This is the fourth in a series of articles designed to counter a pervasive attitude that common stocks are expensive today. Furthermore, we would agree with those that contend that we have been in a stealth bull market for the last 18 months or more. However, would also contend that stocks were so cheap prior to this stealth bull-run that even though they have risen, there are still many stocks that remain fairly priced and even many that are undervalued. Blue-chip Dividend Aristocrats represent one of the best examples of our thesis.

A second, but very important additional theme of this series of articles focuses on the reality that it is, in truth, a market of stocks and not a stock market. Therefore, we argue that investors and their portfolios are best served by focusing on specific companies they may be interested in investing in, in lieu of worrying about the general levels of broad markets and/or the economy, etc. Links to our previous articles can be found here: Part 1 , Part 2 and Part 3.

Blue-Chip Dividend Aristocrats – Many Attractive Buying Opportunities

The equity asset class that many believe is overvalued is the high-quality dividend growth stock. This perception has been created in part because many of these stocks have performed well lately. However, as we will illustrate later, many in this group were so undervalued that even after their prices rose they have only become fairly valued, while some still remain undervalued.

The prestigious Standard & Poor’s Dividend Aristocrat list is comprised of 50 companies that have increased their dividends for 25 or more years in a row. Thanks to the almost effortless efficiency of the F.A.S.T. Graphs™ fundamentals analyzer software tool, it has been an easy task to run through this list of 50 quality dividend growth stocks one at a time. Therefore, a clear perspective of the valuation on each constituent was easily and quickly accomplished. We believe this is far superior to relying on a vague idea about valuations based on notions of the markets at large, or pre-judgments about a large group.

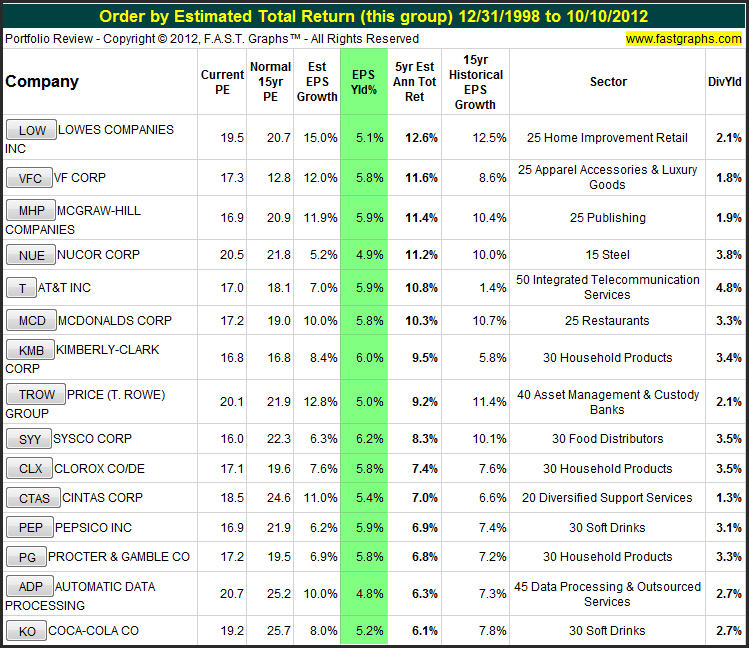

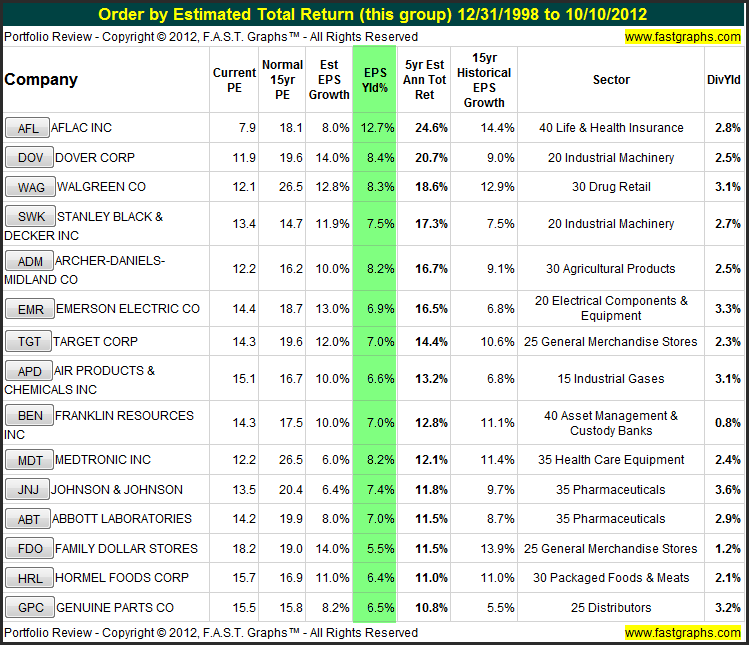

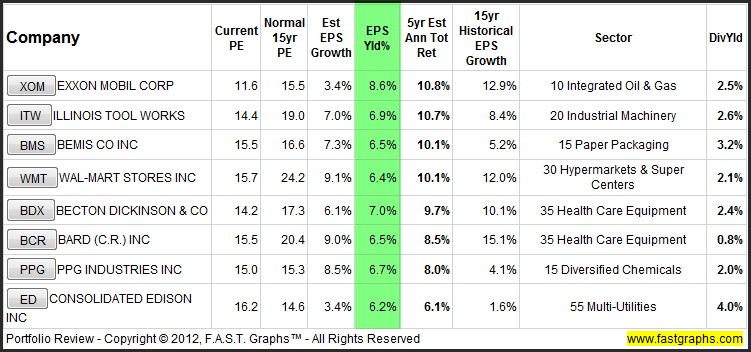

This exercise empowered us to organize the Standard & Poor’s Dividend Aristocrat list into four simple groups based on valuation. With so many investors perceiving stocks as generally overvalued, the results were quite gratifying. Of the 50 Blue-chip Dividend Aristocrats, we found 23 that were fairly valued to undervalued, 16 that were moderately overvalued, only 8 that we felt were dangerously overvalued, and finally, 3 that we felt had fundamental issues. The following tables and individual examples will be presented in reverse order, starting with the most overvalued and moving on to where we see the best valuations.

Dangerously Overvalued Dividend Aristocrats

The label “dangerous overvaluation” refers to Dividend Aristocrats whose prices have risen far enough above rational earnings justified valuations that short to intermediate-term price movements could result in temporary losses of 20% or greater. However, because of the quality of these names and their long-term consistent records of earnings and dividend growth, each of these eight names are still expected to generate positive long-term total returns in spite of today’s overvaluation.

Therefore, the real message here is that we believe investors would be best advised to wait patiently for what we believe will be inevitable corrections, representing better entry points. In concert, this would also imply that current owners might want to consider either lightening up on these positions or even outright sales of the total position. Moreover, the reader should recognize that this is primarily a valuation recommendation, because most of the companies on this list are superb businesses with great long-term operating records. In other words, we like the stocks, but not their current prices.

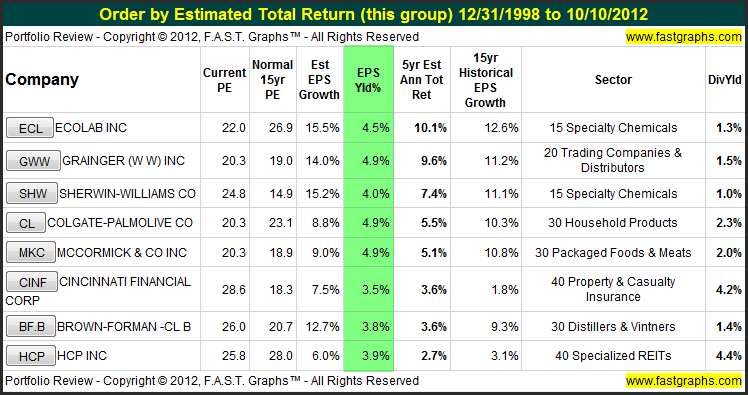

The following table lists the eight dangerously overvalued Dividend Aristocrat constituents by order of highest expected future return to the lowest. As a valuation measurement, we believe the highlighted column “EPS Yld%” provides important insight into valuation. A preponderance of historical evidence has led us to conclude that a minimum earnings yield of 6.5% to 7% is required for fair value to be present. Therefore, the reader will notice that all of the names on this list possess earnings yields below 5%. In other words, this suggests that the company’s earnings and cash flows do not adequately compensate investors for taking the risk of owning the equity.

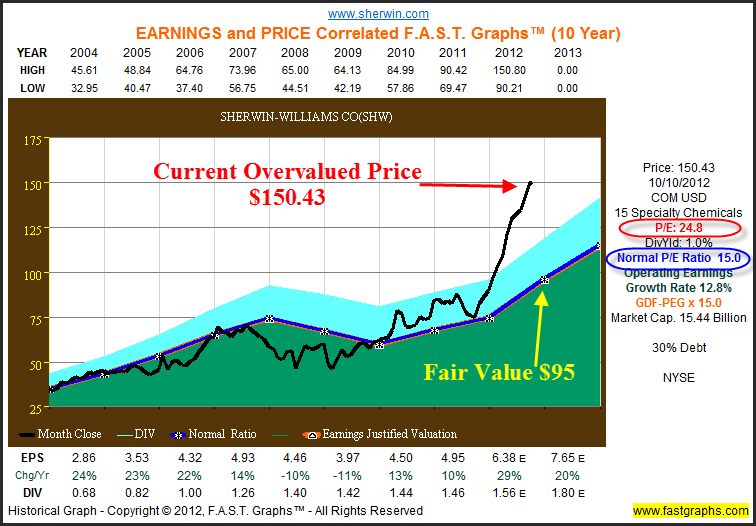

Sherwin-Williams Co. (SHW): A Clear Picture Of Overvaluation

A quick glance at the following earnings and correlated F.A.S.T. Graphs™ on Sherwin-Williams vividly displays how the company’s stock price has currently deviated from its intrinsic value. Moreover, it is clear that this is completely unsupported by historical precedent. Furthermore, it’s important that we focus on the fact that Sherwin-Williams was very reasonably priced at the beginning of 2004, and essentially stayed that way until inexplicably price started deviating in late 2011.

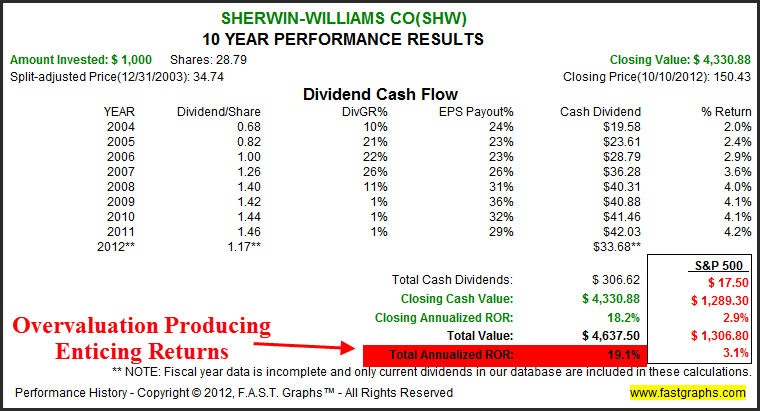

We believe the Sherwin-Williams’ example illustrates one of the great dangers of relying on statistical data when looking for investment candidates. The 10-year track record of this high-quality dividend aristocrat that has produced a compounded annual return in excess of 19% per annum could easily entice investors into believing that it is an excellent investment choice. However, we would argue that the proper view would be that Sherwin-Williams was an excellent investment choice in 2004. On the other hand, we believe the picture above clearly illustrates that this company is dangerously overvalued today.

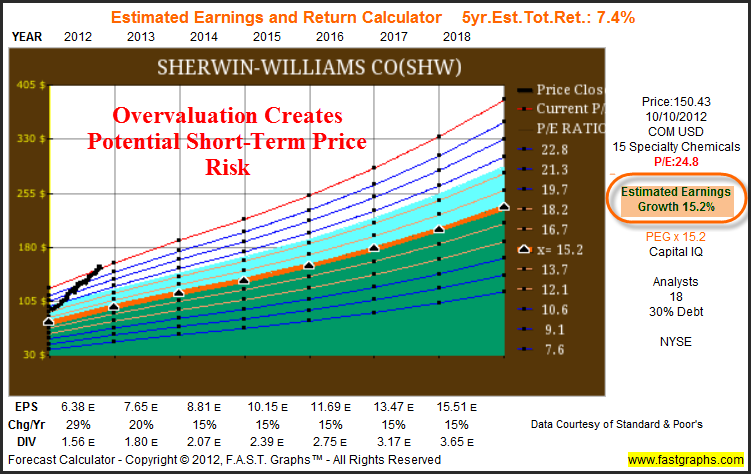

Even looking to the future, and acknowledging that Sherwin-Williams is expected to have accelerated earnings growth in excess of 15%, still does not justify today’s high valuation. Consequently, we feel that now would be an excellent time to lighten up on, or even completely sellout of, this high-quality Dividend Aristocrat. We believe it would even be prudent to hold the cash with a parentheses around it that says “this money is earmarked to be returned to Sherwin-Williams when its valuation inevitably comes back in alignment with earnings.” However, there are not many investors that possess this kind of discipline or rational thought.

Moderately Overvalued Dividend Aristocrats

When we examine the 16 moderately overvalued Dividend Aristocrat constituents, we are presented with an interesting challenge. Even though past and present operating results play an important role in the valuation decision, we believe that the greatest weight should be given to the forecasts of the future operating potential of each company. The challenge that this presents rests with the accuracy of the forecasts. For example, if the estimated future earnings growth is too low, then these companies may not be overvalued after all, and vice versa.

Nevertheless, looking at an earnings and price correlated F.A.S.T. Graphs™ provides a great deal of information and insight that can be useful in regards to making this kind of determination. Furthermore, if we accept the consensus forecasts provided by leading analysts, we discover that our earnings yield, although below are 6.5% to 7% threshold, is closer to fair value than we saw with what we designated as the dangerously overvalued group.

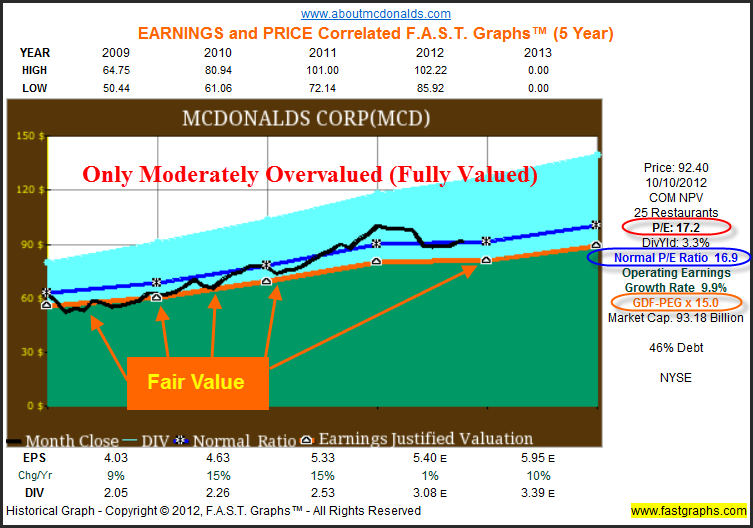

McDonald’s Corp. (MCD) – Moderate Overvaluation?

McDonald’s Corp. represents a classic example of moderate overvaluation. Technically, the current PE of 17 is supported by the company’s normal PE ratio since calendar year 2009 (post recession). On the other hand, since McDonald’s is currently trading at a PE ratio greater than 15, which would be the earnings justified valuation calculation of intrinsic value, it is technically moderately overvalued. Furthermore, even when viewing this chart, that only provides 4 years and 10 months of actual history (note that estimates for calendar year 2013 are included on this graph), we see several times where McDonald’s stock price was touching the orange line representing fair value. Consequently, the patient investor may be wise to wait for an entry point when McDonald’s is firmly in value.

In other words, this could imply that a patient investor might get the opportunity for a more attractive entry price. On the other hand, buying it today might not be so terrible either. This is the conundrum that moderate overvaluation presents. More simply stated, we would not consider McDonald’s Corp. dangerously overvalued by any stretch of the imagination. Perhaps, the term fully valued would be more appropriate, and might also apply to most of the other 15 examples in this moderately overvalued group.

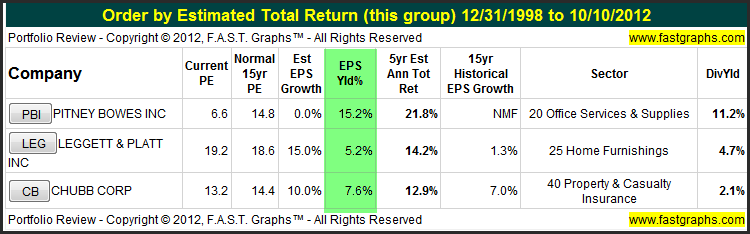

Fundamental Issues – Dividend Aristocrats

There were 3 of the 50 Dividend Aristocrats that cause us concern based on what we would call real or potential fundamental issues. Ironically, two of these three, Pitney Bowes Inc. (PBI) and Chubb Corp. (CB) show earnings yields that are significantly greater than our 6.5% to 7 % threshold. On the other hand, both of these companies have operating histories that, at the very least, make us question the reliability of future growth. Perhaps even more ironically, we might favor Leggett & Platt (LEG) over the other two, yet it is the only one with an earnings yield below our threshold.

We believe this simply validates our belief that there is no substitute for comprehensive research. On the other hand, we believe that powerful tools such as F.A.S.T. Graphs™ can certainly make that effort easier and more efficient. Statistics alone will often mislead investors if they don’t have a clear picture of what is really transpiring within a given business.

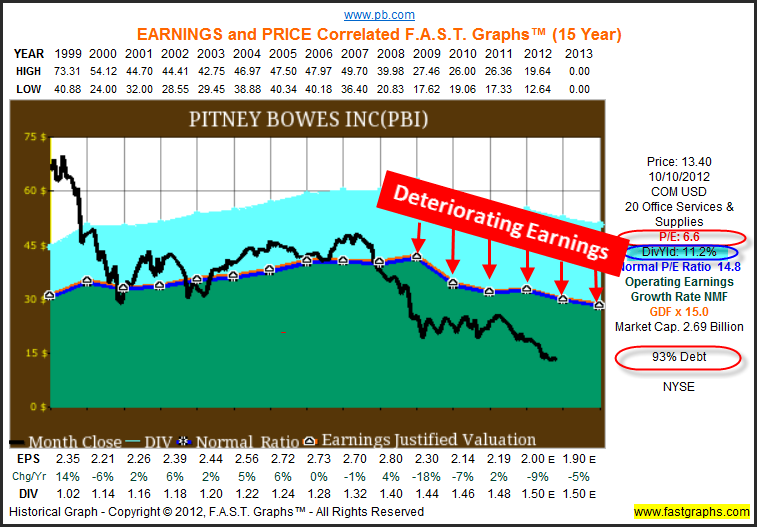

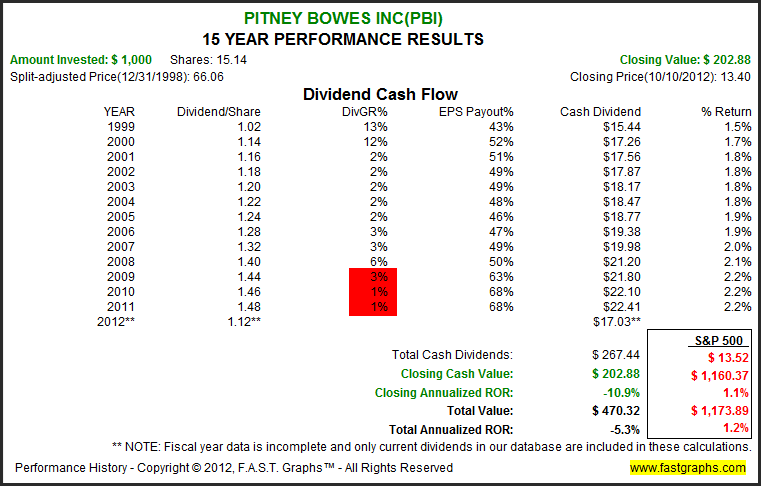

Pitney Bowes Inc (PBI): A Clear Picture of Deteriorating Earnings

Companies that are found on prestigious lists such as the Standard & Poor’s Dividend Aristocrats or David Fish’s Dividend Champions would imply strong companies based on their long-term histories of raising their dividends each year for at least 25 consecutive years. And frankly, and even for the most part, those implications would prove true. However, deeper research can often indicate otherwise. Pitney Bowes Inc. appears to be a company that deviates from the strong company assumption.

A quick glance at the earnings and price correlated graph below shows that earnings have been in a freefall since the great recession of 2008. However, a more cursory look at the current dividend yield of 11% on a Dividend Aristocrat that has increased its dividend every year for 25 years seems quite alluring. Consequently, we offer this as a prime example of how simple statistics like dividend yield and even Pitney Bowes’ low PE ratio of 6.6, looked at in isolation, can be misleading.

When you review Pitney Bowes’ price performance over the past 15 years there are two issues that need to be considered. First of all, this company was clearly massively overvalued at the beginning of 1999. Then, stock price appropriately tracked earnings up to and including the great recession. Since that time both earnings and stock price have been in a freefall. But perhaps the most telling factoid indicating a red flag is that dividend growth has slowed to a crawl over the past three years.

However, in all fairness to Pitney Bowes, we would suggest that prospective investors should look much deeper into what is currently happening with this company. If the last few years are any indication, then this company may be on the threshold of becoming a fallen angel. Currently, only a few analysts are following the company and are forecasting zero growth going forward. Finally, Pitney Bowes’ high debt load represents another caveat. Finally, the primary learning point here is that you can’t rely on statistical representations of valuations based on measurements such as average PE ratios or even earnings yield, without seeing all these facts in relation to each other. In other words, a picture is truly worth 1000 words.

Dividend Aristocrats: Good Values – Good Buys

A quick run through of the individual earnings and price correlated graphs on the 23 Dividend Aristocrats that appear to be attractively valued, validate that they are. Of course, some are more favorably valued than others, and one name, Family Dollar Stores (FDO), could have easily been included with our moderately overvalued group. In other words, there are ranges of valuation and no absolute or precise calculation applies to all.

Furthermore, some of the names on this list have had good run-ups recently, but continue to be fairly valued or even undervalued based on our earnings yield criteria. And, although each of these are Dividend Aristocrats (and Dividend Champions), some are more attractive for their growth, others for their yield, and others for a combination of both. In other words, their attractiveness will depend on the investment objectives of the respective individual investor considering them.

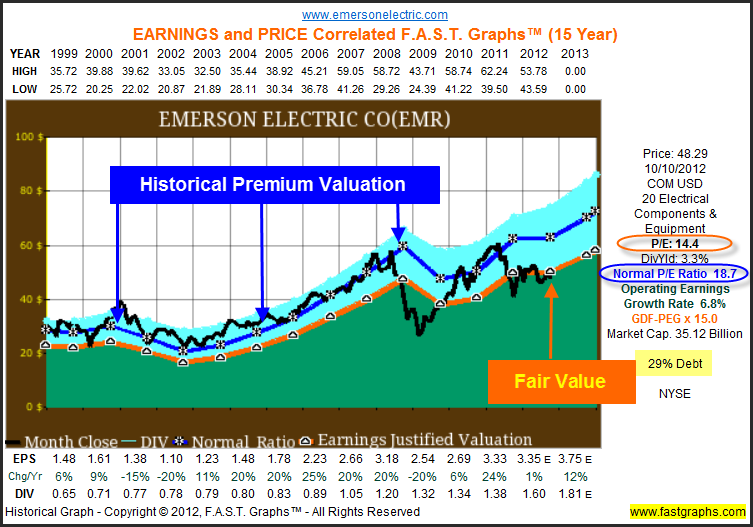

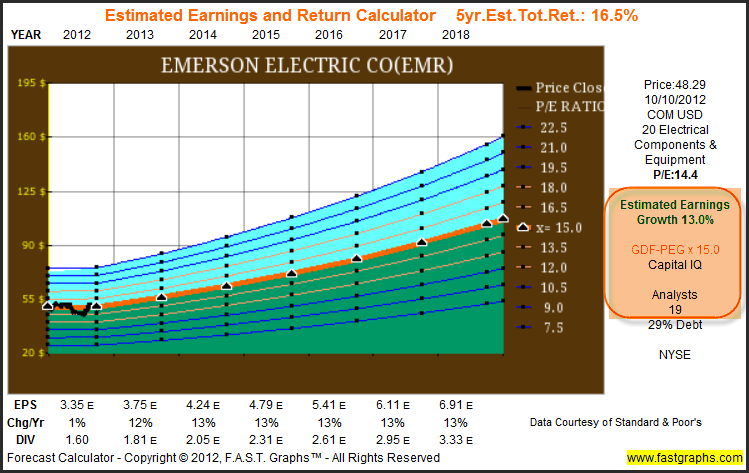

Emerson Electric Co. (EMR): A Premium Valuation Legacy Currently on Sale

Emerson Electric is an example of a Dividend Aristocrat that the market has typically priced at a premium valuation. However, the great recession of 2008 changed that dramatically as the price fell below its earnings justified valuation. However, it’s interesting that the market price (valuation) returned to its normal premium PE of 18.7 so quickly. Then, apparently because we have a flattening of earnings expected this year, the stock is now uncharacteristically trading at its earnings justified fair valuation (the orange line).

Perhaps the most interesting fact regarding Emerson Electric, is that the consensus of analysts following the company expect future earnings growth to be almost double the company’s historical earnings growth. If this turns out to be true, then today’s reasonable valuation, coupled with its above-average current yield, indicates that this blue-chip dividend growth stock is currently on sale, or at least reasonably priced.

Valuation Is A Relative Concept

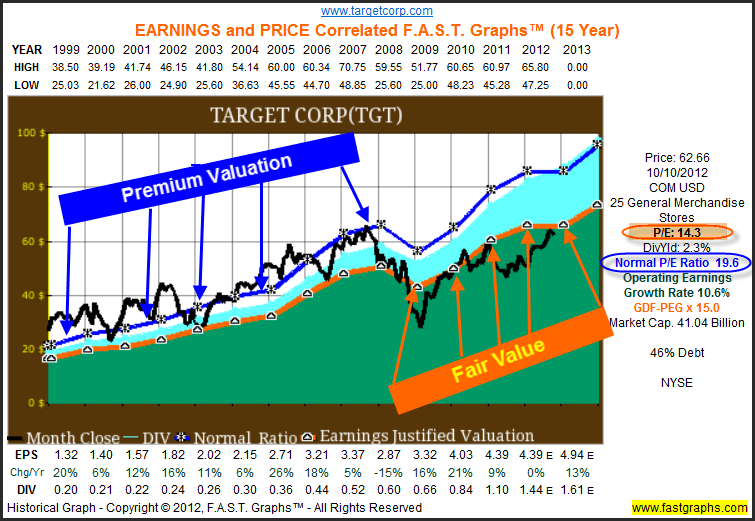

In order to assist us in solidifying our thesis that many blue-chip dividend growth stocks are still attractively valued, even though their stock prices have risen recently, we will turn to Target Corporation (TGT). We have recently seen a comment suggesting that since Target was trading at a 52-week high, it surely must be overvalued. However, our analysis utilizing the earnings and price correlated graph below provides a clear illustration that this is an erroneous assumption.

It is a fact that Target is trading at a 52-week high, it is also a fact that Target’s stock price has turned in a strong performance since June of 2011. However, what those facts do not reveal is how undervalued Target was in 2011. Consequently, this recent strong performance has only brought the company back to its earnings justified valuation level (the orange line). Moreover, the graph also shows that Mr. Market has historically placed a premium valuation on this blue-chip retailer. Therefore, it’s arguable at least, that Target could even be considered undervalued if you were to rely on the market’s historical pricing precedent.

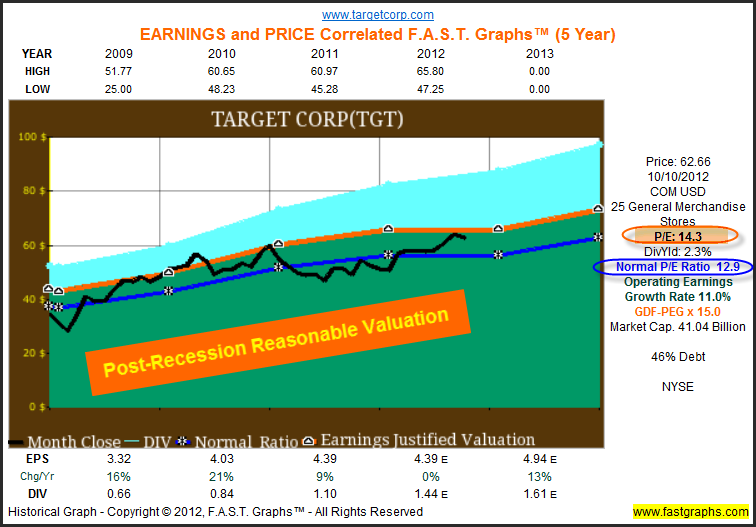

Furthermore, by running an earnings and price correlated graph since calendar year 2009 (post recession) we discovered that Mr. Market appeares to be pricing Target at more rational fundamentally based levels since the great recession. This is a recent fact that should be factored into the decision process. Nevertheless, Target appears to be reasonably priced under this more rational scenario.

Summary and Conclusions

We believe there is a lot of value in this market. Moreover, we believe there is especially a lot of value to be found in the blue-chip dividend growth stocks. This is important, because many people believe that these stocks have become overvalued as a result of some good performance recently. We hope that this article put some of those fears to rest. However, it’s important to add that our position is based on being long-term shareholders of the businesses.

In other words, there is always a possibility that Mr. Market could drive many of the shares of the companies discussed in this article lower over the short run. On the other hand, we believe that although it’s impossible to hit a perfect bottom (or top), buying a great business at a sound valuation is a long-term winning strategy.

Finally, we hope this article provides additional insights into the importance of making investment decisions one company at a time, over having vague general notions. As we have often stated, in every market, whether it’s a bull market or bear market, there will always be fairly valued, undervalued and overvalued individual companies to be found. The prudent investor understands this, and we believe, should always be willing to separate the wheat from the chaff. In that vein, we feel there is a lot of wheat in the equity asset class dividend growth stocks.

Disclosure: Long MCD, AFL, WAG, ADP, KO, MDT, JNJ, ABT, GPC, MKC, ITW, BCR, MHP, T, KMB, SYY, CLX, PEP, PG at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.