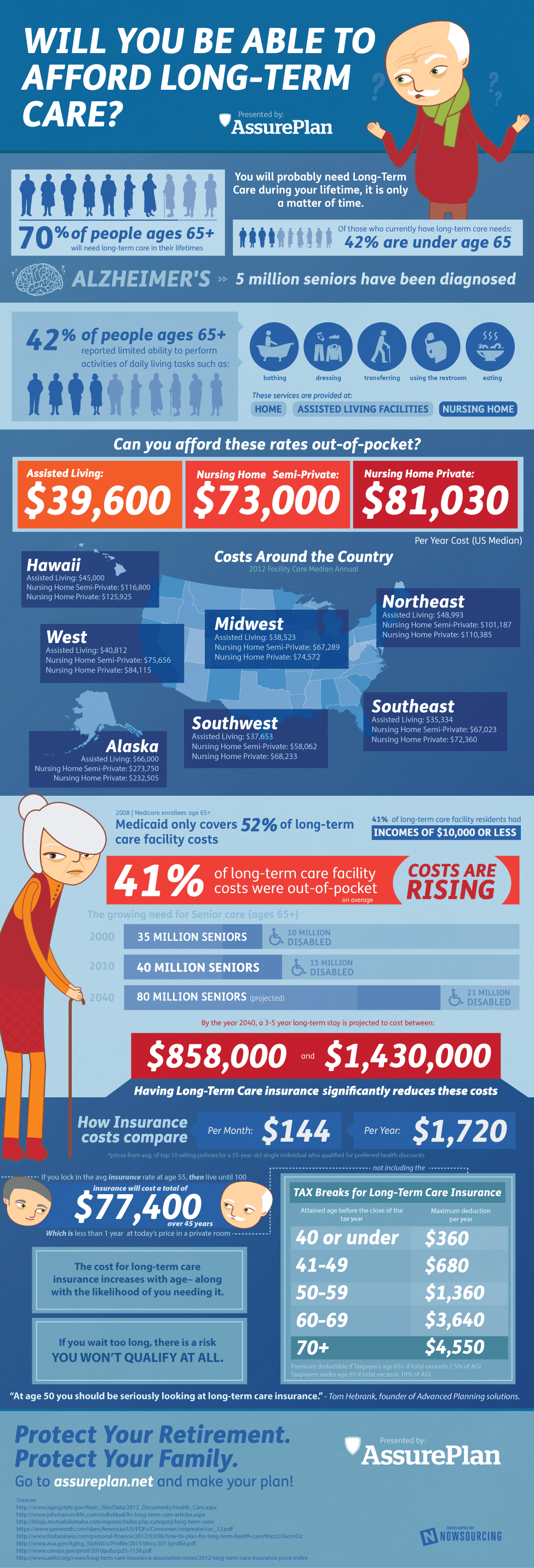

You will most likely need long-term care during your lifetime, it really is only a matter of time. After all, 70 percent of people ages 65 and over will need long-rerm care in their lifetimes. Of those who currently have long-term care needs, 42 percent are under the age of 65. Five million seniors have been diagnosed with Alzheimer’s, a progressive disease that destroys memory and other important mental functions. Furthermore, 42 percent of people ages 65 and over report limited ability to perform such daily activities as bathing, dressing, transferring, using the restroom, and eating.

The median annual cost of assisted living is $39,600; for nursing homes, it’s $73,000; and for private nursing homes, it’s $81,030. Can you afford these rates out-of-pocket? Of course, these rates vary significantly by region. The Midwest, Southwest, and Southeast tend to have cheaper rates than the Northeast. The median annual cost of facility care in Hawaii and Alaska are significantly higher than the rest of the country. In 2008, Medicaid only covered 52 percent of long-term care facility costs—41 percent of long-term care facility costs were out of pocket.

By the year 2040, a 3-5 year long-term stay at a medical care facility is projected to cost between $858,000 and $1,430,000. Having long-term care insurance significantly reduces these costs. To learn how, check out the infographic below by AssurePlan. Your future is on the line.