Creating a balance sheet can be a challenging task for small business owners.

Especially if you’re not schooled in finance and do not fully understand the ins and outs of financial statements, you may feel uncertain at first.

In this post, I’ll cover what a balance sheet is, how it benefits your business, and the important sections you need to include.

Let’s get started.

What is a balance sheet?

A balance sheet is one of the three primary financial statements used to monitor the health of your business, along with your cash flow statement and the income statement.

Your balance sheet should be included as part of your business plan. Think of it as a snapshot of your company’s financial position — what you own and what you owe — at a singular point in time, like at the end of a month, quarter, or year.

The things you own are called assets, such as cash in the bank, inventory, vehicles, equipment, buildings, and accounts receivable, which is money customers owe you for sales made but not yet paid for.

The items you owe are called liabilities, such as accounts payable, which are purchases you have made but not yet paid for; taxes you owe, including sales, payroll, general purpose loans; and mortgages.

The difference between what you own (assets) and what you owe (liabilities) is called net worth, or owner’s equity. In other words, after all the bills have been paid and all obligations have been satisfied, any value remaining belongs to the owners.

What is the benefit of having a balance sheet for your business?

At a glance, the balance sheet will give you an idea if your business has the financial resources to expand and manage the normal swings in receiving and spending cash, or needs immediate attention to bolster cash reserves.

In terms of operational management, the balance sheet provides insights where cash needs to be collected, inventory managed, and bills paid.

How can you use a balance sheet to manage your business?

To use a balance sheet to manage your business, first look at your current and fixed assets.

Current assets can be converted into cash within the next 12 months:

- Cash in the bank: Keeping track of cash and projecting what it will be in one to four weeks lets you know if you have sufficient funds to make payroll, pay your bills, and pay yourself.

- Accounts receivable (A/R): You made the sale and incurred the cost of providing the product or service and are now waiting to be paid. Use your balance sheet to track if customers are paying on time, or if you need to call and remind them payment is due. If you know that customers are late on payments, you might consider holding off on subsequent sales. Some companies encourage prompt payment by offering a discount. The listing of when payments are due is called an accounts receivable aging statement. A financial ratio to help manage A/R is called days’ sales outstanding.

- Inventory: If your business has inventory, you need to ensure you can meet projected sales and not have too much left over. A manufacturing business might have three levels of inventory, each of which needs to be managed — raw material, in process, and finished product — while a retail clothing business needs to track inventory by style and size. A financial ratio to help manage inventory is called inventory turnover.

Fixed assets will be around for more than 12 months:

- Vehicles, equipment, and buildings: You need to track these for insurance purposes and probably depreciate the expense for tax purposes.

Now let’s look at your liability accounts.

The first three types of liabilities are known as current liabilities, as they are usually due within the next 12 months.

- Accounts payable (A/P): Having vendors that allow you to pay on credit is wonderful. Track these obligations, and make sure you pay on time. If that’s not possible, contact the vendor and let them know when you will make payment. Vendors often provide discounts for prompt payment, so if you have the funds, do not miss the payment date. Purchases charged to your credit card are included in this section.

- Taxes: Keep track of sales tax collected from customers. This is not your money; you are the tax collecting agent for the government. Payroll taxes withheld from employee paychecks are also not your money. If you are using a payroll service (highly recommended), they should be handling this for you. Some jurisdictions collect personal property and real property taxes, and depending on your form of legal organization (e.g., sole proprietorship, LLC, corporation), you may also have company state and federal income tax obligations.

- Loans: If you have any loans in which payments are due within the next 12 months, they are listed here. Do not miss any payment dates, as in some cases, this might cause your loan to go into default.

- Long-term loans: This includes mortgages where payment is due in more than 12 months.

A financial ratio that combines current assets and current liabilities is called current ratio (current assets divided by current liabilities). The ratio should be greater than 1, which demonstrates you have the financial resources to pay your bills.

The third section of the balance sheet shows your net worth.

Besides the personal satisfaction of knowing you are worth more each year, bank loans often have stipulations that net worth must be kept at a certain level, so you need to track your net worth to ensure you’re not in default.

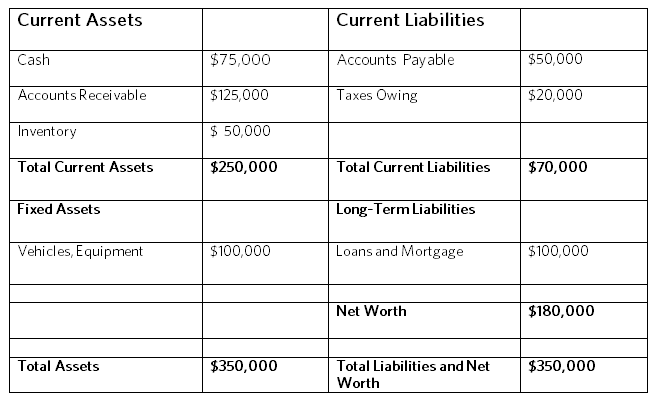

Sample Balance Sheet

Here’s an example of a simplified balance sheet that shows a snapshot of a business on March 31, 2016:

Note that at $350,000, total assets equal total liabilities, plus net worth. From this example, we see that the $350,000 in assets has been financed with $170,000 from others and $180,000 from the owners.

Key Lessons

- The balance sheet is one of the primary financial statements that can be used to manage your business on both a long-term and daily basis.

- While you may delegate the preparation of the balance sheet to an accountant or bookkeeper, it represents your business, so you should understand how to read it and use it.

Read more: