There’s no getting away from the fact that today’s economic climate makes for a challenging investment environment. Rising inflation has led to higher interest rates, which have wreaked havoc on asset prices across the board. However, regardless of the macroeconomic situation, UK-based investors always have several options for where to park their cash in an attempt to generate a return.

With that in mind, this guide takes a closer look at the best investments in the UK, covering the reasons why they’re suited to today’s economic environment. We’ll also provide an overview of the top asset classes available to trade before detailing several effective tactics investors can use to identify potentially lucrative investments.

The 10 Best Investments UK for 2025

The decision of whether to invest in cryptocurrency, stocks, bonds or any other asset class, is one that must be taken with care. Due to the prevailing ‘risk-off’ sentiment within the market, many assets are showing high price volatility – which can make things challenging for beginner-to-intermediate investors.

However, listed below are 10 of the best investments in the UK right now, each offering the opportunity to generate a return in today’s market. We’ll explore each of these assets in the following section, ensuring investors have the information needed to make an informed investment decision.

- High Potential Crypto Presales Like Love Hate Inu – The Best Investment in the UK in 2025

- Tech Stocks – One of the Best Investments of the Last 20 Years

- High Yield Savings Accounts – The Safest Place to Park Your Money

- SPDR S&P 500 ETF (SPY) – Passive Investment for Tracking the US Stock Market

- WTI Crude Oil – Popular Commodity with Numerous Important Uses

- Unilever (ULVR) – Defensive Stock Listed on the FTSE 100

- Gold – Traditional ‘Safe Haven’ with New Relevance

- Vanguard Total Bond Market ETF (BND) – Leading ETF for US Bond Market Exposure

- iShares Core FTSE 100 UCITS ETF (ISF) – Widely-Used ETF for Exposure to the UK Stock Market

- Ethereum (ETH) – Top Blockchain Network with Huge Potential

A Closer Look at the Best Investments in the UK

Those who have opted to buy shares in recent months will understand the need for additional research and analysis before entering the market. Although the financial markets are always fast-paced, this is particularly evident in 2025, given the constant rate increases and geopolitical tensions.

Although nothing in the market is guaranteed, the above assets represent 10 investments in the UK that could have positive returns potential. Wondering what the best way to invest £75k in the UK is? Let’s take a closer look at these investments, covering what they are and why they’re so popular in today’s market:

1. High Potential Crypto Presales Like Love Hate Inu – The Best Investment in the UK in 2025

Cryptocurrencies are one of the best ways to make massive gains in a short space of time, though they’re not for the faint-hearted. Buying crypto comes with more risk than some of the other assets on this list, although buying during a crypto presale can offset the risk significantly. When done right, crypto presales can be the best short term investments in the UK.

Buying a crypto during its presale is similar to buying shares of a company before its IPO. The presale is an opportunity for early investors to buy in at a lower rate than the launch price. The presale price usually increases in the run-up to the official launch.

For example, our top crypto presale pick, Love Hate Inu, started its presale at $0.000085 per coin, but that will rise by 70% for launch to $0.000145. That means a £1,000 investment during the first week would be worth around £1,700 when the official launch takes place.

A recent presale success story was Lucky Block which began selling for $0.00015 but skyrocketed to $0.009 shortly after launch. That’s a 6,000% increase in weeks.

Love Hate Inu – The Best Crypto Presale for UK Investments

Love Hate Inu is perhaps the best crypto presale around right now. This new crypto is meme coin meets utility coin and could be ready to take the internet by storm.

Love Hate Inu is a meme coin, similar to the incredibly popular Reddit investment, Dogecoin, but it is introducing real-world usability to the meme coin format with its vote-to-earn system. Unlike Dogecoin, which is only a meme coin, Love Hate Inu will benefit from the popularity of viral meme coins while using its vote-to-earn system to maintain long-term sustainability.

LHINU users will be able to stake their coins to take part in votes on a wide variety of topics. In doing so, Love Hate Inu owners will be able to earn more tokens with each poll they participate in. That means LHINU stakers have a vested interest in taking an active role within the community.

In the first few days of the presale, the popularity of Love Hate Inu is already evident. Over $400,000 was raised within the first three days after its March 8 opening date. People have scrambled to buy into LHINU in the first week while it is at its lowest presale price of $0.000085. Each week, the presale price will increase slightly until the coin officially launches in May with a price of $0.000145.

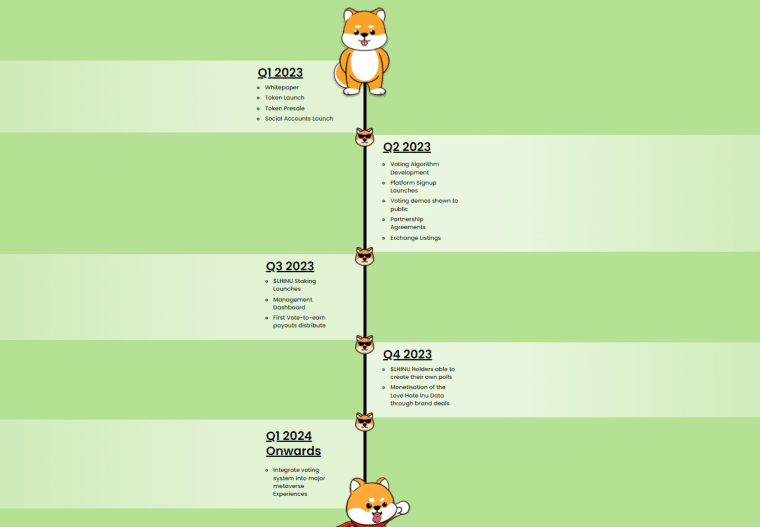

The roadmap for the first year of Love Hate Inu is as promising as its reception thus far. In Q3 2023, users will be able to start staking their coins and begin voting on polls put forward by the founders. In Q4 2023, LHINU owners will be able to create their own polls, and data from votes will start being used in conjunction with brands for analysis and research.

This will help Love Hate Inu establish a footing as a successful vote-to-earn coin due to its popularity and usefulness. Looking ahead, LHINU eventually aims to be a key part of voting in the Metaverse. Vote-to-earn via crypto is a secure method of voting due to its blockchain authentication, making it a necessary way to participate in the future Metaverse. There have even been calls for governments to begin using blockchain voting in national elections due to its security.

If Love Hate Inu establishes itself as a premiere vote-to-earn coin on the internet and within the metaverse, the investment potential is massive. It could be one of the best ways to invest £25k or more.

| Presale Started | March 8, 2023 |

| Purchase Methods | ETH, USDT, Credit/Debit card. |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

2. Tech Stocks – One of the Best Investments of the Last 20 Years

Tech stocks have been one of the best investments since the turn of the century. It almost seems like everywhere you look, a popular tech stock has made mind-boggling gains over the last 20+ years.

That’s why tech stocks are one of the best options for long-term investors. There are dozens of companies that fit the mold for this type of investment, but the key to good investing is to do research into companies you’re familiar with.

When considering what tech stock to invest in, there are two main factors to consider.

Is the company still growing?

If a tech company is still in its growth phase, it could still be a good investment, even for mature companies like Apple or Alphabet. Growth is often the key to making money in tech stocks because they rarely pay dividends. To analyze the growth of a company, look at the financial results of the last few years. Are revenue and profits still increasing? By how much? Does it look like revenue is beginning to taper off? These are all key factors when considering if a tech stock is still in its growth phase.

What industry is the company in?

Tech stocks cover a wide variety of industries. Netflix has a very different set of operating parameters from Uber. There may be a lot of crossover with tech stocks but be sure to consider the main industry the company makes money from and weigh up the future of that industry. For example, Nvidia has traditionally made most of its money from gaming, but with the rise of AI, it could make substantially more from that area.

Knowing what industries the tech stock you choose is likely to benefit from is crucial. For example, tech stocks can be combined with an ethical investment in the UK, depending on the industries chosen.

When you’ve considered the above, decide how much you want to invest and for how long. Typically with tech stocks, the longer you hold onto the stock, the better off you will be, but you usually won’t have any actual returns until you sell the stock. So it’s important to consider your investment timeline, whether that’s for retirement or something else.

3. High Yield Savings Accounts – The Safest Place to Park Your Money

High-yield savings accounts won’t make investors massive amounts of money quickly, but they’re a key part of any portfolio, and right now, saving rates in the UK are very favourable.

In the UK, a two-year fixed savings account pays up to around 4.45% interest per year. That’s a nice rate compared to the often sub-2% rates of years passed. There are also options that give you access to your money up to a certain number of times per year. Be careful not to check how many withdrawals are allowed, though. Too many, and you could be dropped down to a lower rate.

During times of economic uncertainty, high-yield savings accounts can be one of the best places to put money. When the stock market can be uncertain and liable to big swings, the peace of mind of a guaranteed interest rate is often worth the potentially lower gains.

When looking for a high-yield savings account, consider the various interest rates available and what conditions there are to meet the requirements for said rate. Easy access accounts typically give a lower interest rate but allow unlimited withdrawals, which is handy if you need to access the money in a pinch.

Notice accounts give access to your money but only with a certain amount of notice which can be up to 90 days, in exchange for a slightly higher rate.

Fixed-term interest accounts typically give a higher interest rate the longer you lock money away. They usually can’t be accessed without cancelling the agreement but offer, on average, the highest interest rates. Normal options for fixed-term savings accounts are one year, two years, and three-five years. The two-year fixed terms tend to offer the best interest rate to time locked away ratio.

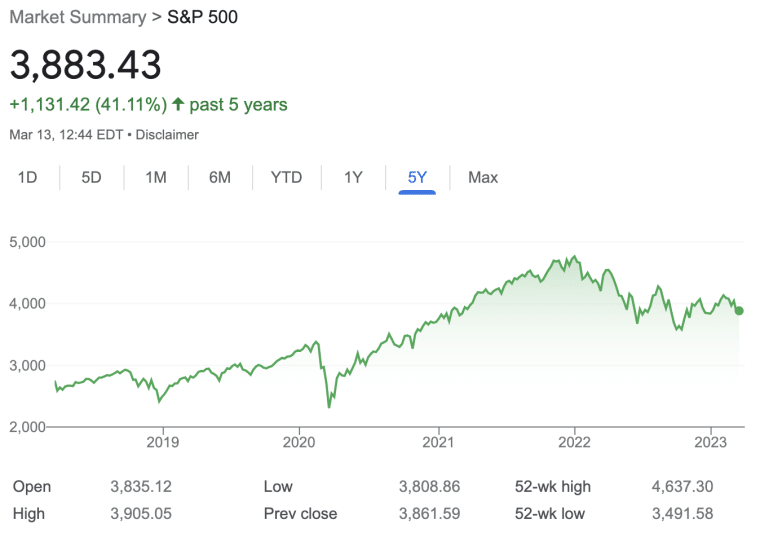

4. SPDR S&P 500 ETF (SPY) – Passive Investment for Tracking the US Stock Market

Those who have £10k to invest and are looking for an asset to hold long-term may wish to consider the SPDR S&P 500 ETF. This ETF can be invested in using many of the best trading platforms since it is one of the largest index funds in the world. Making it perhaps the best place to invest in the UK.

As the name suggests, the SPDR S&P 500 ETF emulates the S&P 500 – a market index tracking the performance of the 500 largest publicly-traded companies in the US. According to Forbes, the S&P 500 is often used as a proxy for the overall health of the stock market and the US economy.

This ETF is so popular since the S&P 500 has generated positive returns on average since its inception. In its current form, which began in the 1950s, the S&P 500 has generated an annualised return of 11.88%.

Due to this, many investors opt to place their capital in the SPDR S&P 500 ETF and leave it for years – or even decades. Some even opt for a dollar-cost averaging approach to compound their position, making it one of the top investments in the UK when saving for retirement.

5. WTI Crude Oil – Popular Commodity with Numerous Important Uses

Another of the investments in the UK that have attracted attention in recent times is WTI Crude oil. Crude oil is a type of fossil fuel that is key to creating products like gasoline, diesel, and liquefied petroleum. Importantly, crude oil is a finite resource, meaning its value is influenced by the laws of supply and demand.

Crude oil is viewed by many market analysts as the world’s most important commodity, as it is necessary to fuel vehicles and ships and also to power production plants. Much of the oil supply is controlled by OPEC, which is an organisation that represents some of the world’s largest oil-exporting countries.

Investors can buy oil using day trading platforms and investment apps to gain exposure to its price fluctuations. At the time of writing, OPEC has decided to cut the oil supply by two million barrels per day. This move is designed to reduce supply and put upwards pressure on price – which may provide an investment opportunity for investors with a higher risk appetite.

6. Unilever (ULVR) – Defensive Stock Listed on the FTSE 100

Unilever is a UK-based consumer goods company that owns an array of well-known brands. These brands include Dove, Lynx, Ben & Jerry’s, Persil, Hellman’s, Magnum, and more. Given this diversified selection of brands, Unilever is often defined as a ‘defensive stock’.

According to Business Insider, defensive stocks are among the best shares to buy UK as they can provide stability to an investment portfolio, regardless of how the market or economy is doing. Due to this, Unilever is well-suited to today’s volatile business environment since consumers will still require the company’s products, even if they have less discretionary income.

At the time of writing, the ULVR share price is up 19% from the lows of March 2022, highlighting the company’s resilience during these testing times. Furthermore, the share price tends to be less volatile than other FTSE 100 stocks, meaning it may represent an investment opportunity for those with a low risk tolerance level.

Investors can gain exposure to ULVR stocks via the best investment platforms in the UK.

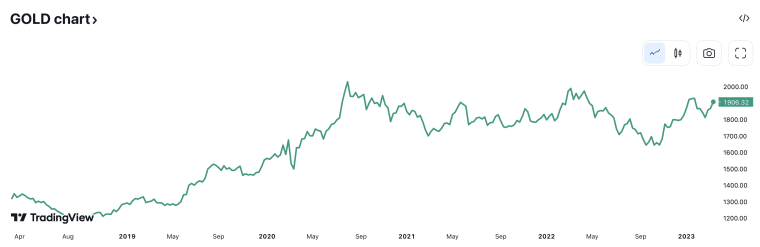

7. Gold – Traditional ‘Safe Haven’ with New Relevance

Gold has garnered a reputation as a ‘safe haven’ asset, meaning that many investors will buy it during bear markets. This tends to be because other asset classes, like stocks and ETFs, are experiencing significant price decreases – so investors require somewhere to park their capital to preserve value.

The price of gold shot up after the collapse of Silicon Valley Bank as investors looked to put their money into the traditionally stable commodity. The price of gold in March 2023 hit a near two-year high following the fallout from the banking sector. Gold investment in the UK is one of the hottest portfolio additions right now.

The price increase could be the sign of a wider economic return to gold as a safe haven, meaning now could be a good time to get in.

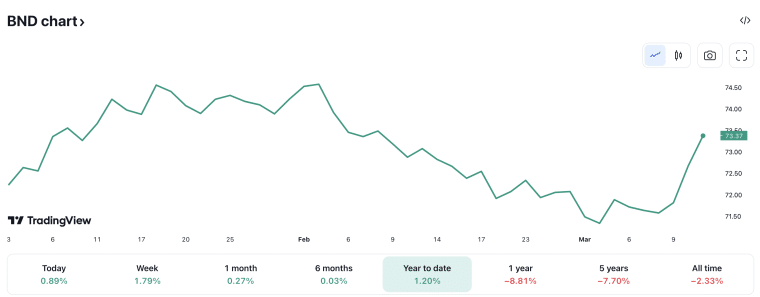

8. Vanguard Total Bond Market ETF (BND) – Leading ETF for US Bond Market Exposure

Those looking to make a £10,000 investment (or any other large amount) may find the bond market more appealing. This is because the best bonds UK, especially government bonds, tend to offer a ‘risk-free’ way of generating a return.

Due to the harsh macroeconomic conditions, bonds have become more appealing in recent months. This is why investors may wish to consider the Vanguard Total Bond Market ETF, as this fund provides broad exposure to the USD-denominated bond market.

According to the Vanguard website, this ETF has generated a positive return in seven of the last nine years. It also has an expense ratio of just 0.03% – much lower than the average expense ratio of similar funds. Although annual returns rarely exceed 6%, the Vanguard Total Bond Market ETF may be a suitable option for those more interested in preserving the value of their capital.

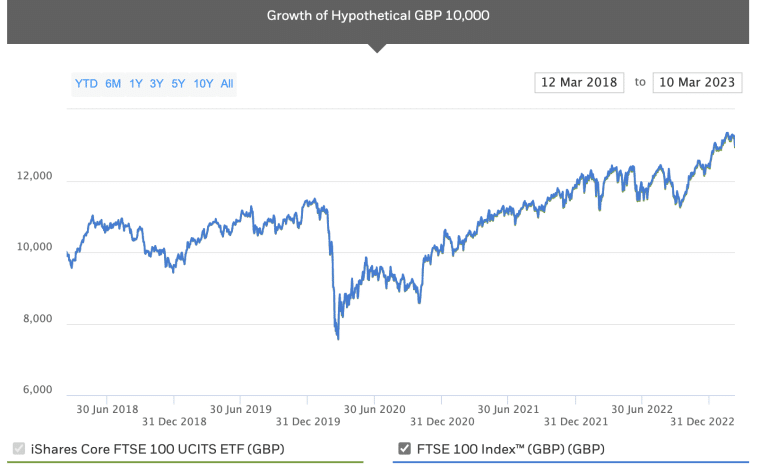

9. iShares Core FTSE 100 UCITS ETF (ISF) – Widely-Used ETF for Exposure to the UK Stock Market

As its name suggests, the iShares Core FTSE 100 UCITS ETF is a fund that looks to track the performance of the FTSE 100 index. The FTSE 100 is comprised of the 100 companies listed on the London Stock Exchange (LSE) that have the highest market capitalisation. That makes it a great option to invest in the UK stock market.

Investors wondering how to invest £10k may find this ETF appealing, given that the FTSE 100 has a long-standing reputation for providing positive annual returns. Since it launched in 1984, the FTSE 100 has delivered an average annual return of 7.75% – which means the iShares Core FTSE 100 UCITS ETF offers a suitable opportunity for compounding.

Moreover, investing in the iShares Core FTSE 100 UCITS ETF is well-suited for those with little experience in the market since there’s no requirement to pick stocks. It’s a great way to learn how to invest in the UK. Finally, with an expense ratio of just 0.07%, investors can hold this ETF for years (or even decades) without accruing any substantial fees.

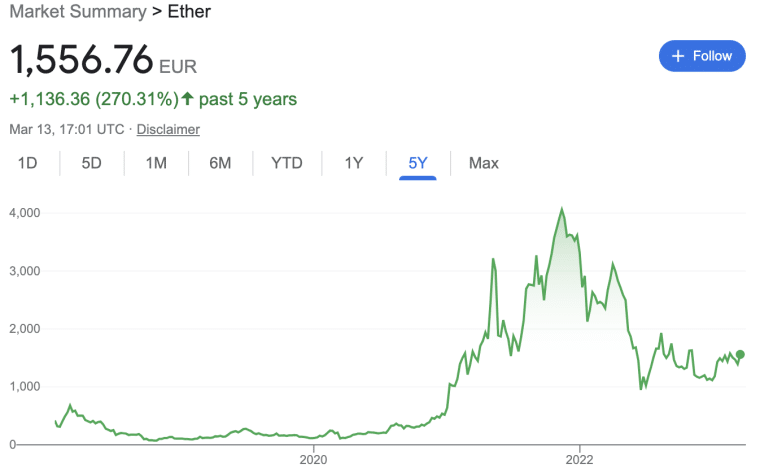

10. Ethereum (ETH) – Top Blockchain Network with Huge Potential

Rounding off our list of the best investments in the UK is Ethereum. Many people opt to buy Ethereum as an alternative to Bitcoin since it is often cited as having a much higher ceiling.

As a blockchain network, Ethereum offers a foundation for decentralised app (dApp) developers to construct their platforms. This means Ethereum has become a hub for some of the most exciting areas of the crypto market, ranging from decentralised finance (DeFi) to NFTs.

Ethereum has recently transitioned to a ‘Proof-of-Stake’ (PoS) consensus protocol, making the network harder to attack and much more energy-efficient. Although the ETH price is down over 60% since the beginning of 2022, many crypto analysts believe this blockchain is the future – meaning a potentially-lucrative rebound could be on the cards soon.

Types of UK Investments

When looking for investments in the UK with positive returns potential, it’s vital to understand the various asset classes on offer. Below are some of the most best asset classes that UK investors may wish to buy:

Cryptocurrency

One of the top asset classes in the UK is cryptocurrency. Although most people opt to invest in Bitcoin, there are hundreds (if not thousands) of altcoins that can offer similar or better performance.

Crypto is also a popular option for investors looking to diversify their portfolios. Although cryptocurrencies and equities have become more correlated in the past year, many coins can still act as a hedge against pricing risk in the stock market. Most cryptocurrencies can be accessed via the most popular decentralized exchanges on the market.

Stocks

Ever wondered what the best way to invest £20k in the UK is? Stocks represent a share in the ownership of a particular company, meaning stock investing is an ideal way to gain exposure to that company’s growth. Although investing in individual stocks is an option, most investors opt to create a portfolio comprised of numerous stocks to improve their risk/return ratio.

Stocks are considered risky compared to ‘safer’ assets like bonds – yet tend to offer higher returns during periods of positive performance. Moreover, stocks are perhaps the most easily-accessible financial instrument since they can be bought using most investment apps and trading platforms. Some investors even prefer to open a stocks and shares ISA because of the tax benefits they offer. With an ISA account, users do not have to pay capital gains tax or income tax on profits made from investments made within the Individual Savings Account.

Exchange-Traded Funds (ETFs)

Ever wondered how to trade ETFs? Exchange-traded funds (ETFs) are pooled investment vehicles that track a specific index, sector, or commodity. ETFs are listed on major stock exchanges, meaning that investors can buy and sell them in the same way as equities.

Since ETFs invest in numerous assets, they offer a suitable option for investors interested in passive investing. In addition, many ETFs track major indices like the S&P 500 or the FTSE 100, allowing investors to gain exposure to the broader equity market.

Mutual Funds

Like ETFs, mutual funds are pooled financial instruments that invest in assets like bonds, stocks, and commodities. These mutual funds are managed by experienced money managers who decide which assets to invest in and how the fund’s portfolio should be structured.

The key difference between ETFs and mutual funds in the UK is that the latter are not listed on stock exchanges. Instead, investors must use a professional brokerage or financial institution to invest in mutual funds, meaning they’re often more appealing to those with a higher capital base.

Bonds

As defined by Standard Life, bonds are a type of fixed-income instrument that is akin to lending money to a government or corporation. The loan amount is returned at the end of the designated period, with the lender also receiving regular interest payments throughout the bond’s lifespan.

Although there’s an element of risk with all assets, buying investment-grade government bonds is the closest thing to a ‘risk-free’ investment. However, bonds tend to offer a low rate of return relative to other assets, meaning they might not be suited to more speculative investors.

NFTs

Non-fungible tokens (NFTs) are a relatively new asset class connected to the cryptocurrency market. Each NFT is unique and is hosted on the blockchain, usually representing a real-world asset like artwork or property.

Using NFTs, creators can ‘tokenise’ their creations, meaning they can be bought and sold using crypto. Many NFT collections, such as Bored Ape Yacht Club, have sold for millions of dollars – yet since these assets aren’t fully understood, their values can still be highly volatile.

Commodities

Those wondering what to invest in with £10k may also wish to consider commodities. Commodities are the raw materials used as inputs in the production process and include items like oil, gold, grain, beef, and natural gas.

Investors can speculate on the price of these commodities in the spot and derivatives markets without owning the underlying item. Like many other assets, commodities can be an excellent way for investors to diversify their portfolios – especially if they lean towards equities.

Currencies (FX)

Finally, UK-based investors may also wish to buy and sell currencies. This process, usually referred to as forex trading, allows investors to benefit from the constant price fluctuations in the world’s major currencies.

Currency prices are affected by countless factors, ranging from data releases to elections, meaning that forex trading can often be quite risky. Moreover, this asset class is more suited to those looking for a short-term investment UK due to the overall volatility.

How to Find the Best Investments with High Returns

Whether investors have £10k to invest or £100k to invest, it’s crucial to understand how to identify assets with high return potential. Although there’s no foolproof way to achieve this, presented below are three approaches that can help investors uncover enticing opportunities in the market:

Analyze the Asset’s Financials

When making a £10,000 investment (or any amount), the most important thing to do is analyze the asset’s financials. Using stocks as an example, this may involve examining the following:

- Price history

- Earnings per share (EPS)

- Price-to-Earnings (P/E) ratio

- Financial reports

The exact metrics will vary depending on the asset, but reviewing the underlying financials can give investors an idea of whether the asset will likely generate a positive return during the investment timeframe. Many leading financial media outlets, such as the Financial Times, offer free financial data on thousands of assets.

This also applies to anyone looking for the best ways to invest £100k in the UK in 2025.

Be Aware of Economic Factors

When researching potential assets, it’s also crucial to understand the macroeconomic situation. At the time of writing, inflation is still sky-high, meaning central banks around the world are frantically raising interest rates to reduce inflation and protect the economy.

Situations like this will naturally affect all asset classes in some way, meaning investors must understand how certain assets react. For example, rising interest rates hurt companies with lots of debt, as it means servicing this debt is more expensive. However, higher rates may benefit banks since they can generate more interest income through their lending actions.

Utilise Social Media

Finally, UK-based investors can also use social media to uncover assets that may provide high returns. An asset’s price movements can be heavily influenced by hype generated via retail traders on social media – so keeping track of which assets are trending can be a great move.

It’s essential to combine any social media-based research with additional forms of analysis to ensure confluence. This is because many people on social media have an emotional bias toward the asset they’re discussing, meaning that the information presented may not be completely objective.

Best Investments in the UK – Conclusion

To conclude, this guide has presented 10 of the best investments in the UK, exploring the various reasons why they are so highly regarded in today’s macroeconomic climate. There’s no one best way to invest in the UK, but the ones we have listed offer a wide range of options.

Those wondering where to invest £10k (or any amount) may wish to consider Love Hate Inu. This revolutionary new crypto offers compelling usability with an excellent way to maintain popularity via its meme coin status.

Love Hate Inu can currently be purchased during its presale period for 70% less than its launch price, meaning a £10,000 investment during the week one $0.000085 price could be worth around £17,000 when LHINU officially launches for $0.000145 in May.

Love Hate Inu - Next Big Meme Coin

- First Web3 Vote to Earn Platform

- Latest Meme Coin to List on OKX

- Staking Rewards

- Vote on Current Topics and Earn $LHINU Tokens