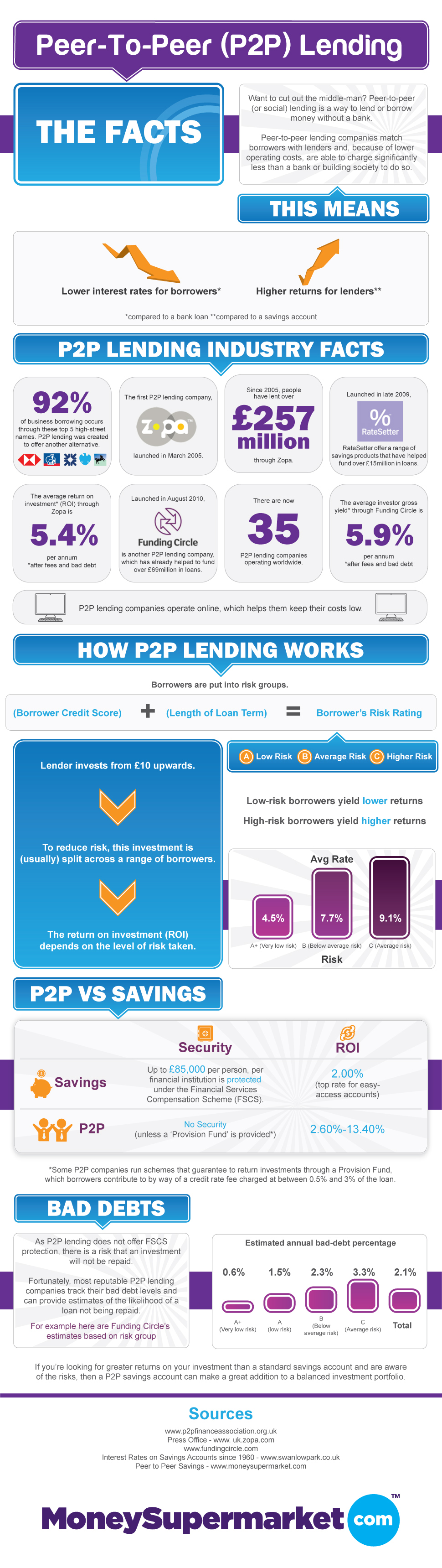

Peer-to-peer lending ( frequently abbreviated to P2P lending ) is the practice of lending money to previously unrelated individuals or “peers” without the use of traditional financial institutions. These lending companies match borrowers with lenders and as they have lower operating costs this allows them to charge significantly less than banks or building societies. Basically it is people who have spare money who lend it directly to people who need to borrow. There are no banks in the middle, no huge overheads and no hiden fees, meaning everyone gets better rates.

92% of businesses borrow money from the top 5 building societies and banks. Finding a niche in this market, Zopa launched the first P2P company in March 2005 and since then they have lent over £257 million. RateSetter was launched in 2009, offering a range of savings that have helped fund over £15 million in loans. More businesses have since been set up, with a total of 35 lending companies now operating worldwide.

Borrowers are put into risk groups, with their credit score and the length of the loan term making up their risk rating. Those assessed as having a higher risk of default are therefore assigned higher repayment rates. Lenders can mitigate the risk that borrowers will not pay back the money they received by choosing which borrowers to lend to and by spreading their investments among different borrowers.

With P2P lending savers decide how much to lend, and the rate at which they are prepared to do so. After setting the rate and loan amount, they are matched with a borrower who is happy to agree to this rate. Like any high street bank or building society, lending companies do the background work to ensure the credit worthiness of borrowers. The Peer-to-Peer Finance Association mandates the member companies to implement arrangements to ensure the servicing of the loans even if the broker company goes bankrupt