Robo advisors are ideal for beginners that wish to invest in the financial markets passively. The best robo advisors in the UK will automatically build, rebalance, and maintain a selection of investments on behalf of the investor – often at competitive fees.

In this guide, we review the best UK robo advisor platforms in 2025 for performance, fees, user-friendliness, safety, and more.

The best short-term investments in the UK to consider gaining exposure to in 2025 are listed below: The above list of short-term investment options covers digital assets, crypto presales, stocks, and more. Read on to learn more about each investment.10 Best Robo Advisors UK 2025 List – Compare Robo Advisors

Best UK Robo Advisors Reviewed

In this section, we explore 10 of the best short-term investments in the UK to consider today.

Across each investment, we highlight the risk and potential reward to take into account, alongside the fundamentals of how to enter a position.

1. Dash 2 Trade – Newly Launched Analytics Platform With Ongoing Crypto Presale

Although Dash 2 Trade is not a robo advisor per se, the project might suit investors in the UK that are looking for short-term investment opportunities. The reason for this is that Dash 2 Trade is offering UK and global investors its native crypto token – D2T, via a presale launch. This means that early investors will secure a favorable entry price.

This is not too dissimilar to investing in a company before it goes public via an IPO. The Dash 2 Trade project will be launching its innovative analytics terminal – which will be jam-packed with features, in 2023. The team of developers is working hard to ensure that Dash 2 Trade becomes the go-to platform for crypto data and trading tools.

One such example is the Dash 2 Trade signal service – which will be available to premium members that pay their fees in D2T tokens. This will provide several trading suggestions throughout the week that inform members of which crypto asset to buy or sell – whether that’s Bitcoin, BNB, or Ethereum.

Members will also be told the suggested entry, stop-loss, and take-profit order price. This means that D2T holders can buy cryptocurrency in the UK without needing to spend many hours researching the market each day. Instead, members can head over to a UK crypto exchange and enter the orders as per the Dash 2 Trade signal.

Additionally, Dash 2 Trade will provide an entire dashboard that is dedicated to real-time metrics and insights. This includes social media metrics that highlight trending cryptocurrencies and presales, ICO ratings, strategy-building, and backtesting tools, on-chain statistics, new exchange listings, and much more.

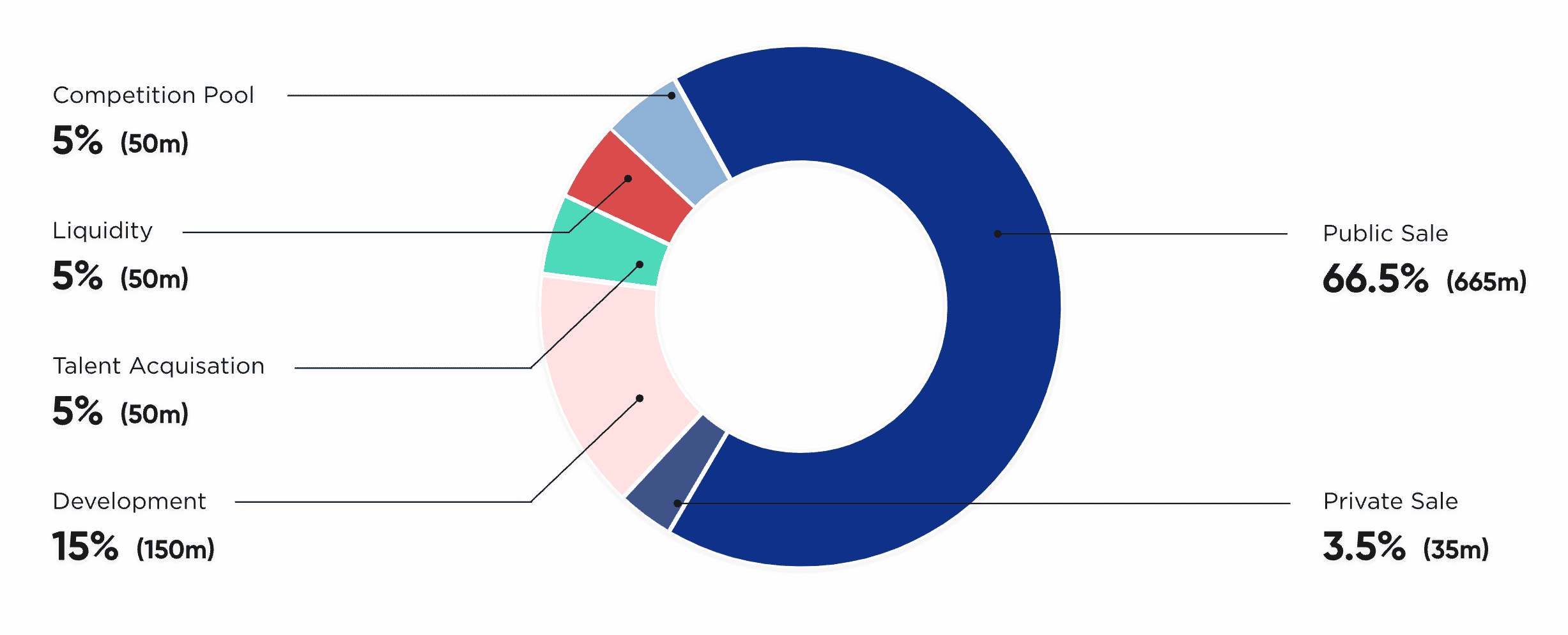

The Dash 2 Trade whitepaper provides a full and detailed explanation of each feature and tool that its analytics dashboard will offer. Investors in the UK can now take part in phase two of the Dash 2 Trade presale, which is offering the D2T token at $0.05 each. More than $2.5 million has been raised in the first week of the presale alone.

After each phase – of which there are nine, the presale price will increase. From an investment perspective, this offers an immediate upside for those that purchase D2T tokens as early as possible. Check out the Dash 2 Trade competition too – which will offer one lucky investor ($150 minimum investment) the chance to win $150k worth of D2T Tokens.

Check out the Dash 2 Trade Telegram group too – which is where the team releases new updates on the project. Also, consider reading our guide on how to buy D2T tokens.

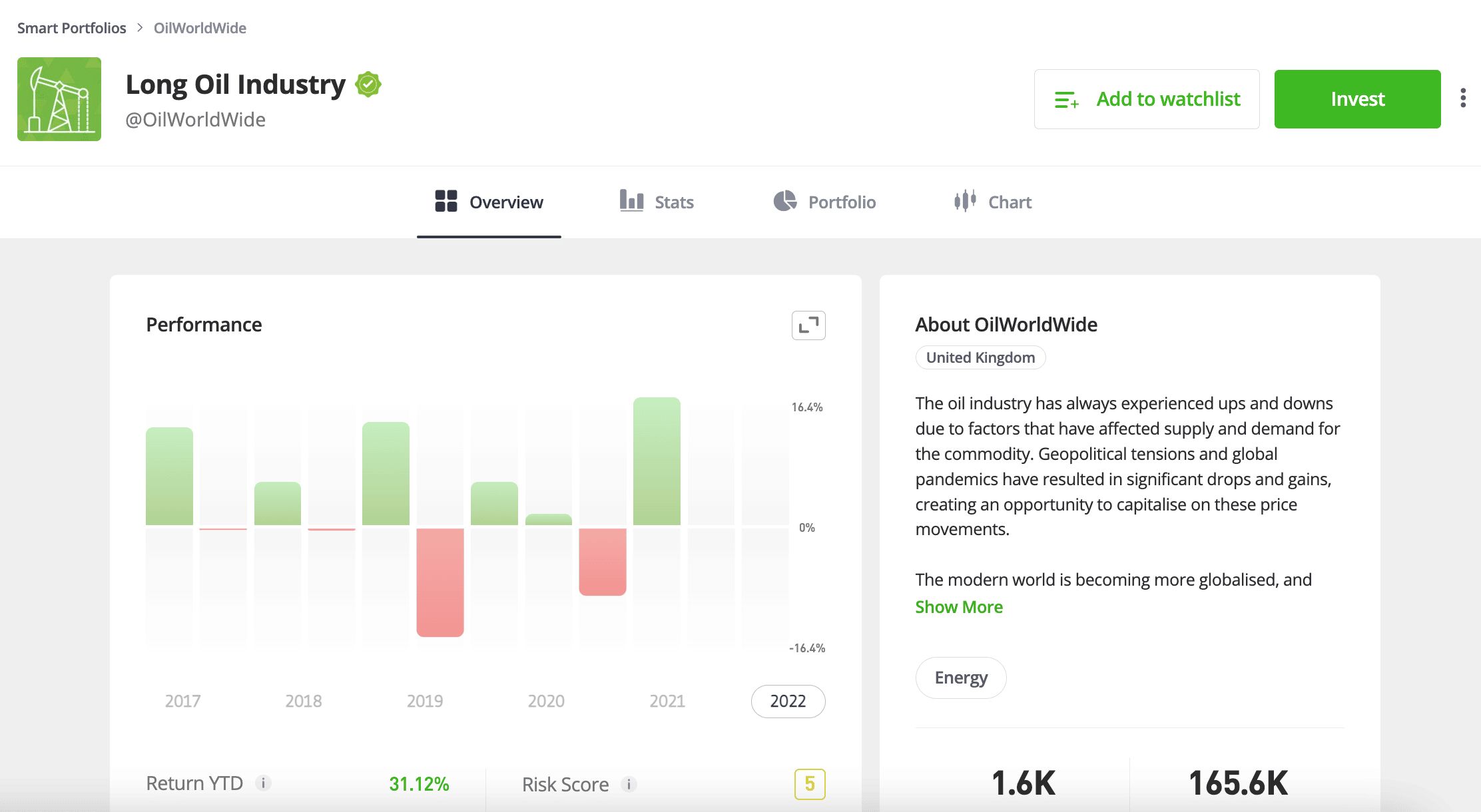

2. eToro – Passively Trade Stocks, ETFs, Crypto, and Forex via Copy Trading

In addition to the aforementioned Dash 2 Trade presale, investors in search of the best UK robo advisors might also consider eToro. Although eToro doesn’t standalone conventional robo advisors, it does host an industry-leading Copy Trading platform. This means that investors in the UK can elect to trade passively simply by ‘copying’ their favorite trader, or a ‘Smart Portfolio’ of assets.

One of the most popular of the latter is known as ‘Napoleon-X‘, which makes use of robo trading style strategies, which it refers to as ‘quantitative machine-learning’. Notably those copytrading Napoleon-X outperformed the 2022 crypto bear market.

In other words, eToro users will automatically mirror the investments of a successful trader that has an extended track record of making consistent gains. There are no extra fees to pay when utilizing the Copy Trading tool and at eToro, all stock and ETF investments are commission-free.

Moreover, crypto assets are charged just 1% per slide, and CFD instruments on a spread-only basis. The minimum Copy Trading investment is $200 per trader – or about £180. In terms of how the process works, positions are copied on a proportionate basis. For example, we’ll say that somebody in the UK makes a £10,000 investment into a successful stock trader that uses eToro.

A couple of days later, the stock trader elects to risk 10% of their investment capital into HSBC stocks. This means that the eToro user will automatically buy £1,000 worth of HSBC stocks (10% of £10,000 investment). A few months later, the investor sells their HSBC stock investment at gains of 32%. This means that the eToro user also makes a profit of 32%, albeit, on a £1,000 trade.

When compared to robo advisor investing, Copy Trading offers significantly more flexibility. For instance, many robo advisors only offer access to a small number of portfolios that exclusively invest in ETFs. However, there is no option to add individual investments. Copy Trading, on the other hand, offers access to thousands of traders and day trading markets.

| Assets | Fees | Min Deposit |

| Copy Trading across stocks, ETFs, forex, crypto, and indices | No additional fees for Copy Trading. Stocks/ETF at 0% commission. Crypto at 1%. CFDs on a spread-only basis. | $200 (about £180) |

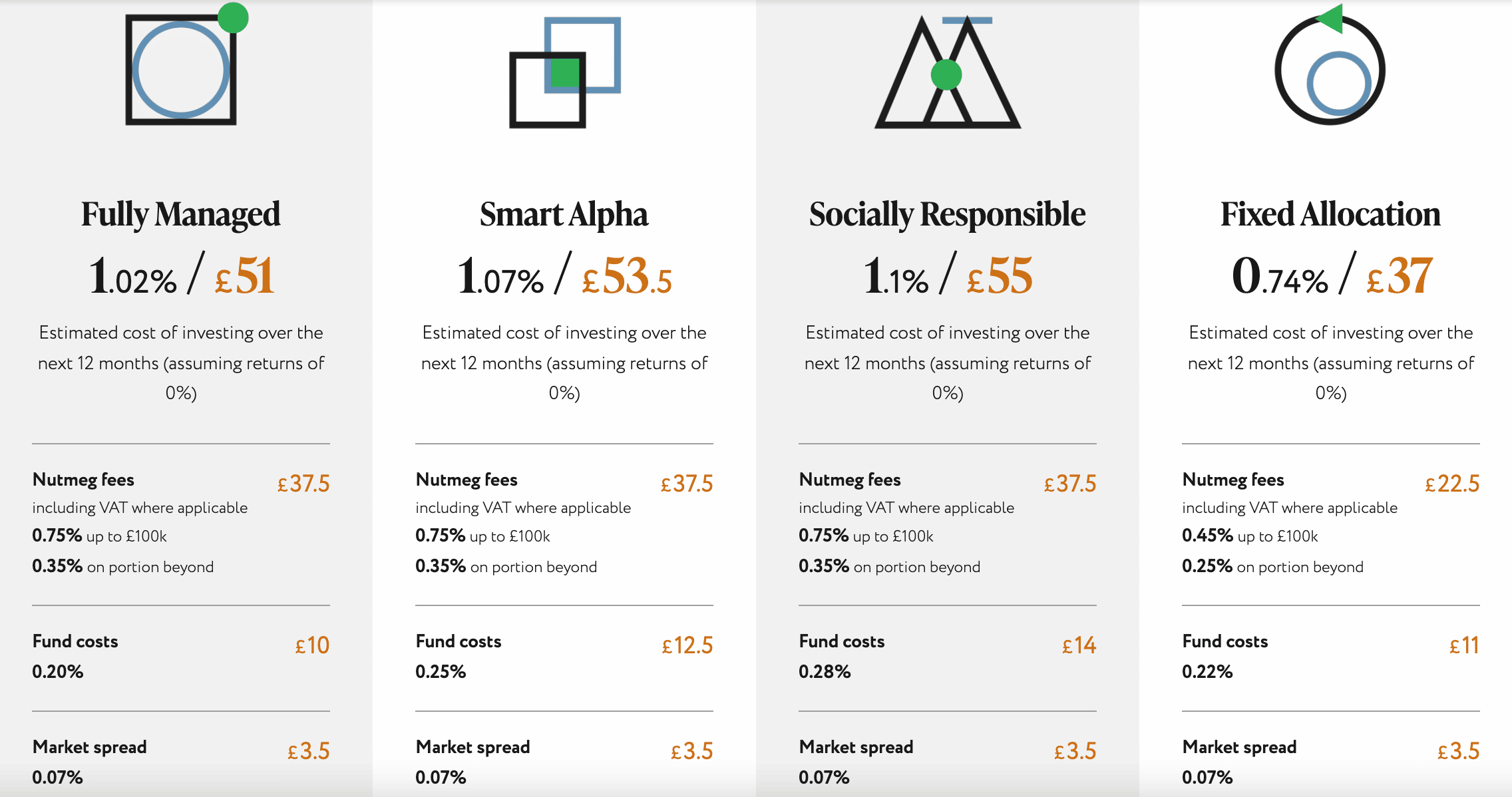

3. Nutmeg – Popular Robo Advisor Platform in the UK

Those in the market for a traditional robo advisor might consider Nutmeg – which has been active in this space for over a decade. Nutmeg offers a variety of robo advisor portfolios – all of which are managed and rebalanced on behalf of investors. The fully managed portfolio is one such example, which offers exposure to ETFs mainly in the US and UK.

There is also exposure to Japan, Canada, and France. The fully managed portfolio attracts Nutmeg fees of 0.75% annually, and 0.35% on investments above £100k. There is also a fund cost of 0.20% and a market spread of 0.07%. Another option is the socially responsible robo advisor portfolio.

As the name implies, this Nutmeg portfolio invests exclusively in ETFs that have high ESG (Environmental, Social, and Governance) standards. The cheapest robo advisor portfolio at Nutmeg is the fixed allocation fund. This attracts Nutmeg fees of 0.45% up to the first £100k, and 0.25% on anything over this figure.

Nonetheless, when compared to other options in the market (such as buying ETFs directly), Nutmeg is considered expensive. The minimum investment that Nutmeg requires is £500. Although the Nutmeg robo advisor suggests a minimum holding period of three years, investors can withdraw their capital at any given time without penalty.

| Assets | Fees | Min Deposit |

| ETFs only | Nutmeg fee of up to 0.75%, fund cost of up to 0.28%, market spread of up to 0.07% | £500 |

4. Wealthify – Choose From Five Different Risk-Adjusted Robo Advisor Portfolios

Wealthify is one of the best robo advisors in the UK for those that like to invest based on risk. The platform offers five risk-adjusted robo advisor portfolios that go from cautious to aggressive. Depending on the chosen risk level, the portfolio will hold investments from a variety of asset classes.

This includes everything from stocks and property to government bonds and cash. When it comes to performance, all five robo portfolios made a loss of between 6-7% in the 2021/22 financial year. In the previous financial year, the adventurous portfolio was the best performer, generating gains of 18.15. The cautious portfolio, on the other hand, made just 1.50%.

Those on a budget will appreciate that there is no minimum investment requirement at Wealthify. Moreover, investors can withdraw funds from their Wealthify account at any given time. In terms of fees, Wealthify charges an annual fee of 0.60%. There are also investment fees to take into account and Wealthify notes that this averages 0.16%.

| Assets | Fees | Min Deposit |

| Stocks, property, cash, infrastructure, government bonds | Wealthify annual fee of 0.60%, average investment fees of 0.16% | No minimum |

5. Moneyfarm – Diversified Portfolios Across Seven Risk Levels

In a similar nature to Wealthify, Moneyfarm offers multiple portfolios to choose from based on risk. There are seven portfolios in total and the range of assets held will depend on how much risk the investor decides to take. Level 7, which is the highest-risk option, is perhaps the best robo advisor in the UK for performance.

For instance, since the portfolio was incepted in 2016, it has grown by 74.9%. This translates into average annualized gains of 8.9%. The vast majority of funds within this robo advisor portfolio (70%) have exposure to developed market stocks. There is also exposure to emerging market stocks (11%) and commodities (5%).

Other assets include developed government bonds (9%), high-yield emerging market bonds (4%), and cash (2%). At the other end of the spectrum, the Moneyfarm portfolio with a risk rating of 1 has performed very poorly. In fact, since its inception in 2016, it has grown by just 1.4%. This means that the portfolio hasn’t gotten anywhere near the rate of inflation.

The low-risk portfolio is largely invested in cash and short-term government bonds (39%). It also has a large holding in investment-grade corporate bonds (25%) and developed market stocks (19%). In terms of fees, investments under £10k cost 0.75% annually.

This is reduced to 0.70% for investments between £10k and £20k. The lowest price offered is 0.35% – but this requires a minimum investment of £500k. The minimum investment at Moneyfarm is £500, albeit, the platform suggests depositing at least £2,500. The platform also supports direct debits from a minimum of £100 per month.

| Assets | Fees | Min Deposit |

| Government and corporate bonds, stocks, cash, commodities | Moneyfarm fee of up to 0.75% annually, plus investment fees | £500 |

6. eVestor – Invest in a Basket of Managed Assets From Just £1

Those on a budget might consider eVestor the best robo advisor in the UK. After opening an account with this regulated provider, investors can get started with a capital outlay of just £1. eVestor offers three managed portfolios to choose from across three risk levels – low, medium, and high.

Conservative investors opting for the low-risk portfolio will have 61% of their capital allocated to stocks, 34% to fixed-interest assets, and the balance between property and cash. More adventurous investors, however, will have 89% of their capital allocated to stocks. eVestor offers access to both the UK and international markets, via a single portfolio.

When it comes to fees, eVestor charges up to 0.51%, albeit, this will depend on the chosen portfolio. eVestor also offers ISAs for those looking to invest in a tax-efficient way.

| Assets | Fees | Min Deposit |

| Stocks, fixed-rate assets, property, cash | Up to 0.51% annually | £1 |

7. InvestEngine – Low Managed Robo Advisor Portfolio Fees of 0.25%

InvestEngine is perhaps the best robo advisor in the UK for low management fees. By opting for this provider, UK investors will pay an annual management fee of just 0.25%. This is in addition to ETF expense ratios and market spreads, which are standard in this industry nonetheless.

Crucially, however, InvestEngine does not make a markup on market spreads, so investors have access to industry-leading rates. There are two portfolios to choose from at InvestEngine. The growth portfolio is suited for investors that wish to focus their capital on high-growth markets and appreciation.

The income portfolio is ideal for those that seek passive and predictable dividends. In addition to its managed portfolios, InvestEngine also offers DIY accounts and ISAs. The minimum investment at InvestEngine is £100.

| Assets | Fees | Min Deposit |

| ETFs only | InvestEngine fee of 0.25% annually, plus investment fees (no markup) | £100 |

8. Plum – Money Saving App With Automated Investments

Plum might be considered the best robo advisor in the UK for smartphone users. Its mobile app for iOS and Android enables UK users to both save and invest in one safe place. Its savings and budget tool enables users to connect their UK bank accounts and credit cards to make it a seamless task in keeping tabs on spending habits.

This also enables users to compare energy bills and set saving goals. The investment side of the Plum app is also impressive, with 12 pre-made portfolios to choose from. This includes specific investment sectors – such as clean and green companies, in addition to emerging markets like Asia and Africa.

Other popular portfolios offered by Plum include tech giants, medical stocks, and US-only companies. In terms of pricing, the plus account costs just £1 per month and this offers access to all supports portfolios and markets. The annual fund management fee averages 0.48%. The pro plan costs £2.99 per month and this unlocks savings goals and budgeting tools.

| Assets | Fees | Min Deposit |

| 12 portfolios across both UK and international stocks and ETFs | The average fund fee is 0.48%. Free plan available, in addition to a plus (£1/month) and pro (£2.99/month) tiers. | £1 |

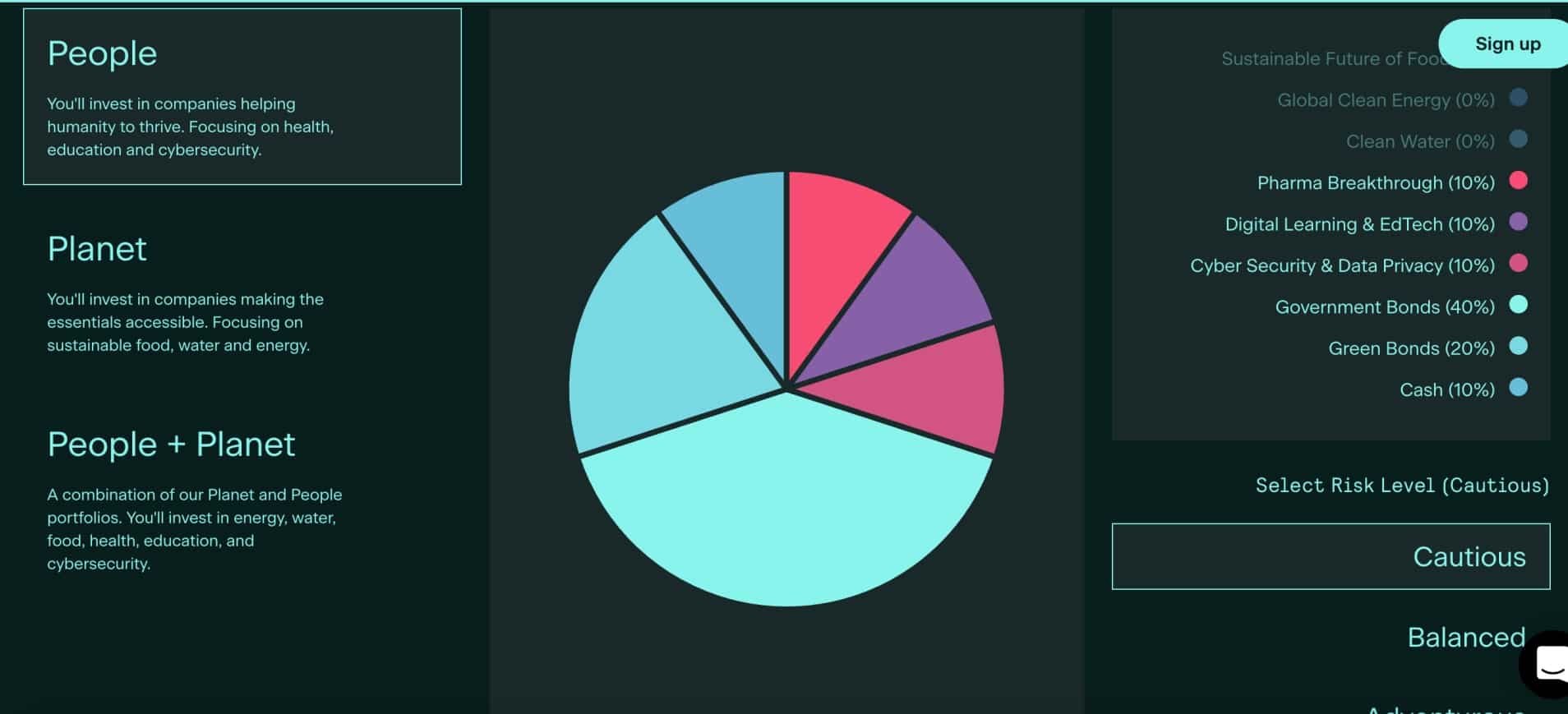

9. Circa5000 – Top Robo Advisor for Ethical and Sustainable Investments

Circa5000 is the best robo advisor in the UK for those wishing to make ethical and sustainable investments. There are a variety of portfolios to choose from across three different risk levels – cautious, balanced, and adventurous.

The ‘people’ portfolio invests in stocks that aim to improve the quality of life for society, and this includes firms involved in cybersecurity, education, and health. The ‘planet’ portfolio invests in stocks that are involved in industries providing sustainable access to energy, food, and water. Investors can also blend the two objectives via the ‘people + planet’ portfolio.

When it comes to pricing, Circa5000 charges £1 per month, plus a platform fee of 0.45% annually. There is also a fun fee that will average 0.24% and 0.65% – depending on the market.

| Assets | Fees | Min Deposit |

| Three risk levels across three portfolio objectives. Focused on green and sustainable industries | £1 per month in addition to a 0.45% annual fee. Average fund fee of between 0.24% and 0.65% | £5 |

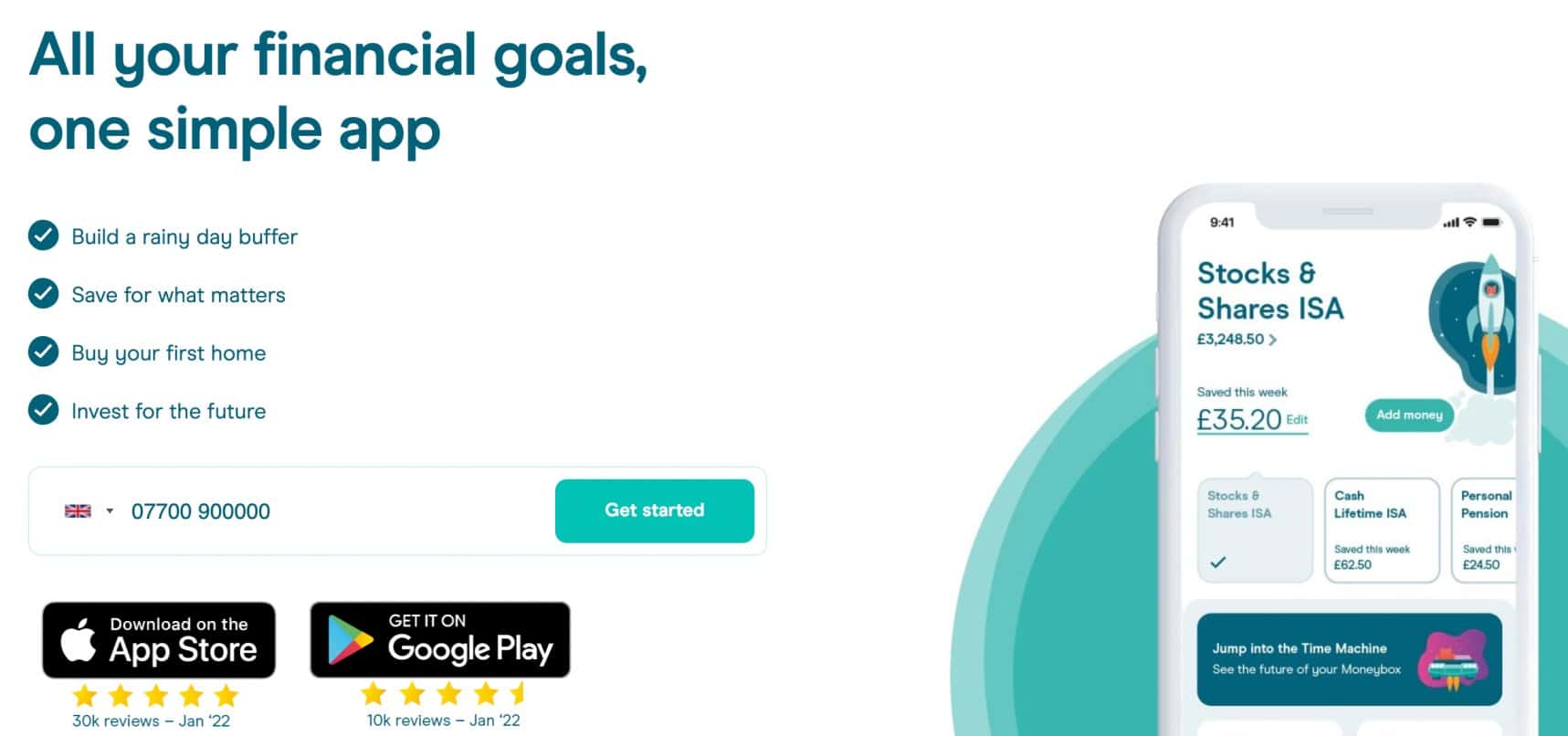

10. Moneybox – Automatically Invest Spare Change From Debit Card Transactions

The final option to consider on this list of the best robo advisors in the UK is Moneybox. One of the top features offered by this provider is its ‘spare change roundup’ tool. In a nutshell, by downloading the Moneybox app to an iOS or Android smartphone, users can automatically invest their spare change.

For example, let’s suppose that the user makes a supermarket purchase of £9.10. Through the Moneybox app, the user can automatically round the transaction up to £10, with the 90p balance being invested into the financial markets. In terms of investment options, Moneybox offers access to a wide range of funds.

This includes ETFs that track UK and international stocks, commodities, index funds, and more. Moneybox charges an annual platform fee of 0.45% for balances up to £100k. There is also a monthly fee of £1, which kicks in after the first three months. ETF costs will vary depending on the fund, but range from 0.12% and 0.58%.

| Assets | Fees |

Min Deposit |

| ETFs that track stocks, commodities, and index funds. | £1 per month (after three months) in addition to a 0.45% annual fee. Average fund fee of between 0.12% and 0.58% | £1 |

What are Robo Advisors UK?

In a nutshell, robo advisors enable investors in the UK to inject capital into the financial markets without needing to have any prior experience. In fact, robo financial advisors promote a completely passive investment experience.

The reason for this is that the robo advisor will determine which assets to buy and sell, based on the investor’s tolerance for risk.

- For example, the best robo advisors in the UK will initially require the investor to answer a series of questions regarding their financial goals and risk appetite.

- The robo advisor platform will then suggest a portfolio of assets that align with these goals.

- The robo advisor will regularly rebalance the portfolio, which means adding, removing, and/or reweighting the basket of assets.

Ultimately, top robo advisors are suitable for beginners that want to put money into stocks, ETFs, and other assets without spending time researching the markets.

Robo advisors charge a variety of fees, which can make the process expensive when compared to traditional DIY investing. This can include a platform, fund, and management fee that is multiplied by the total investment size.

How Do Robo Advisors Work?

The first step for investors to take is to choose the best robo advisor in the UK for their requirements. Further down in this guide, we provide some guidance on what to look for when selecting a provider. Nonetheless, the next step for investors to take is to open an account with their chosen robo advisor and proceed to make a deposit.

In some cases, the provider will require at least £500 to get started. However, some of the best robo advisors in the UK enable investors to get the ball rolling with just £1. Either way, after making a deposit, the investor will need to select the best portfolio for their requirements.

Some robo advisors have a questionnaire structure in place. This asks a range of questions to determine how much risk the investor feels comfortable taking and what kind of financial returns are being targeted.

For instance:

- If the investor wishes to take a conservative approach, the robot advisor might suggest low-risk funds that largely include bonds and cash.

- On the other hand, more adventurous investors might have a portfolio that consists of emerging market stocks and bonds, in addition to commodities.

In other cases, the robot advisor might offer a set of pre-built portfolios that target certain markets. This might include index funds that track the US stock markets or government bonds from low-risk jurisdictions.

After the investment is made, the robot advisor will then manage the portfolio of assets on behalf of investors. As the name implies, the robot advisor will generally make investment decisions through automated technologies. This is in contrast to a traditional mutual fund, which is managed by experienced human analysts.

What Assets do Robo Advisors Invest in?

Once again, the types of assets that investors in the UK have access to will depend on the robo advisor provider. In most cases, however, the robot advisor will invest purely in ETFs. This is with the view of offering the investor access to many diversified markets in a passive and low-cost way.

For example, the best robo advisors will have access to ETFs from both the UK and international markets.

Supported assets might therefore include:

- Shares from the London Stock Exchange and AIM

- Shares from the US and other international markets

- Real estate

- Gold and other commodities

- Government and corporate bonds

- Cash and cash equivalents

Each of the above asset classes will come with its own risks and potential financial returns. This is why the best robo advisors in the UK begin the investment process with a questionnaire, with the view of assessing the financial profile of the investor.

Why Use a Robo Advisor?

Robo advisors won’t be suitable for investor types – especially those that prefer to make their own investment decisions.

Nevertheless, in the sections below, we discuss some of the key reasons why robo advisors are increasingly becoming popular with UK investors.

Passive Investments

Perhaps the most obvious benefit of using a robo advisor is that the process enables UK residents to invest passively.

As noted above, there is often no requirement to actually choose individual investments. Instead, based on the financial objectives and risk tolerance of the investor, the robot advisor will build a suitable portfolio.

Maintained Portfolio

The passive experience does not stop after the initial investment is made. On the contrary, the best robo advisors in the UK will manage and maintain the portfolio on behalf of investors. This generally involves rebalancing and reweighting the portfolio of assets to ensure that it continues to align with the investors’ goals.

Rebalancing will result in the robo advisor adding or removing assets from the portfolio. For instance, if the investor has opted for a low-risk portfolio but as per market conditions, certain assets present a greater level of volatility, the robot advisor might sell the respective financial instruments.

Reweighting, on the other hand, involves increasing or decreasing the percentage that the asset contributes to the overall portfolio. For example, if there is too much exposure to government bonds in an adventurous portfolio, the robot advisor might reduce the position.

Diversification

Another benefit that the best robo advisors in the UK offer is instant diversification. This means that the investment funds will be spread across several different asset classes irrespective of the chosen risk profile.

For example, let’s suppose that a balanced robo advisor portfolio holds 60% worth of US-listed stocks. A well-diversified portfolio might hold hundreds or even thousands of stocks from a variety of industries.

From the perspective of the investor, however, diversification is achieved by making a single investment into their chosen robo advisor platform.

How to Choose the Best Financial Robo Advisor?

As is evident from the comprehensiveness of this guide, there are dozens of robo advisors to choose from in the UK.

In this section, we explore some of the key points to look for when selecting the best financial robo advisor.

Regulation

The first metric to assess when searching for the best robo advisor in the UK is whether or not the platform is regulated.

In most cases, the provider should be authorized and licensed by the Financial Conduct Authority (FCA). This offers UK investors the assurance that the robo advisor is legitimate.

Minimum Deposit

After evaluating the safety of the platform, be sure to assess what minimum deposit requirement the robo advisor has in place.

As noted earlier, Nutmeg might be out of reach for some UK investors, considering that the minimum deposit stands at £500. Wealthify, on the other hand, has no minimum deposit requirement at all.

Supported Portfolios

The best robo advisors in the UK offer a wide range of investment portfolios to choose from. eToro, for example, offers thousands of options when it comes to choosing a trader to copy. This ensures that the investor can diversify their capital efficiently. Read our full eToro UK review here.

It is also important to assess what assets the robo portfolio has access to. Crucially, it’s wise to pick a portfolio that offers instant diversification.

Performance

It goes without saying that investors should also check past performance when selecting the best robo advisor, i.e. backtested data.

While it is true that past performance does not guarantee future results, it can be indicative of the abilities of the robo advisor. When assessing past results, make sure that this is based on at least five years of activity.

Robo Advisor Fees & Charges

Robo advisor platforms are in the business of making money, so investors in the UK should expect to pay fees.

There are a variety of fee types to look out for when choosing a provider, which we summarize below:

- Payments – Most robo advisors in the UK facilitate fee-free deposits and withdrawals. However, this should be checked nonetheless.

- Maintenance Fee – Otherwise referred to as a management/platform fee, robo advisors typically charge an annual percentage rate. For instance, Wealthify charges 0.60% of the total investment amount.

- Investment Fee and Market Spread – There will also be fees relevant to investments that the robo advisor makes on behalf of its investors. This typically comes in the form of an expense ratio charged by ETFs, as well as a market spread.

All in all, the best robo advisors in the UK will not charge more than 1% annually for their services – inclusive of investment-related fees.

eToro was the most cost-effective option that we discussed today, as there are no additional fees when utilizing the Copy Trading tool. Moreover, stocks and ETFs on the platform are commission-free – so investors only need to cover the market spread.

Are Robo Advisors Legit?

Yes, many of the robo advisors discussed on this page are authorized and regulated by the FCA. This means that investors can be sure that they are investing capital through a licensed and credible provider.

However, this isn’t to say that robo advisors are risk-free. On the contrary, there are no guarantees that investors will make money when using a robo advisor.

Instead, if the robo advisor makes poor investment decisions or the broader markets are on the decline, the investor can lose money. Readers may also be interested in our guide to crypto trading bots.

Conclusion

This comprehensive guide has analyzed the 10 best robo advisors in the UK. Although robo advisors serve a purpose, investment returns have historically been sluggish – especially with those that are heavily invested in the UK stock markets.

This is why a more favorable option could be to invest in high-grade crypto presales like Dash 2 Trade. As noted, Dash 2 Trade is offering its newly launched D2T token via a presale launch, which means that early investors get the best price possible.