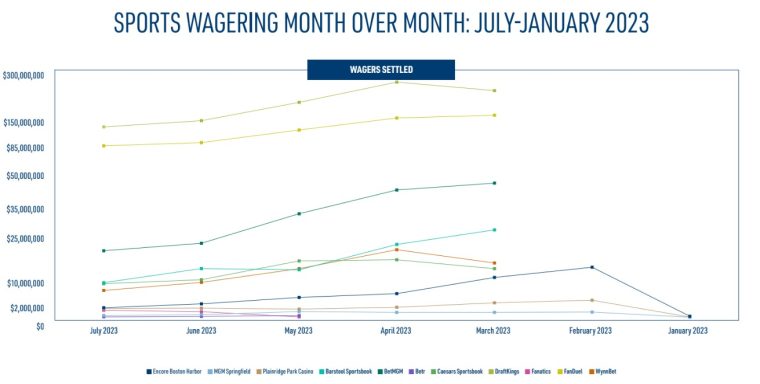

The Massachusetts Gaming Commission has reported a third consecutive month of handle decline, with the lowest reported figure ($294.9 million) in July since the legalization of mobile sports betting in Massachusetts.

MA handle was down 11.4% from $332.0 million wagered by bettors in June, and 48.3% from March 2023’s record handle of $568.2 million. Taxable revenue was down 8.7% to $29.4 million from $32.2 million in June 2023. Before Federal Excise deduction, accrual win by licensee was $30.1 million overall.

Expected decline continues, but handle surpasses $2 billion

The decline in MA sports betting handle is expected, given the dry period in the United States sporting calendar. Nevertheless, Massachusetts hit another milestone in July, with handle breaking the $2 billion mark since legalization.

DraftKings continues Massachusetts market share dominance

Per reported operator numbers, DraftKings was the MA bettor’s operator of choice reporting $145 million of handle for July. With regards to handle market share, that gives DraftKings a whopping 50.3% of the MA online betting market. The company reported a 10.2% margin to post taxable revenue of $14.4 million.

FanDuel posted a higher hold percentage with 11.7% to turn $9.9 million taxable revenue from $86 million handle. The Flutter owned operator captured 29.9% of handle, giving the two market leading operators just over 80% of online market share.

The story is similar for BetMGM and Caesars as it is in many other states, with both brands lagging behind the two market leaders. BetMGM held 7.8% market share, posting $22.5 million handle and $2.5 million taxable revenue. Caesars and Barstool both posted 3.9% and 4.0% market share respectively. Caesars handle was $11.3 million, with a hold of 7.1% leaving taxable revenue at $0.8 million.

What challenge does ESPN Bet face?

Barstool Sportsbook/PENN posted a statewide low hold with 3.35%. From $11.7 million handle, the company posted taxable revenue of just $0.4 million. The PENN and Barstool partnership is set to end shortly, with Dave Portnoy purchasing Barstool back, and PENN instead signing a significant deal with media giant ESPN. ESPN Bet will take the place of Barstool and aims to compete with DraftKings and FanDuel for market share.

Things… can only get Betr?

WynnBet also revealed it would be shutting operations in eight states. In addition, the brand has put Michigan online casino under review, as well as sports betting in New York, which sits on the MA border. Nevada and Massachusetts are to continue operations given the company has a retail presence. In MA, Wynn operates the Encore Boston Harbor book. Handle taken by Wynn for July was $9 million, with an 8.0% hold generating $0.7 million in taxable revenue.

There was reason for Fanatics to be optimistic with $2.3 million handle an uptick of $0.5 million on June 2023. The same, however, can not be said for Betr which saw handle almost half from $290,649 to $155,581 (-46.5%). In three months of operation, handle has fallen 73.8% from $592,965 to $155,581.