Many governments around the world have installed regulations that limit the amount of carbon dioxide or equivalent gases that companies can emit. This has resulted in a globally traded carbon credits market.

The purpose of this guide is to discuss the best carbon credit brokers that are available to retail investors in 2024.

The four platforms listed below offer access to the carbon credit markets. Some of the platforms listed above are not technically carbon credit brokers. They do, however, offer a more seamless and cost-effective way for retail clients to trade carbon credits from the comfort of home.The 4 Best Carbon Credit Brokers in 2024

Reviewing The Best Carbon Credit Brokers

The best carbon credit brokers are traditionally reserved for large companies and financial institutions. With that said, we have sourced a variety of alternative avenues that enable retail investors to access the carbon credit trading space.

Read on to evaluate the best carbon credits brokers in the market right now.

1. IMPT – Gain Exposure to Carbon Credits via Digital Tokens

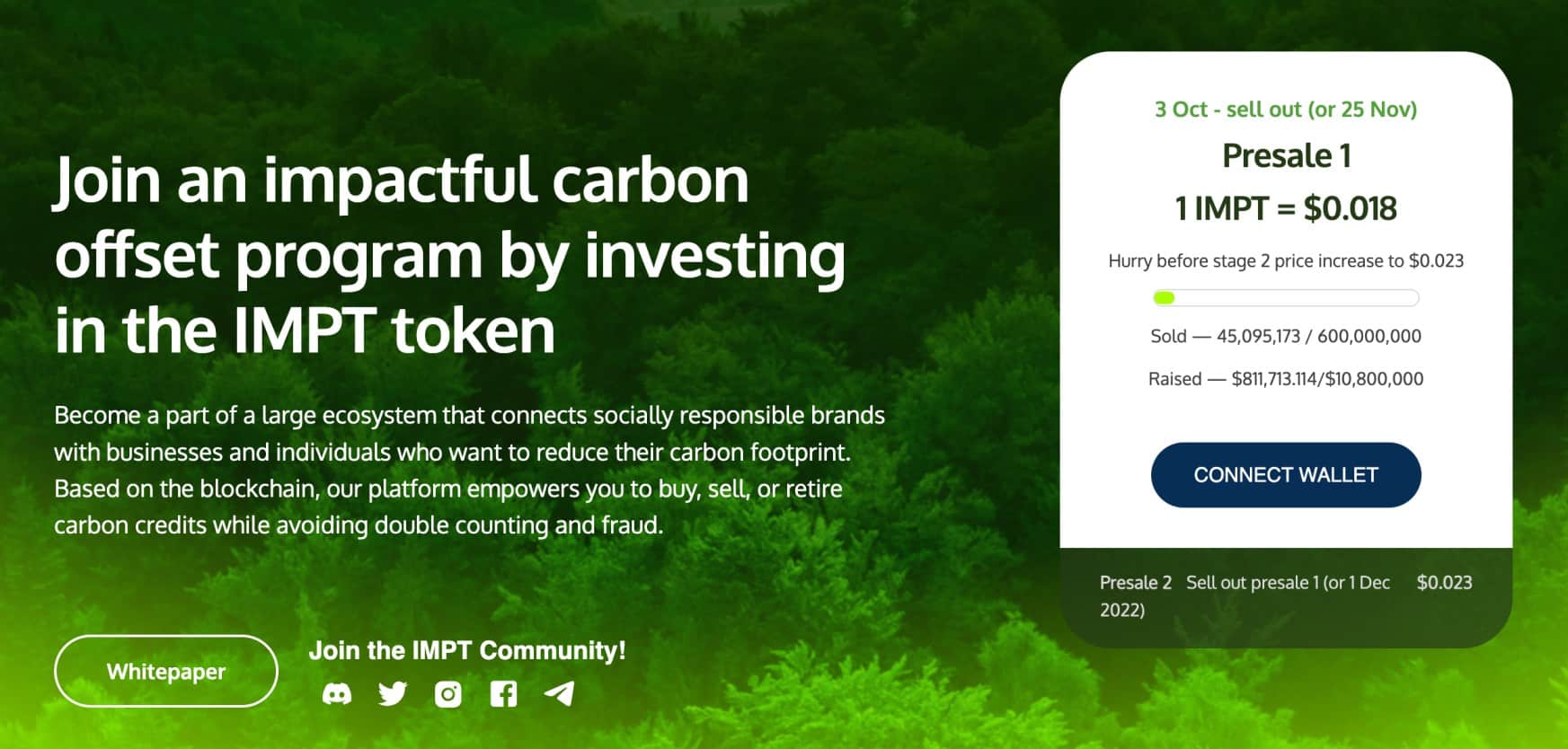

The overall top alternative for those searching for the best carbon credit brokers for retail clients is IMPT. In a nutshell, IMPT is a newly founded blockchain-based project that operates on the Ethereum network. IMPT offers a decentralized framework that enables access to the carbon credit trading industry for both corporations and individual investors.

The IMPT ecosystem is not only suitable for buying and selling carbon credits, but retiring them too. The course of action that investors wish to take will ultimately depend on their goals. For example, some might choose to buy credit credits via IMPT from an investment perspective.

The purchase will be backed by an NFT, which will remain in the investor’s crypto wallet. If the value of carbon credits increases in the open market, this could allow the investor to sell their IMPT NFT for a premium. Others might simply decide to burn the carbon credit token, which means that a positive footprint will be left on the environment.

In doing so, IMPT will issue a unique NFT. IMPT also notes that thousands of brands have agreed to join its platform, which consists of more than 2 billion individual products.

In terms of the investment process itself, the initial step is to register an account on the IMPT.io platform before buying IMPT tokens with a credit/debit card or crypto. Next, the IMPT tokens can be converted into carbon credits – via an NFT minting process. IMPT is building a comprehensive dashboard that will make the carbon credit trading procedure seamless.

At this stage, however, IMPT is currently engaged in its presale launch. Put simply, this means that investors can buy IMPT tokens at the best price possible before they are listed on public exchanges. Moreover, the first phase of the presale is offering IMPT at $0.018 per token. Phase two will increase the price by 27% to $0.023.

This means that early investors have access to an immediate upside. Before proceeding, investors are advised to read through the IMPT whitepaper, which can be downloaded via the project’s homepage. The IMPT Telegram group is also worth exploring, as this offers real-time updates on the project. Complete beginners might consider reading our guide on crypto ICO presales.

Pros

- Invest in the carbon credit market via blockchain assets

- Carbon credit tokens backed by NFTs

- Option to burn the carbon credit token

- Investors could make a profit if the value of carbon credits increases

- Presale launch is offering preferential pricing to early investors

Cons

- Crypto assets operate in an unregulated marketplace

2. Evolution Markets – Access Carbon Credits via the OTC Markets

In order to gain exposure to carbon credits via Evolution Markets, traders will be required to go through the OTC (Over-the-Counter) process.

This is because there is no centralized trading exchange for carbon credits, so trading is effectively accomplished between buyers and sellers on a peer-to-peer basis.

It should, however, be noted that OTC markets typically require larger upfront investments. Moreover, trading carbon credits on an OTC basis comes with added risk – especially when it comes to finding suitable liquidity to cash out.

Pros

- Gain exposure to carbon credits, renewable energy, and emissions

- Access multiple carbon credit markets

Cons

- Only supports OTC markets

- Not suitable for retail clients

4. Karbone – Market Specialist in US and Canadian Carbon Credit Programs

In a similar nature to Evolution Markets, Karbone helps clients access the carbon credit trading scene via an OTC framework. Once again, this not only means that Karbone is best-suited for large-scale investors, but the OTC system often results in unfavorable pricing and a lack of liquidity.

Nonetheless, Karbone states that it has expertise in spot, forward, and structure contracts from within the renewable industry. In terms of carbon markets, Karbone typically targets programs in the US and Canada.

Pros

- Suitable for large-scale investors

- Expertise in spot, forward, and structure contracts

Cons

- Trading facilitated via OTC markets

- Strong focus on US and Canada only

5. Redshaw Advisors – UK-Based Advisor With Access to European Carbon Credits

This is inclusive of risk management provisions, financial exposure tools, and in-depth insight into the carbon credit space.

Largely, Redshaw Advisors is suited to accredited investors that wish to gain exposure to the European carbon markets in a risk-averse manner.

Investors will need to speak with Redshaw Advisors to get a tailored strategy on how best to approach the carbon credit markets.

Pros

- Bespoke strategies to access the carbon credit markets

- High-level risk management tools

Cons

- Tailored services aimed at accredited and institutional investors

- More geared towards the European markets

What is a Carbon Credit Broker?

Carbon offset brokers are tasked with providing investment access to renewable commodity markets. In addition to carbon credits, this may also include emerging energy products, emissions, and offshore sustainable funds.

In this sense, carbon offset brokers operate in a similar way to conventional brokerage platforms, as they simply sit between the investor and their desired market. However, carbon credits operate in a highly fragmented marketplace, with no centralized exchanges as we have with stocks and ETFs.

On the contrary, even the best carbon credit brokers in this space only provide access to the OTC markets. This means that the carbon credit broker will operate as a middleman between the investor and another market participant that wishes to sell their allocation.

In a similar nature to the penny stock trading scene, buying and selling carbon credits on an OTC basis can be highly detrimental – especially for those that do not have expertise in this emerging market. For example, due to rising demand and a lack of a centralized exchange body, investors will often need to pay a huge premium to buy carbon credits via the OTC markets.

Furthermore, when it comes to cashing out the investment, the investor might be forced to accept a much lower price if there is a lack of liquidity. This will ultimately depend on market conditions at the time of trade and whether the ball is in the court of buyers or sellers.

Another barrier to entry in this industry is that trading carbon credits via the OTC markets is typically only accessible to accredited or institutional investors. The good news, however, is that there are some great alternatives for retail clients wishing to access this market.

As we have discussed, investors can utilize an inclusive platform like IMPT, which offers access to the carbon credit arena via digital assets that are backed by NFTs.

How Does Buying Carbon Credits Work?

The concept of buying and selling carbon credits was created specifically for the business world. Companies will have an annual allocation of carbon dioxide or equivalent gases that can be emitted each year. Limits will ultimately depend on the jurisdiction that the company is registered in.

Take Tesla as a prime example. The firm specializes in electric cars and clean energy sources, which means that it consistently has excess carbon credits to hand. As a result, Tesla generates significant revenues by selling its surplus carbon credits to other companies.

This is where things get tricky. Although on the one hand there is now a fully-fledged carbon credit trading market, there is no centralized exchange process that can facilitate buyers and sellers. As noted above, this means that the only surefire way to get access to this space in the traditional sense is via the OTC markets.

For the average retail investor, OTC trading is not advisable. Instead, casual investors might consider one of the methods outlined below.

Blockchain Assets

As we discussed in great detail, blockchain asset projects like IMPT have opened up the doors to the carbon credit investment scene.

After registration with the platform, investors can then buy IMPT tokens, which are converted into carbon credits. From an investment perspective, IMPT holders capitalize on rising prices by trading their tokens.

This can be executed on the IMPT secondary market – meaning that the project offers an all-in-one ecosystem for carbon credit speculators.

Stocks and ETFs

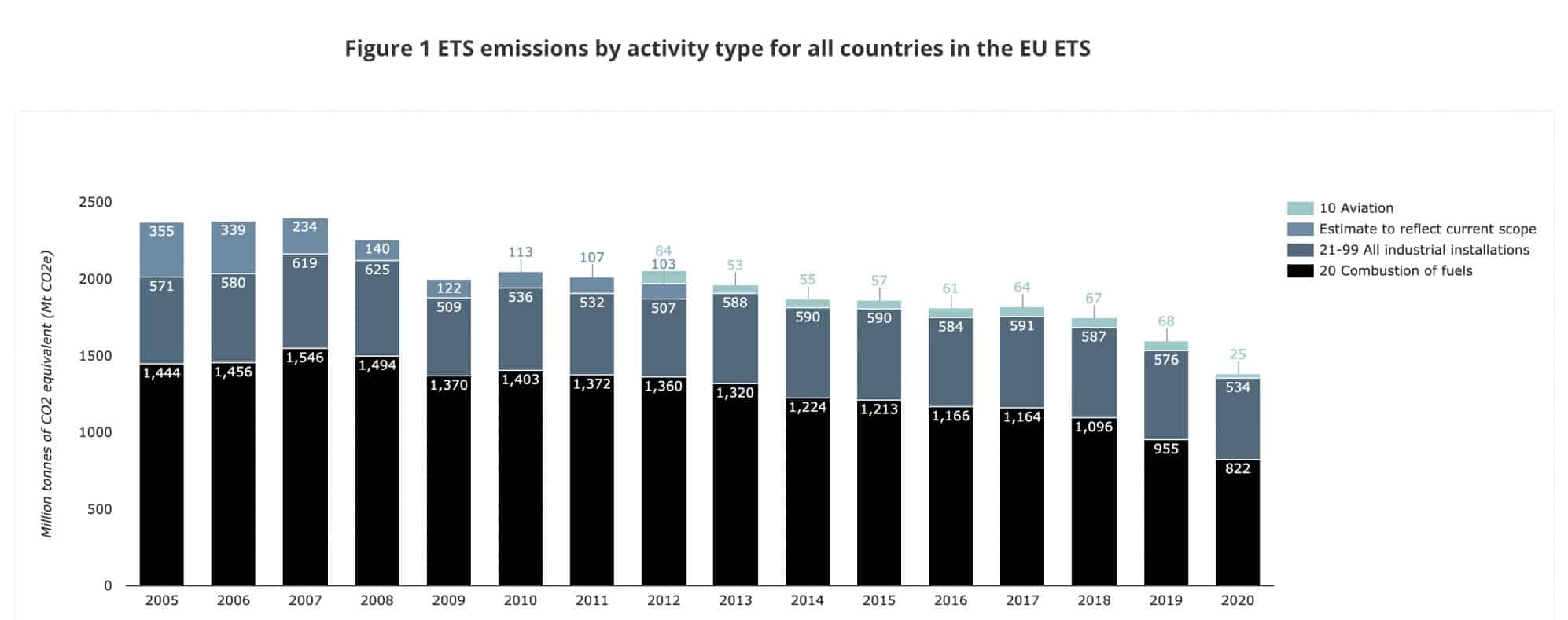

Another seamless way to gain exposure to carbon credits is to invest in a suitable stock or ETF. Regarding the latter, one of the most popular ETFs in this space is offered by KraneShares. The KraneShares Global Carbon Strategy ETF tracks the IHS Markit’s Global Carbon Index.

Which means that investors will gain exposure to a wide variety of relevant programs. This is inclusive of the United Kingdom Allowances (UKA), California Carbon Allowances (CCA), and the European Union Allowances (EUA). This ETF has an expense ratio of just 0.78%.

In terms of carbon credit stocks, there are no pure-play companies in this space per se. Companies like Tesla, Microsoft, and Plug Power, however, do have a vested interest in carbon credit programs.

CFDs

Another option to consider when searching for ways to trade carbon credits is to explore CFDs.

How to Buy Carbon Credits with IMPT

This insight into the best carbon credit brokers has ascertained that retail investors will need to look at alternatives to avoid utilizing the OTC markets.

In this regard, one of the best alternatives to consider is IMPT – which enables investors of all budgets to buy, sell, and trade carbon credits via cryptocurrencies and NFTs.

Here’s a walkthrough on how to buy IMPT tokens via the ongoing presale at the best price possible.

Step 1 – Install a Crypto Wallet

The first step is to install a suitable crypto wallet that can connect to the Ethereum blockchain. Investors that already have a wallet can proceed to the next step of this tutorial

First-time crypto investors, on the other hand, might consider MetaMask. This is one of the best crypto wallets in the market for newbies, and it comes in the shape of a mobile app and a browser extension.

MetaMask is free to download. To set the wallet up, choose a strong password and write down the recovery phrase.

Step 2 – Fund the Wallet With ETH or USDT

Before connecting the wallet to the IMPT presale dashboard, investors will need to ensure that it is adequately funded.

The presale supports two digital currencies – Ethereum (ETH) and Tether (USDT). Those with either of these digital currencies in their wallet can proceed to the next step.

Alternatively, the IMPT presale also supports third-party integration with Transak. This enables first-time investors to use their debit or credit card to buy ETH, which can then be converted to IMPT.

Step 3 – Connect Wallet to IMPT Presale

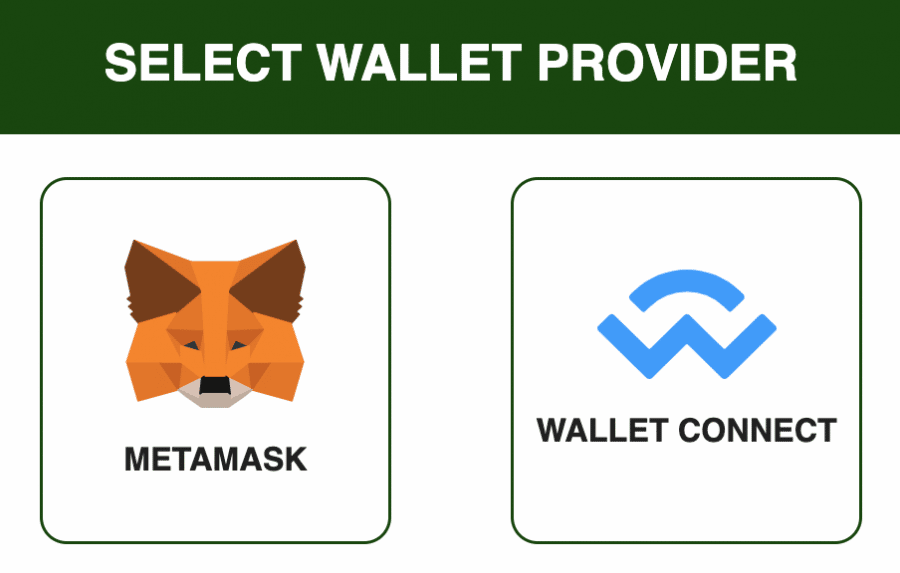

Once the crypto wallet is funded with either ETH or USDT, the investor will then need to visit the IMPT website before clicking on the ‘Connect Wallet’ button.

This will then offer two options – Metamask or Wallet Connect. As noted, we typically suggest using MetaMask as a first-time investor, so simply choose the option when it appears.

With that said, Wallet Connect is a third-party dApp that can connect to dozens of other wallets.

Step 4 – Buy IMPT

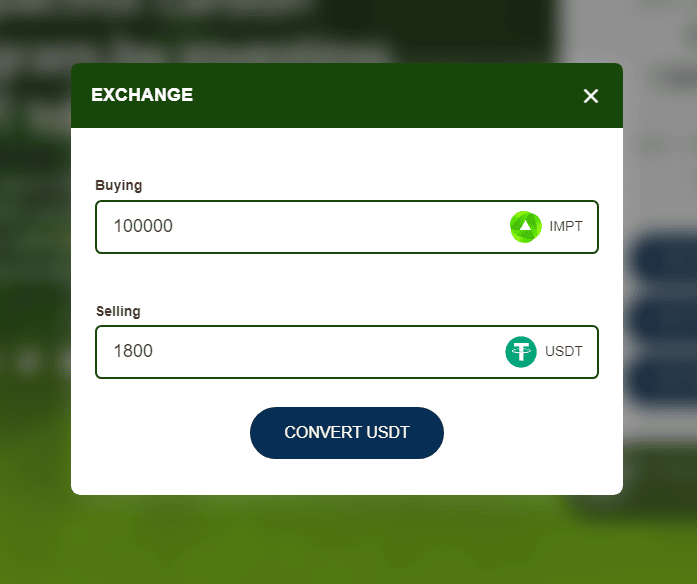

The final part of the process will require the investor to set up an order to instantly buy IMPT at presale prices. First, choose the payment currency from ETH or USDT.

In the example below, we are opting for the latter.

Next, the investor will need to type in the number of tokens that they wish to swap for IMPT. In the example above, we are swapping 1,800 USDT.

Finally, click on the ‘Convert USDT’ or ‘Convert ETH’ button, depending on the chosen payment currency.

After the presale has ended, investors can return to the IMPT dashboard to claim their tokens. The IMPT tokens can then be converted into carbon credits.

Conclusion

In summary, although there is significant interest in the carbon credit investment scene on an institutional level, retail clients will find it challenging to access this market. Most carbon credit brokers only provide OTC services, which will likely be unfavorable for casual investors.

As a result, we found that the best alternative to a carbon credit broker is IMPT. This blockchain asset project enables investors to buy IMPT tokens – which can then be converted into carbon credits. IMPT will host a secondary market for investors to buy and sell their tokens.

Right now, IMPT is running its much-anticipated presale launch – which offers the best price possible to invest in this project.

FAQs

Who is the largest seller of carbon credits?

What brokers have carbon credits?

What are the best carbon credit brokers?