flexible withdrawals.

To offer some insight into what is available, as of writing, Crypto.com is offering interest of up to 8.5% on the popular stablecoin USDC, 6% on Ethereum, and 5% on Bitcoin. In order to obtain the highest APY, a lock-up term of three months should be selected. Flexible accounts with instant withdrawals offer less competitive APYs.

11. Bonds – Invest in a Variety of Bonds for Passive Income

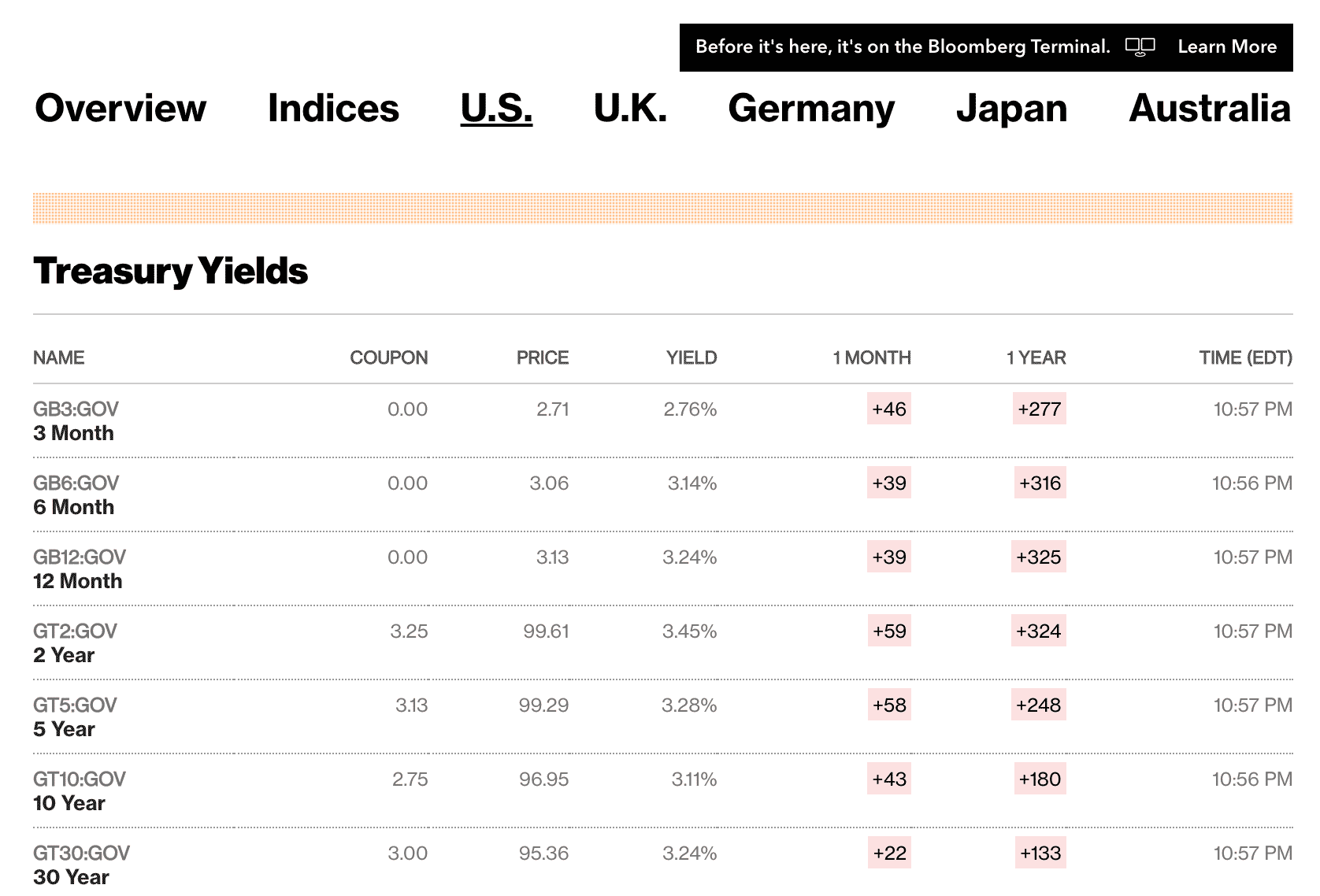

Those wondering what to invest $100k with for consistent, passive income might consider bonds. Bonds are issued by corporations and governments as a way to raise capital. Those buying a bond will be paid a fixed rate of interest, which is usually every six months. The investor will not receive their principal investment back until the bond matures.

The bond duration might last anywhere from a few months to several decades. When it comes to yields, this will depend on a wide variety of factors. At the forefront of this is how much risk is attached to the issuer and the length of the term. Short-term bonds issued by the US government, for example, carry very little risk.

In turn, the yield on short-term US Treasuries will be modest On the other hand, a 30-year bond issued by a small-cap company could carry sizable levels of risk but offer an attractive rate of interest. This is why many investors will build a basket of bonds that covers various risk levels, durations, and yields. One of the most cost-effective ways of investing in bonds is via an ETF.

Some ETFs offer access to thousands of different bonds, and there is also the opportunity to earn both income and capital gains. The reason for this is that many ETFs will sell their bond holdings before the date of maturity. And, if this results in a profit, investors of the ETF will be entitled to their share.

Let’s look at an example. We’ll say that the investor wishes to take a limited risk, so they purchase $100k worth of 5-year US Treasury bonds. The bonds pay a coupon rate of 3.2%. This means that every six months, the investor will receive an interest payment of $1,600 ($3,200 annually). The investor will receive their $100k back once the bonds mature in five years’ time.

How to Choose the Best $100k Investments For You

In this section of our guide on how to invest $100k, we will explore some of the most important considerations to make when building a portfolio on a DIY basis.

On a side note, for those looking to invest $500k we have a complete guide that covers the most popular assets and instruments in 2024.

Consider the Long-Term Strategy

The first step to consider when assessing how to invest $100k is with regard to the long-term strategy. This will enable the investor to create trackable targets and objectives.

For instance, if the investor wishes to build a retirement plan of 20 years, they can first assess how much they will need to live upon reaching this target.

Then, the investor can evaluate how much they will need to invest in the financial markets each month. Other investors will have shorter-term goals, and thus – the investment strategy should reflect this.

Passive or Active Investments

Some asset classes are conducive for passive investors. For example, when investing in an ETF or index fund, the provider will take care of maintaining and rebalancing the portfolio on behalf of its investors.

This means that the investor does not need to put any time or effort into researching the markets. On the other hand, those looking to buy crypto or individual stocks should be prepared to actively manage their investments.

Whether or not this is feasible will depend on how much experience and time the investor has.

Risk Assessment

When learning how to invest $100k, it is important to assess how much risk the investor feels comfortable taking. Some asset classes are riskier than others, albeit, typically this results in higher gains.

- For example, although crypto assets like Ethereum are highly volatile, the token has increased by more than 1,600,000% since it was launched in 2015.

- Another example of an asset that was considered risky when it first went public in 2010 is Tesla stock. Once again, the risk was worth taking, as Tesla stock has since grown by more than 21,000% since its IPO.

However, as the investor increases the amount of risk being taken, this amplifies the odds of making a loss. Therefore, when assessing how to invest $100,000, the portfolio should also consist of lower-risk assets to help create more balance.

Income, Growth, or Both

Another metric to consider when assessing the best way to invest $100k is whether the investor prefers assets that favor income, growth, or a good blend of the two.

For example, crypto assets are typically associated with growth. This means that in order to make a return, the value of the token will need to rise in the open market.

This is also the case with growth stocks like Tesla and Amazon, which do not pay dividends but have generated sizable capital gains since becoming public companies.

On the other hand, some assets only generate income and offer little to no growth. A good example here is bonds, which only offer interest payments.

Then there are assets that offer a good blend of income and growth. Dividend stocks are a great example, as they distribute quarterly payments – which is in addition to capital gains if the value of the shares increase.

Liquidity

Often not considered by inexperienced traders, another important metric to take into account when evaluating the best place to invest $100k is how liquid the respective market is.

This refers to how easy or difficult it will be to sell the investment for cash when the time arises. For example, the likes of stocks, crypto, and ETFs are very liquid, and the investor can cash the position out whenever the market is open.

However, bonds and real estate should be considered illiquid. For instance, bonds remain active until the maturity date is reached, and selling real estate requires the investor to find a suitable buyer – however long that takes.

Where to Invest $100k Right Now – The Best Option?

When assessing what to invest in right now with $100k, the investor might consider a selection of the asset classes that we have discussed on this page. This includes a variety of potential upsides and risk profiles, throughout stocks, bonds, index funds, and more.

One of the best investments that we came across is FightOut ($FGHT) – a fitness app that gives its users an opportunity to earn M2E rewards by completing their daily workouts. At press time, $FGHT can be bought at a discounted price of $0.0167.

How to Invest $100k – FightOut Tutorial

Those asking “what can I invest in with $100k” right now might consider a blend of low-risk asset classes, in addition to growth markets such as crypto presales.

Below, we offer some insight into how to invest in FightOut via its presale dashboard in less than 10 minutes.

Step 1- Setup a Crypto Wallet

Buyers need to ensure that they have a crypto wallet like MetaMask. (Mobile users are recommended to download the TrustWallet)

Step 2- Connect the Wallet to Presale

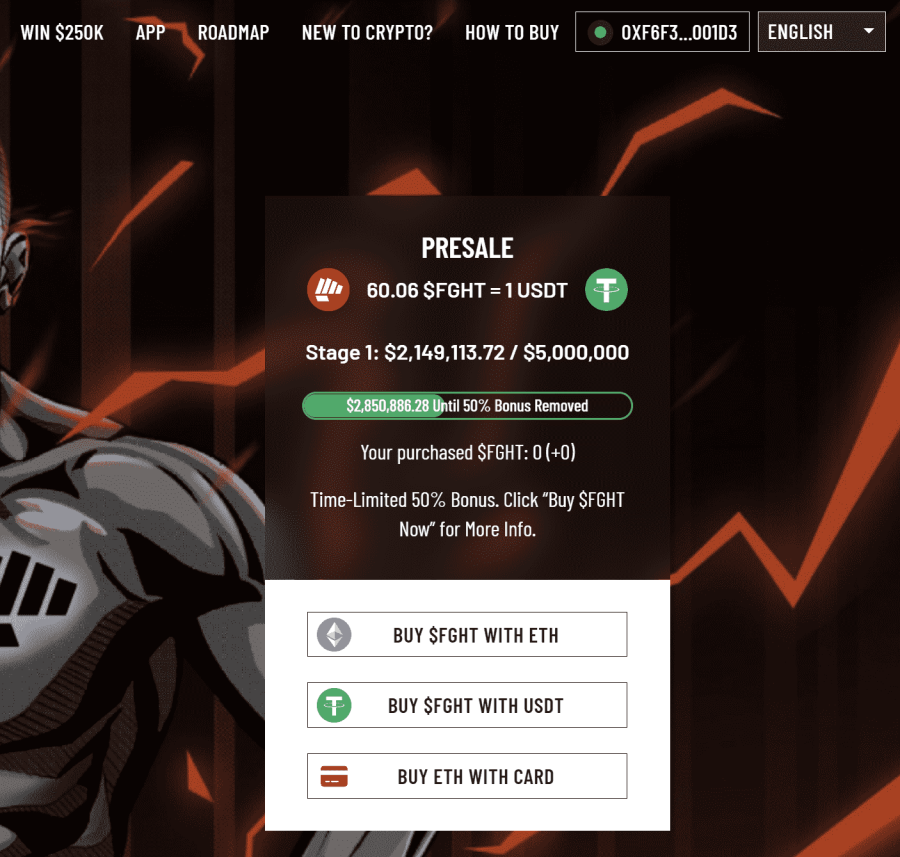

After the installation, investors should head toward FightOut’s official presale page. Buyers should then find and click on the “BUY $FGHT NOW” button. Then, they must choose the wallet they have installed (eg Metamask or TrustWallet) and login to their wallets.

Step 3- Acquire ETH/USDT

For this step, investors must have an adequate balance of ETH/USDT in their wallets. Herein, buyers also have the option to buy ETH via a credit card.

Now, investors can click either on the “Buy $FGHT with ETH” or “Buy FGHT with USDT” button.

Step 4- Buy $FGHT Tokens

In this step, buyers should enter the amount of ETH/USDT they wish to exchange for $FGHT tokens.

Step 5- Claim the Tokens

In the last step, buyers can confirm the transaction after checking the number of $FGHT tokens they would receive. However, they can claim these tokens based on the vesting period they choose to go for.

Conclusion

This guide has cleared the mist on the best way to invest $100k. No two investor profiles are the same, which is why it is important to assess the long-term objectives of the portfolio in terms of risk and upside.

In addition to index funds, gold, stocks, and bonds – we also considered up-and-coming crypto projects that offer early access in return for preferential pricing.

FightOut, for example, is offering its token at presale prices. The project is in its development journey – in which it will aim to help users maximize their crypto earnings by incentivizing them with Move-to-Earn rewards. $FGHT has already raised over $2.3 million in a short period. Investors can grab these tokens at a low price of $0.0167 per token.

Fight Out - Next Big Train-to-Earn Crypto

- Backed by LBank Labs, Transak

- Earn Rewards for Working Out

- Level Up and Compete in the Metaverse

- Presale Live Now - $5M Raised

- Real-World Community, Gym Chain

FAQ

What is the best way to invest $100k safely?

How much interest does $100k earn?

Should I invest $100k in stocks or real estate?

How to invest $100k to make $1 million?

What is the best way to invest $100k for income?

References

- https://www.ameriprise.com/financial-goals-priorities/taxes/how-are-investments-taxed

- https://www.irs.gov/retirement-plans/401k-plans

- https://www.hl.co.uk/news/articles/bond-funds-sector-review-volatile-times-for-bonds