If you’re looking to buy Bitcoin for the very first time, there are many popular crypto exchanges that support Indian residents. In fact, when choosing a platform that accepts debit/credit card or e-wallet deposits, you can complete your purchase in less than five minutes from start to finish.

In this beginner’s guide, we show you how to buy Bitcoin in India with low fees via a trusted exchange.

How to Buy Bitcoin in India – Quick Guide

The process of learning how to buy Bitcoin in India is very straightforward – so the quickfire guide below might suffice.

If not, you will find a more comprehensive walkthrough in the sections below.

- ✅ Step 1: Open an Account With Capital.com – We found that the best place to trade Bitcoin in India is Capital.com – as the platform offers 0% commissions on all supported markets. It takes just two minutes to open an account with Capital.com as you simply need to enter some personal information and upload a copy of your ID.

- Step 2: Deposit Funds – If you wish to deposit funds into your Capital.com account with a debit/credit card or e-wallet, then the minimum funding requirement is just $20. Or, if you want to transfer funds via a bank wire, you will need to meet a $250 minimum.

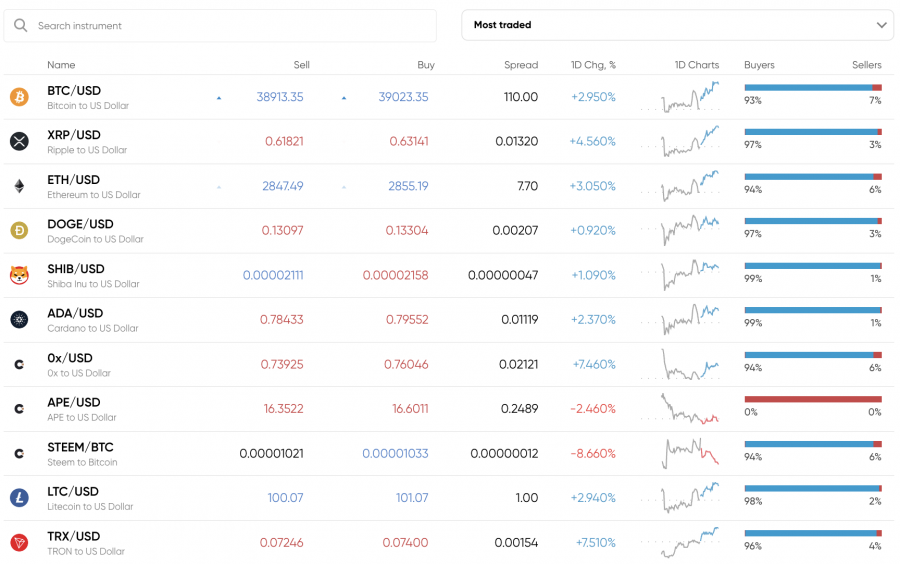

- Step 3: Search for Bitcoin – You can now use the Capital.com search to find Bitcoin. The platform offers many Bitcoin markets, but you might want to focus on BTC/USD as a beginner.

- Step 4: Trade BTC – You will now need to set up a trading order. If you think that Bitcoin will rise in value, opt for a ‘Buy’ order and enter your total stake. Confirm the order and Capital.com will execute your position instantly.

Cryptoassets are a highly volatile unregulated investment product.

When you trade Bitcoin at Capital.com, you are buying and selling CFDs. As such, there is no requirement for you to own or store any BTC tokens – as CFDs simply mirror the real-world price of Bitcoin.

Where to Buy Bitcoin in India

In order to buy Bitcoin in India, you will need to register an account with one of the best crypto exchanges in India.

Due to the size of the domestic trading market, many exchanges allow Indian residents to buy and sell Bitcoin – and the best platforms in this space support debit/credit cards and even e-wallets.

When choosing where to buy Bitcoin in India, you might want to consider one of the platforms discussed below.

1. Capital.com – Overall Best Place to Trade Bitcoin

We like Capital.com as the overall best place to trade Bitcoin in India for a variety of reasons. Opening an account with this platform takes just two minutes and when funding your account with an e-wallet or debit/credit card, the minimum requirement is just $20. Bank wires require a minimum of $250.

Nonetheless, when you have money in your Capital.com account, you can then trade Bitcoin against a variety of fiat and digital currencies. This includes the most popular crypto pair for volume – BTC/USD. In total, Capital.com offers access to over 470 crypto pairs – so you can easily diversify your trading portfolio.

Capital.com is actually a CFD trading platform, which means that you won’t directly own Bitcoin tokens. Instead, you will be speculating on the future value of Bitcoin via a financial derivative. As such, you do not need to worry about storing your digital assets in a private wallet.

When trading Bitcoin on this platform, you will not pay any commissions, and spreads are very competitive. A core advantage of buying and selling CFD instruments is that you can trade Bitcoin with leverage. Therefore, you can trade with more money than you have in your Capital.com account.

Another benefit of trading Bitcoin CFDs is that you can choose from a buy or sell order when opening your position. This means that you can speculate on Bitcoin rising or falling in value. We also like that once you have opened a Capital.com account, you can also trade CFDs that track thousands of stocks, ETFs, forex pairs, commodities, and indices.

You will not be charged any fees to open an account, nor when you deposit and withdraw funds. You can also trade at Capital.com via its iOS or Android mobile apps.

If you want to learn how to become a better Bitcoin trader, Capital offers a wealth of educational resources and guides, also covering stocks and other assets. Overall Capital is a popular multi-asset trading platform.

| Number of Cryptos | Fee to Trade Bitcoin | Debit Card Fee | Minimum Deposit |

| 470+ markets | Commission-free | No fee | $20 on debit/credit cards and e-wallets and $250 on bank wires |

What we like

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and can afford the risks.

2. Crypto.com – Buy Bitcoin and Earn Interest on Your Investment

Crypto.com is the next best place to buy Bitcoin in India. This popular crypto exchange is very user-friendly and opening an account takes just minutes. You will also have access to competitive trading fees and a wide range of support payment methods.

For instance, standard commissions at Crypto.com amount to just 0.40%. But, if you buy and stake the platform’s native digital token – CRO, then your trading commissions will be lowered. In terms of paying for your Bitcoin purchase, Crypto.com supports debit/credit cards issued by both Visa and MasterCard.

If you prefer to deposit funds via a bank wire, this is also supported. Once you have purchased Bitcoin, you might consider leaving your tokens in a Crypto.com savings account. In doing so, this will allow you to generate a yield on your investment. The highest interest rate with Bitcoin that you can earn at Crypto.com is 6%.

This would require you to stake CRO and lock your tokens for at least three months. Lower rates are offered on 1-month and flexible accounts that require no CRO staking. Either way, if you are looking to buy and hold Bitcoin for the long term, then it makes sense to generate income on your investment.

In addition to Bitcoin, Crypto.com allows you to buy and sell more than 250 other digital currencies. This includes everything from AAVE, Ethereum, and Dogecoin to Tether, Cardano, and Decentraland. You can also apply for a Crypto.com credit card – which is issued by Visa. This allows you to spend your Crypto.com balance in the real world.

Other top-rated features on the Crypto.com website include an NFT marketplace and lending services. If you prefer to invest in Bitcoin in India on the move, you might consider downloading the Crypto.com app. This user-friendly trading app is available for both iOS and Android smartphones.

| Number of Cryptos | Fee to Buy Bitcoin | Debit Card Fee | Minimum Deposit |

| 250+ | 0.4% standard commission | 2.99% | $20 |

What we like

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

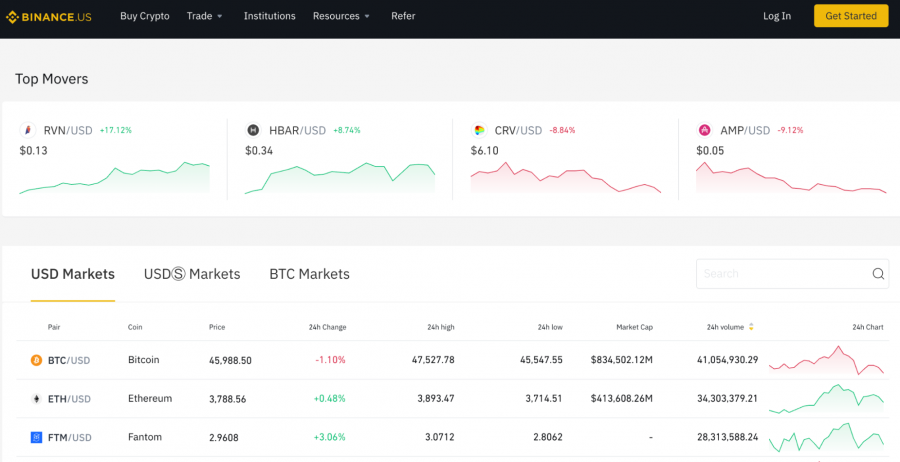

3. Binance – Popular Bitcoin Exchange That Supports 600 Digital Assets

The third exchange to consider when learning how to buy Bitcoin in India is Binance. This platform is good for trading Bitcoin and other digital currencies on a short-term basis, not least because it charges a standard commission of just 0.10%.

In addition to Bitcoin, you can also buy 600+ other crypto assets – which includes a great blend of large, medium, and small-cap tokens. To fund your account in INR, you will need to use the Binance P2p marketplace. This gives you access to a variety of convenient payment methods, such as Paytm, cash deposits, and bank transfers.

With that said, the easiest and safest option to deposit funds at Binance is with crypto. Nonetheless, once you have bought Bitcoin at Binance, you can withdraw the tokens to a private wallet at the click of a button. You can also deposit your Bitcoin into a Binance savings account – which yields up to 5% in interest.

However, only the first 0.01 BTC is paid at this rate. Anything above this figure is paid at a much lower APY of 0.8%. With that said, Bitcoin savings accounts on Binance are flexible, so there are no withdrawal limitations. If you are interested in buying less liquid digital currencies, higher APYs are offered.

Moreover, Binance is a great option if you wish to trade exotic digital currencies, not least because the platform is home to over 600 crypto assets. You might also choose to buy Bitcoin in India via the Binance exchange if you seek advanced chart analysis tools. This includes technical indicators and access to TradingView.

Binance might also appeal if you are looking for a top-rated crypto wallet to store your Bitcoin tokens. Trust Wallet – which is backed by Binance, is a decentralized app that gives you full control over your private keys. You can also keep your Bitcoin in a Binance savings account, which will enable you to earn interest on your investment.

If you are an experienced crypto trader, Binance gives you access to a plethora of advanced tools. This includes real-time charts and technical indicators. You can also access crypto derivatives, which allow you to trade Bitcoin with leverage. The Binance mobile app is also worth considering if you want to buy Bitcoin on the move.

| Number of Cryptos | Fee to Buy Bitcoin | Debit Card Fee | Minimum Deposit |

| 600+ | 0.1% standard commission | Determined by P2p marketplace | Varies depending on the payment type |

What we like

Cryptoassets are a highly volatile unregulated investment product.

Should I Buy Bitcoin?

Now you know where to buy Bitcoin in India, it’s important to do your research before investing. But what about using BTC to place bets via the best Bitcoin casinos in India?

With the global stock markets stagnating in recent months, more and more Indian residents are looking at alternative asset classes like Bitcoin.

You likely already know that Bitcoin is a speculative asset that can be prone to high levels of volatility. On the other hand, Bitcoin has generated significant growth since it was launched in 2009.

To help you determine whether or not you should buy Bitcoin in India, the following sections will discuss the benefits and drawbacks of investing in this digital currency.

Benefits of Buying Bitcoin

Let’s take a look at the benefits to consider when learning how to buy Bitcoin in India for the first time.

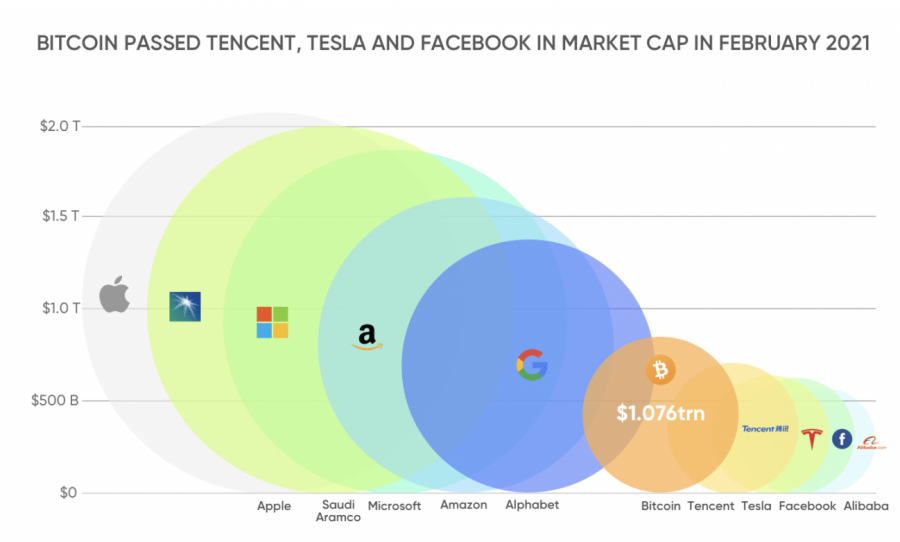

Huge Returns Since Bitcoin Was Launched

Bitcoin as an investment class is attractive when you consider how much it has grown in value since the network was launched in 2009.

Those that saw the vision of Bitcoin and blockchain technology during the first couple of years after it launched would have paid less than a dollar per BTC token.

- The digital currency has since increased to thousands of dollars per token, which translates into growth of millions of percent.

- In more recent times, you could have bought Bitcoin for roughly $1,000 back in early 2017.

- Bitcoin last hit an all-time high in late 2021 at nearly $69,000 per token – so when compared to 2017 prices, this equates to gains of almost 6,800%.

- In other words, had you invested $1,000 back in early 2017, at its peak, your Bitcoin portfolio would have been worth $68,000.

When you compare the returns of Bitcoin against the traditional stock markets, the disparity is huge. For example, over the prior five years, the S&P 500 has increased by just 72%.

Consolidation Period Offers Great Entry Price

Shrewd investors will often look to buy an asset when it goes through a market correction. In basic terms, a market correction is when an asset temporarily drops in value before resuming its upward trend.

- In the case of Bitcoin, although the digital currency hit highs of $69,000 in late 2021, it has since entered a market correction.

- In 2022, Bitcoin has mainly hovered between $40,000 and $44,000 – which offers a great entry point if you are learning how to buy Bitcoin in India for the first time.

- After all, why pay $69,000 per token when you can get yourself a huge discount?

In fact, even at the higher end of $44,000, this works out at a cost price that is 36% lower than Bitcoin’s prior peak. As such, if you’re thinking about when to buy Bitcoin, entering the market during a dip can be a great strategy.

Bitcoin is Decentralized

Now focusing on the underlying technology itself, Bitcoin is highly innovative. At the forefront of this is that Bitcoin is a decentralized digital asset. In a nutshell, this means that no single person or authority has control over Bitcoin.

Furthermore, and perhaps most importantly, Bitcoin is not backed by a central bank or nation state. This means that once you buy Bitcoin in India and keep the tokens in a private wallet, only you have access to your funds.

Bitcoin Supply is Determined by Immutable Code

Leading on the from the above section, Bitcoin’s decentralized nature ensures that its supply cannot be manipulated. This is in stark contrast to traditional fiat currencies – which are controlled by central banks.

If you’re wondering why many countries around the world are struggling with soaring inflation levels, this is a direct result of central bank policies.

More specifically, central banks continue to print new money into circulation as a defense mechanism against the COVID-19 pandemic. Crucially, in the case of Bitcoin, supply is governed by code.

This immutable code ensures that just 6.25 BTC newly minted tokens enter circulation every 10 minutes.

This will be halved to 3.125 BTC every 10 minutes – which is projected to happen in 2024. This process will continue until the total supply of Bitcoin hits 21 million – which is expected to occur in 2140.

Bitcoin is a Finite Store of Value

As noted above, the total supply of Bitcoin will never surpass 21 million tokens. This means that Bitcoin – just like gold and silver, is a finite asset class. In fact, just like the aforementioned precious metals, Bitcoin is also viewed as a store of value.

This means that holding Bitcoin over the course of time could be a great alternative to owning stocks. After all, as demand continues to outpace supply, this can have the desired impact of increasing the intrinsic value of Bitcoin.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and can afford the risks.

Ways of Buying Bitcoin

The best ways to buy Bitcoin in India are discussed in the section below:

Buy Bitcoin With Credit Card or Debit Card

If you decide to trade Bitcoin at Capital.com or Crypto.com, you can pay for your investment with a debit or credit card. This is the fastest and most convenient way of entering the market for the first time.

Capital.com in particular is a great option if you are planning to use a debit or credit card, as the platform does not charge any deposit fees.

Buy Bitcoin With PayPal

Being able to buy Bitcoin instantly with PayPal is no easy feat in India, not least because very few exchanges accept e-wallets. With that said, the best option you have is to use Capital.com – which not only supports PayPal but Google Pay and Trustly.

Moreover, when using an e-wallet or debit/credit card at Capital.com, you only need to meet a minimum deposit of $20.

Cryptoassets are a highly volatile unregulated investment product.

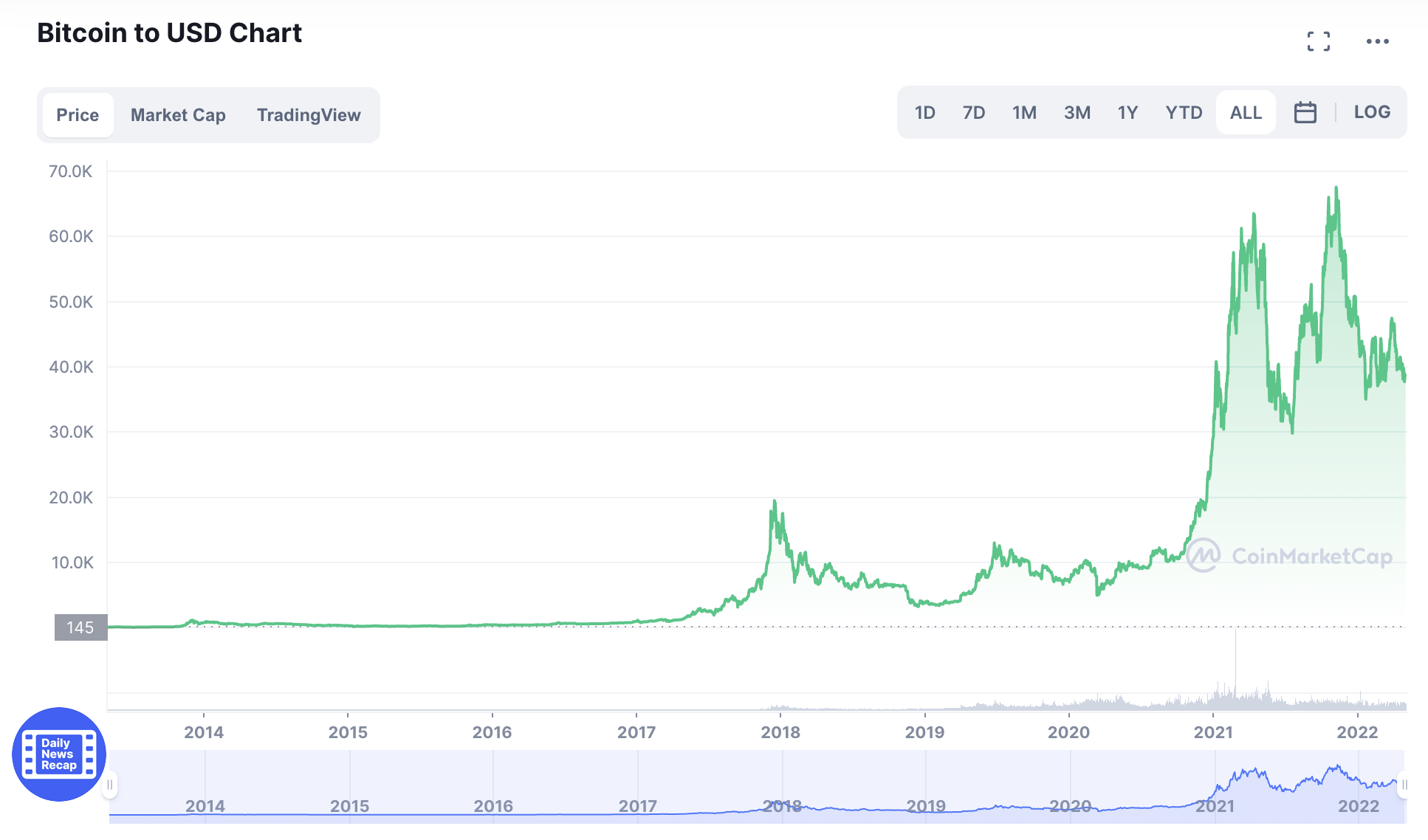

Bitcoin Price

The Bitcoin price will fluctuate throughout the day – oftentimes in a more volatile manner than traditional assets like stocks and bonds. This is, however, one of the main draws for speculative investors that seek above-average market gains.

The vast majority of crypto exchanges that support Indian residents will allow you to trade Bitcoin against the US dollar. This is not too dissimilar to trading gold, oil, and other commodities – most of which are also quoted against USD.

In terms of its price history, Bitcoin has increased in value by a considerable amount since launching in 2009. As noted earlier, its most recent all-time high stands at nearly $69,000.

If you want to track the real-time value of Bitcoin, you can do this through all of the exchanges that we discussed today. You can also download the Capital.com or Crypto.com app and set up Bitcoin price alerts.

This will send a notification to your phone when Bitcoin moves up or down by a certain amount. You can also set up your own Bitcoin pricing alerts based on your own preferences and targets.

Bitcoin Price Prediction

Throughout 2022, Bitcoin has been stuck in a consolidation period that has averaged a pricing bracket of $40,000 to $44,000. At the higher end, this represents a decline of 36% from its prior peak of $69,000.

Moving forward, many proponents of Bitcoin argue that when the next upward trend begins, a target of over $10,000 per BTC should be in sight.

However, when the next Bitcoin bull market arrives remains to be seen. With that said, it’s best not to be too fixated on short-term price fluctuations if you are looking to invest in Bitcoin in the long term.

After all, Bitcoin has gone through many ups and downs since it was launched in 2009. But, the longer-term trend has always been positive.

How to Buy Bitcoin Safely

Many people that are new to Bitcoin are worried about the safest of their investment. This is often due to the issue of exchange and wallet hacks.

- As such, if you want to buy Bitcoin safely, the first thing that you need to do is to ensure that you are using a trusted exchange.

- If your chosen exchange is licensed, then it has the legal remit to offer Bitcoin trading services.

- The licensed platform will also need to meet a variety of guidelines and regulations with regard to investor protection.

On the other hand, if you were to buy Bitcoin in India from an unlicensed exchange, your capital is at risk.

Over the prior few years alone, many unregulated exchanges have been hacked remotely, which has resulted in customers losing their deposits.

As such, you need to think very carefully about which exchange you decide to use when learning how to buy Bitcoin in India.

- Another important method to ensure that you can buy Bitcoin safely is to understand the ins and outs of wallet security.

- For example, you’ll want to choose a wallet that offers two-factor authentication at a bare minimum.

- If you decide to leave your Bitcoin tokens in the wallet offered by the exchange that you used to make the purchase, then make sure that the provider keeps client funds in cold storage.

Alternatively, if you decide to trade Bitcoin at a CFD platform like Capital.com, you don’t need to worry about any of the above risks.

First and foremost, Capital.com is regulated by four bodies – the FCA, ASIC, CySEC, and NBRB. Second, as you are trading CFDs, you do not own any digital tokens. As such, you don’t need to get involved with wallet storage or security.

How to Buy Bitcoin in India – Tutorial

This section of our beginner’s guide will explain how to buy Bitcoin in India every step of the way.

This includes the process of how to set up an account with Capital.com, make a minimum deposit of $20 with your debit/credit card or e-wallet, and finally – place a trade.

Step 1: Open Capital.com Account

To get started with an account at Capital.com, visit the provider’s website and click on the ‘Trade Now’ button. You will then see a registration form appear like in the image below.

After entering your email address and a chosen password, click on the ‘Continue’ button. Next, you will be asked to enter some personal information surrounding your identity and home address.

The final part of the registration process at Capital.com is to upload a clear copy of your government-issued ID. We find that the platform is able to validate ID uploads in just a few seconds.

Step 2: Deposit Funds

Before you can trade Bitcoin at Capital.com, you will need to meet the minimum deposit requirement.

- If funding your account with a debit/credit card or e-wallet, the minimum deposit is just $20

- If opting for a bank wire deposit, you will need to transfer at least $250

Crucially, no deposit or withdrawal fees are charged by Capital.com irrespective of the payment method that you choose.

Step 3: Search for Bitcoin (BTC/USD)

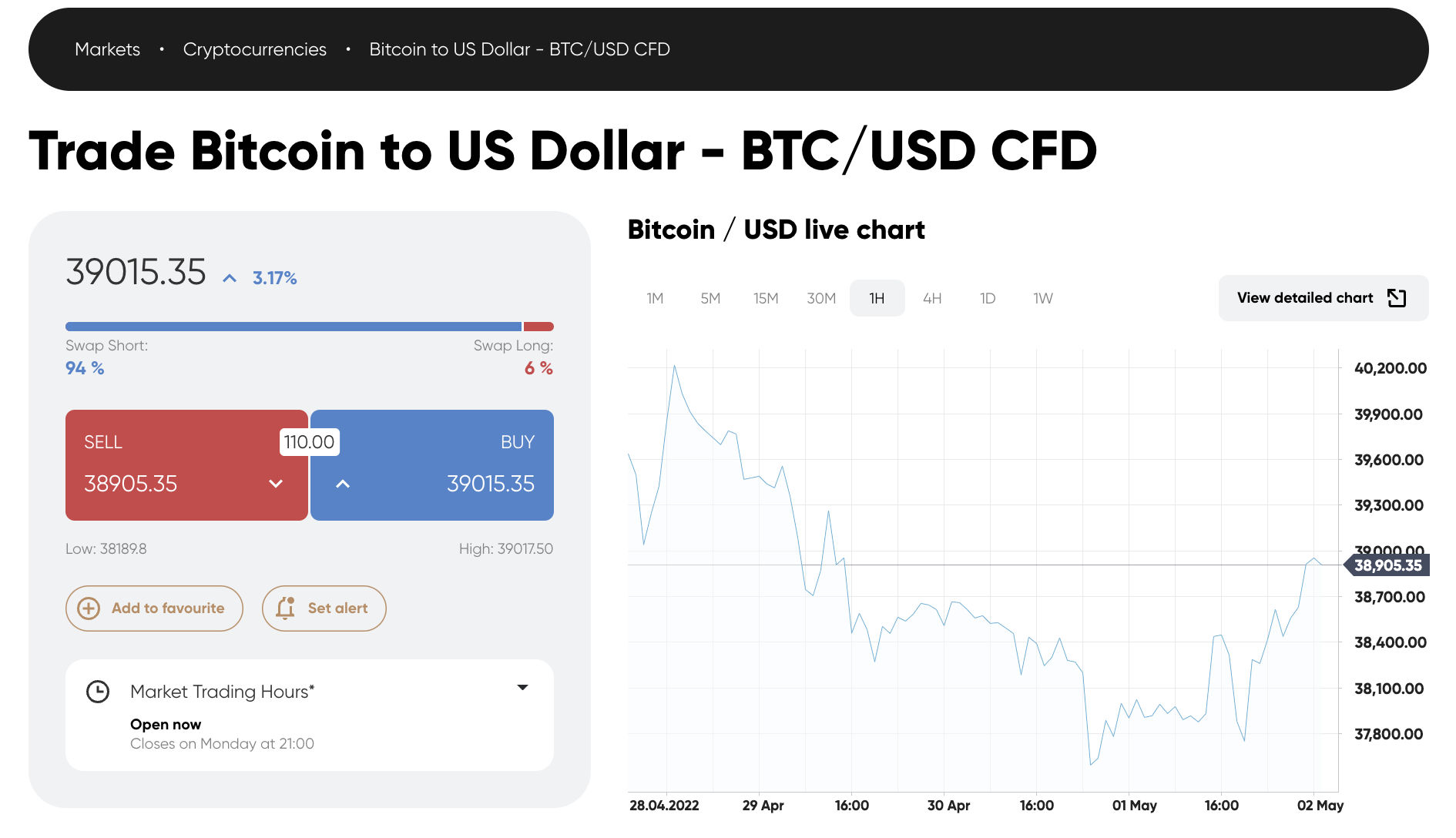

At Capital.com, Bitcoin can be traded against a full suite of fiat currencies – such as the euro, pound sterling, and rupee. However, if you are just learning how to buy Bitcoin for the first time, then it’s best to trade BTC/USD.

This means that you will be trading the future value of Bitcoin against the US dollar.

To find this trading market, you simply need to enter ‘BTC/USD’ into the search box. Then, click on the respective market when you see it appear.

Step 4: Trade Bitcoin

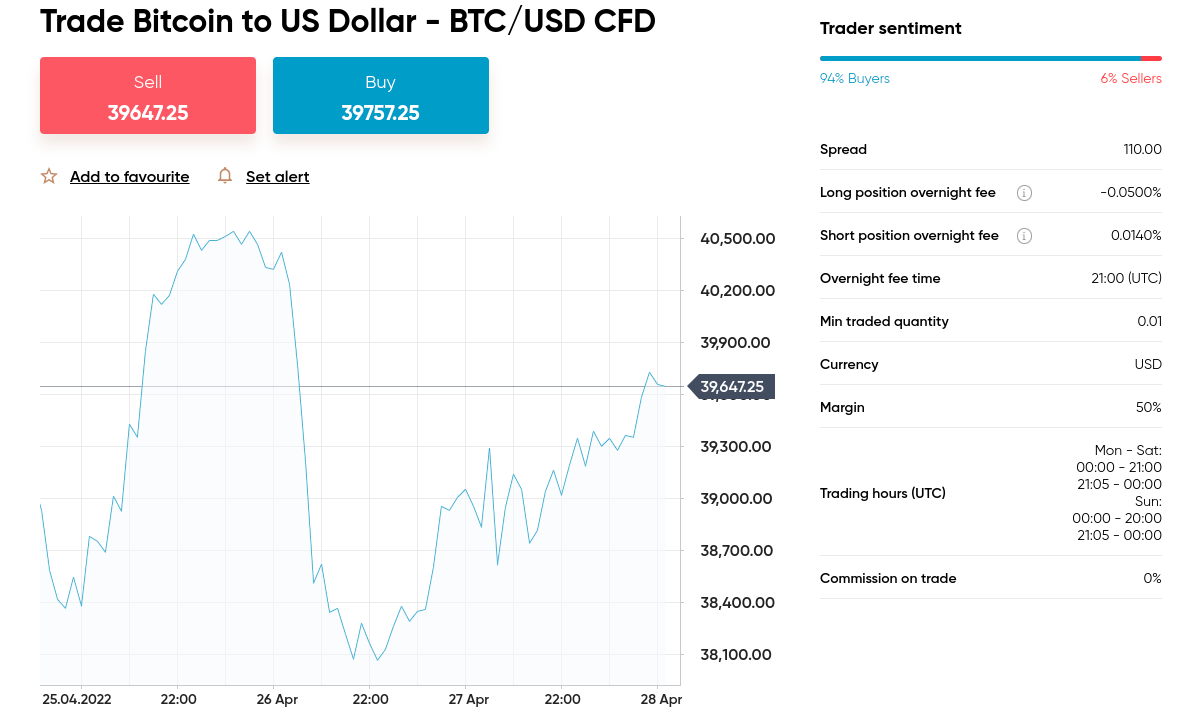

You will now be presented with a real-time pricing chart of BTC/USD – or whichever pair you decided to trade.

On the right-hand side of the chart, you will see some useful information surrounding trading sentiment, margin requirements, and financing fees.

In order to place a trade on Bitcoin, you need to choose from a buy or sell order. You will opt for the former if you think that the price of Bitcoin will rise, and the latter if you believe the opposite.

After entering your stake in US dollars, confirm the order. Your Bitcoin trading order will subsequently be executed in real-time and will remain open until you decide to cash it out.

How to Sell Bitcoin

Selling Bitcoin in India is just as easy as the buying process outlined above. The specific process will, however, depend on which exchange you used.

- For example, if you followed the above walkthrough with Capital.com, then cashing out your position is as simple as placing a sell order.

- In doing so, Capital.com will instantly close the position and the funds from the trade will be added back to your account balance.

If you decided to use a conventional exchange like Binance and you withdraw your Bitcoin to a private wallet, the process is slightly more cumbersome.

This is because you will need to transfer the Bitcoin back to an exchange before selling the tokens for cash.

Conclusion

This beginner’s guide has cleared the mist on how to buy Bitcoin in India. In addition to discussing where to buy Bitcoin in India, we have also explained the benefits and drawbacks of this digital currency from an investment perspective.

We found that overall, the best way to gain exposure to Bitcoin is with a regulated CFD platform like Capital.com. You can open a Capital.com account in a matter of minutes and subsequently deposit funds fee-free with a debit/credit card or e-wallet.

Best of all, when using Capital.com to trade Bitcoin – you will not be charged any commission.

Cryptoassets are a highly volatile unregulated investment product.