Investment platforms enable traders to buy and sell a range of financial instruments – such as stocks, ETFs, forex, and cryptocurrencies.

This comparison guide ranks and reviews the 7 best investment platforms in the UK.

Within each review, we explore the respective investment platform in terms of supported markets, fees and commissions, account minimums, analysis tools, safety, and much more.

The Best UK Investment Platforms for Beginners 2025

The best investment platforms for 2025 are ranked in the list below:

- XTB – Zero-Commission Trading Platform With Tight Spreads

- AvaTrade – Multiple Investment Suites to Choose From and 0% Commission Trading

- Pepperstone – Trade Assets Tax-Free via Spread Betting Markets

- IG – 13,000+Shares, ETFs, and Trusts via a Single Investment Platform

- Hargreaves Lansdown – Simple Investment Platform for Buying and Selling Shares

- AJ Bell – Make Investments Through a Tax-Efficient Account

- Free Trade – User-Friendly UK Investment App for Trading Shares

To compare investment platforms, such as those listed above – read on to find our comprehensive reviews.

Best Investment Apps UK Reviewed & Compared

The investment platform comparison reviews that are to follow in the sections below cover everything a trader needs to make an informed decision. Read on to explore the best investment platforms in the UK for 2025.

1. XTB – Zero-Commission Trading Platform With Tight Spreads

XTB is a top-rated trading platform that supports nearly 2,000 tradable stocks, alongside a range of other asset classes. This is inclusive of forex, commodities, indices, and more. All of the assets supported by XTB are contracts-for-differences (CFDs). This enables UK residents to trade their preferred asset with leverage – in line with FCA limits.

For example, when trading currencies at XTB, positions can be entered with leverage of up to 30x. This means that for every £100 stakes, the trader can enter a position worth £3,000. Gold CFDs can be traded with leverage of 1:20 and stocks at up to 1:5. This will appeal to traders on a budget that wish to enter larger positions, but do consider the added risks.

XTB also enables traders to enter positions with either a buy or sell order. As such, traders can attempt to profit from both rising and falling prices. XTB offers a 0% commission pricing structure across all of its supported markets. There are no fees when funding an account with a debit card or bank transfer, which is also the case with withdrawals.

Spreads are also tight at XTB, which is an indirect cost related to the bid/ask price of the respective market. Do note that when keeping a position open overnight, XTB will charge a financing fee. This is the case with all CFD brokers in the UK. XTB offers plenty of analysis tools via its native investment platform – xStation.

This will perhaps be of more interest to experienced traders, considering that xStation is jam-packed with technical indicators and charting tools. With that said, beginners are catered for too, as XTB offers a wealth of educational material on its website. XTB also offers one of the best investment apps for beginners.

The XTB app is available to download on both iOS and Android smartphones, as well as tablets. Complete newbies may wish to get started with the free XTB demo account, which mirrors live market conditions. Finally, XTB is authorized and regulated by the FCA. Therefore this is a safe place to trade online.

| Number of Stocks | 1,850+ |

| Pricing System | No deposit fees when using a debit card. 2% deposit fee when using Skrill. |

| Fee to Trade Amazon Shares | 0% commission |

| Min. Deposit | No minimum |

| Trading Platforms | Proprietary web trading platform and mobile app (xStation) |

| Top Features | Trade CFDs with leverage, supports thousands of markets, one of the best investment apps in the UK, free demo account will appeal to newbies, high-level charting tools |

Pros

Cons

81% of retail investor accounts lose money when trading CFDs with this provider.

2. AvaTrade – Multiple Investment Suites to Choose From Plus 0% Commission Trading

AvaTrade is a CFD trading platform that is regulated in no less than nine different regions. The platform requires a minimum first-time deposit of £100 and accounts rarely take more than two minutes to open. AvaTrade supports debit cards, which are processed instantly, in addition to conventional bank transfers.

Ever wondered what the best options trading platform in the UK is? At AvaTrade, traders have access to hundreds of stocks, ETFs, options, and indices, alongside commodities and currencies. All of the supported assets at AvaTrade can be short-sold and/or traded with leverage. Best of all, this investment platform supports trading on a 0% commission basis, which is the case across all supported markets.

AvaTrade offers its own advanced trading suite that can be accessed online or via an app for iOS and Android devices. With that said, AvaTrade also supports MT4 and DupliTrade. The latter enables investors in the UK to trade passively, by automatically copying a third-party strategy.

| Number of Stocks | 620+ |

| Pricing System | No deposit or withdrawal fees |

| Fee to Trade Amazon Shares | 0% commission |

| Min. Deposit | £100 |

| Trading Platforms | Proprietary web trading platform and mobile app, alongside MT4, and Duplitrade. |

| Top Features | Heavily regulated, no commissions payable on any supporters markets, supports MT4 and DupliTrade |

Pros

Cons

76% of retail investor accounts lose money when trading CFDs with this provider.

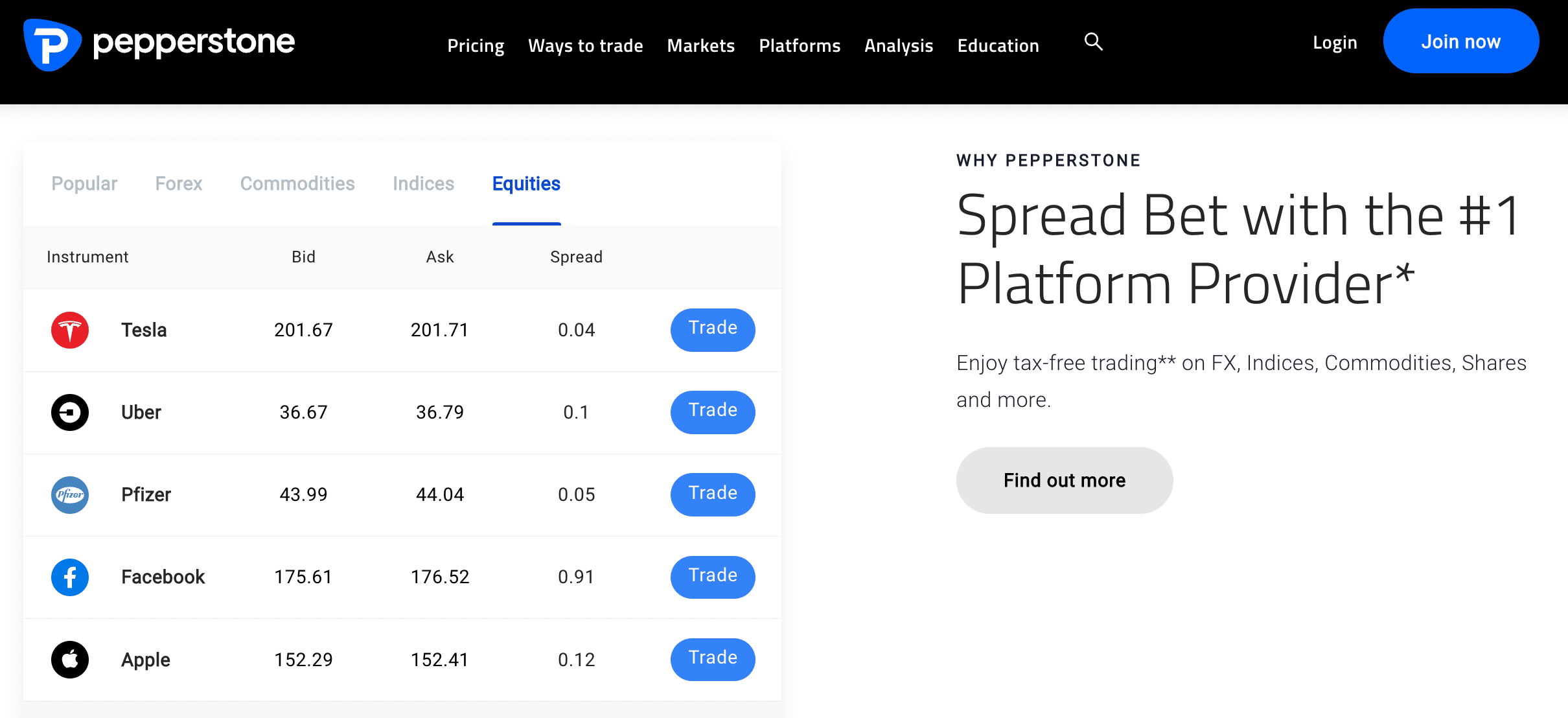

3. Pepperstone – Trade Assets Tax-Free via Spread Betting Markets

Pepperstone is an established trading platform that supports everything from stocks and forex to indices and commodities. This platform is ideal for trading in a tax-free way, as Pepperstone supports spread betting markets. The chosen spread betting instrument will track the respective market in real-time, so traders can speculate without owning the underlying asset.

Pepperstone also enables traders to spread bet with leverage of up to 1:30 on forex, and less on other asset classes. There are no trading commissions to pay at Pepperstone on the standard account, nor any minimum deposit requirements. Pepperstone supports various trading platforms including MT4 and cTrader.

| Number of Stocks | 1,200+markets in total, including UK and international stocks |

| Pricing System | No deposit or withdrawal fees. Spread-only trading on all markets. |

| Fee to Trade Amazon Shares | 0% commission |

| Min. Deposit | No minimum |

| Trading Platforms | No proprietary platform – but supports MT4, MT5, cTrader, and TradingView |

| Top Features | To spread betting platform for tax-free trading, no minimum deposit on the standard account |

Pros

Cons

75.3% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

4. IG – 13,000+Shares, ETFs, and Trusts via a Single Investment Platform

IG is one of the best investment platforms in the UK for diversification. Crucially, the platform is home to over 13,000 shares, alongside ETFs, funds, investment trusts, and more. This not only includes the London Stock Exchange and AIM, but international markets.

Regarding the latter, IG offers access to the NYSE and NASDAQ at £10 per trade, irrespective of the amount being invested. If the investor places three or more trades in a month, IG scraps the commission on US-listed shares. UK-listed shares cost £8 per trade or £3 when the aforementioned monthly minimum is met.

IG does not support fractional shares, which will be a major drawback for investors on a budget. After all, investors will need to purchase full shares. Nonetheless, there is no minimum deposit when funding an IG account via a bank transfer. Debit card payments, on the other hand, require £250 or more.

| Number of Stocks | 13,000+ |

| Pricing System | £8 on UK shares, reduced to £3 when trading 3 or more times in a month. |

| Fee to Buy Amazon Shares | £10, or £0 is trading 3 or more times in a month. Plus a 0.5% FX fee. |

| Min. Deposit | No minimum on bank transfers. £250 when opting for a debit card. |

| Trading Platforms | Proprietary web trading platform and mobile app, alongside MT4 and ProRealTime |

| Top Features | Trusted brokerage that was established in 1974, user-friendly platform for buying and selling shares, huge selection of funds |

Pros

Cons

5. Hargreaves Lansdown – Simple Investment Platform for Buying and Selling Shares

Complete beginners may consider Hargreaves Lansdown when researching the best investment platforms in the UK. Opening an account is a simple process and the minimum deposit is just £1. Furthermore, Hargreaves Lansdown offers a beginner-friendly interface, so even beginners are welcome.

Hargreaves Lansdown supports the vast majority of shares listed on the London Stock Exchange and AIM. Investment fees are high at £11.95 per trade. Furthermore, just like IG, Hargreaves Lansdown does not support fractional shares. Hargreaves Lansdown also supports bonds, investment funds, trusts, ETFs, and more.

| Number of Stocks | Several thousand stocks from the UK and international markets |

| Pricing System | £11.95 per trade. Reduced to £8.95 if trading more than nine times in a month. 0.45% annual fee on ISAs. |

| Fee to Buy Amazon Shares | £11.95 commission plus 1% FX fee |

| Min. Deposit | £1 |

| Trading Platforms | Proprietary web trading platform and mobile app |

| Top Features | Huge selection of UK shares, supports UK-issued bonds, get started with just £1 |

Pros

Cons

6. AJ Bell – Make Investments Through a Tax-Efficient Account

The next option to consider on this list of the best investment platforms in the UK is AJ Bell. This platform is popular with investors who wish to buy shares through a tax-efficient account. This is because AJ Bell supports a range of ISAs, in addition to SIPPs. With that being said, fees at AJ Bell are high, especially when compared to platforms like XTB.

For example, it costs £9.95 to buy and sell shares online. The only way to reduce this to £4.95 is to place at least 10 trades in a month. Furthermore, when investing via an ISA, there is an annual fee of 0.25% We also found that AJ Bell charges a £1.50 fee when customers elect to reinvest their dividends.

| Number of Stocks | Most UK-listed shares plus access to 24 international markets |

| Pricing System | £9.95 per trade, reduced to £4.95 when placing 10 or more trades in the previous month. £1.50 to reinvest dividends. |

| Fee to Buy Amazon Shares | £9.95 commission plus 0.75% FX fee |

| Min. Deposit | £1 |

| Trading Platforms | Proprietary web trading platform and mobile app |

| Top Features | Popular investment platform for beginners, offers access to UK IPOs |

Pros

Cons

7. Free Trade – User-Friendly UK Investment App for Trading Shares

One of the best investment apps in the UK – Free Trade, is worth considering as a beginner. Free Trade’s app for iOS and Android has been designed with first-time investors in mind. Free Trade supports over 6,000 shares – not only from the UK, but across various US and European exchanges too.

All shares supported by the Free Trade app can be traded on a commission-free basis. The basic account at Free Trade comes without any monthly fees. However, those wishing to invest through an ISA will be required to pay £4.99 per month. In addition to shares, Free Trade also supports ETFs, investment trusts, and even over-the-counter equities.

| Number of Stocks | 6,000+ |

| Pricing System | 0% commission on all supported shares. Basic account is free. ISAs require the standard account, which costs £4.99 per month. |

| Fee to Buy Amazon Shares | 0% commission |

| Min. Deposit | No minimum |

| Trading Platforms | Proprietary investment app for iOS and Android |

| Top Features | Supports more than 6,000 UK and global shares, beginner-friendly mobile app |

Pros

Cons

How We Ranked the Top UK Investment Platforms

Choosing the best investment platform is no easy task. Investors will need to consider a wide range of factors, such as user-friendliness, commissions, and account minimums.

Here’s an overview of how we determined the 9 best investment platforms in the UK:

Range of Assets

The best investment platforms in the UK not only support domestic shares, but international markets too. XTB, for instance, allows clients to buy shares in the US, Germany, Hong Kong, France, Saudi Arabia, and many other global exchanges.

Furthermore, XTB also supports commodities, indices, currencies, and cryptocurrencies.

Fees

We assessed each and every fee charged by an investment platform before compiling our review. Low-fee investment platforms like XTB offer 0% commission trading across stocks and ETFs.

XTB also waivers stamp duty tax when buying shares listed on the London Stock Exchange.

Tools & Analysis

The best investment platforms online host research and educational materials on their respective websites. This should include market insights, investment ideas, and charting tools for technical analysis.

Minimum Deposit

We always evaluate the minimum deposit requirement when reviewing investment platforms.

There is no deposit minimum at XTB, which will suit beginners.

Mobile App

The best investment app in the UK is one which allows its users to trade around the clock from their mobile device. This is where XTB mobile trading app comes in.

Share investment apps enable users to buy and sell stocks via an iOS or Android smartphone. XTB offers one of the best UK investment apps for newbies, as the interface is user-friendly and free of unnecessary jargon.

The XTB investment app supports full functionality, such as placing orders, depositing and withdrawing funds, and viewing the real-time value of the portfolio.

Demo Account

We also like investment platforms that offer a free demo account. This gives first-time investors the opportunity to test the platform out before investing in any real money.

Payment Methods

Most investment platforms in the UK accept debit card payments, as well as bank transfers. Paypal and other e-wallets are also an option with platforms like XTB.

Customer Service

We also give priority to UK investment platforms that offer quality customer service. XTB, and many of the other online investment platforms discussed today offer live chat.

Hargreaves Lansdown and IG offer customer service over the telephone.

How to Get Started with a Regulated UK Investment Platform

Below, we offer a step-by-step tutorial on how to get started with the UK’s best investment platform.

Follow the steps below to begin investing in UK and international shares at 0% commission.

Step 1: Open an Account

Visit the XTB website and begin the account opening process. End-to-end, registration with XTB takes just five minutes.

Some of the information that XTB will collect includes the full name and address of the account holder, alongside an email and mobile number.

Step 2: Deposit Funds

To deposit funds, choose from the list of available payment methods. Most XTB clients deposit funds with a debit or credit card, but bank transfers and a selection of e-wallets are supported too.

The minimum first-time deposit is $10 (about £8).

Step 3: Search for Investment

The easiest way to find an asset to invest in is to use the search box. For example, in the example image below, we are searching for ‘Apple’ shares.

The other option is to click on the preferred asset class for inspiration on what to invest in. For example, by clicking on ‘Stocks’, this will reveal a range of filters, such as the exchange or industry.

Step 4: Confirm the Investment

Once an investment market has been chosen, click on the ‘Trade’ button. This will populate an order box.

In the ‘Amount’ section, enter the total investment size. Stocks, ETFs, and crypto can be traded most of the times from just $10.

To confirm the investment, simply click on the ‘Open Trade’ button.

Conclusion

This comparison guide has reviewed the 9 best investment platforms in the UK for low fees, supported assets, account minimums, and more.

We ranked XTB as the overall best investment platform and app, not least because it offers 0% commission markets on stocks and ETFs, plus competitive fees on cryptocurrencies, forex, and commodities.