The UK bond market has had one of the worst years on record, thanks to political crisis as well as rising interest rates and inflation. With yields for new bonds on the rise, existing bonds are less valuable. So investors are naturally asking what are the best bonds to invest in UK by performance: are there any bargains out there for investors looking for a regular fixed income?

Below we explain how bonds work and what returns an investor might expect. We review some examples of single bonds on the open market, as well as growth bonds available as savings accounts. In order to pinpoint the best bonds to buy according to traders, we cast an eye over the hand-picked bundles of bonds available to UK investors in bond funds and ETFs. Finally, fixed-income products aside, we highlight some exceptional investment prospects in the high-growth crypto presales sector.

Best Bonds to Invest in UK by Performance 2025

The best bonds to invest in are readily available to retail investors as fixed-interest savings accounts. Single bonds on the open market are only accessible through specialised brokers, or as part of bond funds and ETFs. Below we investigate examples of each type:

- Crypto Presales – A Better Alternative to Bonds in 2025

- RCI Bank Fixed Term Account 5 Years – Among the Best Growth Bonds to Invest in For UK Savers

- UK Premium Bonds – Best Bond to Invest in UK According to Investors

- UK Treasury 6% Gilt 07/12/2028 – Top of the Treasury-Issued Best Bonds to Invest in By Performance

- Lyxor Core UK Government Inflation-Linked Bond ETF – Best Government Bonds to Buy According to Experts

- Amundi Index Breakeven Inflation USD 10y UCITS ETF – Best Bonds to Invest in Outside of the UK

- iShares GBP Ultrashort Bond ETF (ERNS) – Best Investment Bonds to Buy For Short-Term Interest Rate Rises

- Abrdn Ethical Corporate Bond Fund – Popular Bonds to Buy UK for Ethical Investors

- U.K. Government Bond Index Fund – Best Investment Bonds to Buy For Credit Rating

- Lyxor iBoxx GBP Liquid Corporates Long Dated UCITS ETF – Best Bonds to Invest in for Large Corporate Performance

- Halifax 13.625% Perp Subord BDS Regd GBP – One of the Best Bonds to Invest in UK by Performance

Dash 2 Trade - New Gate.io Listing

- Also Listed on Bitmart, Changelly, LBank, Uniswap

- Collaborative Trading Platform Token

- Featured in Bitcoinist, Cointelegraph

- Solid Proof & CoinSniper Audited

- Strong Community of 70,000 Traders

Crypto Presales – A Better Alternative To UK Bonds?

Investors looking for the best investments UK may be well advised to feature bonds in their portfolio. Unlike stocks, bonds deliver a fixed, regular income over the long term and are considered to be less risky than many other assets (despite the UK bond crisis of October 2022).

But bonds are not about growth potential – let alone short-term gains. Investors looking for the best short-term investments UK will need to look elsewhere. And where better than cryptocurrency presales?

Crypto cynics say that the crypto market has run its course. The big money, they say, has been made. But that is simply not true with crypto presales.

Investors familiar with IPO stock sales will understand the principle of crypto presales. With a stock IPO, shares of a company soon to list on the stock exchanges are offered at a fixed price before the stock hits the open market. With a crypto presale, the process is similar – but potentially far more lucrative.

With new crypto, tokens are offered before they list on exchanges. This presale phase is divided into stages. At each stage, the price of the token goes up. This means that investors who get in early on a presale are guaranteed a (paper) profit by the time the presale ends. And when it does, of course, the price of the crypto can spike spectacularly, adding to the investor’s gains.

Below we outline three hot crypto presale opportunities:

Dash 2 Trade (D2T) – Pioneering Crypto Analytics and Signals Platform in Presale Now

Launched by the successful team behind crypto signals platform Learn 2 Trade, Dash 2 Trade has caused great excitement amongst crypto-hungry investors looking for a quality bargain. This project benefits from experienced management and great tokenomics. Best of all, it offers users of its platform real utility.

The Dash 2 Trade platform gives investors top-grade market intelligence to help them trade crypto successfully. Using the D2T token, users can access a suite of powerful tools. This includes incisive trading signals, social media sentiment analysis on what crypto is hot on the likes of Reddit and Facebook, graded rankings for crypto presales, automated trading facilities, a sandbox mode for trying out trading strategies cost-free – and more.

There is still time to get in on the ground floor with this promising project. The D2T token is at stage 3 of its presale. Investors can buy the D2T token now for just 0.0513 USDT. The price will jump to 0.0533 USDT in stage 4. With 9 stages in all, the price is guaranteed to reach $0.0662 when the presale closes – with a total price increase of 39%.

| Price Stage | Amount Raised In Stage | Token Allocation |

| $0.0476 | $1,666,000 | 35,000,000 |

| $0.0500 | $3,500,000 | 70,000,000 |

| $0.0513 | $3,591,000 | 70,000,000 |

| $0.0533 | $4,663,750 | 87,500,000 |

| $0.0556 | $4,865,000 | 87,500,000 |

| $0.0580 | $5,075,000 | 87,500,000 |

| $0.0606 | $5,302,500 | 87,500,000 |

| $0.0635 | $5,556,250 | 87,500,000 |

| $0.0662 | $5,792,500 | 87,500,000 |

Investors can explore the innovative potential of this project – as well as confirm its compelling tokenomics – with the Dash 2 Trade whitepaper. For news updates, join the Dash 2 Trade Telegram group.

How to Buy D2T

Investors may buy D2T in just four steps:

- Set up a MetaMask crypto wallet.

- Connect the wallet to the Dash 2 Trade presale platform.

- Buy D2T using Tether (USDT) or Ethereum (ETH).

- Get your D2T tokens when the presale phase completes.

| Min Investment | 1000 D2T |

| Max Investment | NA |

| Purchase Methods | ETH, USDT |

| Blockchain | Ethereum (ERC-20 token) |

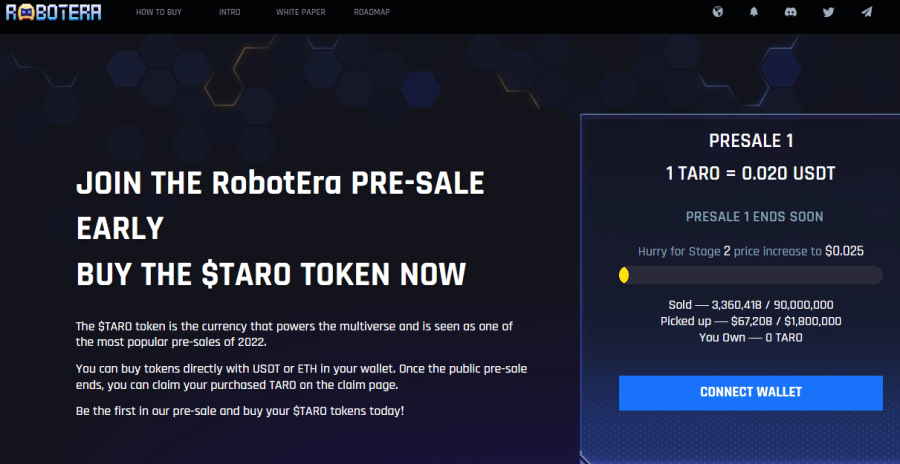

RobotEra – Innovative Play-to-Earn Metaverse Project in Presale Now

RobotEra is a metaverse world to stir the imagination. On planet Taro, users play as robots: building, managing, trading and creating.

For compelling trading possibilities, NFTs take centre stage in the RobotEra metaverse. And a frictionless play-to-earn experience is promised by the developers for players who want to earn the in-house token TARO. Players can also look forward to spectacular new levels of gaming immersion with Virtual Reality and Augmented Reality coming to RobotEra in Q1, 2023.

One of the many ways in which this project stands out is the commitment to decentralization through the RobotEra DAO. All players holding RobotEra assets get a say in the running of the metaverse. ‘The reconstructed Taro,’ say developers in the RobotEra whitepaper, ‘will become a bright star in space.’

The good news for eagle-eyed crypto investors is that stage 1 of the RobotEra presale is still open – with TARO priced at $0.020. In stage 2, the price will rise to $0.025. So investors who buy now are guaranteed to be sitting on a paper profit of 25% almost immediately. With only $93,230 committed so far, the RobotEra project stands out as a true undiscovered gem; the growth potential is enormous.

TARO investors should get in right away before Taro hits the exchanges; the RobotEra roadmap says that TARO will be listing on some of the best crypto exchanges UK as early as Q4 2022.

For breaking news, check out the RobotEra Telegram page. Or join almost 10,000 other metaverse afficionados on the RobotEra twitter page.

How to Buy TARO

Investors can get their hands on TARO immediately in just four steps:

- Set up a MetaMask crypto wallet (or a Trust wallet if using a smartphone).

- Connect the wallet to the RobotEra presale platform.

- Buy TARO using Tether (USDT) or Ethereum (ETH).

- Receive your D2T tokens when the presale phase completes.

| Min Investment | NA |

| Max Investment | NA |

| Purchase Methods | USDT and ETH |

| Blockchain | Ethereum |

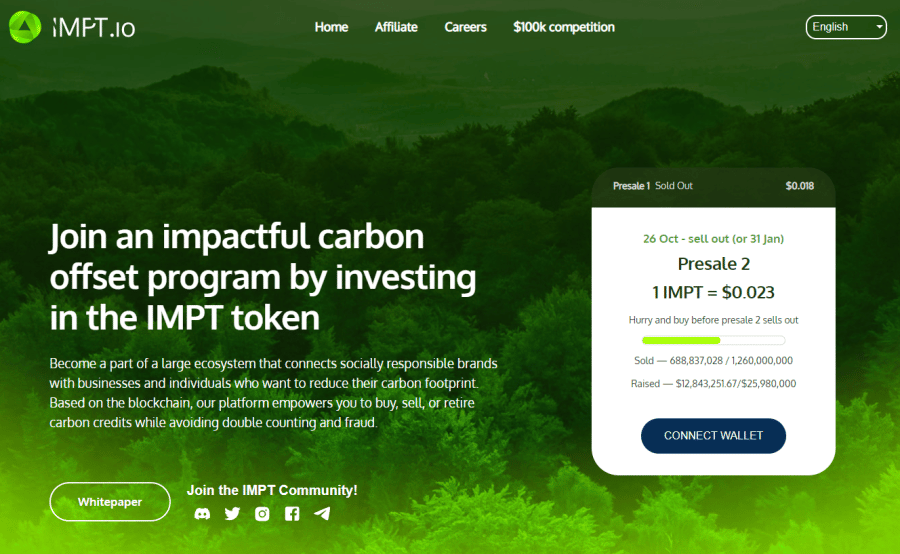

IMPT – Blockchain Carbon Offsetting Project in Presale Now

The IMPT token empowers consumers to offset their own carbon footprint. Users can use the IMPT token to buy carbon credits as NFTs. These can then be traded on the IMPT platform – or burnt, as a contribution to carbon offsetting.

Also, users can earn IMPT as they shop. Using deep-linking, IMPT has partnered with 10,000+ key brands – including Amazon, Lego and Microsoft – to top up IMPT users’ balance automatically.

Ever researched how to buy carbon credits UK? Generally, it is a closed shop to retail investors. IMPT opens the door. And, using the blockchain to defend against fraud and double-counting, the IMPT project ensures that users receive only genuine carbon credits.

Stage 1 of the IMPT presale sold out four weeks ahead of schedule. With stage 2 underway, green investors have committed almost $13 million.

- At stage 2, the IMPT token is currently available for $0.023.

- At stage 3, the price rises to $0.028 – which is a 55% rise on the stage 1 price of $0.018.

- Stage 2 ends on January 31st, 2023 or when its remaining 570 million tokens are sold out.

How to Buy IMPT

Investors can buy IMPT in four steps:

- Set up a MetaMask crypto wallet.

- Connect the wallet to the IMPT token presale platform.

- Purchase using Tether (USDT), Ethereum (ETH) or fiat currency with credit card.

- Receive IMPT tokens when the presale phase ends.

| Min Investment | $30 recommended |

| Max Investment | NA |

| Purchase Methods | ETH, USDT, fiat |

| Blockchain | Ethereum (ERC-20 token) |

Best Performing Bonds UK Reviewed

Information and ratings on individual bonds are often kept behind paywalls. And to buy into individual bonds, retail investors often need to sign up with a specialized broker. So it can be tricky to pinpoint and access singly the best bonds to invest in UK by performance.

The good news is that we can opt for the best growth bonds to invest in with providers like the Post Office and NS&I – or identify the best bonds to buy according to traders and fund managers by simply considering bond funds and ETFs. The investment professionals use these latter instruments to invest in multiple bonds at once.

Bond funds and ETFs offer three key practical advantages over individual bonds:

- Ratings information is freely available on bond funds and ETFs.

- Only specialized brokers provide access to individual bonds, whereas bond ETFs are accessible with many of the best stock trading apps UK.

- Diversifying within an asset type – in this case, by holding many bonds at once – is a recognized form of successful risk management.

2. RCI Bank Fixed Term Account 5 Years – Among the Best Growth Bonds to Invest in For UK Savers

The advantage of growth bonds is that the investor does not have to worry about actually trading a bond, or its running yield being decreased by a drop in its market value. Retail growth bonds have no market value.

This 5-year bond tops the Moneyfacts.co.uk league table of 373 best bonds to invest in UK by performance in the retail space. It pays 4.95% AER gross interest over its five year term. The catch – as with all the best growth bonds to invest in – is that the investor may not withdraw their funds during the bond term.

RCI Bank offers four bond terms in all. A sliding scale of interest rates applies:

| Bond Term | Interest Rate (Gross/AER fixed) |

| 5 Years | 4.95% |

| 4 Years | 4.90% |

| 3 Years | 4.85% |

| 2 Years | 4.85% |

3. UK Premium Bonds – Best Bond to Invest in UK According to Investors

Rather than being a standalone financial instrument – like some of the best bonds to buy according to traders, for example – premium bonds are accessible via a savings account.

Unusually for bonds, interest is not paid on premium bonds according to a fixed rate. Rather, prizes are awarded to individual bond-holders picked at random by NS&I’s ‘ERNIE’ – ‘Electronic Random Number Indicator Equipment’.

Below is the breakdown of the interest give-away for October 2022:

| Prize | Number Available | Winning Odds Per £1 Bond in 1 Month |

|---|---|---|

| £1 million | 2 | 1 in 59,562,773,505 |

| £100,000 | 18 | 1 in 5,956,312,828/ |

| £50,000 | 36 | 1 in 2,127,254,943 |

| £25,000 | 71 | 1 in 938,001,831 |

| £10,000 | 178 | 1 in 390,578,009 |

| £5,000 | 357 | 1 in 179,949,067 |

| £1,000 | 4,375 | 1 in 23,650,245 |

| £500 | 13,125 | 1 in 6,559,093 |

| £100 | 730,541 | 1 in 159,110 |

| £50 | 730,541 | 1 in 80,532 |

| £25 | 3,493,262 | 1 in 23,957 |

| £0 | 119,335,128,719 | virtual certainty |

And, with the chances of gaining any interest at all starting at 1 in 23,957, premium bonds would be unlikely to be considered the best government bonds to buy according to experts. (For those who are feeling lucky, on the other hand, premium bonds might be the best savings bonds to buy!)

| Minimum Purchase | £25 |

| Maximum Holding | £50,000 |

| Chances of Winning £50 | 1 in 80,532 |

4. UK Treasury 6% Gilt 07/12/2028 – Top of the Treasury-Issued Best Bonds to Invest in By Performance Government

The UK government does not have the highest credit rating available, but it is close – with AA from Standard & Poor’s, Aa3 from Moody’s and AA- from Fitch.

With interest rates going up in government efforts to control inflation, good coupon rates are to be expected from these ‘gilts’ (UK Treasury Bonds) in future. With 6%, this bond pays the highest coupon rate of all treasury gilts available via one of the UK’s biggest specialised brokers. The bond comes to maturity in December 2028.

Some good news here is that this bond could be considered cheap priced at £114.87 – down from a year high of £137.49.5.

| Current Price: | £114.87 |

| Running Yield: | 5.257% |

| Expenses: | Brokerage fees – variable |

5. Lyxor Core UK Government Inflation-Linked Bond ETF – Best Government Bonds to Buy According to Experts

Rather than the investor having to work out which are the best investment bonds to buy, the Lyxor ETF is invested in £50.2 million of UK inflation-linked gilts tracked by the influential FTSE Actuaries UK Index-Linked Gilts All Stocks Index. This index covers 32 UK government securities, and is used for benchmarking pensions benefits.

This ETF pays dividends twice a year, with its index featuring an average yield of 0.3% per bond covered. Notably the Total Expense Ratio for this ETF is low, at just 0.07%.

With all bonds under price pressure thanks to rising interest rates – culminating in the October 2022 UK bond crisis – this ETF has dropped in value by almost 45% in the last year.

| Current Price: | £157.45 |

| Yield: | 0.3% |

| Total Expense Ratio: | 0.07% |

6. Amundi Index Breakeven Inflation USD 10y UCITS ETF – Best Bonds to Invest in Outside of UK

This ETF is similar in structure to the Lyxor ETF reviewed above. But its performance could not be more different. In the last year, this ETF has increased in value by 1%; over 3 years, its value has risen by almost 16%. And that is because this ETF tracks 10 year US Treasury Inflation-Protected Securities (TIPS) – rather than UK government bonds. However, there are no distributions with this bond ETF. The fund’s net income is entirely capitalised.

This ETF’s running costs are twice as expensive as the Lyxor ETF, with a Total Expense Ratio of 0.16%. Amundi gives this ETF a risk rating of 3 out of 7.

| 3 Year Price Change: | +16% |

| Yield: | NA |

| Total Expense Ratio: | 0.16% |

7. iShares GBP Ultrashort Bond ETF (ERNS) – Best Investment Bonds to Buy For Short-Term Interest Rate Rises

What’s more, the short maturity of its bonds means that, if interest rates continue to go up after a year, the investor will not be stuck with bonds that are paying less than the going rate – which is when bonds lose value.

Launched in 2013, this ETF has net assets worth £654 million spread across 146 corporate bonds. It distributes income twice-yearly. And, as we would expect from an ultrashort bond ETF, it rebalances its portfolio monthly.

| Current Price: | £100.77 |

| 12 Month Trailing Yield: | 0.39% |

| Total Expense Ratio: | 0.09% |

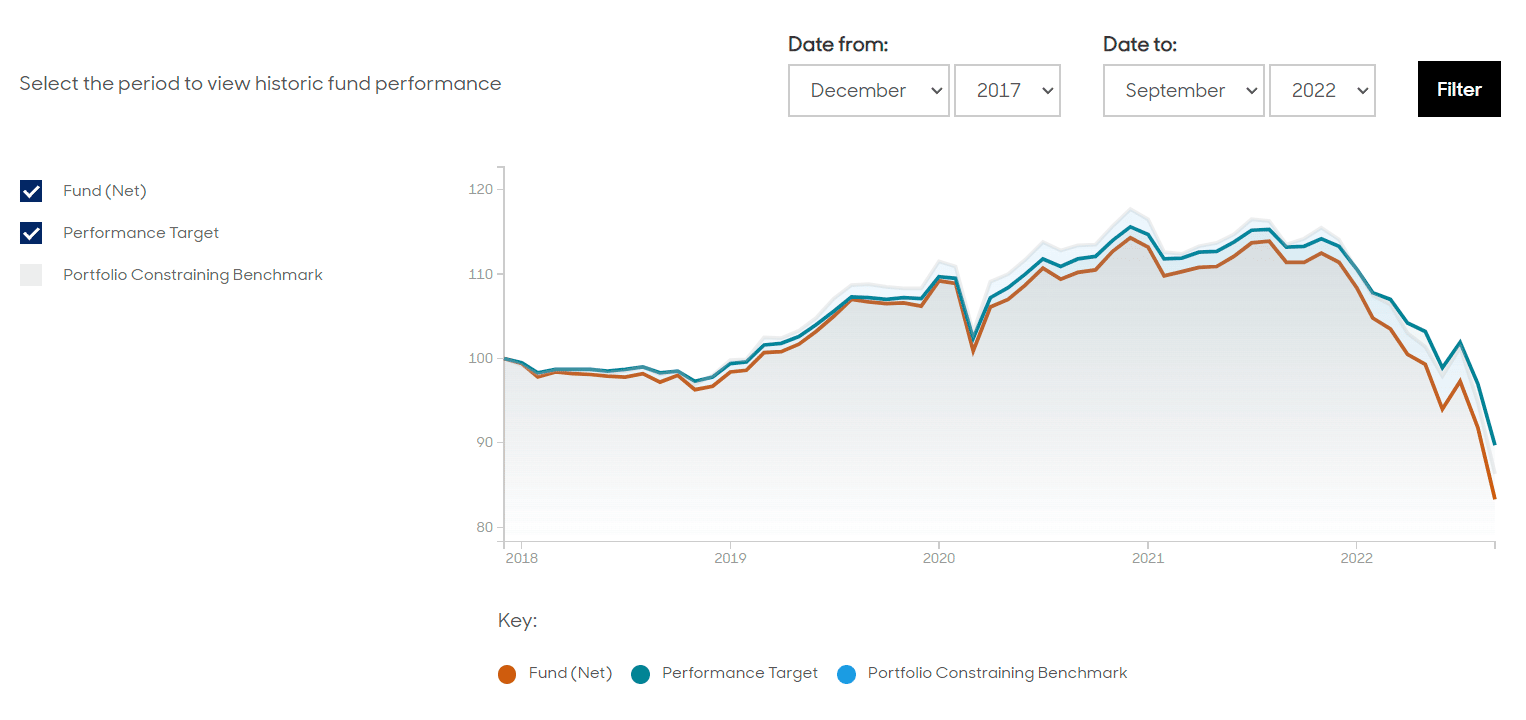

8. Abrdn Ethical Corporate Bond Fund – Popular Bonds to Buy UK for Ethical Investors

Performance-wise, the fund aims to exceed the IA Sterling Corporate Bond Sector Average. But, thanks in part to the 2022 UK bond crisis, the fund has lost 25% of its value over the last 12 months – compared to a benchmark loss of 21%. It does, however, boast a yield to maturity of 7.37%.

As with many mutual funds, there are fees to consider here: an entry fee of 4.00% as well as an Ongoing Charges Figure (OCF) of 1.01%.

| Current Price: | £46.41 |

| Yield: | 7.38% |

| OCF (Ongoing Charges Figure): | 1.01% |

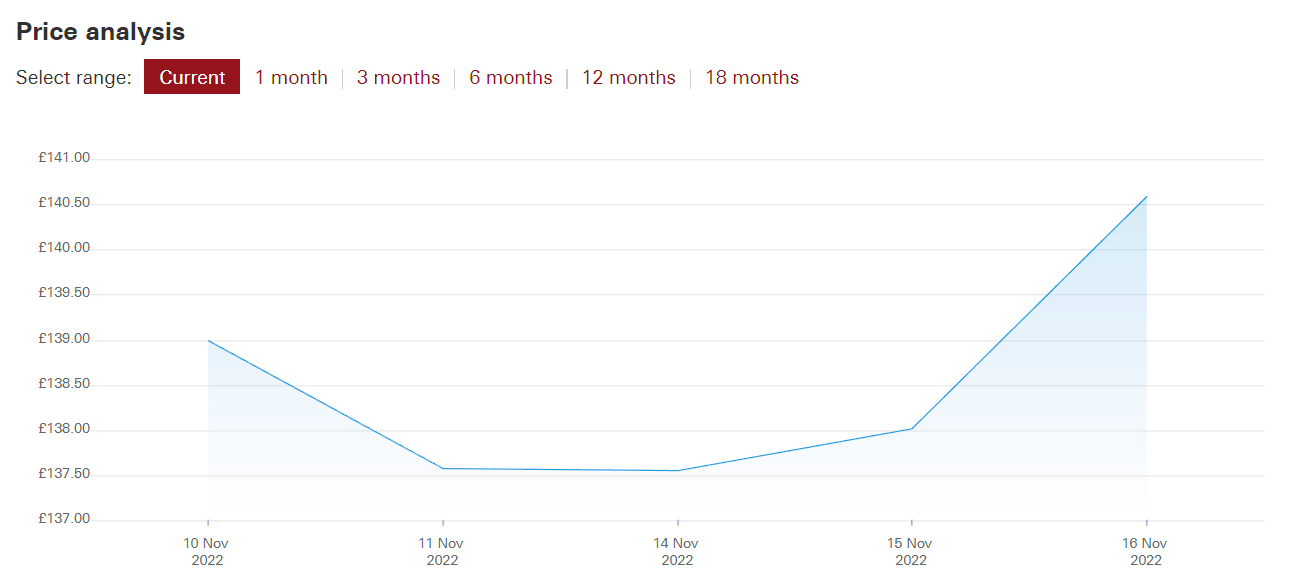

9. U.K. Government Bond Index Fund – Best Investment Bonds to Buy For Credit Rating

The fund, launched in 2009, tracks the Bloomberg U.K. Government Float Adjusted Bond Index. The value of its net assets has dropped significantly, with its current price of £140.59 down from its 52-week high of £189.77.

Like any fund related to UK gilts, the yield – 1.26% – is not spectacular. As an accumulation class fund, the yield is automatically reinvested in the fund on the investor’s behalf.

| Current Price: | £140.59 |

| Yield: | 1.26% |

| OCF (Ongoing Charges Figure): | 0.12% |

10. Lyxor iBoxx GBP Liquid Corporates Long Dated UCITS ETF – Best Bonds to Invest in for Large Corporate Performance

This ETF has lost 29% of its value over the last 12-months (thanks to the bond market crisis). With a TER of just 0.09%, though, it remains a fund with cheap running costs and a yield of 4.98%. Distributions are made twice-yearly.

Bonds issued by financial companies are the top category – claiming 47% of the portfolio. The Utilities sector is second, with 10%. And the Consumer Discretionary sector is third, with 8.26%.

20% of this ETF’s bonds are AA-rated, 25% A-rated, 38% BBB-rated, and 8% not-rated.

| Current Price: | £117.2 |

| Current Yield: | 4.98% |

| Total Expense Ratio: | 0.09% |

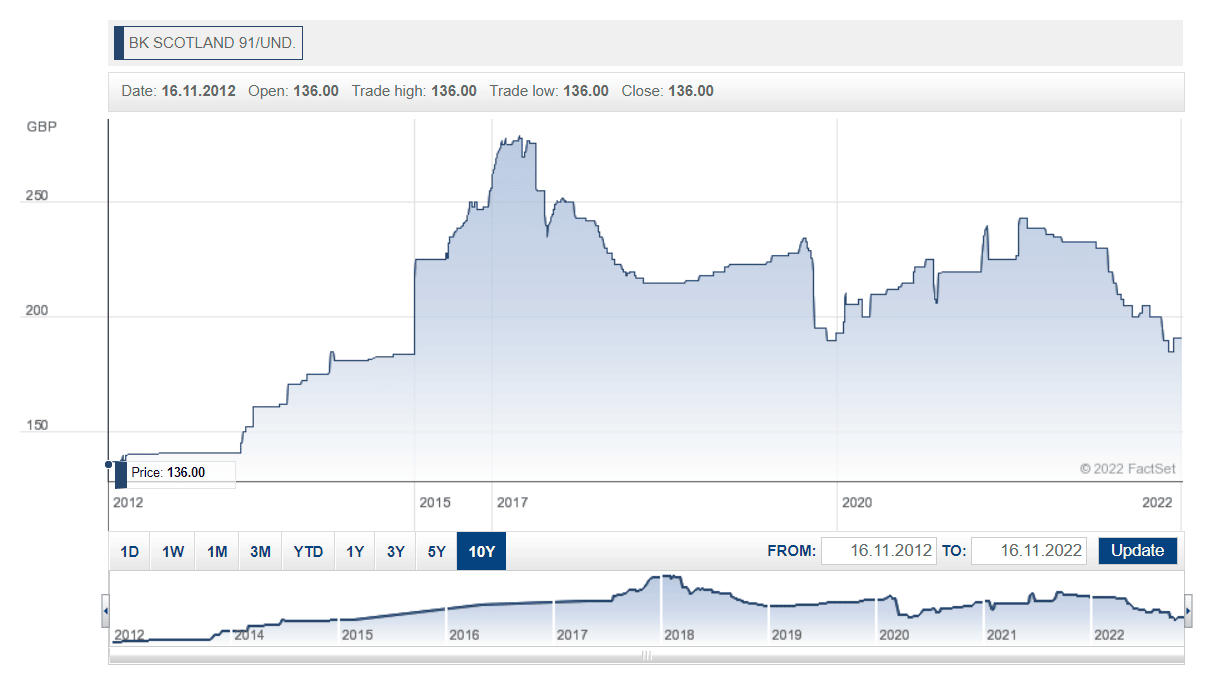

11. Halifax 13.625% Perp Subord BDS Regd GBP – One of the Best Bonds to Invest in UK by Performance

This is a single corporate bond issued by the Bank of Scotland. It has the highest coupon rate (13.6250%) of all bonds available with one of the UK’s biggest specialised brokerage platforms. This bond is interesting for two reasons:

- A minimum investment of £50,000 is required to access the high yield offered.

- The coupon rate is spectacularly high at 13.6%. But, as we look into below, judging the performance of a bond is about more than the coupon rate. The coupon rate describes the rate of interest that is set at bond issuance. But the value of the investment is also affected by the price of the bond – which always starts at £100. Hence, investors use the running yield (sometimes called ‘current yield’) calculation to give a combined picture of performance based on the yield and the price.

So:

Current (Running) Yield = Coupon Rate/yesterday’s closing price for the bond x 100

In the case of this bond: 7.134% = 13.625/191 x 100

| Current Price: | £191.00 |

| Current Yield: | 7.134% |

| Charges: | Brokerage Fees |

Investment Bonds Explained

To learn how to invest in bonds UK, we need to pinpoint exactly what a bond is:

- One definition of a bond is a debt instrument that delivers a fixed-income.

- Another (more colloquial) definition is that a bond is effectively an IOU from the issuer to the buyer. As per the terms of the IOU, the issuer agrees to pay the buyer a fixed income according to an agreed schedule, and then buy the bond back at its issue price when it comes to maturity. Hence bonds are called debt instruments because the issuer agrees to be in debt to the buyer.

Key Definitions with Popular Bonds to Buy UK

Coupon Rate: This describes the money paid to the investor on an annual basis. It is set at bond issuance. It is written as a percentage of the cost price of the bond. So if a bond costs £100, a coupon yield of 2% would pay £2 to the investor until the bond matures.

Market Price: The value of the bond. Bonds can be sold on the open market at any time until maturity. Otherwise, they may be redeemed with the issuer when the maturity period is over. With bonds, in other words, investors get their money back.

Current Yield (also known as Running Yield): This is calculated by dividing the coupon rate by the market price of the bond.

What are Bonds?

What is the best type of bond to invest in for British investors? There are five main types:

- Corporate bonds: Issued by corporations. They tend to have attractive yields, but varying default risks.

- Government bonds: Issued by the UK Treasury. They have the highest credit rating, but generally low yields. In Q4 2022, their prices are severely deflated after the run on bonds in October.

- Municipal bonds: Issued by UK councils, often through an agency. In the US, municipal bonds offer tax advantages.

- Agency bonds: Issued by agencies – the UK Municipal Bonds Agency, for example, issues municipal bonds on behalf of local councils.

- High-yield bonds: Bonds from any issuer which offer high yields, but usually a higher risk of default too.

Why Invest in Bonds in the UK?

With the UK bond market jittery after the October 2022 UK Bond Crisis, this is a good question. The UK government only just averted a massive sell-off of government bonds which threatened to descend into margin call mayhem.

Investors have traditionally used bonds to buttress their asset portfolio with a low-risk, low-reward – as well as contrarian – asset. But recent times have shown that no asset is immune from potential catastrophe.

Investors seeking high growth potential may find the world of crypto presales – which we cover above – risky too. But crypto presales offer potentially spectacular rewards in a very short time. And certainly UK bonds no longer look like the safe option they once were thought to be.

How Many Bonds Can I Have?

Investors can have as many bonds as they want if those bonds are single bonds on the open market or bond funds/ETFs. Investors in NS&I premium bonds are restricted to a total holding of £50,000.

How is an Investment Bond’s Performance Judged?

Assessing the best UK bonds to invest in by performance is complicated. This is why risk-averse investors tend to opt for either:

- Bond funds and ETFs which contain the best bonds to buy according to traders and bond professionals; the hard work is done for us with curated portfolios of bonds.

- The best growth bonds to invest in with retail providers like the Post Office or NS&I.

Casting our eye now on the open bond market: say we try to pinpoint a single bond amongst the top bonds to invest in by performance. The problem is that the goalposts are always shifting.

- First, the value of a bond changes according to market movements. Specifically, if interest rates rise above the coupon rate of a bond, the value of that bond will decrease. If interest rates decrease, the value of that bond will rise.

- Second – and here is the key problem with assessing the performance of a bond – the effective yield of a bond is inversely correlated to its price. So as the price of a bond rises, its Current Yield reduces and vice versa. The problem here is simple. As the bond matures, the investor will still get paid the original coupon rate – but, if the value of the bond has decreased, that Coupon Rate is making less positive impact overall.

Investing in Bonds UK: What Fees Should You Expect?

Single Bond Fees

Brokers generally charge fees to hold single bonds, but they do not come with charges per se.

Retail Growth Bond Fees

Growth bonds – ie. fixed term savings accounts – generally do not come with fees in the UK.

Bond ETF Fees

Bond ETFs have running costs which your broker will arrange to take as part of your transactions. These running costs are expressed as the Total Expense Ratio (TER). This percentage divides running costs by the ETF share price. Bond ETF TERs tend to be very low, and usually less than 0.5%. By contrast, crypto index ETFs can feature TERs upwards of 2.0%.

Bond Fund Fees

Bond mutual funds, like ETFs, feature running costs which are passed onto the investor. These are often described as OCF: Ongoing Charges Figure. Mutual funds are generally thought to be more expensive than ETFs. This is one of the reasons that ETFs have become so massively popular.

Why Crypto Presales are a Better Investment than Bonds

Canny investors do not overlook crypto presales for the following nine reasons:

1. Low Prices & High Upside Potential

Getting in on the ground floor is the dream for investors looking for the best shares to buy UK. And the same applies to crypto. Crypto presales offer the perfect chance to buy when prices are low and benefit from guaranteed token appreciation.

If an investor were to buy Bitcoin, for example, it is probable that they will not experience appreciation of their coin by many times its worth (particularly at the moment). Bitcoin’s glory days are likely over. But, with a new crypto in presale, there is a very real popularity that its value could spike to many times its original value.

2. Token Appreciation

As crypto presales progress, the price of the token rises according to a schedule. This locks in a guaranteed paper profit for investors who buy early.

- For example, the price of the Dash 2 Trade token rises an impressive 39% from stage 1 to stage 9 of its presale.

3. Utility

Meme coins – fun coins, in other words – did very well in 2021. The likes of Shiba Inu and Dogecoin delivered truly staggering returns on the back of hype and celebrity endorsement. But those days are over. What the market rewards now is a coin that is actually good for something rather than simply as a store of value. And all three tokens in crypto presale that we have looked at are used to pay for platform services.

4. Avoid Fear Of Missing Out (FOMO)

Crypto presales regularly sell out fast. Other investors are quick to spot the growth potential of cryptos at the very beginning of their market journey.

- Dash 2 Trade: this crypto analytics platform has raised $6.4 million already, with only $2.3 million worth of D2T now available in presale stage 3.

- RobotEra: just getting started, this stellar metaverse/P2E project has raised $105,693 in presale stage 1. $10k was added overnight on October 16th, 2022.

- IMPT: this carbon offsetting pioneer has raised $12.9 million of its $25.9 million target, in presale stage 2.

5. Decentralization

Despite the ongoing winter of crypto prices, the principle of decentralised crypto finance remains one that ethical investors are keen to support.

- The RobotEra whitepaper, for example, is notable in stressing the community feel of the Taro metaverse, centring on the RobotEra DAO (Decentralised Autonomous Organisation).

6. Eco-Conscious

Now that Proof-of-Stake is the dominant model for crypto authentication, crypto is a lot greener. The Proof-of-Work model – still used by Bitcoin – is enormously energy-consuming.

- Ethereum’s transition to the Proof-of-Stake model in 2022 is reported to be cutting the blockchain’s energy consumption by 99%.

7. Carbon Credit Tokenization

The IMPT Project delivers a master-stroke by giving consumers easy access to the otherwise inaccessible carbon credit market via the in-house token IMPT – as well as guaranteeing the authenticity of carbon credits using the blockchain.

8. NFTs and the Metaverse

Both the NFT and metaverse sectors have taken substantial hits in 2022. Significant coin devaluations were to be expected as the initial hype died down. The versatility of NFTs as units of exchange remains – and is fully exploited, for example, by the RobotEra metaverse as well as by IMPT Project carbon credit tokenisation.

9. Trust in Tokenomics

Generally, the supply of new tokens issued by a crypto presale is strictly limited. Hence:

- Dash 2 Trade‘s D2T total supply is capped at 1 billion.

- RobotEra‘s TARO total supply is capped at 1.8 billion.

- The IMPT Project‘s IMPT total supply is capped at 3 billion.

This is one aspect of what is known as ‘tokenomics’ i.e. the economics of tokens. Maintaining an upper cap on supply aims to keep the token on the right side of the supply vs. demand equation.

Another key feature of tokenomics is the use of the in-house token to pay for services provided by the house platform. Dash 2 Trade users, for example, pay for their subscription with D2T. And users of IMPT buy carbon credits with the IMPT token. This model supports demand for the token.

Conclusion

Above we have outlined the scope of the best bonds to buy 2022. We have looked at UK treasury bonds, bond ETFs and funds, as well as the well best growth bonds to invest in with retail savings accounts.

For investors looking for exciting growth potential and the chance to buy at basement prices, we have further highlighted three crypto presales: IMPT (IMPT), Dash 2 Trade (D2T) and RobotEra (TARO). These three projects stand out spectacularly from the 21,000 crypto out there – and all three are available at presale prices right now.

Dash 2 Trade - New Gate.io Listing

- Also Listed on Bitmart, Changelly, LBank, Uniswap

- Collaborative Trading Platform Token

- Featured in Bitcoinist, Cointelegraph

- Solid Proof & CoinSniper Audited

- Strong Community of 70,000 Traders