With the price of gold bullion down significantly in 2013, it appears many are simply ignoring all gold mining stocks, lumping them into one category and avoiding the group as a whole.

Personally, I love buying when things are on sale. I hate paying full price on anything, no matter if it is for a stock or clothes. When it comes to gold mining stocks, the market sentiment hasn’t been this bearish in years.

Market sentiment tends to oscillate, and for the long-term investor, one should be looking to buy when others are selling and looking to sell when others are buying.

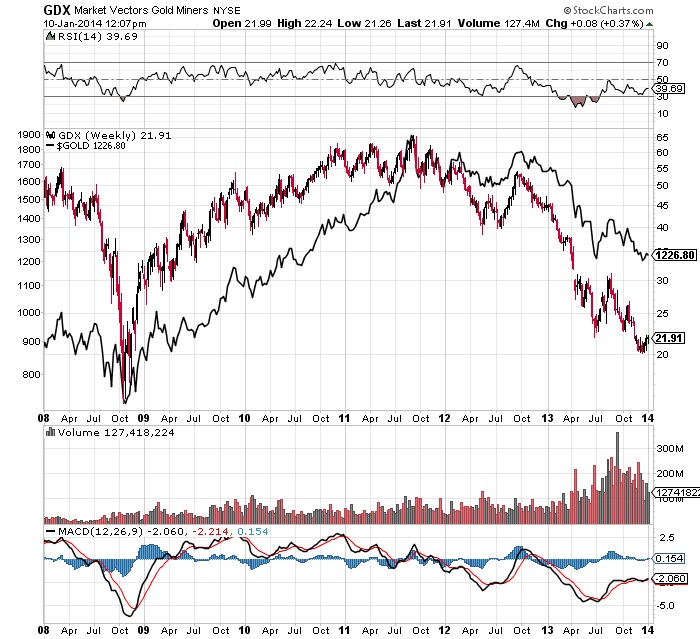

Chart courtesy of www.StockCharts.com

The above chart shows the price of gold bullion (black line) on top of the price of gold mining stocks (red line) as exhibited through the exchange-traded fund (ETF) Market Vectors Gold Miners ETF (NYSEArca/GDX).

As shown in the chart, gold mining stocks are nearing lows we haven’t seen since late 2008. Although some gold mining companies are struggling financially because of high production costs, there are definitely some firms that look very appealing given the amount of bad news already factored into the market.

This is what you have to consider as an investor: is market sentiment too bullish, too bearish, or somewhere in between?

I believe that both gold bullion and gold mining stocks look attractive at this point because most of the bad news has already been priced into the market.

Since the price of gold bullion is still low, companies that can’t function in this setting will struggle. However, some gold mining stocks can produce at an all-in sustaining cost that is lower than the current price of gold bullion, allowing them to stay profitable.

If a company still has strong assets, a solid balance sheet, and is able to create positive cash flow, this type of firm is of interest to me, especially when market sentiment is so negative. One such company investors may want to consider is Primero Mining Corp. (NYSE/PPP).

As a group, I believe gold mining stocks have significant potential to move up over the next few years because of fundamental changes to their business model. Because the price of gold bullion has dropped, companies have changed their approach. When gold bullion was rising sharply, gold mining stocks were expanding at a rapid rate. Companies were taking on projects that were barely profitable, simply for the sake of expanding. However, the focus for gold mining stocks these days is on efficiency and cost-cutting.

Many properties are now sitting idle and expansion plans have been put on hold. This means that we will see less supply growth of actual gold bullion onto the market.

With physical gold bullion demand still remaining strong, at some point, the fundamental backdrop will take hold. You can’t have lower supply and strong demand without an eventual rise in price.

In addition, easy money by central banks around the world continues to flow, and this, too, will ultimately have a positive impact on the price of gold bullion.

I think that when we look back in a few years, many investors will wish they had added some gold mining stocks to their diversified portfolio.

The market is cyclical, and for long-term investors, focusing on adding sectors when they are weak and taking profits in sectors when they are strong is usually a recipe for success.

This article How to Profit Big from Gold Mining Stocks Left for Dead was originally published at Daily Gains Letter